Gryphsis加密货币周报:比特币ETF获得SEC批准

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium, for deeper research and insights.

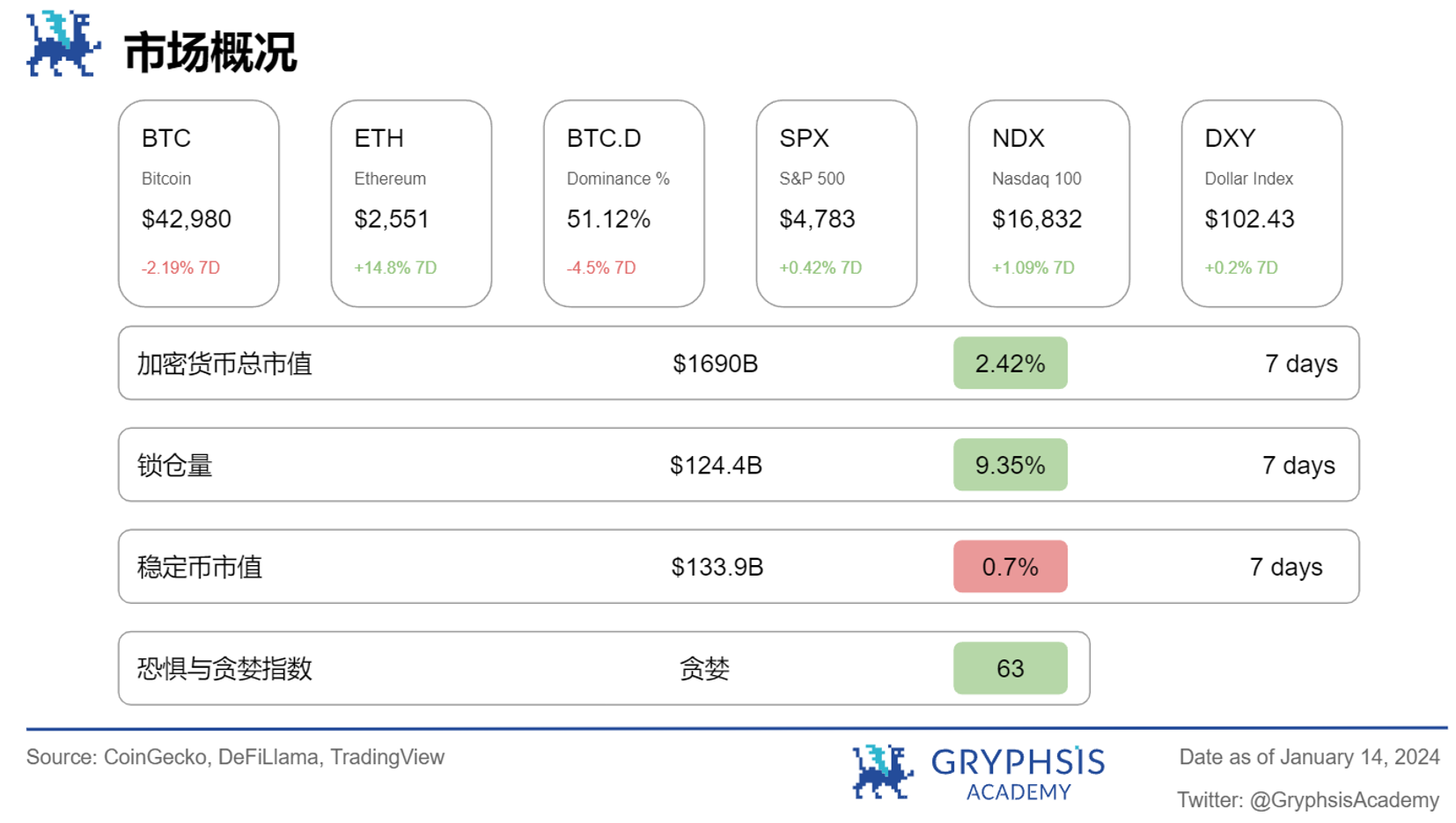

Market and industry snapshots

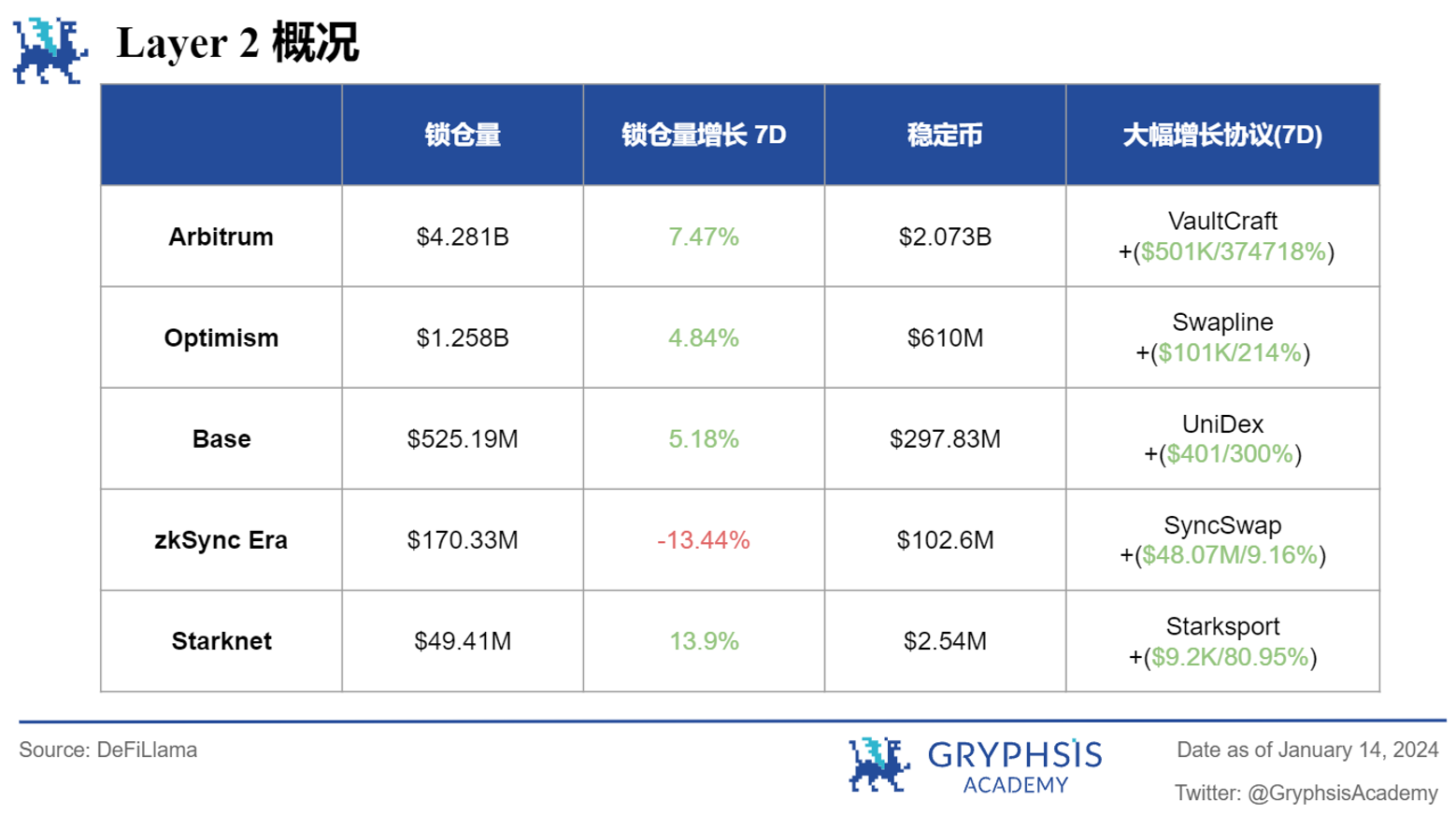

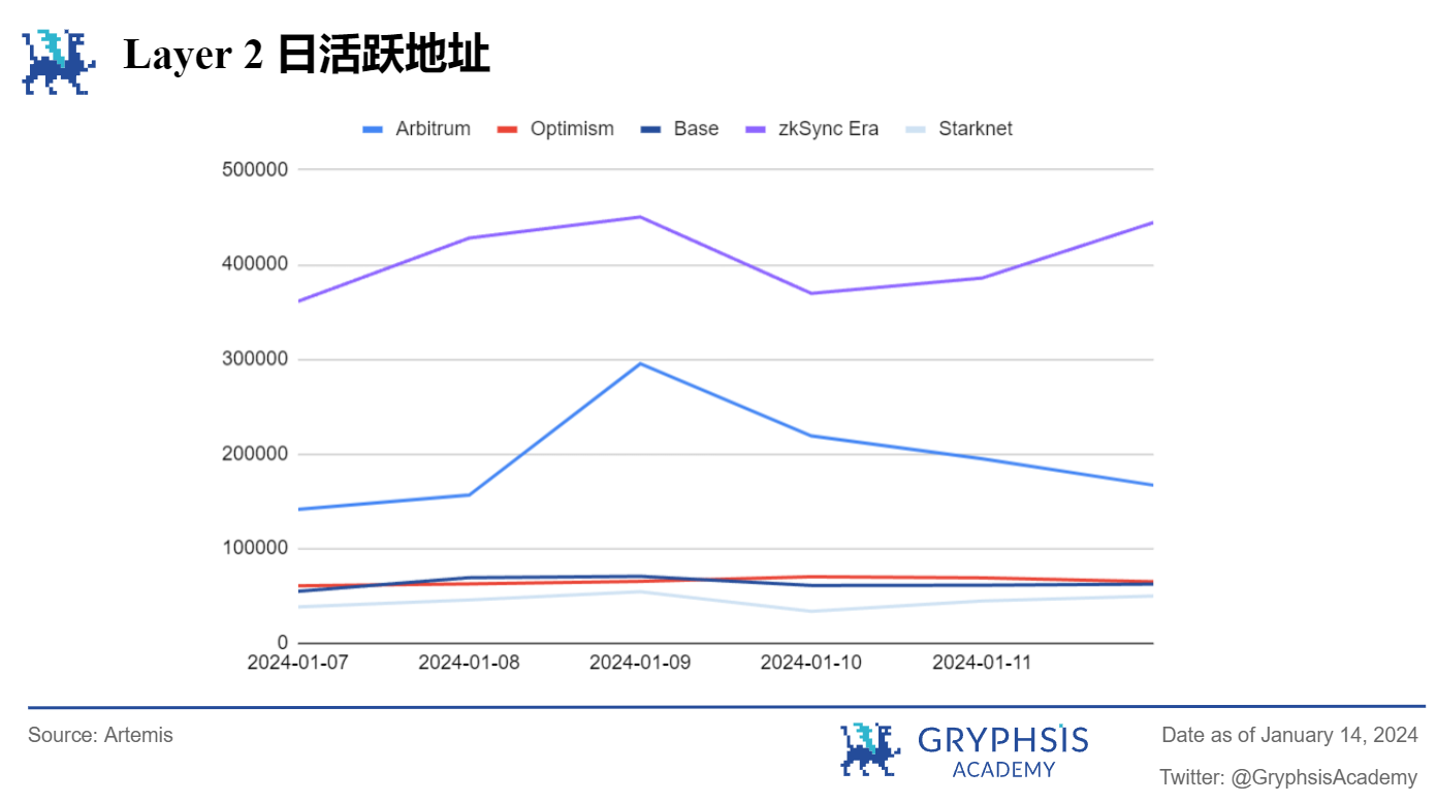

