MT Capital 研报:去中心化排序器赛道拆解研究

Author: Xinwei, Severin MT Capital

TL;DR

The decentralized sorter is an emerging technology that aims to optimize the transaction sorting process of blockchain networks through decentralization, in order to improve transaction efficiency, reduce costs, and solve the MEV problem. The development of this technology marks further efforts in the blockchain field to pursue higher performance and stronger decentralization.

Metis' "self-operated store" model and Espresso's "outsourced module" approach represent two main paths for building and maintaining decentralized sorters. The former emphasizes the security and stability of internal management and operation, while the latter provides more flexibility and openness, promoting technical universality and reducing operational burden.

The development of decentralized sorters signifies the potential progress of blockchain technology in network security, censorship resistance, transaction efficiency and cost, as well as ecosystem diversity and interoperability. Further optimization and innovation of these technologies, such as batch processing and state channels, will enhance the performance of L2 platforms, reduce user costs, and promote the formation of a more open and interconnected decentralized ecosystem.

Although decentralized sorters face challenges such as technical implementation, network performance optimization, and governance model design, their crucial role in building a more efficient, secure, and open decentralized world cannot be underestimated. Future development may focus on researching more efficient consensus mechanisms, scalable network architectures, and developing user-friendly interfaces and tools to meet the growing market demand and user expectations.

Introduction to Sorters

As the name suggests, a sorter is used to sort the originally unordered transaction data in a blockchain, organizing it into ordered block data for execution. Every L1 blockchain has its own sorting system, but for L2, centralized sorters have become an increasingly serious problem.

For L2, a sorter is not necessary. L2 can also choose to use L1's sorter. However, running its own sorter for L2 can bring users a more affordable and convenient user experience in terms of cost and speed. Running its own sorter for L2 can compress hundreds or thousands of L2 transactions into a single L1 transaction submitted to L1, greatly saving gas fees. Additionally, users can enjoy the fast soft confirmation experience provided by L2 sorters without being restricted by Ethereum's transaction throughput. Therefore, running its own sorter for L2 is an inevitable choice to enhance user interaction experience.

Current Status of Sorters

Although running its own sorter can improve the user experience of L2, the centralization of L2 sorters has become an undeniable issue nowadays. Currently, the amount of locked assets in Ethereum L2 has reached 22B, and there is a constant emergence of massive L2 solutions. However, almost all L2 sorters are centralized, relying on a single sorter to determine the transaction ordering on L2. Centralized sorters face multiple issues, such as the theoretical possibility for the single sorter to exclude user transactions, the ability for the single sorter to extract MEV from transactions without restrictions, and the vulnerability to censorship resistance. In addition, a single sorter also faces the risk of a single point of failure.

source: https://l2beat.com/scaling/summary

When addressing the complex challenges of MEV, rollups face a delicate balance between maintaining user protection and profitability. This challenge involves preventing harmful MEV behaviors like frontrunning and sandwich attacks while effectively utilizing block space for revenue generation. Although traditionally, rollups have relied on a single operator model and first-in-first-out (FIFO) ordering to protect users from MEV impact, this approach may miss out on revenue opportunities from block space and ignore the essential role of economic incentives in promoting rollup stability and growth. Furthermore, ensuring compliance with FIFO principles and maintaining transparency in block ordering poses additional operational challenges. Moreover, utilizing underlying block space as a source of revenue, while profitable, also raises trust issues for users who must trust that operators will not exploit this space to harm their interests through sandwich attacks and similar means, potentially eroding the integrity of transactions and user trust.

The Shared Sorter provides an innovative solution for addressing MEV issues, bringing significant benefits to Ethereum Layer 2 solutions such as rollups by introducing a more secure and fair transaction ordering mechanism in the blockchain network. It effectively balances the demands and interests of network participants by dividing the block space of rollups into a top block space that protects user transactions and a bottom block space that allows builders to leverage MEV. Using Practical Verifiable Delay Encryption (PVDE) technology, the Shared Sorter ensures that user transactions are not visible to malicious actors, preventing harmful MEV practices such as front-running and sandwich attacks. Furthermore, by allowing beneficial MEV activities in the bottom block space, the Shared Sorter generates revenue for rollups while maintaining the integrity and trust of the network. This mechanism enhances transaction security and fairness and, through innovative revenue generation, supports the sustainable development of the blockchain network. In summary, the Shared Sorter brings positive changes to the blockchain ecosystem through its unique handling of MEV, achieving a balance between protecting user interests and promoting the healthy development of the network.

In general, the problems of centralized sorters stem from the excessive power and risk exposure of sorter composed of a single node. Decentralized sorters composed of multiple nodes can effectively address the issues faced by centralized sorters. Decentralized sorters not only ensure the robustness and effectiveness of L2 sorting but also bring additional benefits. For example, decentralized sorters represented by Metis empower tokens and realize profit sharing. The Shared Sorter eliminates the need for L2 to build its own sorting network while providing convenient interoperability for multiple shared sorters in L2. In the long run, the wave of modularity and L2 will drive the decentralization of sorters, leaving a huge market space for decentralized sorter projects.

