LD Capital宏观周报(1.7):2024开年反转,就业数据虚火,机构集体转空,木头姐清空COIN?

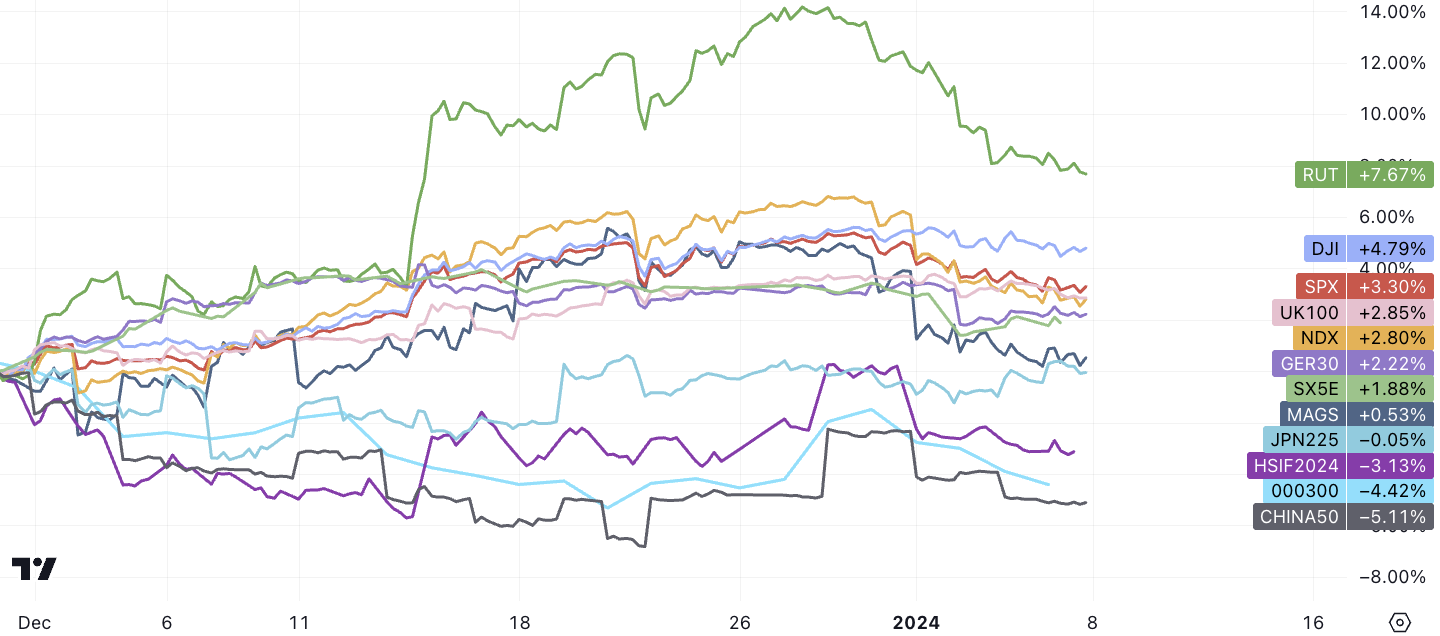

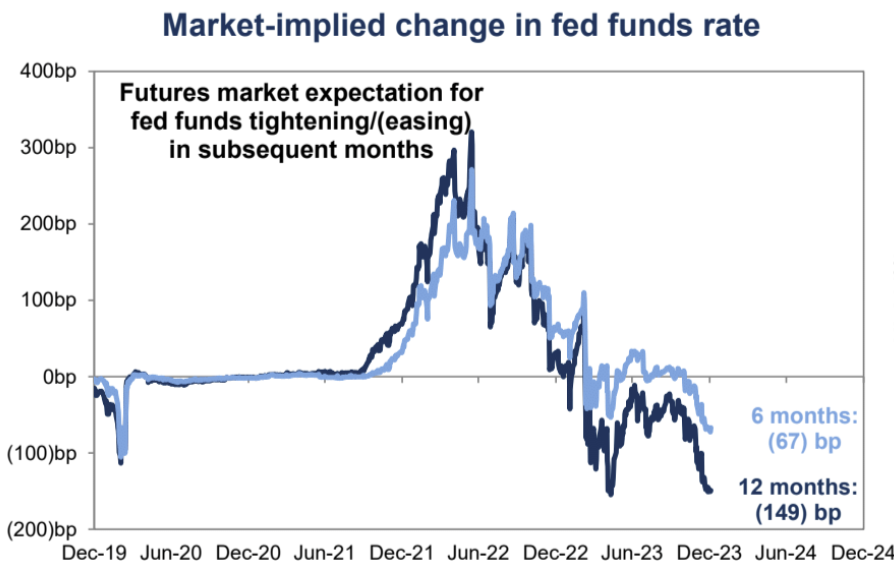

Last week, the global market was basically a complete reversal from the end of 2023. Last week, stocks and bonds fell, digital currencies trembled, the U.S. dollar and crude oil rose, gold basically flatlined, and Nasdaq fell 4% from its high of 12.27. The markets original aggressive interest rate cut expectations began to retreat (albeit not significantly), and the probability of a March interest rate cut dropped from 73% on the 29th to 63% last Friday.

Market expectations for a full-year interest rate cut are still 149 bp, much higher than the 75 bp expected by the Fed

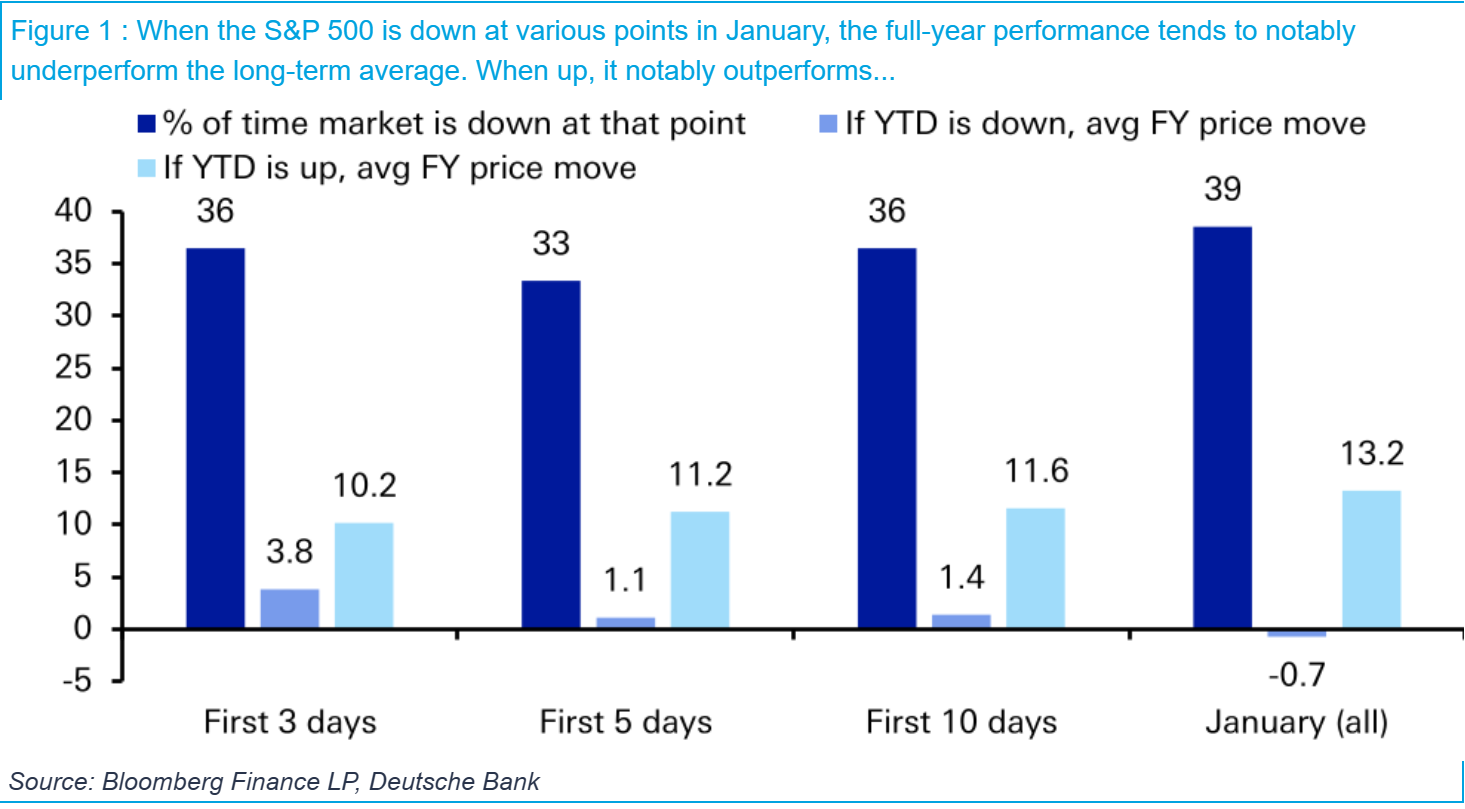

According to DB statistics, if the U.S. stock market starts the year with a weak rise, the full-year trend will also be weaker than the average:

The biggest impact is Fridays non-farm employment data. The 216,000 new jobs in December exceeded expectations (many people joked that government employment and temporary workers saved the data again this time), and the average wage growth was slightly higher than expected. The unemployment rate in December was 3.7%, lower than the expected value of 3.8%, the same as before November, and has been below 4% for 23 consecutive months. The firm unemployment rate is due to a reduction in the labor force. The labor force participation rate further dropped to 62.5% from the previous value of 62.8%. The 0.3 percentage point decrease in a single month was the largest monthly decrease in the past three years. In addition, the working hours decreased (from 34.4 hours to 34.3 hours). ) In addition to the decline in the participation rate, most of the data are manifestations of a strong labor market. Another thing to worry about is that past employment growth has been significantly reduced again (-71,000 in October and November). U.S. Treasury Secretary Yellen said that the United States has achieved Soft landing, the Fed did a great job. Fed Brainard said that this NFP shows that the economy is very healthy, and Fed wire Nick believes that this data does not bring much change to the Fed.

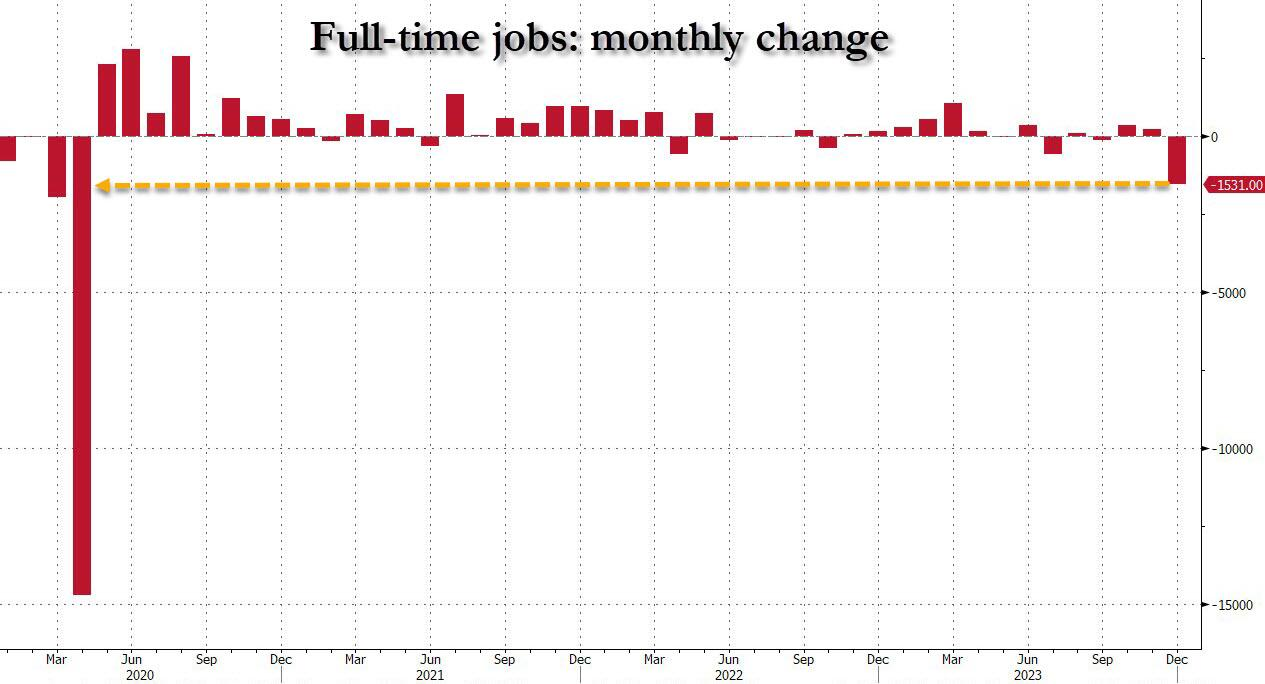

However, a closer look shows that the number of full-time jobs fell sharply in December, falling by 1.531 million to 133.2 million. This is the largest monthly decline in full-time jobs since the COVID-19 pandemic. Of course, with the sharp decline in full-time jobs, there must be something to offset this decline. , and sure enough, it’s all about the proliferation of part-time workers. In December, the number of part-time workers jumped by 762,000, the second-highest monthly increase since the coronavirus lockdown, to 27.794 million, the highest increase since March 2018, suggesting that the U.S. economy is on fire.