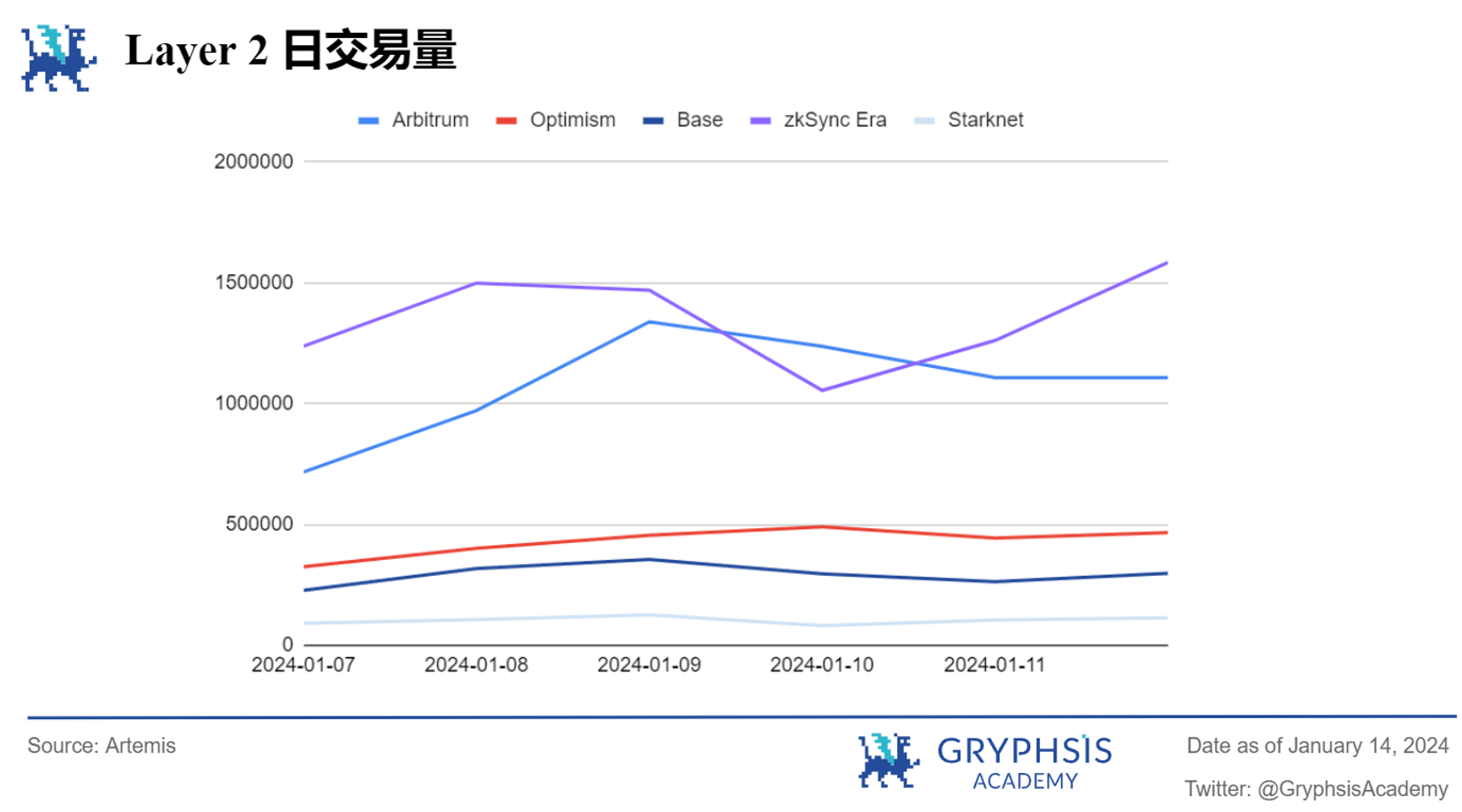

Layer 2 Overview:

Last week, Layer 2 showed an upward trend except for zkSync Era, which fell by 13.44%. Starknet rose most significantly by 13.9%. Protocols like VaultCraft, Swapline, UniDex, SyncSwap, and Starksport have demonstrated noteworthy TVL growth rates.

