Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMediumGet deeper research and insights.

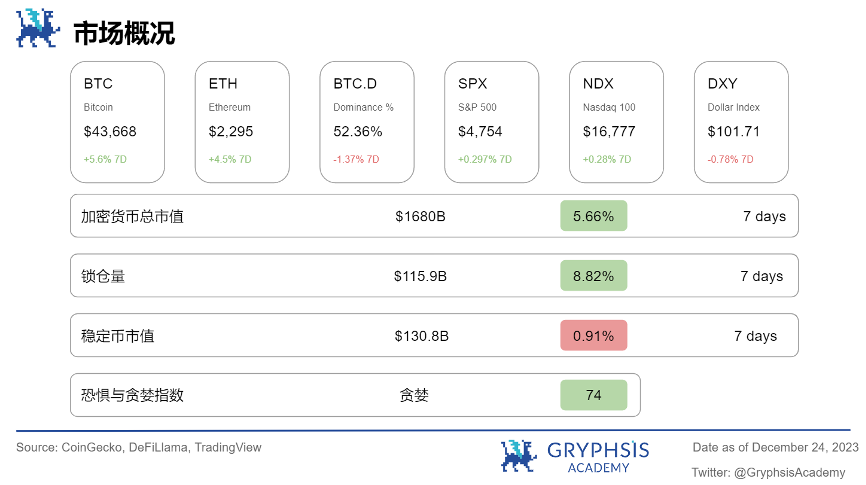

Market and Industry Snapshot:

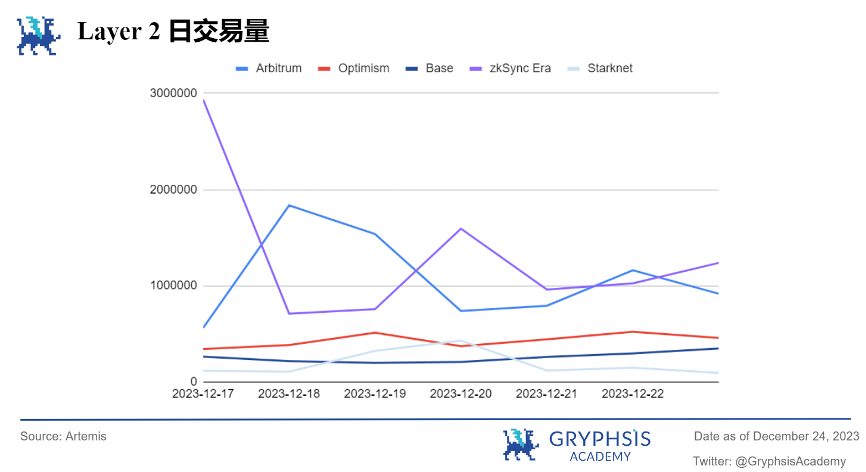

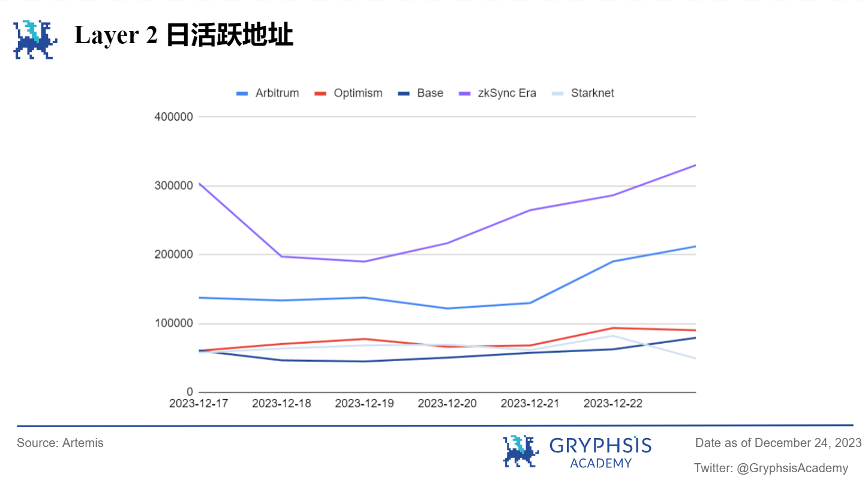

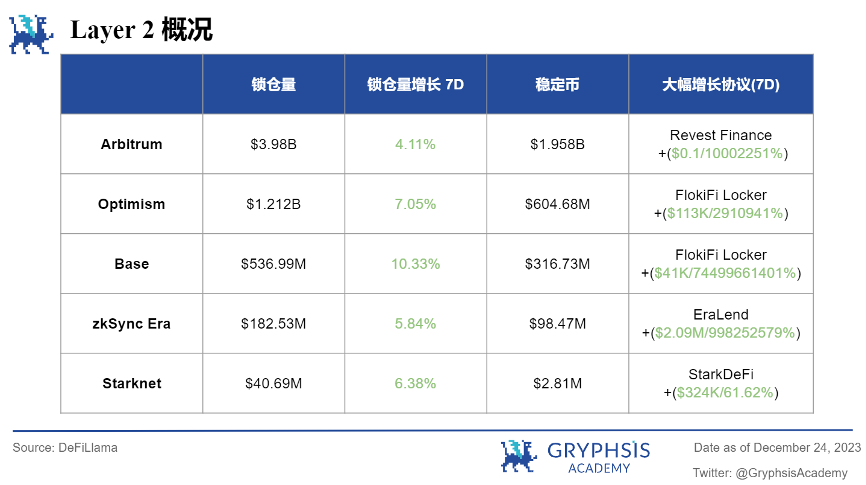

Layer 2 Overview:

Last week, Layer 2 showed an upward trend, with Base showing the most obvious growth of 10.33%. Protocols like Revest Finance, FlokiFi Locker, EraLend, and StarkDeFi have demonstrated noteworthy TVL growth rates.

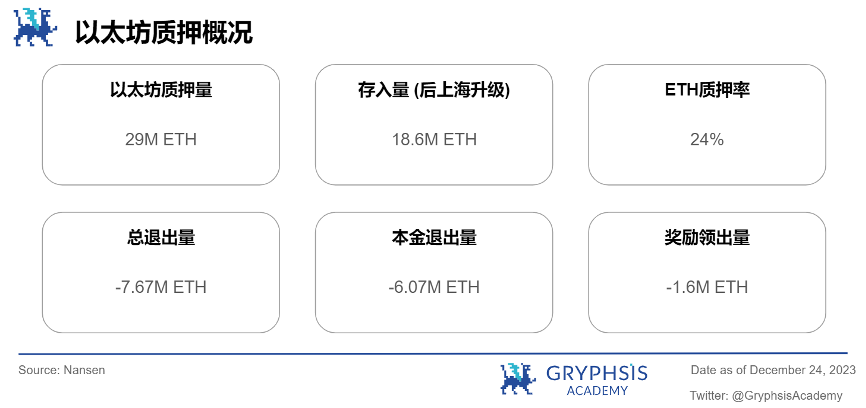

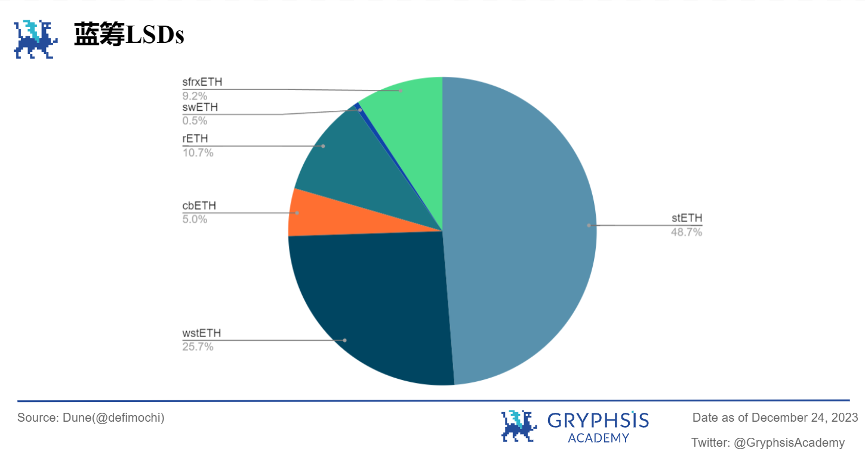

LSD Sector Overview:

In the LSD space, Ethereum pledges and deposits remained essentially unchanged, but total withdrawals fell by 16.12%. In terms of market share, most blue-chip LSDs have seen significant changes, with swETH having the most significant decline this week at 46.49%, and stETH rising by 56.21%.

