SignalPlus宏观分析(20240227):GBTC流出趋近于零

In yesterday's price movement, there seemed to be slight cracks in the bull market. First, fixed income, large-scale corporate bond and government bond issuances have finally caused some indigestion. After last week's $60 billion new debt supply, the market welcomed another $20 billion in corporate bond issuances on Monday, with a total issuance size of $145 billion from February to date, just $5 billion lower than the record high set last year. At the same time, the issuance volumes of 2-year and 5-year government bonds were also high, reaching $63 billion and $64 billion respectively. The market demand for both auctions was relatively relaxed, leading to a rebound in yields close to the December high and a return of all gains since the beginning of the year.

Equities performed slightly better, although the Nasdaq and SPX indices both closed lower due to expectations of month-end rebalancing. As SPX (+4.8%) outperformed US Treasuries (-1.5%) significantly this month, Wall Street expects a considerable amount of rebalancing funds to be shifted to the bond market in the coming days.

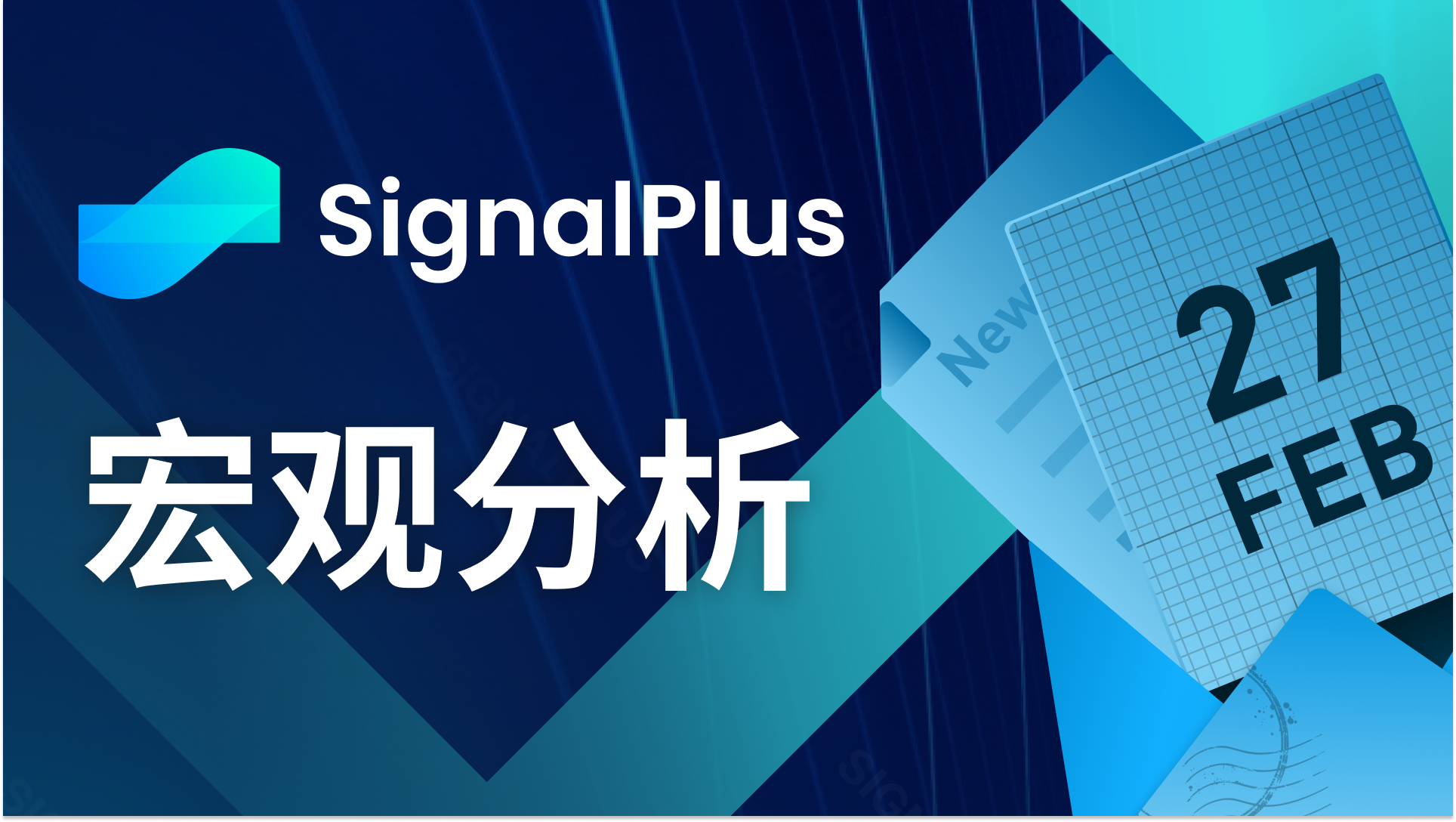

Despite the surge in stock prices, investors continue to flock to the stock market, with only the net position of Hong Kong stocks showing a negative trend. According to a survey by Bank of America, the proportion of investors expecting the U.S. economy to not land (i.e., the economy will not experience a recession) has risen to 41%.