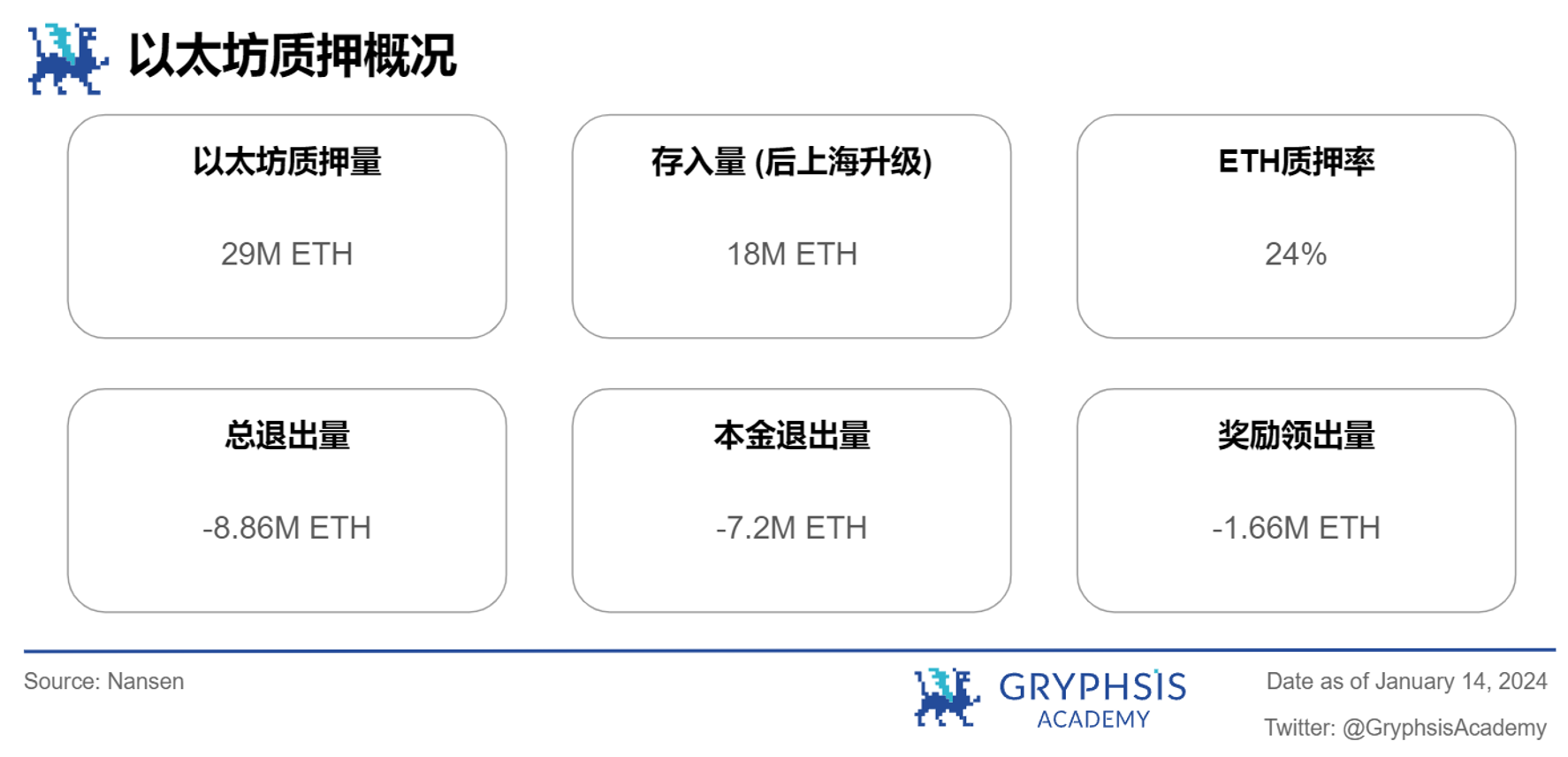

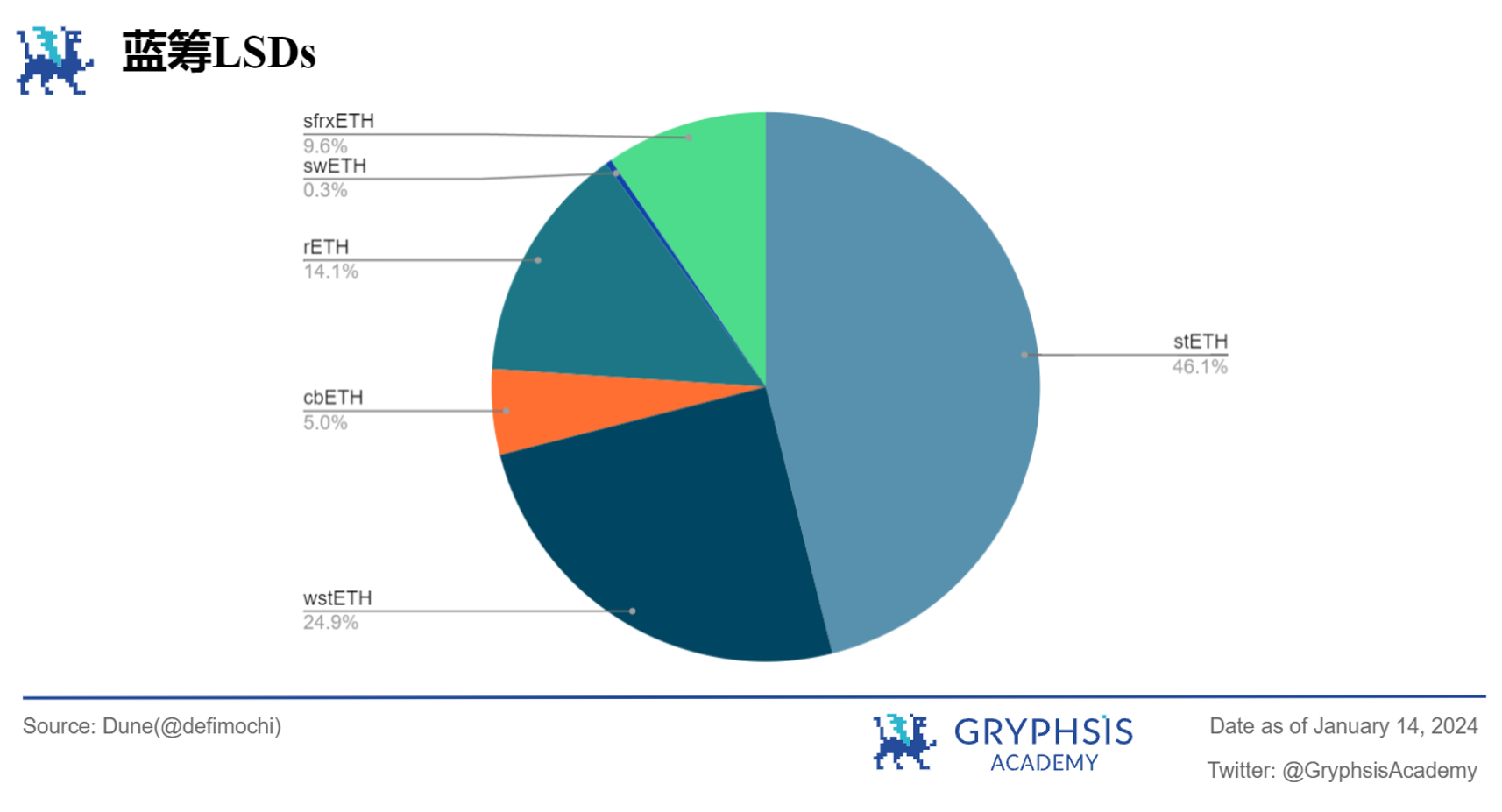

LSD Sector Overview:

In the LSD field, Ethereum deposits did not change much, but the total withdrawals increased by 7.92%. In terms of market share, all blue-chip LSDs are up more than 10%, with sfrxETH having the most significant gain this week at 20.42%.

