SignalPlus宏观分析(20240222):Nvidia财报超预期,美联储将持续保持高利率水平

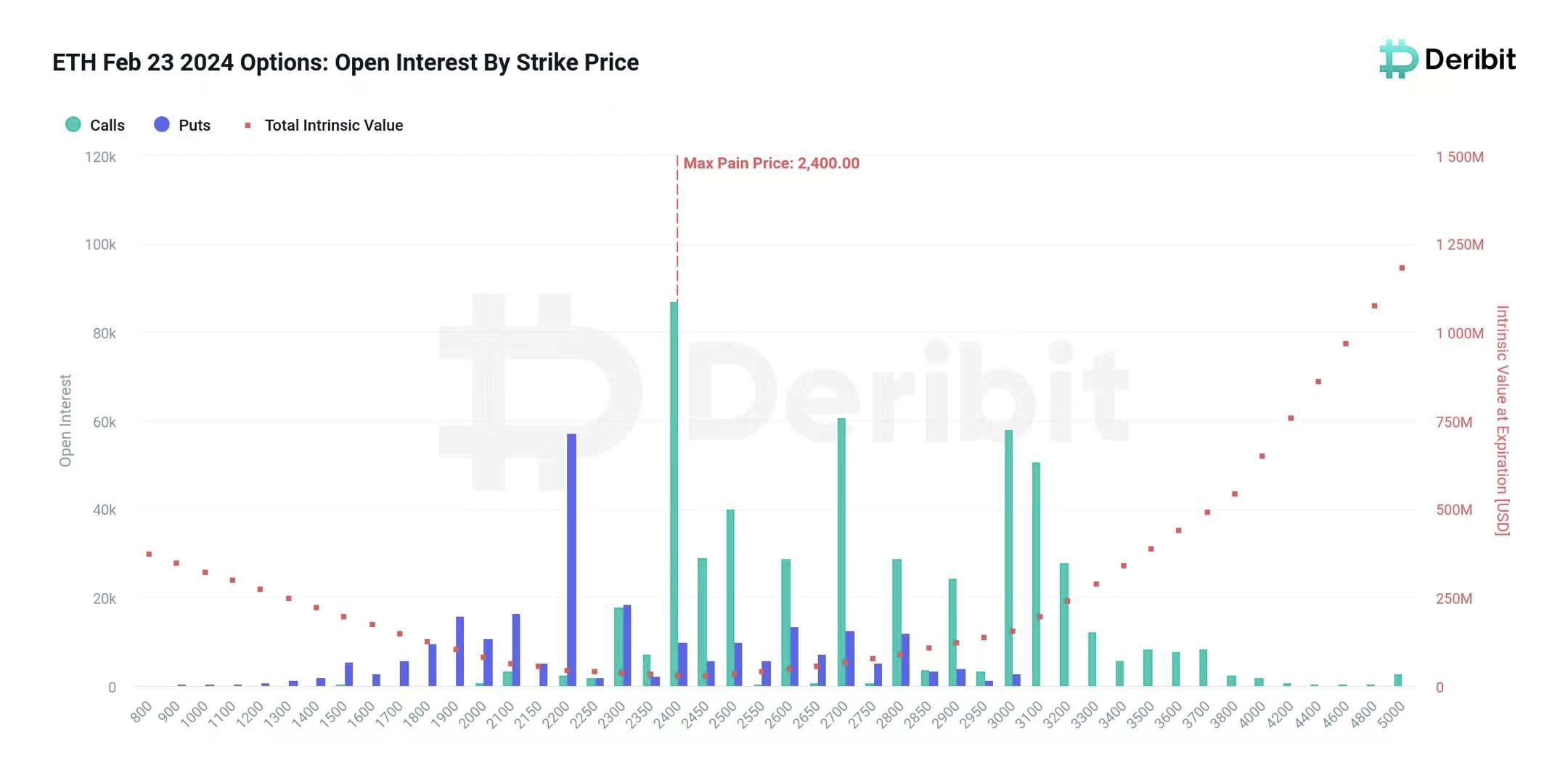

ETH options delivery at 4 pm tomorrow is also the end of February. This time it is very large, about 2.31 billion will be settled, and the biggest pain point is 2400. Look at the recent surge in ETH. It is estimated that after the settlement, both the IV and the price will surge upward.