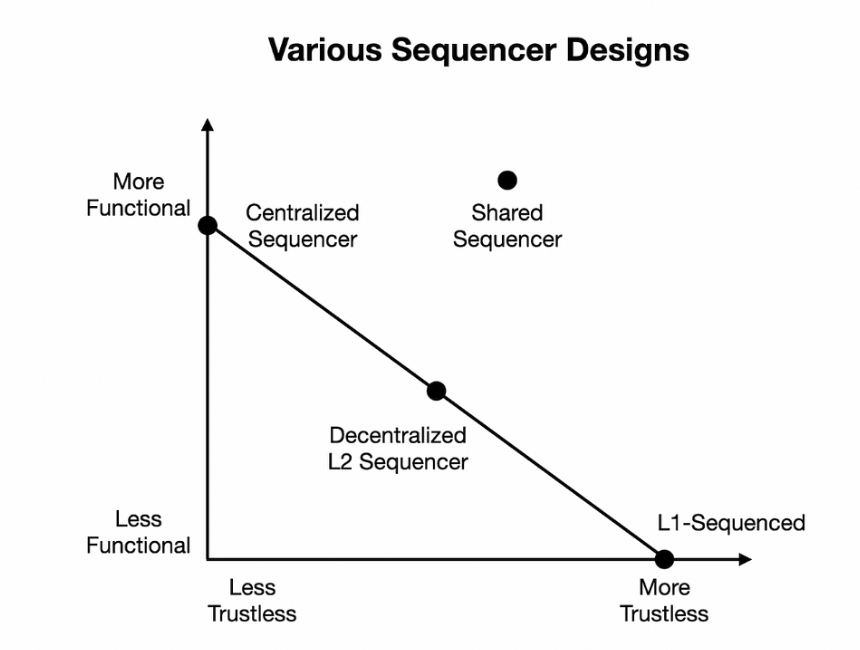

source: https://joncharbonneau.substack.com/p/rollups-arent-real

Decentralized Sorter Projects

Metis

Elena Sinelnikova, the co-founder and CEO of Metis, has been dedicated to blockchain industry education and advocacy. She is a co-founder of CryptoChicks, an educational nonprofit organization that is currently the largest women-led blockchain community in the world, with members spanning 56 countries. Kevin Liu, also a co-founder of Metis and the Head of Product, is the co-founder and CEO of ZKM. Kevin is also an active researcher in token economics, DAOs, DeFi, and blockchain governance.

Metis is the first Ethereum L2 to propose and test a decentralized sequencer.

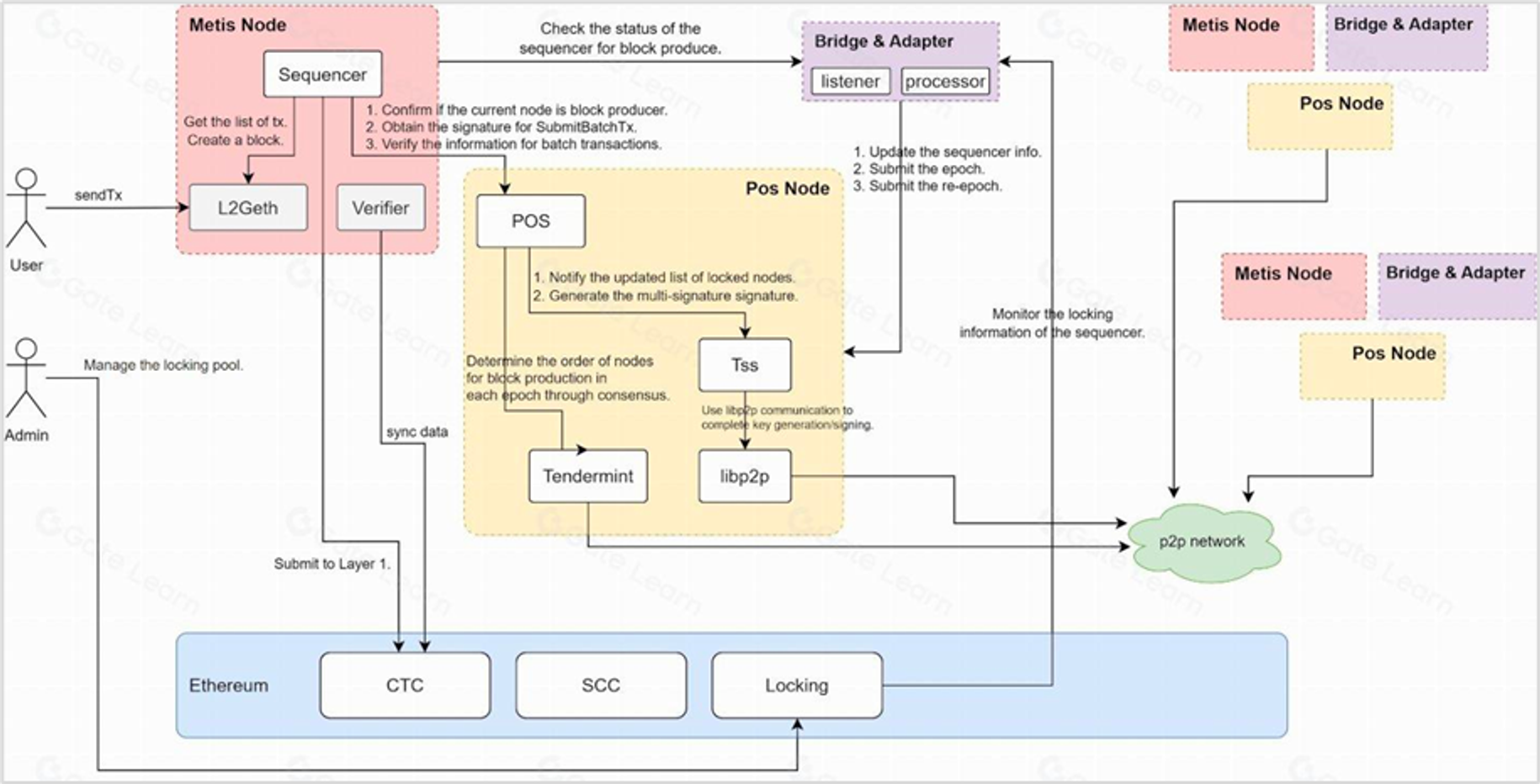

Metis changes the original single sequencer node to a sequencer pool composed of multiple nodes and achieves decentralization of the sequencer through a mechanism of random rotation.

First, there will be an Admin role in the decentralized sequencer network of Metis. The Admin is responsible for managing the decentralized sequencer system, including adding qualified sequencer nodes to the Sequencer List whitelist, setting the staking limit for individual nodes, and the release rate of block rewards, etc.

Then, Metis introduces the node staking mechanism. Any node that stakes 2 w METIS tokens can become one of the nodes in the sequencer pool. Nodes in the sequencer pool have the right to see the content in the transaction pool, and selected sequencer nodes have the right to package transactions.

Next, Metis introduces the PoS node rotation mechanism. Metis randomly selects block producers by combining the staking amount of each node with a randomly dropped hash value. The selected sequencer node can then package block transactions.