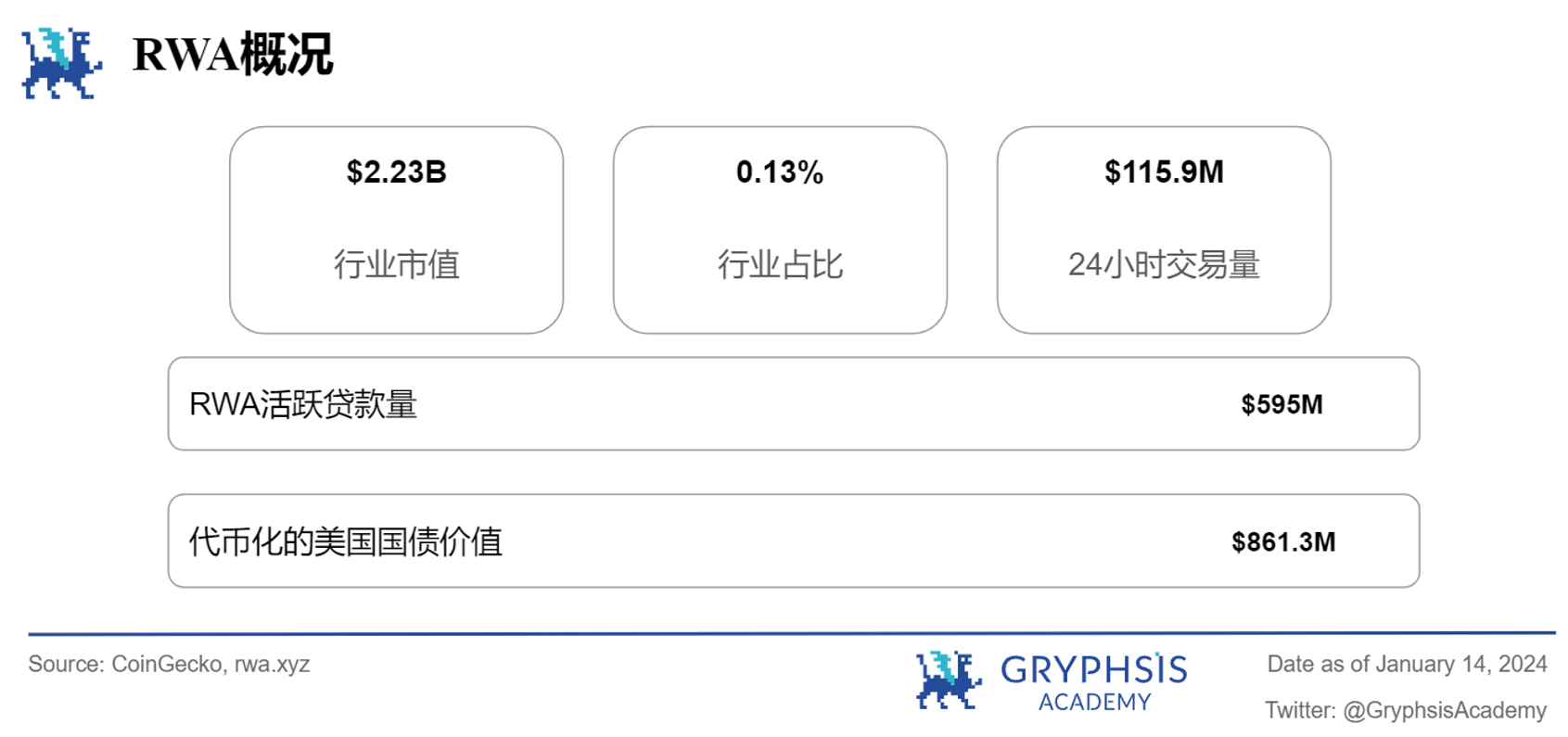

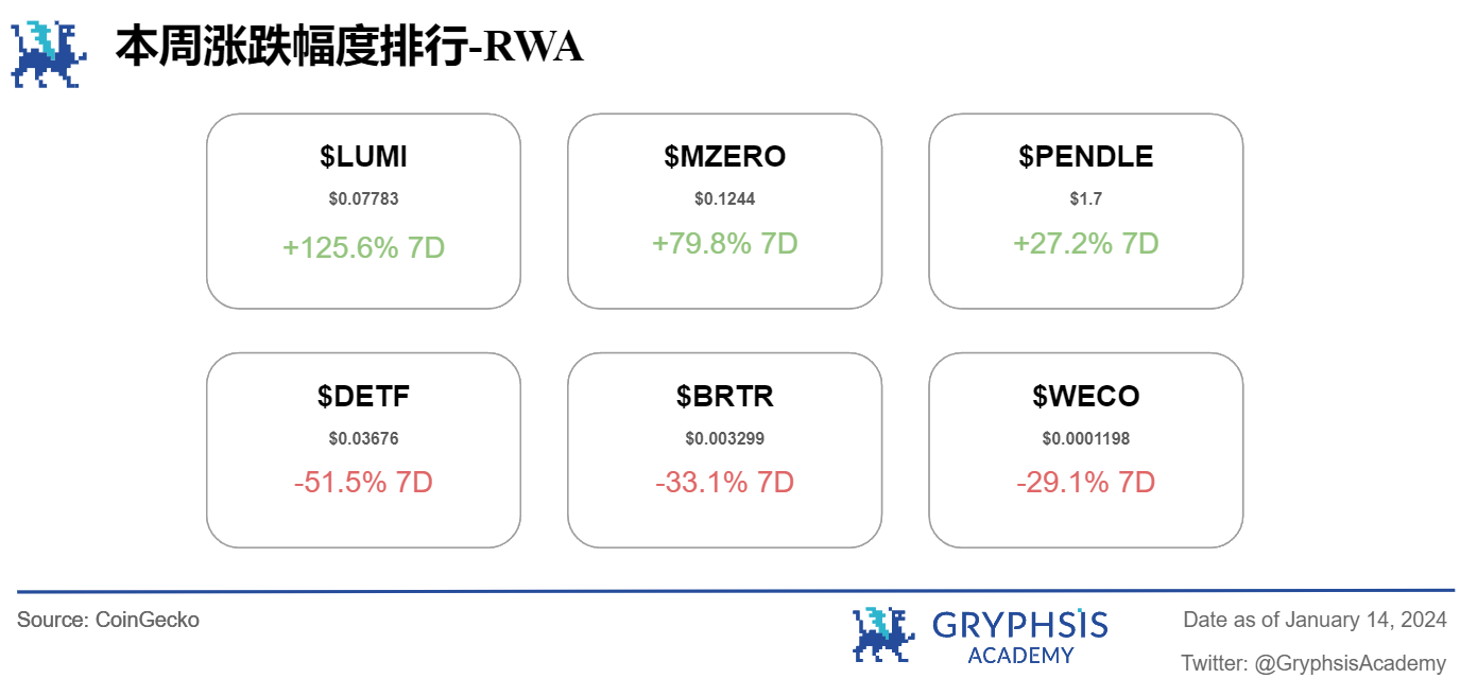

RWA Sector Overview:

Last week, the world real asset market capitalization increased by 4.69%, but the 24-hour trading volume dropped by a significant 61.48%. RWA Tokenized Treasuries rose 1.54%, while tokenized U.S. Treasury bonds fell slightly in value by 0.03%. Notable growth tokens include $LUMI, $MZERO, and $PENDLE. Tokens like $DETF, $BRTR, and $WECO experienced larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

The Bitcoin ETF is approved by the SEC

Weekly Agreement Recommendations:

AIT Protocol

Weekly VC Investing Spotlight:

Finoa($ 15 M)

Entangle Protocol($ 4 M)

AI Arena($ 6 M)

Twitter Alpha:

@MoonKing___ on Realio Network

@poopmandefi on Berachain

@Deebs_DeFi on THORchain

@wacy_time 1 on Ethereum Beta

