SignalPlus波动率专栏(20240226):ETH站上3000关口,IV维持高位

Since the release of Nvidia's better-than-expected financial report last week, the technology sector has seen an amazing rise. Although it fell slightly on Friday due to some profit taking, the US stock market remains near its all-time high. On the other hand, bearish economists have been revising up their forecasts for US economic growth, with the likelihood of an economic recession falling to less than 40%. The median forecast for economic growth in 2024 is 2.1%, and Goldman Sachs has pushed back its forecast for the first Fed rate cut to June due to strong economic data. The current market probability of rate cuts in May and June is priced at around 22% and 68% respectively. As for US Treasuries, the 10-year yield experienced a sharp drop in the US afternoon session on Friday, now at 4.242%, while the 2-year yield fell to 4.682%.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

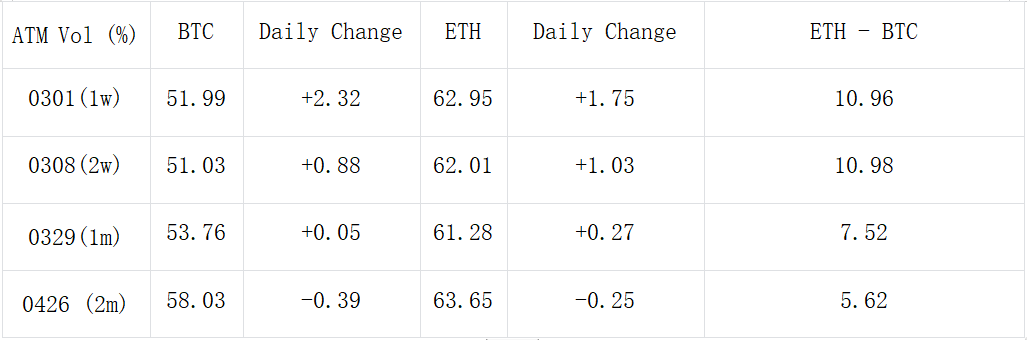

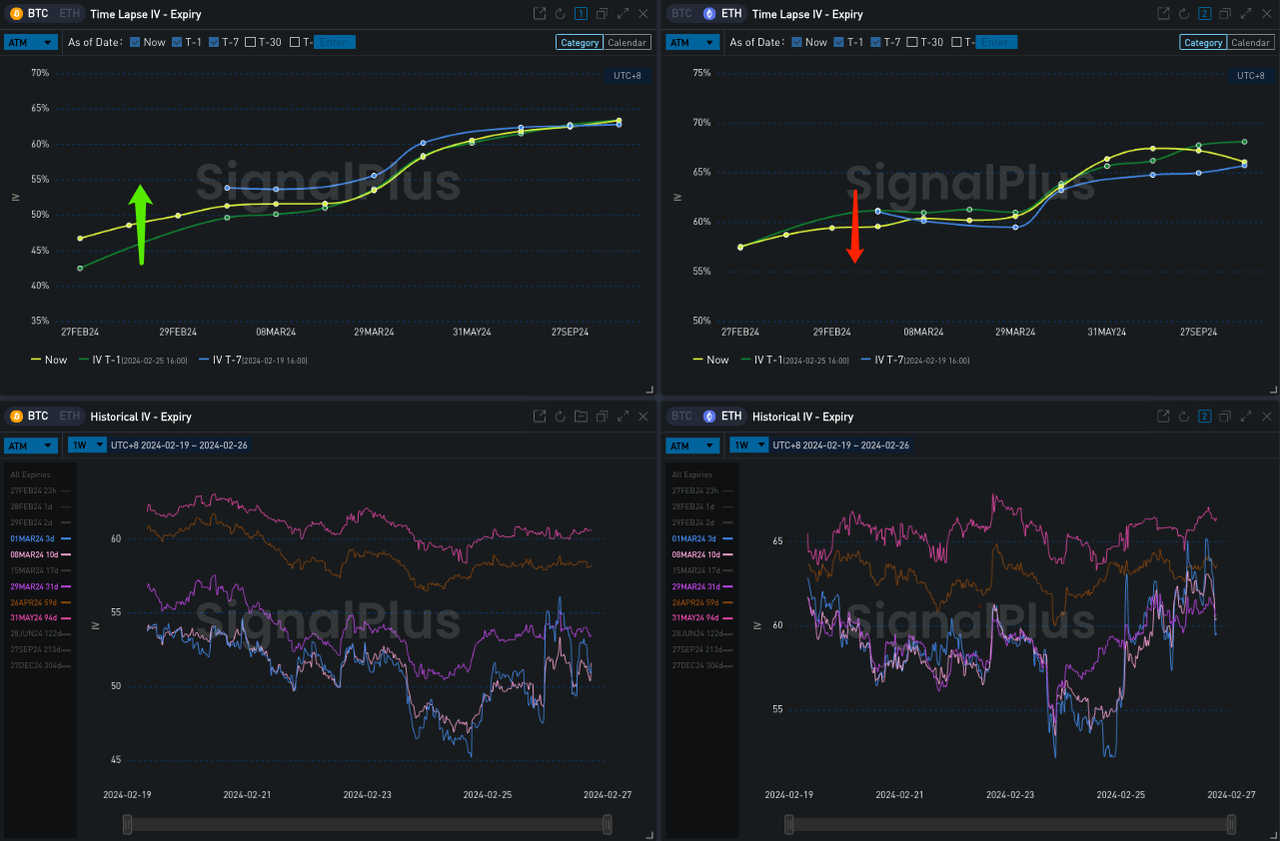

In terms of cryptocurrencies, BTC has been trading sideways near $51,000-$52,000 for almost 12 days, while ETH has made further breakthroughs and reached above 3,000 points, closing at 3,092 (+2%). In terms of options, the implied volatility of ETH is still around the high of 60%, while BTC is mostly around 50%, with a significant IV gap of 10% Vol.

Source: Deribit (as of 26 FEB 16:00 UTC+8)

