SignalPlus Macro Research Report (20240123): GBTC funds continue to flow out, FTX sells shares

Markets have been relatively subdued this week, with U.S. stocks hitting record highs again, while China/Hong Kong stocks are still struggling, down 10% year-to-date. The continued decline in Chinese risk assets has heightened expectations for easing policy, and Chinese authorities said they It plans to use 2 trillion yuan ($278 billion) of offshore funds from state-owned enterprises to provide buying support for the domestic market through Hong Kong Stock Connect, while also setting aside another 300 billion yuan to support the stock market. Market expectations are rising for further measures to be introduced next week, although whether these measures will provide much-needed structural solutions is still unknown.

In the United States, risk sentiment remains unstable, with stocks rising 2-3% over the past week, but analytical data suggests the market has softened, with 10-year yields rising 19 basis points. In addition, although economic data has largely outperformed the market Citis economic surprise index was +4 in the past week, which has fallen sharply from the average of +37 in 2023. In other words, market expectations have been raised, and the economy has exceeded expectations. If the market continues to exclude expectations of interest rate cuts, it may pose resistance to the U.S. stock market in the short term.

In addition, although hard data (such as retail sales, GDP) have remained strong since the end of the fourth quarter of last year, soft data has lagged behind, which reminds us of the situation in 2023. Generally speaking, soft data will lead in the long-term trend. Hard data, however, that was not the case last year and optimism finally prevailed, will lady luck be on our side again this year?

Given that the outlook remains unclear, it seems reasonable that risk sentiment has cooled significantly since the start of the year.

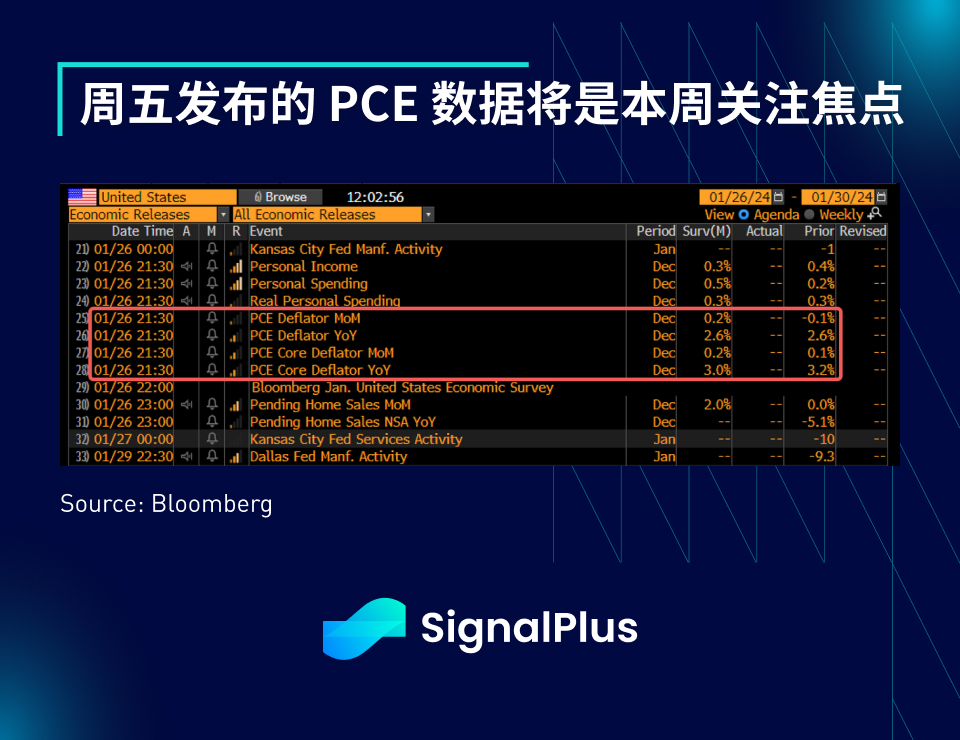

The next focus will be the core PCE data released on Friday. The current market expectation is for a month-on-month growth of 0.2% and an annual growth rate of 2.9-3.0%, while the six-month annual growth rate is only 1.9%. If the data results are in line with expectations , would provide further support to the soft landing narrative that the Fed craves.

Cryptocurrencies are still underperforming. Since the launch of the ETF, the price of BTC has fallen by nearly 20% from its high point. As funds continue to flow out of GBTC, the spot price has fallen below $40,000; there are reports that the bankrupt FTX sold out of its 2/3 stake in Grayscale Trust (via Marex Capital Markets), worth the equivalent of $500-600 million, which may constitute a large part of the outflow.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com