SignalPlus波动率专栏(20240221):ETH挑战3000点

Yesterday (20 FEB), the market began to discuss whether the Federal Reserve needs to restart interest rate hikes. Citigroup said that investors should have more hedges against the risk that the Federal Reserve may only conduct a very short easing cycle and restart interest rate hikes soon thereafter. According to measures, U.S. bond yields have shown a V-shaped trend, with the current two-year/ten-year rates at 4.589%/4.270% respectively. In terms of U.S. stocks, before the release of Nvidia’s financial report, the SPX experienced an overall decline (-0.6%) led by technology stocks, and the Dow/Nasdaq also closed down 0.17%/0.92% respectively.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

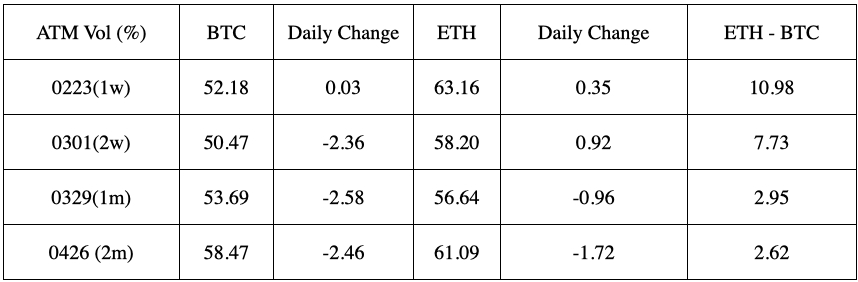

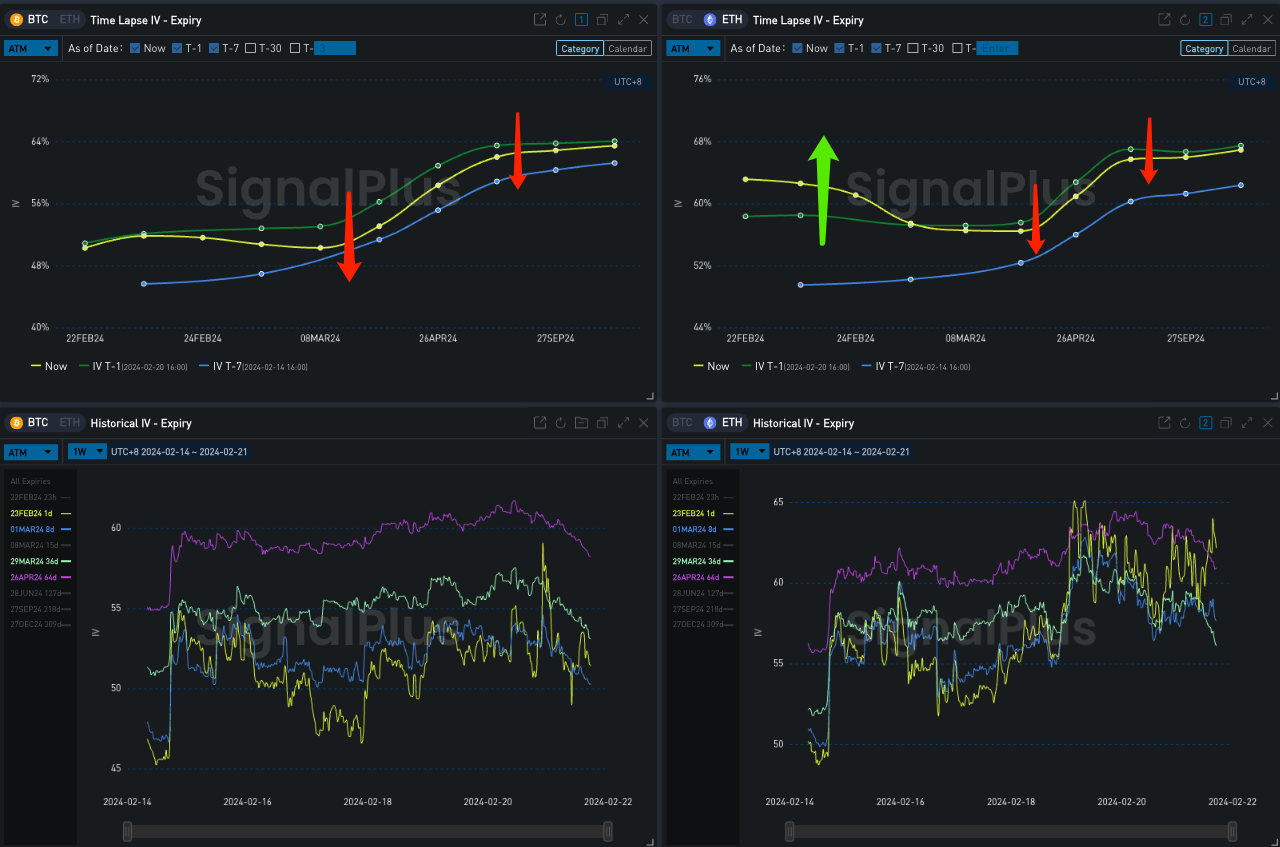

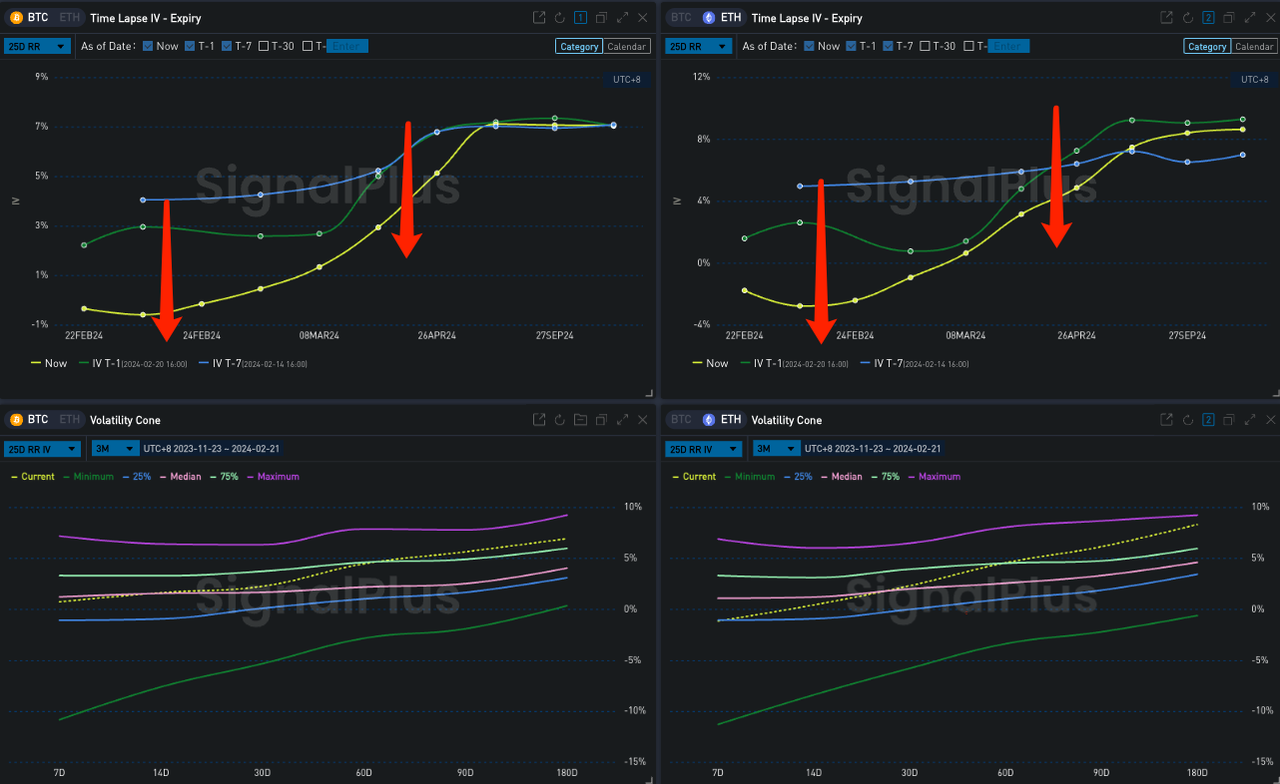

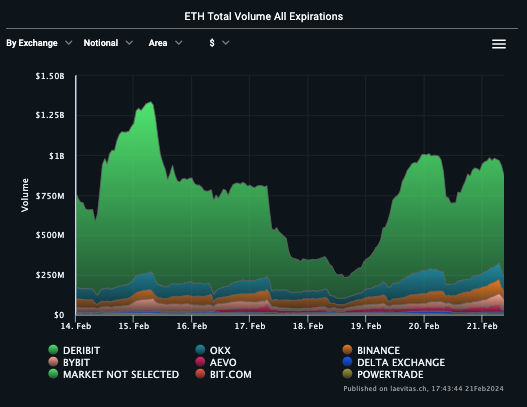

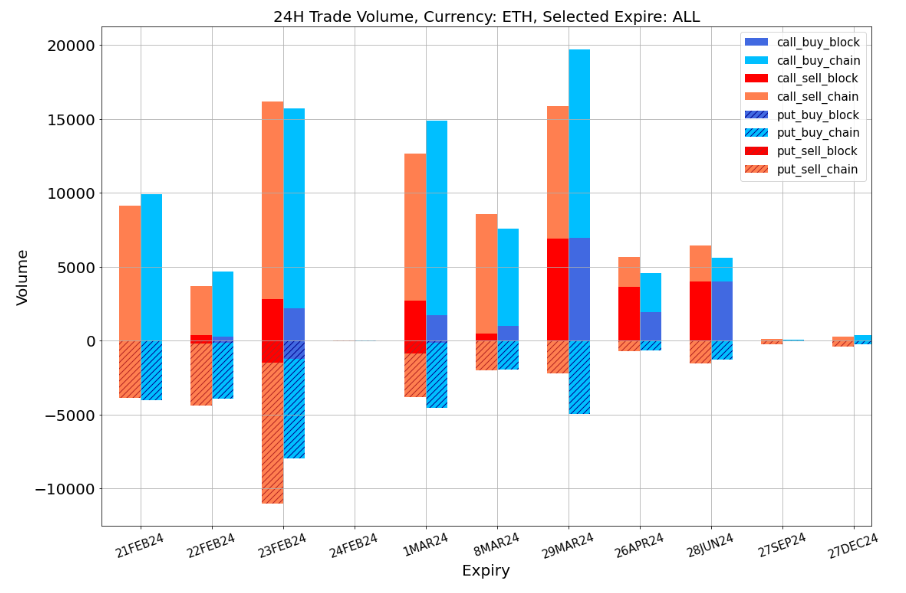

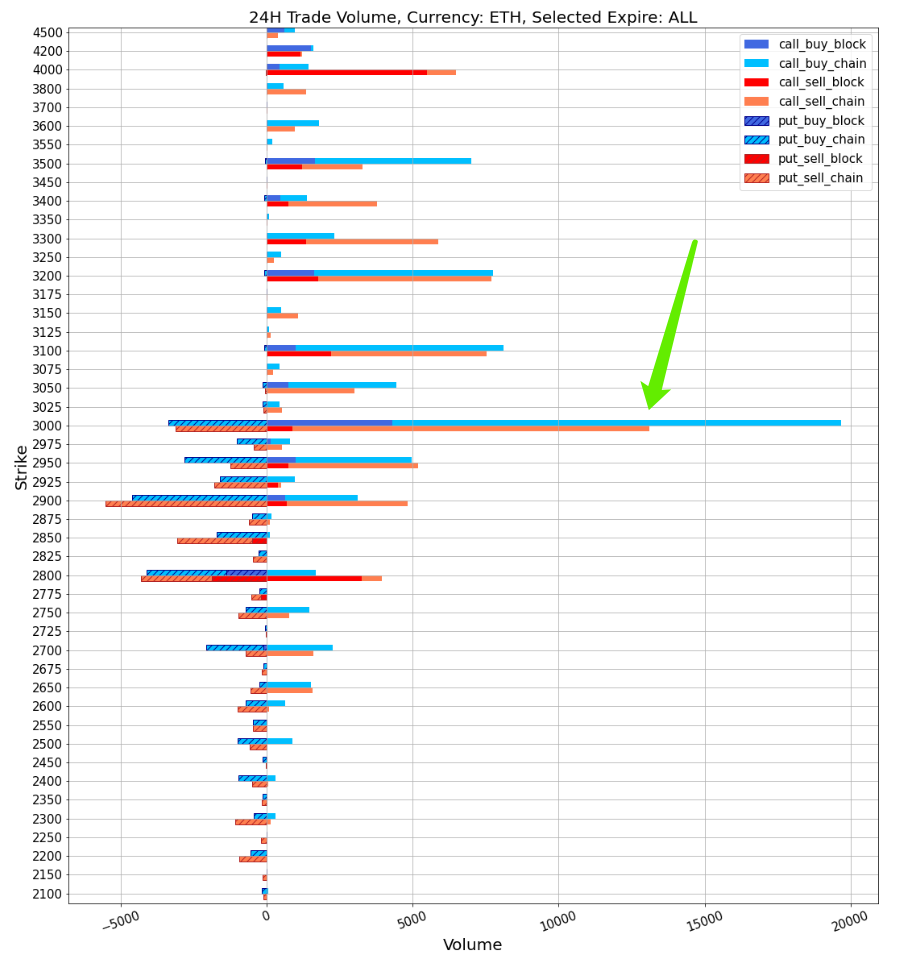

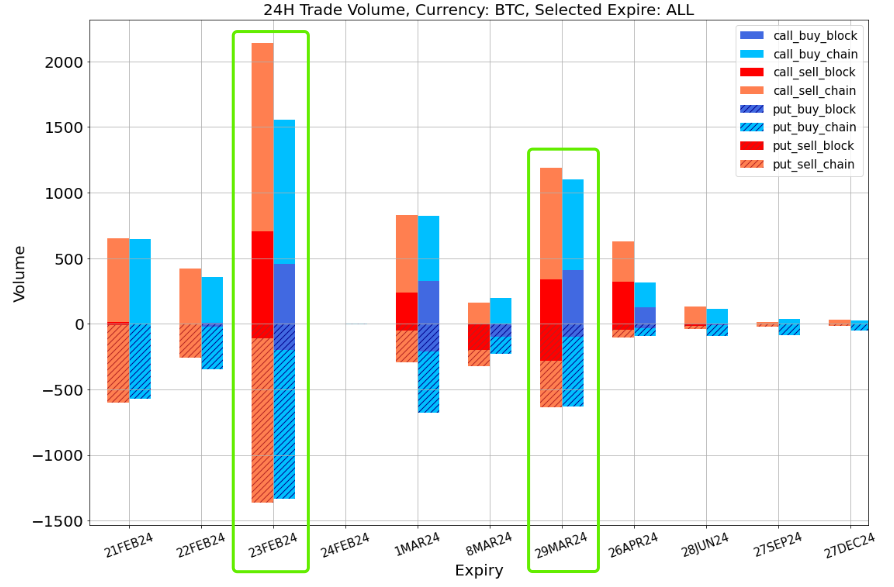

