比特币现货ETF的胜负手?灰度胜诉SEC及比特币现货ETF情况

Original author: Steven, E2M Research

1. Founder of Grayscale

Grayscale founder Barry Silbert has spent many years laying out a complete encryption ecosystem. It occupies the leading ecological niche in investment, media, exchanges, financial products, etc., paving the way for Grayscale GBTC to maintain a premium rate and stabilize Ponzi for many years.

Grayscale founder Barry Silbert is also the founder of Grayscale’s parent company, Digital Currency Group.

Founded private equity trading platform SecondMarket in 2004 to enable private companies and investment funds to more efficiently raise capital and provide liquidity to their stakeholders by simplifying complex transaction workflows and accreditation of investors such as direct and accredited investors. The company was acquired by Nasdaq in October 2015;

In 2011, he made his first pot of gold by investing in Bitcoin;

In 2012, Barry founded Bitcoin Opportunity Corp to conduct angel investments in cryptocurrency-related fields;

In 2013, he invested in three then-startup companies, namely Coinbase, Bitpay, and Ripple, and proposed that SecondMarket invest $3 million in the purchase of Bitcoin, but this was not approved, paving the way for his resignation in 2014;

Established cryptocurrency exchange Genesis Global Trading and Bitcoin trust company Grayscale in 2014;

Founded in 2015, DCG raised funding from Bain Capital, Mastercard, New York Life Insurance Company and the venture capital arm of Canadas CIBC Bank

DCG acquires Coindesk in 2016

2. What is Grayscale Trust? Why buy GBTC? Why convert to an ETF?

2.1 Grayscale Trust Background

On September 25, 2013, Grayscale established the first Bitcoin Trust Fund (GBTC) on the market, and obtained private placement exemption registration from the U.S. Securities and Exchange Commission (SEC) that year. In 2015, it obtained the U.S. Financial Industry Regulatory Authority (FINRA) ) approved for listing. At the time Grayscale charged a 2% management fee (up from 1.5% today).

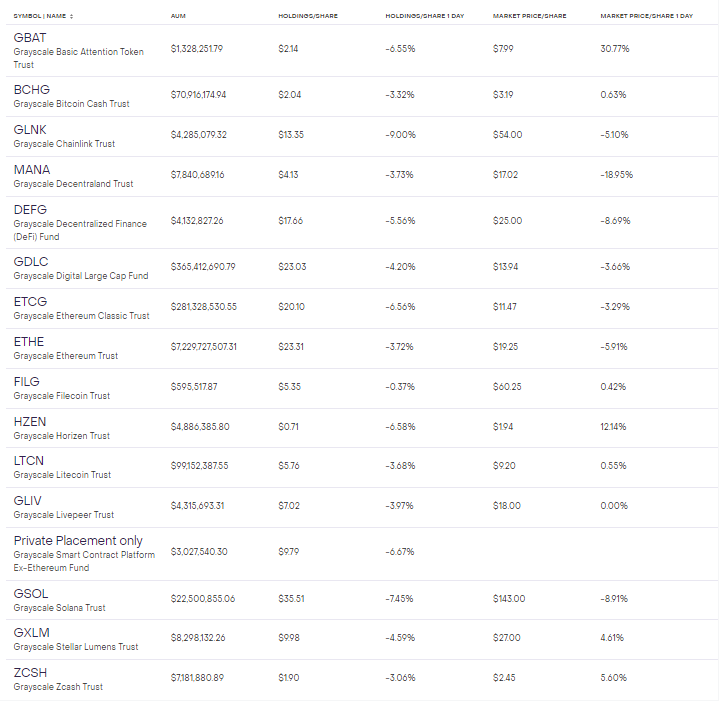

In addition, Grayscale has currently launched 16 trust products in addition to GBTC, and the combined value of these assets is close to US$8 billion.

For a long time, GBTC was the only investment product that could be traded in the U.S. secondary market and track the price of Bitcoin. It was also the only product in the U.S. pension plan that could buy Bitcoin exposure.

2.2 Design features of GBTC

**Non-redeemable:** In order to meet SEC regulatory rules, Grayscale has set up a non-redeemable mechanism for the trust. Investors can only buy it but cannot redeem it. This feature directly eliminates the sellers liquidity crisis of Bitcoin and completely eliminates the opportunity for selling. This is why Grayscale is called the Pixiu of Bitcoin.

**GBTC shares can be traded in the secondary market: **Although GBTC cannot be redeemed, GBTC shares can be circulated in the secondary market in the form of stocks. However, according to SEC regulations, GBTC held by investors must be locked for 6 months before they can be bought and sold in the secondary market.

**The handling fee is based on Bitcoin: **GBTCs 2% annual management fee is based on currency, so as time goes by, the Bitcoin content of each GBTC will become less and less. When it was released in 2013, each share of GBTC was approximately 0.001 Bitcoins, and you would only own 1 Bitcoin if you purchased 1,000 shares. Now, one GBTC share contains only 0.00095236 Bitcoins.

2.3 Why convert to an ETF?

ETF (Exchange Traded Fund) is a traded open-end index fund, which is an open-end fund with variable fund shares that is listed and traded on an exchange. The price of an ETF fund needs to be strictly anchored to the price of a certain index/asset. The Bitcoin ETF, or Bitcoin exchange-traded fund, is a fund that tracks the Bitcoin price index.

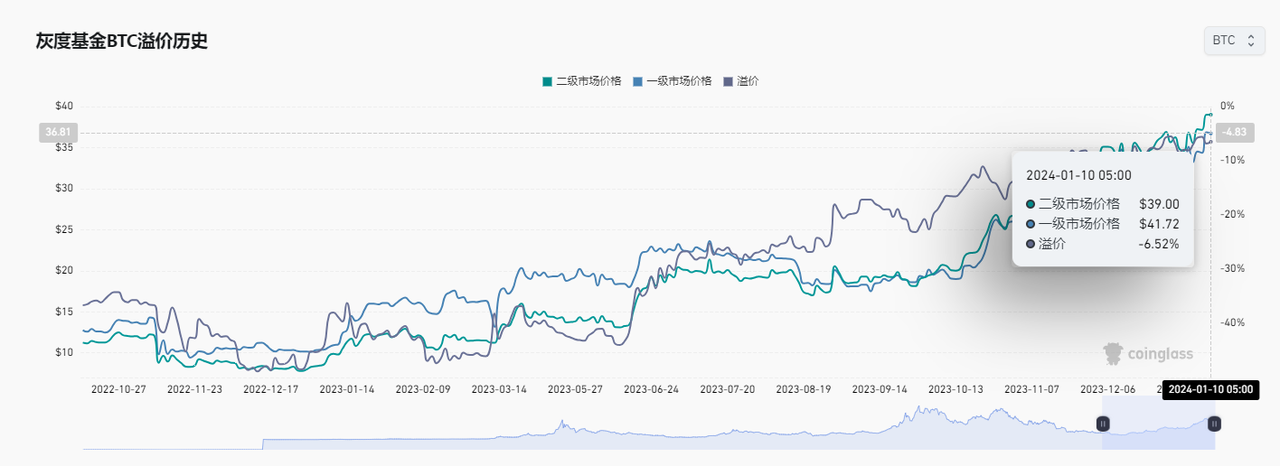

GBTC is a closed-end fund, commonly known as an investment trust, that invests exclusively in Bitcoin. The number of shares available in such funds is limited, and the price of its shares floats freely, and the shares may be higher or lower than the Bitcoin they represent. When it is higher than the value of the Bitcoins it holds, it is called a premium, and when it is lower than the value of the Bitcoins, it is called a discount (discount).

