LD Capital secondary market observation: ACE (Fusionist) recent situation tracking

1. Fundamental situation

1. Game overview

Fusionist is a space mecha game. Set in the 2800s, Earth has become largely uninhabitable, leading to massive war. Hyperspace travel has become possible, and Fusionists set out to explore the universe to find habitable homes for DNA sequences in human form, seeding humanity throughout the galaxy.

Source: Fusionist

There are three main game types, namely:

Colonization-Building: Collect resources, build Odaily, upgrade technology, etc.

Conquest - Turn-Based Combat: PVE PVP

Unity - explore, expand, exploit, destroy

The game will be released on Steam in late 2023

Endurance is the main network of Fusionist, an infrastructure layer for social and gaming, a side chain, application chain, and expands the use of this chain by other partners and games. ACE is Endurance’s primary token.

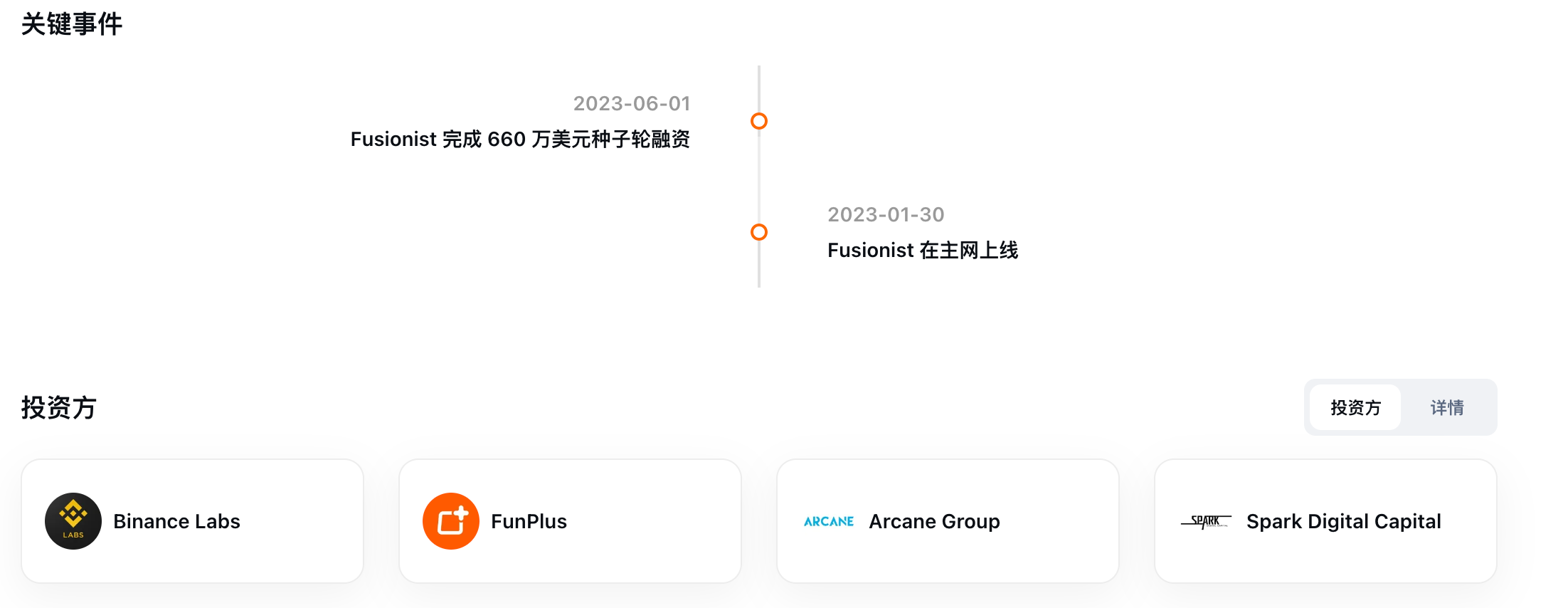

2. Key nodes

(1) August 2022: Release of Game Introduction and Game 1-Colonization

(2) October-November 2022: NFT white single minting, start to earn points to obtain rights, tokens, airdrops, etc. in the future

(3) January 2023: Endurance mainnet launched and ACE token launched

(4) March – November 2023: Game 2-Expedition and Galactic Duel versions and activities will be continuously updated

(5) December 2023: Fusionist announces cooperation with South Korean blockchain gaming platform MARBLEX

To promote the progress of cooperation with Korean game developer RedBrick Engine, 0x spin will launch Op-Endurance: Sparkle (the second layer of Endurance built with support provided by OP Stack), and players can receive ACE and RedBrick token rewards

Disclosed that the web game ACE Arenas, a MOBA game independently developed by the Fusionist team and produced using the Unity engine, will exclusively use $ACE as the core token. Likewise, all future games and apps developed by Fusionist will follow this model.

