Galaxy比特币年度挖矿报告:直面哈希价格波动

Original author: Galaxy

Original translation: 1912212.eth, Foresight News

Summary

As we wrote a year ago, 2022 was the most challenging year for Bitcoin miners, as they faced headwinds that forced them to reduce costs, sell assets, and liquidate Bitcoin inventory at lower prices. In contrast, 2023 was a year of rebound, as significant growth in Bitcoin price, transaction fees, and network difficulty highlighted. The Bitcoin price rebounded from its low of $16,524 at the end of 2022 to $42,217 by the end of the year (+155%), mainly due to expectations of the approval of a physically-backed Bitcoin ETF.

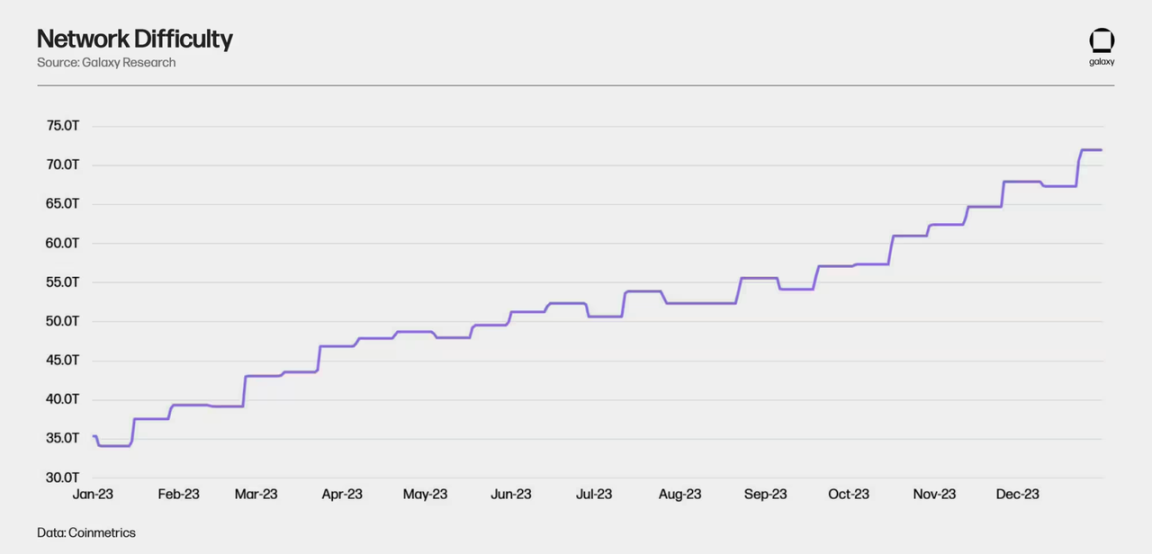

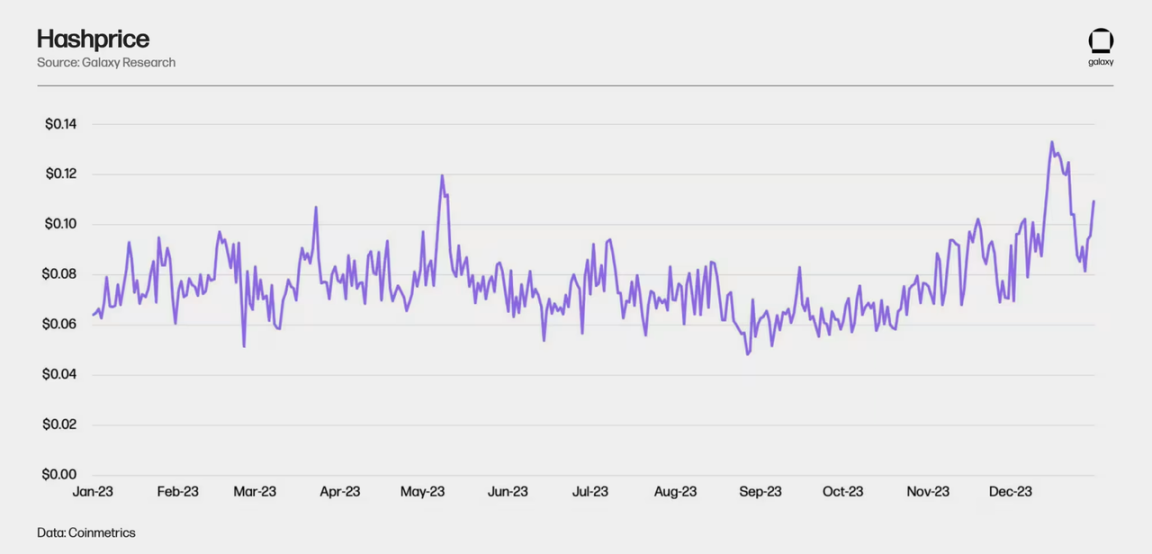

With the introduction of Inscriptions, transaction fees increased by 336% compared to the previous year, fueling the vibrant development of Web3 applications and Bitcoin tokenization. The combination of rising Bitcoin prices and transaction fees significantly increased the Hash price. The increase in Hash price, along with the introduction of updated and more efficient ASICs to the market, led to a significant increase in network difficulty (+104% YoY). Despite the substantial growth in network difficulty, the 7D Hash price ended the year at $0.095 (+57%). Another highlight of 2023 was the rise in international hashrate in regions such as the Middle East, South America, Bhutan, China, and Russia.

In preparation for the halving, several major miners made significant ASIC purchases using equity financing to expand their mining facilities' scale and improve efficiency. In this report, we delve into every significant event and trend that impacted the Bitcoin mining industry in 2023 and provide our outlook and perspectives on the situation for 2024, including the upcoming fourth halving.

As the title of this report suggests, Hash price volatility is the new frontier that miners must master after fine-tuning their operations during bear markets. Conquering the frontier of computational power is crucial for the survival of existing players, facing challenges such as halving and unstable transaction fees.

Key Points

After a turbulent 2022, miners had a much-needed respite in 2023, driven by rising Bitcoin prices, soaring transaction fees, and a drop in energy prices. The rapid increase in computational power offset some of these changes, with a 104% growth in computational power in 2023.

