Original author: Kris Xu, CoinW Academy

In 2023, we have witnessed the booming development of the cryptocurrency field. During this period, conflict and integration are intertwined, showing the multi-faceted trend of rapid industry evolution. In this rapidly evolving environment, supervision and compliance have become the main theme this year.

The growth of the cryptocurrency market stems from the widespread acceptance and application of cryptocurrency worldwide. This globalization trend has a particularly significant impact on the market. Looking back on 2023, it becomes necessary to conduct an in-depth analysis of the development dynamics of the cryptocurrency market and the evolution of the market landscape.

Today, we will look at the cryptocurrency field from a macro perspective, from the development of blockchain technology to the track sectors in various subdivisions, to comprehensively analyze and evaluate the current situation of the cryptocurrency industry. While considering technological changes, we conduct a comprehensive analysis of industry trends, regulatory trends, and market performance in order to gain a deeper understanding and grasp of the development trend of the cryptocurrency industry.

Cryptocurrency Market Overview 2023

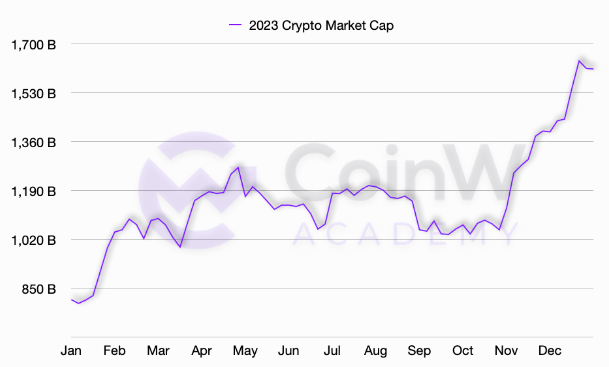

The market capitalization data of the cryptocurrency market in 2023 reveals the context of its comprehensive development. In the early days, the market capitalization experienced sustained and gradually rising fluctuations, quickly surging until it exceeded $1 trillion in early 2023. Subsequently, the market value showed relatively large fluctuations, but the overall trend still showed steady growth. The second and third quarters of 2023 generally showed a volatile trend, with the market value remaining in the range of US$1.1 trillion to US$1.3 trillion, and then breaking through and stably maintaining above US$1.5 trillion in the fourth quarter. The market capitalization once climbed to $1.6 trillion and continues to remain at this level, marking a perfect end to the cryptocurrency market in 2023.

Figure 1: Total cryptocurrency market capitalization in 2023

Track section inventory

2023 has witnessed unprecedented turbulence and innovation in the cryptocurrency field. Ethereum and Bitcoin, as representatives, are leading a new era of competition. This year, countless infrastructure and public chain projects have flourished. They have not only made breakthroughs in decentralization, but also focused on providing a fast and convenient transaction experience and actively shaping practical application scenarios that adapt to market needs. These innovators continue to push the boundaries of technology and applications, leading the cryptocurrency industry into a more diversified and mature stage of development.

Shanghai’s upgraded Ethereum

In the first half of 2023, the focus in the cryptocurrency space was entirely on the Ethereum Shanghai upgrade (EIP-4895). This upgrade is a highly anticipated and major change for Ethereum stakers. It allows stakers to release funds staked as validators.

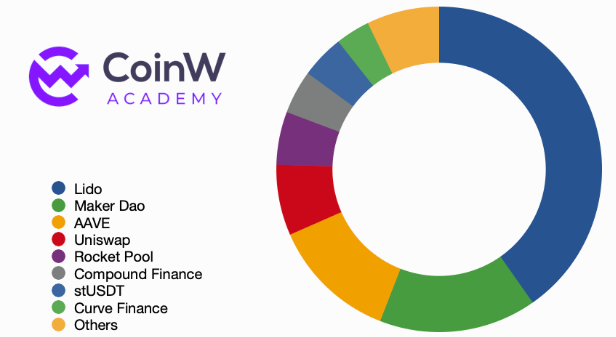

Liquid Staking Derivatives

As part of Ethereums proof-of-stake mechanism, pledgers need to lock 32 ETH to run the verifier node to ensure network security and verify the validity of transactions. The implementation of the Shanghai upgrade gives stakers the right to withdraw these locked ETH, a feature that has not been implemented on previous Beacon Chains.

