重回5万美元,BTC何时突破历史前高?

Original - Odaily

Author-husband how

Early this morning, BTC exceeded 50,000 USDT, setting a new high since December 2021.

Ouyi OKX market shows that in the past 5 days, BTC has risen from 43070 USDT to a maximum of 50380 USDT; as of press time, BTC is temporarily trading at 50062 USDT, with a 24-hour increase of 0.33%.

The prices of altcoins have also generally risen in the past five days. Among them, ETH once rose from 2368 USDT to more than 2686 USDT, and the ETH/BTC exchange rate has been fluctuating in the range of 0.05-0.06; the price of SOL rose from 96 USDT to 114 USDT; the price of ORDI also increased significantly. Back above 70 USDT; Ethereum second-layer projects also rose simultaneously, with OP and ARB leading the gains.

Crypto-related listed companies have also been affected by the rising market, with stock prices generally rising by more than 20% in the past week. Among them, the share price of Coinbase (NASDAQ: COIN), a US-compliant encryption platform, rose 3.75% today and was provisionally reported at $147.31; the stock price of MicroStrategy (NASDAQ: MSTR), a listed company with the largest Bitcoin holdings, rose 11.02% today and was provisionally reported at $717.52. The BTC held by MicroStrategy The value has exceeded US$3.5 billion.

Affected by the upward trend of the overall market, the current total crypto market value has exceeded US$1.9 trillion, up 3.35% in 24 hours; crypto users trading enthusiasm has increased significantly. Todays Panic and Greed Index is 79. The degree of greed has increased from last week, and the level has become extremely greedy.

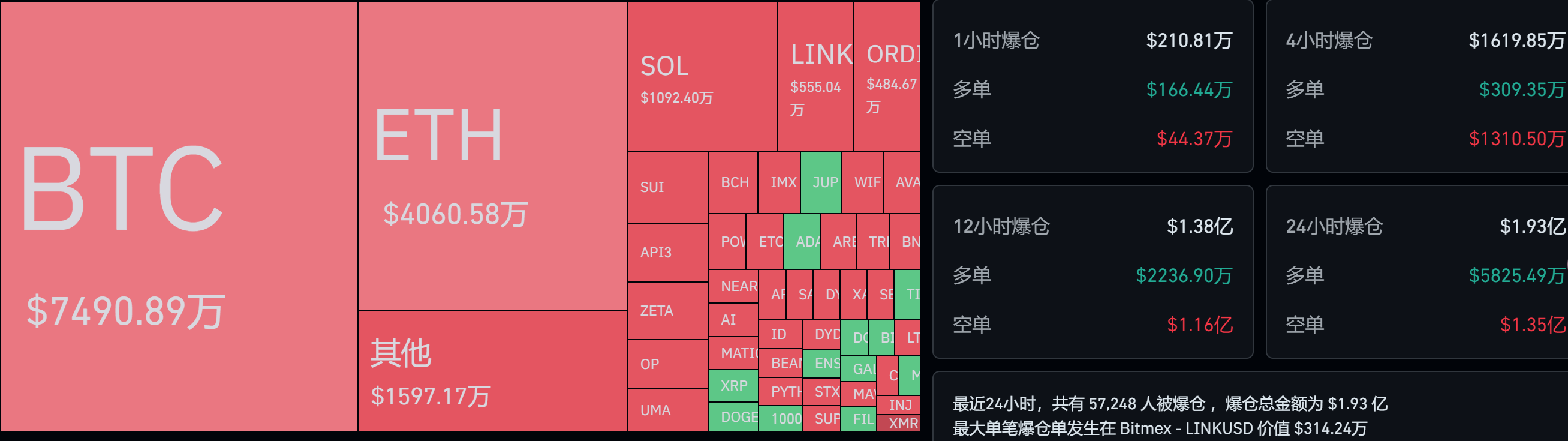

Coinglass data shows that the entire network liquidated $193 million in the past 24 hours, of which long orders liquidated $58.1438 million and short orders liquidated $135 million. In terms of currencies, BTC liquidated $74.9089 million and ETH liquidated $40.6058 million. Dollar. The current nominal value of the networks BTC options open positions is $13.621 billion, and the notional value of the ETH options open positions is $7.786 billion.

Reason: Spot ETF support + US election

After the spot ETF was approved, the price of Bitcoin once fell below $40,000, which also made the market doubt the ETFs holding effect. Although Grayscale continues to reduce its holdings of Bitcoin, the remaining eight spot ETFs have been increasing their holdings. Among them, BlackRocks IBIT ETF has increased its holdings of 13163.2914 Bitcoins in the past week, an increase of 20.29%.

At present, the total market value of Bitcoin spot ETFs is approximately 32.3 billion, of which Grayscale accounts for more than 60%, but BlackRock’s turnover and trading volume occupy the top spot. According to unfolded data, U.S. Bitcoin spot ETF trading volume accounts for 10-15% of the total Bitcoin spot trading volume on global centralized exchanges.

In addition, the U.S. election is approaching, which may be one of the reasons for this round of rise.

New research from Coinbase shows that California’s cryptocurrency users are expected to have a significant impact on the political direction of the state in the 2024 elections. It is reported that about 27% of adults in California, or about 8.2 million people, own digital assets. This group represents a large and potentially decisive group of voters in the election.

The study also found that people overwhelmingly support policy initiatives that encourage disruptive technologies such as blockchain and digital assets, viewing them as critical to future financial and social progress. This sentiment is expected to translate into political action, with cryptocurrency holders likely to support candidates who advocate for the cryptocurrency industry and blockchain technology.

At the same time, the leader of the Democratic Party, Biden, who has always been unfriendly to cryptocurrencies, also posted pictures of laser eyes on the On the other hand, Republican candidate Trump also promoted NFT to express his recognition of the encrypted world and even Web3.

Bitcoin expected to reach new highs this year

The price of Bitcoin has returned to US$50,000 and has returned to the top ten assets in the world. What will be the trend of Bitcoin in the future?

First, the Feds interest rate cuts are one of the contributing factors. Fed Kashkari said that if the labor market continues to be strong, the policy interest rate can be lowered quite slowly; at present, it seems that 2-3 interest rate cuts this year seem appropriate.

It can be seen from this that the Federal Reserve is expected to cut interest rates this year, which will boost global markets and may bring more New Money to Bitcoin and even the crypto market.

Secondly, Bitcoin will usher in a halving event in April this year. During every Bitcoin halving cycle, the market price rises, which seems to have become a tacit consensus among everyone. As the halving approaches, Bitcoin prices may continue to rise.

In addition, with the continued support of Bitcoin spot ETFs and the expected approval of the Ethereum spot ETF, the market may repeat the rising wave before the approval of the Bitcoin spot ETF.

As Ki Young Ju, founder of Crypto Quant, posted on social media, driven by ETF capital inflows, Bitcoin may reach $112,000 this year.

In addition, Grayscale stated that although miners may sell Bitcoin after the Bitcoin halving to maintain their rising costs, the nine Bitcoin spot ETF products may serve as a hedging force against the selling pressure of miners, and stated that Bitcoin ETFs could significantly absorb selling pressure, potentially reshaping Bitcoin’s market structure by providing a steady source of new demand, which would be beneficial for the price.

Finally, as the U.S. election approaches, crypto users must be the ones competing for votes between the Democratic and Republican parties, and this has already begun to emerge.

Market price fluctuations have increased recently. Odaily reminds that investment is risky and needs to be treated with caution.