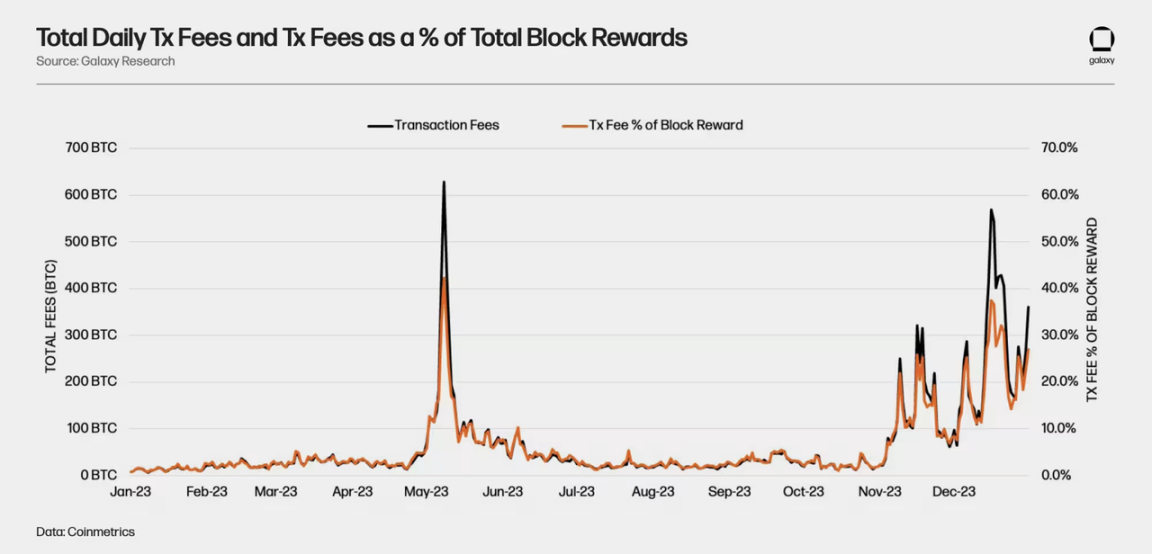

Transaction fees were the huge dark horse of 2023. The regular spikes in transaction fees throughout the year helped significantly increase miner revenues. The total transaction fees in 2023 amounted to 23,445 BTC, with Ordinals contributing 5,000 BTC. The fees in 2023 were over four times the total transaction fees in 2022, amounting to a total of 5,375 BTC.

With fluctuations in block space demands, computational power price volatility will increase in 2024, leading to sharp fluctuations in transaction fees and further changes in computational power.

During this year, miners purchased over 94 EH of mining machines worth over $1.53 billion. Miners focused particularly on purchasing the new generation of machines with efficiency below 20 J/TH to update their fleets before the halving.

It is estimated that network computing power will be between 675 EH and 725 EH in 2024.

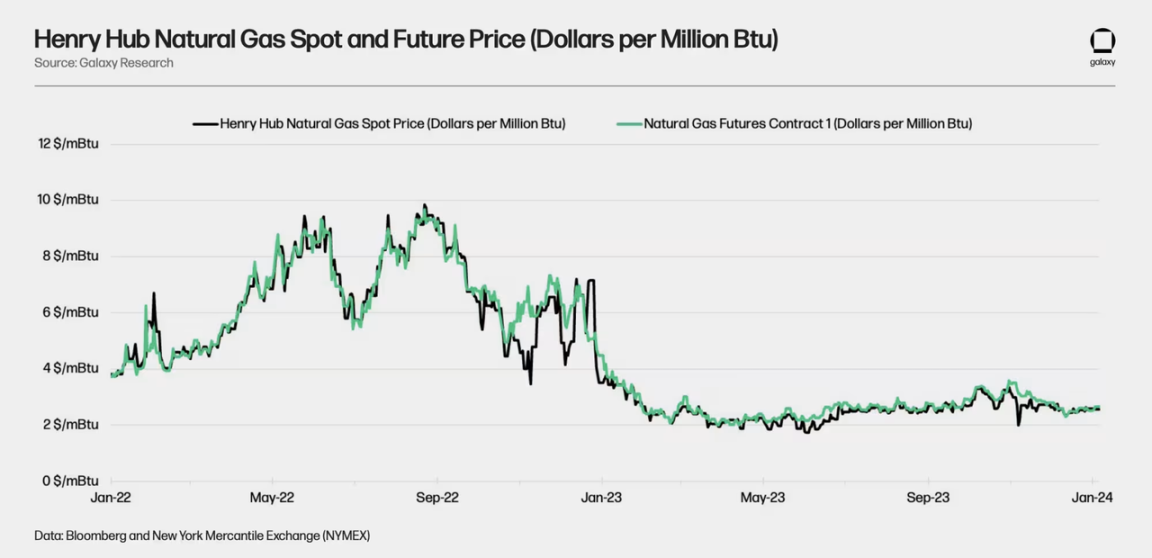

In 2023, the global mining electricity cost mainly influenced by natural gas remained very stable, especially in the United States. This is in stark contrast to the volatility caused by the Eastern European turmoil in 2022. The stable driving factors include record-high natural gas production in the United States, inventory surplus, reduced demand due to warmer temperatures, and a slight decline in industrial consumption, providing miners with a stable energy cost environment leading up to the upcoming halving event.

Bitcoin miners, facing income fluctuations and high dependence on transaction fees, are actively evaluating new risk management strategies, including hash rate derivative contracts and other tools, to ensure income predictability, stability, and maintain investor confidence.

2023 Review

Network Indicators

Bitcoin Price

The price of Bitcoin was $16,524 at the beginning of the year and $42,217 at the end of the year, an increase of 155%. The rise in Bitcoin price in 2023 was driven by the following factors:

The foundational effect caused by the initial slump of Bitcoin, due to the collapse of FTX and the forced sell-off of several well-known bankrupt companies at the end of 2022;

The banking crisis drew attention to the use cases of Bitcoin;

The announcement of multiple spot Bitcoin ETF filings/re-filings sparked people's enthusiasm for a large influx of capital into the asset after the approval of ETFs;

The historical price trends observed in previous halving events.

Transaction Fees

The total transaction fees in 2023 amounted to 23,445 BTC, more than four times the 5,375 BTC paid by users in 2022. The significant increase in script activity in 2023, particularly surrounding BRC-20 minting and trading, resulted in continuous fee pressure in May, November, and December. In 2023, fees generated by Ordinals transactions exceeded 5,000 BTC.