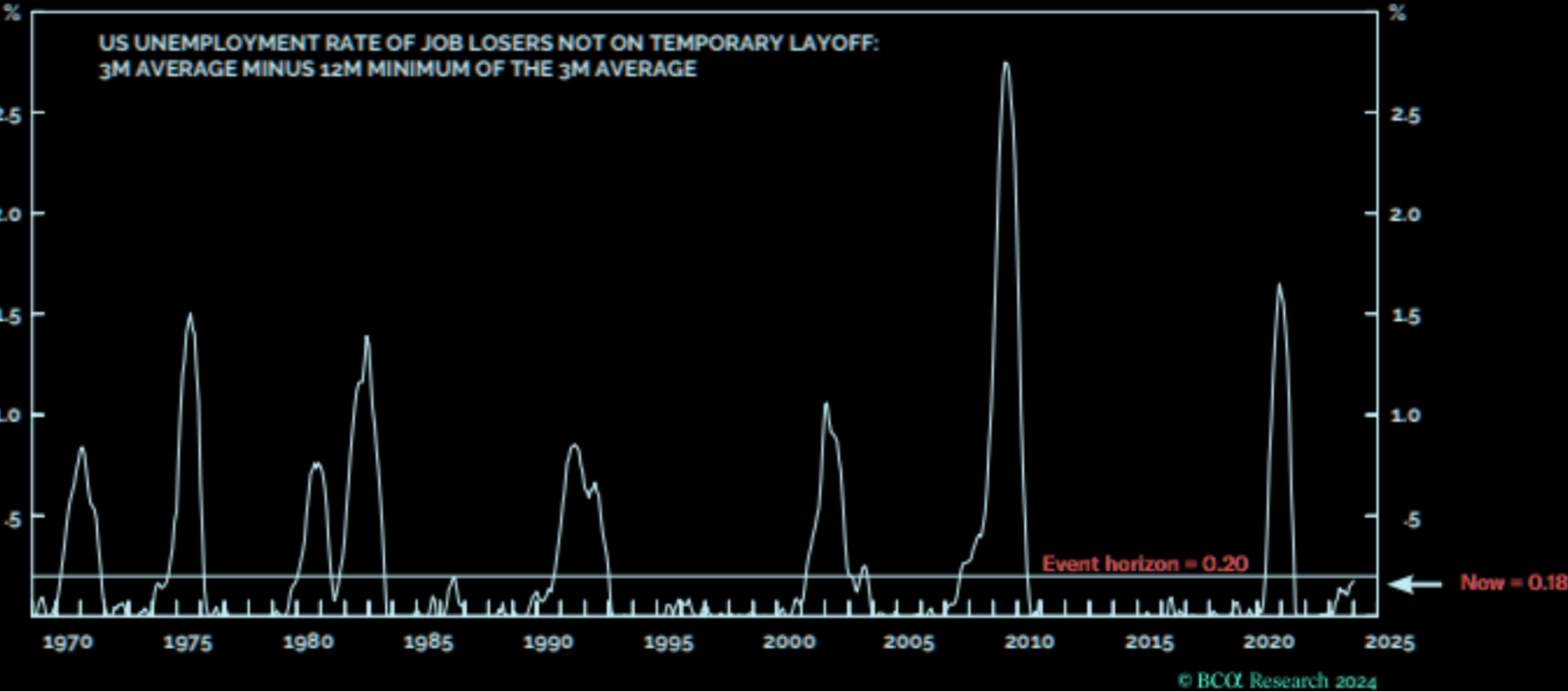

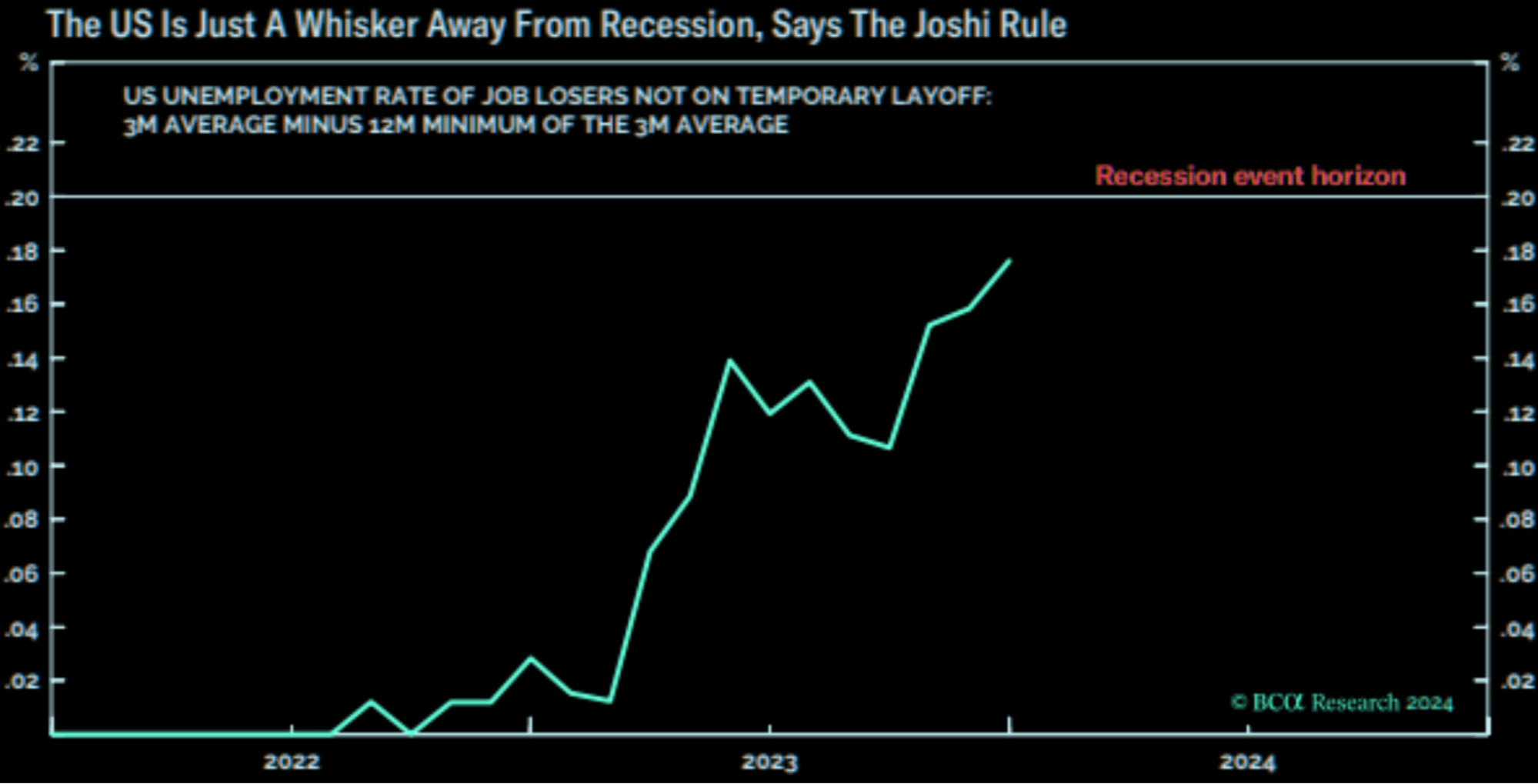

BCA Researchs Recession Indicator serves as a reference. The indicator uses the three-month moving average of the number of non-temporary workers laid off to rise by 0.20% from the low of the past 12 months as the threshold for entering a recession, which is currently 0.18%.

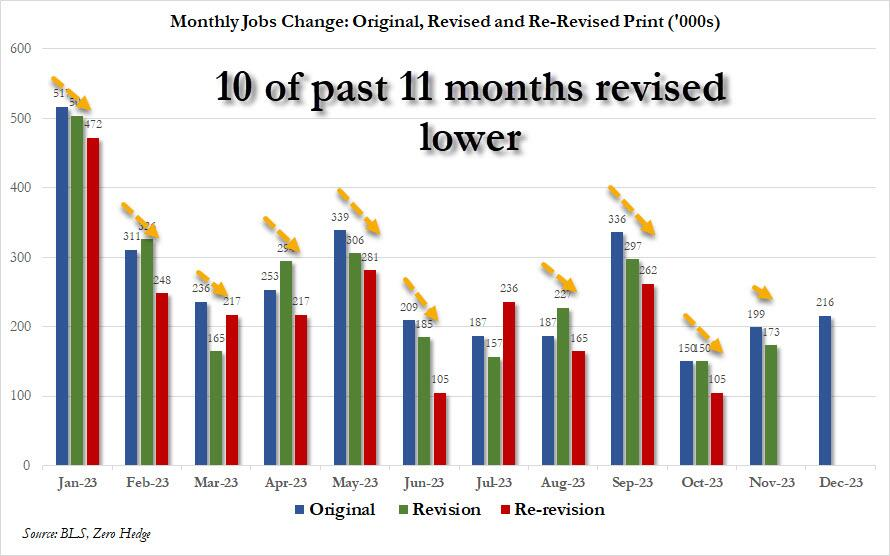

Public opinion on social media no longer believes in the initial value figures. As shown in the chart below, the initial values for 10 of the past 11 months have been lowered. Comments believe that the White House can take credit for a strong number, but in A month or two later, when no one was looking, the number was quietly lowered:

The market that reacted the most this time was U.S. Treasuries and the U.S. dollar. Yields surged and then fell. 10y once reached 4.1 and then plummeted to 3.96, finally closing at 4.05, which was still significantly higher than the level of 3.79 on December 28. The U.S. dollar index once rose to 103, then fell to 101.98, and finally closed at 102.44, basically unchanged from the opening price.

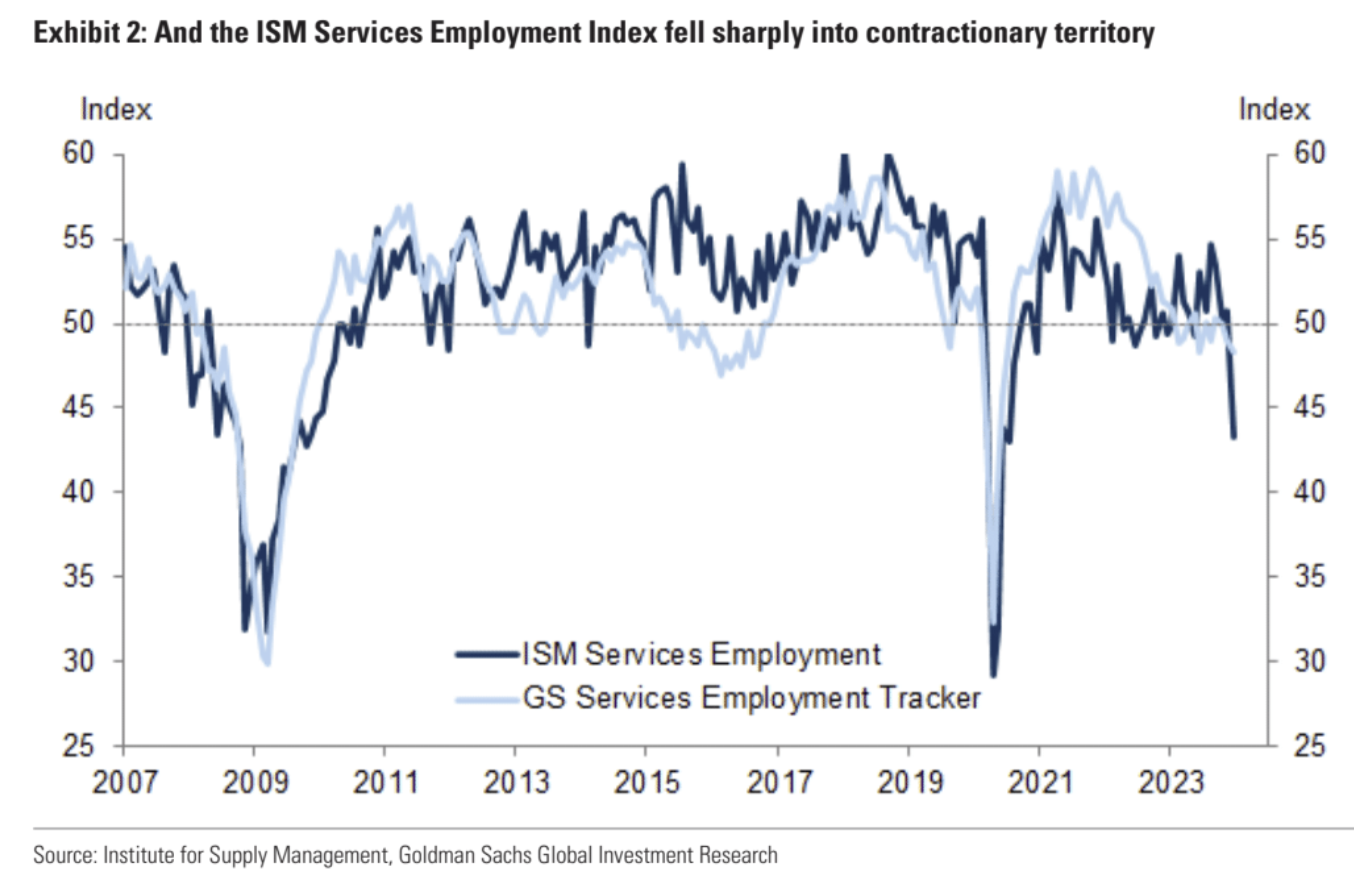

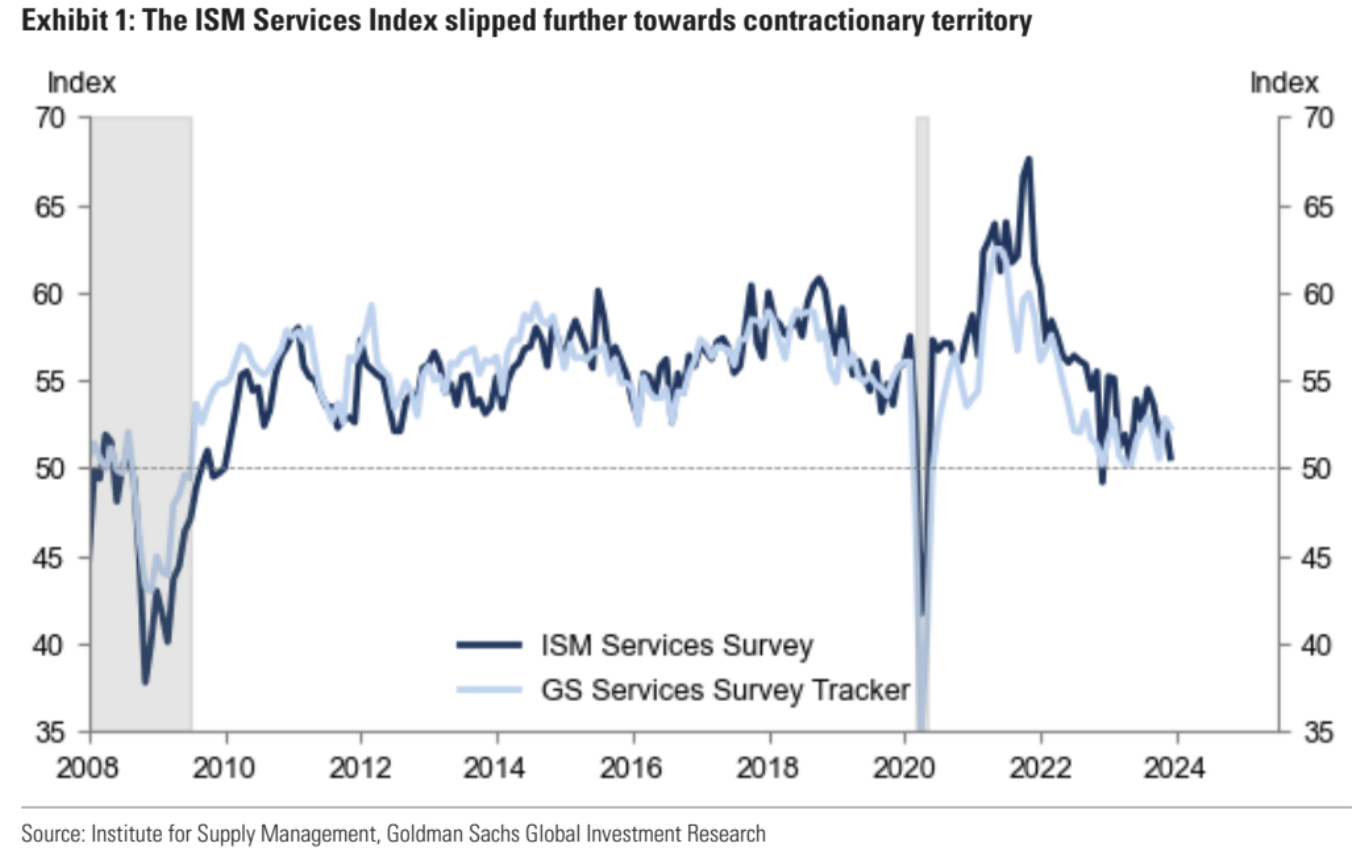

Because first of all, the non-agricultural data was not that good, and the previous value was significantly lowered to offset the increase in December. Secondly, the U.S. ISM service industry unexpectedly fell sharply in December (the largest decline since March last year, falling to 50.6, which was the highest level last year). The lowest since May, almost stagnant) In particular, the industry sub-index plummeted, falling deeply into the contraction range, hitting a new low since July 2020. Some analyzes emphasized that the lagging effect of rising interest rates is emerging, and this data has restored some market sentiment. Confidence in cutting interest rates ahead of schedule. However, the figure of 43.4 in the employment sub-item only appeared in 2008 and 2020. If true, it indicates that the job market has undergone devastating changes. Unfortunately, there is not much evidence to support the collapse of the U.S. job market. The number of high-frequency unemployment insurance recipients has not increased significantly, which makes people wonder whether this is caused by technical or one-time reasons.