3. Team and financing

Fusionist’s team comes from well-known Web2 game companies such as Tencent. The core members are:

(1) Ike T. Founder and CEO: 14 years of experience in the industry. Joined Tencent in 2009 as AAD (Associate Art Director)

(2) Daniel Fang Marketing Director: 14 years of experience in the industry. He joined Tencent in 2009 and has successively served as ADP (Associate Development Producer), Publishing Producer, and Operations Manager. He is responsible for the development and promotion of games.

(3) Charles D. Technical Director: 11 years of experience, full stack engineer, chief engineer of MOONTON GAME

On June 1, 2023, Binance Labs disclosed $6 million in financing information as a major investor

Source: RootData

2. Token situation

The total supply of ACE tokens is 140 million. It is the main token and native asset of the Endurance network. The main use cases of the token are:

Gas Fee

NFT market transaction and service fees

Application tokens for teams independently developing apps

Staking on an Endurance Network validator node

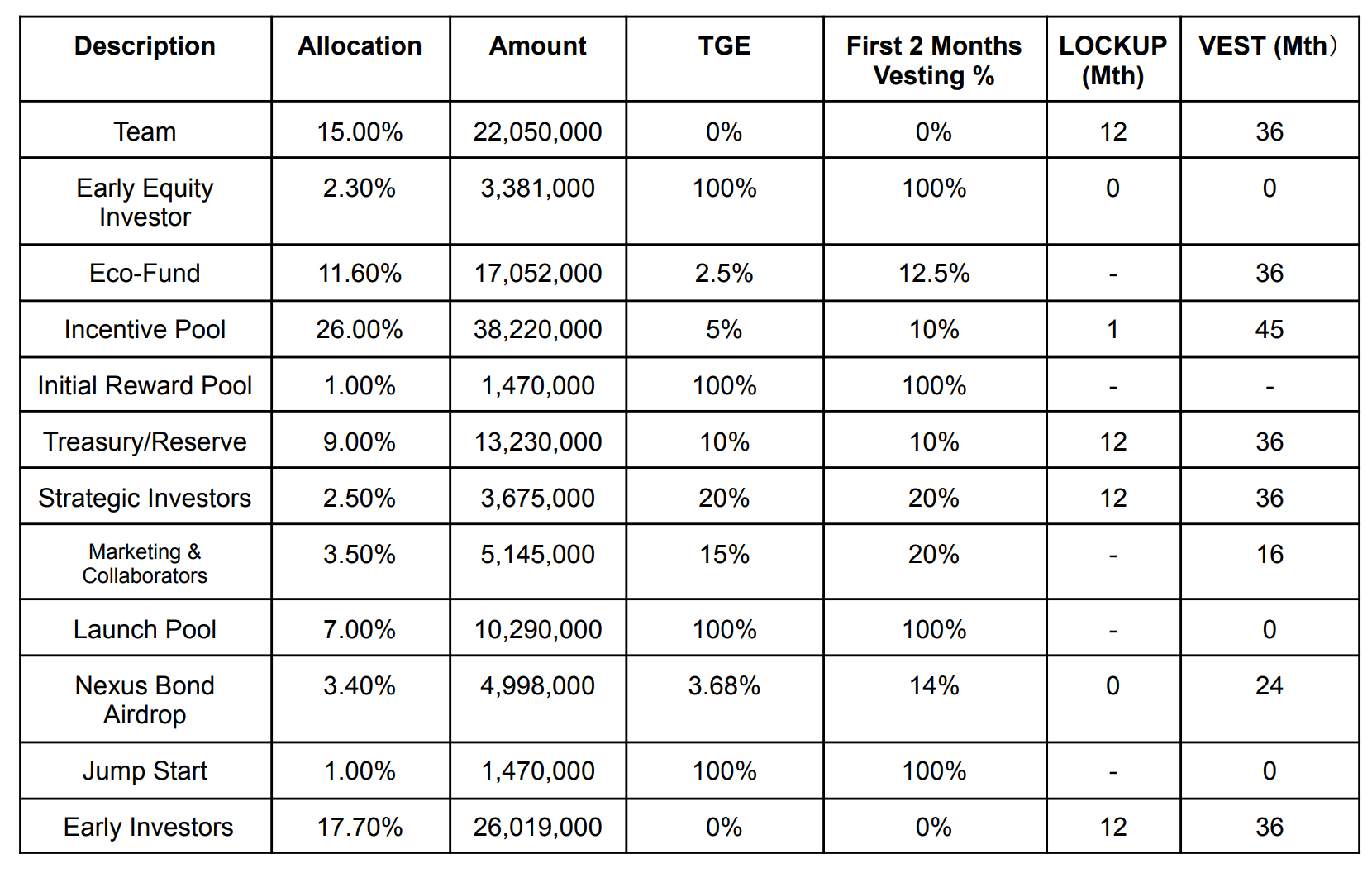

The distribution ratio of tokens in the white paper is as follows. The team and investors will allocate approximately 40% of the total amount of tokens; by calculating TGE, the current circulating supply is 21,969,520 tokens, 10,290,00 tokens are provided by Binance Distributed by Launch Pool, early equity investors hold 3,381,000 tokens, accounting for 15.38% of the current circulating supply.