Network Difficulty and Hash Rate

By 2023, the network difficulty has increased from 35.3 T (implied hashrate of 253 EH) to 72.0 T (implied hashrate of 515 EH), a year-on-year growth of 104%. The hashrate growth in 2023 far exceeds that in previous years. The hashrate increased by 45.7%, 30.5%, and 34.8% in 2022, 2021, and 2020, respectively. There are several favorable factors driving the increase in hashrate this year, some of which we outlined in our mid-year report for 2023, including:

One of the biggest drivers of hashrate growth is the delivery and launch of new ASIC projects during the previous bull market starting in 2022;

Bitmain, MicroBT's new generation of relatively inexpensive miners, such as the M50 series, M60 series, S19k Pro, S21, T21;

Natural gas prices have decreased in 2023, reducing miners' energy costs;

Bitcoin prices have been continuously rising throughout the year;

Transaction fees have periodically skyrocketed, providing additional income for miners;

International hashrate is online;

ASIC manufacturers maintain the production capacity of their foundries and release new, more efficient models;

Miners underclock their miners to improve their balance of income and expenses;

Equity capital markets slowly open up in 2023, allowing miners to raise funds for recent growth opportunities.

Hashrate Price

The fluctuation of Bitcoin prices, transaction fees, and network difficulty collectively result in the hashrate price fluctuating between $0.06 and $0.10 for most of 2023. The hashrate price refers to the expected value of 1 TH/s of hashrate per day and is a function of BTCUSD, difficulty, and miner income (block subsidy + fees). The hashrate price briefly fell below this range at the end of August and exceeded this range during the increase in transaction fees in May, November, and December.

Energy Prices

Natural gas is a key pricing component for most of the electricity used by miners globally, especially in the United States, where it accounts for 30-35% of the world's implied hashrate. Natural gas prices are expected to be highly stable in 2023. This stability is in contrast to the significant fluctuations experienced in 2022, partly due to the unrest in Eastern Europe, which brought uncertainty to natural gas pipelines and global energy trade. During this period of prevailing uncertainty, there is a pressing global need for the production and storage of natural gas.

Multiple factors contribute to the relative stability of natural gas prices in 2023. In the United States, record natural gas production has surpassed consumption growth, playing a crucial role in maintaining price stability. At the same time, the increase in natural gas inventories further promotes this stability. During the first half of 2023, mild temperatures across various regions in the United States reduced heating demand, particularly in the residential and commercial sectors. This consistent and flat pricing trajectory provides miners with a more stable energy cost environment throughout 2023, offering welcome relief in terms of profits and positioning them favorably for the upcoming halving event.

Regulations

Some key legislation in 2023 may impact the operational capabilities of miners, particularly in ERCOT:

Texas House Bill 1929, released in the first half of 2023, requires significant virtual currency mining facilities with interruptible power demand to register within the ERCOT power region. This bill will take effect on September 1, 2023.

Texas House Bill 1751 proposes a ban on miner participation in ancillary services and grid balancing programs, but has not advanced further than congressional representatives. This bill has had a profound impact on the industry sentiment, as it represents the first offensive legislation against the mining sector in the ERCOT region.

The Digital Asset Mining Energy (DAME) tax, proposed by the Biden administration, seeks to impose a significant new tax on Bitcoin mining operations. Although the tax has been removed from the budget, it is a major victory for Bitcoin advocates.

New FASB rules permit the fair value measurement of Bitcoin on company balance sheets. We discussed this rule change in our previous end-of-year report (2022), and it is expected to primarily benefit miners with substantial BTC holdings, as it allows them to calculate their value at current prices, making their net profit figures more attractive. This change is expected to take effect in 2025 but allows for early adoption as well.

Senator Elizabeth Warren has proposed an extension of the Bank Secrecy Act (BSA), as part of the Digital Asset Anti-Money Laundering Act, to expand KYC requirements to miners.

Developments outside the United States indicate that countries are now competing to attract Bitcoin miners and provide clear regulations for the mining industry.

Russia continues to expand its regulatory framework, treating Bitcoin as an exportable commodity. By equating Bitcoin mining to natural resource extraction, Russia not only recognizes the importance of Bitcoin but also incorporates it into its economic framework. This is expected to further drive the country's recent expansion into the mining industry and provide a "business-friendly" alternative for countries with stricter policies.

2024 Regulatory Trends

Last year, the debate about the environmental impact of Bitcoin seemed to shift towards cautious optimism, and we expect this trend to continue in 2024, especially as the approval of Bitcoin ETFs in the spot market will change institutional attitudes towards the industry. Mainstream media's almost hostile coverage of Bitcoin mining has given way to more nuanced discussions about grid balancing, renewable energy incentives, and waste consumption.

However, we believe that the position of US mining pools may be challenged with the emergence of new mempool dynamics (MEV) and the adoption of new pool mining technologies.

There is a growing focus on the role of mining pools and miners in the transaction selection process. In the second half of 2023, two new mining pools (OCEAN and DEMAND) were established, focusing on decentralized pooled mining using technologies like Stratum V2. The main advantage of Stratum V2 is that it allows miners in a pool to participate in the block template construction process determined solely by the pool operator. Democratizing block template construction is valuable for decentralized mining, but this feature is optional for miners to join and is associated with some regulatory risks from a KYC/AML perspective, making it unlikely that most miners would want to create their own block templates.

Insights and Trends from Publicly Listed Miners

Capital Management Strategy

Despite increased revenues for the full year of 2023 due to the rise in BTC price and significantly higher fees, publicly listed miners sold relatively fewer BTC throughout the year.

In 2022 and 2021 during the bull market, listed mining companies basically adopted the HODL strategy in their production. As the market shifted and the price of Bitcoin declined, many listed mining companies were forced to sell assets to reduce their balance sheet leverage and pay for operational costs. Subsequently, the fund management strategy of listed mining companies has evolved towards a more cautious direction, either holding Bitcoin in a balanced manner or selling all Bitcoin directly for cash. With the improvement of the mining economy in the second half of 2023, listed mining companies have become more willing to hold more Bitcoin and bear the price risks that may arise from ETFs and halvings. Now, FASB has updated its guidance allowing for fair value accounting of Bitcoin held on the balance sheet of listed companies, and listed mining companies may be more inclined to accept holding Bitcoin on a larger scale on their balance sheets.