Then, the packaged transaction batch needs at least 2/3 of the sequencer signatures to be considered valid and submitted to L1. The signing keys of sequencer nodes are managed by the PoS consensus layer of Metis. The consensus layer generates and shards multisignature keys when sequencer nodes join or exit the network.

Finally, to prevent malicious behavior by sequencers, Metis will introduce the role of validators to randomly sample blocks and check the correctness of transaction sequence within the blocks. Nodes that maliciously misbehave will be penalized by the confiscation of staked funds.

source:https://www.metis.io/decentralized-sequencer

Based on the above process, Metis has built a decentralized sequencer architecture based on PoS network consensus. Staking 2 w METIS tokens can become a sequencer node, making the sequencer nodes more diverse and avoiding single points of failure, single manipulation of sequencer nodes, and malicious MEV extraction. The node rotation mechanism and multisignature confirmation make the selection of sequencer nodes more fair and can also to some extent prevent malicious behavior by sequencer nodes. The sampling checks by validators and the penalty of confiscation further reduce the risks brought by malicious behavior of nodes.

To further incentivize more nodes to participate in the decentralized sequencer network of Metis, additional incentive mechanisms have been introduced. After a sequencer node successfully generates a block, it not only receives gas income from the original sequencer but also additional METIS token emission rewards. Metis' incentive mechanism has the potential to create a positive growth flywheel. The prosperity of Metis network's transaction activities will drive an increase in sequencer node income. The increase in sequencer node income will attract more users to pledge METIS, become sequencer nodes, and capture sequencer income. The reduction of circulating METIS and the increase in demand for METIS generated by pledging will further drive up the market price of METIS. The increase in METIS price will also increase the asset value of pledged nodes and the value of pledged rewards, thereby creating greater attraction for nodes, attracting more nodes to pledge, and forming a flywheel loop.

Metis' decentralized sequencer network based on PoS is the first attempt to implement a decentralized sequencer on Layer 2. The landing of Metis' decentralized sequencer is expected to drive other Layer 2 solutions to advance their decentralized sequencer plans.

Espresso Systems

The team behind Espresso has an impressive background. Co-founders Charles Lu and Ben Fisch both hold Ph.D. degrees in computer science from Stanford University, and team members have previously worked at top companies in Web2 and Web3 such as Binance Labs, Coinbase, and Google. Previously, Espresso successfully raised $23 million in funding from top venture capital firms such as Sequoia Capital, Coinbase Ventures, Polychain, and Robot Ventures.

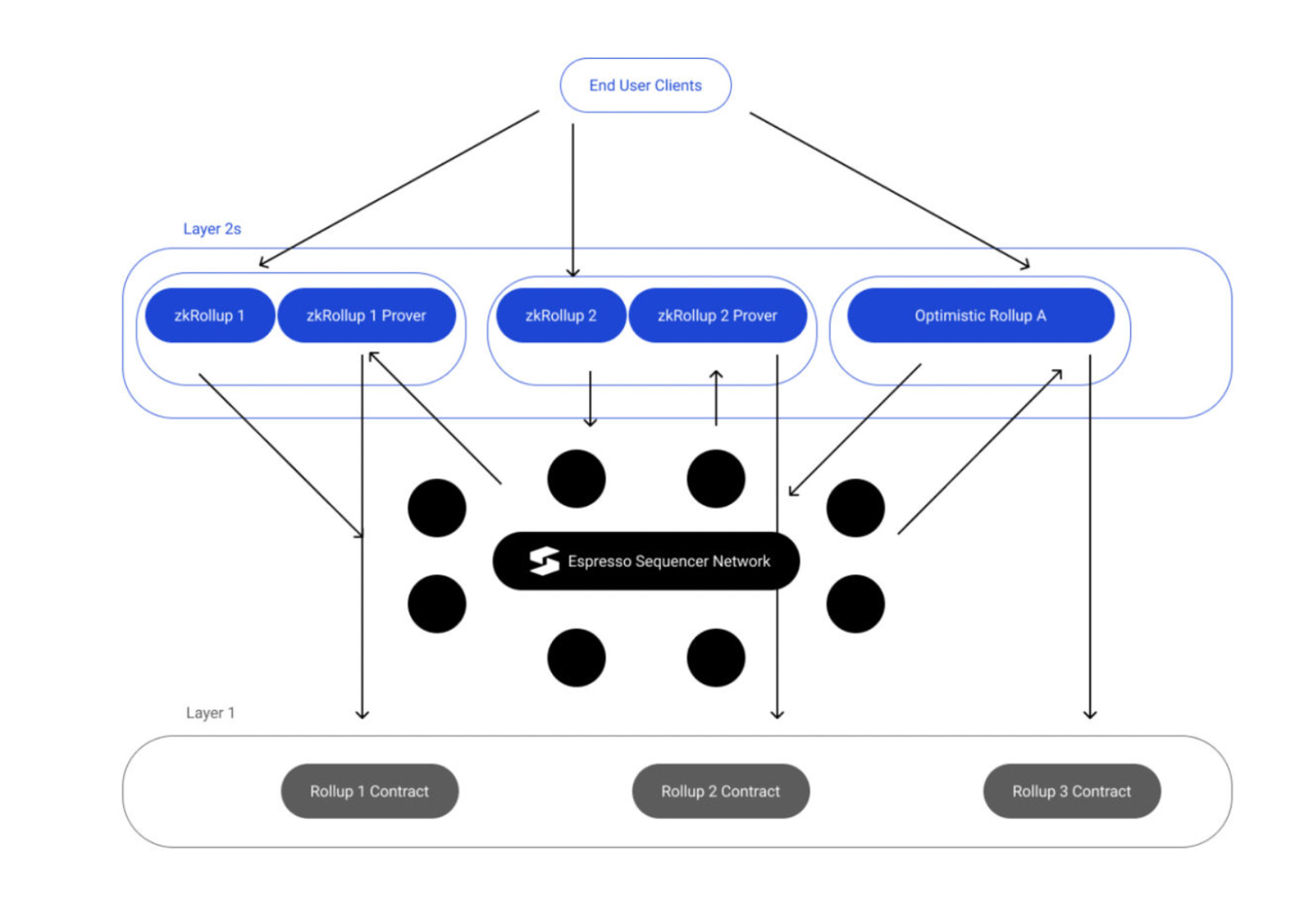

Espresso positions itself as middleware between L1 and L2, decoupling sequencing from execution, aiming to become a decentralized shared sequencer network that provides decentralized sequencing services for different Layer 2 solutions. Similar to the concept of modular outsourcing, Espresso's services are more like transaction data sequencing outsourcing services. Like modular outsourcing, the sequencing outsourcing services provided by Espresso are also independent of chains and virtual machines, and any type of Layer 2 can use Espresso's sequencing services.