What GBTC and Bitcoin ETFs have in common is that they both provide investors with a compliant channel to invest in Bitcoin, without actually purchasing and keeping Bitcoin assets, and without taking on the risks of key custody, but they can still obtain investment. Bitcoin earnings.

ETFs allow market makers to create and redeem stocks at will. GBTC does not allow redemptions during the duration, and fund shares must be liquidated through secondary market transactions. (GBTC has changed from Pixiu to a compliant product)

GBTC has a 6-month lock-up period and usually has a premium, ETFs are more liquid and usually don’t have a premium or discount.

GBTC trading fees are high, involving broker fees, annual management fees (2%), and premiums. Bitcoin ETF fees are even lower, with some ranging from 1% to even lower (0.4%).

GBTC has a high investment threshold and is only open to qualified investors, with a minimum of $50,000. Bitcoin ETFs have fewer restrictions on investors and investment amounts.

2.4 Clear arbitrage opportunities arising from Bitcoin premium

The GBTC built by Grayscale under the SEC framework is actually a mechanism that allows cash to flow one-way from the stock market to the currency market, and BTC flows from the currency market through investors to Grayscale in one direction.

Grayscale appears to be a trust, but in fact, if BTC is given to Grayscale, investors no longer have control. Grayscale uses SEC provisions to establish a mechanism that BTC cannot be reversed and redeemed.

Grayscale is more like the issuing institution of this special stock of GBTC. One reason for disclosing changes in positions every day is SEC requirements, and another more important reason may be to maintain the premium rate for placing orders. Of course, Grayscale itself is friendly to traditional institutions because it also accepts the U standard, that is, Wall Street institutions, pension funds, etc. can participate normally.

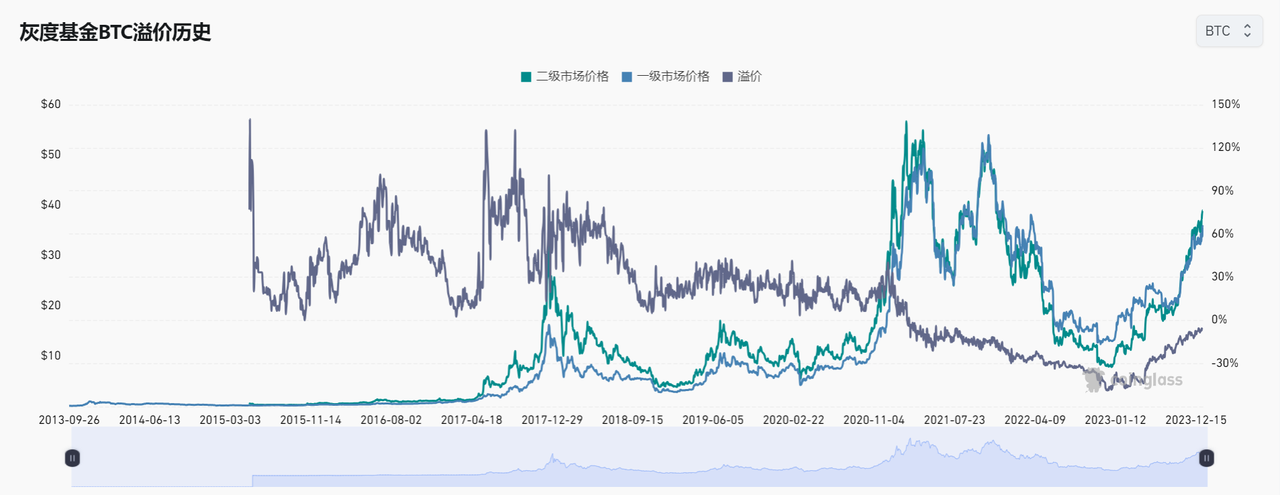

Until the end of the first quarter of 21, early Grayscale Bitcoin was at a long-term premium. Excluding the extreme data in the initial period, the premium rate was mainly between 15% and 30%.

Data Sources:https://www.coinglass.com/zh/Grayscale

Why are users willing to give money to Grayscale and get GBTC?

The first thing is that Grayscale accepts currency-based investment, and then GBTC is locked and can only be traded after 6 months. In the 2019 Q3 report, Grayscale showed that from January to September 2019, 79% of investors chose physical investment (Bitcoin investment). In other words, most of the Bitcoins flowing into GBTC come from Bitcoins already circulating on the market, and are not Grayscale is buying newly mined Bitcoins as everyone thinks.

If you are a user of coin-based investment, if the premium rate is stable and Bitcoin does not plummet within 6 months, you will have a clear risk-free U-based arbitrage.

From a longer-term perspective, if investors believe that the premium rate will remain constant and are bullish on Bitcoin, they will give BTC to GBTC over and over again, sell it through the secondary market after 6 months, and then obtain it at a premium. More BTC, then buy GBTC again, creating a circular arbitrage.

Why does GBTC have a premium until the end of the first quarter of 21?

In theory, this premium should be evened out by arbitrageurs over a period of time, yet Grayscales premium rate has persisted for 5 years? This shows that some bookmakers are deliberately maintaining premium rates to allow this cycle of arbitrage (Ponzi) to continue, and the obvious biggest beneficiaries are Grayscale itself and the bookmakers behind it.

The semi-annual unlocking of GBTC corresponds to the phased increase in the price of BTC, and the premium shows a trend of rising first and then falling.

February 3, 2021 ushered in the ninth unlock. Unsurprisingly, the currency price ushered in a surge. However, unexpectedly only 20 days later, on February 23, GBTC experienced a negative premium for the first time since 2015.

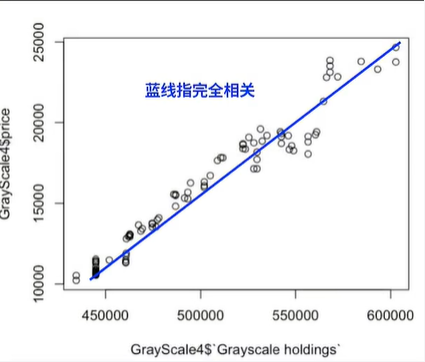

In 2020-2021, the correlation between the price of Bitcoin and the holdings of Grayscale (DCG’s LPs are basically old Wall Street institutions such as Bain Capital and Oaktree Capital) was as high as 95%.

