Gryphsis Cryptocurrency Weekly: SEC Releases Final Bitcoin ETF Application Documents

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium, for deeper research and insights.

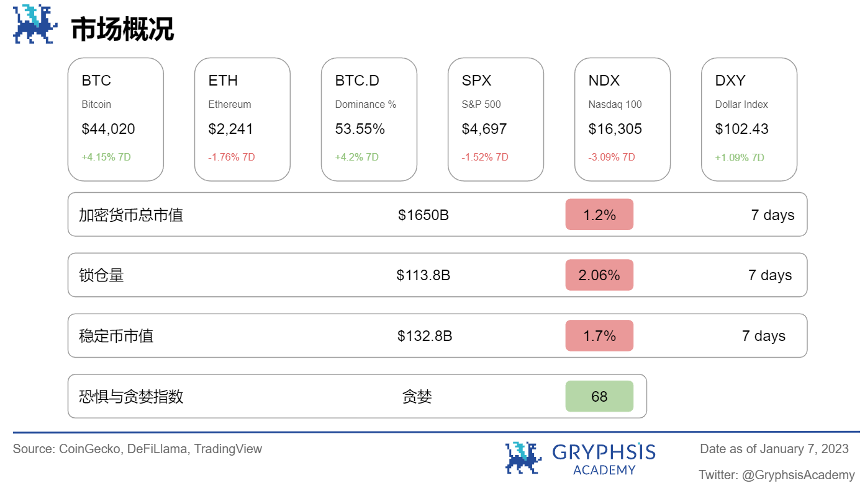

Market and Industry Snapshot:

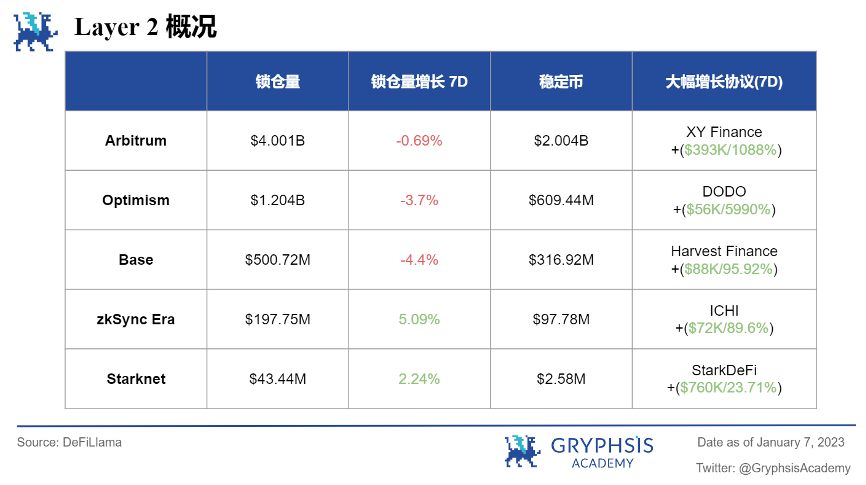

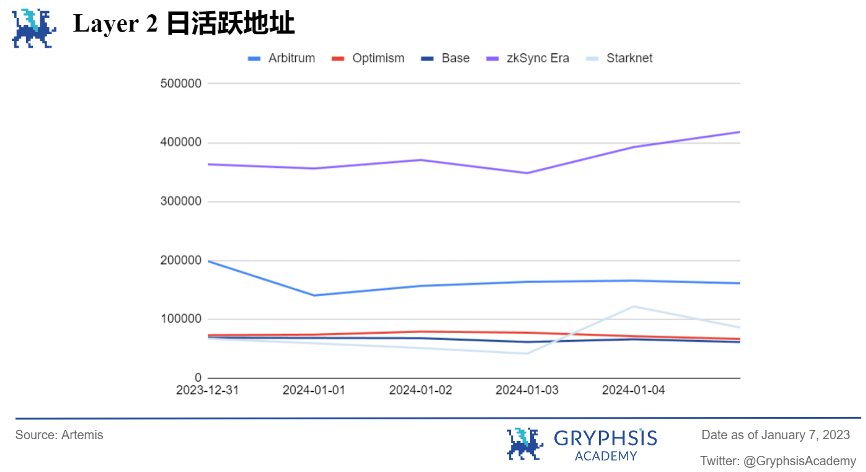

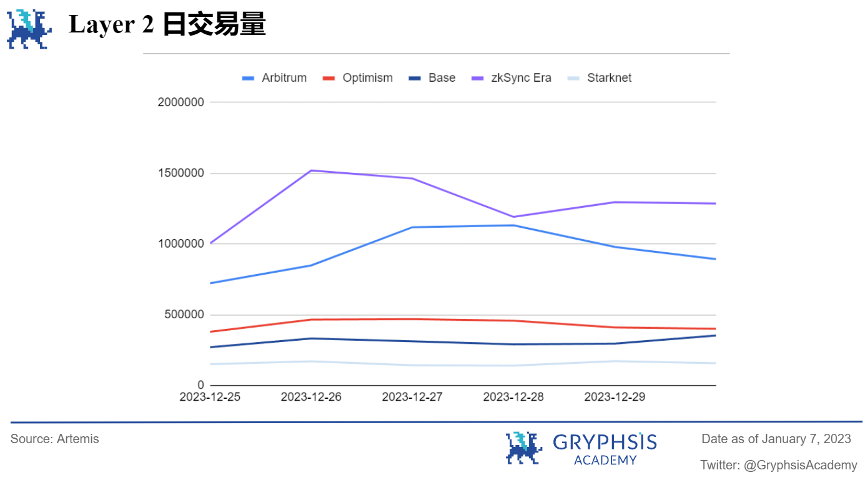

Layer 2 Overview:

Last week, Layer 2 showed an upward trend except for zkSync Era and Starknet. Base dropped the most significantly by 3.33%, and zkSync Era increased by 5.09%. Protocols like XY Finance, DODO, Harvest Finance, ICHI, and StarkDeFi have demonstrated noteworthy TVL growth rates.

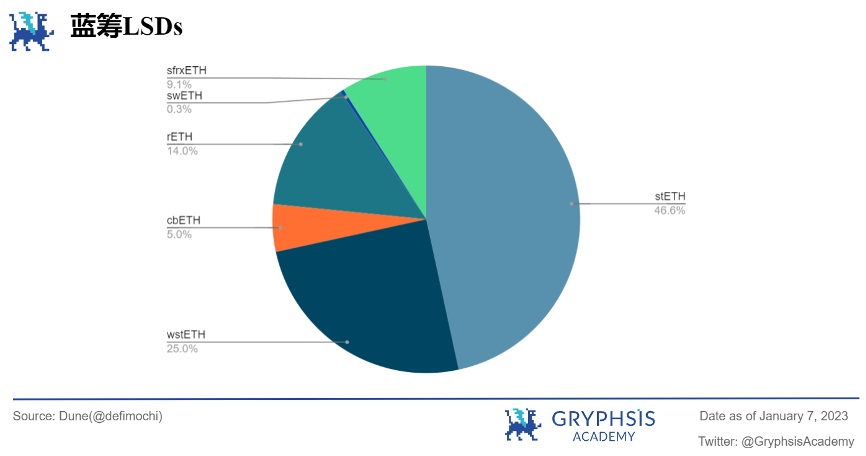

LSD Sector Overview:

In the LSD space, both Ethereum deposits and total withdrawals rose slightly. In terms of market share, blue-chip LSD has declined, with swETH having the most obvious decline of 17.09% this week.