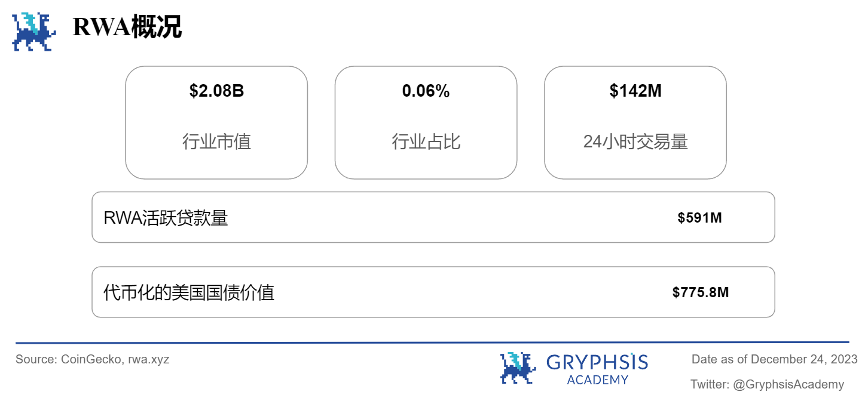

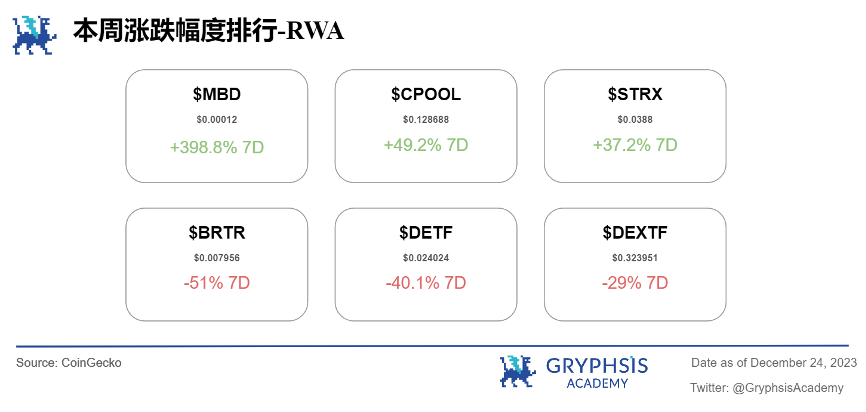

RWA Sector Overview:

Last week, the worlds real asset market value increased by 9.47%, but the overall encryption industry grew significantly, and the overall industry share dropped to 0.06%. RWA tokenized treasuries and tokenized U.S. Treasuries showed slight increases in value. Notable growth tokens include $MBD, $CPOOL, and $STRX. Tokens like $BRTR, $DETF, and $DEXTF experienced larger losses.

Main Topics

Macro overview:

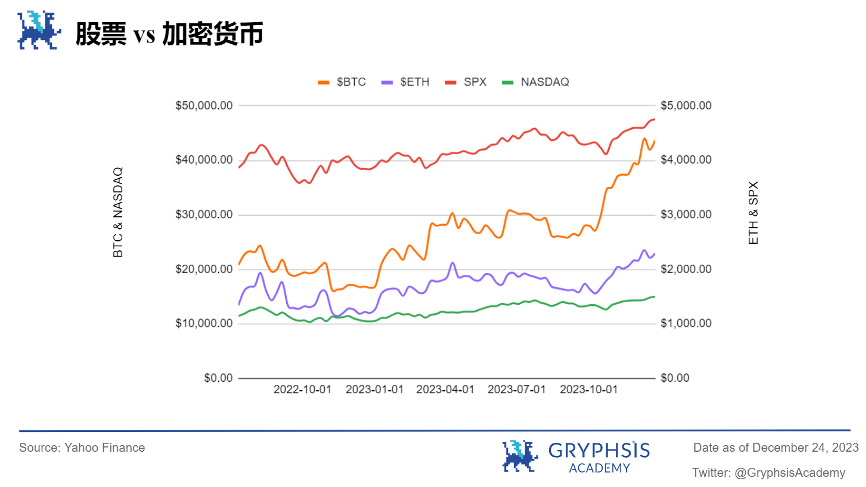

US Stock V.S. Crypto

Big news this week:

Hong Kong Regulators Consider Spot Crypto ETF Applications

Weekly Agreement Recommendations:

Analysoor

Weekly VC Investment Focus

Chainge Finance($ 47 M)

MapleStory Universe($ 100 M)

4 EVERLAND ($ 2 M)

Twitter Alpha:

@DeRonin_ on NFTFi

@0x AndrewMoh on Injective

@Deebs_DeFi on Shrapnel

@MoonKing___ on Detf

@zerokn 0 wledge_ on Eigenlayer

Macro overview

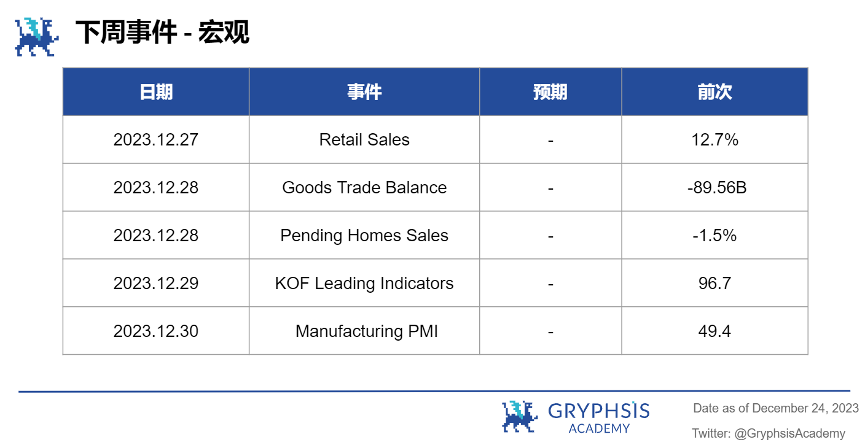

This week, the trend went in the opposite direction at the stock market level and the crypto industry, with the SPX and NASDAQ gaining 0.75% and 1.21% respectively. In the week ahead, watch for key events such as the Goods Trade Balance, Pending Home Sales, KOF Leading Indicator and Manufacturing PMI.

Big news this week

Hong Kong regulator says spot cryptocurrency ETF application will be considered

Hong Kong regulators say they are ready to consider applications for spot cryptocurrency exchange-traded funds (ETFs). The Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) said in a joint statement that the virtual asset environment has changed since 2018, when the SFC instituted professional investors only regulations method.

Hong Kong has relaxed its stance on cryptocurrencies this year, with regulators shifting their risk assessment of digital assets for retail investors. In October, the SFC updated its rule book to allow a wider range of investors to participate in spot cryptocurrency and ETF investments. Then, last month, SFC CEO Liang Jinsong said that the regulator was moving towards allowing retail investors to purchase spot cryptocurrency ETFs and would “welcome proposals for the use of innovative technologies that improve efficiency and customer experience,” provided is to address any risk issues.

“The virtual assets landscape is evolving rapidly and is beginning to expand into mainstream finance,” the two regulators said in a statement on Friday. The SFC is prepared to accept applications for authorization from other funds with exposure to virtual assets, including virtual asset spot exchange-traded funds (VA spot ETFs).

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose Analysoor, a new protocol that combines the concepts of inscriptions, memes, and gambling on Solana.

Analysoor has been committed to building a data center for NFTs, especially Ordinals and Solana NFTs. By tracking these collectibles and the smart money behind them, Analysoor has gained a large following and recently launched its own NFT collection and native token $ZERO.