GBTC issued by Grayscale began to show a negative premium at the end of February 2021, and the ratio continued to expand as it entered a bear market in 2022. It was not until BlackRock applied for a Bitcoin spot ETF negative premium in 2023 that it gradually stabilized.

3. Success or failure is arbitrage, how can GBTC trap the evil institutions such as Three Arrows Capital and BlockFi?

Article quoted from:https://www.tuoluo.cn/article/detail-10099651.htmlPart

GBTC and its enemies

GBTC arbitrage is something BlockFi and Three Arrows Capital are all too familiar with.

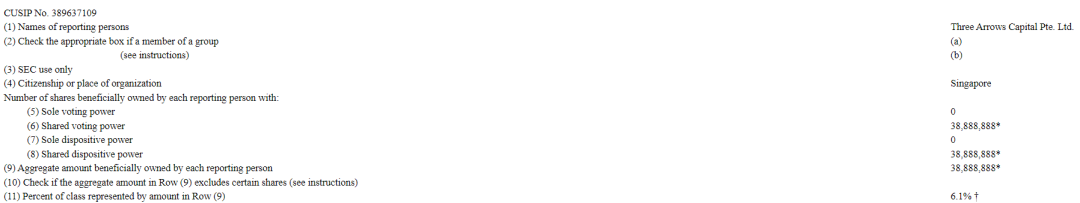

According to the SEC Form 13 F documents previously disclosed by Grayscale, the GBTC holdings of only two institutions, BlockFi and Three Arrows Capital, once reached 11% (the institutional holdings accounted for no more than 20% of the total circulation).

This is one of the levers used by the new rich - using users BTC for arbitrage, and locking BTC into Grayscale, which is only in and out.

For example, BlockFi previously attracted BTC from investors at an interest rate of 5%. According to the normal business model, it needs to lend out at a higher interest rate. However, the real lending demand for Bitcoin is not large and the capital utilization rate is very low.

Therefore, BlockFi chose a seemingly safe arbitrage path, converting BTC into GBTC, sacrificing liquidity and gaining arbitrage opportunities.

Relying on this method, BlockFi once became the largest holding institution of GBTC, but was later surpassed by another unfair institution, that is, Three Arrows Capital (3AC).

Public information shows that at the end of 2020, 3AC held 6.1% of GBTC shares, and has been the largest holding since then. At that time, the trading price of BTC was US$27,000, the premium of $GBTC was 20%, and 3AC’s positions exceeded 1 billion. Dollar.

The news of GBTCs largest holding institution made 3AC quickly become an industry star. Of course, more peoples questions are, why is 3AC so rich and where did these BTC come from?

Now all the answers have surfaced - borrowed.

Shenzhen TechFlow learned that 3AC borrowed BTC unsecured at ultra-low interest rates for a long time and converted it into GBTC, and then mortgaged it to Genesis, a lending platform also belonging to DCG, to obtain liquidity.

During a bull market cycle, this is all great, BTC continues to rise, and GBTC is at a premium.

The good times did not last long. After the launch of 3 Canadian Bitcoin ETFs, the demand for GBTC decreased, so that the premium of GBTC quickly disappeared and a negative premium appeared in March 2021.

Not only 3AC panicked, but so did Grayscale. In April 2021, Grayscale announced plans to transform GBTC into an ETF.

The content and frequency of Twitter posts by the two founders of 3AC are basically a barometer of 3AC. From June to July 2021, they became quiet on Twitter and began to talk about TradFi and hedging bets. There was even a paragraph Time rarely mentions cryptocurrencies.

It wasn’t until a wave of altcoin prices led by new public chains that 3AC’s book assets took off, and the two founders regained their former vitality on Twitter.

Secondly, 3AC lends to institutions and does not have much immediate and scattered redemption pressure. However, BlockFi raises BTC from public investors and has more redemption pressure. Therefore, BlockFi has to continue to sell GBTC at a negative premium. In the first quarter of 2021 , selling and reducing holdings all the way.

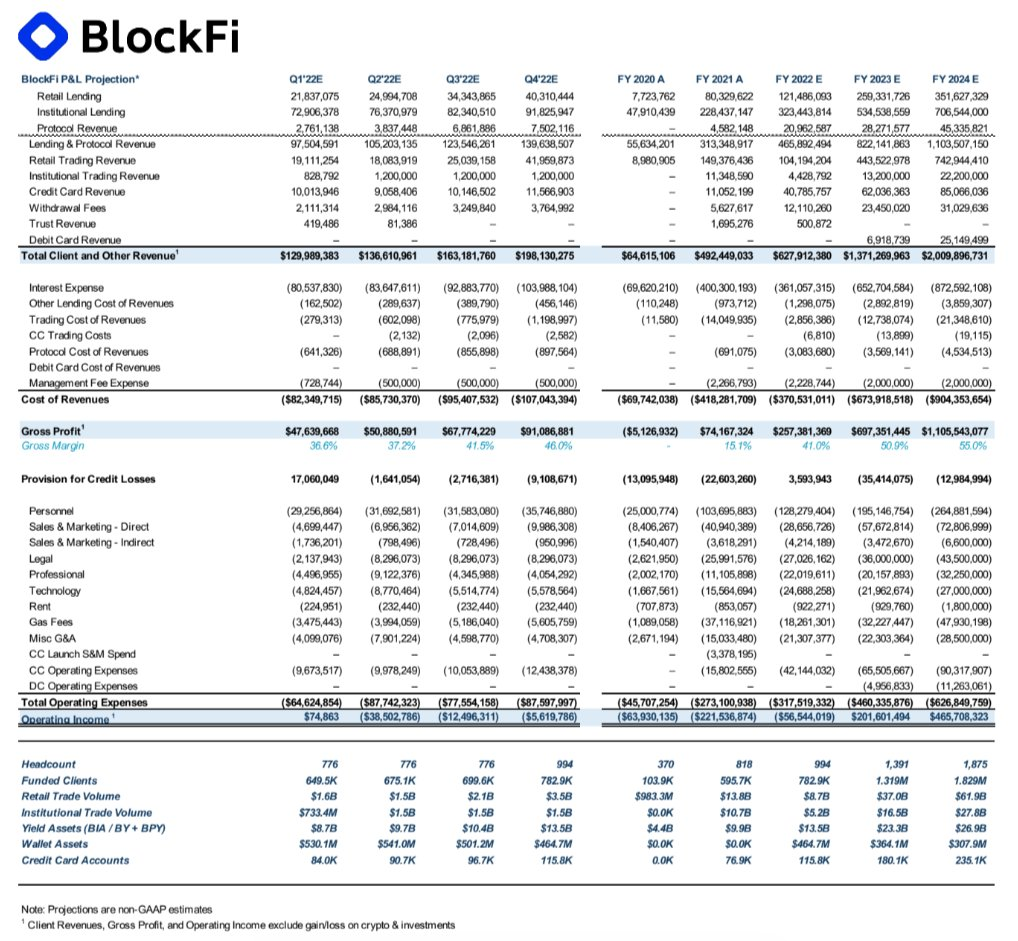

Even in the two-year crypto bull market in 2020 and 2021, BlockFi lost more than $63.9 million and $221.5 million respectively. According to a crypto lending institution practitioner, BlockFi’s losses on GBTC were close to $700 million.

