IOSG Ventures:如何定价非理性市场的项目公允估值(FDV)?

Original author: Nelson, IOSG Ventures

introduction

The recent hit of Flowers shows the audience the secrets of the capital market, especially the last scene when different characters buy and sell stocks and change market liquidity to affect stock prices and their own profits and losses. These plots not only reveal the complexity of the stock market, but also reflect the different risks that investors face in the market.

Misestimation of market capitalization is very common in the traditional financial world, especially during the dot-com bubble, when liquid stocks were relatively limited and the stock prices of many companies were overvalued, while actual assets and profitability did not support such market capitalization, causing the market to Instability and eventual collapse.

A similar situation exists in the current cryptocurrency space. Due to the emerging nature and immaturity of the crypto market, coupled with imperfect regulation, the market is more susceptible to price manipulation and speculation. In this environment, it is important to understand the true value of assets.

Introduction

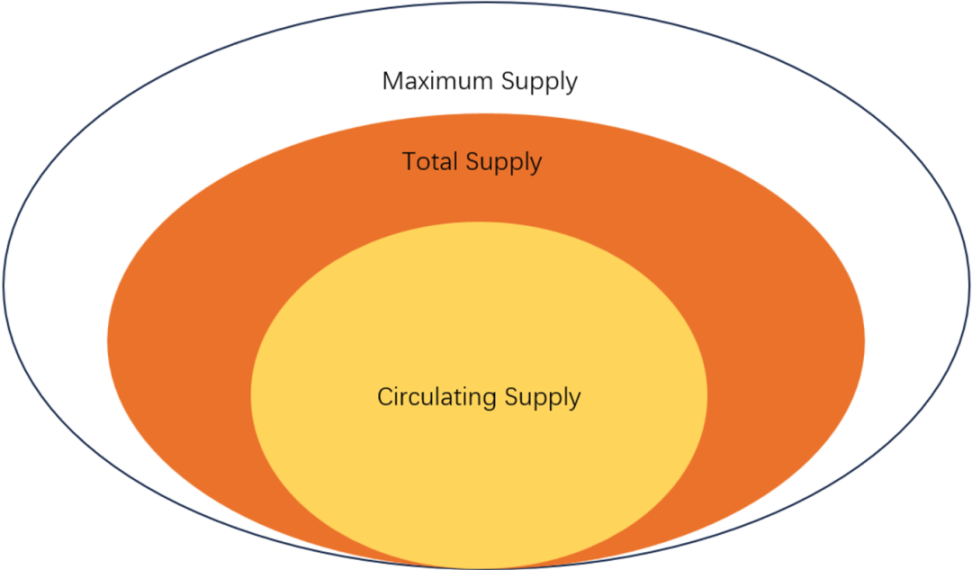

For newcomers, terms such as Circulating Supply (Circulating Supply), Total Supply (Total Supply), Maximum Supply (Maximum Supply) and Market Capitalization (Market Capitalization) in the cryptocurrency secondary market are usually their first exposure. content. These concepts are crucial in understanding the dynamics of cryptoassets. Circulating supply is the amount of currency currently in public hands and available for transactions. The total supply further develops to include all coins minted, minus coins no longer available. Maximum supply represents the absolute limit of money that will ever exist and is a key indicator of a currencys potential scarcity. Market capitalization is typically calculated by multiplying a currencys current price by its circulating supply, providing information about its market value.

These metrics are very informative numbers; they are an essential tool for assessing the health and potential of a cryptocurrency. When exploring a protocol’s tokenomics, we often come across detailed currency allocations, but translating this information into actionable insights into different types of currencies can be challenging. Here, the concept of Fully Diluted Value becomes relevant. It estimates a project’s market capitalization by assuming its token supply is fully circulating, thus providing a broader perspective on the long-term market potential. However, using todays prices to calculate future fully diluted value is problematic and often provides limited information because it ignores how market dynamics may change over time. How do we efficiently calculate different categories of currency and decide whether to include them in our calculations?

To illustrate this issue, Optimism and Arbitrum might be a good case study. When conducting a market cap calculation on Optimism, we found that its description of the uses of different tokens is quite complex. This article aims to tease out these categories and provide suggested treatments for each. We need an objective way to measure the current market valuation assigned to a specific project, regardless of whether this token has inflationary or deflationary dynamics in the future. We wanted to answer some simple questions, such as how should we decide the market capitalization of a project, and based on the valuation method, which project is currently more popular on the market, Arbitrum or Optimism?