Market Share of Listed Mining Companies' Network Hashrate

The cryptocurrency market crash in 2022, coupled with rising interest rates, made it extremely difficult for listed Bitcoin mining companies to raise new equity or issue debt. Therefore, the stock and debt capital markets remained mostly closed in the first half of 2023, making it challenging for listed mining companies to prioritize growth for most of 2023. Mining companies from other regions also began to cut into the North American mining companies' share of the hashrate. In the second half of 2023, with the improvement of the mining economy, there was a greater demand for equity capital markets exposure to the mining industry. North American mining companies gained a significant advantage over private mining companies and mining companies from other regions by accessing capital through public markets.

Investment in ASIC Miners

In the first half of 2023, most mining companies remained focused on activating ASIC purchase orders from before 2022, while a few mining companies made significant purchases of ASICs. As the equity capital markets improved in the second half of 2023, particularly in the fourth quarter, several mining companies announced large orders for ASICs. It is worth noting that listed mining companies raised a total of $1.1 billion in equity capital in the first three quarters of 2023. With the improvement in Bitcoin price and sentiment, this situation may further accelerate in the fourth quarter (as of the time of writing this article, financial data of listed mining companies have not been released). A spot Bitcoin ETF has been approved. Compared to equity capital, only $44 million of debt capital was raised, highlighting the extreme challenges mining companies face in relying on debt as a means of growth financing.

With the rapid approach of the halving in the early second quarter of 2024, the main focus of miners is to improve fleet efficiency (reduce J/TH), while infrastructure and capacity expansion become secondary goals.

In this year, miners have purchased over 94 EH worth of mining machines, valued at over $1.53 billion.

In the second half of 2023, miner purchasing orders increased by 59.3%, from 39.4 EH to 62.8 EH. Miners are particularly interested in purchasing new generation mining machines with efficiency below 20 J/TH, such as the S 21/T 21 from Bitmain and M 66/M 56 from MicroBT.

As of now, miners have purchased over $393 million worth of mining machines in 2024, with CleanSpark and Pheonix leading the way.

2024 Forecast

Post-Halving Transaction Costs and Block Space Dynamics

Rising Transaction Fee Volatility

The block space market underwent fundamental changes in 2023 due to scripting and other emerging token standards. As discussed in detail in our Bitcoin Scripting and Ordinals reports, this year has seen incredible new developments for Bitcoin, bringing new demand for Bitcoin block space. In turn, this demand has introduced or exacerbated mempool dynamics in a way not fully understood by all market participants.

The direct consequence of this new activity is increased transaction fee volatility and periods of mempool congestion, indicating that relatively little activity on the blockchain can drive fees for Bitcoin miners to sustainable levels (sufficient to cover the diminishing Bitcoin issuance). The percentage of transaction fees to the overall block reward is an indicator commonly used to compare fee levels across different periods. In 2023, the network experienced absolute growth in transaction fees, with rewards frequently surging to over 25%, around half of post-halving miner revenue.

Especially the transaction fees generated by inscriptions may become the largest "wildcard" in Bitcoin miner income in 2024, but such usage is often unstable. Currently, the income of most miners (and mining pools) does not rely heavily on unstable transaction fees. For example, although we may expect computing power to decrease after halving, a significant increase in fees during the same period may increase revenue to a sufficiently high level, allowing inefficient miners to continue mining profitably, otherwise these miners will be unprofitable. In addition, although most industry participants are concerned about the impact of halving on the profitability of miners, significant changes in transaction fees in specific years may cause significant fluctuations in computing power prices, making it more difficult for miners to predict their income.

To mitigate this problem, we suspect that further financialization of the mining industry will lead to the emergence of block space and transaction fee futures, allowing miners to hedge transaction fee fluctuations. We may even see a new type of opportunistic miners who only come online when fees skyrocket, similar to how Texas miners exploit arbitrage opportunities in the ERCOT electricity market volatility.

The emergence of Bitcoin as a settlement chain for new economic activities (NTF, DeFi, stablecoins) will consolidate the demand for Bitcoin block space and bring new dynamics to the memory pool. If 2024 is similar to 2023, we are likely to witness some narrative innovations in Bitcoin, which bring new utility to Bitcoin and therefore more value to BTC).

Another thing to consider in 2024 is the possibility of more complex forms of MEV appearing on the Bitcoin blockchain. In 2023, we experienced two types of "MEV-like" events, both of which had a significant impact on market participants. New types of "MEV-like" events may also emerge in 2024.

Using RBF in a high fee environment will affect memory pool activity

For regular users, the use of fee increases is becoming increasingly common and useful. RBF or "Replace-By-Fee" is one solution for Bitcoin users to increase transactions when they are stuck in the memory pool due to fee increases. RBF allows users to increase the fees of previously broadcast transactions, thereby increasing the incentive for miners to include them in blocks. With other solutions such as Child Pays For Parent (CPFP), RBF is especially useful during peak fee periods as it allows users to confirm their transactions more quickly through the network when needed. As we explained before, 2023 was a year of transaction fee fluctuations, so users found it more difficult to understand and set the "correct" fees for their transactions, resulting in a significant increase in RBF usage.

In turn, the increase in RBF usage leads to higher fees in the memory pool and higher miner revenue. The typical replacement fee is 20% to 50% higher than the fee of the original transaction, which increases the incentive for miners to include these transactions in blocks.

Although technical users often use RBF to increase fees, other solutions have emerged to help ordinary users. These services are called "transaction accelerators" and are promoted by mining pools like Binance and data aggregators like Mempool.Space. Accelerators allow users to make direct payments to a liquidity pool (using fiat currency or bitcoin off-chain) to have their transactions included in the next block. These off-chain (OOB) transactions do not reflect in the total reward of a block but can significantly increase miner revenue.

As the competition for block space intensifies, the optimal fee rate for transactions becomes increasingly unpredictable. Therefore, as the financialization of block space continues, we can expect OOB transactions to occupy a larger proportion in pool/miner revenue.

With the ongoing rise in transaction fees, the fee share of RBF transactions will increase by 2024. An surprising finding from an analysis of RBF substitutes is the amount of fees generated by such transactions:

Under normal mempool conditions, the fee share generated by RBF substitutes hovers between 10% and 20%, surging during low fee periods, reaching a peak of 50% in September 2023.

With the upcoming halving and the doubling of the proportion of transaction fees in block rewards, RBF transactions will become more relevant for miners, thus providing greater incentives for miners to run full RBF nodes to examine these transactions in the mempool and include them in their block templates. According to Bitcoin developer Peter Todd's research, as of August 2023, at least 31% of the hash power from 4 different mining pools is mining full RBF (possibly reaching as high as 70% by January 2024).