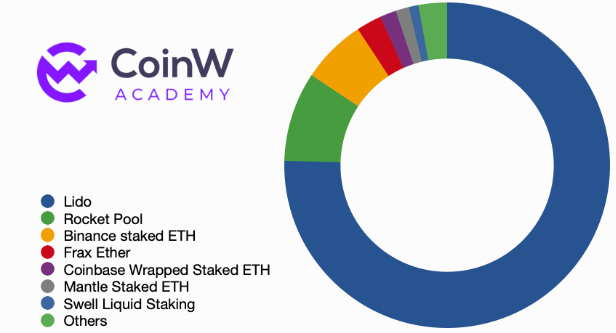

This change accelerated the evolution of the liquid staking derivatives market, namely Liquid Staking Derivatives (LSD). Through the LSD service, people can trade staked Ethereum (ETH) to derive tokenized versions (such as sETH) on different platforms. As the liquidity of the tokenized version of pledged ETH increases, the huge selling pressure that could have been generated by ETH is reduced, which has a significant impact on the stability of Ethereums price. LSD has also become the hottest field in 2023, and the governance tokens of excellent LSD service providers such as Lido Finance and Rocket Pool have also become one of the most popular trading tokens.

Figure 2: Amount of ETH pledged by each protocol

Layer 2

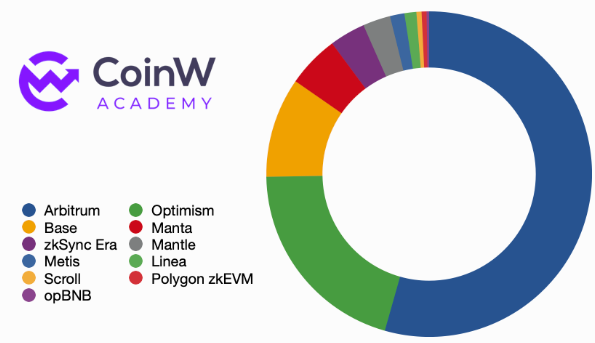

Layer 2 technology is an important solution to solve the congestion of the Ethereum network. They are designed to increase transaction speed, reduce transaction fees, and improve user experience. The current mainstream Layer 2 technology is mainly Rollup, among which Optimistic Rollup occupies a dominant position. Currently, Arbitrum and Optimism in Optimistic Rollup account for 74.7% of the Total Value Locked (TVL) of all Rollup-like Layer 2 public chains, and the proportion of ecological protocols, projects and tools is as high as 66.8%. We can even say that Arbitrum and Optimism are Layer 2 The absolute core of the public chain.

Rollup Layer 2 has shown epic growth in 2023, with its TVL soaring from US$4.44 billion at the beginning of the year to US$17.84 billion today. Compared with Optimistic Rollup, ZK Rollup is obviously a failure in 2023. Representative projects zkSync and Starknet have no clear plans for token deployment in 2023 and face multiple issues with compatibility with the Ethereum Virtual Machine (EVM). These challenges have left ZK Rollup lagging far behind Optimistic Rollup in market share.

Although ZK Rollup technology has the advantages of high security and mathematical verification, it still needs to overcome several challenges in practical application and widespread adoption. With the launch of the Starknet airdrop program, zkSync’s EVM compatibility has become more mature, and we are optimistic about the development of ZK Rollup.

