代币激励将至,Aevo是如何快速崛起的?

Original - Odaily

Author - Nan Zhi

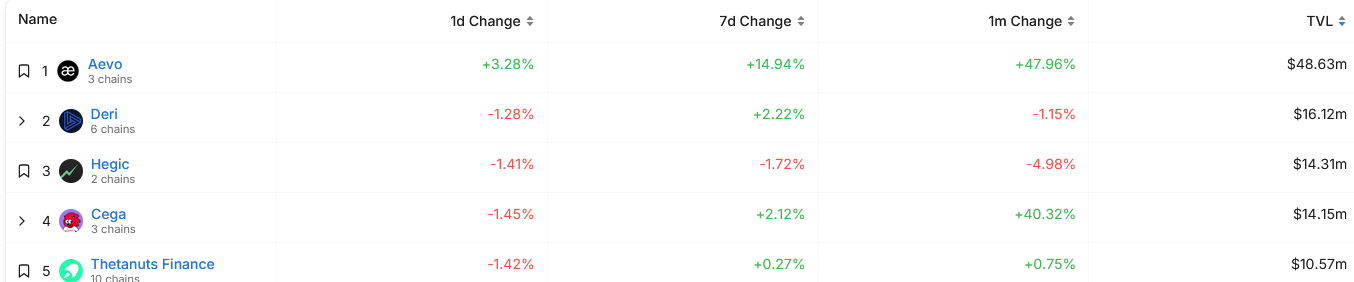

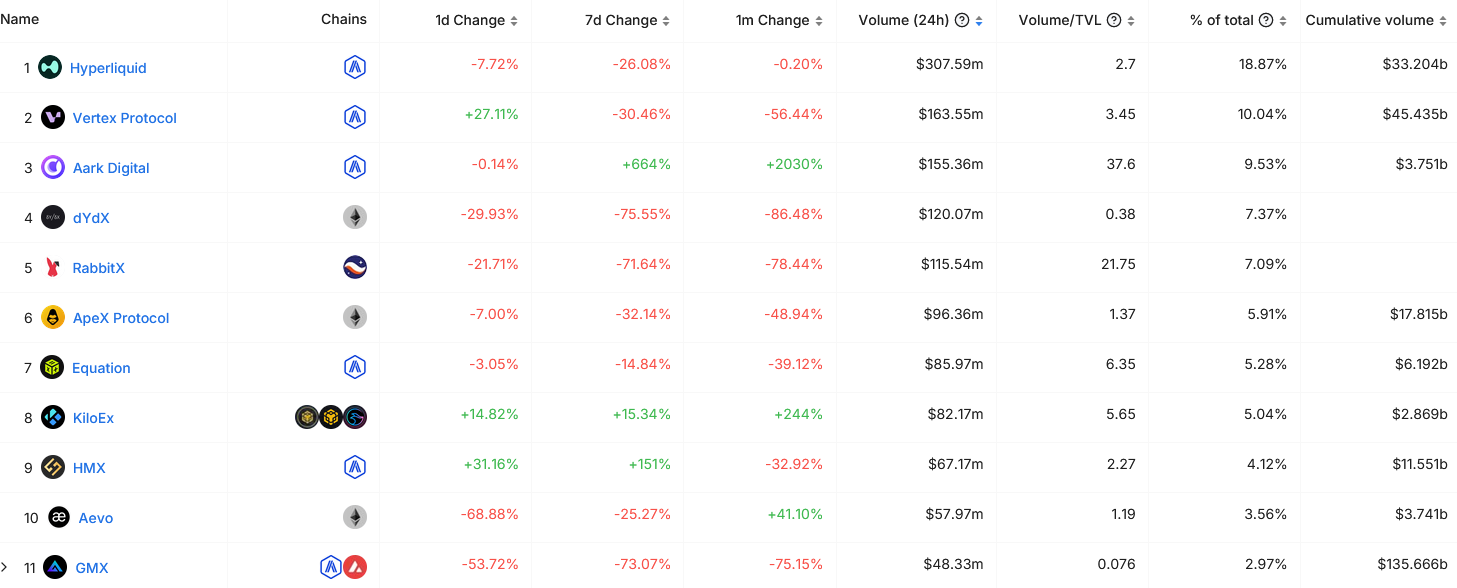

DefiLlama data shows,Current Aevo TVL is $48.5M, the 24-hour derivatives trading volume reached US$57.9 million, and the cumulative trading volume exceeded US$3.74 billion. Under DefiLlamas Options category, Aevo currently ranks first in TVL; in the on-chain derivatives category, it ranks tenth.

