五大数据维度分析:大热的新L2们是否被高估

Original - Odaily

Author - Nan Zhi

Recently, the TVL and currency price of Layer 2 Manta have experienced a substantial increase; ZKF once surged to 0.025 USDT and has now been cut in half, but the TVL is still high; some Layer 2 such as zkSync and Linea are also expected to issue coins in 2024.

Amid the excitement, Odaily will conduct comparisons between Layer 2 based on various data such as TVL and market capitalization, and horizontally compare overestimation and underestimation.

Comparison of TVL and market capitalization of new and old L2

According to L2 BEAT data, the top ten TVL Layer 2 are as shown in the table below (where Blast TVL is combined with Dune data). At the same time, Odaily also integrated Coingecko to summarize the circulating market value and fully diluted market value (FDV) of issued Layer 2 tokens:

Based on the table below, the following salient features exist:

Recently, only Manta and ZKFair TVL have significantly improved, while the rest of Layer 2 has not changed much;

In terms of TVL, Arbitrum and OP occupy a significant lead and still perform above the median at this volume;

And the TVL of Manta and Blast is already ranked third and fourth between Layer 2;

Except for Metis, several old Layer 2 companies have similar market capitalizations, all in the billions of dollars.

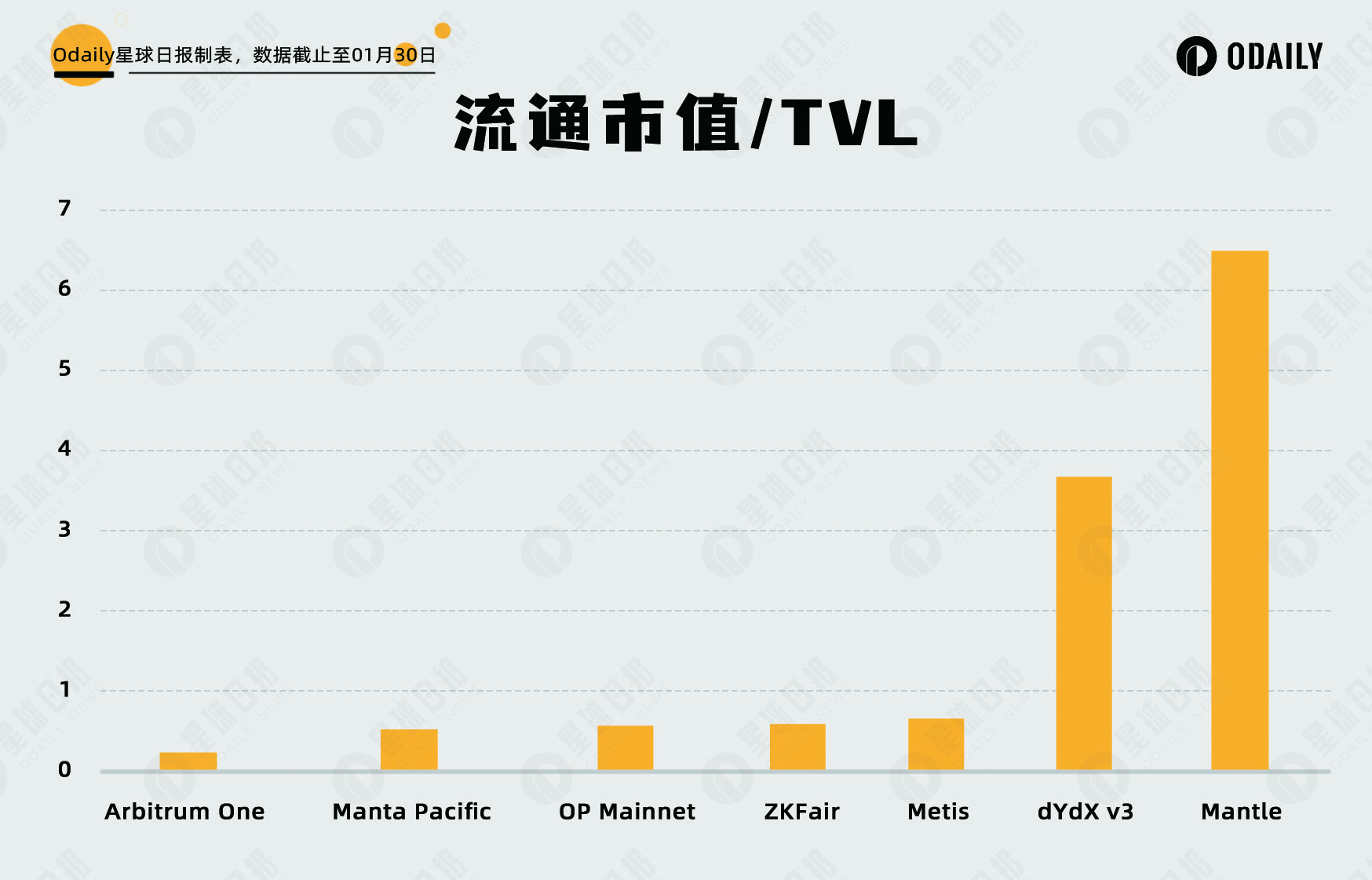

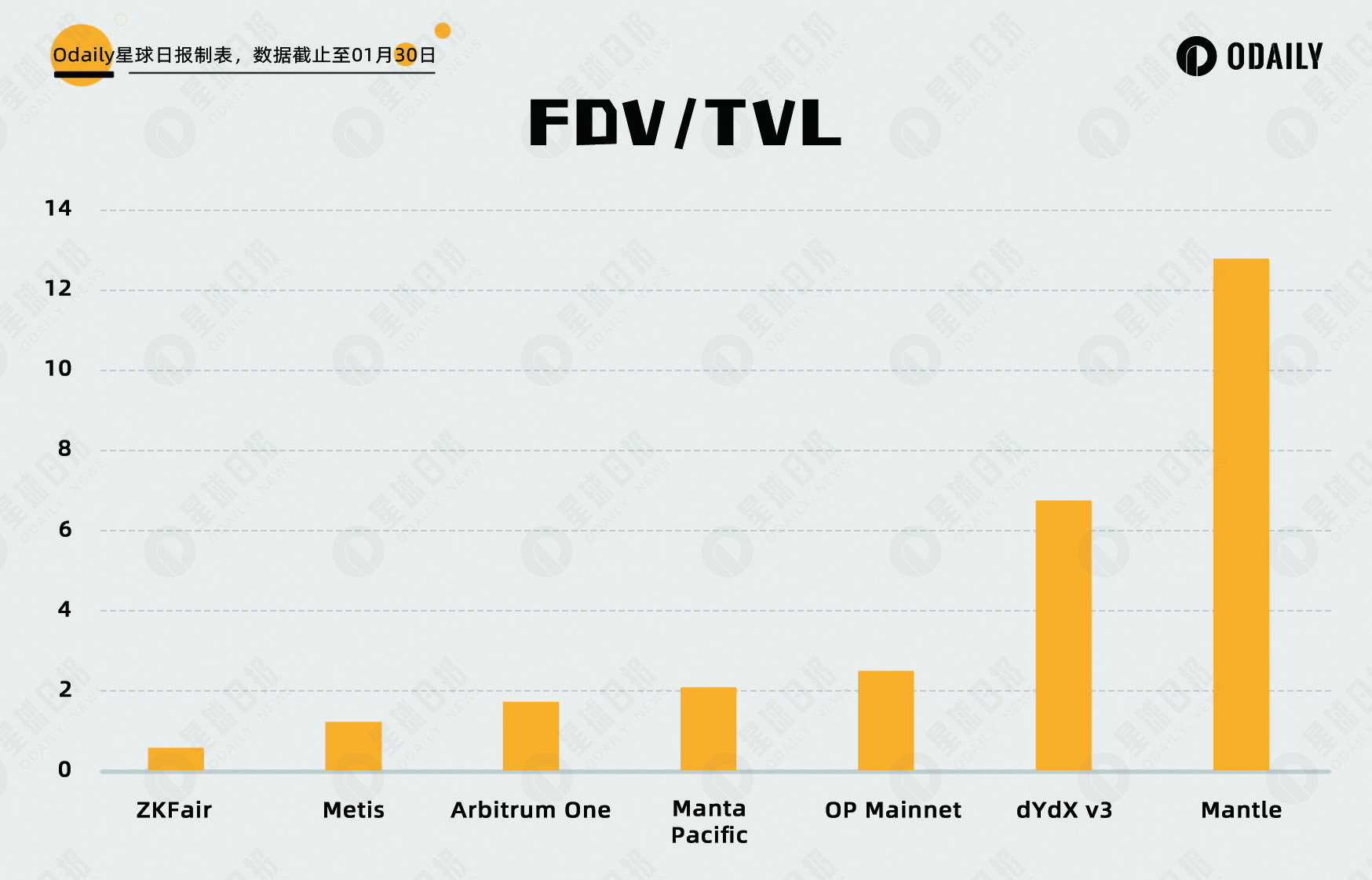

Odaily proposes hereTwo calculation indicators: circulation market value/TVL and FDV/TVL. The larger the value, the higher the degree of overestimation of the corresponding token.. Its data and rankings are shown in the figure below.

It can be seen that Mantle and dYdX v3 are in a relatively overvalued position. The rapidly rising valuation of Manta is still within the average range of mainstream Layer 2, while ZKF’s FDV/TVL after being cut in half is significantly lower than other Layer 2. The upside potential is greater.

ecological active comparison

According to DefiLlama data, the number of protocols, TVL, and 24-hour DEX trading volume of each ecology are as shown in the following table:

As can be seen from the table:

Arbitrum has a significant lead in terms of number of protocols, TVL, and transaction volume;

The number of Arbitrum, OP, and Base protocols is much higher than other Layer 2, and ZKF is significantly less than other Layer 2.