Source: SignalPlus

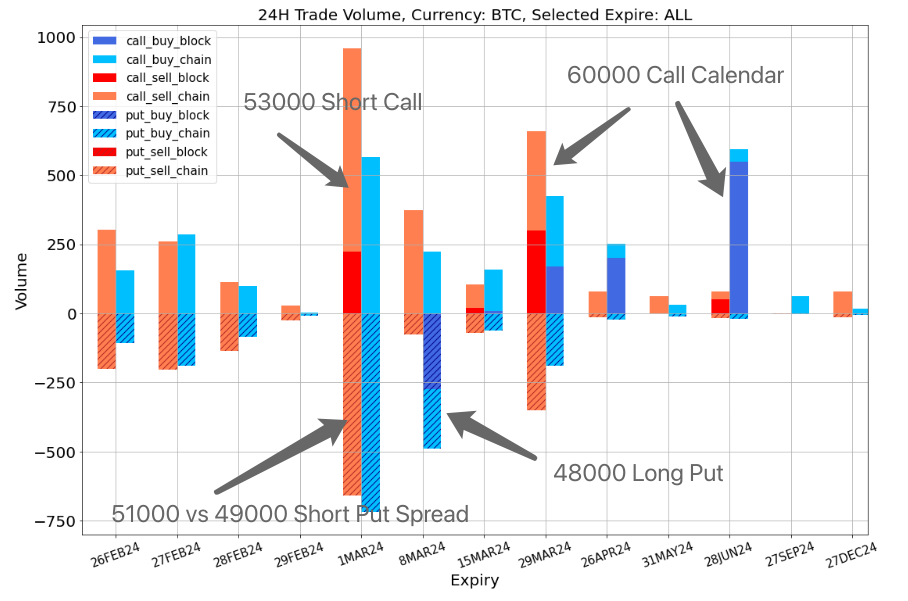

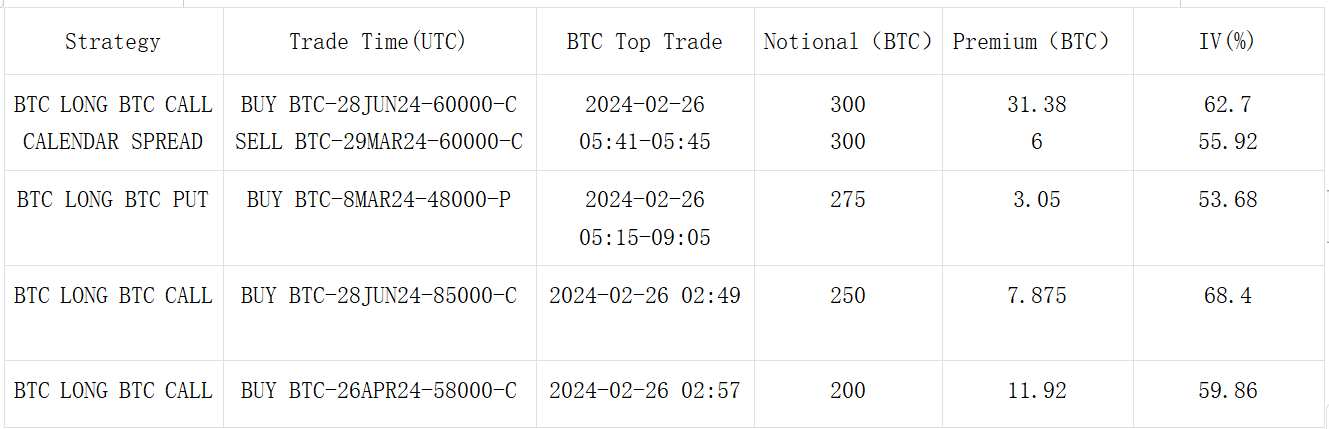

In terms of trading, BTC saw a sudden influx of bullish options buying at the end of June, mainly from a large volume of 85,000 Call purchases, as well as a calendar spread of Buy 28 Jun Sell 29 Mar 60,000-C. Apart from that, despite being a popular expiration for buying Vol last week, the majority of trading in the past 24 hours has been dominated by Short Put Spreads and Short Calls for 1 MAR.