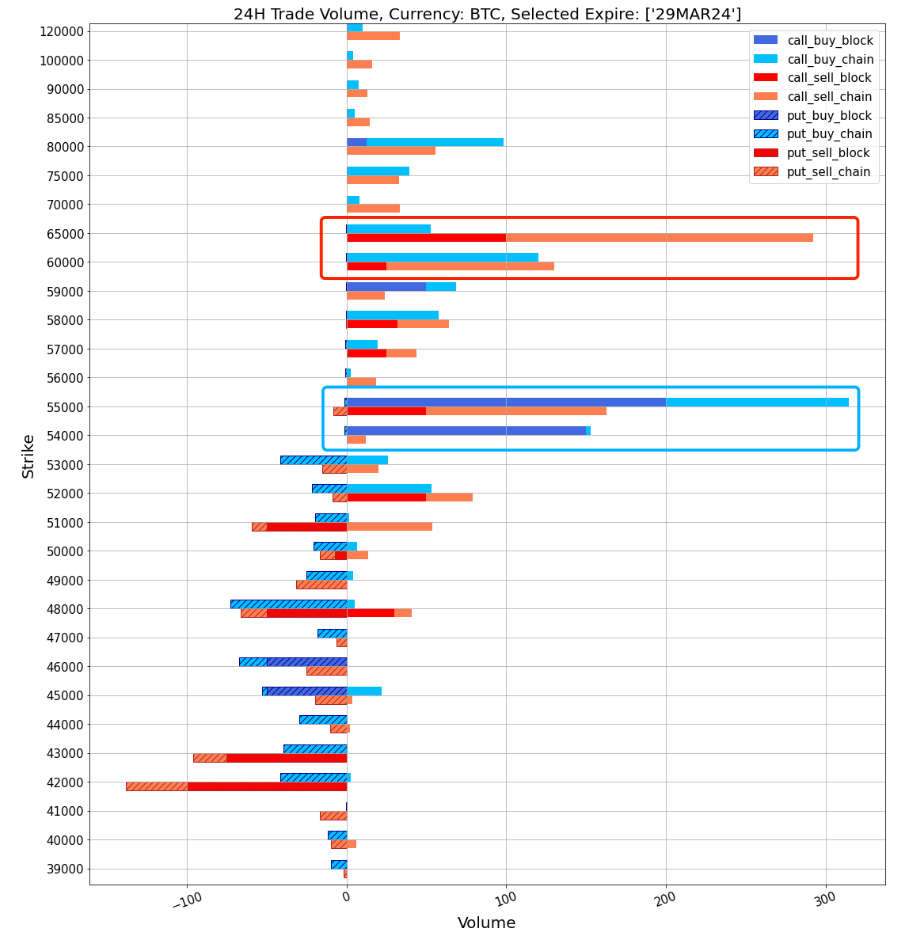

In terms of digital currency, ETH led to a correction of BTC after touching 3,000 points again. The two are currently oscillating above 51,000 and 2,900 respectively. In terms of options, the far-end IV has generally fallen by about 1 to 2% Vol in the past 24 hours. The overall level of ETH is more than 2.5% Vol higher than that of BTC. The front-end IV has risen significantly stimulated by its challenge to 3000 points, but the options trading