source: https://hackmd.io/@EspressoSystems/EspressoSequencer

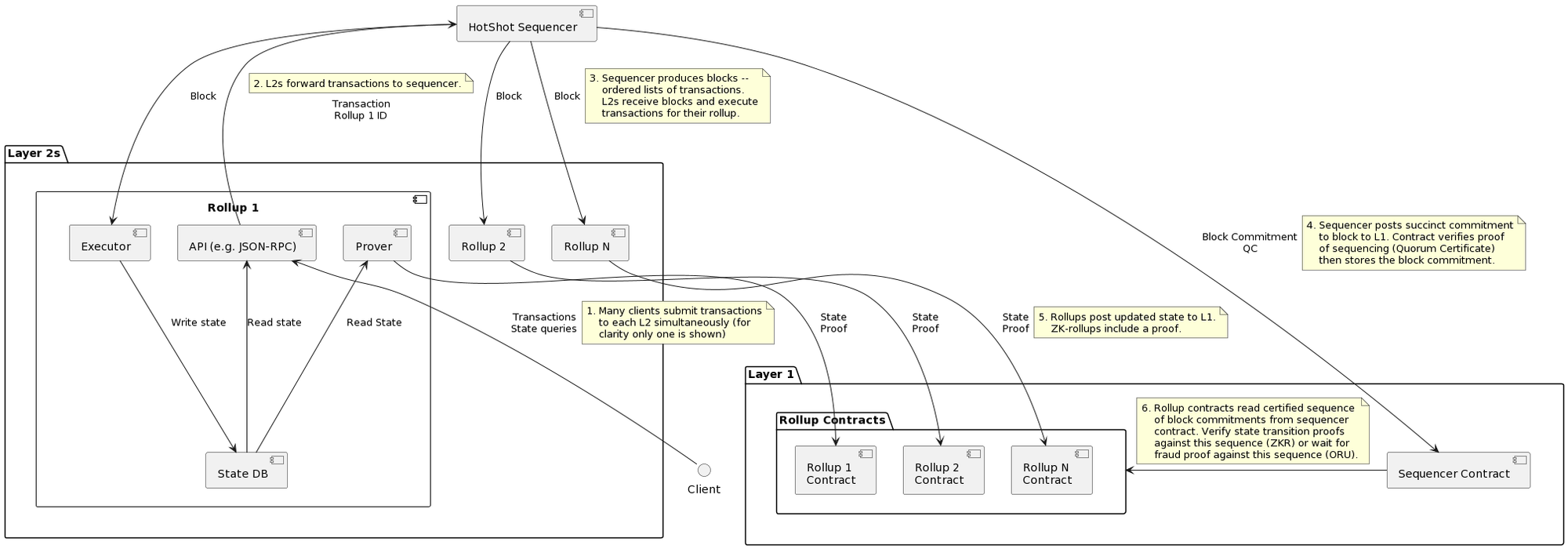

The core idea of Espresso is to provide a modular sorting middleware for L2. After users send transaction data through the client, the transaction data, together with the identifier of the L2, is sent to Espresso's sorting network by the L2. The nodes of Espresso (nodes of the Espresso Hotshot proof-of-stake system) will sort the transactions and broadcast them to the subscribers (L2 nodes) after the sorting is completed. Then, L2 executes the pre-sequenced transaction data. At the same time, Espresso also submits blocks containing transactions to the sorting contract of L1. Finally, L2 needs to send the updated state to L1, and the Rollup contract of L1 will use the block commitment from Espresso to verify the state updates submitted by L2, ensuring the correctness of the execution.

source:https://docs.espressosys.com/sequencer/espresso-sequencer-architecture/system-overview

In the future, Espresso also plans to involve existing Ethereum validation nodes in the sorting process through Eigenlayer, to achieve higher security.

In summary, Espresso's decentralized sorting solution is more aligned with the concept of modular blockchain. By outsourcing sorting and utilizing its own PoS network, it achieves decentralized sorting and acts as a middleware in the decentralized sorting network between L1 and L2. The versatility of Espresso's sorting service allows it to be a shared sorting network that can be used by any L2. Furthermore, L2s that use Espresso as their sorting service provider can even enjoy seamless interoperability.

Astria

Astria's CEO, Josh Bowen, is the main driver of the project. Josh Bowen has previously worked at Edge & Node, a startup behind The Graph, as well as Celestia Labs. His previous work experience has given him a deeper understanding of concepts such as modularity and decentralization. He has shared important insights about the role of shared sequencers in maintaining blockchain scalability and decentralization. Bowen emphasizes that most application-specific Rollups may not need their own sequencers, and fostering a more decentralized and modular network of shared sequencers would be beneficial in building a more decentralized and efficient blockchain system. Josh Bowen and Astria's vision have gained support from institutions such as Maven 11, 1kx, Delphi Ventures, and Figment Capital, and have raised $5.5 million in seed funding.

Similar to Espresso, Astria aims to provide a decentralized network of shared sequencers. Astria's shared sequencer network is a middleware blockchain with its own decentralized set of sequencers that can accept transaction data from multiple L2s. Similarly, Astria can process sequencing requests from any type of L2. Furthermore, L2s using Astria can also benefit from the atomic-level interoperability provided by Astria.