@ViktorDefi on Desci

Macro overview

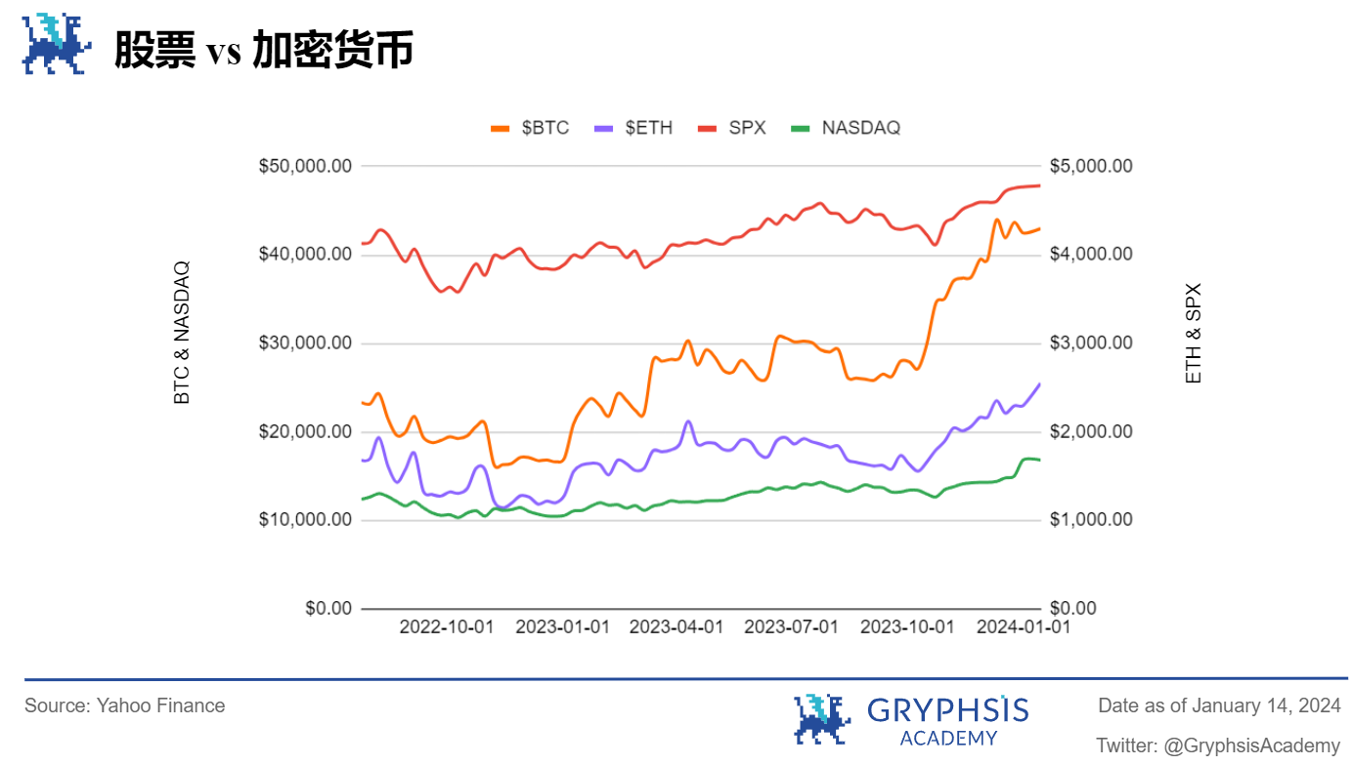

This week, the changes in the stock market were weaker than those in the crypto industry, with SPX and NASDAQ increasing by 0.29% and 0.04% respectively. In the coming week, focus on core retail sales, Philadelphia Fed manufacturing index, existing home sales and other major events.

Big news this week

Bitcoin ETF gets SEC approval

The SEC announced on Wednesday that key filings for the listing have become effective and that trading will begin on Thursday. Following the decision, Bitcoin price topped $47,500 and other cryptocurrencies also rallied.

More than a dozen companies, including BlackRock, Fidelity, and Grayscale, have announced plans to cut the fees they charge investors as they compete for their money.