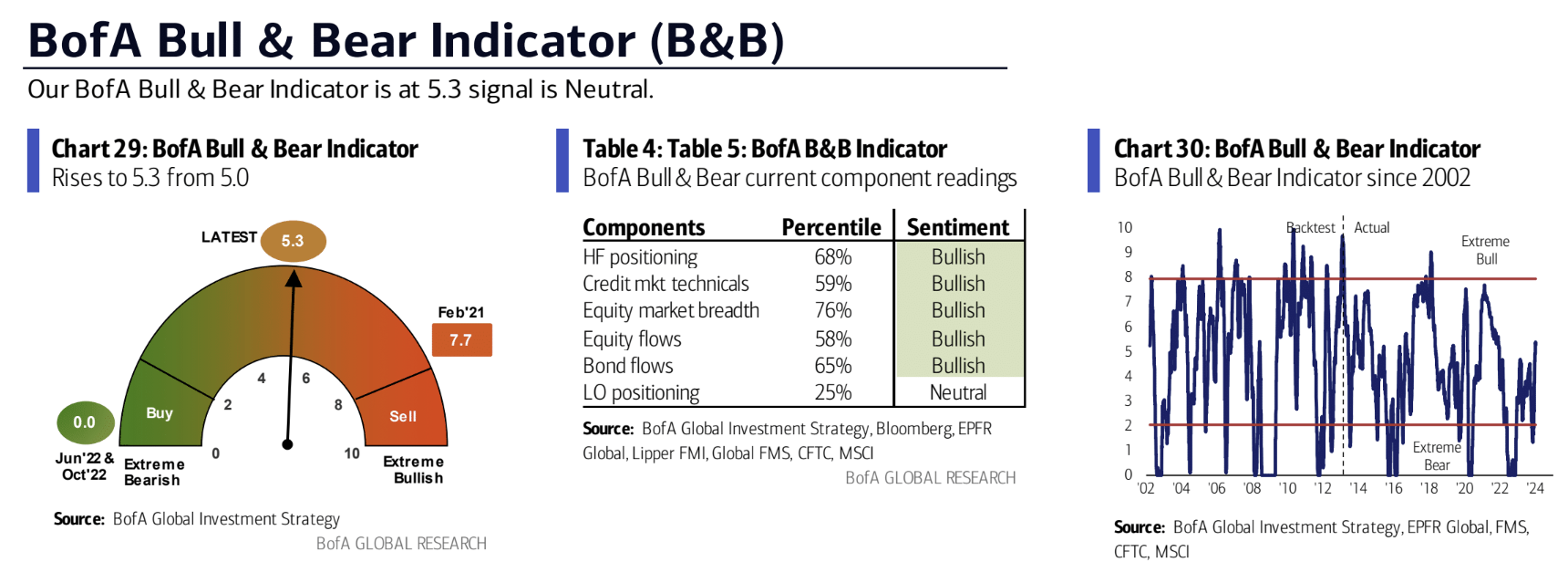

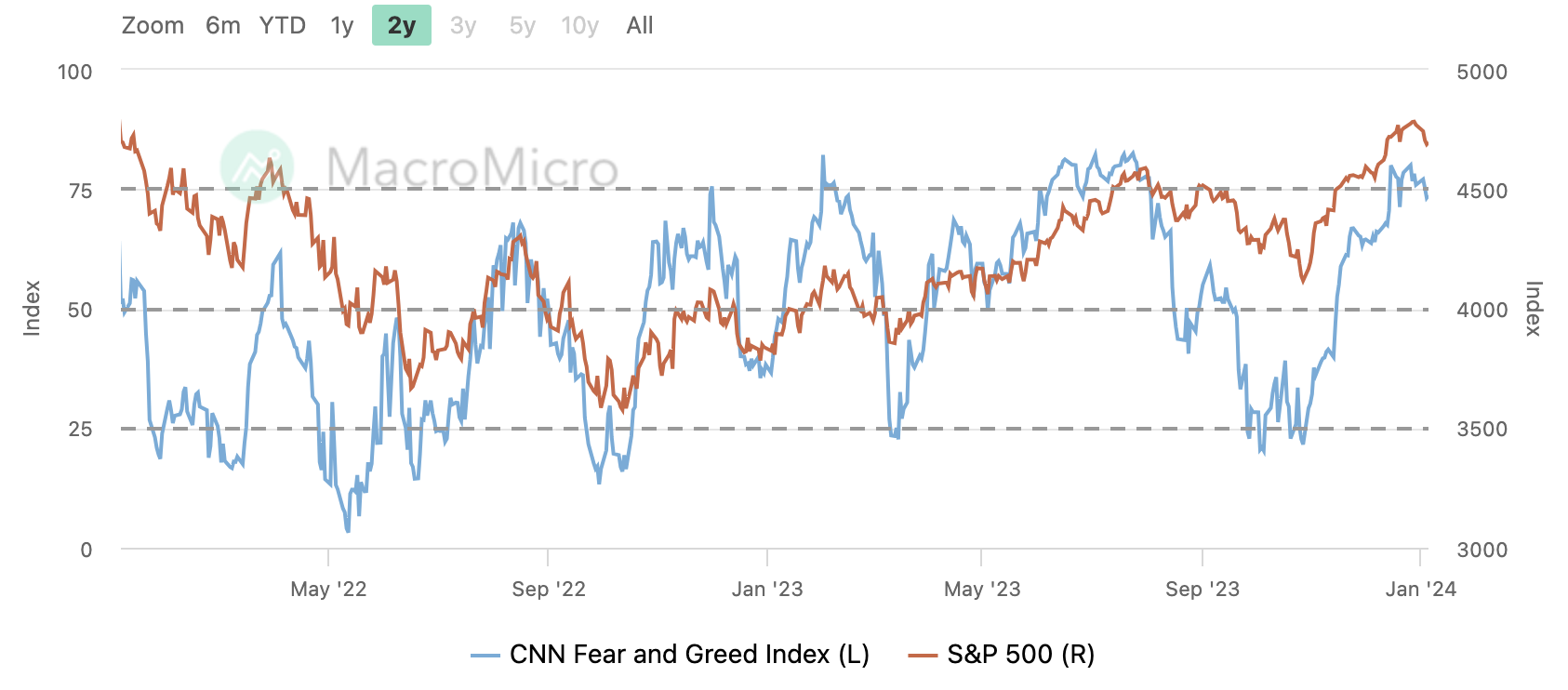

However, from the closing point of view, the U.S. dollar and U.S. bond yields did not correct much, and finally managed to close up. This seems to indicate that the overall trend should now enter the reversal channel after previous over-pricing, or hint at the interest rate cut transaction. The price/performance ratio starts to decrease. But if the United States loses the support of its service industry, its economic prospects will become very unpredictable. We have analyzed the data from our previous morning meeting. In the past two months, institutions have been on Fomo. The overall positions have been replenished a lot, but there is still a lot of room. However, to further release this replenishment space, we need to cooperate with further optimism. data or policies, otherwise the driving force for these funds to pursue higher prices will only become weaker and weaker.

Economic data surprises continue to weaken since August:

For Fed interest rate futures pricing, after the release of NFP data, the price of interest rate cuts in 2024 fell from 135 basis points to nearly 125 basis points, surged to more than 145 basis points after the release of the ISM service, but fell back to 135 basis points at the close. Showing no change in market pricing for the Fed.

The company is paying attention to Apple, which fell 6.55% last week, the largest drop since July. This is mainly because Apple is facing the threat of antitrust lawsuits after being downgraded. Then Foxconn also reported poor sales data due to sluggish demand, which affected Apples expectations. Got cold water. The proportion of analysts who are optimistic about Apple is currently at a three-year low. Apple is the only large technology stock to have seen revenue shrink in the past four quarters.

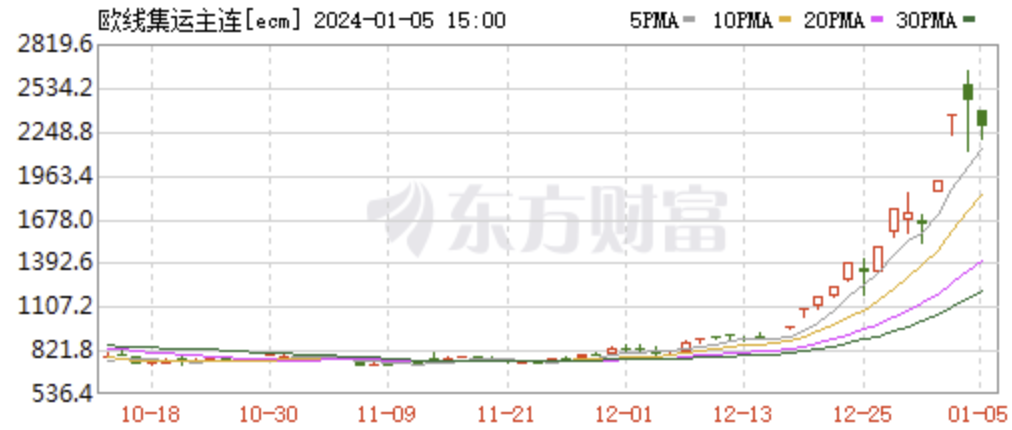

The Red Sea crisis escalated, and oil prices were largely unaffected by the Red Sea crisis. At press time, Brent crude oil prices were hovering around $78 a barrel, slightly below levels seen at the outset of the Israeli-Palestinian conflict on October 7. Judging from market reports, the oil market has been less affected by the disruption, and many companies specializing in shipping oil are still willing to cross the Red Sea route, despite facing higher insurance costs. Some people have calculated that if they go around the Cape of Good Hope, it will take an extra 20 days for oil tankers from the Middle East to Europe. Assuming there are 150 ships every day, each carrying 2 million barrels of cargo, that means 300 million barrels of crude oil are floating at sea during these 20 days. Given that There are 80 million barrels of global products per day, so it cannot be considered a large supply. The small impact on supply mainly depends on when and how much freight rates increase.

European line container shipping futures have tripled since the beginning of December:

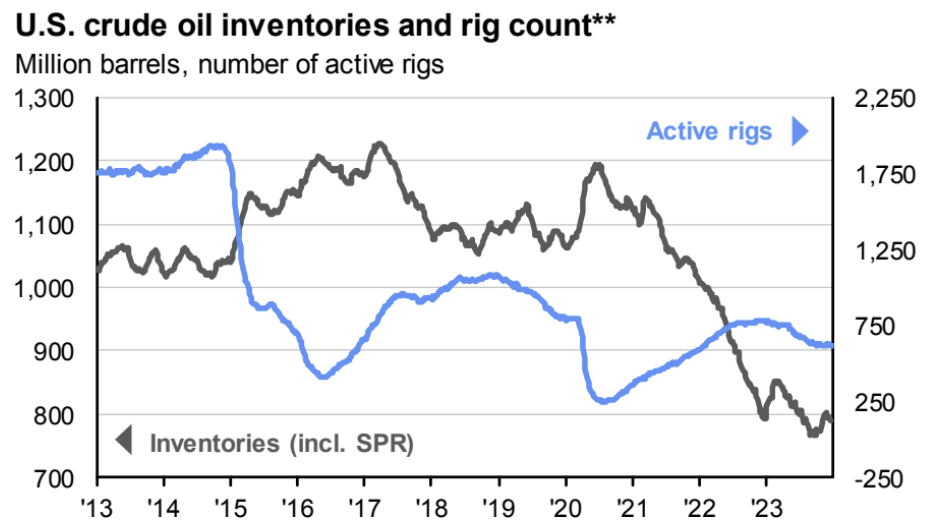

U.S. inventories turned downward after a slight replenishment, and the number of drilling rigs stabilized:

The U.S. dollar index has risen for five days in a row (its longest winning streak since September), marking the greenbacks best start to a year since 2005. Given that the U.S. dollars rivals, especially the interest rate differential between the euro and the U.S. dollar, are unlikely to widen significantly, the U.S. dollar is also expected to remain strong if the Federal Reserve adopts a dovish stance.

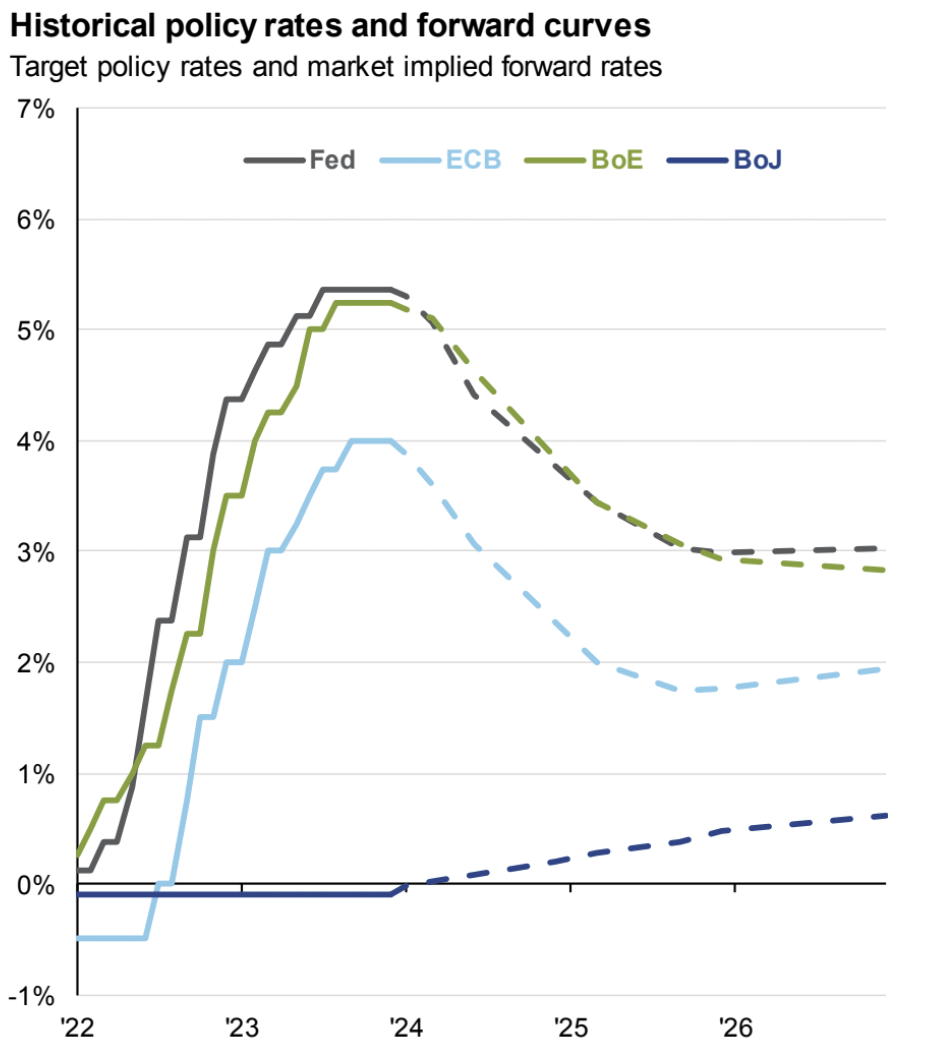

Fed meeting minutes are conservative

The minutes hinted that the rate hike was complete but did not provide a timetable for a rate cut. Almost all officials expected the policy rate to eventually be lowered before the end of this year. However, the guidance still retained that if inflation rises unexpectedly, further rate hikes may be possible. possibility. The original article also noted that there was an unusually high degree of uncertainty surrounding these rate cut outlooks. The minutes suggested officials could be nervous if markets rise too much as financial conditions ease, as that could make it more difficult for the Fed to continue cooling the economy and inflation.