Peter Todd's proposal for "one-time fee substitution" will also be a major factor in providing additional incentives for miners to run full RBF nodes. In fact, this new RBF policy will come into effect through "allowing replacement only when [the fee] immediately makes the transaction close enough to the top of the mempool to be mined in the next block or so," which increases competition among high time-preference users of the blockchain. In a sense, this new form of RBF can provide a constant level of demand for the next block, which determines the overall transaction fees for miners.

In looking ahead to the future, we anticipate proposals centered around memory pools, such as Cluster Mempools, Package Relay, V3 Transaction Relays, and Ephemeral Anchors, will provide users with more tools and policies to determine optimal fees based on their needs. This will help avoid overpaying for transactions while also benefiting miners by allowing them to construct more efficient block templates.

Exploring the Relationship Between Block Time and Fees

Historical data shows a close relationship between block time and fees. Considering that unprofitable miners may go offline during halvings and periods of increased block time, we quantified the impact that increasing block time may have on exacerbating fee pressure.

Except for in 2009 and 2021, the average block time has been faster than the 10-minute block interval set by the Bitcoin network. In the past three years (since January 1, 2021), the average block time was 9 minutes and 51 seconds, corresponding to a sharp 262% increase in mining difficulty during the same period. This leads us to believe that this phenomenon may affect miners' income by naturally reducing the cost levels of the mempool. Although this concept is easily understandable and logically sound (more frequent blocks result in shorter periods of fee pressure), we find that its consequences are often overlooked.

Firstly, we conducted a correlation analysis of block time and the average Sats/vByte of median transactions per block, starting from block 390,000 (mined in December 2015) to block 825,460 (estimated to be mined in January 2024), in order to confirm this relationship with on-chain confirmations. Generally, the median Sats/vByte (fee) steadily increases with longer block times, although this relationship becomes less apparent as block time deviates from 10 minutes. The following graph displays the total number of blocks mined at different one-minute intervals from 0 minutes to 100 minutes, as well as the median Sats/vByte for each block:

In addition, we can quantify the relationship between block time and median transaction fee in Sats/vByte by conducting regression analysis. The analysis below indicates that, on average, for every minute faster than 15 minutes that blocks are mined, the fee decreases by about 2.2 Sat/vByte per minute (or approximately 4% of the median block fee of about 54 Sats/vByte for blocks mined in about 10 minutes). However, for every minute slower than 15 minutes, the fee increases by 0.71 Sat/vByte per minute (or approximately 1% of the median block fee of about 54 Sats/vByte for blocks mined in about 10 minutes). We differentiate between trends of block times below and above 15 minutes because there is a noticeable change in slope around that block time. After 15 minutes, the impact of longer block times on fees gradually diminishes. One reasonable explanation for this phenomenon is that beyond 15 minutes, the block template is likely close to its final form, and unless there are significant changes in the mempool (i.e., from ordinal sets being written into), it becomes increasingly unlikely for other transactions to replace the currently expected ones in the block.

The inference from these findings is that fees have naturally decreased over the past few years with the expansion of network hash power, and this trend is expected to continue until 2024 unless exceptions occur during the halving, when a decline in hash power could increase fee pressure.

While hash power itself may not be a primary catalyst for overall fee rates, it undoubtedly has the potential to amplify existing fee dynamics. For example, the recent surge in fees has been primarily driven by a surge in block space demand rather than corresponding changes in hash power. However, if block times slow in 2023, it could exacerbate these peaks, leading to longer intervals between blocks and a more pronounced accumulation of fees.

Next, we leverage the above content to understand the impact of this relationship between block time and transaction fees on miner revenue, as transaction fees become more important after the halving. By extending these analytical results to overall mining revenue, we can begin to explore how the halving and ongoing competition among miners to enhance mining capacity will influence fee rates. An example of how miner activity affects block time and fees is when a majority of miners in ERCOT simultaneously reduce their operations due to high electricity prices, causing a sudden increase in network fees.

To illustrate this point, if we anticipate approximately 20% of network hash power to go offline during the halving period, block times would on average increase by 20% before adjustment. This is due to a mechanism called "difficulty adjustment," where mining difficulty (the average expected time to find a block) is adjusted every two weeks (2016 blocks) to keep block times around 10 minutes.

Using the relationship we previously derived for block times less than 15 minutes, this would result in a corresponding 8% increase in the average fee rate (12 minutes block time, meaning 2 minutes higher than the 10-minute target, multiplied by a 4% increase per minute - all other conditions being the same). To put this into perspective, if we apply it to a fluctuating fee period, such as epoch 407 (adjusted upward +6.98% between blocks 820,512 and 822,528), an 8% increase in fees over this difficulty period would mean an additional 355.7 bitcoins (calculated at a bitcoin price of $42,000, totaling $15 million) in miner fee revenue.

On the other hand, if the average block time in 2024 is around 9.5 minutes (compared to an average block time of 9.74 minutes in 2023), we can expect a theoretical negative impact of about 2% on miner revenue from transaction fees. (This analysis focuses solely on the impact of hashrate on fees, and not the income increase associated with the halving and the subsequent difficulty decrease.)

* However, some might argue that the extra income from obtaining more block subsidies due to miners mining more blocks in a given year would largely compensate for the suppressed revenue from lower fee rates. In fact, both interpretations are valid and depend on your time preference (i.e., miners generating more income in a given year but speeding up the arrival of another halving by mining blocks faster).

In conclusion, the increase in engraving activity, the growing usage of fee replacement (RBF), and the slowdown in block times could collectively coordinate to create an unprecedented surge in fee pressure and volatility coinciding with the halving event in April.

Risk Management Strategy

Power Hedging

The expected volatility of hash prices during the upcoming halving period in April 2024 adds an additional layer of complexity to miners' energy strategies. Miners are distributed across different geographical regions and operate their electricity in various ways, including standard grid connections, renewable energy hosting, waste gas power generation, and more. Miners facing variable grid pricing need to approach their energy management strategies with caution.

The table below shows the break-even revenue per megawatt-hour (in USD) generated under different combinations of queue efficiency and hash price. Electricity costs above this break-even threshold will result in ASICs being unable to turn a profit. At the time of writing, the hash price is 0.082 USD (with a BTC price of 43,000 USD, 10% fees, and 520 EH), which will decrease to 0.045 USD after halving. At this hash price level, miners with a fleet efficiency of 30 J/TH require an energy price below 63 USD/MWh to achieve positive gross profit.