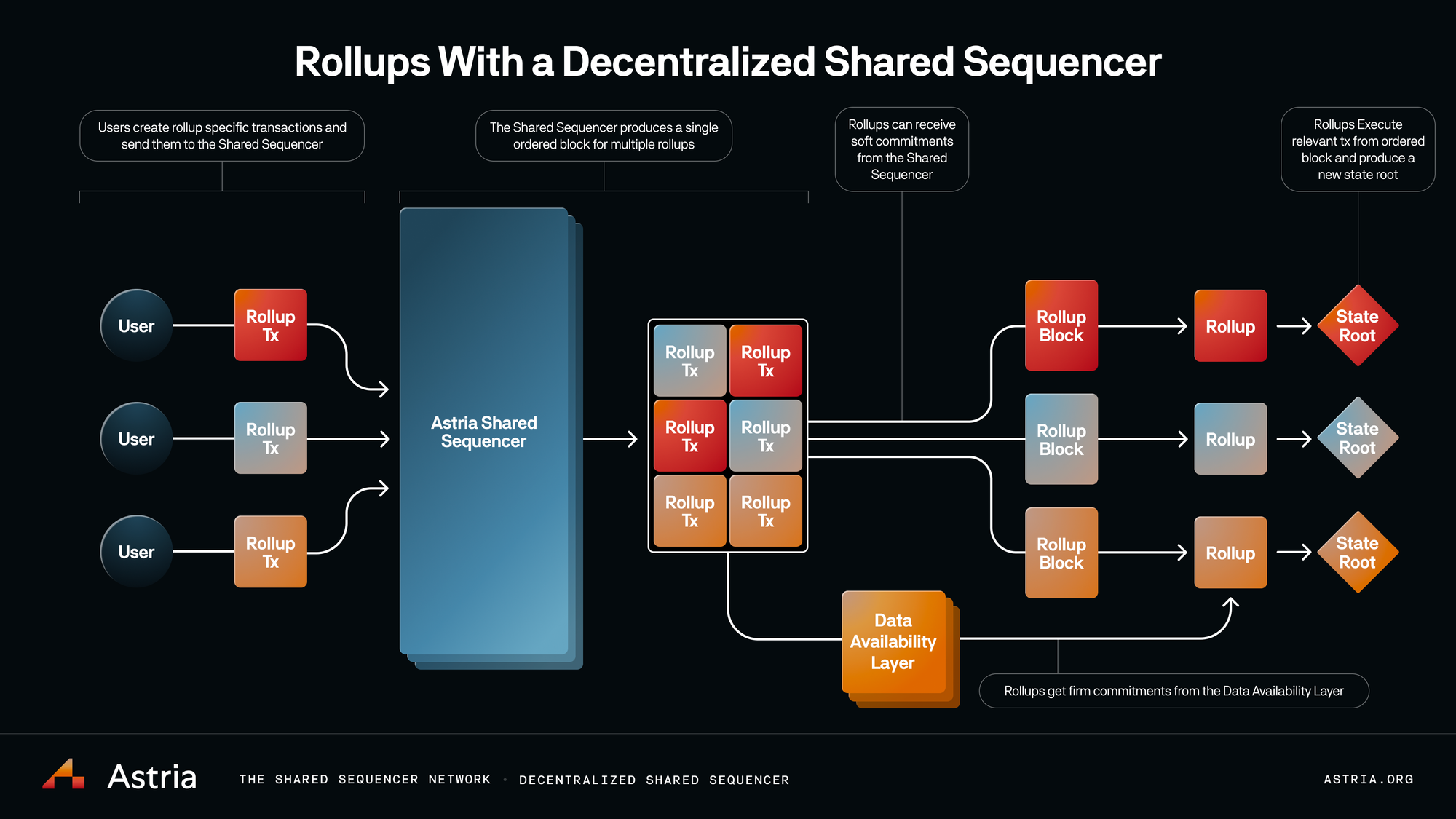

The sequencing process of Astria is illustrated in the following diagram.

After users submit transactions, L2s submit transaction data to Astria through an interface.

Astria's shared sequencers reach consensus on transaction ordering and package them into blocks through the ComeBFT PoS consensus network. Astria's shared sequencer network uses CometBFT as its consensus algorithm. During the network consensus phase, proposers determine the transactions for each block and make commitments to the sequencing data for each Rollup. Subsequently, other nodes in the network need to validate and reach consensus on it to reach a final agreement.

Once the transaction data is sequenced, Astria's Conductor parses the required data for each sequenced block from different Rollups. It then verifies the batch of data, including the final confirmation of the block, the integrity and correctness of the extracted Rollup data, and the correct ordering. After completion of verification, the Conductor converts the sequencing data of the Rollup into a list of transactions and passes it to the Rollup's execution engine for execution.

source: https://docs.astria.org/docs/overview/why-decentralized-sequencers/

Pursuing faster user experience, L2 can accept soft commit sequencer blocks from Astria through read interfaces to provide users with fast block confirmation. L2 can also read hard commit sequencer blocks written by Astria through the DA layer.

source: https://docs.astria.org/docs/overview/why-decentralized-sequencers/

Astria's decentralized sequencer network is very similar to Espresso's solution, both are committed to providing decoupled decentralized sequencing services for any L2. L2 can further simplify the development process and operation cost of L2 by outsourcing sequencing services and enjoy composability at the atomic level between L2s.

Radius

Radius focuses on developing a trustless shared sequencing layer to address the challenges of harmful MEV extraction and censorship in the blockchain field. Radius has successfully raised $1.7 million in pre-seed funding from investment institutions such as Hashed, Superscrypt, Lambdaclass (Ergodic Fund), and Crypto.com.

Radius also aims to build a trustless and censorship-resistant shared sequencer network, and its biggest feature compared to Espresso and Astria is its ability to effectively reduce harmful MEV through encrypted mempool.

The overall architecture of the Radius shared sequencer network is similar to mainstream shared sequencer networks. Users submit encrypted transaction data and proofs to the sequencer layer through Dapps. The sequencer validates the transaction data and proofs provided by the users and packs them in order. Subsequently, Rollup accepts sequencer blocks from the sequencer network, executes transactions in order, and submits the executed state and state proof to the settlement layer.

source:https://docs.theradius.xyz/developer/architecture

interestingly, Radius introduces encrypted memory pool to prevent sorters from extracting harmful MEV. User-submitted transactions will be encrypted and submitted to the sorter network in the form of encrypted data. Sorters cannot obtain the key to decrypt and view the specific content of each transaction. Therefore, sorters cannot extract MEV by malicious sorting or inserting transactions.