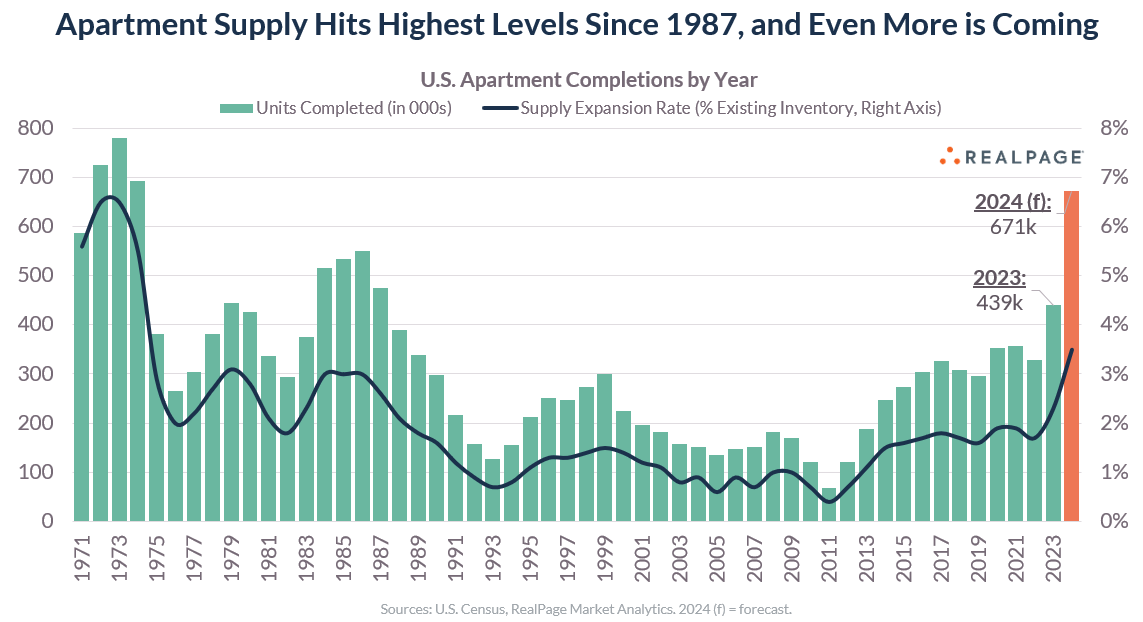

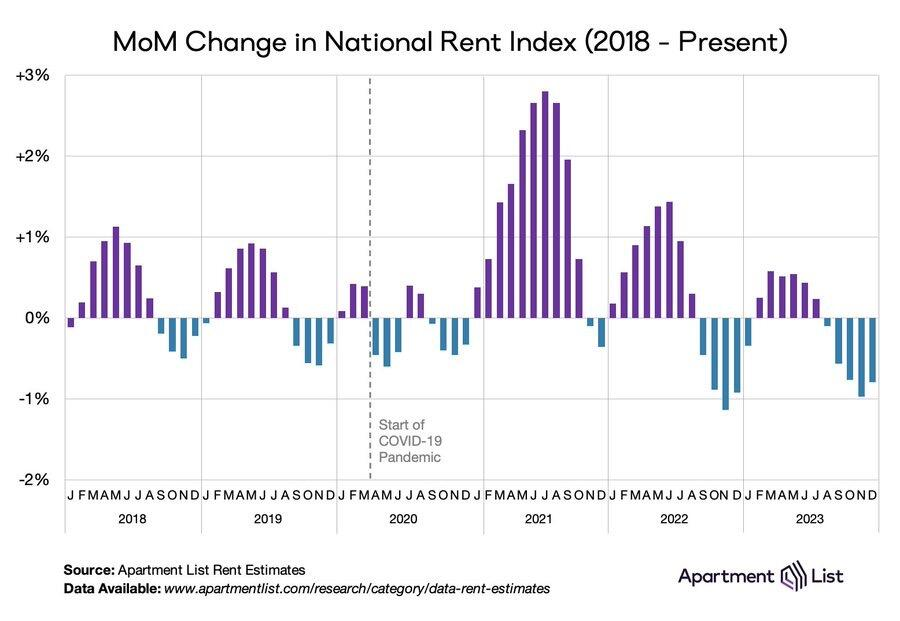

U.S. apartment supply reaches 40-year high

U.S. apartment supply surged to its highest level since 1987 in 2023, with more than 439,000 units completed. Additional units will be completed in 2024. That means renters suddenly have more choices, which should suppress rental growth.

However, we must also consider that as the cost of buying a new home has increased dramatically, the demand for renting has also increased.

Geopolitical aspects:

North Korea fired more than 200 artillery shells on its own side of the border near Yeonpyeong Island, and South Korea ordered the evacuation of nearby residents.

The Red Sea crisis has escalated. Maersk stated that in view of the recent attack on the Maersk Hangzhou in the Red Sea, in the foreseeable future, all ships transiting the Red Sea/Gulf of Aden will be diverted southward, bypassing the Cape of Good Hope. Customers are expected to prepare for continued complications in the region and significant disruption to global supply chains.

As the conflict between Hezbollah, the Houthis and Israel intensified, the United States announced that the USS Ford aircraft carrier would withdraw westward and reduce its military presence near the coast of Beirut, resulting in a significant reduction in Israels deterrence.

The case files related to Epstein who committed suicide in 2019 were approved by a Manhattan judge to be released to the website, involving many politicians and celebrities around the world, but it accidentally gave Trump a positive advertisement on social media.

liquidity

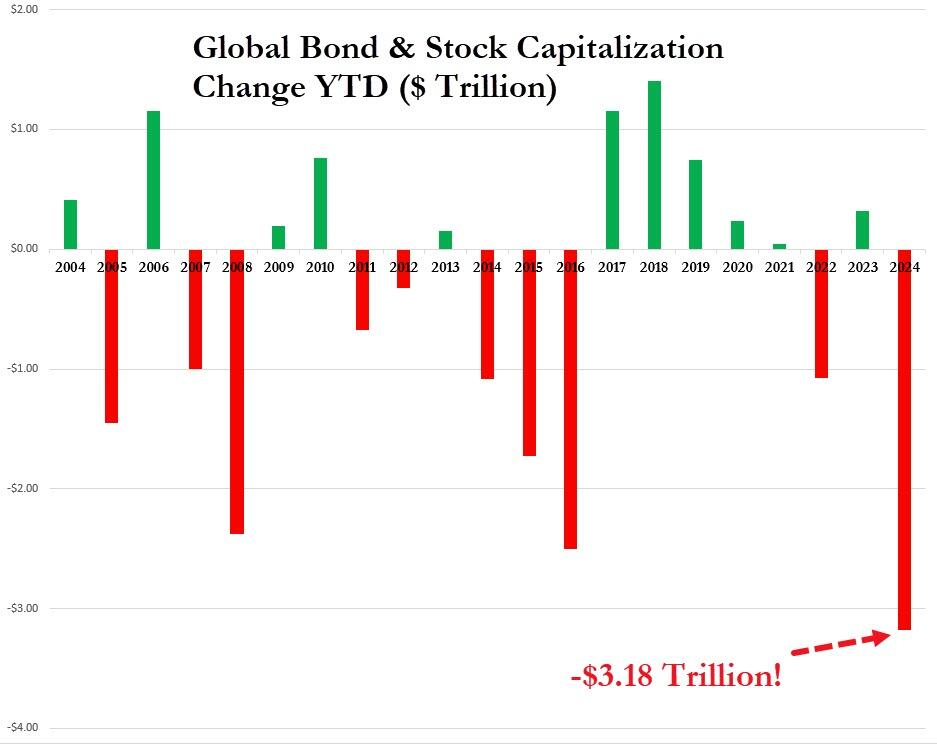

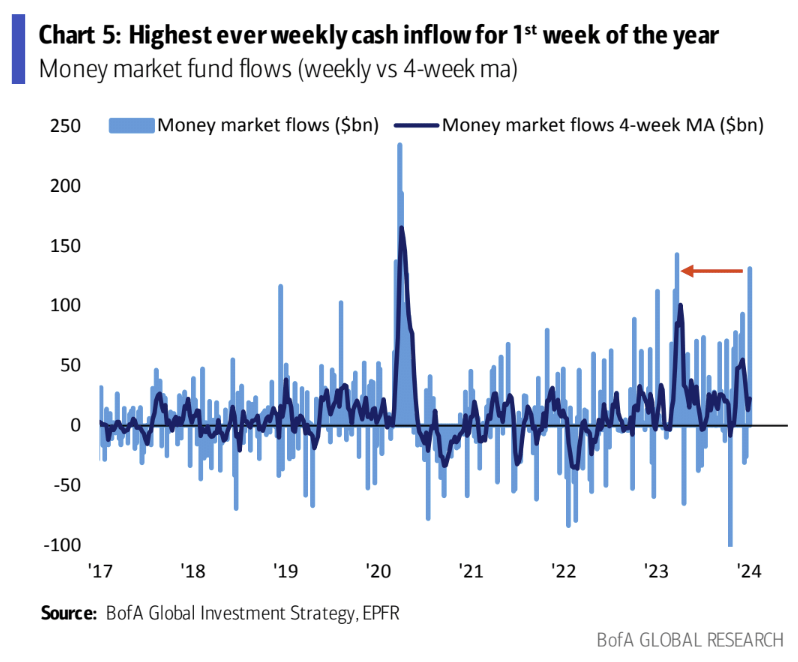

Cash is once again in demand as global stock markets begin to give back some of last quarters gains.

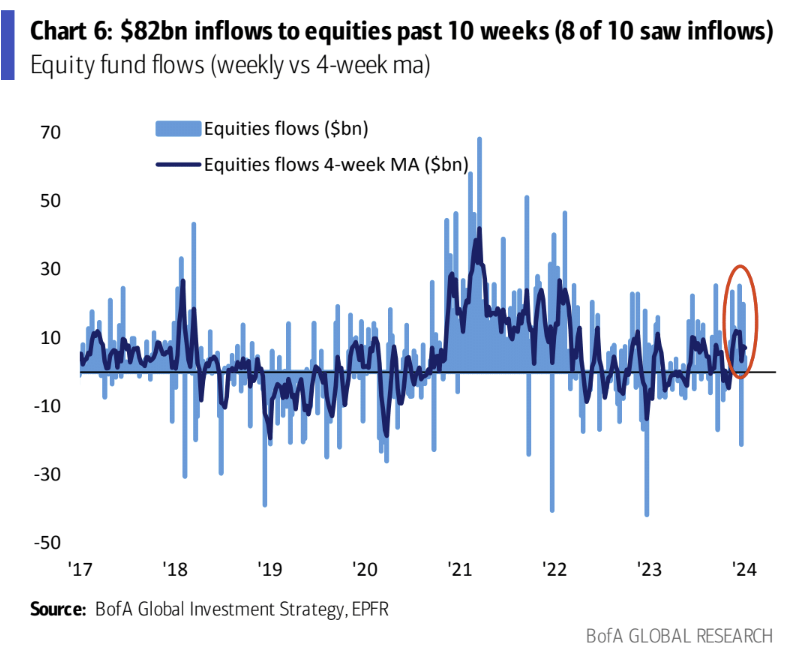

Investors poured $123 billion into money market funds in the week ended Jan. 3, the largest weekly inflow since March 2023, EPFR data showed. By comparison, inflows into stocks and bonds were just $7.6 billion and $10.6 billion, respectively.

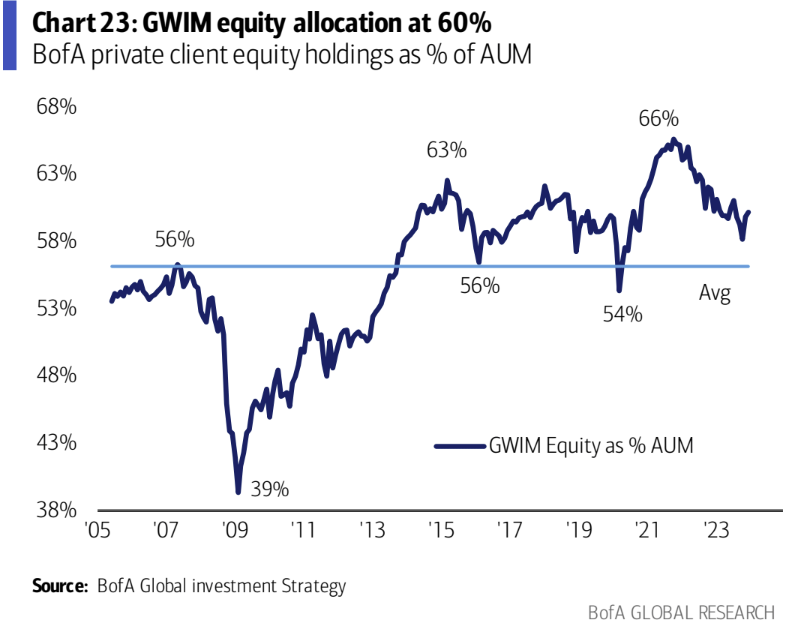

Bank of America clients continue to increase their holdings of stocks, taking allocations to a six-month high of 60.2%

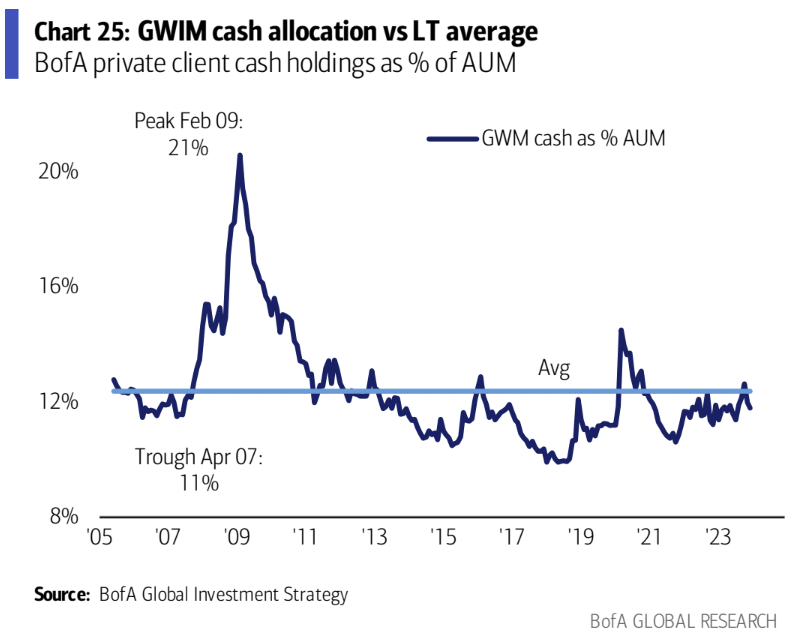

The cash allocation ratio dropped to 11.8%, and the average in 2007 was 11%:

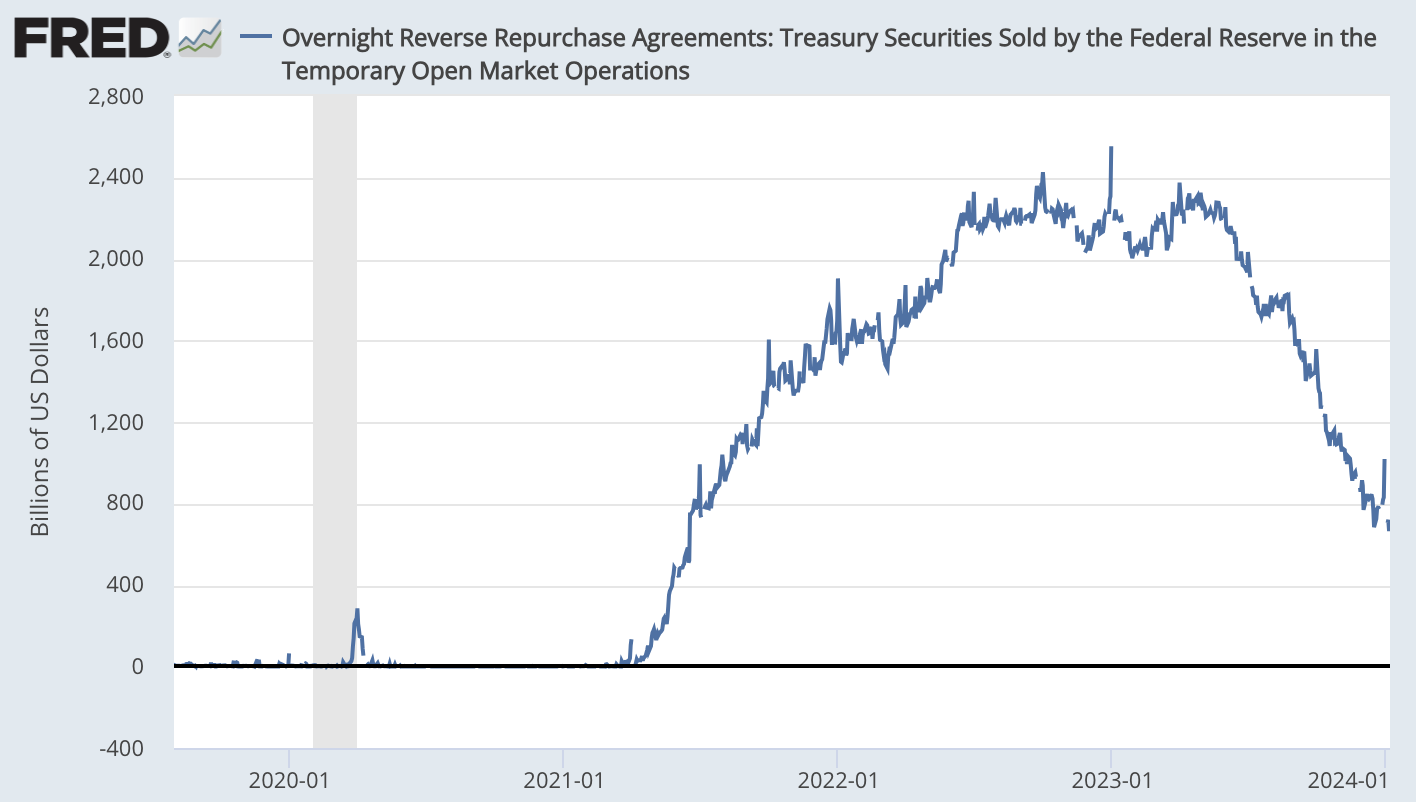

ONRRP continues to hit new lows after a brief recovery at the end of the year

Overnight reverse repo ONRRP serves as a reservoir of idle funds for non-bank institutions. When there is sufficient liquidity in the market, the Monetary Fund deposits cash into the overnight reverse repo market, so the trend of this account can be reflected to a large extent. The current liquidity status of the market. As of January 5, 2024, the size of the New York Feds overnight reverse repos has shrunk significantly from the peak of US$2.55 trillion at the end of 2022 to US$694.4 billion, a reduction of more than 70%, reflecting that market liquidity has dropped significantly. The big investors should take over the spot U.S. bonds, and then flow into monetary funds. If this part of the funds is close to drying up, it may cause panic in the market (but everything has two sides, and this will also be a reason for the Fed to turn. Not necessarily It may be a rate cut, or it may be a QT slowdown).

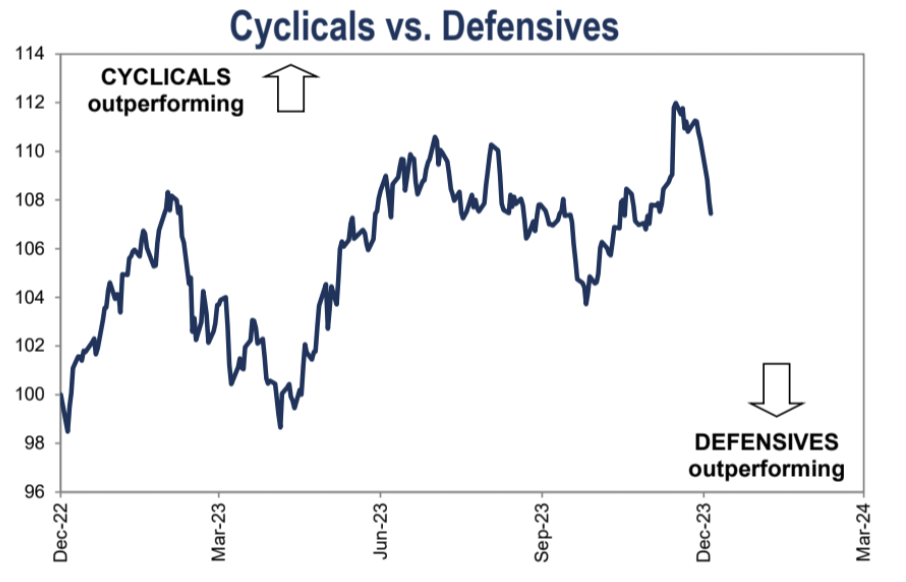

The market as a whole is reducing risk, leading to better performance in defensive themes:

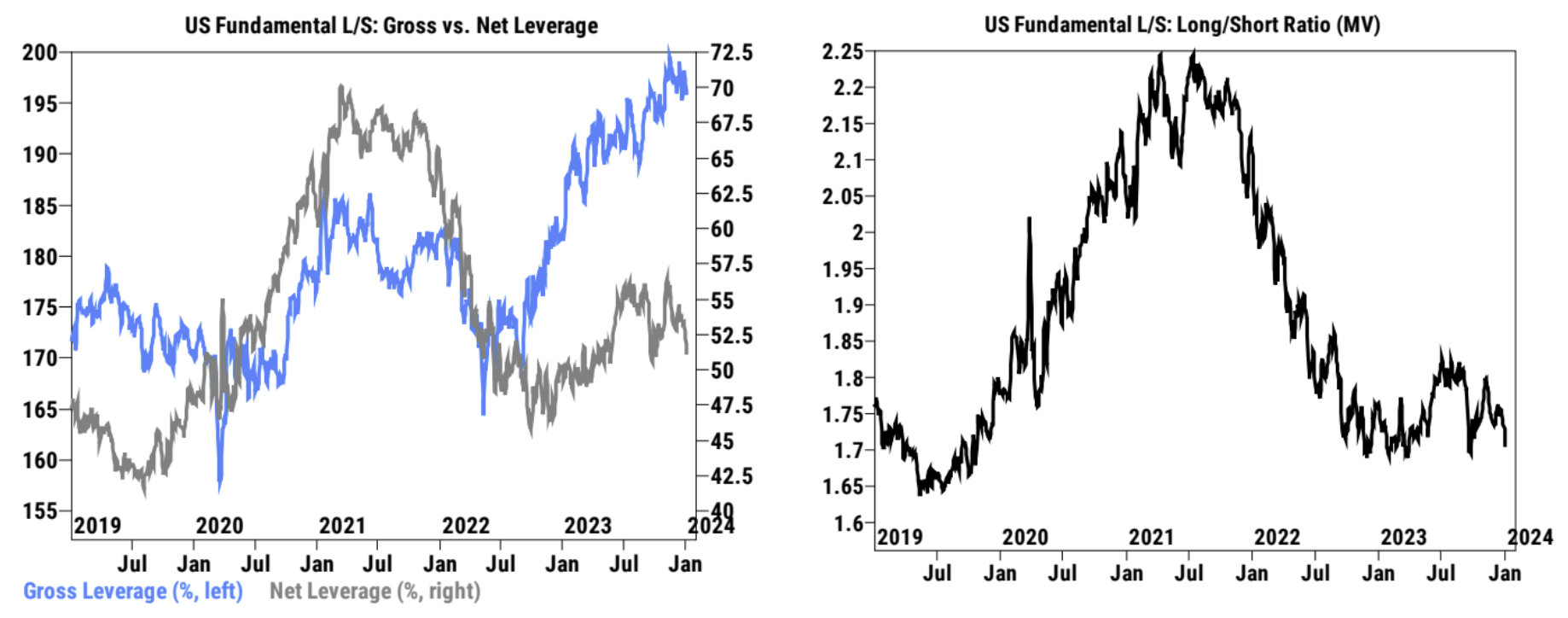

Gross leverage for U.S. fundamental long-short strategies fell 1.8% to 196.5% (95th three-year percentile), while net leverage fell -2.7% for the third consecutive week, the largest week-over-week decline in 3 months Decline, to 50.6% (25th percentile over three years). Total U.S. fundamental long-short strategies fell 2.4% this week to 1.693 (1 st percentile over three years):

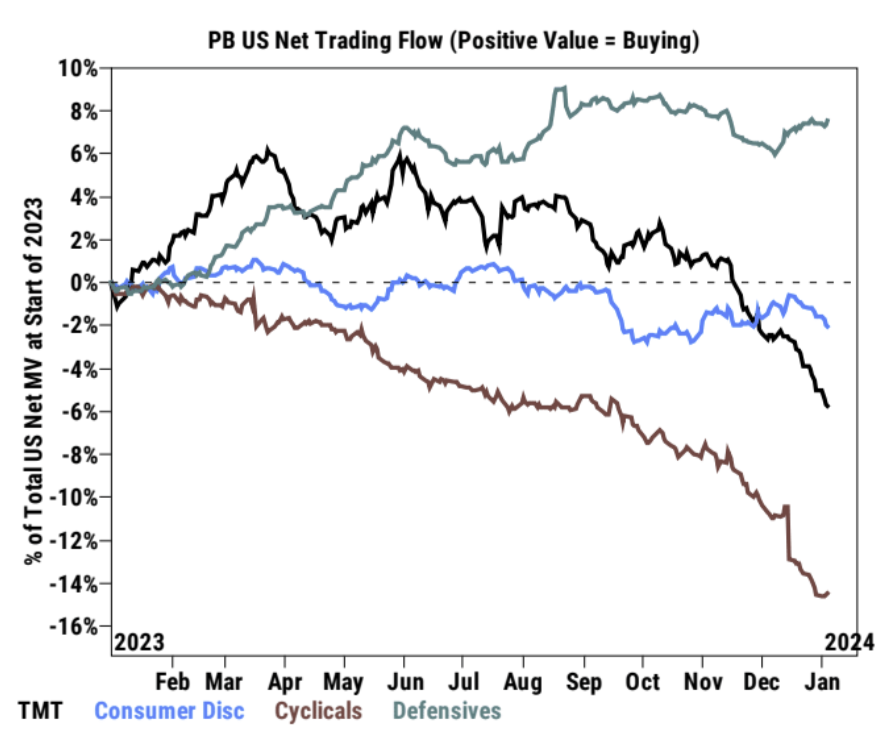

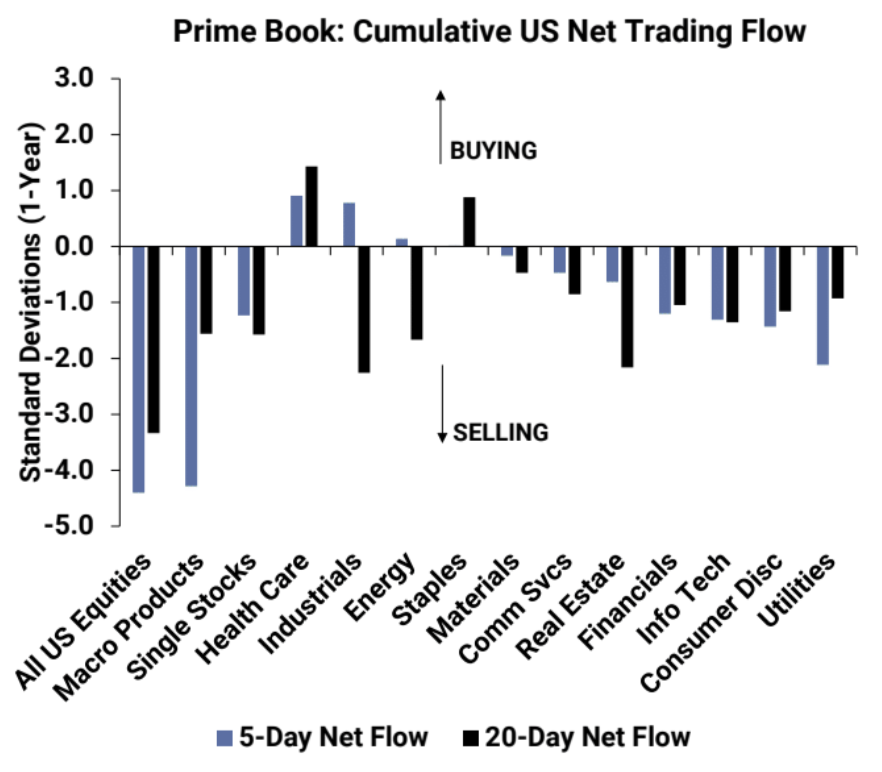

TMT and cyclical stocks experienced massive fund outflows:

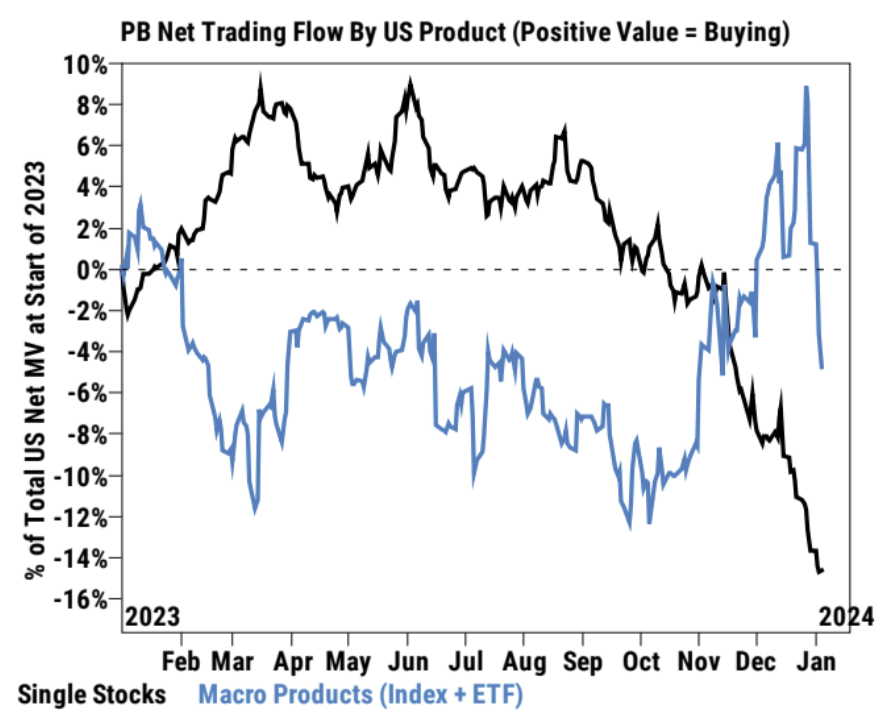

Hedge funds have been rapidly reducing their exposure in the past two weeks, mainly selling macro ETF products, accounting for 85% of all net selling volume: short selling volume is 4 times that of buying volume. The Information Technology, Consumer Discretionary, Financials and Utilities sectors were the most net sellers. Healthcare, energy, and industrials saw the most net buying.