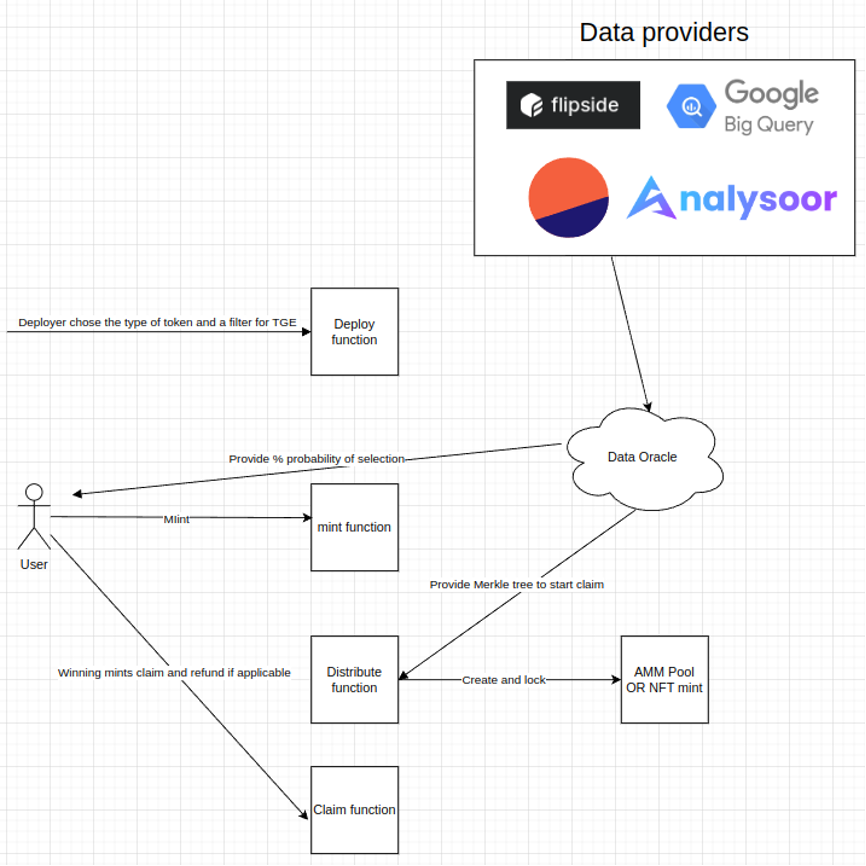

Analysoor introduces a unique mint mechanism designed to ensure fairness and transparency in the NFT and MEME minting process. Different from traditional NFT airdrops, Analysoor uses block hash random numbers + participant investment costs to eliminate unfair competition such as robots or large players through randomness, thereby creating a fair competitive environment for ordinary users.

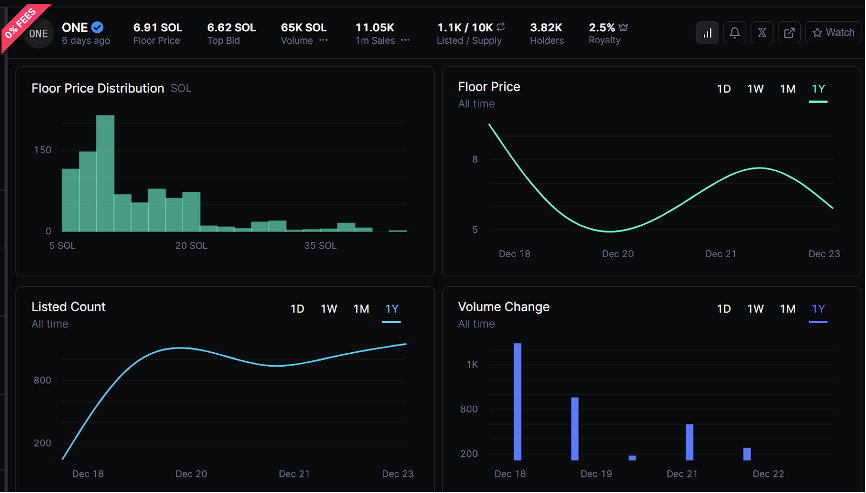

The Analysoor NFT collection includes 10,000 unique NFTs, each representing a block in the blockchain. Only one NFT can be minted per block.

The Solana blockchain generates a block every 400 milliseconds on average

If only one valid mint request is selected in each block, the mint process takes approximately 1 hour and 30 minutes.