volume has not Seeing the obvious rise, the game of 3000-C in each period occupied a large amount of yesterdays ETH transactions. In addition, Vol Skew has also fallen from its historical highs along with the price correction. The front-end has even fallen below negative values. In addition to the common positive correlation between the Skew indicator and price statistically, it can be interpreted from a trading perspective. , BTC’s short-term large number of Sell Calls, or the Long Call Spread (Buy ATM Sell OTM) formed on 29 MAR 24 also partially explained the decline of 25 dRR.

Source: Deribit (as of 21 FEB 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Source: Laevitas, ETH did not lead to an increase in options trading volume after hitting 3000

Data Source: Deribit, 3000-C has become a hot spot in the market

Data Source: Deribit

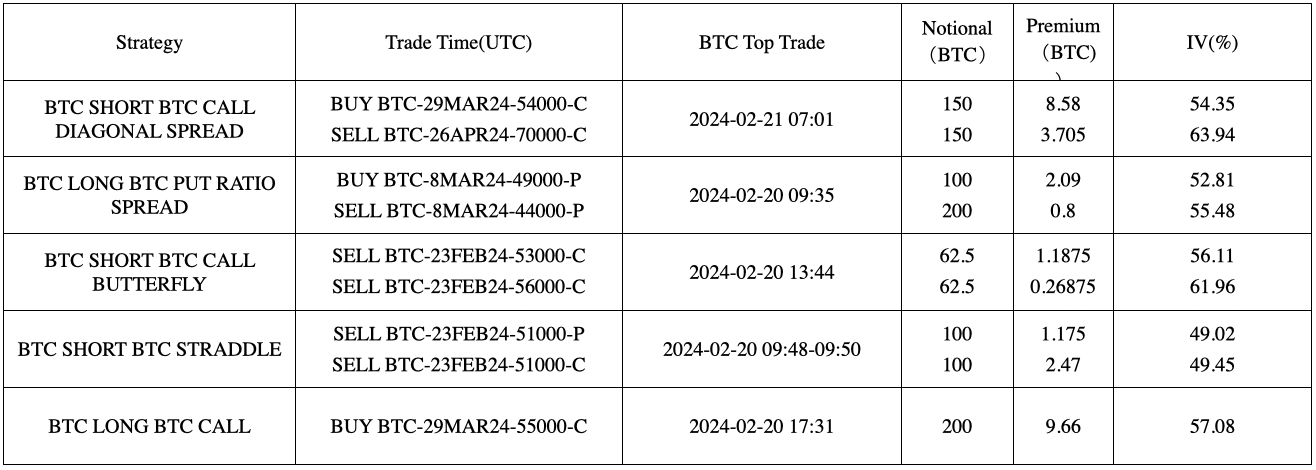

Source: Deribit Block Trade

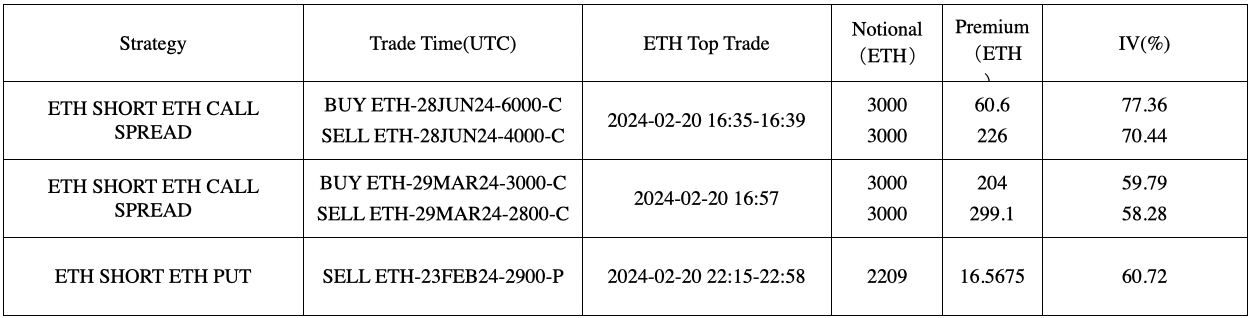

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com