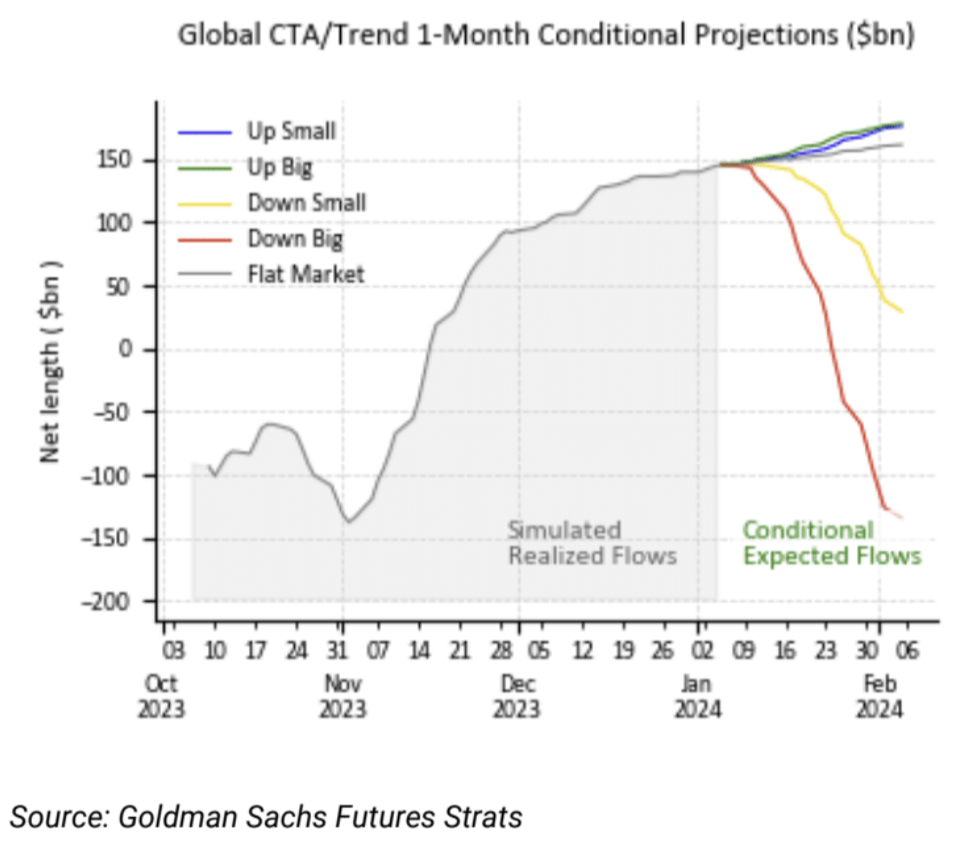

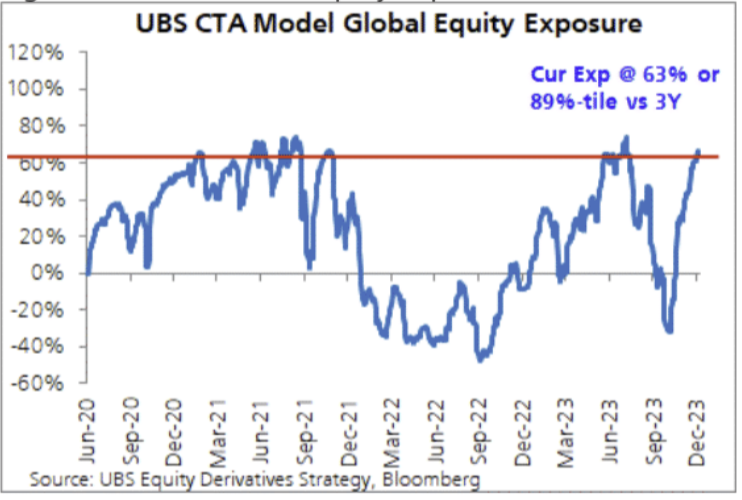

GS’s model shows that in the coming weeks CTA funds will tend to sell when the market is falling, with far greater momentum than buying when the market is rising:

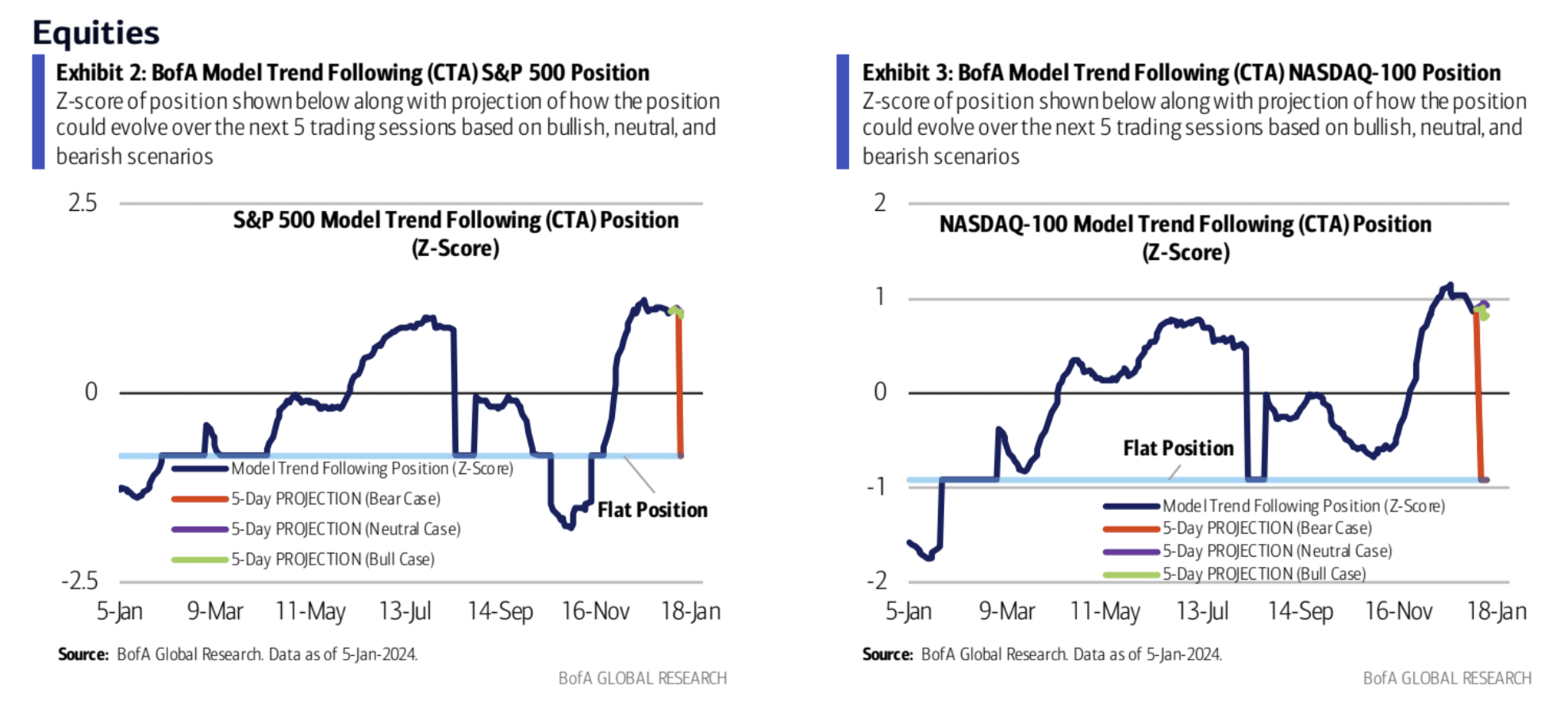

Bank of Americas model has a similar conclusion. Bank of America further pointed out that because CTA funds have carried out aggressive replenishment before, the model now shows that the SP 500 index is at 4644 points (1.1% lower than the current price) and the Nasdaq 100 is at 16215 points ( There will be stop-loss pressure near 0.6%):

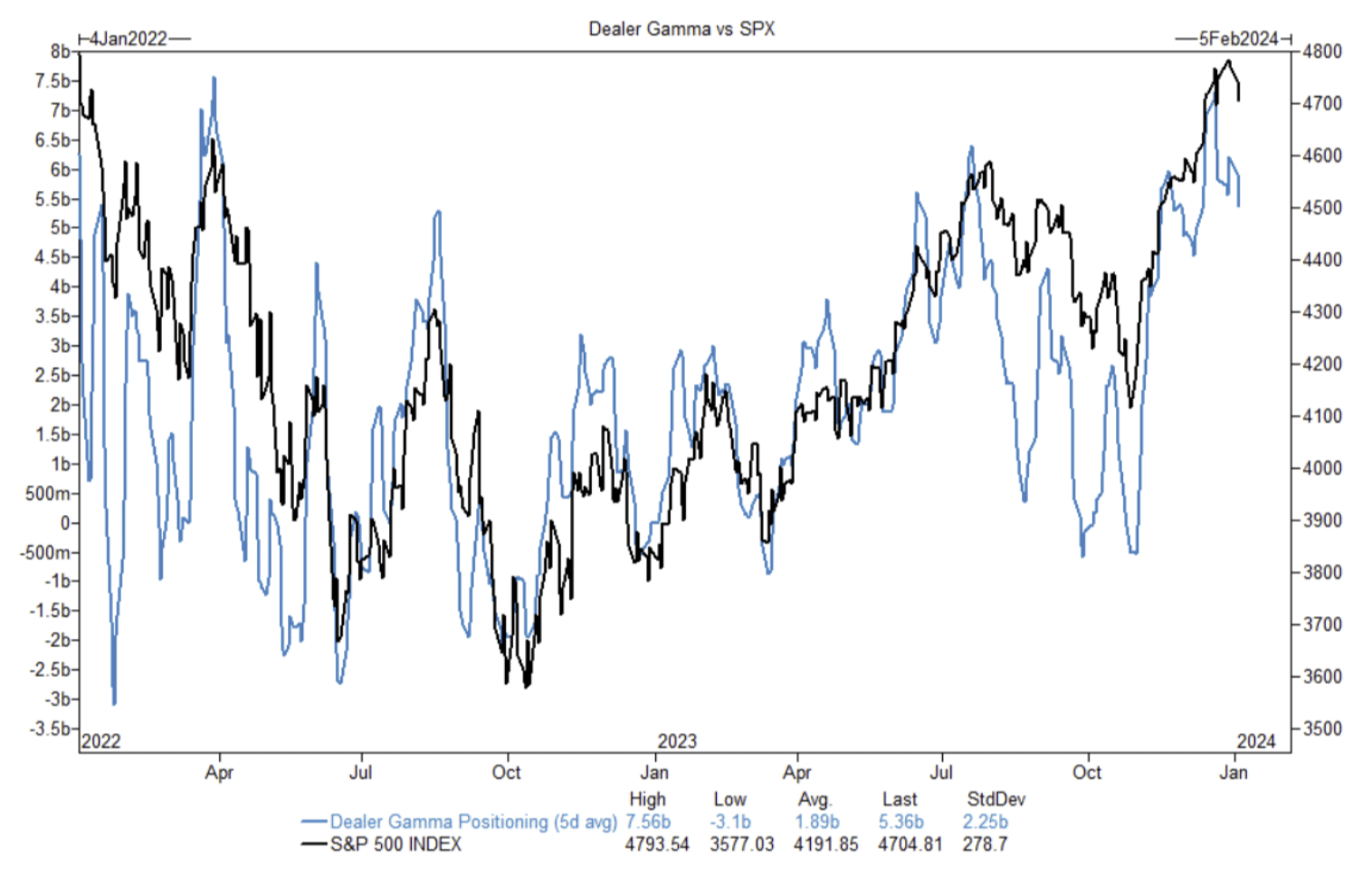

GS strategy recommendation: After two months of bull market, we are more cautious in tactics and recommend to gradually buy on dips near 4600 points (-2%), because the positions are already full, traders are reducing Gamma, and many good news are coming. Already priced. Select higher quality underlyings in rotation trades, such as rotating from the Russell 2000 index into small-cap stocks with higher free cash flow.