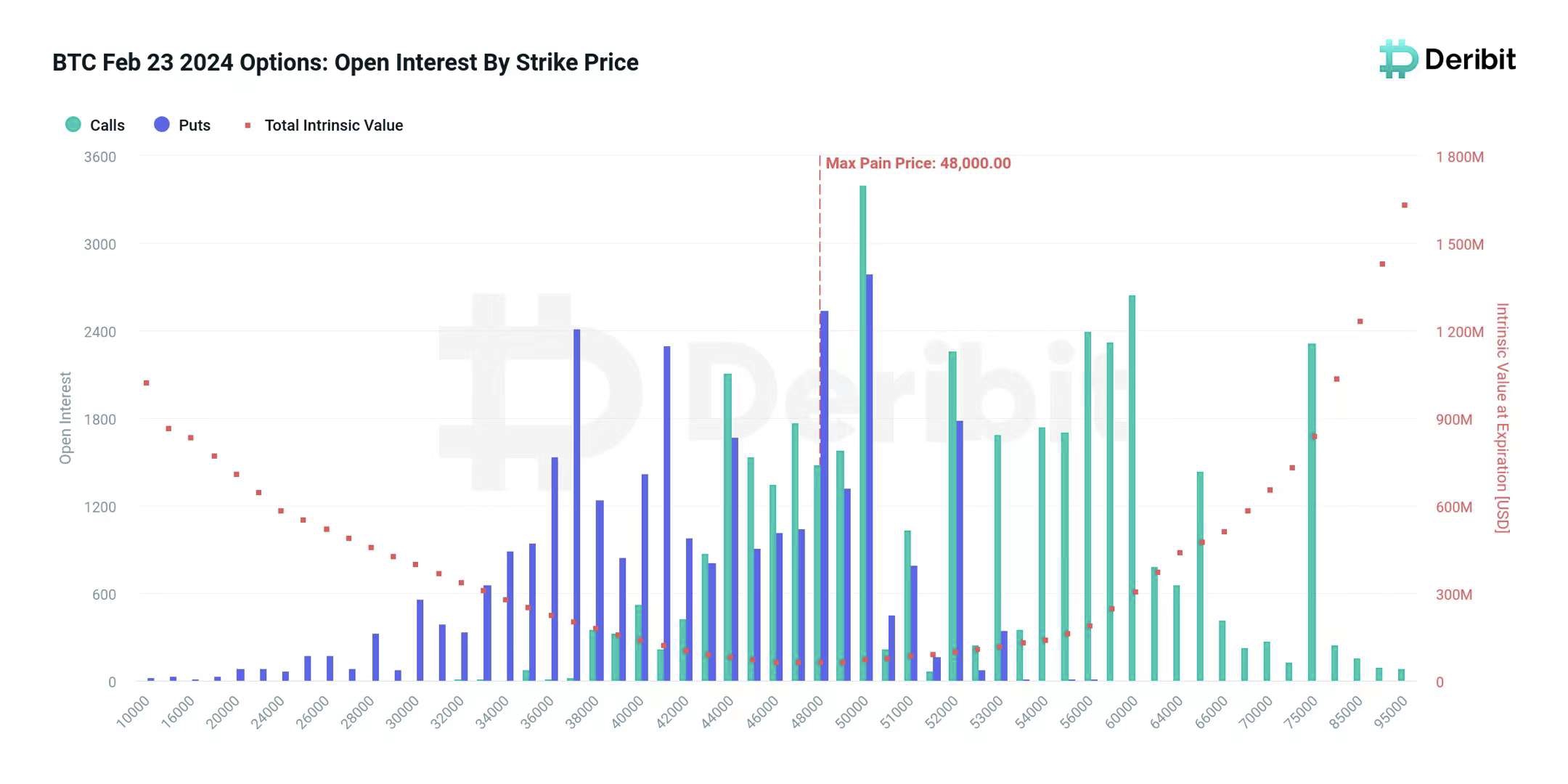

NVIDIAs financial report is very good, stabilizing technology stocks and this wave of adjustments in BTC. Tomorrow at 4 oclock in the afternoon is the monthly delivery of February options, but this delivery is very large. 3.68 billion positions will be settled. The biggest pain point is 48,000. On the day of settlement, the price will generally drop a bit, and the IV will also drop today and tomorrow. You can Take this opportunity to add to your BTC long options position.