The SEC’s approval of a Bitcoin ETF comes after years of delays and denials. In August, the Court of Appeals for the District of Columbia Circuit ruled that the SEC was “arbitrary and capricious” in rejecting Grayscale’s attempt to convert approximately $26 billion of the Grayscale Bitcoin Trust (GBTC) into a spot ETF. In a statement, SEC Chairman Gary Gensler pointed to a 2023 court defeat as one of the impetus for approving more than a dozen filings this week.

Proponents of a spot Bitcoin ETF have long argued that a regulated trading product for the world’s oldest cryptocurrency would expose Bitcoin to retail investors and institutional investors without requiring them to set up wallets or invest directly in the digital asset. For example, ETF shares will be available to any U.S. investor with a brokerage account. However, SEC Commissioner Caroline Crenshaw said she opposed the approval, citing “substantial evidence” that the Bitcoin spot market is unsafe and vulnerable to fraud or manipulation. She said spot and futures products are not the same and she disagreed with the 2023 court ruling.

As optimism among spot ETFs grew, Bitcoins price rose from levels of around $27,000 on October 1 to $45,000 in early 2024.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we selected Ait Protocol, an artificial intelligence data infrastructure that provides Web3 artificial intelligence solutions.

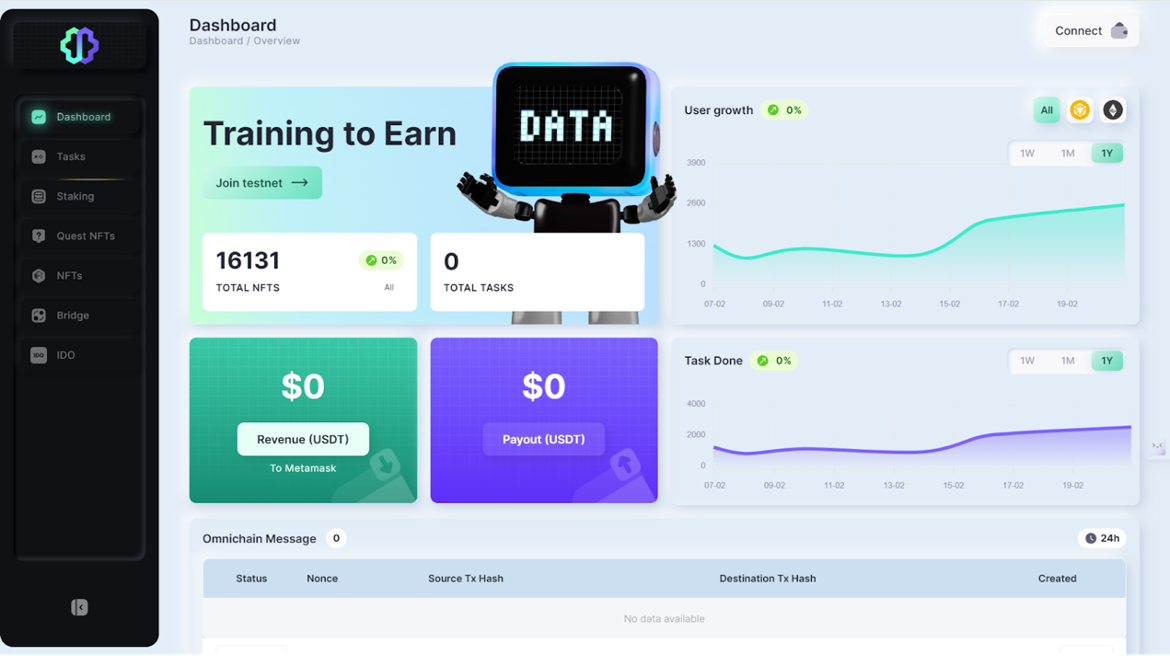

AIT Protocol is a Web3 data infrastructure built on the blockchain, mainly used for data annotation and AI model training. Allow crypto users to receive rewards while participating in “Train-To-Eran” tasks and contributing to AI model development and training. On December 23, 2023, MorningStar Ventures, Megala Ventures, etc. and a group of angel investors participated in the investment and financing. The specific amount has not yet been disclosed.

The problems of low efficiency and high cost of traditional data annotation are mainly solved in the following ways:

Human-In-The-Loop (HITL): Human-machine collaboration reduces reliance on manpower and improves the overall efficiency of the annotation process by combining human intuition with the efficiency of artificial intelligence.

Web3 Global Workforce: Breaking down geographic and accessibility barriers, anyone with an internet connection can easily participate in data annotation tasks, providing an affordable, 24/7 global workforce.

Streamlined Onboarding Cross-Border Payments: Seamless cross-border payments ensure that transactions and payments can be carried out safely and quickly, thereby giving the global workforce a seamless experience.

Permissionless Marketplace: Empowers companies, projects, and individuals to formulate their own data annotation tasks, and provides a dynamic market opportunity for users to contribute annotated data sets.

Leverage HITL, Web3 global workforce, streamlined onboarding process, and permissionless marketplace to solve the inefficiencies and high costs that plague traditional approaches. Paving the way for the future of intelligent data processing. Customers give their data to AIT, which annotates it with the participation of community members and combines it with scientific machines to optimize the data more precisely. At the same time, customized AI services are created for the companys specific needs to provide business exclusive to the enterprise.

AIT Protocls native token $AIT, with an issuance limit of 1 B, is mainly used for market subscription fees, data processing, artificial intelligence leasing and Launchpad.

The AIT product page mainly contains the following content: Dashaboard, Task (only users holding AIT iPass NFT are eligible to complete tasks), Staking (used to pledge $AIT for additional token incentives), Quest NFTs (by completing fixed tasks) Obtain NFT, and other ecological cooperation allows Holder to enjoy product discounts and other services), NFTs, Bridge (NFT cross-chain supported by LayerZero), IDO.

It is worth noting that in the future, AIT will gradually open NFT Staking, data annotation on the main network and points system; it will cooperate with the AI DePIN project EMC Protocol, including AI integration, using EMC computing power to build customized AI, etc.

Generally speaking, the AIT protocol has financing, and its Web3+AI track is currently attracting attention. There are also [Tain To Earn] token incentives that enable cryptocurrency users to receive rewards when completing tasks, and actively contribute to artificial intelligence. Contribute to the development and development of intelligent models.