Some miners with grid interconnection face the task of determining the proportion of total capacity they want to hedge. Miners choosing higher index exposures face the risk of long-term energy prices exceeding their fleet's marginal break-even point, leading to increased downtime and reduced bitcoin mining. Miners hedging energy prices can withstand energy price fluctuations and capture upside risks, but there is a risk of locking in a fixed hedge price that exceeds their marginal break-even point and spot electricity settlement prices.

This analysis also highlights the importance of prioritizing miner efficiency. In the above scenario, if the hash price falls below 0.07 USD, older generation miners with an efficiency of 35 J/TH will become unprofitable, while miners with S21-based miners will require a hash price below 0.04 USD to remain profitable, hedging electricity costs at 80 USD/MWh. In a hosted environment, miners with newer generation miners can still tolerate higher fixed fee contracts post-halving.

We can also observe the impact of efficiency improvements on gross margins. In the table below, we adjust the previous table, assuming a fixed energy price of 80 USD/MWh, and calculate the gross margins for different efficiency miner fleets at different hash price levels.

The table above shows that at a hash price of 0.07 USD, the fleet with an efficiency of 35 J/TH generates a gross margin of only 4%, while the fleet with an efficiency of 17.5 J/TH still maintains a strong 52%.

In conclusion, the decision for miners to enter into different forward hedges becomes more complex post-halving and largely depends on queue efficiency. Miners face risks in entering hedges where the fixed prices they take exceed their miners' marginal break-even point and spot electricity prices, resulting in either unprofitable mining or hedging at currency prices.

Production Hedging

Bitcoin mining bears interesting similarities to traditional commodity production businesses, such as the practices in the oil and gas industry. In some cases, the similarities are striking. However, there are significant differences in the realm of risk management, which may receive more attention from publicly listed miners and result in greater disclosures.

2023 is a period of upheaval for miners, especially in the context of block rewards. As we mentioned above, this volatility can be attributed to innovative bidding strategies and the rising transaction fees resulting from the utilization of block space. As the anticipated halving event draws near, miners have found themselves increasingly reliant on transaction fees to sustain their income and offset the upcoming reduction in collective subsidies. This high level of dependence and the accompanying uncertainty are driving miners to explore hedging strategies, becoming critical elements of more robust risk management practices. This move is not only aimed at appeasing investors but also indicates a strategic shift towards utilizing various derivatives that are suitable for their risk profile and speculative tendencies.

Although there are several positive aspects to using such derivative products, they also present many challenging issues that may result in a scarcity of seller products and a lack of buyer activity. The complexity of these contracts, especially the differences between cash settlement and physical settlement variants, poses complex challenges. In particular, contracts involving physical settlement bring significant counterparty risks that involve not only computing power operators (miners) but also the mining pools they choose and other factors that affect normal operating times.

The market reflects these complexities, with the illiquidity of this structured product being evident, highlighting its poor pricing efficiency. As we enter 2024, the new year brings a fresh perspective on the fluctuation of miner income, caused by the halving as well as the rise of ordinal and launch activities. The ever-changing landscape prompts a reassessment of the complex dynamics surrounding these derivative contracts.

In addition to computing power derivatives, miners have a plethora of choices to hedge and integrate various risk management products into their strategies. This includes options, costless collars, and forwards. These simple structures have high liquidity and short execution times.

Bitcoin miner strategy divergence

In 2023, due to the lower hash price in 2022 and the uncertainty surrounding the upcoming 2024 halving event, there have been significant divergences in Bitcoin miner business models. Consequently, the entire industry has reflected on its cost structure, prompting miners to seek ways to improve profit margins. As electricity costs account for a significant portion of total cash expenses, miners have refined their energy strategies and approached the source through vertical integration to avoid additional hosting fees. In this paradigm shift, miners with hosting business lines have found themselves forced to recalibrate their contractual economics to better align with mining cash flows. Finally, with the decrease in mining industry capital, some miners have ventured into high-performance computing (HPC) in an attempt to leverage other sources of capital, particularly in the context of soaring valuations in the artificial intelligence industry. Below, as the halving approaches and the approval of physically settled Bitcoin ETFs, we will delve into the feasibility and impact of these different business models for 2024.

Vertical Integration

By 2024, we expect increased volatility in hash prices due to factors such as cost/memory pool dynamics, the approval of spot Bitcoin ETFs and their impact on prices, and the potentially significant fluctuations in difficulty after the halving. To better protect themselves from the effects of hash price fluctuations, we expect miners to drive further vertical integration by eliminating additional costs from third-party intermediaries and positioning themselves at a lower point on the cost curve. Lack of infrastructure, hosting proprietary mining operations can certainly help miners generate cash flow on miners, and miners who choose this route will have to focus on deploying new generations of miners and finding hosting partners with favorable conditions.

Hosting Business

The hosting landscape will undergo changes in 2024. Hosting providers may prioritize working with clients who can deploy new generation miners that achieve higher breakeven dollar thresholds per megawatt hour, ensuring that clients can stay online as much as possible.

In particular, contracts signed with miners who own older machines must also be built in a manner consistent with the miners' cash flow generation. This means that hosting contracts will shift from fixed-price contracts to cash flow splits, especially for clients seeking to deploy older generations of miners. Cash flow splits allow hosting providers to benefit from an increase in hash prices, while miners can remain profitable when hash prices decline. Energy reduction splits may also become common, providing upside risk to energy prices for miners and hosting providers while reducing the overall costs of Bitcoin mining.

Hosting still provides miners with a capital-efficient way to grow by monetizing as much available power as possible by filling temporary capacity available on third-party miners. Companies that can effectively manage energy prices can generate relatively stable cash flow, which helps underwrite infrastructure.

High-Performance Computing (HPC)

Due to lower computing power prices, a lack of funds available to support mining growth, and the booming development of artificial intelligence, some mining companies have announced expansion plans into the HPC data center sector in 2023. These companies aim to diversify their sources of revenue and acquire different sources of capital before the halving. The scarcity of large-scale power generation in the primary and secondary markets in the United States further drives the transition to HPC for mining companies.