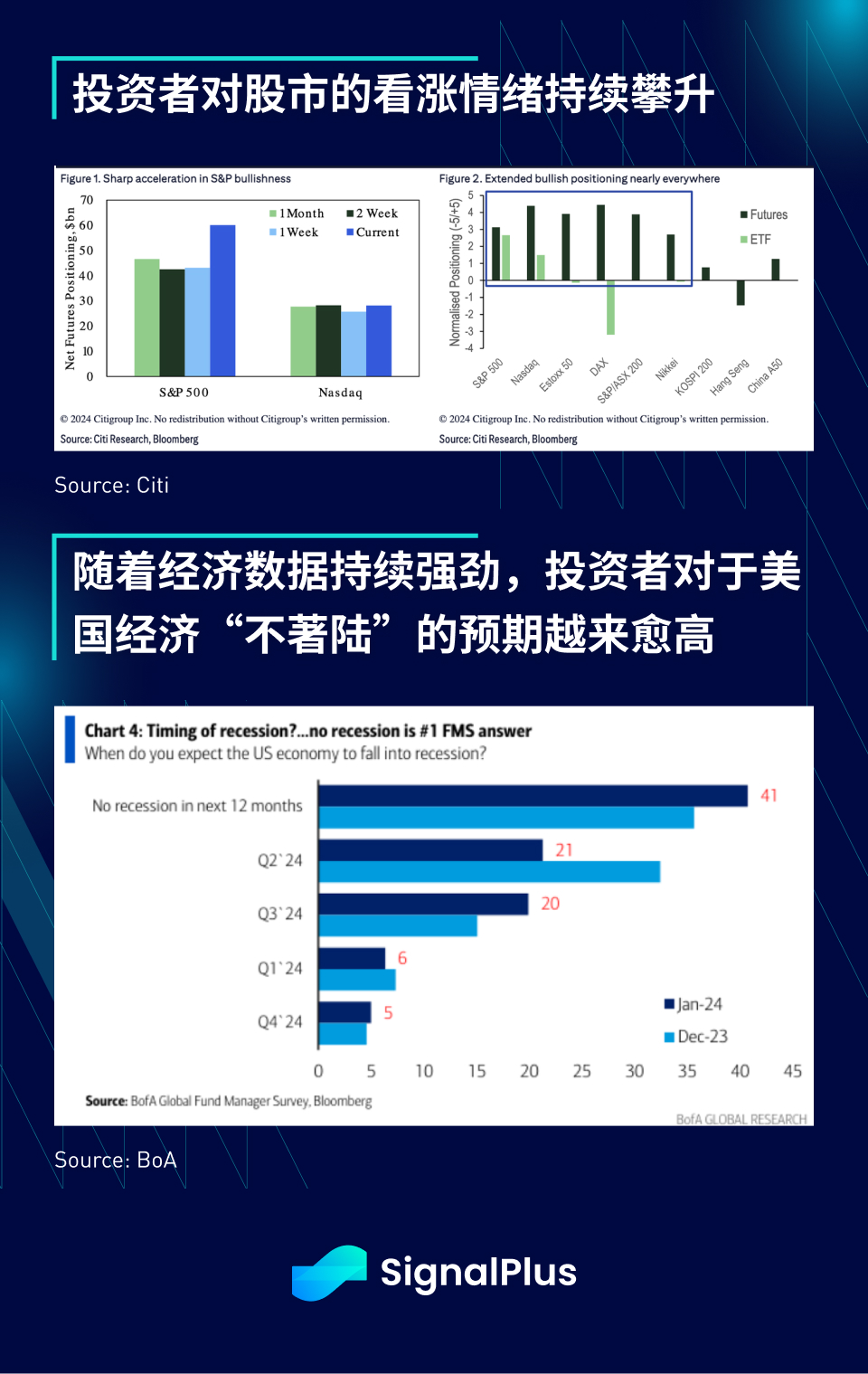

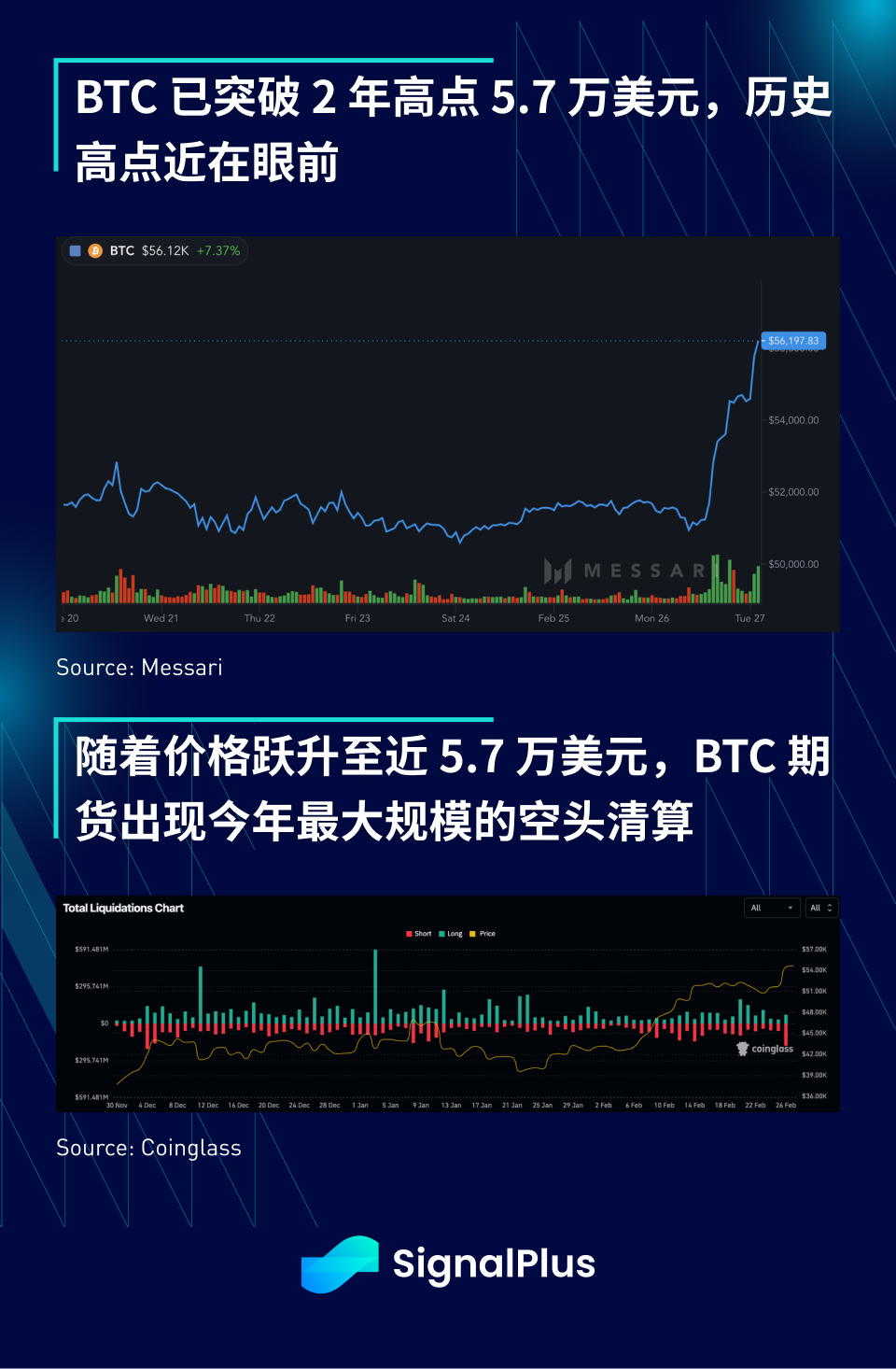

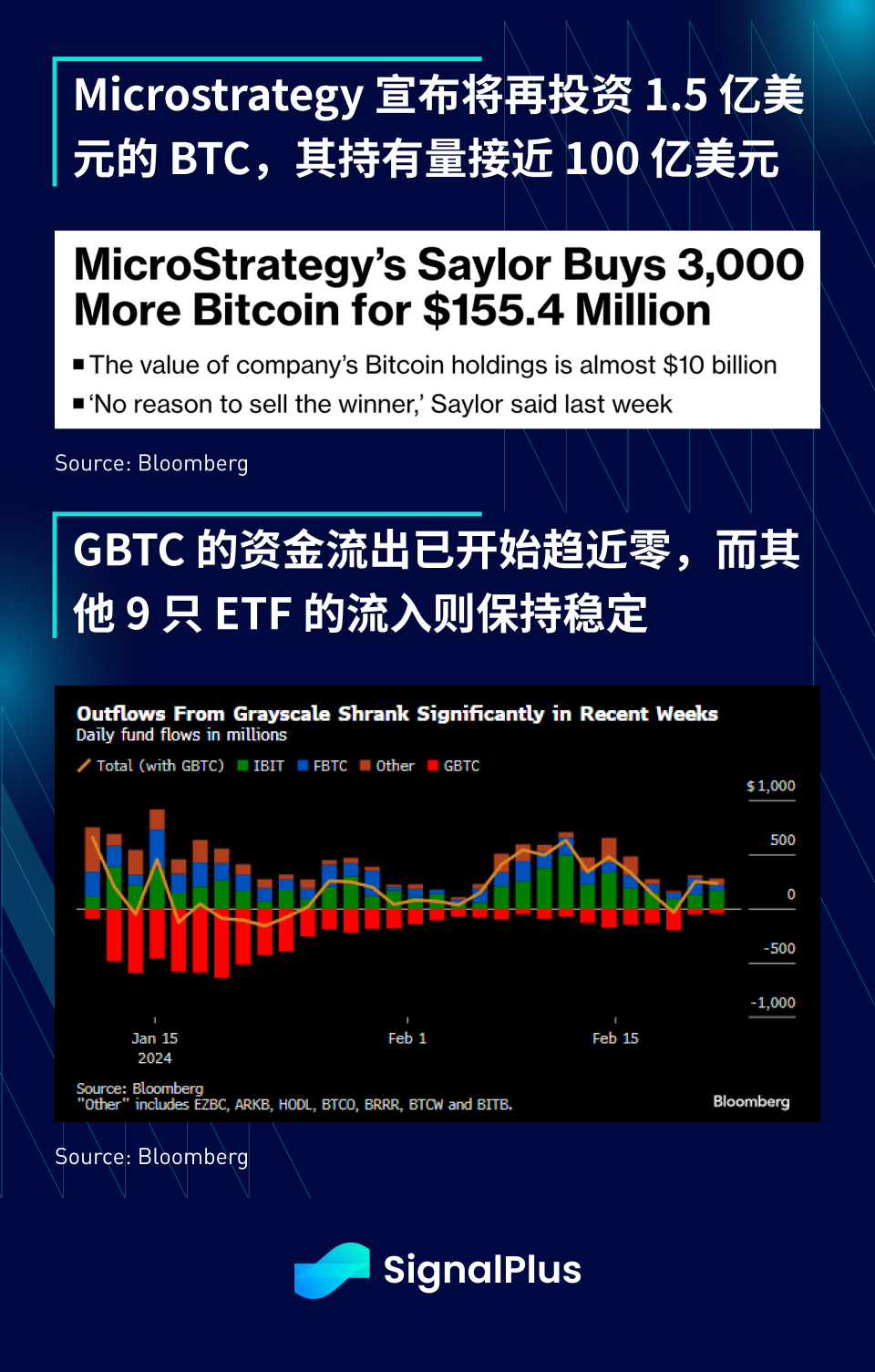

Speaking of FOMO, as of the time of writing this article, BTC has surged to nearly $57,000, and the market seems to be entering an accumulation phase. MicroStrategy announced an additional purchase of $150 million worth of BTC (bringing their total holdings to nearly $10 billion, with a cost as low as $31,000!). This news has once again boosted market confidence, while a decrease in outflows from GBTC and continuous inflows into new ETFs further support the narrative of mainstream market participation.

At the same time, analysts at the European Central Bank took the opportunity to reiterate that despite ETF approval, "cryptocurrencies are worthless" because they lack any intrinsic value (or something like that). Perhaps for central bank officials, buying negative-yielding bonds (approximately between 2016-2021) is a better "investment decision" for pensions...

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3 or join our WeChat group (add assistant's WeChat: SignalPlus 123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com