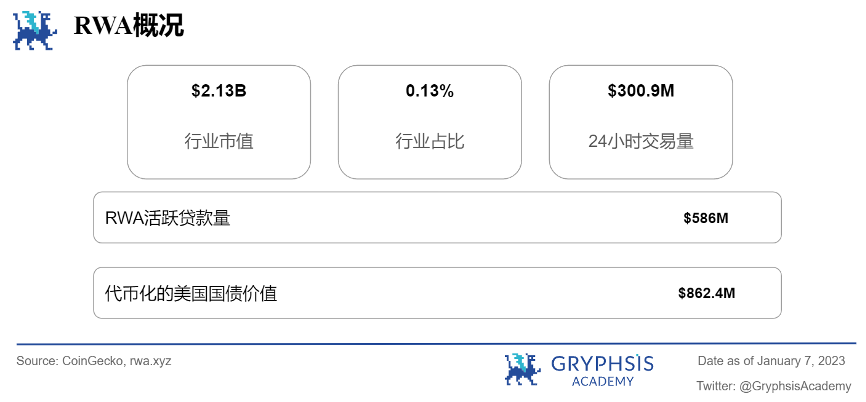

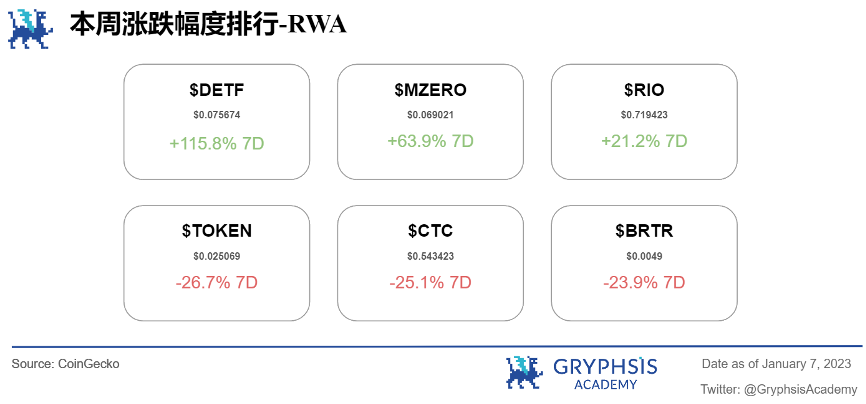

RWA Sector Overview:

Last week, the worlds real asset market capitalization fell by 4.91%, but the 24-hour trading volume increased by a significant 126.58%. RWA tokenized treasury declined slightly but the value of tokenized U.S. Treasuries increased by 1.89%. Notable growth tokens include $DETF, $MZERO, and $RIO. Tokens like $TOKEN, $CTC, and $BRTR experienced larger losses.

Main Topics

Macro overview:

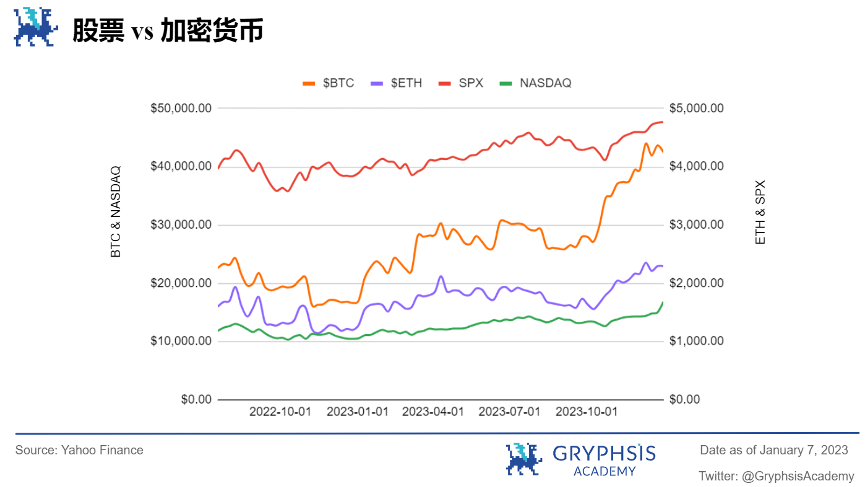

US Stock V.S. Crypto

Big news this week:

SEC has posted the final Bitcoin ETF application filings.

Weekly Agreement Recommendations:

SolMash

Weekly VC Investing Spotlight:

PowerPod($ 1 M)

BracketX($ 2 M)

EZswap($ 1 M)

Twitter Alpha:

@Haylesdefi on RWA

@0x AndrewMoh on Cakepie

@0x DefiLeo on Sui

@0x AndrewMoh on Sei

@wist_defi on Metis

Macro overview

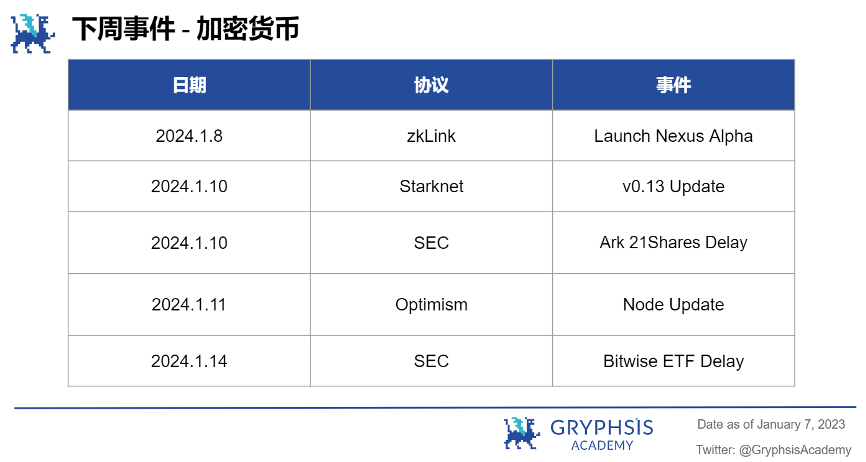

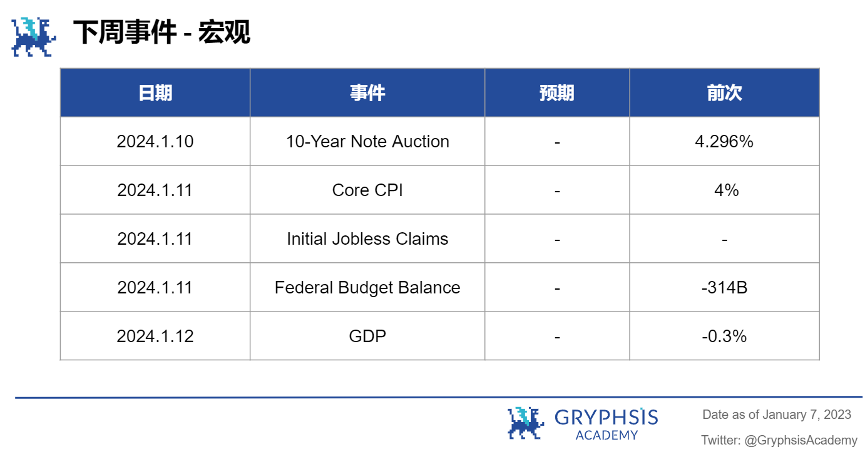

This week, the changes in the stock market were weaker than those in the crypto industry, with SPX and NASDAQ increasing by 1.51% and decreasing by 3.09% respectively. In the coming week, pay attention to the 10-year Treasury bond auction, core CPI, initial jobless claims, federal budget balance, GDP and other major events.

Big news this week

SEC releases final Bitcoin ETF filing

A U.S. spot Bitcoin exchange-traded fund (ETF) appears to be launching soon, as the exchange that will list it has filed revised documents and expects approval from the U.S. Securities and Exchange Commission in the coming days.

The Amended 19 b-4 filing, which represents institutions such as BlackRock, Grayscale, Fidelity and other issuers, joins last month’s Amended S-1 filing that addressed feedback from the SEC. There are more than a dozen applicants hoping to launch the first spot Bitcoin ETFs in the United States, with multiple issuers likely to be approved at the same time.

Individuals from two different issuers told CoinDesk on Thursday that their companies expect to receive approval sometime next week. One of the people told CoinDesk that submitting the revision does not guarantee approval, but said they were optimistic. The final deadline for SEC action on at least one filing is Jan. 10, suggesting regulators may approve all final filings that are appropriate by that date.

“This is an important step in upgrading GBTC to a spot Bitcoin ETF,” Grayscale spokesperson Jennifer Rosenthal said in a statement, referring to the company’s desire to convert its Bitcoin trust into an ETF. “At Grayscale, we continue to work with the SEC and will be ready to operate GBTC as an ETF once regulatory approval is obtained.” Earlier this Friday, Bloomberg reported that SEC commissioners “are expected to proceed with a trading rule submission next week. Vote. Before an ETF can launch, regulators need to approve a 19 b-4 filing and an S-1 filing.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose SolMash, a Launch Pad platform that spans the BRC ecosystem and the SOL ecosystem.

Solmash is Solanas native Inscription Launch Pad focused on bringing BRC-20 Inscriptions and Ordinals to the Solana ecosystem. Projects will be able to easily and quickly launch inscriptions and connect them with KOLs and communities to achieve success. SolMash is more than just an inscription casting platform, it aims to create a new launch model that provides ordinary retail investors with the same advantages usually reserved for institutional investors and encourages projects to think long-term.

The first Launch project on SolMash, SoBit, became an instant hit. The $SOBB 200 U whitelist received a hundredfold profit of up to 20,000 U. Many of SolMashs $mash token issuances will be combined with Sobits token $SOBB.