3AC has no BTC redemption pressure in the short term, but the pledged GBTC has the risk of liquidation, and the risk will be simultaneously transmitted to DCG.

On June 18, the Bloomberg terminal once cleared 3AC’s GBTC holdings to 0. The reason given by Bloomberg was that since January 4, 21, 3AC has not submitted 13 G/A documents, and they could not find any confirmation of the three Arrow still holds the data for $GBTC and deletes it as stale data.

Less than a day later, the data was restored, with Bloomberg saying until we confirm they no longer own the position, which may require looking at the 13 G/A filing.

At present, it can be confirmed that in early June, 3AC still held a large number of GBTC positions, and it hoped that GBTC could save 3AC.

According to The Block, starting on June 7, TPS Capital, an over-the-counter trading company under 3AC, has promoted GBTC arbitrage products on a large scale, allowing TPS Capital to lock Bitcoin for 12 months and return it after expiration, and receive a promissory note. in exchange for Bitcoin and a 20% administrative fee.

A crypto institution told TechFlow that 3AC contacted them around June 8 to promote arbitrage products, saying that 40% profit could be obtained within 40 days through GBTC arbitrage, with a minimum investment amount of US$5 million.

Theoretically, there is still room for arbitrage in GBTC with a severe negative premium.

DCG is actively applying to the US SEC to convert GBTC into a Bitcoin ETF.

Once successful, the ETF will more effectively track the price of Bitcoin, eliminating discounts and premiums, meaning that the current negative premiums of more than 35% will disappear, leaving room for arbitrage.

At the same time, DCG promised to reduce GBTC management fees, and GBTC’s trading venue will be upgraded from OTCQX to NYSE Arca, which has higher liquidity.

As the largest holding institution of GBTC, what Zhu Su has been looking forward to is that GBTC will be officially recognized as soon as possible and upgraded from a trust to an ETF, so that the value of its holdings will quickly jump by more than 40%.

In October 2021, Grayscale submitted an application to the US SEC to convert GBTC into a Bitcoin spot ETF. The deadline for the SEC to approve or reject the application is July 6. Therefore, 3AC said to a large number of institutions that it only takes 40 days. A profit of over 40% can be achieved, essentially betting that the SEC will approve the application.

But regarding this arbitrage product, Bloomberg ETF analyst James Seyffart said:

“In traditional finance, they call this a structured note, but regardless, they take ownership of your Bitcoin and also make money on your BTC. They get your BTC and in either case (GBTC converted to ETF or not) both take returns away from investors. Even if Three Arrows/TPS is solvent, it would be an absolutely terrible deal for any investor.”

It is reported that 3AC did not rely on this product to obtain too much external funds, waiting for 3AC or a tragic liquidation.

On June 18, Genesis CEO Michael Moro tweeted that the company had liquidated the collateral of a large counterparty because the counterparty failed to meet margin calls, adding that it would use all possible means to means to proactively recover any potential remaining losses, the potential losses are limited and the company has escaped the risk.

Although Moro did not directly name 3AC, combined with the current market dynamics and Bloomberg’s deliberate clearing of 3AC’s GBTC holdings data on this day, the market believes that this large counterparty is most likely to be Three Arrows Capital.

4. Grayscale VS SEC timeline review

According to the document submitted by Grayscale to the SEC on April 5, 2021, the ultimate goal of all Grayscale products is to become an ETF:

Image Source:https://www.sec.gov/Archives/edgar/data/1588489/000156459021017510/gbtc-ex991_6.htm

The planned process for all Grayscales products is: launch a private placement, obtain public quotations in the secondary market, become an SEC reporting company, and convert to an ETF.

4.1 On the eve of litigation

All litigation-related documents can be found at:Found at https://www.grayscale.com/company/gbtc-lawsuit

In October 2021, Grayscale filed a Form 19 B-4 with the SEC to convert the Grayscale Bitcoin Trust (OTCQX: GBTC) into a spot Bitcoin ETF. The standard 240-day public review period begins after the application is submitted.

During this time, Grayscale developed and deployed a national, multi-channel campaign to elevate investor voices. Encouraged by the outpouring of support from all 50 states, we submitted more than 11,500 comment letters in support of GBTC conversion.

However, on June 29, 2022, the SEC rejected the application to convert GBTC into an ETF. On the same day, Grayscale Legal Counsel filed a petition for review with the Court of Appeals for the D.C. Circuit, challenging the SECs decision.

The process of litigation includes: The litigation process involves several stages, including presentations, selection of a judge, oral arguments, and final ruling.

**Statement:** Over the coming weeks and months, Grayscale’s legal counsel will work with the Court to develop a briefing schedule. A written brief will be filed setting out the substance of the argument and emphasizing why it believes the court should overturn the SECs decision. The SEC will also have an opportunity to file a rebuttal, and then Grayscale will be given a final opportunity to rebut the SECs response. Third parties with a serious interest in the matter may also file amicus curiae, or state why they believe the court should or should not rule in Grayscales favor.

**Judge Selection:** Concurrent with the briefing process, three judges will be selected from the DC judge pool to hear the case and ultimately render a ruling.

**Oral Argument:** Grayscales attorneys, including Donald B. Verrilli, Jr., will share Grayscales arguments before the panel of judges and answer any questions the judge has. SEC attorneys will have the same opportunity. These oral arguments will be heard in the Court of Appeals for the D.C. Circuit. Oral arguments are recorded and later shared with the public.

**Final Verdict:** The jury will vote and ultimately decide who wins.

4.2 Core viewpoints of grayscale

Grayscale was beforeNew Arguments for Bitcoin ETFsandAnother New Argument for Bitcoin ETFsThe substance of the argument is described in . Simply put, the SEC’s denial draws a distinction between Bitcoin futures ETFs and spot Bitcoin ETFs because it believes the exchange that trades Bitcoin futures — the Chicago Mercantile Exchange (CME) — has sufficient safeguards to deal with fraud and manipulation, among other things. Issues of regulation and oversight. However, Grayscale believes these distinctions make no difference in the context of Bitcoin ETF approval because Bitcoin futures and spot Bitcoin are priced from the same underlying spot Bitcoin market. Therefore, it is argued that approving a Bitcoin futures ETF instead of a Bitcoin spot ETF is “arbitrary and capricious” and “unfairly discriminatory” in violation of the Administrative Procedure Act (APA) and the Securities Exchange Act of 1934 (the “Exchange Act”). ). Law or 34 Law).