The discussion will unfold in the following manner, starting with an analysis of the various types of currencies that should be considered in our valuation calculations. This will include an examination of their respective functions, processing methods, and the rationale behind these choices. We will then map these currency types against the specific categories outlined in [Optimism] and [Aribitrum]’s Token Economics.

Token type

Before we figure out what to do with each category, let’s get some consensus on what the circulating supply, total supply, and maximum supply of Optimism are.

Based on the definition of [Optimism] and [Table Record of Optimism], the long-term maximum supply of OP tokens is expected to be approximately 4.3 billion. Optimism defines the circulating supply as the number of OP tokens that circulate freely without any transfer restrictions. The total supply includes not only these circulating tokens, but also tokens governed by specific distribution plans. Currently, the circulating supply is 911 million, while the total supply, including distribution-controlled tokens, is around 2.2 billion. The diagram is as follows:

When calculating market cap, people typically only consider the circulating supply. But its not a comprehensive measure. Lets break this diagram into three parts and discuss what should be done with them.

Type 1:

Currency circulating in the blockchain

Definition: These are currencies that are actively traded within the blockchain ecosystem.

Whether to include in market capitalization calculation: Yes

Reason: These currencies have active market value and are an important part of the blockchain economy.

Uncirculated currency:

Distinguish between different types of illiquid currencies: Although these currencies are not currently in circulation, they are reserved for specific roles and have the potential to impact the future value of the blockchain. Therefore, when considering including them in our circulating supply calculations, it is key to examine the conditions under which these currencies will be distributed and evaluate their potential impact on the ecosystem. More specifically, the key question to consider is whether the circulation of these currencies is used to reward community contributions that benefit the ecosystem, or whether they are distributed because they fund projects. For example, regarding investors locked-in shares, this situation can be compared to the real world: when the company goes public, the founders will have a lock-up period, but when calculating the uncirculated shares, we still consider this part, although this may not be consistent with the market. Liquidity does not match.

Type 2:

Currency allocated but locked

Definition: Typically, the portion of the total supply not included in the circulating supply is mainly held by core contributors and investors, which is what Optimism calls sugar xaddies. Tokens allocated to contributors and investors are currently locked, but according to the planned timeline, they will be unlocked and tradable in the future.

Whether to include in market capitalization calculation: Yes

Reason: These tokens have been allocated, and whether the project gets better or worse in the future, sooner or later they will be tradable.

Type 3:

unallocated currency

Definition: Typically, the portion of the total supply not included in the circulating supply is primarily held by the Optimism Foundation. They reserve this portion of the tokens for future distribution to developers, contributors, and other important stakeholders to reward them for their contributions to the project.

Are included in market capitalization calculations: No, until they are assigned

Reason: These tokens are primarily held by the Optimism Foundation for future investment and will not be distributed if no value is generated in the future.

More specific example:

The previous discussion may have been a bit obscure, so in the following sections we would like to discuss different scenarios. These cases may not happen in the OPs situation.

1. Paying employees: This type of use should be accounted for after it occurs. Compared to tokens locked for contributors, this situation is more autonomous and we dont know what will happen in the future.

2. Exchanging tokens for USDC and selling them to the market: This type of transaction should also be recorded after it occurs. But we have to remember that this will also inflate the asset side of the balance sheet (just like selling treasury stock on the stock market). This is an act of value exchange rather than value creation.

3. Allocate tokens to ecosystem projects: This is an investment in the future of the ecosystem, usually autonomous and well thought out. Therefore, once a certain distribution is granted, it should be included in the market capitalization calculation.

4. Airdrop tokens to users: This is an investment in its users, either to gain their loyalty or to market its protocol, and should be factored into it once it happens.

5. Burning Tokens: These should be deducted from the calculation as they will no longer be active in the future

Map to specific categories of Optimism

click this pageCome see how Optimism distributes its tokens and how.