Figure 3: Layer 2 TVL

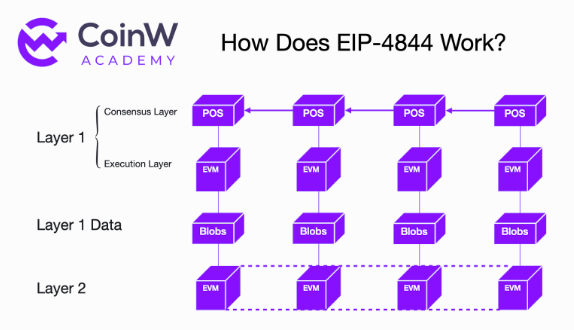

Cancun upgrade with EIP-4844

The Cancun upgrade is an additional improvement to Ethereum (ETH) following the Shanghai upgrade, which mainly included the much-talked-about EIP-4844. EIP-4844 introduces a new transaction type, Blob, that moves transaction data into a temporary blob storage, allowing for cheap storage costs. This upgrade is designed to increase the speed of Ethereum Layer 2, which is said to be expected to increase it by 10 times or even 100 times, while significantly reducing the cost.

The target launch time of the Cancun upgrade is early 2024. The current test network Devnet is intensively promoting testing work to ensure that the Cancun upgrade can be deployed smoothly. This upgrade will greatly stimulate the development of the Layer 2 ecosystem. In the past, the vast majority of transaction costs paid by users Layer 2 Rollups were due to data storage. The implementation of EIP-4844 will reduce Layer 2 transaction fees by an order of magnitude, and the cost of each transaction will be dozens of times cheaper. This will promote lower transaction fees and a better transaction experience, which may lead to more application scenarios. We believe that the Cancun upgrade will be an important turning point in the development of Ethereum Layer 2.

Figure 4: Illustration of EIP-4844

The Renaissance of the Bitcoin Ecosystem

Inscription is a type of writing inscribed on bronze vessels during the Yin, Shang and Western Zhou dynasties in ancient China. However, what we call inscriptions today - Bitcoin inscriptions - is a unique asset that is inscribed through the Ordinals protocol by writing content into satoshi, the smallest unit of Bitcoin. This kind of inscription has an eclectic form and can cover various types of information such as text, pictures, videos and audios, and each satoshi is assigned a unique serial number and therefore has a unique number.

In the development of the Bitcoin ecosystem, people have explored various ways to stimulate its vitality, whether it is off-chain verification, lightning network, or a fork caused by a certain disagreement. Unexpectedly, Inscriptions, or the Ordinals protocol, turned out to be the catalyst for awakening the Bitcoin ecosystem.

Fair Launch, a new way to issue crypto assets

In the past, the traditional token issuance model was often limited to investment by VC institutions, which were developed by project parties and ultimately issued tokens in a way that rewards early investors. This method allows ordinary investors to participate in investments in the secondary market. This method of token issuance is often shrouded in a black box, with unfair distribution of tokens and opaque information. Large investment and financing institutions often enjoy more investment privileges and sometimes even unlock tokens in advance or hide unlocked tokens, which violates the promise of token economics in the white paper.

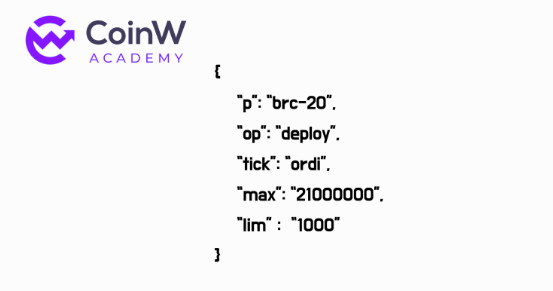

Fair Launch subverts the traditional token issuance model in decentralized encryption networks. It puts the power to earn, own and manage tokens in the hands of the community, ensuring that anyone has the opportunity to participate from the start. The core idea of this fair issuance is to prevent early access, pre-mining or unfair token distribution situations.