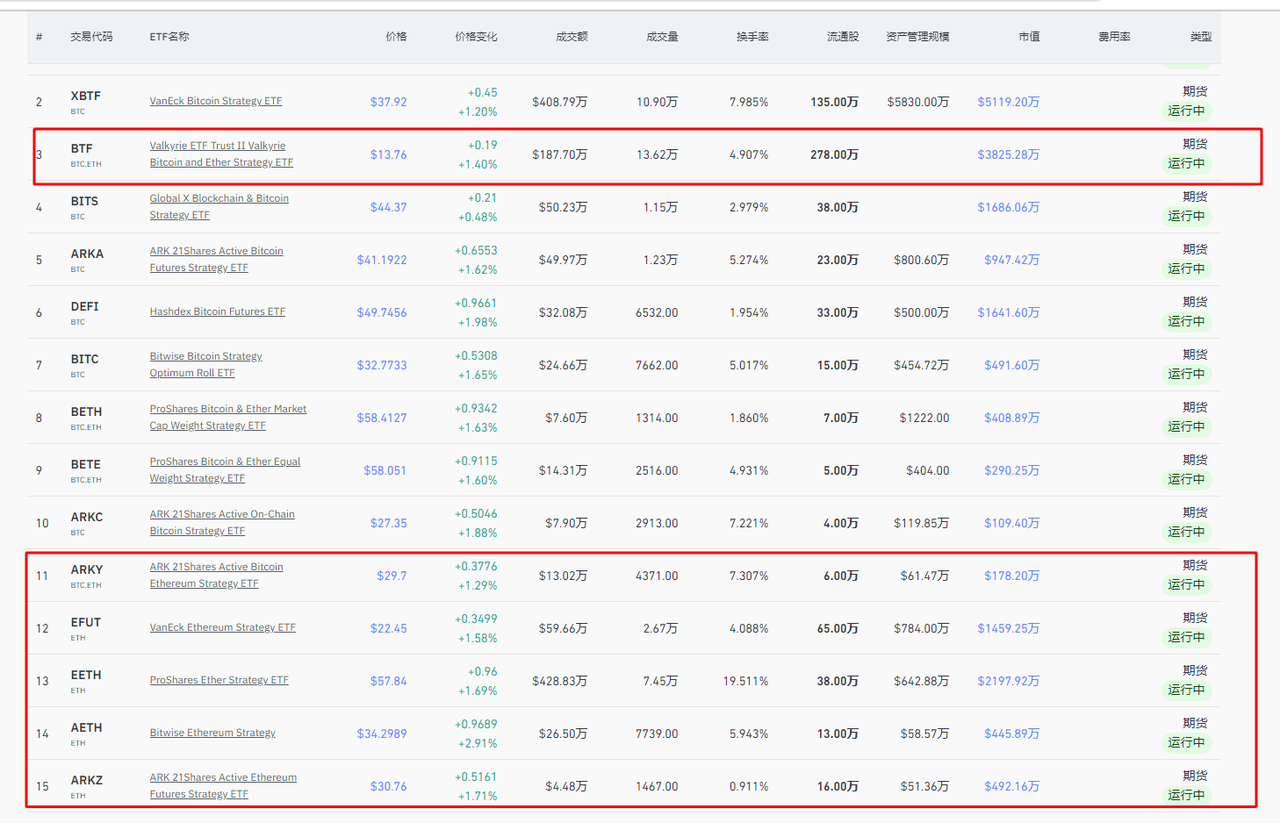

One thing that is also worthy of attention is that on October 2, 2023, the SEC approved 9 Ethereum futures ETF futures products and started trading. Can institutions directly apply the same point of view so that the SEC cannot refuse? Or, because the Ethereum Futures ETF has a shorter passage time, there is room for rollback?

The APA is a statute that governs how regulators regulate and, to a certain extent, requires the SEC to treat similar situations differently without reasonable justification. In the context of Bitcoin ETFs, this means treating both futures and spot ETFs. The Exchange Act (or the “34 Act”) governs the ability of Bitcoin ETFs to be listed on national securities exchanges such as NYSE Arca. Given that both types of ETFs are priced based on the same underlying Bitcoin market, Grayscale believes it has a strong shot at winning.

4.3 Get the win

On March 7, 2023, the lawsuit challenging the SEC’s denial of Grayscale Bitcoin Trust’s (GBTC) application to convert into a Bitcoin spot ETF reached a key milestone: the D.C. Circuit Court of Appeals heard oral arguments. Grayscale is represented by Donald B. Verrilli, Jr., former U.S. Deputy Attorney General and partner at Munger, Tolles Olson.

On August 29, 2023, the U.S. Court of Appeals for the District of Columbia issued a landmark ruling in the case of Grayscale v. SEC. In a major victory for Grayscale, a court judge ruled that the SEC erred in rejecting Grayscale’s application for a spot Bitcoin ETF, vacating the SEC’s initial denial order. The court’s decision hinged on a key finding: Grayscale convincingly demonstrated that its proposed Bitcoin ETF was “substantially similar” to a Bitcoin futures ETF previously approved by the SEC.

The court’s reasoning for this decision centered around the close correlation between the underlying assets of the two types of ETFs: Bitcoin and Bitcoin futures. Additionally, Grayscales proposal was found to be identical to a surveillance-sharing agreement between the Chicago Mercantile Exchange (CME) futures ETFs. The judges stressed that the protocols should have an equal likelihood of detecting fraud or manipulation in the Bitcoin market.

Essentially, the court found the SEC’s rejection to be “arbitrary and capricious” because it failed to explain why Grayscale’s possession of actual Bitcoin (as opposed to Bitcoin futures) would have affected CME’s ability to detect fraud. The decision marks a critical moment in the ongoing debate over Bitcoin ETFs and has far-reaching consequences for the cryptocurrency and asset management industries.

In a sense, the SEC was unable to find a reason to reject Grayscale’s trust-to-bitcoin spot ETF. In fact, it was also unable to refute the reason for “passing a bitcoin futures ETF but not a similar bitcoin spot ETF.”

Investors in most markets may not have paid enough attention to the reasons and process of Grayscale winning the lawsuit, which also led to many OGs and KOLs talking the same nonsense as the SEC when they published why the Bitcoin spot ETF was rejected in January. .