Odaily will analyze below how Aevo achieved its current status after the mainnet was launched only half a year ago.

Main business and features

Options and Perpetual Contracts Trading

On April 7, 2023, the options trading platform Aevo mainnet was officially launched, allowing users to use USDC for transactions and real settlement. Users can first trade ETH options on the options chain, supporting daily, weekly, monthly and quarterly settlement.

Aevo is launched by Ribbon Finance, an on-chain structured product, and the platform is built on Ribbon Finance’s customized Ethereum Rollup, using an order book and margin model. Aevo Exchange is built on Aevo Chain, and users can transfer funds directly to Aevo Chain. Initially, Aevo only supported USDC cross-chain.

In addition to its original Ethereum, Aevo has also expanded to Optimism and Arbitrum. The next most critical step is that Aevo has established a perpetual contract module (Perpetual Futures).

Its technical features and structure include:

Off-chain order book and risk control engine: Orders are matched off-chain, and will be posted to the Aevo smart contract only after successful matching. A risk control engine will check the standard margin or combined margin situation before being uploaded to the chain.

On-chain settlement: Users’ funds and positions always remain on-chain, meaning all fund flows occur in smart contracts.

Layer 2 architecture: The contract runs on Aevo Rollup and publishes a batch of transactions to the main network every hour.

Liquidation: The risk control engine will perform liquidation inspection, and the liquidation engine will be responsible for the liquidation operation.

Through the above design, Aevo can achieve efficient matching and low-cost on-chain contracts and options trading, so Aevo has successfully occupied a place in derivatives trading. Website data shows that on January 22, the ETH contract trading volume reached US$34.1 million, the BTC contract trading volume reached US$16.2 million, and the total derivatives trading volume was US$57.9 million, ranking tenth on the entire platform, higher than GMXs US$48.3 million. , lower than HMXs $67.1 million.

Pre-Launch Token Futures

On August 9, 2023, Aevo announced the launch of Pre-Launch Token Futures, providing perpetual contract trading services for upcoming tokens.

This product has no index price and no funding rate, but once the token is listed on the spot market, it will immediately start to refer to the index price and enforce the funding rate. Aevo stated that due to the experimental and high-risk nature of the product, Aevo will implement strict position limits and open interest caps in these markets, and the first token to be launched will be SEI.

Previously, before the token was officially launched, advance transaction requirements were often realized through OTC, and usually in the form of double pledges. OTC merchants charge high commissions and occupy a lot of funds for both parties to the transaction. Aevos move provides users with a safe, effective, and low rate The advanced trading place avoids the above problems.

And how accurate is its market pricing?

At 20:00 on August 15, 2023 (UTC+ 8), SEI was officially listed on Binance. Its closing price in the first hour was 0.1734 USDT, while Aevo’s closing price in the previous hour was 0.3946 USDT, a deviation of 117%.

The remaining open tokens are as follows:

TIA: The exchanges 1-hour closing price is 2.243 USDT, and Aevos closing price in the previous hour is 2.2932 USDT, with a deviation of 2%;

JTO: The exchanges 1-hour closing price is 2.144 USDT, Aevos closing price in the previous hour is 1.264 USDT, and the deviation is -41%;

It can be seen from the above data that Aevos pre-opening price is not enough to effectively predict the official market launch price, or it is mainly due to insufficient trading volume, but its characteristics are enough to serve as an effective substitute in some OTC scenarios.