Source: Endurance White Paper

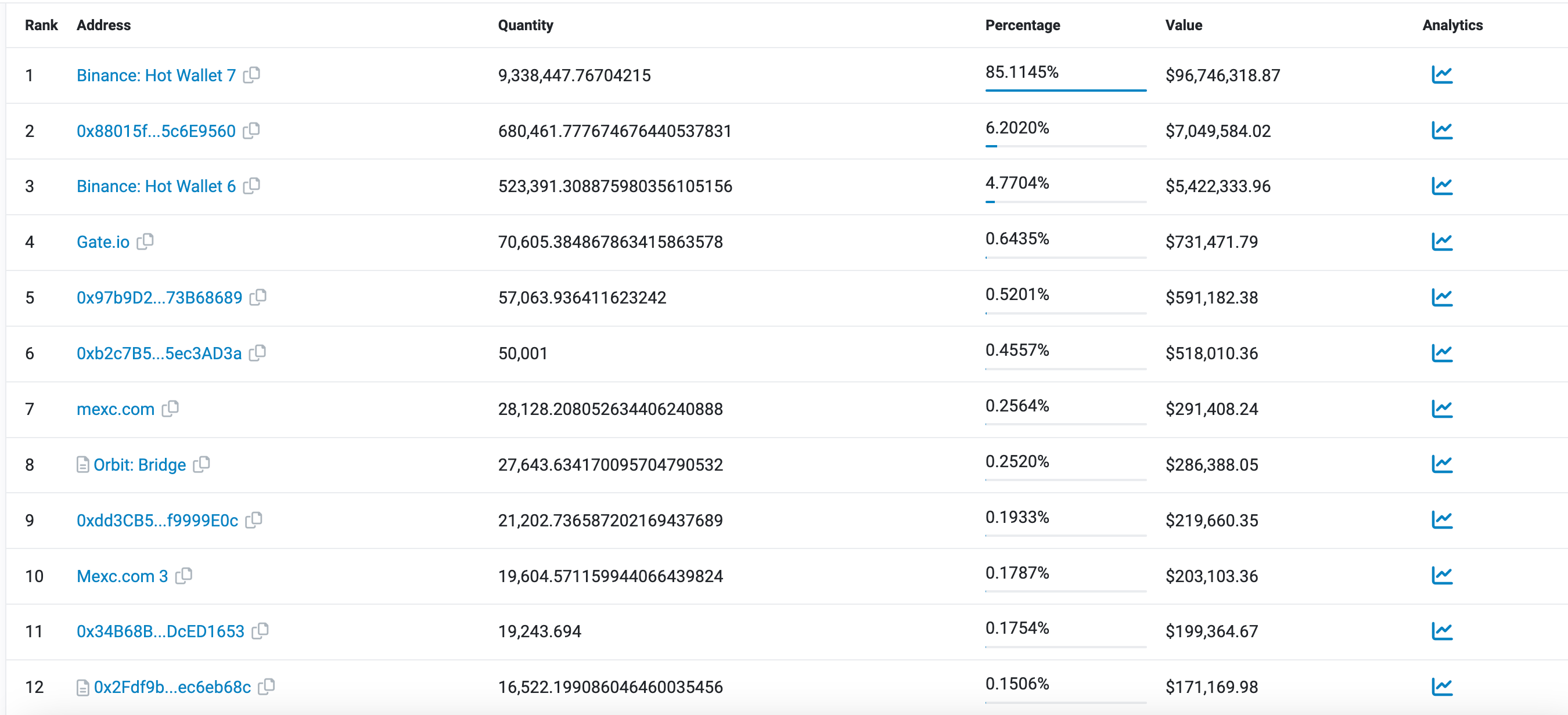

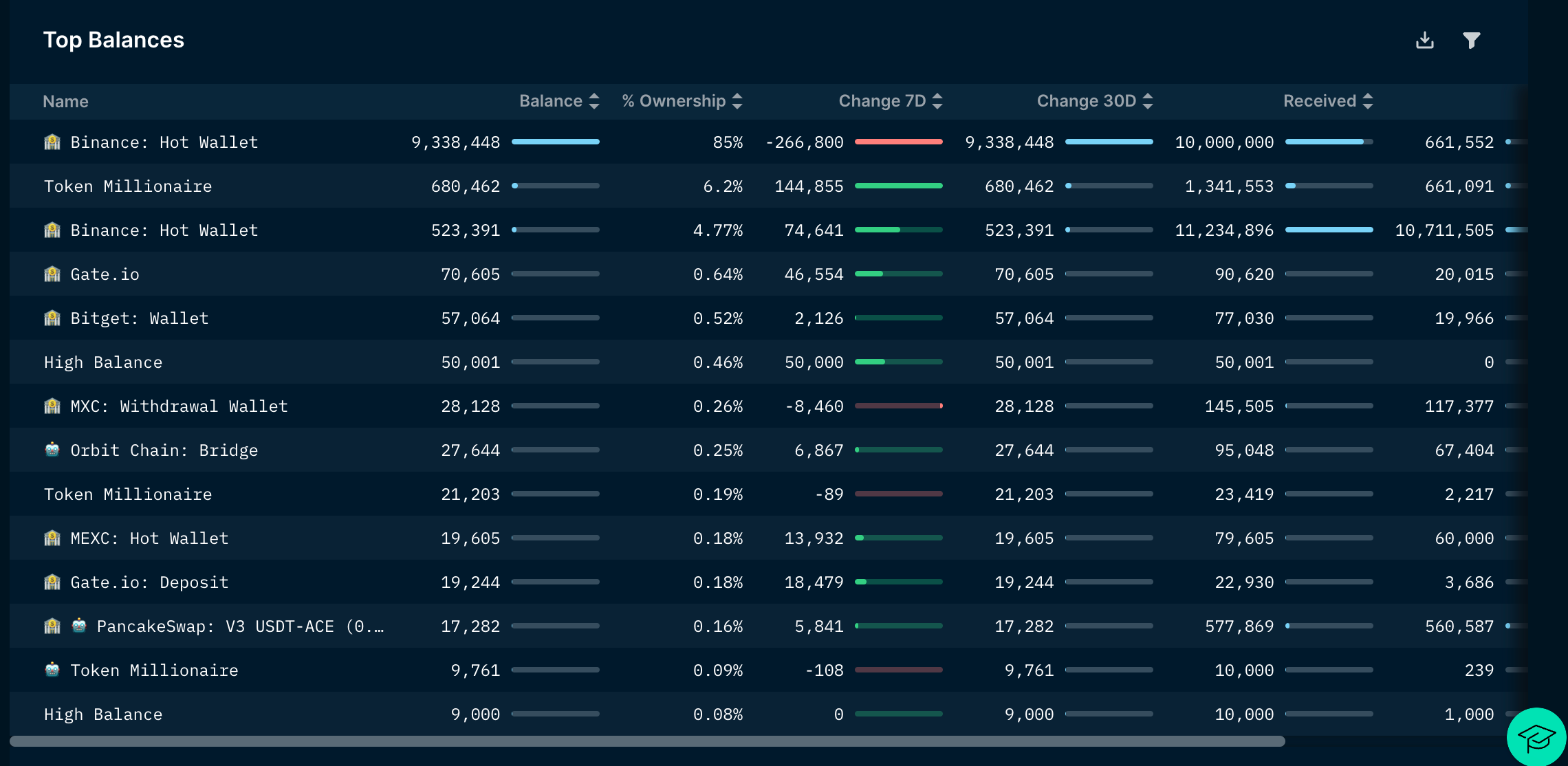

ACE tokens are mainly distributed on the BSC chain and the Endurance main network. BscScan can currently track 10,971,626 tokens, of which Binance addresses account for about 90%, and the second largest currency holding address 0x 880 holds about 6.2% of tokens.

