EigenLayer increases TVL limit again, how to interact before closing?

Original - Odaily

Author - Azuma

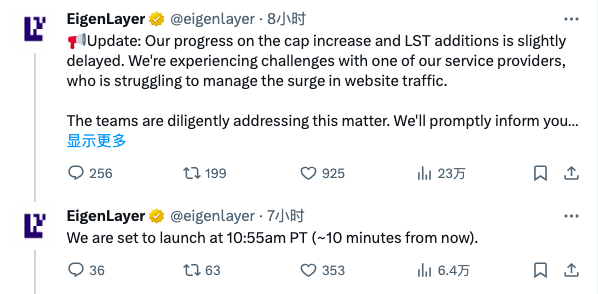

In the early morning of December 19th,The Ethereum re-pledge protocol EigenLayer has once again opened the deposit window for liquid restaking, and has increased the total re-pledge limit (can be understood as the TVL limit) of major ETH liquidity derivative tokens (LST) from 100,000 Increased to 500,000 pieces.

In the first half of this year, EigenLayer completed a $50 million Series A round of financing, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Zonff Partners, Bixin Ventures, Hack VC, Electric Capital, IOSG Ventures and others.

Earlier, EigenLayer had completed a $14.5 million seed round of financing, led by Polychain Capital and Ethereal Ventures.

Since the original re-pledge mechanism has opened up the imagination to expand the trust layer of Ethereum, and the data availability solution EigenDA being tested recently has also made breakthrough progress, the market is currently very optimistic about the valuation and airdrop of EigenLayer. High expectations.

Odaily Note: For an introduction to the mechanism of EigenLayer, please refer to EigenLayer: Expanding the Ethereum trust layer through “re-staking”》。

In June, July, and August of this year, EigenLayer raised the re-staking limit of LST three times after the first phase of the mainnet was launched, but it quickly reached the hard cap within a few hours of each increase., which is enough to show the market’s crazy sentiment towards this project.