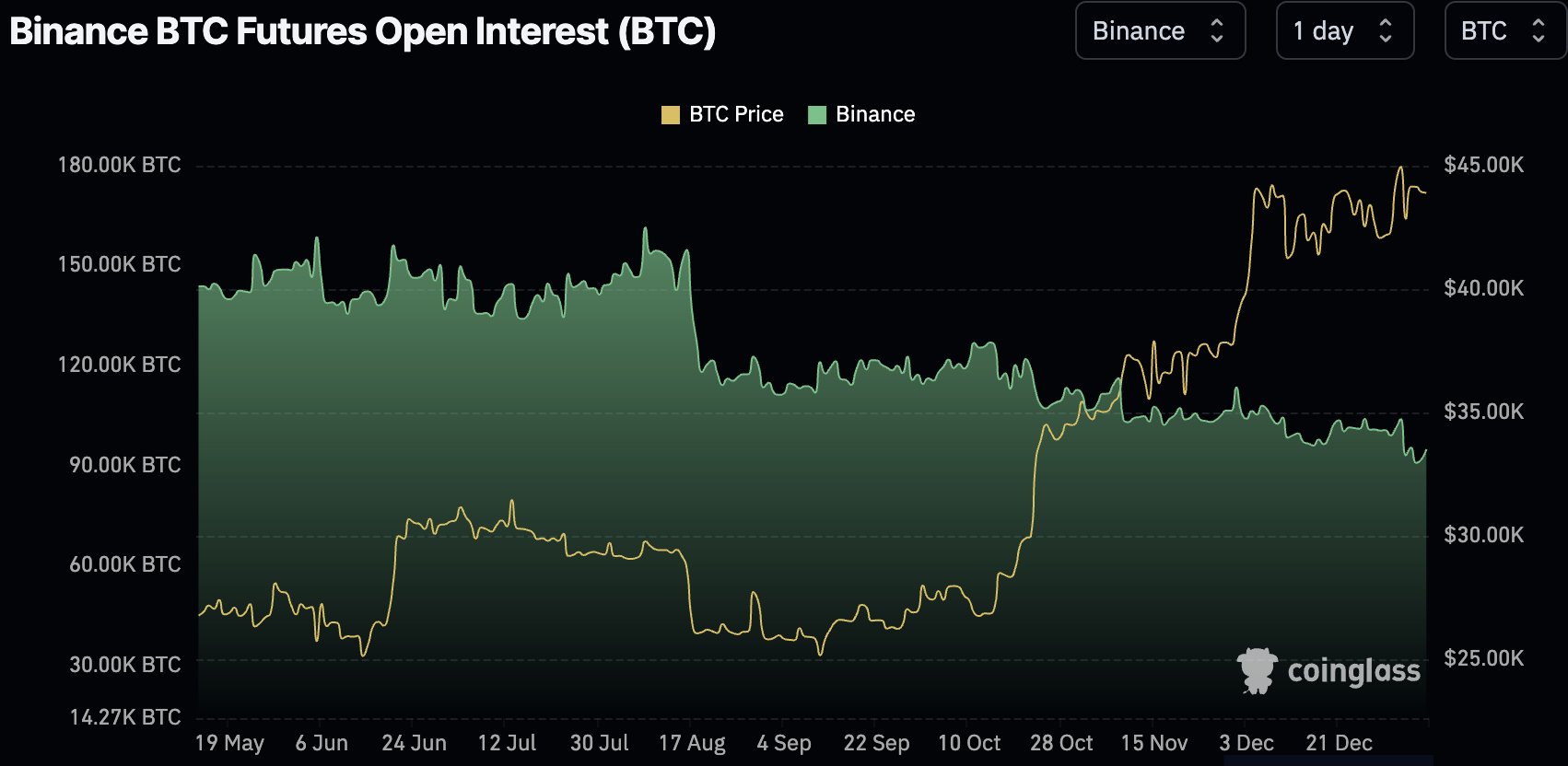

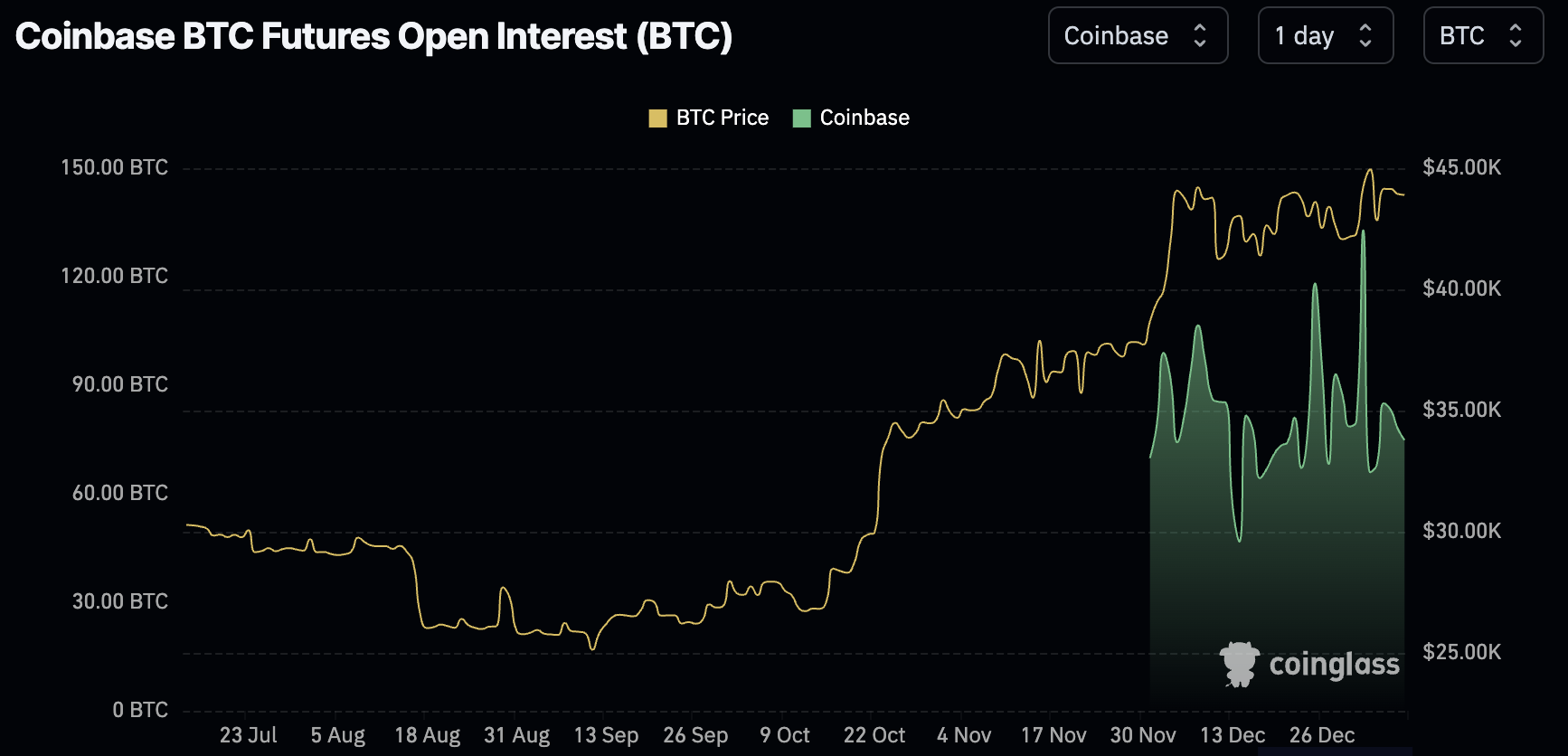

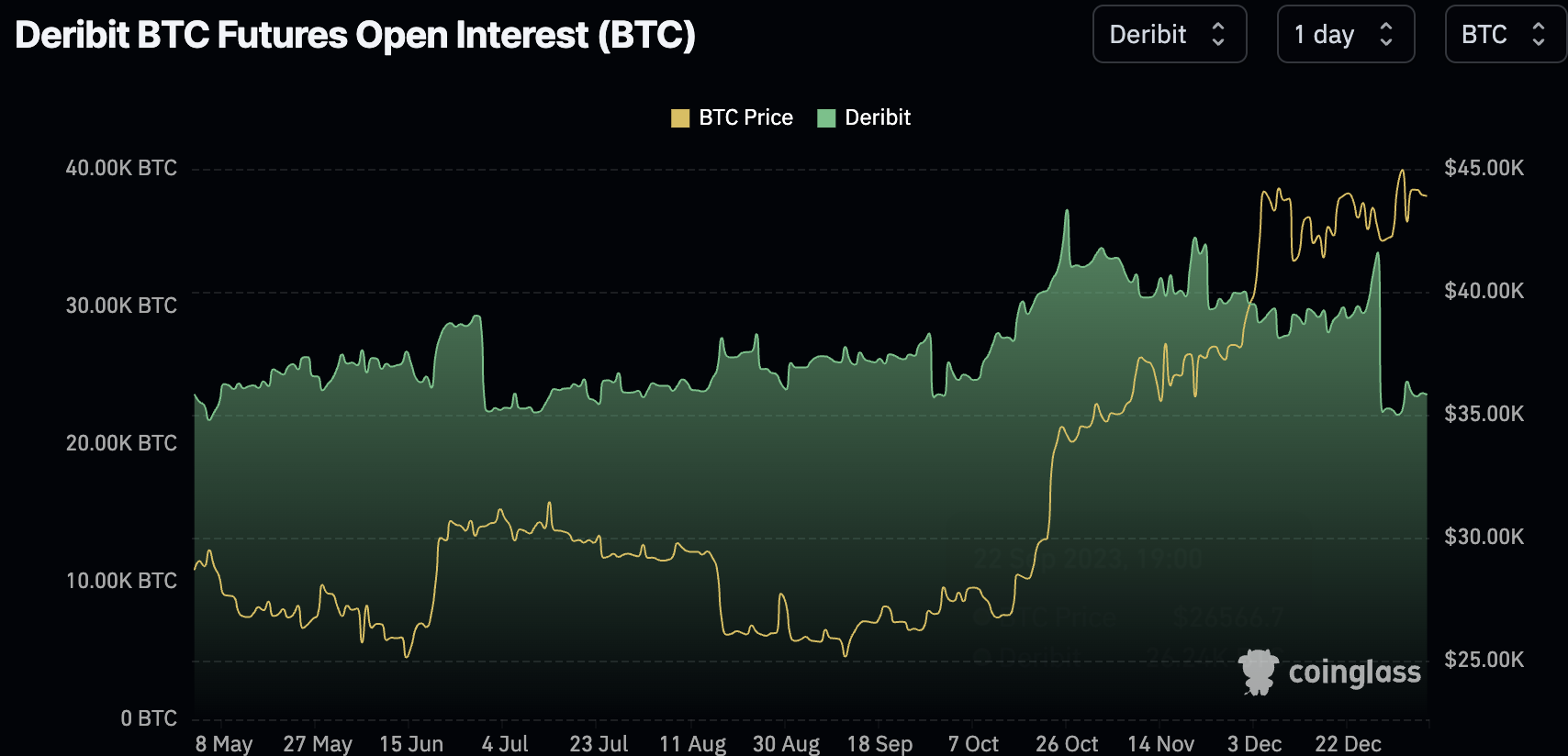

The cryptocurrency market experienced an unexpected plunge last Wednesday, which greatly reduced the futures holdings (BTC standard) of many cryptocurrency exchanges, but this did not affect CME’s holdings. This seems to be a relatively positive signal that ETF is about to pass as expected:

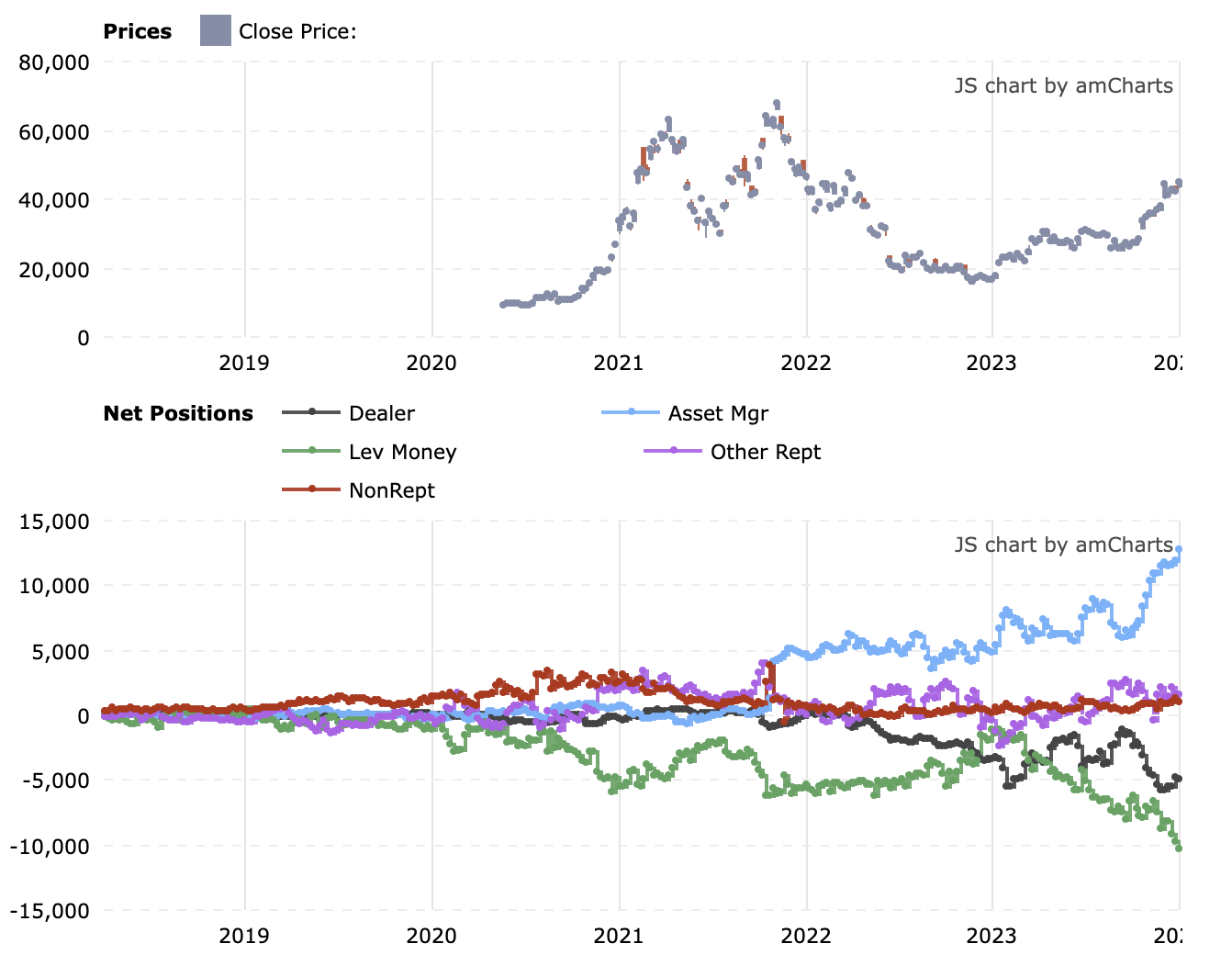

The differences in views between BTC asset management and leveraged funds are even more obvious, with net positions both hitting record highs. The last time this happened was before BTC peaked at 60,000 in October 2021:

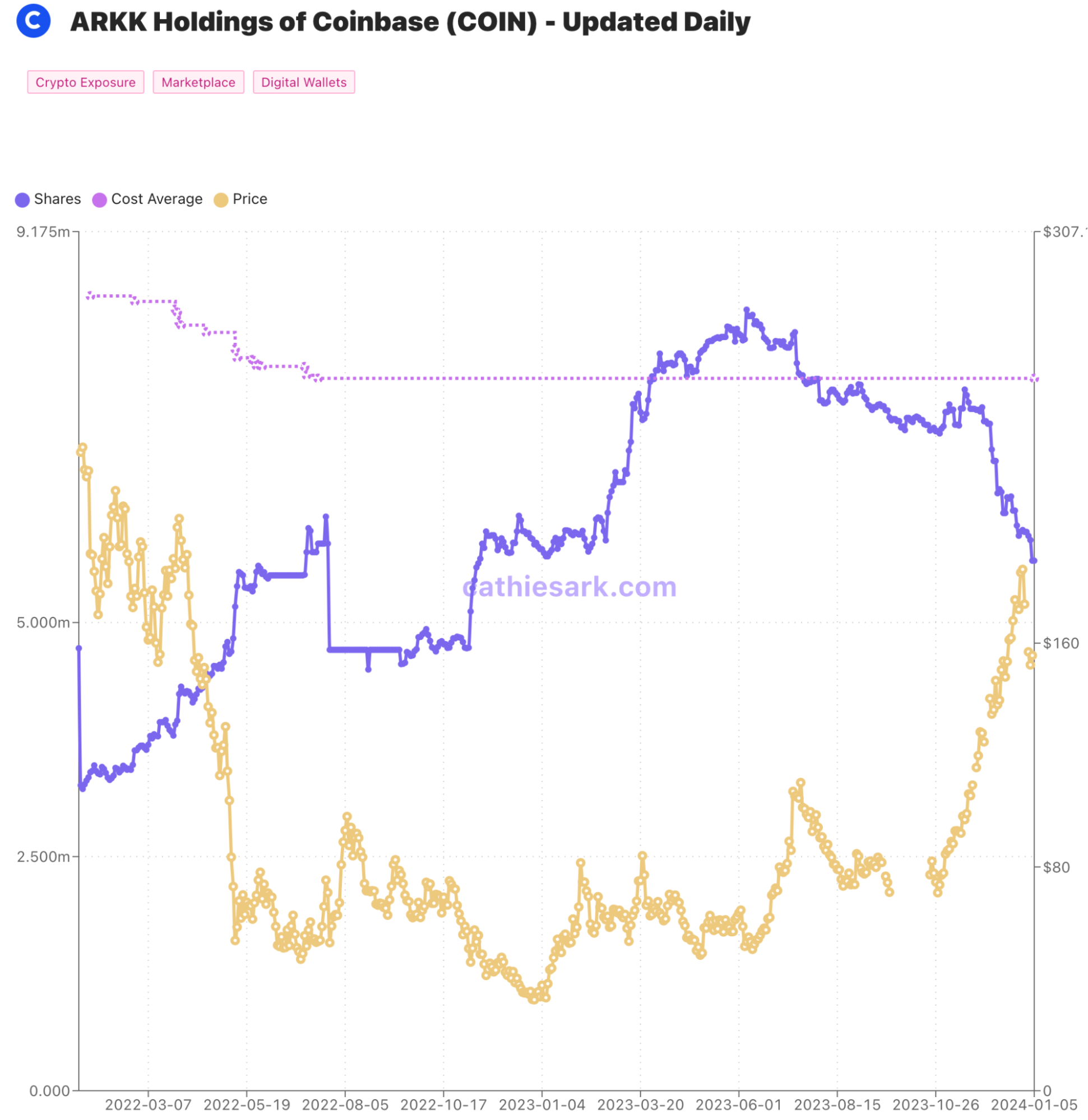

Catherine Wood has sold all the COIN that she added to her position in 2023. However, considering that the price has increased too much, the weight of COIN is too high, and there are many factors to passively reduce the position. Even if the position is reduced by 32%, it is still the largest among the ARK series funds. Position:

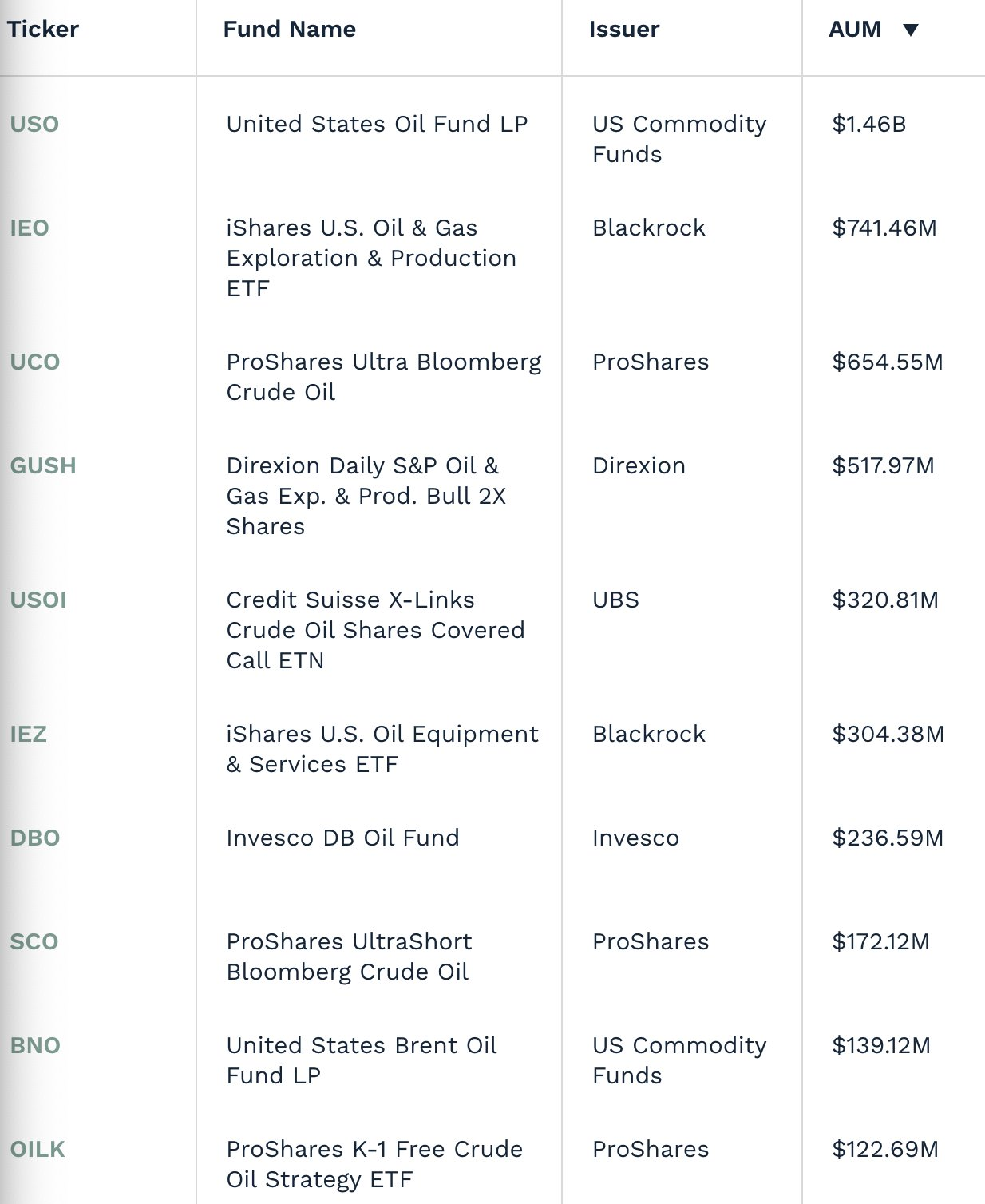

The so-called traditional market will enter the crypto market on a large scale because of ETFs may be just wishful thinking. In fact, stock market funds can also increase crypto exposure through futures ETFs, and spot is not required. Even if they want to enter, it is for other reasons. Considering that the ETF of crude oil, the king of commodities, is also based on futures, it does not affect everyones investment. In addition, considering that the total size of ETFs with energy stocks is only 4.6 billion US dollars, it is difficult to imagine that the BTC ETF will have 2 billion US dollars at the opening (if it does, it will really be a bull market)

market sentiment

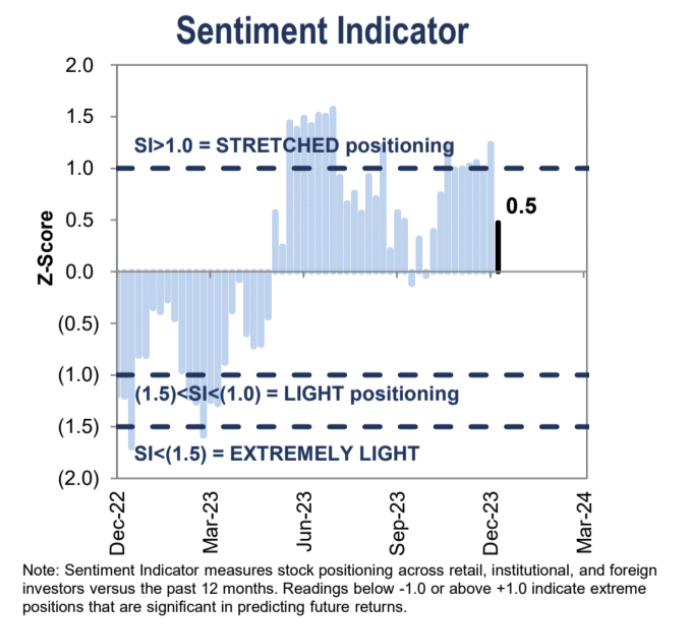

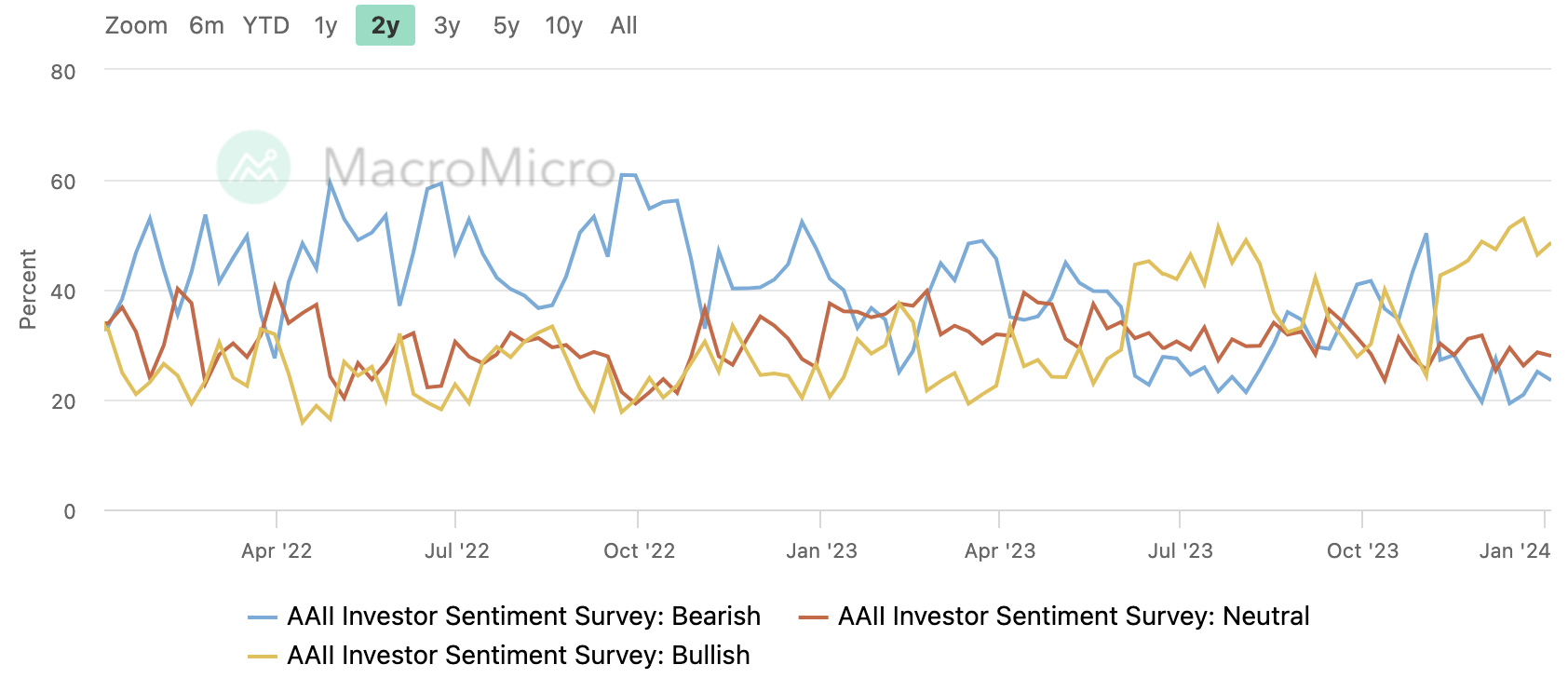

Institutional sentiment begins to decline, but retail investor sentiment remains overheated

institutional perspective

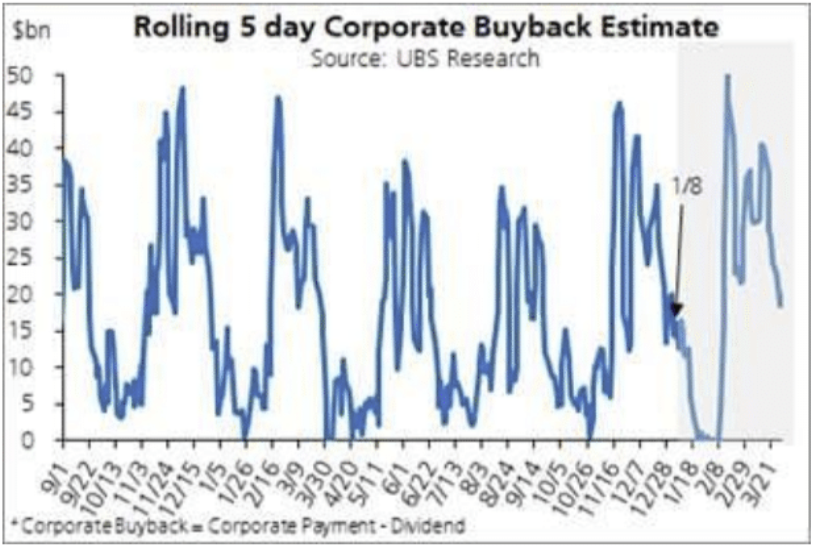

UBS: Continue to be bearish

Although the market has corrected a lot at the beginning of the year, the bearish view of the beginning of 2024 still exists, predicting that the SP 500 Index will have at least 10% downside, and the Nasdaq will fall even more, based on three key technical signals: A reversal of macro excess flows following the December Fed meeting, selling behavior from UBS clients, and a signal of the end of the short squeeze. Other negative factors include that the companys repurchase window will be at a low level for the next two weeks, which has limited support for the market, and hedge fund positions are relatively high. In order to avoid taxes, investors have postponed profits that should have been cashed in 23 to 24, thus resulting in capital gains. Taxes are also postponed to 24 years; bearish asymmetric risks of CTA funding flows, etc.

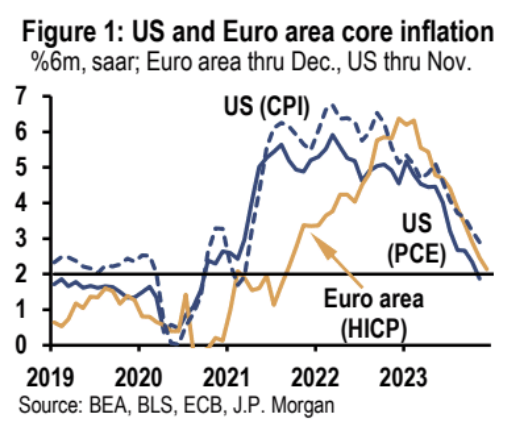

BNP: Hedging recommended

Regarding this week’s CPI: A higher-than-expected reading (they expect core CPI to rise 0.3% year-on-year, higher than the 0.2% expected by the market) will challenge market expectations that the trajectory of inflation will be smooth. With the odds of a March rate cut already high, rebounding CPI could put a damper on rate cut trades. On the contrary, if CPI is weak, the market will only view this as further confirmation of the recent inflation trend, so the risk of this data is asymmetric.

Regarding U.S. stocks, the market expects corporate earnings growth to accelerate significantly to 12% in 2024. However, considering that the price-to-earnings ratio is already high and full-year earnings are likely to be disappointing, the downside risks are greater than the upside risks. But options pricing in the stock market does not reflect this downside risk. Instead, the implied volatility of stock index puts is only in the 7th percentile over the past decade.

Given the dual risks of rising yields and lower earnings estimates in the coming weeks, BNP recommends buying QQQ (current price 397) $380/370 put spread options expiring in March, with a risk-reward coefficient of about 5 times (i.e. buying $380 The cost of the strike price put minus the proceeds from selling the $370 strike price put) can grow to five times that amount in the best case scenario.

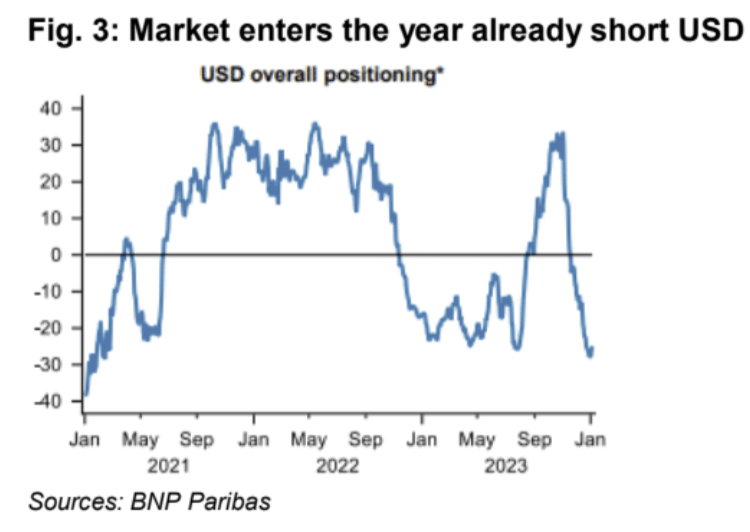

Regarding the U.S. dollar: The current level of short selling is too high. The higher yield of the U.S. dollar will support the U.S. dollar. It is recommended to buy U.S. dollar call spread options.

Follow this week

In the coming days, the worlds three largest economies - the United States, China and Japan - will report inflation data. In the United States, the market expects that both the year-on-year and month-on-month CPI numbers may slow down, focusing on the core inflation rate month-on-month number, which is expected to decline from 0.3% to 0.2%. Prices in Japan are expected to continue falling, which will put less pressure on the Bank of Japan to change policy after the recent earthquake. China is expected to report slightly lower deflation than in November. Still, the economy needs more support, with further interest rate cuts expected later this month.

The U.S. Q4 earnings season officially starts on Friday, and the financial reports of major banks will be the first to appear.

U.S. Treasuries are scheduled to be auctioned over the next two weeks for more than $320 billion, a peak in January, with concerns over how the auction results may disrupt the market.