Bitcoin (BTC) is considered one of the first fair-issue tokens. Anyone can earn tokens by providing computing power to the Bitcoin network. Today, this tradition has extended from Bitcoin to the Bitcoin ecological token BRC-20. Fair Launch makes the distribution of tokens more inclusive, allowing the community to participate in the creation and operation of tokens in a fair and transparent manner.

Figure 5: ORDI deployment code

In the crypto market, the popularity of crypto assets like ORDI, SATS, etc. is due to many reasons. The popularity of these BRC-20 tokens has triggered other public chain networks to follow suit, and even attracted many blockchain networks that support smart contracts to join this Renaissance.

However, it is worth acknowledging that BRC-20 tokens still have some limitations. One of the significant issues is that they are subject to third-party indexing systems, resulting in many counterfeit coins entering the market, like the recent counterfeit SATS token. This kind of token was once used by hackers to cheat by using the TS hyphen, successfully bypassing the detection of the index system, and was listed on the DEX market. This exposes some weaknesses in the BRC-20 token’s index validation and filtering.

Figure 6: ORDI price trend in 2023

The boom in the inscription market has brought endless controversies. Due to the inherent problems of the BTC network, high gas fees and abnormal congestion of the on-chain network have been criticized. Frequent BRC 20 token transactions have led to a spike in BTC network gas fees. Even when popular token products were minted intensively, gas fees once soared to 300 sat/vb per unit. This situation makes Bitcoin miners happy to see the results, and some people believe that miners are the driving force behind the prosperity of the Bitcoin ecosystem.

At the same time, these issues have caused dissatisfaction among many Bitcoin fundamentalists. On December 6, 2023, Bitcoin Core developer Luke Dashjr issued an article stating that Bitcoin Inscriptions (Inscriptions) is exploiting Bitcoin Core vulnerabilities to attack the Bitcoin blockchain. This “junk” data is left on the Bitcoin chain, causing network congestion. Luke Dashjr hopes to finally fix this problem before the v2 7 version is released in 2024, fundamentally solving the hidden dangers caused by inscriptions.

However, it is obvious that the profits and popularity brought by the inscription market have made the vast majority of node maintainers and miners stand together. We believe that the market has its own rules and laws. As a representative of decentralization, Bitcoin makes it difficult for developers to act arbitrarily. The market and users will make the right choice. Let a hundred flowers bloom will become the main theme of the BRC 20 market and even more blockchain network ecology and its tokens.

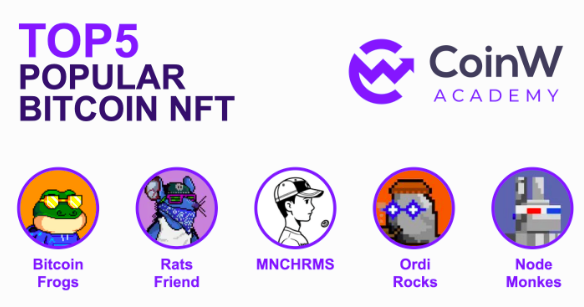

Real digital collectibles—Bitcoin NFT

When the Ordinals protocol emerged in the early days, Bitcoin NFT was the earliest application example. Bitcoin Punks, based on the Bitcoin mainnet Ordinals protocol, completed minting at 15:00 on February 9, 2023, with a total of 10,000. Even though it mimicked Crypto Punk, a well-known blue-chip NFT project on Ethereum, it still generated widespread hype and discussion. Then, Bitcoin Ape is also replicated 1:1 on the Bitcoin network. People are starting to realize that it is possible to own NFTs even if the Bitcoin blockchain cannot create smart contracts.

Elon Musk once said in The Joe Rogan Experience that many NFTs are not completely stored on the chain, and some peoples NFTs are stored on external servers, which may pose risks to holders. In other words, he believes that NFTs on Ethereum and other EVM-based public chains are not “real NFTs.” These NFTs only upload metadata to the chain, while actual data such as pictures are stored on centralized external servers.