The transition from Bitcoin mining to high-performance computing is a complex task, with fundamentally different business models. From a construction and design perspective, HPC data centers have more complex parallel network structures, fine-tuned to optimize data throughput for faster runtime. They also adhere to stricter redundancy and cooling requirements to minimize unplanned downtime. While the required uptime depends on the client and can be relaxed in certain cases, HPC data centers must also have appropriate caching mechanisms to seamlessly resume operations from interruption points when the system comes back online, which is not the case for Bitcoin mining data centers. As a byproduct of these more detailed construction specifications, the capital requirements for building high-performance computing data centers are several orders of magnitude larger than those for Bitcoin mining data centers.

From an operational and financial perspective, these businesses also have differences. HPC enterprises can coexist with other cloud service providers (CSPs) or create their own cloud platforms. The former is much simpler, with data center operators signing leasing-type agreements with CSPs and primarily focusing on site management with minimal interaction with end users. The cash flow in this leasing structure is usually stable and recurring, with profit margins higher than those of mining hosting businesses. In the latter, the company must establish a more extensive software, sales, and billing teams to expand the customer base and enhance user experience. Unlike the leasing scenario, providing cloud services may also mean investing in GPUs that interact with the cloud platform. This adds a significant amount of additional capital required. However, as CSPs, these enterprises may be able to charge higher fees to end clients compared to intermediate CSPs that interact with the end clients.

There are also external variables that companies cannot control, which bring risks to operational vitality. The soaring demand for new-generation GPUs and related infrastructure has led to medium-term supply shortages, making it difficult for enterprises to receive equipment on predictable timelines.

Compared to Bitcoin mining, the generated cash flow may be higher and less volatile. Although the HPC expansion announcement has accelerated the valuation of certain companies, the most important factors for the success of this business sector are the capabilities in construction, design, operations, and finance. It is also necessary to mitigate the external risks mentioned above. Companies entering this field in 2023 are still in the early stages of growth, and 2024 will be a true test of their survival capabilities.

Entering HPC in a bear market has helped miners find new sources of funding in 2023. However, there are inherent opportunity costs in allocating electricity to Bitcoin mining compared to HPC workloads. With the approval of a Bitcoin ETF and the expected capital inflow into the industry, companies may reorient themselves towards the continuously growing mining business. In the long term, companies that expand too quickly in the field of high-performance computing may find reduced correlation with Bitcoin prices, limiting their upside potential as investors place more value on the business as a traditional data center rather than a Bitcoin proxy.

Impact of Bitcoin ETF on Miners

With the approval of Bitcoin ETF products, investors can now directly access Bitcoin prices. Before the approval of ETFs, listed mining company stocks were one of the only traditional tools through which investors could gain exposure to the appreciation of Bitcoin prices. In the short term, the approval of ETFs is likely to become a factor for investors considering investing in publicly traded mining stocks. Retail investors may continue to view mining companies as leveraged long positions in Bitcoin trading, with ETFs as the primary performance benchmarks. On the other hand, institutions appear more likely to take long positions on Bitcoin ETFs and short mining stocks, a trend we have observed since early 2024.

In the long run, Bitcoin ETFs should pose competition to listed mining companies. As more sophisticated investors enter the market, Bitcoin miners will have to prove through their earnings why they are a better investment than spot Bitcoin. Miners' beta values and trading multiples on Bitcoin should depend on their ability to generate strong free cash flow. This could pose financing challenges for companies with lower profit margins, higher costs, and a poor track record of return on capital. Mining companies' stock prices should also react negatively to dilution as a means of financing growth, unless they can demonstrate strong prospects for return on capital, as investors can purchase ETFs without the concern of dilution. However, Bitcoin miners can benefit from the inclusion of a wider range of ETFs and fund products as well as research and reporting, which outweigh some of the disadvantages of increased competition from Bitcoin ETFs.

Mergers and Acquisitions

The fourth halving still brings potential challenges. Mining companies that are unprepared for the halving may find themselves at a disadvantage, although upgrades and joint ventures can enhance operational resilience. The increase in M&A activity in 2024 is partly due to the following reasons:

Attractive small-cap stocks: Public mining companies with smaller market capitalization may become attractive targets for mining companies with better access to capital and stronger liquidity, especially those with lower debt levels.

Targeting verticals: Private mining companies, especially those with higher levels of vertical integration, may become targets for acquirers or mergers with synergies, allowing them to reduce mining costs and have better control over their own destiny. For example, some mining companies with lower levels of vertical integration lack the ability to reduce operations when their computing power exceeds breakeven prices.

Value deals: Private mining companies with lower valuations, undergoing restructuring, or seeking survival routes may be attractive targets for acquisition. Acquirers may see these as value deals and expect future returns when market conditions improve.

Physical options: Mining operations demonstrate positive immediate cash flow, assuming lower energy costs and minimizing operational expenses at current hash price levels, providing an attractive entry point for robust IRR. This claim becomes more appealing when site acquisition costs fall within acceptable ranges, especially when managed by operators with experience in operating mining facilities. Additionally, sites located in relaxed regulatory markets may be seen as more valuable by bidders, as these facilities can act as proxies for monetizing electricity that would otherwise face power cuts. The strategic positioning of mining operations in such markets enhances their value proposition, aligning with a broader trend of industry participants seeking to optimize operational efficiency.

Over the past year, mining companies have faced issues of financial strain and poor liquidity. Through the strategy of raising funds through ATM stock issuance, despite significant discounts and dilution of shareholders, the main objective is to upgrade ASIC clusters, but this has made miners more urgently search for suitable locations to accommodate the influx of computing power.

Due to existing sites being fully operational and limited understanding of new production capacity, there is an opportunity to explore the acquisition of sites or entities that can accommodate orders. Finding such opportunities may be challenging as many power-on schedules extend to 2025 to 2026, and the delivery time for deferred delivery orders for power infrastructure is also long.

However, 2024 will be a critical year as these networks are ready to fill this new computing power. Mining companies' current trading conditions are much better than early 2023, and they are eager to make acquisitions to meet their growing liquidity and capacity needs.

Computing Power Forecast

Estimating network computing power during the halving event is an extremely difficult task due to the significant impact of sensitivities to mining's economic viability. Nevertheless, we have employed a top-down approach and utilized a range of scenario modeling to attempt to provide a reasonable range of expectations for end-of-year network computing power. We propose a method for forecasting computing power. There are other methods that can be adopted, such as a bottom-up approach, which may yield slightly different conclusions. Based on our analysis, we expect the network computing power to be between 675 EH and 725 EH by the end of 2024.