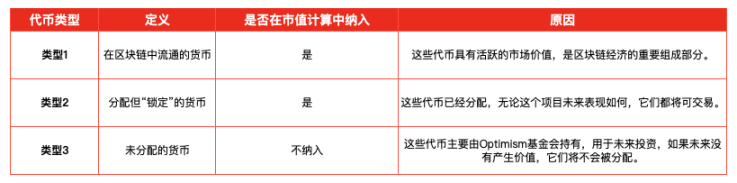

Airdrop - Type 1

Included in market capitalization calculations: Yes

Reason: Airdrops are similar to loyalty/marketing fees and can be freely traded once awarded. Participants are free to trade these tokens; they should be considered Type 1 and we need to include all tokens in this category. Prior to distribution, these tokens are held by the Optimism Foundation (Type 3). There has been a lot of discussion around the allocation conditions on the forum (https://gov.optimism.io/t/treasury-appropriation-proposal-foundation-year-2-budget/5979/6). An important metric is return on investment (ROI).

Ecosystem Fund – Type 3

Whether to be included in market capitalization calculations: Not included until allocated

Why: Within this category there are four distinct subcategories: Governance Funds, Partner Funds, Seed Funds, and Unallocated Funds. Based on the information provided by [cryptorank](https://cryptorank.io/price/optimism/vesting) we can conclude that partners, seeds and unallocated funds are not tracked and therefore are not counted as tokens in circulation currency. A portion of the governance fund is considered a token in circulation. This is the right decision. These tokens are used for future investment and growth plans. They should be accounted for after any distribution is announced.

RetroPGF-Type 3

Whether to be included in market capitalization calculations: Not included until allocated

Reason: RetroPGF tokens represent payment for past contributions and should be included in valuation calculations after any distribution is announced. But such inclusion should be limited to the amount already allocated. Because allocations through this channel are voted on regularly, based on peoples contributions, just like a company outsourcing projects to other external entities. This approach ensures that contributions are appropriately recognized and rewarded, aligning incentives with the growth and success of the community. Moreover, this type of fund is sure to have the highest return on investment (ROI) for this ecosystem, because rather than buying a promise of the future, it feels more like compensation for outstanding achievements.

Nature and distribution of RetroPGF: RetroPGF, conceived by Vitalik Buterin, operates on the principle of rewarding past rather than expected contributions. Governed by a DAO (Decentralized Autonomous Organization), it will retroactively fund projects of value to the community. The allocation of these funds is handled by the DAO, known as the result oracle, which allocates rewards based on past performance and impact.

Core Contributor - Type 2

Whether to include in market capitalization calculation: Yes

Why: These tokens represent the entity’s original issued shares and are critical to its foundation. They are type 2 and should be fully included in the valuation. Although they have a lock-up period, they can be thought of as IPO lock-ups that restrict core members from selling shares within a certain period. This will not affect their holdings regardless of future events. These stock grants are rewards for their past actions and contributions to ecosystem building. Even if they cease active participation, their holdings will continue to increase as planned.

Sugar Xaddies- Type 2

Whether to include in market capitalization calculation: Yes

Reason: Similar to core contributors, these tokens are critical to the entity and should be considered Type 2 and therefore fully included in the valuation.

Mapping to specific categories of Arbitrum

click this pageCome see how Optimism distributes its tokens and how.

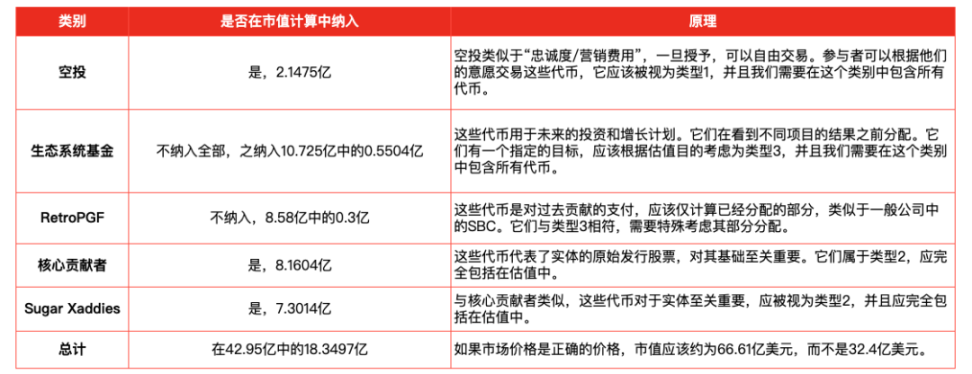

DAO Treasury- Type 3

Whether to be included in market capitalization calculations: Not included until allocated

Why: Arbitrum describes it as used to fund the ongoing development and maintenance of the organization and its technology. Therefore, the distribution of these tokens should be considered a one-time cost or investment. Prior to any deployment, these tokens are not in circulation and generate no value.