This view provides new evidence for the development path of Bitcoin NFTs. NFTs on the Bitcoin blockchain are truly engraved on the chain. This property is considered a “real NFT.”

The Boring Ape NFT project of Yuga Labs, which focuses on the NFT market, was the first to enter the Bitcoin NFT market and launched TwelveFold, Yuga Labs’ first NFT collection on the Bitcoin network. Subsequently, more and more institutions began to pay attention to the potential of the Bitcoin NFT market, and the market also ushered in epic growth.

The first blue-chip project “Bitcoin Frogs” detonated the NFT market. As one of the earliest 10K NFTs, Bitfrog’s value has quickly risen, and its current floor price has reached 0.28 BTC. The Bitcoin NFT market has also seen the emergence of many original works of art that make full use of the characteristics of the Bitcoin blockchain. For example, MNCHRMSs works perfectly demonstrate the concept of Bitcoins simplicity and eternity in black and white.

Figure 7: Popular Bitcoin NFT

To date, NFT sales on the Bitcoin chain have reached $1.83 billion, ranking third in NFT sales, behind Ethereum ($42.12 billion) and Solana ($4.62 billion). The potential of the Bitcoin NFT market still needs to be further explored.

Heir to Meme, DRC-20

Originally regarded as a clone of Bitcoin, Dogecoin has gained global popularity due to its humorous nature and memetic properties that are good at spreading, making it the undisputed King of Memes. With the wild growth of the BRC-20 ecological token in the cryptocurrency market, DRC-20 was born in order to open up more possibilities and explore the potential prospects of meme culture in the inscription market.

The Ordinals protocol plays a vital role in the BRC 20 ecosystem, and Cardinals is the biggest booster of the DRC 20 ecosystem, which defines the smallest indivisible unit in Dogecoin - elon. In the Dogecoin system, 1 Dogecoin is equal to 100 million Elons. Each Elon is serially numbered in the order in which it was mined, starting with 0. These numbers are called Cardinals and they represent each Elons order within the total supply.

The DRC-20 standard not only brings new development prospects to Dogecoin, but is also an interesting and creative change to the traditional cryptocurrency paradigm. By introducing Cardinals, the Dogecoin community has created a unique connection between memes and cryptocurrencies, which also provides a solid foundation for the future development of the DRC-20 token.

We believe that in the current era when the Fair Launch model is popular, Memecoin has its natural attribute advantages. In addition to the Bitcoin ecosystem led by BRC 20, the Dogecoin ecosystem led by DRC 20 should not be underestimated in the future.

DeFi, returning to the financial nature of cryptocurrency

At the end of 2022, FTX’s Lehman moment cast a pall over centralized exchanges (CEXs), prompting users to urgently focus on how to safely handle their crypto assets. Compared with the era of DeFi innovation in 2021 and the financial opportunities brought by DeFi Summer, the main theme of the DeFi industry in 2023 shows a stable development trend. This can be seen from the total lock-up value of all DeFi projects. Compared with the total market value of the cryptocurrency market, which increased by 205.89% throughout the year, the total locked value of DeFi projects only increased by 51.04%.

Figure 8: DeFi TVL

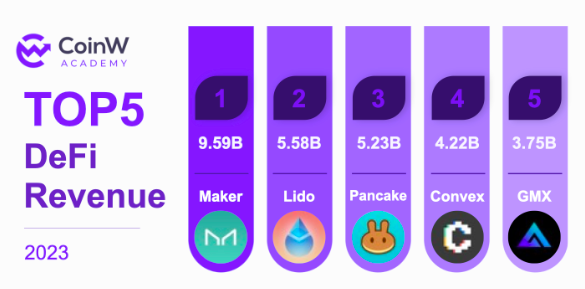

At present, the DeFi sector is mainly focused on protocols such as liquidity staking, lending protocols, cross-chain bridges, decentralized exchanges, stable coins, and RWA (real world assets on the chain). Agreement income has become an important indicator to measure the value of DeFi projects. .