Method

In our preliminary analysis, considering different Bitcoin price levels and different levels of implicit hash prices after the halving, we examined how much computing power the network can tolerate assuming transaction fees are 20% of block rewards.

Using the table above, we can see the implicit computing power for different levels of hash prices and BTC prices. We estimate that with the increase in the vitality of new-generation mining machines, the lower limit of the new hash price breakeven point for the network after the halving may be $0.035. In order to arrive at this estimate, we analyzed the breakeven hash prices of various ASIC models at different electricity costs. We use $0.035 as a reasoned guess for the low point of the hash price for the next cycle, which represents a 36% decrease compared to the low point of the hash price in the current cycle. Additionally, $0.035 represents the average breakeven hash price of new-generation mining machines with a cost of $75 per megawatt-hour of electricity.

As shown in the analysis, even with relatively high electricity costs for miners, the latest generation of miners (such as the S 21, T 21, or M 60 S series) can still be profitable at very low hash prices. This indicates that even without substantial improvement in the price of Bitcoin, there is still significant room for increased computing power after the halving. Additionally, if miners can obtain cheap electricity or underclock their miners, they can still profit by operating the S 19 j Pro. Since the S 19 j Pro currently dominates the network, we may not observe a significant portion of these miners going offline after the halving.

Based on these two studies, if the price of Bitcoin in 2024 is between $45,000 and $55,000, assuming a lower limit hash price of $0.035, the network hash rate could reach as high as 694 EH - 849 EH. In order to profit under these conditions, the ASICs that may constitute the majority of the network are the S 21, T 21, M 60 S, S 19 XP, and M 50 series miners. However, the main constraint will be the supply chain and production capacity of these new generation miners, as well as the capital required to acquire them. Based on the current delivery schedule, it is highly likely that we will not see the new generation miners surpassing the S 19 and M 30 series miners until 2025.

Next, we would like to understand some limitations on computing power growth, such as infrastructure availability. To do this, we quantified how much hash rate the network can support if we assume all existing miners are currently replaced by the new generation miners. In the left column of the table, we sensitize the current network efficiency to calculate the implied power capacity supporting the network (assuming a network hash rate of 500 EH).

If we assume the current average network efficiency is 30 J/TH, equivalent to a power capacity of 15 GW, and if we assume each existing ASIC in the network is replaced with the ASIC model proposed in the analysis, 30 J/TH is a reasonable benchmark assumption as it is the efficiency of the S 19 j Pro miner.

Next, assuming the average miner efficiency in the network is 30 J/TH, we can increase the net growth of computing power by replacing existing miners in the network with the new generation miners. The previous sensitivity table reflects the theoretical upper limit based on the assumption that all miners in the network are replaced with the new generation miners. However, in reality, we know that due to supply chain and capital constraints, as well as miners being able to profit by underclocking or operating older generation miners with lower electricity costs, this scenario is highly unlikely to occur.

For example, the table shows that if we assume that 25% of the mining machines are replaced by M 60 S mining machines, the network hash rate will increase by a net of 78 EH.

Next, we create a sensitivity table for additional infrastructure capacity that may be activated in 2024, assuming that this new capacity will be enabled through various new generations of ASIC models. If we assume that the average efficiency of mining machines commissioned in 2023 is 30 J/TH, this means that the additional capacity that year is 8 GW. However, the growth and expansion capacity delivered in 2023 is largely due to the investment cycle in 2021.

To bring all the analysis together, we combine the results of the mining machine replacement sensitivity table and the expansion sensitivity table to create the table below, which shows the total potential computing power range at the end of 2024. The annual network computing power is 500 EH, and it includes the computing power added to the network due to various capacity expansions, as well as the percentage of existing mining machines replaced (assuming S 21, T 21, M 60 S, S 19 XP are evenly distributed) and M 50 S++ mining machines.

Based on public announcements from mining companies regarding infrastructure expansion and ASIC purchases, we believe that 2-3 GW of infrastructure capacity will be added in 2024, and 25-35% of existing ASICs will be replaced by new ASICs, which is reasonable. According to our analysis, the estimated computing power range at the end of 2024 could be 675 EH to 725 EH, which corresponds to a 35-45% growth in network computing power for that year.

How much computing power could be offline during the halving?

According to Coinmetrics data, by the end of 2023, about 19.7% of the network's computational power will be composed of M 20 S, M 32, S 17, A 1066, A 1246, and S 9 miners. The estimated network computational power at the end of the year is about 515 EH, with these miners contributing approximately 98 EH to the network's computational power. To estimate the percentage of offline miners, we calculated the profitability of popular ASIC models in the network, considering the halved economic estimates, with a bitcoin price of $45,000, a block subsidy of 3.125, and transaction fees accounting for 15% of the rewards per megawatt-hour. We then carried out a combined analysis of forward-looking electricity prices and the implied power costs of listed miners to understand the percentage of offline computational power estimated by our ASIC models.

Given the sensitivity of the profitability of various ASIC models to changes in bitcoin price and the percentage of transaction fees in rewards, we estimate that 15-20% of the network's computational power from the ASIC models described below may go offline, which means a range of 86-115 EH.

Miners operating these older and less efficient miners are likely running custom firmware to improve ASIC efficiency and raise their breakeven thresholds. Additionally, some ASIC models are likely to not exit the network completely but instead be passed on to miners with lower electricity costs. For miners no longer able to run S 19 and in need of an upgrade, miners currently operating S 17 or less efficient models can upgrade their miners to S 19 or S 19 j Pro.

Conclusion

2023 is a year of growth and recovery for the mining industry, with miners benefiting from higher bitcoin prices, increased transaction fees, and lower energy costs, resulting in significantly improved computational power prices and profits despite doubling network computational power this year. Looking ahead to the halving, miners are leveraging equity capital market liquidity and improved demand to fund infrastructure expansion and ASIC purchases for improved efficiency.

With the upcoming halving, we expect computing power to continue to rise, thanks mainly to the installation of new-generation miners such as the T 21, S 21, and M 60 series. As the halving approaches and miners find their position and adapt to the post-halving economic situation, there may be an increase in mergers and acquisitions of private miners and infrastructure. Lastly, we believe that the fluctuation of transaction fees is the biggest "wildcard" in the post-halving mining industry, as it will become an important driver of hash price, difficulty, and block time differences, and will have a wider impact on mining pool payment plans and miner reduction signals.