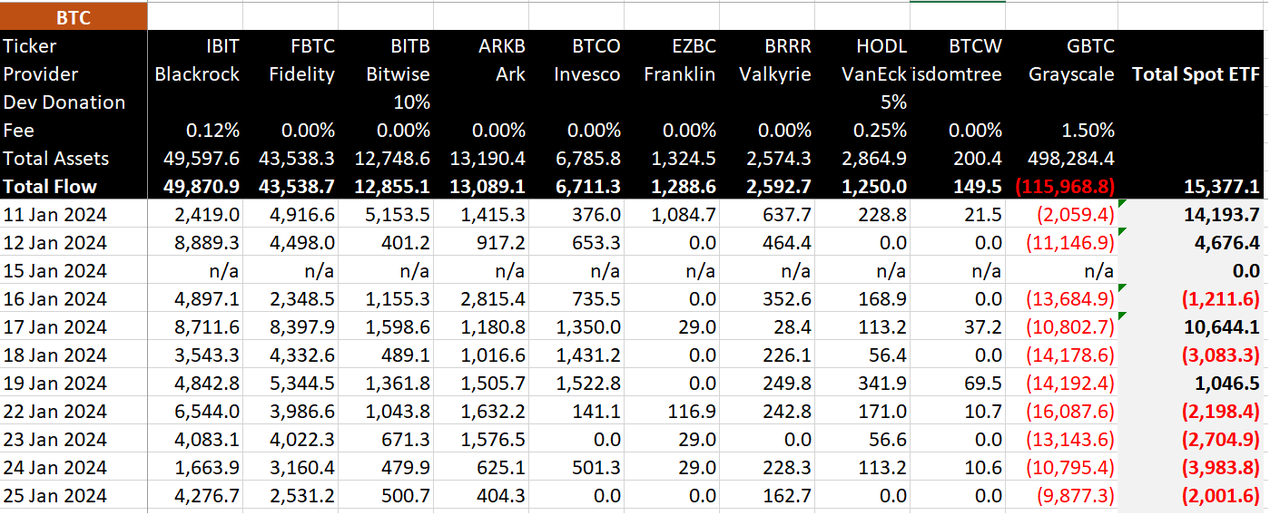

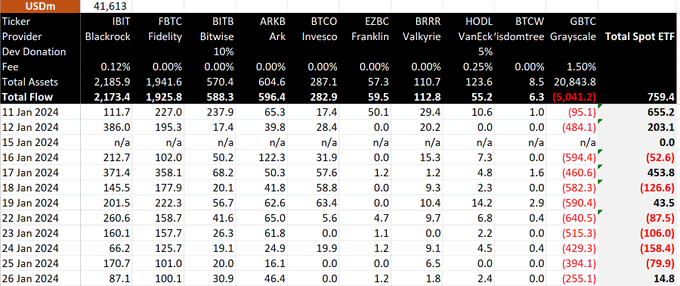

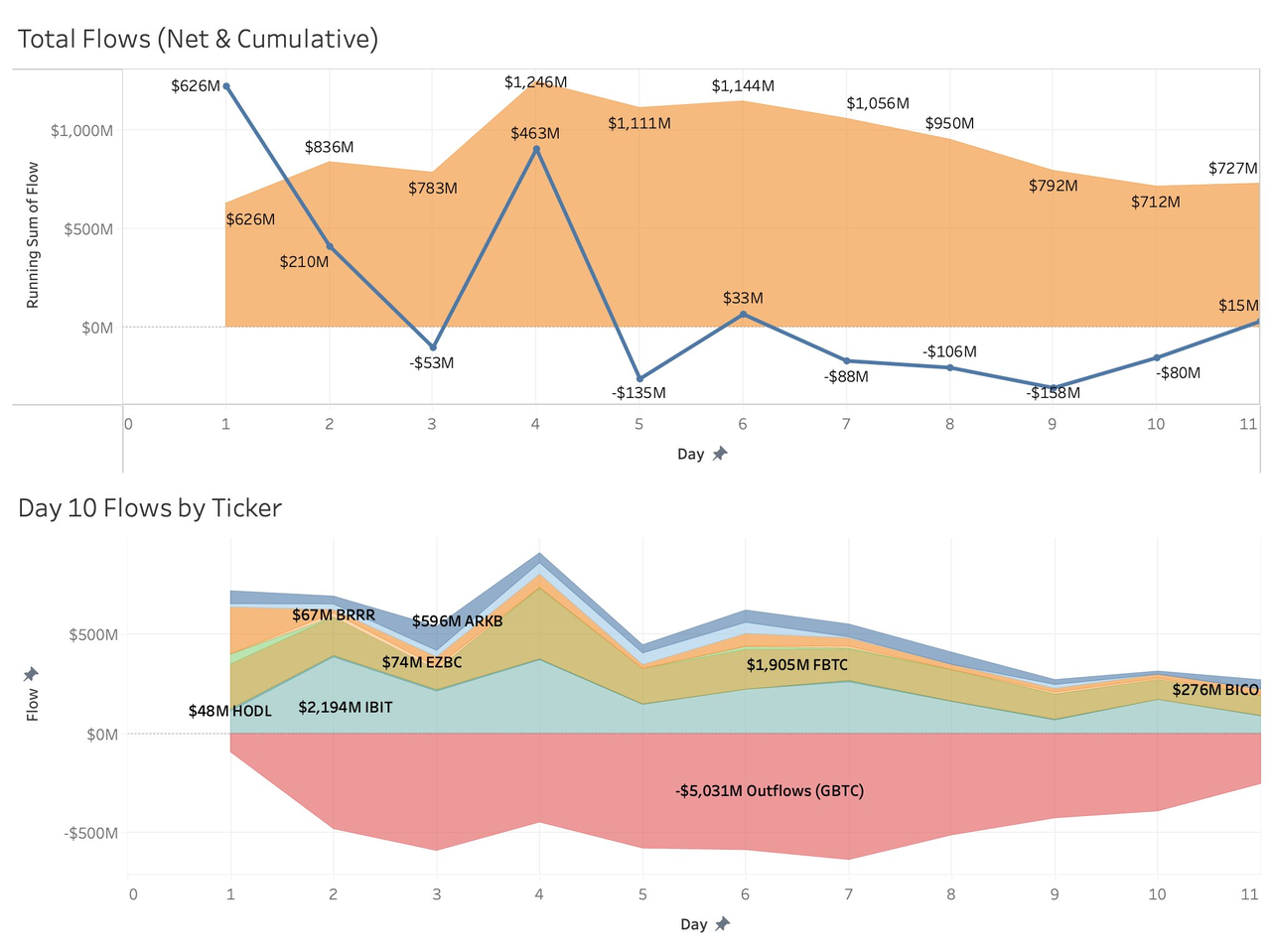

5. Recent spot ETF and grayscale data

5.1 Recent situation of 11 Bitcoin spot ETFs

Single-day net flow situation (currency basis)

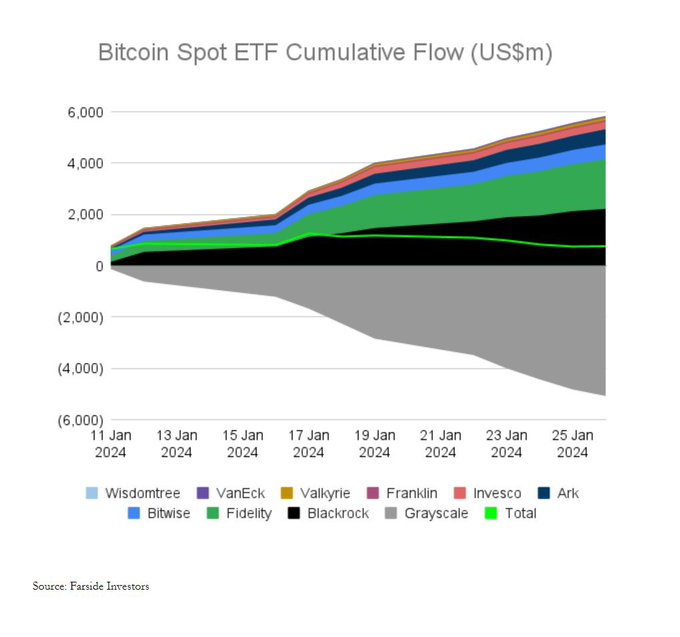

Grayscale’s daily outflows have been fluctuating around 10,000 and currently still holds 500,000 Bitcoins. At present, it seems that this part of the money cannot be completely converted into other spot ETF products. On January 26, there was a net outflow of the currency standard, but the net inflow of the u standard was more due to the recovery of currency prices.