Maker began gradually buying U.S. Treasuries in 2022 to capture the benefits of rising interest rates. Among the eight Fed interest rate decisions in 2023, the Fed carried out four 25 basis point interest rate hikes and also had four decisions to keep interest rates unchanged. Maker, as one of the beneficiaries, topped the list of DeFi project income with an income of $95.91 million.

In second place was Lido, with $55.79 million in revenue, thanks to the successful implementation of the Shanghai upgrade and the booming LSD circuit. The overview of the LSD track has been mentioned previously, so I won’t go into details here. Followed by PancakeSwap in third place with revenue of US$52.31 million; fourth place is asset management protocol Convex Finance with revenue of US$42.23 million; fifth place is decentralized perpetual swap. futures exchange GMX, with revenue of $37.52 million.

Figure 9: DeFi protocol revenue rankings in 2023

In the distribution of DeFi protocols in public chains, Ethereum is indeed the undisputed leader. There are 2,363 DeFi protocols on the Ethereum chain, with a total locked value (TVL) of up to $33.298 billion. Next is Tron, which has just over 20 protocols but its $8 billion in TVL still puts it in the lead.

Of particular concern is Solana, whose TVL growth reached an astonishing 98.98% in the past month. We will continue to pay attention to Solana and look forward to its future development.

How to put RWA real-world assets on the chain?

We have noticed that RWA (Real World Assets On-Chain) is one of the hottest tracks this year. Many established DeFi projects have entered the market, but the overall market is still in its early stages. Subject to the current need for cryptocurrency compliance development by traditional financial and regulatory agencies, RWA seems to be a good topic. Well-known Wall Street institutions such as BlackRock and Morgan believe that RWA will be a trillion-level market.

In 2023, many RWA projects have made substantial breakthroughs and progress. MakerDAO is one of the first protocols in the DeFi field to adopt RWA (real world assets). As early as 2020, it began to incorporate RWA into its strategic planning to expand the issuance of DAI stablecoins. DAI, as a stablecoin pegged to the US dollar, is one of the most common applications of MakerDAO.

The agreement established multiple RWA treasury, mainly using U.S. debt as collateral. Especially now that the DeFi industry is in an overall downturn, MakerDAO has further increased its investment in RWA, especially U.S. debt. In 2023, the platform continued to expand the scope of RWA, including cooperation with Coinbase, opening a real-life asset vault through its custody service, injecting up to $500 million in USDC stable coins into it, and paying an annual interest of 2.6%. MakerDAO has also purchased and invested in large amounts of U.S. bonds through the RWA vault. MakerDAOs revenue has grown significantly by more efficiently allocating assets to Treasuries and investment-grade bonds and increasing the fees it charges DAI borrowers. As mentioned earlier, Maker, as the biggest beneficiary of the purchase of U.S. bonds, topped the list of DeFi project income with an income of US$95.91 million.

In addition to MakerDAO, Compound is also one of the leaders in the RWA track. Compound announced the establishment of Superstate, a new company focused on on-chain bonds. Superstates funds will invest in ultra-short-term government securities, including U.S. Treasury bonds, securities, etc.

When it comes to RWA real-world assets, most projects currently focus on investments in U.S. Treasuries and securities. But there are also many projects that have made unremitting efforts to explore on-chain lending, synthetic assets, on-chain real estate, carbon trading, and other real-world collection transactions. We believe that with the compliance development of the blockchain industry, the RWA track in 2024 will create greater market value. As innovation continues to emerge, more creative new on-chain assets are about to be born.

X to Earn

X To Earn has been hailed as the perfect fusion of Web2 and Web3 and is highly sought after by major investment institutions. This model originally originated from the early DeFi staking project, namely Stake to Earn, which achieves corresponding staking returns by staking tokens. As the cryptocurrency market continues to develop, this model is being applied to more and more fields.