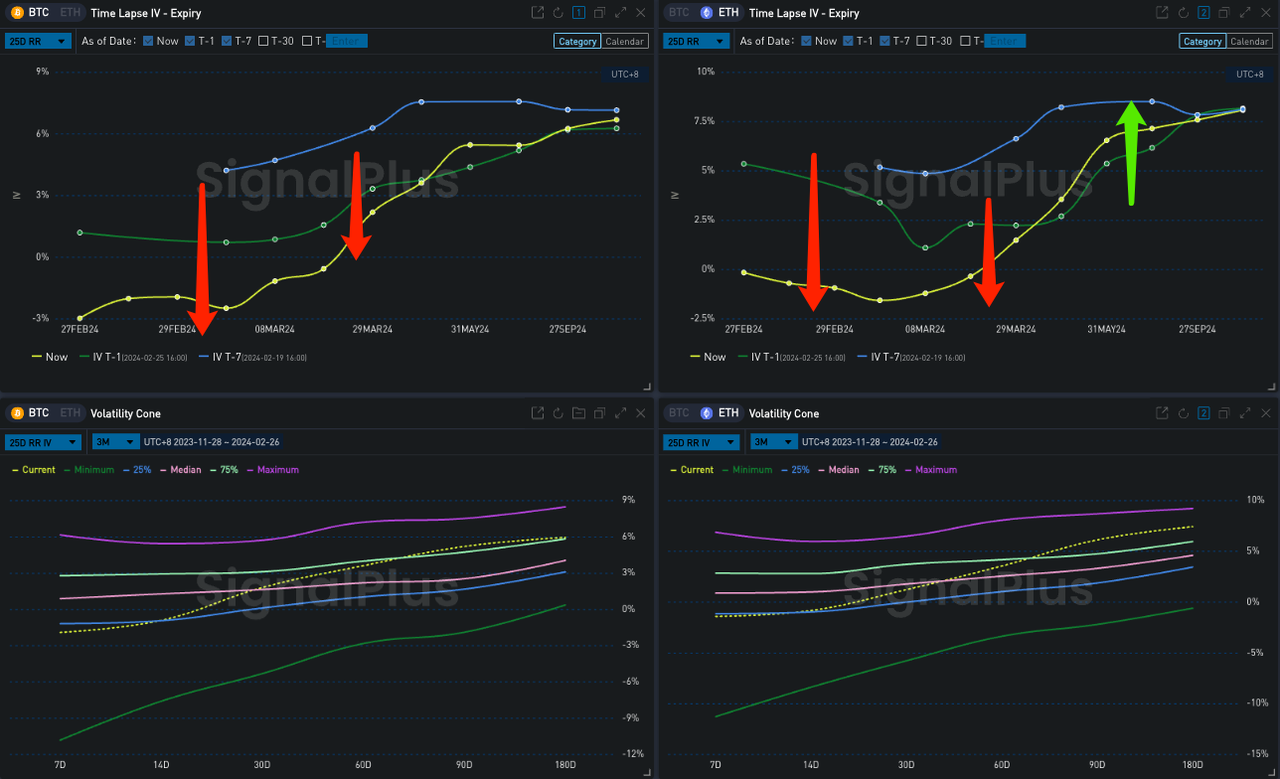

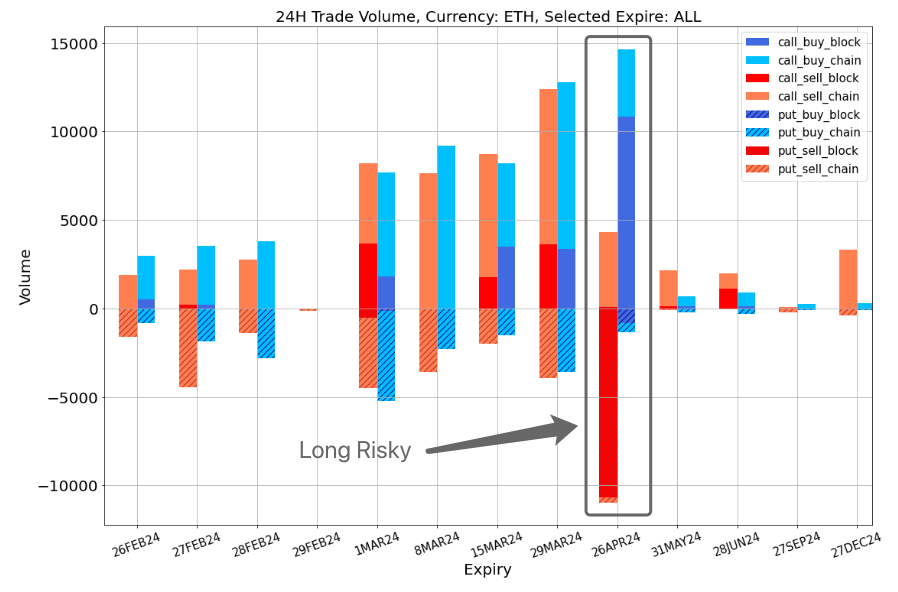

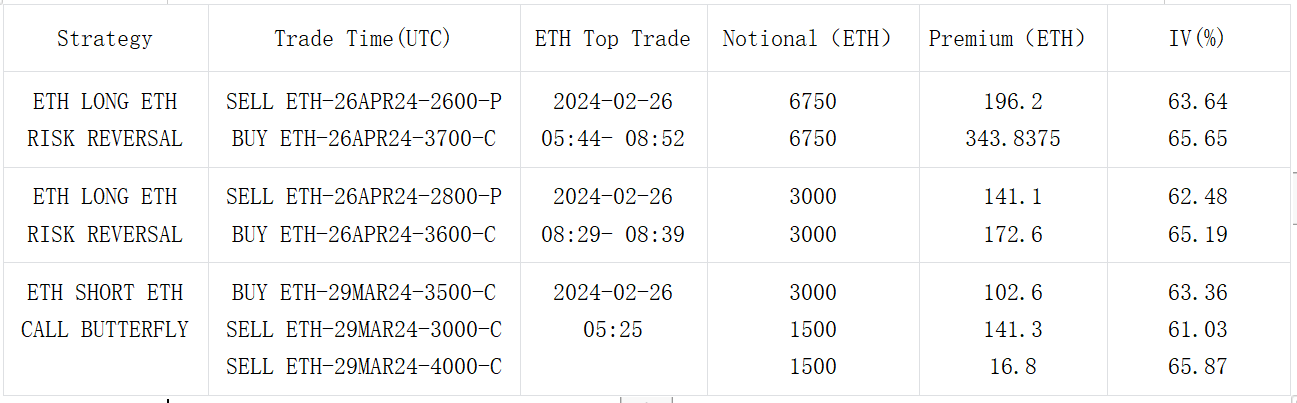

On the other hand, it was observed that the Vol Skew of BTC/ETH front-end has clearly declined in the past 24 hours, and the term after March has risen. From a trading perspective, there were two groups of Long Risky in April, represented by 2600 vs 3700/ 2800 vs 3600 for ETH, with a total turnover of over 10,000 groups.

Data Source: Deribit, BTC transaction distribution

Source: SignalPlus, front-end Vol Skew decline

Data Source: Deribit, ETH transaction distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group, and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com