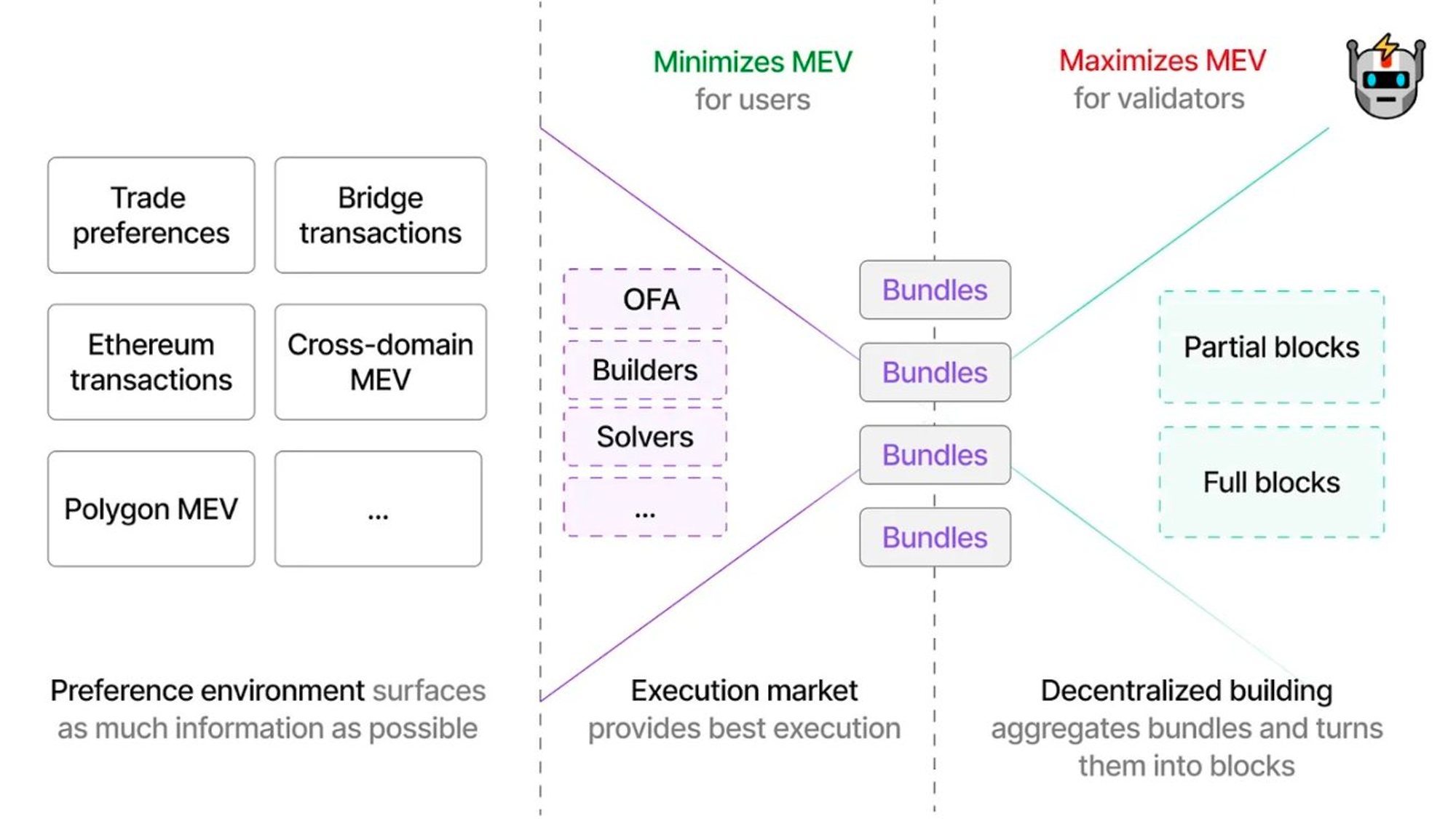

Radius divides block space into top space and bottom space. The top space is dedicated to user transactions, effectively avoiding harmful MEV by encrypting the memory pool. The bottom space introduces an auction-based open market for traders, where cross-rollup benign MEV bundling transactions can be created in transactions, such as benign arbitrage, liquidation, and so on. Subsequently, traders submit bundled transactions and bids to the sorter, and the sorter selects the bundled transaction with the highest bid, includes it in the block, in order to maximize the profits of Rollup, and cultivate a benign MEV competitive market.

Radius has two significant advantages compared to Espresso and Astria. First, by introducing an encrypted memory pool and dividing the block space into top and bottom space, Radius can effectively eliminate harmful MEV transactions, cultivate a healthy MEV competitive market, and maximize the profit of Rollup. Second, the introduction of an encrypted memory pool prevents individual sorter nodes from manipulating MEV, so there is no need to introduce additional consensus mechanisms to ensure the correctness of sorting, which greatly improves the final confirmation speed and scalability of the sorter network.

SUAVE (Single Unifying Auction for Value Expression)

The SUAVE solution was proposed by the Flashbots team, a pioneering team dedicated to solving the MEV problem in the Ethereum ecosystem. The team consists of professionals with deep backgrounds in fields such as computer science, mathematics, psychology, and economics. According to LinkedIn, the team currently has 28 employees with expertise ranging from Python programming, blockchain technology, machine learning to C language and other domains.

The founding team of Flashbots includes Philip Daian and Stephane Gosselin, with the latter leaving the team in October 2022 due to disagreements regarding the review process. Additionally, Alex Obadia, another co-founder and top strategy researcher, left Flashbots in June 2023 for personal reasons. The core members include Andrew Miller, known for his research on cracking Intel SGX code, who currently serves as the director of trusted execution environments and SUAVE research. Miller plans to take a temporary leave of absence from his position as an assistant professor at the University of Illinois, focusing his academic work on electrical and computer engineering. Another core member, Hasu, serves as the strategic director of Flashbots and has extensive influence in the blockchain field, including serving as a strategic advisor to the liquidity staking protocol Lido and a research collaborator at Paradigm investment company. Hasu is dedicated to driving industry development and education through writing, social media, podcasts, and other means.