Teams and Consultants - Type 2

Whether to include in market capitalization calculation: Yes

Reason: Same as Optimism

Investor - Type 2

Whether to include in market capitalization calculation: Yes

Reason: Same as Optimism

Airdrop - Type 1

Whether to include in market capitalization calculation: Yes

Reason: Same as Optimism

DAO in the Arbitrum Ecosystem - Type 1

Whether to include in market capitalization calculation: Yes

Principle: These tokens have been allocated to different DAOs, and they will have independent choices on how to distribute these tokens. Therefore, we can think of these tokens as a two-step airdrop (from Aribitrum to DAO, then from DAO to users). Therefore, Arbitrum has no control over these tokens.

Here is a summary of the above:

Table 1: Token types classified according to functionality

Table 2: Matching Optimism Token Economics to Different Types

Table 3: Matching Aribitrum Token Economics to Different Types

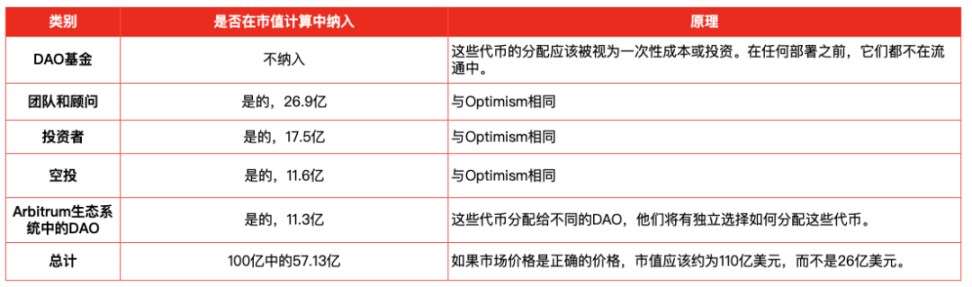

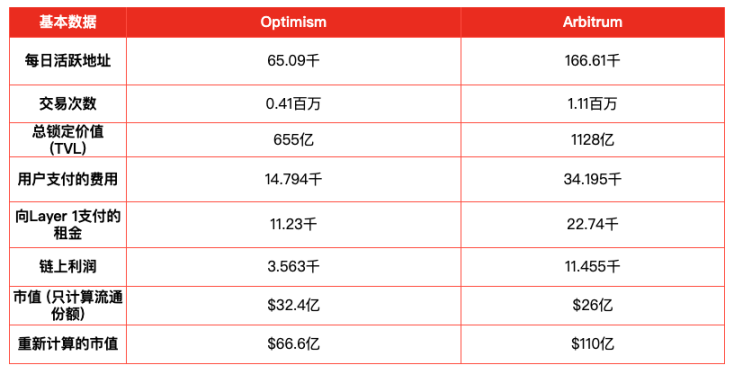

Table 4: Single-day fundamental comparison between Optimism and Arbitrum 2024.1.14 (data provided by GrowThePie)

Summarize

New crypto projects often face the challenge of low circulating supply. Market cap calculations focus primarily on circulating supply and often overlook tokens earmarked for future use. This can lead to inaccurate market capitalization data and raise issues such as potential supply manipulation, complicating accurate assessment of project valuations. The situation is further complicated when secondary market traders focus on circulating market cap and may overlook the large allocation of tokens reserved for the future.

To address these challenges, the goal is to establish a method to assess a projects current market valuation, regardless of its future dynamics. This aims to provide clear answers, such as comparing the market capitalization of projects like Arbitrum and Optimism.

In addressing this issue, it is critical to define the principles that guide market capitalization calculations. These principles should be consistent with the value that each token can generate. For example, tokens allocated for employees, VCs, and airdrops should be included in market cap calculations regardless of their locked status, as they have specific uses. Conversely, tokens reserved for future undefined use shall not be considered future supply until their intended use becomes apparent.

Applying these principles results in general rules for token classification. Tokens with a clear purpose and allocation, intended for VCs, the community, employees or developers, should be included in the market capitalization. But discounts can be applied to account for long-term release plans. Conversely, tokens lacking a specific allocation should be dismissed from consideration until their intended use becomes apparent. Ecosystem funds and reserves are examples of these.