Source: BscScan

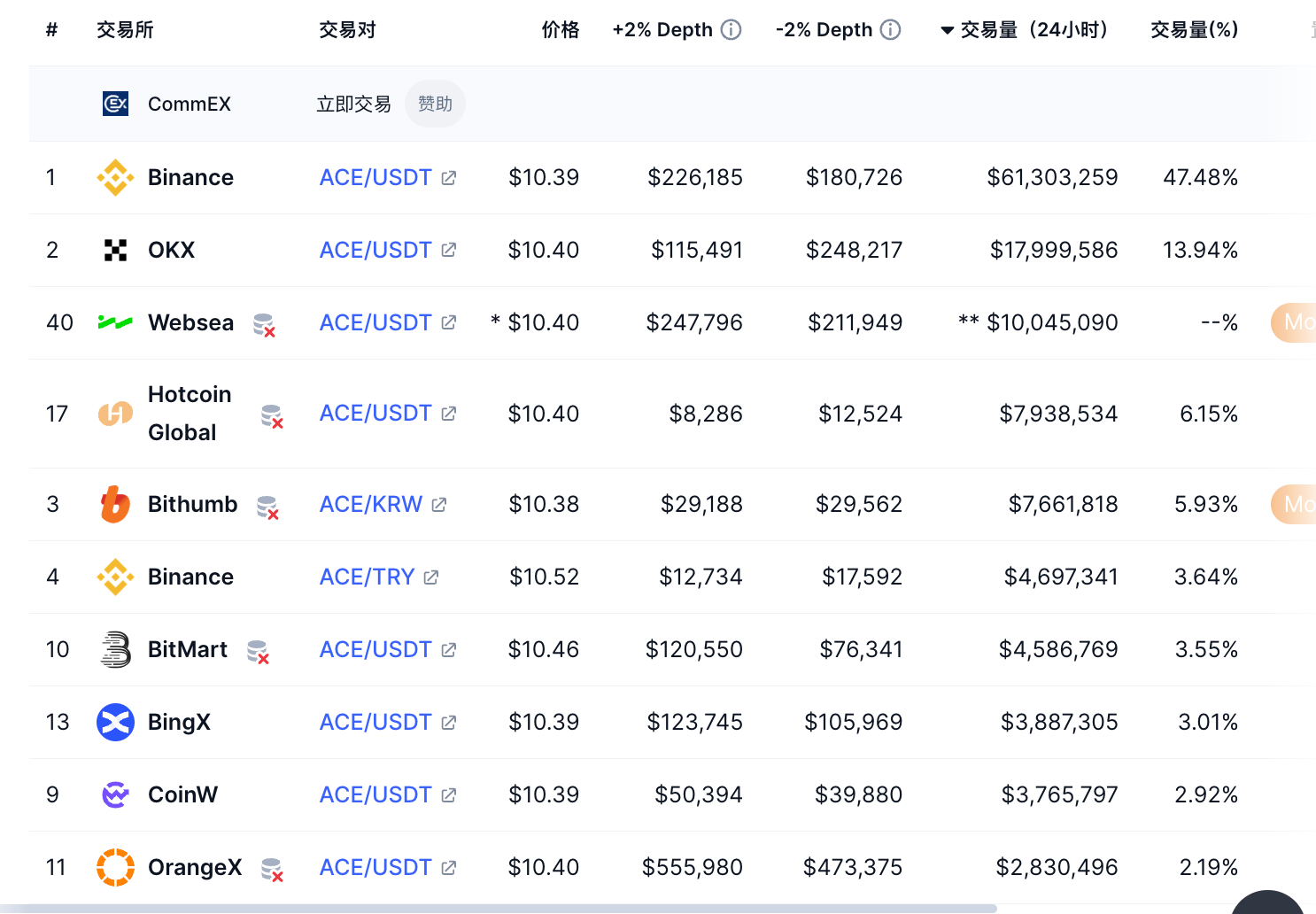

ACE’s main trading venue is Binance (47.48%), followed by OKX (13.94%) and Bithumb (5.93%)