Each block has a unique identifier called the block hash. This hash value is unknown until the block is confirmed and therefore acts as a random number generator

Choose a winning method for minting/trading: First, extract the first number from the block hash (e.g."6MjVseMy2khAe1hXnhwFCMZ6FhzuBpaLaezFYnCxZQuN"6) in, used to determine winning trades. Then, take all the numbers in the hash (e.g. 6216) and check if they are even numbers to determine in which direction to start counting transactions.

Specific implementation: If the number of the block hash is an even number, count from top to bottom; if it is an odd number, count in reverse. Following the first number 6 extracted from the block hash, the first transaction containing the number [6] is picked, selecting a winner on each block.

The only way to cheat is to make multiple minting requests in one block, but the ingenuity of its design is that each minting has a cost, so big investors/scientists who want to dominate the entire block may also suffer heavy losses.

https://www.theblockbeats.info/news/49088

flow chart:

All fees collected during the mint process will not be refunded, but will be used to create AMM pools or be added to bids for NFTs, thus protecting and increasing the value of the NFTs. This strategic move not only ensures that the value of Analysoor NFTs increases, but also creates a vibrant secondary market for these NFTs.

In addition, the official will open the Meme coin $WHEN minting around December 23 (has been postponed), 48.5% of the tokens can be minted at the price of 0.05 $SOL and 1 $ZERO, the minting will last 45 minutes; 48.5% of the supply And all SOL fees will be used to create a Meteora AMM similar to $ZERO; 3% will be distributed to $ONE holders three days after minting.

our insights

Official data indicates that when Mint $ZERO, a total of 8.8 K of $SOL (approximately $841 K) fees were generated and locked in LP, with nearly 2 M generated in just 4 days during the ONE and $ZERO minting process cost of.

Source:Sniper

For those users who are unlucky and have not mint, Analysoor may issue some plans to allow users to gain more benefits instead of relying solely on luck. For example, users can mine in the $ZERO/ONE pool, or pledge $ZERO and ONE to obtain airdrops for new projects deployed on Analysoor, etc., thereby increasing more participation and benefits.

In addition, it is worth noting that Analysoor will create a market driven by AI models. By better detecting real investor addresses, it will make the distribution of chips more reasonable and improve the fairness of the mechanism. Perhaps the launch of this initiative will be more beneficial to $ZERO .

Why is Analysoor’s distribution mechanism so popular? In the recently popular inscription ecology, large investors or scientists gain the upper hand by jumping the gun, and the interests of ordinary retail investors are easily infringed. And the gas fees collected are basically held by miners, which is difficult to feed back into the ecosystem. Analysoor collects fees into the AMM pool and protects NFT prices. In fact, it is also protecting the rights and interests of Holders and safeguarding the interests of users.

It can be said that such a mint mechanism is also given the (0, 1) label to mark its fair and innovative Fair Launch precedent. Perhaps Analysoor is expected to completely change the way we interact with digital assets.

Gryphsis Research Focus

Welcome to this week’s Gryphsis Research Spotlight, where we share the latest insights from our team. Our dedicated research team continues to explore the most cutting-edge trends, developments and breakthroughs in the crypto space. This week, we’re excited to share our newly released report, so let’s dive in!

TL;DR:

Driven by the Internet and AIGC technology, the creator economy has experienced significant development, providing creators with diverse income methods ranging from advertising revenue to direct sales.

AIGC projects open to the public such as DALL-E 3, Midjourney and Stable Diffusion have performed well in AI painting applications. For the creator economy, the addition of AIGC has improved the efficiency and creative freedom of content creation.

Although the creator economy faces challenges such as copyright issues and unstable income, the integration of Web3 provides new solutions, especially in strengthening copyright management and monetizing works.

NFPrompt, as an emerging platform that combines Web3 and AIGC, provides creators with an integrated environment for creation, trading and social interaction. NFPrompt brings wider exposure and participation opportunities to the project by joining the Binance LaunchPool for the initial public offering of the $NFP token.

In the future, with the development of AIGC and blockchain technology, it is expected that the creator economy will be more diverse and inclusive, providing more opportunities and freedom to creators and consumers.