The pre-launch tokens currently listed on Aevo include BLAST, ALT, DYM and JUP. The 24-hour trading volume of the above four tokens exceeds one million US dollars, which is enough to meet the demand of OTC.

With the enrichment and acceptance of listed tokens further increasing, Pre-Launch token trading is expected to bring a new growth curve to Aevo.

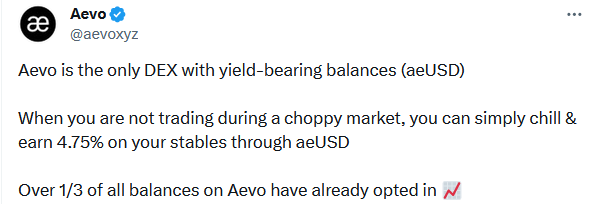

Interest-earning assets aeUSD

aeUSD is an ERC-4626 asset built on L2 Aevo, consisting of 5% USDC and 95% sDAI. By depositing stablecoins into MakerDAOs DSR module, Aevo enables users, market makers, and strategy providers to earn an additional 4.75% APY while depositing stablecoins (similar to Blasts ETH deposit interest-earning mechanism). This move enables efficient use of user funds and provides potential liquidity reserves for the protocol as a whole. According to Aevo, it is the only DEX with an interest-earning mechanism, and more than 1/3 of the funds have chosen to be converted to aeUSD.

Token plan

1 month ago, Aevo issued a document announcing that its weekly active users have tripled in the past few weeks. Subsequent plans include improving scalability and platform stability, and introducing more market makers in 2024.and will launch an incentive program in the first quarter of 2024。

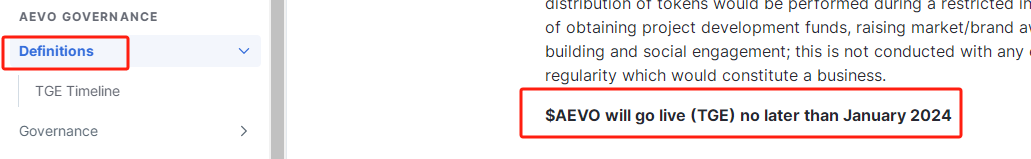

According to a paragraph in the white paper,AEVO will be launched no later than February 1, 2024. At the same time, RBN will also be open for redemption when AEVO is launched.

AEVO features include:

Governance function: propose and vote for governance proposals to determine future features, upgrades and parameters of Aevo, with voting weight calculated in proportion to the staked tokens.

Incentive Function: AEVO provides economic incentives designed to motivate users to put in the effort to contribute and participate in the Aevo ecosystem, thereby creating a reciprocal system in which each participant is fairly compensated for their efforts.

Tokenomics

In the white paper, some AEVO tokens are mentionedEconomics Program, Odaily organizes it as follows:

AEVO did not come out of thin air, but was a rebrand of Aevo’s previous governance token, RBN, voted on by Ribbon Finance’s latest governance proposal, RGP-33. Due to the large amount of circulation in the market, it means that the distribution of tokens cannot be changed.

However, the holder of the largest number of tokens is the DAO Treasury, which has been inactive except for the portion used in the liquidity pool backing RBN.

Through AGP-1, Aevo proposes a more dynamic and functional allocation of the treasury, which will be converted to AEVO at the TGE and the committee will be responsible for the management of these funds.

Aevo proposes a fixed allocation of 45% of RBN owned by the DAO in the following manner:

Up to 16% of AEVO is used for incentives (including airdrops) to promote the spread of governance tokens and attract more users/liquidity into the platform.

Up to 9% of AEVO is used for token liquidity to support AEVO liquidity on decentralized exchanges and centralized exchanges.

Up to 5% of AEVO is used for community growth and rewards for community-related activities and rewards.

16%: Unallocated/reserved for future DAO spending. Note: Aevo project contributors’ 2% annual allocation will come from this portion.

in conclusion

Aevo provides users with a comprehensive and friendly on-chain trading experience by combining DYDX-style on-chain contract experience + Deribit-style options trading + Pre-Launch module. With the expected arrival of currency issuance, Aevo is expected to have further growth.