Source: CoinMarketcap

3. Recent spot changes

1. Spot changes

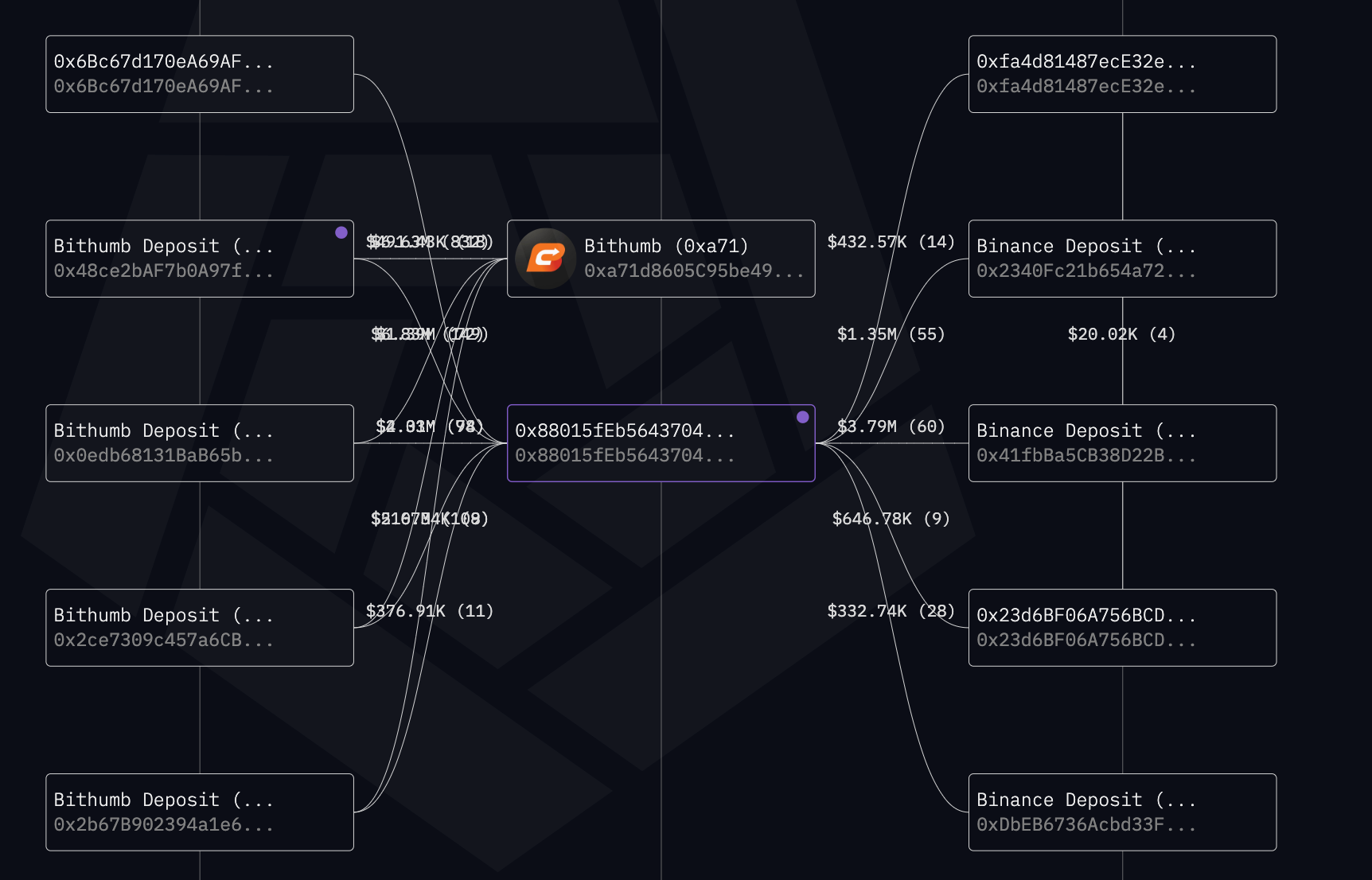

In the past 7 days, there has been a net outflow of 17.2w tokens from Binances two wallets. The second largest currency holding address, 0x 880, has had a net inflow of 14.4w tokens in the past 7 days. This address has frequent transactions with Bithumb and Binance and may be a market maker. Addresses associated with merchants or exchanges are accumulating chips.

Source: Nansen

Source: Arkham

In the past 24 hours, Binance’s spot trading volume has increased compared to the previous day, reaching 536 w tokens. Since the price dropped 13% to US$13 on December 22, the daily trading volume has gradually decreased. The 7-day trading volume is approximately 200 w-500 w ACE/day.

Source: Binance

2. Futures changes

The funding rate of ACE on Binance in the past 24 hours has been between 0.04 – 0.08%, which is on the high side. However, in recent days, the phenomenon of positive funding rates in the entire market has been more obvious. Most of the popular tokens have funding rates above 0.04%. , representing the relatively high bullish sentiment in the entire market in recent days.