Full report:https://link.medium.com/AOVJRzERHFb

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Chainge Finance

Chainge Finance is a cross-chain liquidity aggregator that provides various cryptocurrency management tools, such as a cross-chain wallet that integrates more than 24 EVM and non-EVM compatible chains, allowing users to seamlessly exchange, send and receive crypto assets between networks. There is also an Escrow module, a top DEX aggregator, a futures DEX and the first decentralized options DEX.

https://x.com/FinanceChainge/status/1737472710408634811?s=20

MapleStory Universe

MapleStory Universe can be simply described as an expanded concept of MapleStory, Nexon’s most widely recognized IP. It is ultimately a virtual world ecosystem with MapleStory NFT at its core, creating a more immersive and engaging adventure experience. Emerges as a dynamic virtual ecosystem that seamlessly integrates games and applications with NFTs. Through the integration of Polygon Supernet, players can now earn and trade NFT items during gameplay, fundamentally reshaping the existing in-game economy.

https://x.com/MaplestoryU/status/1736608325113086201?s=20

4 EVERLAND

4 EVERLAND is a Web 3.0 cloud computing platform that integrates storage, computing, and network core capabilities. It provides inter-blockchain communication, decentralized front-end, write-once, and run-anywhere blockchain solutions and Web services. This enables developers to build Web 3.0 applications more easily and faster.

https://x.com/4everland_org/status/1737383366008467699?s=20

protocol event

Phantom adds support for Bitcoin, Ordinals and BRC-20 tokens

Trezor hardware wallets add support for Solana and SPL tokens

Bitfinex Securities announces first tokenized bond on Liquid Network

Ripple approved as Virtual Asset Service Provider by Central Bank of Ireland

EigenLayer deposits surpass $ 900 million amid increased LST caps

Industry updates

U.S. appeals court finalizes mandate for forfeiture of Silk Road bitcoin

China pledges to boost NFT, decentralized application development despite crypto trading ban

BloXrout will reject transactions with OFAC-blacklisted addresses

UK introduces new regulations for its Digital Securities Sandbox

Revolut will suspend trading for UK business customers: report

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/DeRonin_/status/1737535216963502472?s=20

https://x.com/0x AndrewMoh/status/1737446486693290013? s= 20

https://x.com/Deebs_DeFi/status/1737136974543331603?s=20

https://x.com/MoonKing___/status/1737491810866339870?s=20

https://x.com/zerokn0wledge_/status/1737443087339675978?s=20

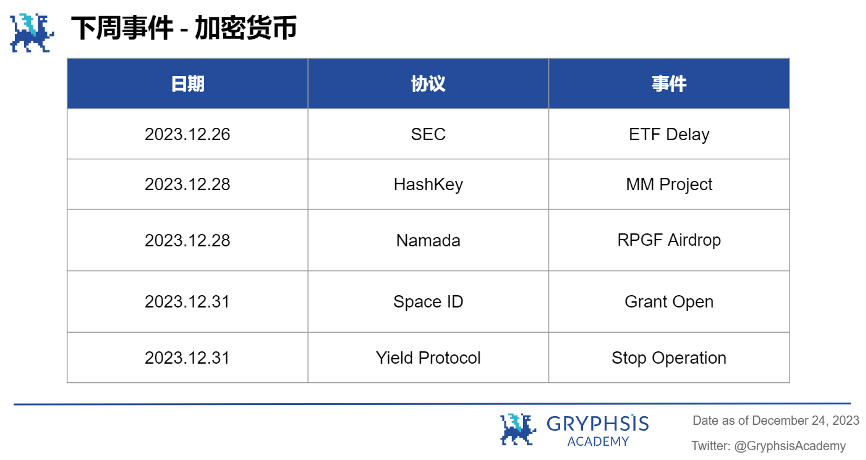

next week events

news source:

https://www.theblock.co/post/268707/phantom-adds-support-for-bitcoin-ordinals-and-brc-20-tokens

https://www.theblock.co/post/268667/trezor-hardware-wallets-add-support-for-solana-and-spl-tokens

https://www.theblock.co/post/268594/ripple-vasp-ireland

https://www.theblock.co/post/268312/eigenlayer-deposits-increased-lst-caps

https://www.theblock.co/post/268528/china-nft-dapp-development-crypto-ban

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.