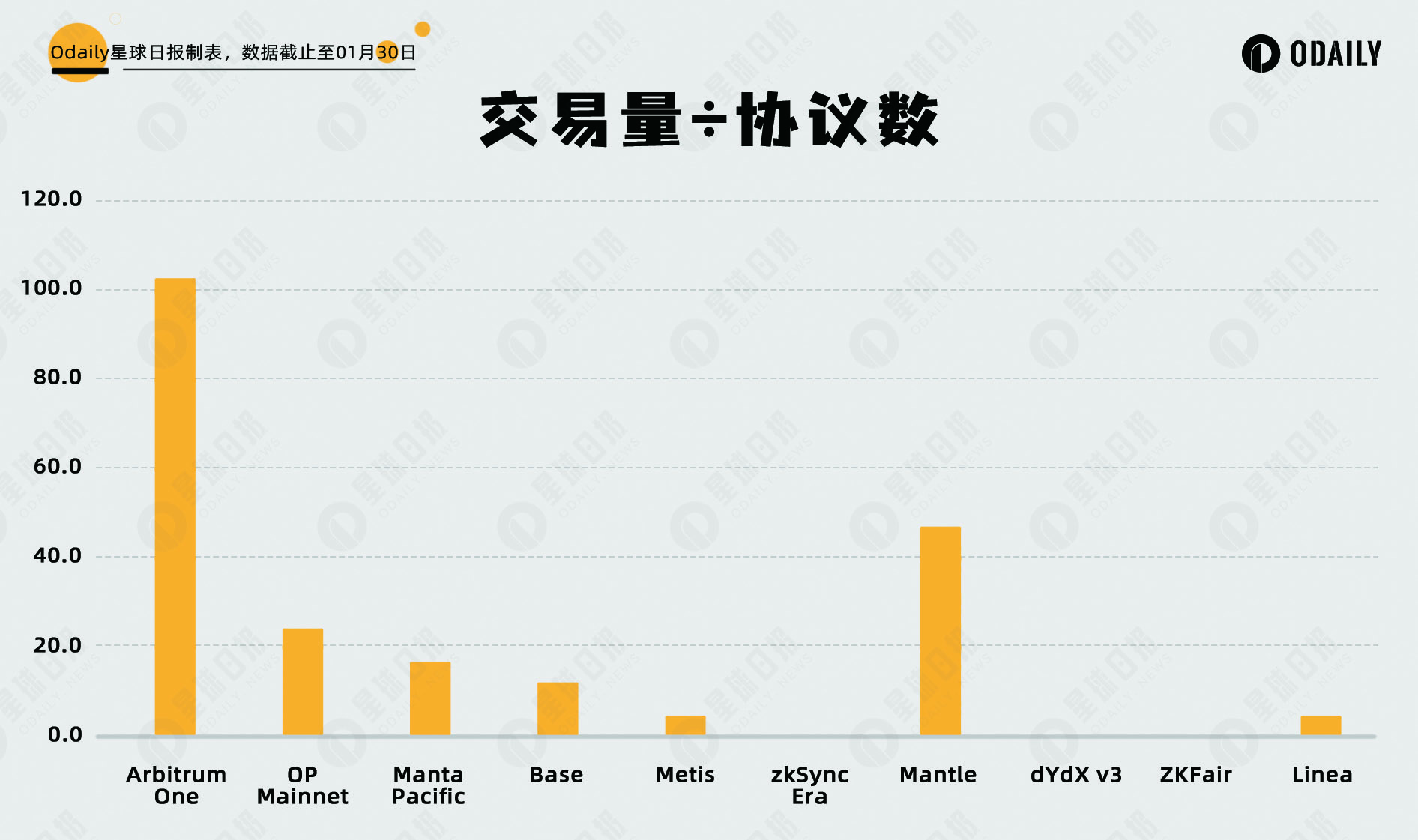

Odaily proposes hereThe two calculation indicators TVL/number of protocols and transaction volume/number of protocols reflect the degree of dispersion of funds and activities. A low value means that funds are evenly distributed among protocols and users have no preference for specific protocols. A high value represents two possibilities: there are star protocols in the ecology, or there is a concentration on a certain protocol to increase the volume.

It can be seen that the locked funds in Manta, ZKFair, and Arbitrum One are more concentrated in a few protocols.

in conclusion

Based on the above data,The recent growth of Manta and ZKF is a return to the average valuation level of Layer 2, and is currently near the average line.

Odaily would like to remind you that TVL and other data are greatly affected by activities and development stages and are not sufficient as a complete basis for decision-making. Readers are advised to integrate other data for research and decision-making.