BlackRock and Fidelity inflows ranged from around 7,000-10,000.

Data Sources:https://twitter.com/BitMEXResearch/status/1751145871742324768

Single-day net flow situation (u standard)

Data source: https://twitter.com/BitMEXResearch/status/1751145871742324768

Image Source:https://twitter.com/Sinz_Bitguide/status/1751311403296727301

Comparison of cumulative inflows and outflows

Image Source:https://twitter.com/NateGeraci/status/1751411838581911886

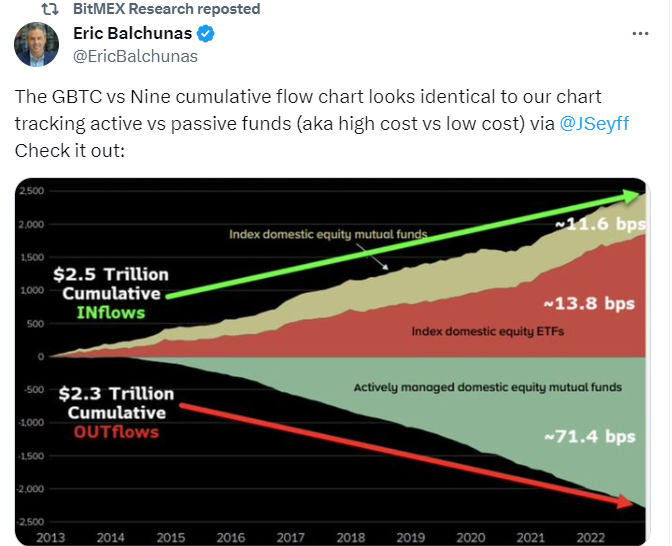

Eric (a very senior ETF researcher at Bloomberg) put up a comparison chart of active vs passive funds.

Image Source:https://twitter.com/EricBalchunas/status/1751321469563420718

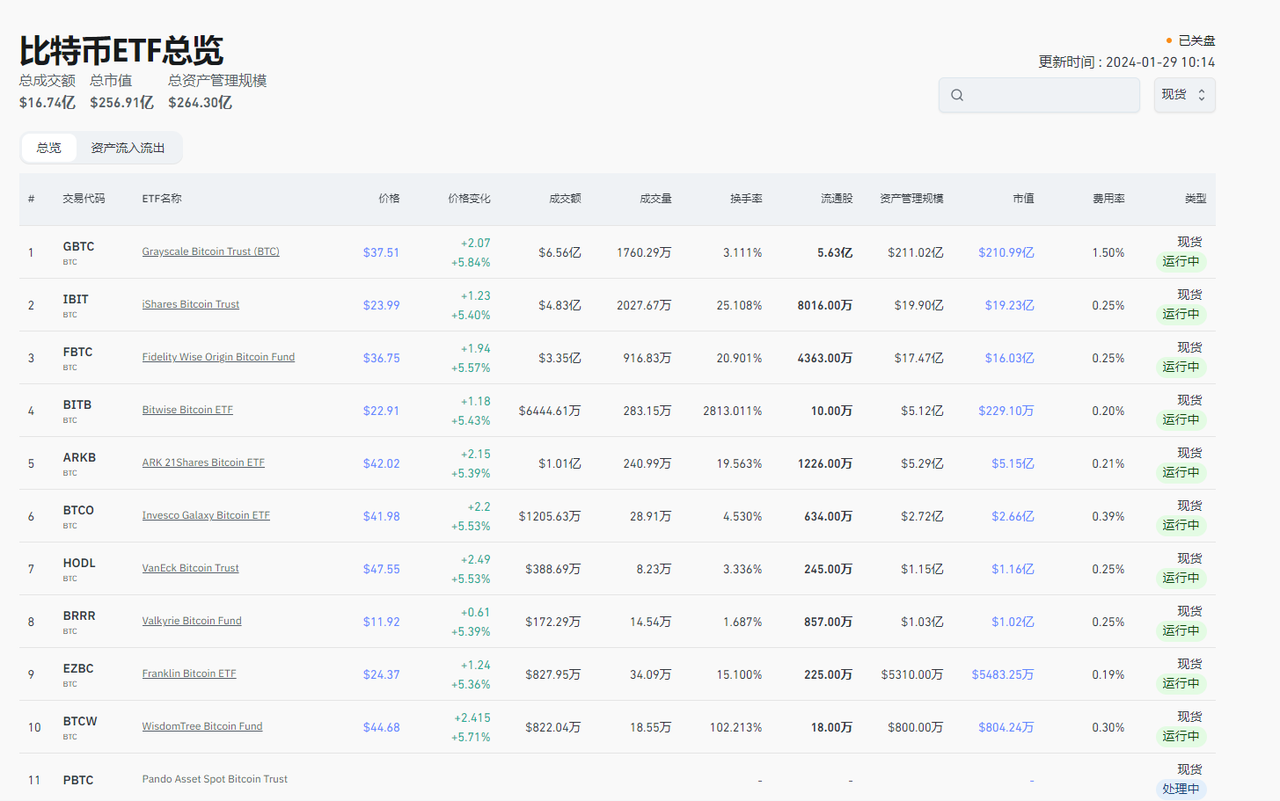

The market value of GBTC is still over 20 billion US dollars.

Data Sources:https://www.coinglass.com/zh/bitcoin-etf

In addition, European Bitcoin spot ETF products have experienced continued outflows after the passage of the US Bitcoin spot ETF.

The main reasons are speculated to be: lower rates, better liquidity and policy protection.