our insights

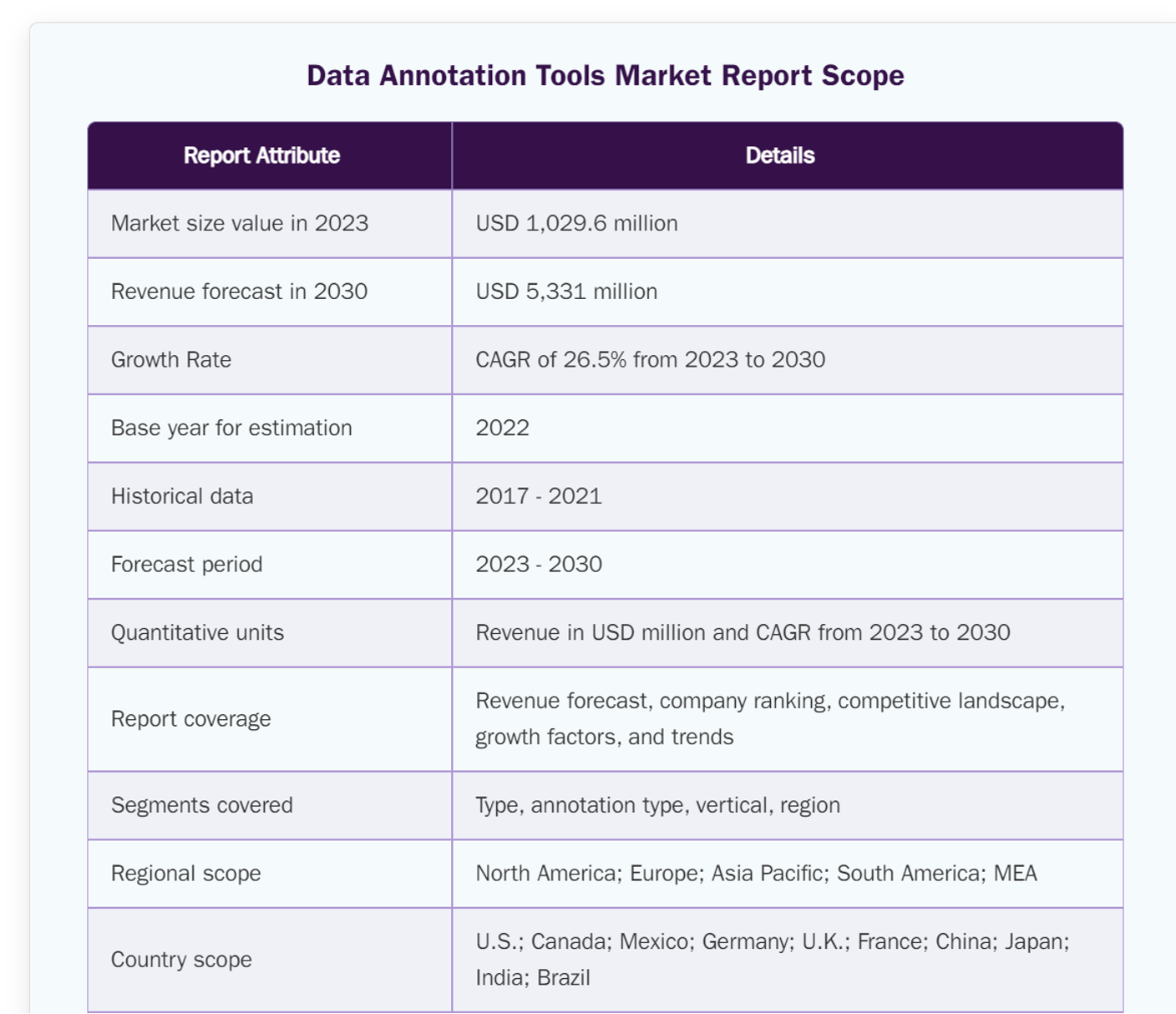

The data annotation service industry that AIT Protocol focuses on has a market value of 1,029 Million in 2023, according to a GrandView Research report, and is estimated to reach a market value of 5,331 Million in 2030. At the same time, after ChatGPT opened the AI era, the development and valuation of the market for intelligent data processing in the AI field have become increasingly optimistic. For traditional data annotators, the AIT protocol is the beginning of their entry into Web3+AI.

Judging from the two main sources of $AIT:

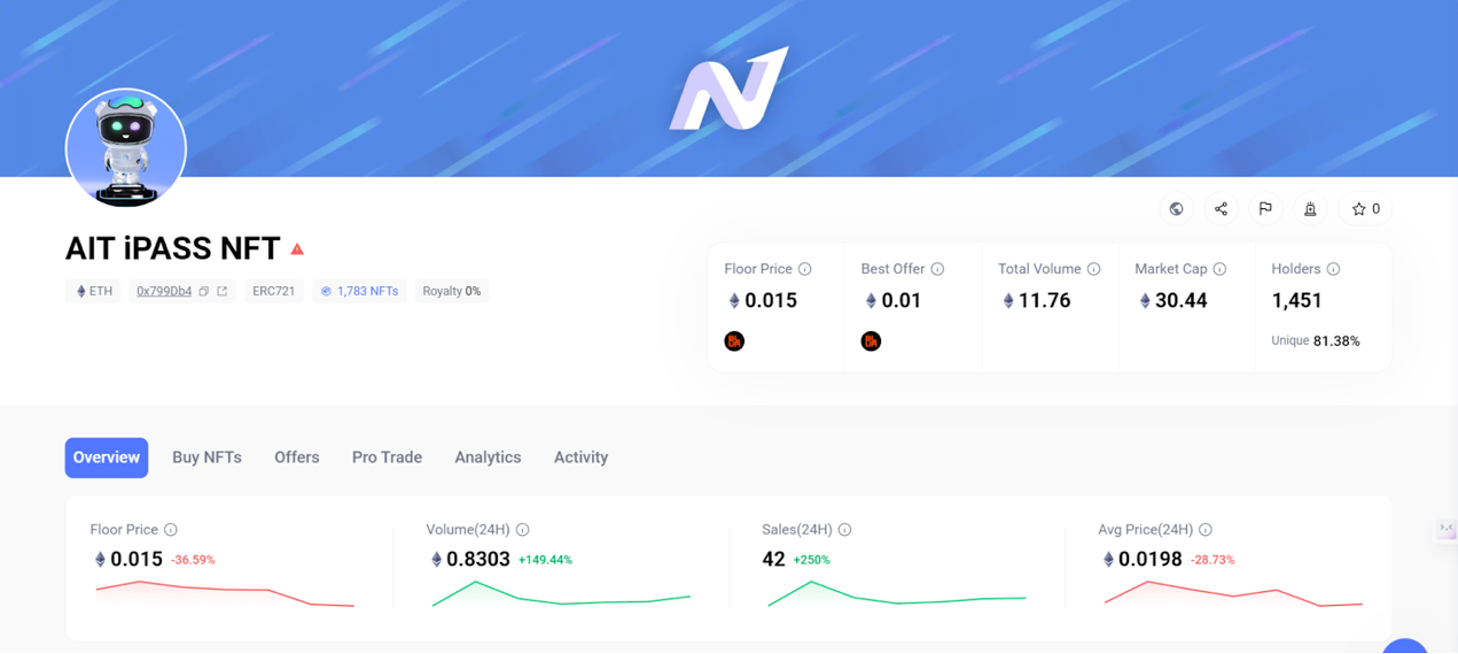

1. [Train To Earn]: Only by holding NFT can you complete the task. We can see in NFTgo that currently 1,451 users hold NFT, and the floor price is 0.015 ETH. The trading volume has increased by 149% in the last 24 hours, but the floor price has dropped by 36.6%.

2. Staking: Stake $AIT to get additional token incentives

From this point of view, if you want more community users to get incentives by completing tasks, the threshold set by NFT is relatively high, and the number of users currently holding it is only more than 1,000, which is a small number; although it can be purchased on DEX Tokens are obtained through staking, but there are still limits on user participation costs.