The X in X to Earn usually represents the application scenario of the project, and"to Earn"It indicates that it has a profit model. This model has penetrated into all aspects of life, among which games are one of the best integration points. The blockchain game Axie Infinity first proposed the concept of Play to Earn. The gameplay, token economics and NFT market all revolve around the Play to Earn model. Since then, more and more concepts have begun to introduce the concept of X to Earn and the corresponding asset issuance methods.

A large number of X to Earn projects emerged in 2023, among which Play to Earn and Social to Earn are the most prominent. These projects have extended and developed many mature economic models and financial systems, known as GameFi and SocialFi.

GameFi

Decentralized application technology is becoming increasingly mature, and NFT application scenarios on major public chains continue to expand, triggering explosive growth in the GameFi market. According to the Global Games Market Report published by GameIndustry.biz, the global gaming market has a total revenue of approximately $184 billion. This huge market has attracted the attention of many investment institutions and game developers, who have begun to explore the combination with Web3 technology, and even many Web2 games are trying to implement blockchain transformation.

Traditional game developers usually rely on unique game content and excellent game experience to attract players to pay. GameFi operates in a completely different way. It first establishes a complete token economic system and relies on players to earn money through games (Play to Earn) to attract them to participate in the game. Countless Web3 game developers are exploring this path. However, how to attract new users has become a challenge. They rely on the performance, fees, and ease of transactions on the public chain. At the same time, limited by cost and talent shortage, the lack of gaming experience is also an important issue. But no matter what, games are still an ideal entry into the Web3 world. We expect GameFi to grow into a market worth hundreds of billions of dollars in the future.

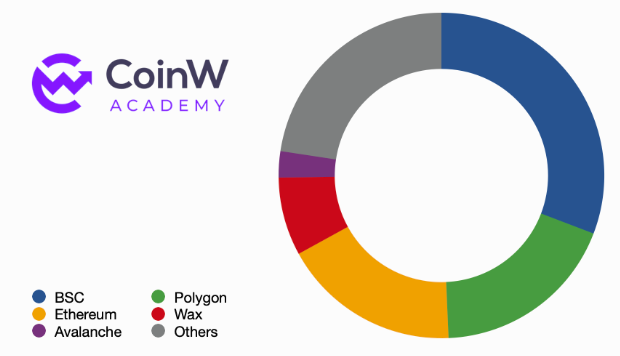

Figure 10: GameFi public chain proportion

To date, more than 2,700 games are active on the blockchain, and GameFi’s market capitalization has reached $8.56 billion, with more than 1.23 million daily active players. Of these games, 30.8% run on the BSC chain, 18.5% on Polygon, and 17.7% on Ethereum. These three account for the majority of GameFi’s share.

It is worth noting that many emerging chain games are active on Arbitrum, such as xPET, which has been very popular recently. xPET is a pet-raising game based on the extension program embedded in X. Pets can participate in Twitter companionship, farming, adventure, PVE and other activities, and ultimately generate token income. Players can upgrade their pets through token consumption, thereby expanding related benefits. This combination of GameFi and SocialFi is a brand new attempt. Using existing social networks to expand pet games may be a breakthrough for GameFi to acquire new users.

SocialFi

The discussion of SocialFi mainly focuses on two core aspects: the first is to establish a decentralized social media model, and the second is to build a feasible economic model to support these platforms. In this area, many projects have been explored from different angles. For example, Lens Protocol, which has built a comprehensive decentralized social application, and FriendTech, which has achieved success in its economic model.

However, no effective method has been found to effectively combine these two key points, resulting in the rapid rise and rapid decline of many SocialFi projects. Take FriendTech, for example, an original decentralized social application that incorporates financial engineering. The app offers a chat room that allows users to purchase keys for Twitter influencers or others, thereby gaining access to their internal group chats. The price of a key changes with market demand, and the more buyers, the higher the price. The project party charges a 10% handling fee to share with the chat room creator.