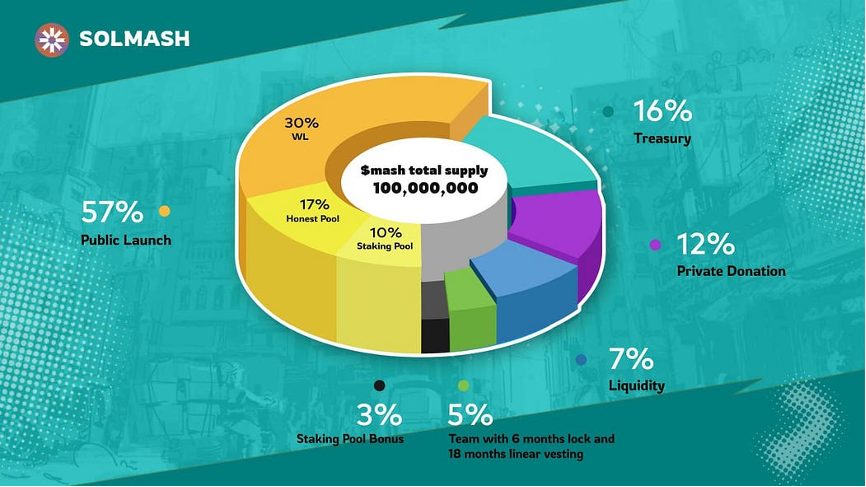

Its native token $MASH is the governance token of the protocol, with a supply limit of 100 M. $MASH will be the platform’s governance token, with a total supply of $100 million. The protocol divides $MASH into three independent rounds: the pledge round, the whitelist round, and the honest pool HonestPool round. The total issuance funds of $MASH are expected to raise $570,000 from the community.

57% public issuance (30% whitelist, 17% honest pool, 10% staking pool)

3% staking pool reward

16% financial treasure

12% private donation

7% liquidity

5% team locked for 6 months and linearly unlocked for 18 months

Round 1: Pledge round

This round will begin on January 6, 2024 at 14:00 UTC with a goal of raising $100,000. Community members can stake $SOBB to earn $MASH, using the dynamic allocation system to adjust the distribution of $MASH based on the final total number of $SOBB staked to ensure fair distribution. At the end of the staking period, the system will automatically deduct the corresponding amount of $SOBB from the stakers in exchange for $MASH whitelist, consistent with the specified whitelist quota of the staking pool. The allocation formula is: {personal pledge amount} / {total pool pledge amount} * {current allocation amount}

For example, if User A stakes $10,000 of $SOBB in a pool of 1 million $SOBB, his allocation is {10,000}/{1,000,000} * 1,000,000 = $10,000 of $MASH.

Round 2: Whitelist round

The whitelist round is scheduled to start on January 8, 2024 at 08:00 UTC and end at 14:00 UTC. The goal for this round is to raise $300,000 within the timeframe. During this round, whitelisted donors will purchase tickets representing their slots. Each ticket represents 10, 000 $MASH. This round will provide $30, 000, 000 in $MASH.

Additionally, community members will be able to purchase whitelisted tickets using $SOBB. Of the total token amount in this round, 22 million $MASH will be allocated to influencers and whales who will significantly enhance the visibility of the project, as well as early community builders. The remainder will be distributed among ambassadors, active community members, campaign winners, and others.

Round 3: Honest Pool Round

Will start on January 8, 2024 at 08:00 UTC and end at 14:00 UTC. This round aims to raise $170,000 via $SOBB or $SOL, with a total of $17 million available in $MASH. There are no limits on the number or amount of participants in an honest mining pool. From all entries, 1, 700 lucky winners will be randomly selected using the trusted VRF Oracle and each winner will receive 1 ticket. If the mining pool does not reach its allocation limit at the end, the remaining allocations will go to the honest pool and be distributed in the same way.

The additional 10% fee is non-refundable regardless of whether the user is selected as a winner. All fees collected will be used for DEX liquidity. The lottery process ensures fairness and transparency, and processing fees help prevent large-scale account registrations from monopolizing winning slots, ensuring all participants have a fair chance.

SolMash was born with a golden spoon, and has in-depth cooperation with SoBit, the founder of Solana OKX Mingnao; as the first Fair Launch platform of the Solana ecosystem, it is backed by the Solana ecosystem; with its European and American endorsement and American-style team, it is most likely to receive new coins from the hot money in Silicon Valley . In general, Solmash is the first cutting-edge infrastructure construction platform in the Solana ecosystem, carrying Solanas ambitions.

our insights

The craze for inscriptions is spreading from the Bitcoin ecosystem to other chains, and Solana has not only become the leading ecosystem in the DePIN sector with the stable performance of its system, but at the same time, driven by the strong performance of SOL and the meme sentiment, Solana is moving from many chains to stand out in the ecology and become the most potential new battlefield in the inscription sector.

