FTX官宣不会重启,FTT重生之我是meme

Original|Odaily

Author|jk

On Wednesday, January 31, local time in the United States,Bankrupt cryptocurrency exchange FTX has told a court it expects to be able to repay its customers in full.The announcement came through a court hearing, and U.S. Bankruptcy Judge John Dorsey has given preliminary approval to the date, despite the disapproval of a significant number of creditors.

According to court procedures,FTX abandoned plans to relaunch its platform and instead focused on repaying its former customers in full.According to court proceedings, FTX abandoned plans to relaunch its platform due to a lack of buyers. Advisors conducted a thorough search of the market to find investors willing to restart FTX, butNo one was willing to provide the cash needed to restart the exchange.

FTX attorney Andrew Dietderich said the reimbursement process will require claimants to submit proof to verify they actually held and lost assets on FTX. This process will be reviewed by restructuring advisors.

Is the platform currency FTT still useful?

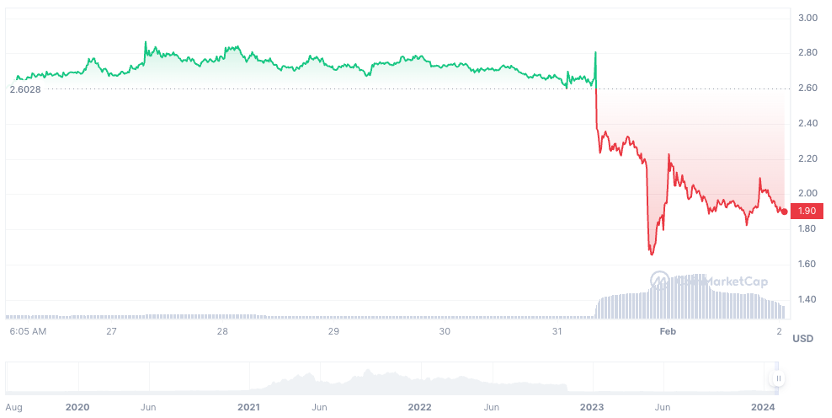

FTX’s native token, FTT, briefly rose after the company’s plans were announced, but then fell sharply. A few days ago, the price of FTT had been fluctuating briefly around US$2.65. However, it has now reached around US$1.91, with the lowest point reaching US$1.65, a 7-day decline of 27.04%.

FTT trend, source: Coinmarketcap

This market reaction is actually to be expected. According to the script that was previously expected to be restarted, the appreciation of FTT is based on the fact that after the restart of FTX, it is still possible to re-enable FTT as the native token, or to exchange FTT according to a certain proportion to release new native tokens.However, this expectation was shattered when FTX announced that it would not restart; after giving up on restarting, FTT has actually been unable to find new uses, and as FTX continues to liquidate assets to compensate customers, the value of FTT will inevitably follow the sell-off. further decline.

In the worst-case scenario, FTT may end up becoming what Luna Classic was after the collapse of Terra.de facto memecoin, fluctuates with the emergence of each relevant news, but there is a high probability that it will not return to the high point of the year.

Full compensation: This is good news, but at what point in time will the compensation be paid?

FTX previously reported that there were more than 36, 000 claims totaling approximately $16 billion. Last year, it said it could only compensate about 90% of its customers. Now, the plan to fully compensate customers is naturally better news, but there is also a problem that comes with it;FTX may not be able to compensate customers according to the original token type, so if compensation is based on the US dollar value, at what point in time is the US dollar value based on?

Before FTX collapsed, Bitcoin was worth around $20,000. If based on the time when FTX declared bankruptcy, the value of Bitcoin would have been around US$16,000, but now it is around US$43,000, a huge difference. “Many of these claims are based on the significant decline in the value of the currency during that tumultuous period,” Kris Hansen, an attorney for the FTX creditors committee, said during Wednesday’s hearing.

According to Bloomberg, U.S. Bankruptcy Judge John Dorsey ruled thatThe size of each claim will be based on the amount owed to customers or creditors by FTX on the date it files for bankruptcy.Dorsey also approved rules for estimating the amount owed by each creditor and customer. Some clients have complained that fixing their claims to prices at the end of 2022 would cause them to miss out on rising digital asset prices. Dorsey ruled that bankruptcy rules require a companys debts to be tied to the date it files for court protection. So, this is similar to the value of the claim that Odaily reported FTX had proposed,The compensation is based on the price of Bitcoin at around $16,000, which will undoubtedly cause great losses to creditors.

On the bright side, if it were not for this bull market starting in 2023, the remaining cryptocurrency assets after FTX’s bankruptcy may not be enough for it to repay all investors. In other words, it is almost impossible to repay according to recent prices, but this round of appreciation has made it possible for FTX to pay out at the price in November 2022.

“I hope the courts and stakeholders understand this is not a guarantee, but a goal,” Dietderich said. Theres a lot of work and risk between us and this outcome. But we believe this goal is achievable and we have the strategy to get there.