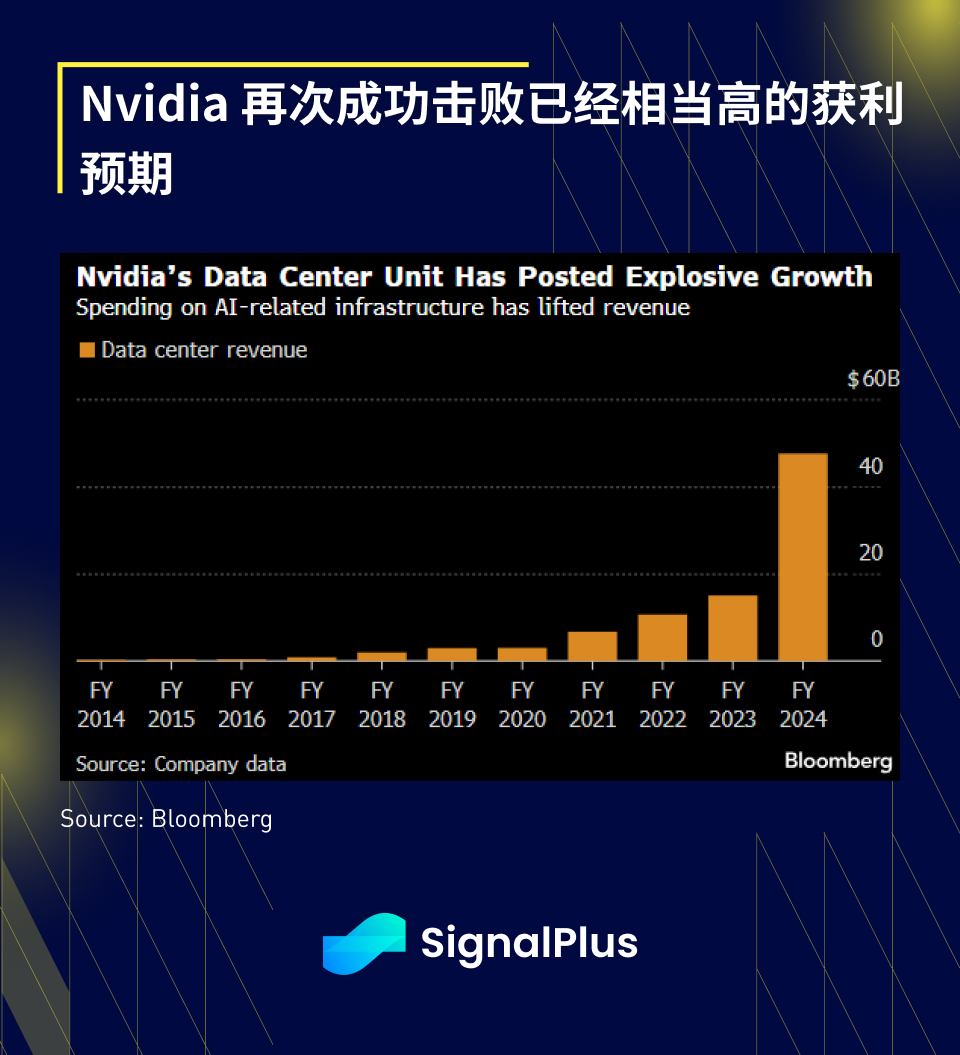

Yesterday, all the focus was on Nvidia. The AI chip giant once again delivered results that exceeded expectations in terms of revenue and net profit.

Revenue reached $22.1 billion, beating expectations of $20.4 billion (last year was only $6 billion), with data centers accounting for 83% of the performance. Gaming revenue increased 58% year over year to $2.9 billion, while gross margins Maintained at 76.7%, higher than last years 66.1%; net profit reached $14.8 billion, exceeding expectations of $13.1 billion, while free cash flow also reached $11.2 billion, higher than expectations of $10.8 billion.

On top of that, the company raised its first-quarter revenue forecast to $24 billion (vs. $21.9 billion expected), with profit margins expected to remain around 77%. In addition, CEO Jen-Hsun Huang confidently stated that “accelerated computing and generative AI have reached a critical point, and demand from companies, industries and countries around the world is surging.” “Demand from vertical industries led by automobiles, financial services, and healthcare is currently also reaches the level of billions of dollars.”

In other words, let’s welcome our new AI overlords.

The companys stock price rose about 9% after the bell. Although it is slightly below the daily breakeven point of the option, this positive result may support the continued rise of risk assets in the short term.

The market was relatively calm before the release of the earnings report. The minutes of the January FOMC meeting released by the Federal Reserve were relatively outdated because the meeting was held before the release of strong non-farm payroll data and CPI/PPI. However, the minutes still had a tough hawkish tone. , the committee expressed concern about prematurely declaring victory in the inflation battle. Some news headlines include:

Fed meeting minutes: Most officials pointed to risks of cutting interest rates too quickly

Some officials believe the inflation process may stall

Officials say demand may be stronger than assessed

Balance sheet discussion guides final balance sheet reduction decision

Several officials pointed to potential risks that loose financial conditions could bring

Overall, officials chose to focus on stalling inflation progress, stronger-than-expected demand and a final decision to slow down the balance sheet reduction to solidify their resistance to a rate cut starting in March.

In addition, the Richmond Feds Barkin expressed a similar view, saying that although overall inflation has improved, recent economic data highlights that price pressures in some industries are still too high. Several Fed officials will be speaking today, including Bowman, Cook, Harker, Kashkari and most importantly Waller, but we dont expect them to make any subversive comments at this time.

On the other hand, a Minneapolis Fed working paper delves into the controversial R-star issue, what academics call the long-term equilibrium interest rate, concluding that as U.S. productivity growth continues to be sluggish, the neutral interest rate may Subject to constraints, this thinking also feeds into the Feds long-term forecasts for monetary policy.

In terms of cryptocurrency, Bloomberg reported that a major SEC litigator responsible for cases such as Coinbase and Ripple is leaving to join White Case, a law firm with 2,600 employees, to become a member of a defense team specializing in cryptocurrency and the Internet field. Members, this is a further sign of a shift in prevailing trends.

In her first public interview, she said:

“Cryptocurrencies are here to stay – something that has become abundantly clear with the launch of a slew of Bitcoin ETFs,” “Given their complexity and volatile law enforcement environment, the legal issues surrounding cryptocurrencies will be the most significant for some time. One of the important issues.”

Trends are turning so fast, should we expect Gensler to join Coinbase as a special advisor after his official duties are over? Such an interesting time...

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com