On the other hand, the number of active users in the Solana ecosystem is breaking new highs. As of December 25, 2023, the number of monthly active addresses on the Solana network exceeded 15.6 million in December, an increase of about 50% from November and higher than 1520 in January 2023. million, and the number of new addresses in December 2023 alone was 6.8 million, up from 6.6 million in May of the same year.

Although the Solana ecology has achieved significant growth in this wave, in fact, there has never been an inscription project with sustained value on Solana. Ultimately, Solana lacks infrastructure that can build a value basis for inscription assets. Judging from the development trend of the inscription sector, the infrastructure facilities track will become the core of the next wave of inscriptions, and some early inscription facilities have achieved good market performance. For example, MultiBit has exceeded the market value of US$200 million, and many investors have gained from it. The $SOBB token of SoBit, the cross-chain bridge linking the Solana ecosystem and BRC 20 assets, also increased by more than 300 times in the short term after the Fair Launch. In addition, the similar Turtsat also performed extremely well and was the golden shovel in the early development of the Inscription LaunchPad field.

Solanas inscription infrastructure segment is still in a window period, so Solmash, the inscription asset launch version project, also has the potential to become a golden shovel on Solana. There will be huge opportunities, and it also has the opportunity to grow into a tens of billions of dollars in inscription market, so The market also has great expectations for the $mash token that is about to Fair Launch, and it is generally believed that the market performance of $mash, which has a high correlation with $SOBB, is expected to start at more than a hundred times.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

PowerPod

PowerPod is a shared electric vehicle charging network that enables users to charge smartly and use their chargers more efficiently. Each participant will receive positive incentives and bring greater value to the network through technological advancement. At its core, PowerPod is designed to provide a reliable and easily accessible charging network for electric vehicles in a variety of locations.

https://x.com/PowerPod_People/status/1742848343615693306?s=20

BracketX

Bracket Labs’ mission is to democratize financial products and introduce on-chain innovative products to volatility trading. Team members have rich backgrounds in the cryptocurrency field and the traditional financial field, and have worked in many well-known companies, including DE Shaw, Merrill Lynch, Barclays, Bloomberg, Consensys, and DeerCreek.

https://x.com/Bracket_Labs_/status/1743096399540179368?s=20

EZswap

EZ Swap is an NFT DEX and engraving marketplace. By leveraging the Automated Market Maker (AMM) mechanism, EZ Swap provides a seamless and efficient trading environment integrated directly with the game. Not only does this revolutionize how game assets are traded and utilized, it also opens up new avenues for gamers and developers, enhancing the entire gaming experience.

https://x.com/Alexpfeth/status/1743046882253754426?s=20

protocol event

dYdX publishes post-mortem on $ 9 million November attack

Huobi Korea shuts down platform citing business difficulties

Klaytn onboards gold RWA DeFi platform

Orbit Chain.#39;s hacked funds 'remain unmoved' following $ 81 million exploit

Radiant Capital reportedly hacked for $ 4.5 million worth of ETH

Industry updates

South Korea proposes ban on credit card payments for crypto

Nasdaq to meet with SEC today to discuss spot bitcoin ETFs: Source

Coinbase shares slip 20% into the new year as price of bitcoin seesaws

Crypto phishing attacks drained nearly $ 300 million in 2023: Scam Sniffer

Crypto exchange volume cracks $ 1 trillion for first time since late 2022

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/Haylesdefi/status/1742867779970023592?s=20

https://x.com/0x AndrewMoh/status/1743079550396067996? s= 20

https://x.com/0x DefiLeo/status/1743038523605971247? s= 20

https://x.com/0x AndrewMoh/status/1742852174215090661? s= 20

https://x.com/wist_defi/status/1742926230364840268?s=20

next week events

news source:

https://www.theblock.co/post/270275/dydx-publishes-post-mortem-9-million-november-attack

https://www.theblock.co/post/270289/huobi-korea-shuts-down-platform

https://www.theblock.co/post/270063/south-korean-klaytn-gold-rwa-defi-platform

https://www.theblock.co/post/270080/radiant-capital-reportedly-hacked-eth

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.