5.2 Grayscale Bitcoin Position

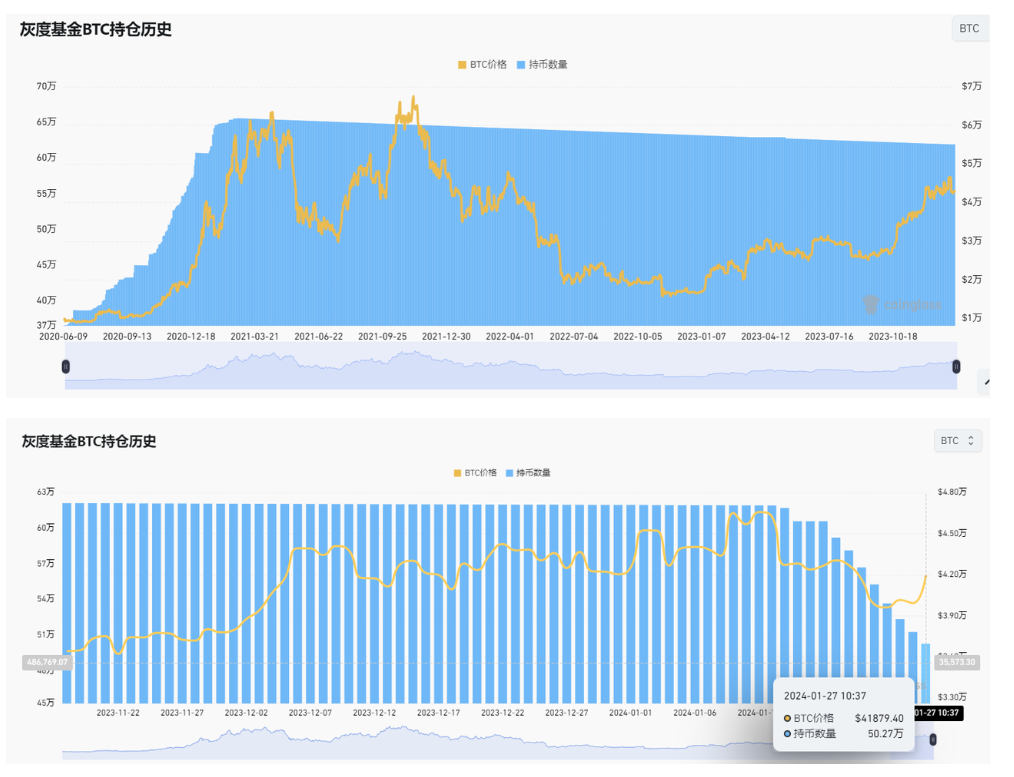

Judging from the historical number of Bitcoins held, in more than half a year from June 2020 to the beginning of 21, the holdings rushed from 370,000 to 655,000, and the price of Bitcoin also rushed from less than $10,000 to $56,000. . After that, Grayscale’s Bitcoin holdings began to decline at a relatively slow rate.

It is worth noting that the last Bitcoin halving was on May 12, 2020. The next Bitcoin subtraction will be in April 2024. Will there be another gray level, with a substantial increase in holdings in a short period?

At that time, Bitcoin could not be outflowed. The official statement was: Note: Grayscale will not sell the digital assets managed by its trust, that is, there is currently no redemption mechanism. The decrease (negative number) in the position in the chart is the yearly deduction by Grayscale from time to time. Fees. The total scale of Grayscale Trust’s assets under management changes with changes in currency prices.”

As of January 27, there were only 500,000 coins left.

Data Sources:https://www.coinglass.com/zh/Grayscale

5.3 Grayscale products

Image Source:https://www.greyscale.com/crypto-products

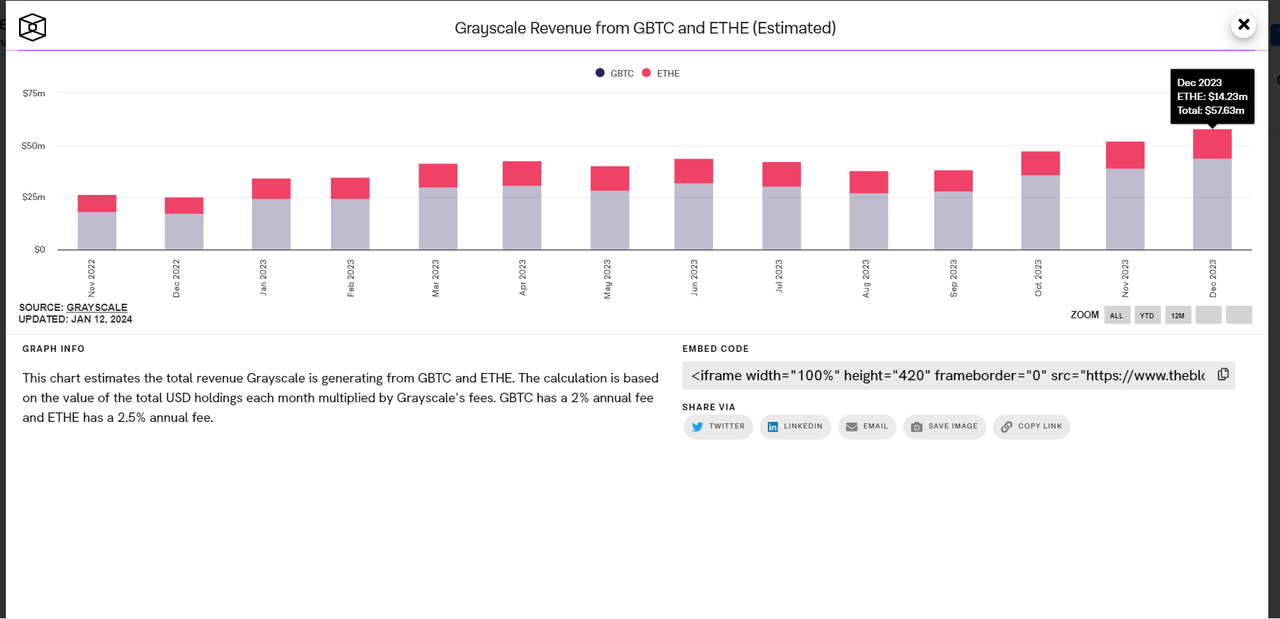

5.4 Grayscale’s income

Grayscales income has exceeded the monthly income of $50m as the Bitcoin spot ETF is approaching approval. Calculated based on an average of $30m/month, the handling fees can be approximately $360 million per year.

Data Sources:https://www.theblock.co/data/crypto-markets/structured-products

5.5 Grayscale Fund Positions

Grayscale’s Ethereum holdings are probably less than 1/3 of Bitcoin, but it is already far more than the current Ethereum futures ETF in the market.

Data Sources:https://www.coinglass.com/zh/Grayscale

5.6 Ethereum Futures ETF

Data Sources:https://www.coinglass.com/zh/bitcoin-etf

5.7 Premium Rate

Data Sources:https://www.coinglass.com/zh/Grayscale

6. Some opinions

@Phyrex_Ni:https://twitter.com/Phyrex_Ni/status/1748335993852440879

appendix

About E2M Research

E2M Research focuses on research and learning in the fields of investment and digital currency.

Article collection:https://mirror.xyz/0x80894DE3D9110De7fd55885C83DeB3622503D13B

Follow on Twitter :https://twitter.com/E2mResearch️

Audio Podcast:https://e2m-research.castos.com/

Small universe link:https://www.xiaoyuzhoufm.com/podcast/ 6499969 a 932 f 350 aae 20 ec 6 d

DC link:https://discord.gg/WSQBFmP772