It is worth noting that in its Roadmap, it will focus on the following parts in 2024:

AIT Moderation Bot: Publishing the bot on Telegram will undoubtedly open the protocol to more Web3 users, expand user contact and introduce more global communities.

Data Validation Data Marketplace: Optimize data validation and improve service quality; expand the market and attract more customers and users.

Web3 AI Solution: A company that provides customized artificial intelligence solutions. Through previously accumulated data annotation business, it can more effectively train artificial intelligence models and continuously expand its business.

It can be seen that whether it is the good development prospects of the data annotation industry itself or the clear expansion blueprint of the AIT protocol, it is foreseeable that AIT will have more community participation and better services to meet the needs of more enterprises in the future.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Finoa

Finoa is a Germany-based provider of cryptocurrency custody and betting services focused on serving institutional clients. Finoa said the strategic funding round was co-led by Maven 11 Capital and Balderton Capital. Finoa supports staking on more than a dozen blockchains and is the third largest validator of the modular blockchain Celestia. Finoas flagship custodial business, meanwhile, accounts for nearly 30% of revenue, with the rest coming from brokerage and other services.

https://x.com/Finoa_io/status/1744738610228908115?s=20

Entangle Protocol

Entangle Protocol is a universal liquidity layer that supports cross-chain synthetic derivatives. Entangle uses synthetics to provide liquidity and yield access while allowing users to borrow and lend against native enUSD stablecoin collateral.

https://x.com/Entanglefi/status/1744751372455784817?s=20

AI Arena

AI Arena is a PVP fighting game developed by ArenaX Labs. Players can continuously evolve their characters through AI learning. The battle mode is similar to Nintendos Smash Bros. game. It combines games, NFT (IP) and AI algorithms to provide players with a new gaming experience, while protecting the intellectual property rights of AI practitioners and helping them achieve profitability. The long-term vision is to create a two-sided marketplace that matches the needs of AI buyers and sellers.

https://x.com/hiFramework/status/1744838173790806341?s=20

protocol event

Robinhood lists all 11 spot bitcoin ETFs on trading app

Solana-based MEV bot earns $ 1.8 million after back-running memecoin trader in seconds

Injective rolls out Volan upgrade focused on real-world assets and connectivity with Cosmos chains

Berachain unveils Artio public testnet ahead of anticipated mainnet in Q2

Circle confidential files for IPO

Industry updates

Grayscale files for bitcoin covered call ETF following conversion of GBTC

Hong Kong lawmaker calls for swift action following US spot bitcoin ETF greenlight

Coinbase executives offer to help the SEC with its security practices

Upbit Singapore wins full digital asset license from MAS

CFTC advisory committee advances recommendations urging a timely focus on DeFi

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/MoonKing___/status/1745402435248529469?s=20

https://x.com/poopmandefi/status/1650109741060997121?s=20

https://x.com/Deebs_DeFi/status/1745465702973362580?s=20

https://x.com/wacy_time1/status/1745506838714417225?s=20

https://x.com/ViktorDefi/status/1745422303976894523?s=20

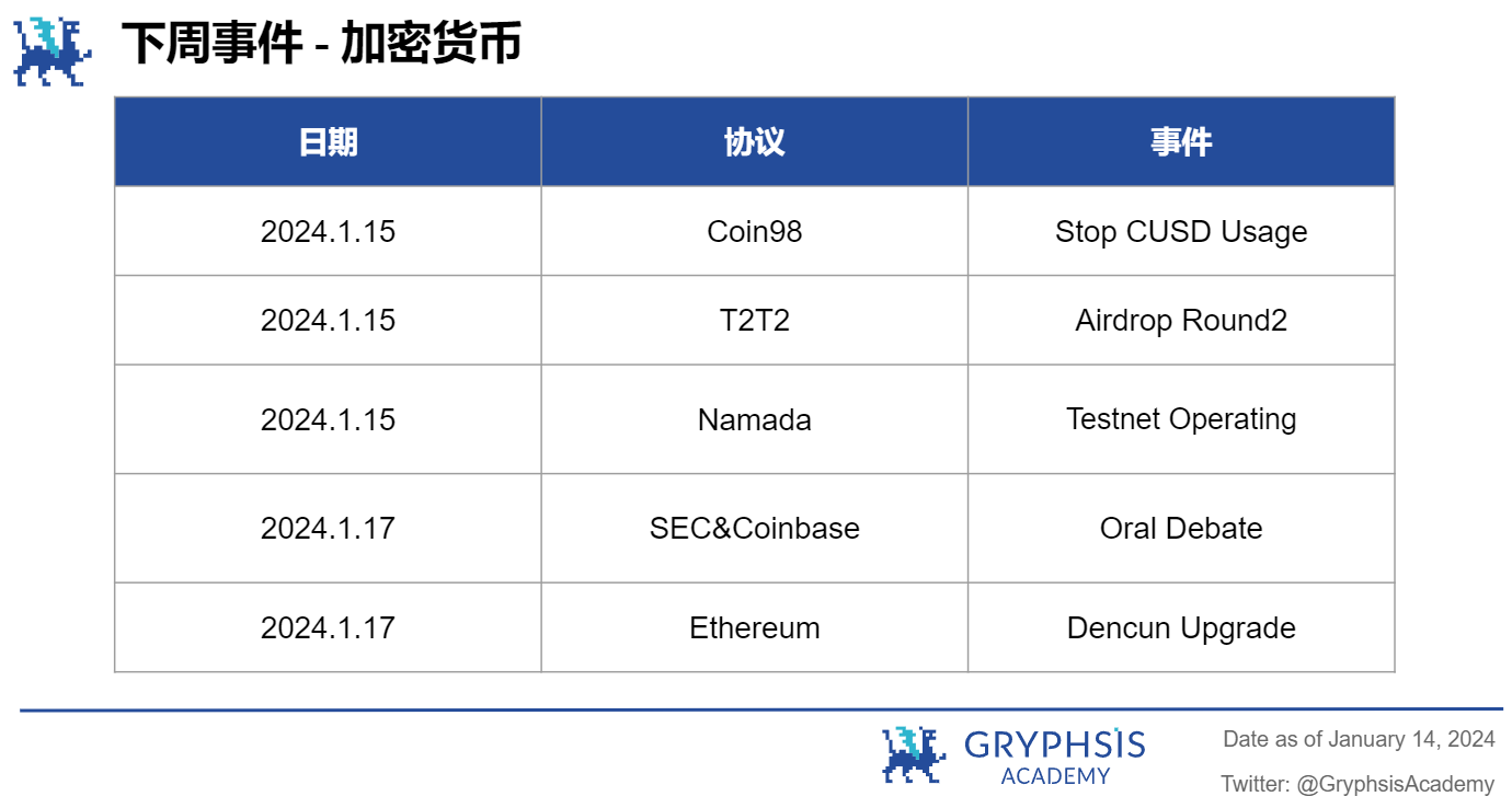

next week events

news source

https://www.theblock.co/post/272177/robinhood-lists-all-11-spot-bitcoin-etfs

https://www.theblock.co/post/271883/berachain-public-testnet-mainnet-q2

https://www.theblock.co/post/271907/usdc-stablecoin-circle-ipo

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.