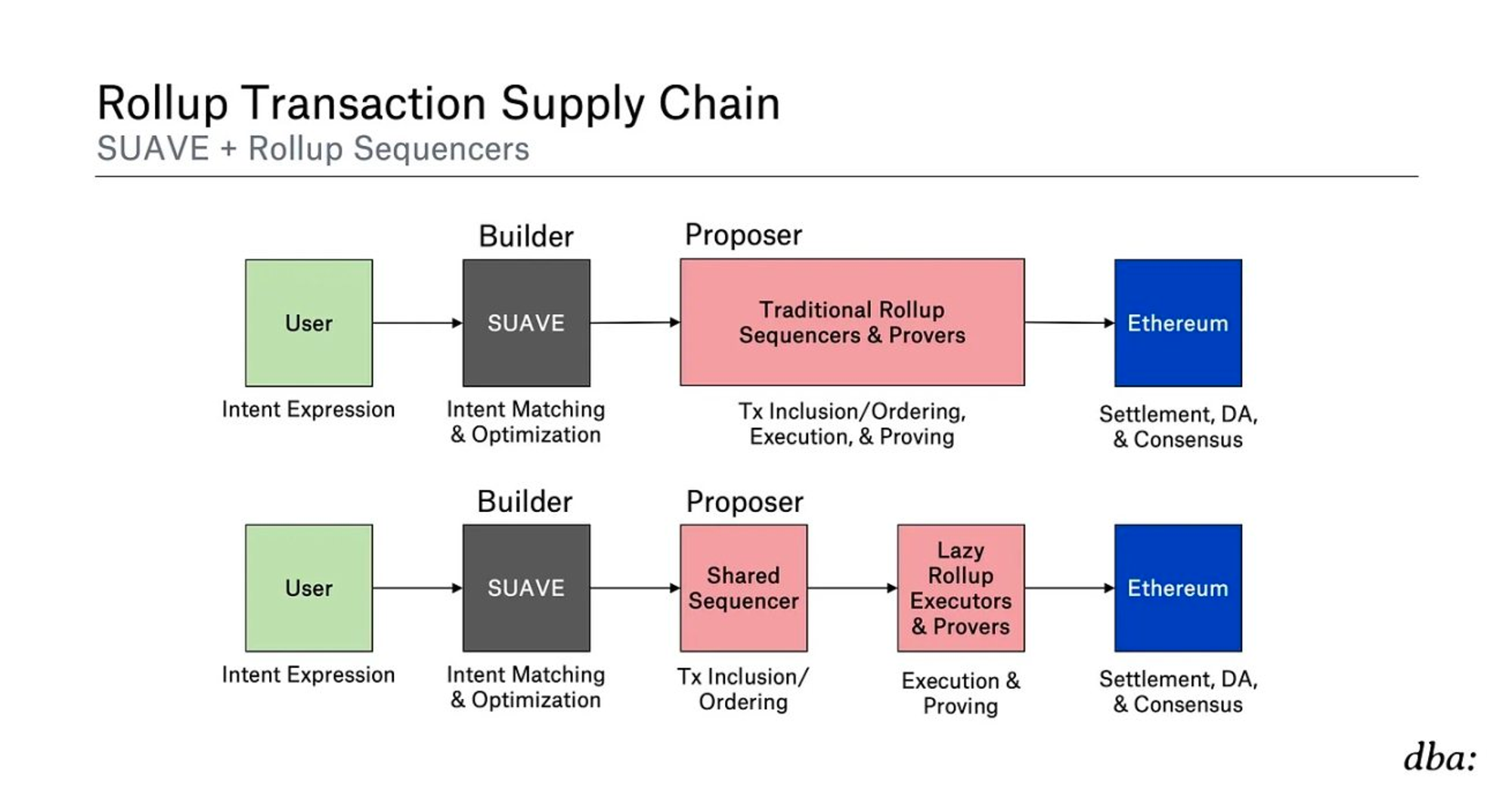

SUAVE is a unique decentralized builder and sorter that has distinct differences from the design of other sharing layers or sorting layers. It aims to provide transaction sorting services for Ethereum and other blockchains but is not directly integrated into the protocols of any chain. Users can send transactions to SUAVE's encrypted memory pool, and SUAVE's executor network is responsible for generating blocks or partial blocks for the chain. These blocks will compete with blocks generated by centralized Ethereum builders and will be selected by Ethereum proposers.

Source: https://foresightnews.pro/article/detail/28930

SUAVE does not replace the mechanism of selecting blocks in Rollup, nor does it change the chain's fork selection rules. It focuses on providing the optimal profit sorting for any chain, usually by having a complete state to simulate the results of different transactions and create the best sorting. This design allows SUAVE to collaborate with shared sorters or other MEV-aware builders to provide services such as atomic cross-chain arbitrage, ensuring that several transactions are executed atomically or canceled simultaneously.

Source: https://foresightnews.pro/article/detail/28930

In the long run, Rollup may be a better choice. Rollup guarantees its security, censorship resistance, and liveliness through L1, while SUAVE, as a chain that focuses on transaction sorting, is not suitable for ordinary users. Its goal is to limit the demand for users to bridge funds to SUAVE, but to focus on providing an operating platform for searchers/builders. SUAVE focuses on providing the most favorable sorting for transactions without completely replacing existing sorting mechanisms. It can handle transactions with complete states to create the optimal transaction ordering.

Source: https://foresightnews.pro/article/detail/28930

There are multiple mechanisms to reduce the potential competition and negative externalities associated with transaction sorting and inclusion when it comes to MEV. For example, Arbitrum's time boosting mechanism and Flashbots' FBA-FCFS model attempt to reduce the incentive for delayed competition by allowing users to express their preference for fast inclusion transactions through fees.

Arbitrum's time boosting mechanism

Time Escalation Mechanism is a security measure designed to prevent a specific type of attack called "Time Bandit Attack". In this attack, the attacker may attempt to reorganize confirmed blocks to exploit previously unknown information (such as exploiting knowledge of a transaction) for profit.