This economic model quickly attracted many social media influencers to join. Their fans are willing to pay exorbitant amounts of money to purchase keys in order to gain access to exclusive information. However, as these influencers creative enthusiasm waned, coupled with the lack of effective methods to maintain activity on the platform, and the rising price of keys, this social experiment ultimately failed.

Looking forward to 2024

Welcome 2024, CoinW Academy will continue to conduct in-depth research on the cryptocurrency and blockchain industry, and is committed to providing more abundant and high-quality research content. We are confident in the future of the cryptocurrency and blockchain industry and firmly believe that the future development prospects will be eye-catching. Here are the areas we are focused on and expect to see significant progress in 2024:

The road to renaissance of DeFi (decentralized finance): As DeFi continues to develop and cater to the compliance trend of the global encryption market, we expect to witness the emergence of more compliant decentralized financial products and services that embrace regulation, and more Complete governance model and more efficient liquidity solutions. At the same time, cryptocurrency wealth management products from traditional financial institutions may also emerge intensively, and more funds will benefit from this move, with DeFi bearing the brunt of the revival.

Bitcoin inscription market: Bitcoin and other public chain inscriptions will continue to usher in innovation. Although limited by the immaturity of the inscription indexing mechanism and current technology, hacker attacks and unknown vulnerabilities may have a certain impact on the inscription industry, the development and exploration of more underlying facilities will also promote the development of this field. In addition to tokenized inscriptions, picture NFT-type inscriptions will also become an important research direction.

Fair Launch: Fair launch assets will become the hottest asset issuance method in 2023, attracting the participation of a large number of new users. As the cryptocurrency field gradually integrates into the regulatory framework, Fair Launchs token issuance method is gradually recognized and accepted by more mainstream institutions. Fair and equitable token issuance methods have attracted much attention and recognition in terms of legality, and this trend is expected to continue to expand in 2024. We expect that Fair Launch assets will continue to expand their influence and become a mainstream token issuance method, and are expected to extend to more asset types.

RWA: With the advancement of spot Bitcoin ETFs, more and more funds from traditional financial institutions are about to enter the cryptocurrency industry. The existing decentralized financial projects in the cryptocurrency industry will continue to integrate more real-world assets (RWA) and expand more real-world asset classes on the existing basis, especially carbon neutrality, real estate, and valuable assets. Projects and applications that fit the blockchain concept, such as securities, will continue to be explored in this field.

GameFi: Games are an important bridge connecting the traditional Internet (Web2) and Web3. Games are also an important entrance to bring in new users. In 2024, it is expected that more public chain projects dedicated to games will sprout, and more chain-modified games will soon join the ranks of blockchain. More chain games that incorporate social elements will combine SocialFi and GameFi to cater to pain points, eliminate weaknesses, and strive for game quality and user growth.

Non-EVM public chains: This will be an era in which a hundred flowers bloom. More public chain projects will no longer be subject to the Ethereum Virtual Machine, and the research and development of non-EVM high-performance public chains will achieve more valuable results. At the same time, cross-chain bridges and Wanchain interconnection are also important research topics. More modular blockchains and application chains will also appear in the market waiting for user testing.

Layer 2: The expected airdrops of Starknet and zkSync, which have attracted much attention, will become the focus of the 2024 Layer 2 track. The performance improvements brought to many Layer 2 public chains after the Cancun upgrade cannot be underestimated. The colorful dapps and Low-cost and high-quality on-chain interaction will soon be possible.

CoinW Academy will continue to pay attention to the development of these fields and maintain close contact with industry experts, scholars and developers to provide timely and accurate information and insights to the majority of learners. In this ever-changing field, we believe knowledge and understanding will be the key to success. Therefore, let us look forward to and work together to shape the bright future of the cryptocurrency and blockchain industry.