Source: Coinglass

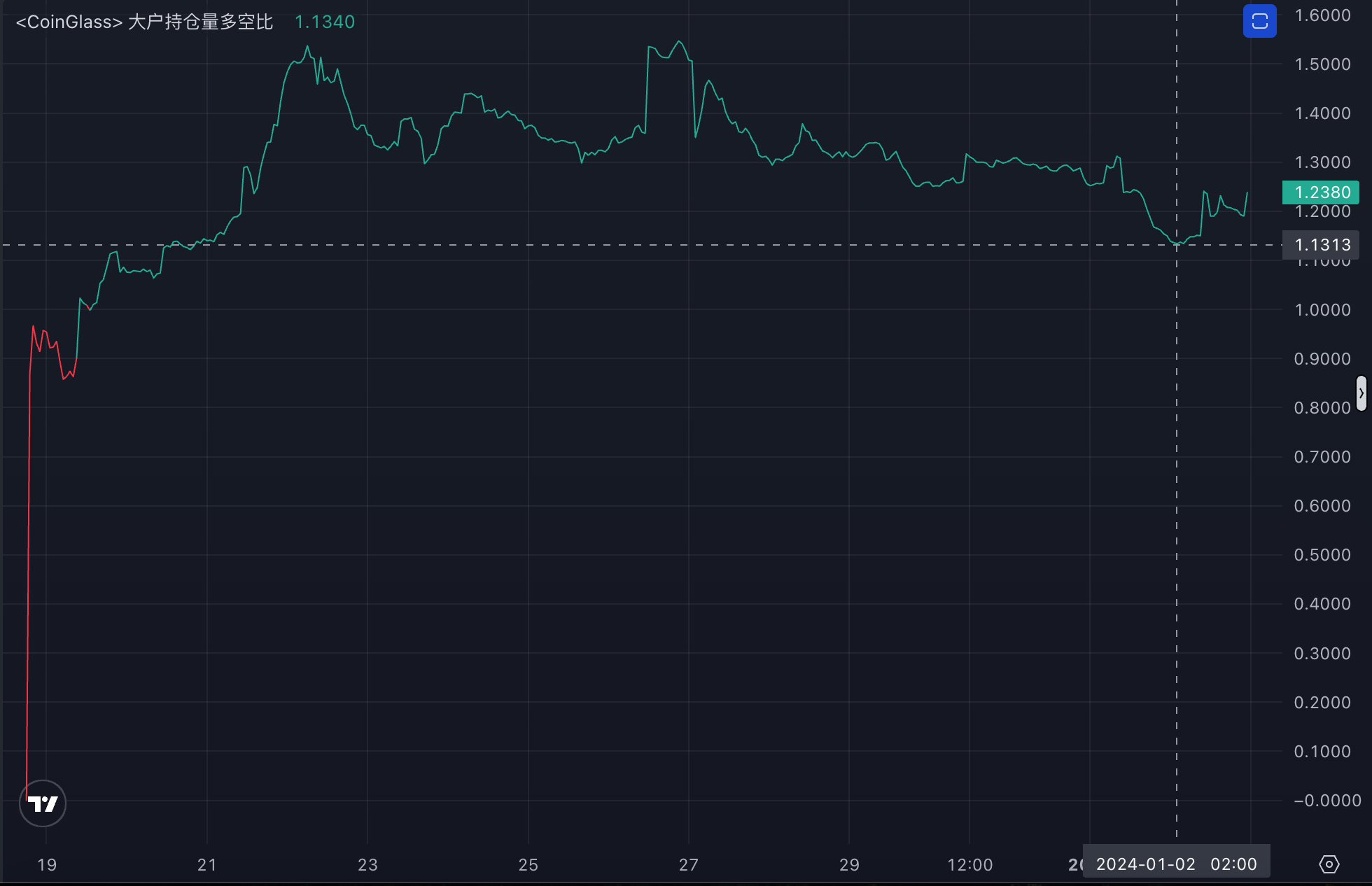

ACEs contract long-short ratio has remained above 2.9 since December 27, 2023, and has been above 3 in the past 24 hours; the long-short ratio of large accounts has remained above 1.13 in the past 7 days