Arbitrum defends against this attack by allowing anyone who detects someone attempting a Time Bandit Attack to submit a "challenge" to prove the attacker's behavior. This mechanism is based on an economic incentive that ensures the attacker's potential gains are offset, thus protecting the network's security and fairness.

Flashbots' FBA-FCFS Model

The FBA-FCFS (First Bid Auction - First Come, First Served) model is a transaction ordering mechanism proposed by Flashbots. The purpose of this model is to address traditional transaction selection and ordering problems, especially in the MEV extraction environment.

The First Bid Auction (FBA) component means that traders can prioritize their transactions by bidding (usually an additional fee paid to miners). This is similar to an auction, where the highest bidder gets priority.

The First Come, First Served (FCFS) component means that under certain conditions, transactions are processed in the order they were submitted, ensuring fairness and transparency.

The FBA-FCFS model aims to balance fairness and efficiency by allowing bidding on transactions to optimize the use of network resources, while ensuring that certain users are not completely excluded due to insufficient payment capacity.

These mechanisms have their own advantages and disadvantages, but their common goal is to improve the efficiency and fairness of transaction processing.

Through collaboration with Rollup and other MEV-aware builders, SUAVE aims to provide higher economic security and efficiency for cross-chain operations while exploring new economic security models and MEV mitigation mechanisms to improve the decentralization of blockchain transaction ordering and execution.

Summary and Outlook

Although projects like Metis, Astria, Espresso, Radius, and SUAVE have different focuses, they all aim to enhance the scalability and transaction efficiency of blockchains, address the MEV problem, and strengthen the decentralization and interoperability of systems.

Metis focuses on optimizing the transaction processing capacity of Ethereum through its Layer 2 solution to reduce costs and improve efficiency, aiming to provide developers and businesses with a more convenient development platform. Astria and Espresso propose the concept of a decentralized shared sorter network, which supports the transaction data processing of multiple Layer 2 solutions. This not only simplifies the development and operation processes but also strengthens the composability and interoperability between systems. The Radius project aims to create a trustless and censorship-resistant network by introducing encrypted memory pools and block space partitioning, aiming to reduce the harmful impact of MEV while enhancing the privacy and security of transactions. SUAVE focuses on addressing the impact of MEV on transaction fairness and transparency through a decentralized sorter network, demonstrating a commitment to improving the fairness of the trading environment.

When exploring the development direction of decentralized sorters, Metis and Espresso offer two completely different models, namely the "self-operated store" model and the "outsourced module" model. These two models reflect the community's different thinking and strategies in building and maintaining decentralized sorters.

The "self-operated store" model adopted by Metis emphasizes managing and operating its decentralized sorter network internally to ensure the security and stability of the network. This approach allows Metis to have direct control over the nodes in its network and maintain a healthy network environment through pledging and incentive mechanisms. Although this model can improve the security and reliability of the network, it also requires Metis to take on greater operational responsibilities and resource inputs, which may restrict the flexibility and scalability of the network to some extent.

In contrast, the "outsourced module" approach adopted by Espresso offers a more flexible and open solution. By allowing any blockchain project to access its sorting services, Espresso promotes the universality and diversity of technology while also reducing the operational burden on individual projects. The challenge of this model is that it may introduce additional trust issues because project teams need to rely on Espresso to process transactions in a fair and secure manner. Additionally, any issues or attacks targeting Espresso's services could potentially impact a wide range of customer projects.

The "self-operated store" model of Metis and the "outsourced module" approach of Espresso represent two main development paths in the decentralized sorter field. Each model has its unique advantages and challenges, and the choice depends on the specific needs of the project, resource conditions, and the importance assigned to decentralization and security.

The development prospects of decentralized sorters suggest the tremendous potential of blockchain technology in enhancing network security, strengthening censorship resistance, improving transaction efficiency, reducing costs, and promoting ecosystem diversity and interoperability. With the continuous advancement of decentralized sorter technology, we can envision a more secure and efficient blockchain network, where decentralized sorting mechanisms can effectively defend against single point failures and malicious attacks, safeguarding the security of user assets and data. Additionally, optimizations and innovations in decentralized sorters, such as batch processing and state channels, will further enhance the transaction processing capabilities of L2 platforms, reduce user transaction costs, achieve high throughput and low latency transaction confirmations, thereby enhancing user experience without sacrificing security and decentralization.

Simultaneously, the popularization of decentralized sorters is expected to drive the formation of a more diverse and interoperable blockchain ecosystem. Shared sorter networks, such as Espresso and Astria, will not only serve multiple L2 platforms but also facilitate the flow of data and assets between different platforms, creating a more open and connected decentralized world. Furthermore, innovations in incentive mechanisms and token economic models will provide reasonable incentives for participants in decentralized sorter networks, while achieving network governance and profit distribution through token economic models, attracting more participants and inspiring community vitality.

Despite the bright prospects of decentralized sorters, they still face challenges in areas such as technical implementation, network performance optimization, and governance model design. Therefore, future development directions may focus on researching more efficient consensus mechanisms, exploring scalable network architectures, and developing user-friendly interfaces and tools to meet market demand and fulfill user expectations. In conclusion, as one of the key factors driving the development of blockchain technology and applications, the future evolution of decentralized sorters will play a crucial role in building a more efficient, secure, and open decentralized world.

References

https://www.gate.io/learn/articles/the-battle-for-decentralized-sequencers/1049

https://ethresear.ch/t/shared-sequencer-for-mev-protection-and-profitable-marketplace/15313

https://maven11.substack.com/p/the-shared-sequencer

MT Capital

MT Capital is managed by a group of experienced investors who invest in Web3 projects globally, including the United States, Hong Kong, Dubai, and Singapore. Our primary investment focus includes:

1) Mass Adoption: Decentralized social platforms, games, applications, and DEPIN that are key to the widespread adoption of Web3 technology to a wide user base.

2) Native Crypto Infrastructure: We specialize in investing in public chains, protocols, and other infrastructures that support and enhance the ecosystem, as well as native DeFi solutions. In addition, our team has years of experience in secondary trading.

Official Website: https://mt.capital/

Twitter: https://twitter.com/mtcap_crypto

Medium: https://medium.com/@MTCapital_US