Source: Coinglass

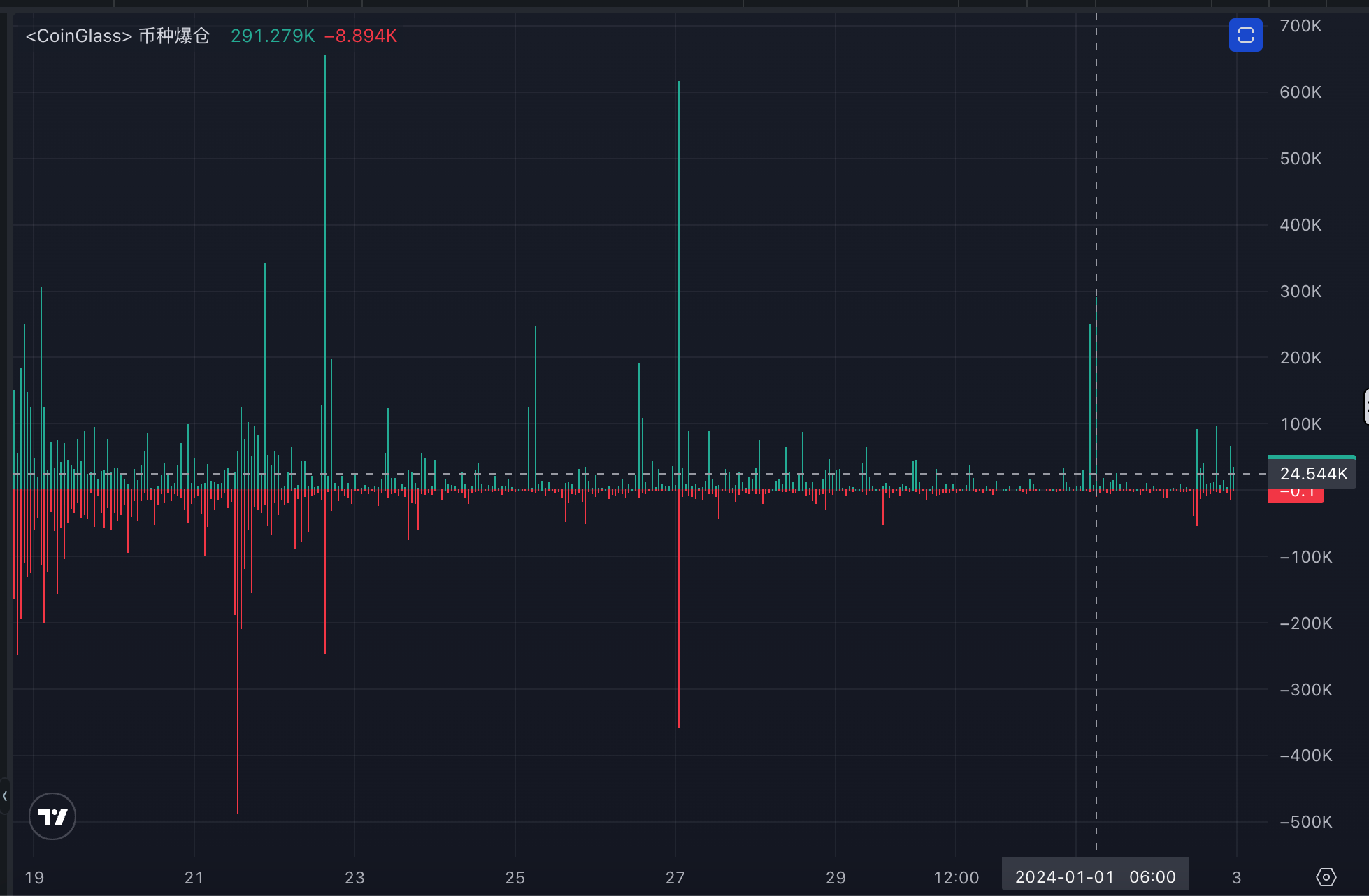

ACE has experienced several large declines in the past 7 days, with the contract exploding, but the positions will be filled quickly after the exploding. Binance contract positions remain above 250w, hitting new highs in the past 24 hours .

It can be seen from the overall contract data that the markets bullish sentiment towards ACE is relatively high.

Source: Coinglass

4. Summary

1. Fusionist has good fundamentals. The main investor is Binance Labs. The core team comes from traditional game manufacturers such as Tencent. It is positioned as a blockchain AAA game, adopts the model of application chain and platform currency, and has close ties with Korean game manufacturers and platforms. Cooperation and the overall game ecosystem are still in the early stages, and there are expectations for stable development.

2. The chip structure of ACE is relatively concentrated. A large number of tokens in the total supply are controlled by projects and investors. Early equity investors hold 15.38% of the current circulation. Among BSC traceable addresses, Binance addresses account for 15.38% of the current circulation. The ratio is about 90%, which constitutes the main source of potential selling pressure.

3. The price of the token on the K line has skyrocketed since its listing. The current spot transaction volume is relatively low, Binance wallet addresses are flowing out, and the address with the second largest currency holdings is flowing in to accumulate chips. Contract data shows that spot prices are closing, and the trading volume has declined in recent days. At the contract level, the filling of long positions and a high long-to-short ratio, funding rates and other data show that the market is bullish.