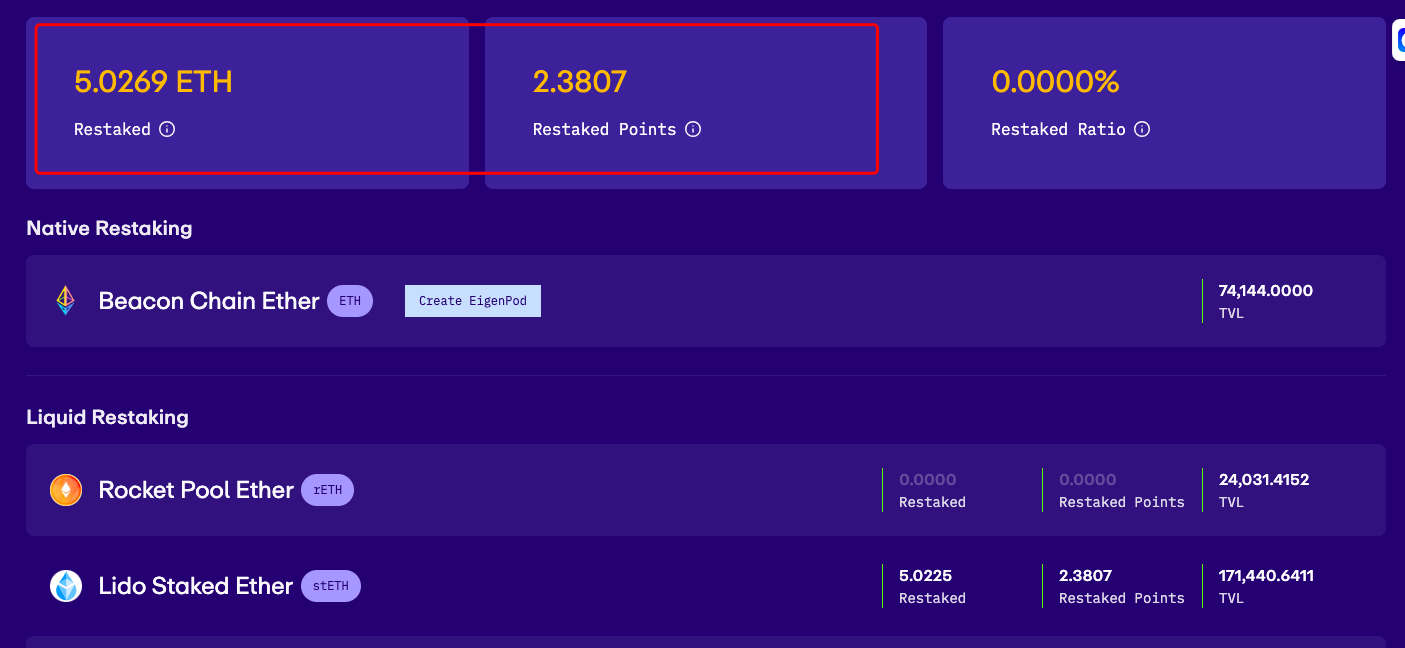

This time, although EigenLayer has fully increased the re-pledge limit of 400,000 LST, in just a few hours from early morning to the time of publishing, the market has quickly deposited more than 200,000 LST (the real-time re-pledge total is 380,390 ETH, minus The 100,000 ETH originally deposited and the 74,144 ETH originally pledged) are getting closer and closer to the hard cap.

So how do users participate in the re-staking of EigenLayer? Currently, users who want to experience and interact with EigenLayer can do so through two methods: liquidity restaking and native restaking. The difference between the two is that the latter is more suitable for staking users who run verification nodes independently. .

In the following, we will describe the operational details of these two re-pledge methods respectively, especially the liquidity re-pledge method that is more suitable for ordinary users.

Liquidity re-hypothecation

In the early hours of this morning, another major update that was synchronized with the increase in the total pledge limit of LST was that EigenLayer added support for osETH (StakeWise), swETH (Swell Network), OETH (Origin Protocol), EthX (Stader Labs), and WBETH (Binance). , AnkrETH (Ankr) and six other LST support.

In addition to stETH (Lido), rETH (Rocket Pool), and cbETH (Coinbase), which have been supported since the initial launch of the main network, EigenLayer currently supports a total of 9 types of LST.

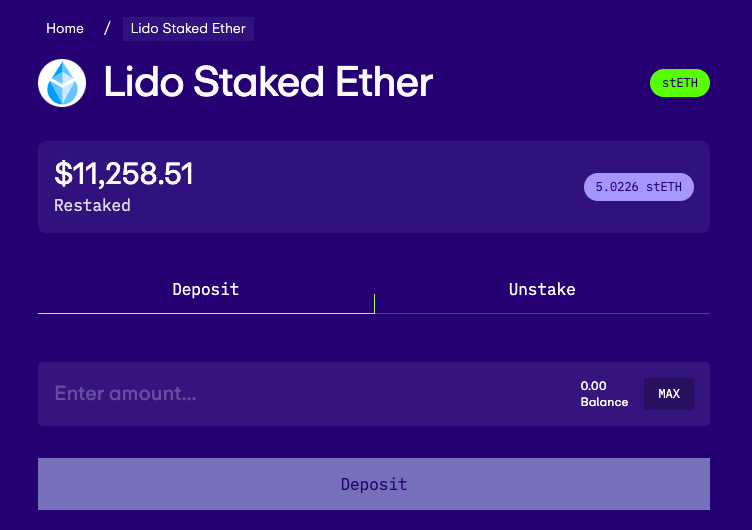

Take stETH, which is most commonly contacted by users, as an example (it can be purchased directly on OKX, and the price is basically the same as ETH). In DappOfficial websiteAfter clicking on the stETH column, you can jump to the corresponding re-pledge page. Next, the user needs to enter the amount of stETH they want to re-pledge, click Next to complete the authorization (a custom spending limit will be prompted here, just choose the largest one) and after confirming the two transactions, see Deposit Successful That means the re-pledge is successful.

It should be noted that in addition to the overall limit of 500,000 pieces, EigenLayer has also set an individual limit of 200,000 pieces for the 9 major LSTs this time, that is, a maximum of 200,000 pieces of each LST can be deposited. The current re-pledge amount of stETH has exceeded 170,000. Once it reaches 200,000, users need to choose other LST for re-pledge operations.

After returning to the homepage, we can directly track the changes in stETH rewards for re-staking, and check our re-staking points (Restaked Points) in real time - this point is very exciting.

After completing the re-pledge, we can also withdraw our assets by unplacing. The specific method is to select UnStake on the re-pledge page of the specific token. One thing to note about unstaking is that there is a 7-day security period required to withdraw funds from EigenLayer, so you must wait at least 7 days before withdrawing assets.

Native re-pledge

Different from liquidity re-pledge,Native re-staking requires independent operation of verification nodes, so the technical threshold and financial threshold for users are relatively high.(It is also 32 ETH, but restrictions on liquidity re-pledge will be relaxed in the future. This is a hard requirement for Ethereum mainnet staking, and it will not change visually in the future).

EigenLayer does not set a hard-top limit for this method, but it is obvious that most users cannot perform complex node autonomous operations.Therefore, as of the publication of the article, only 741.44 million ETH have been deposited, which translates into 2,317 addresses making deposits.

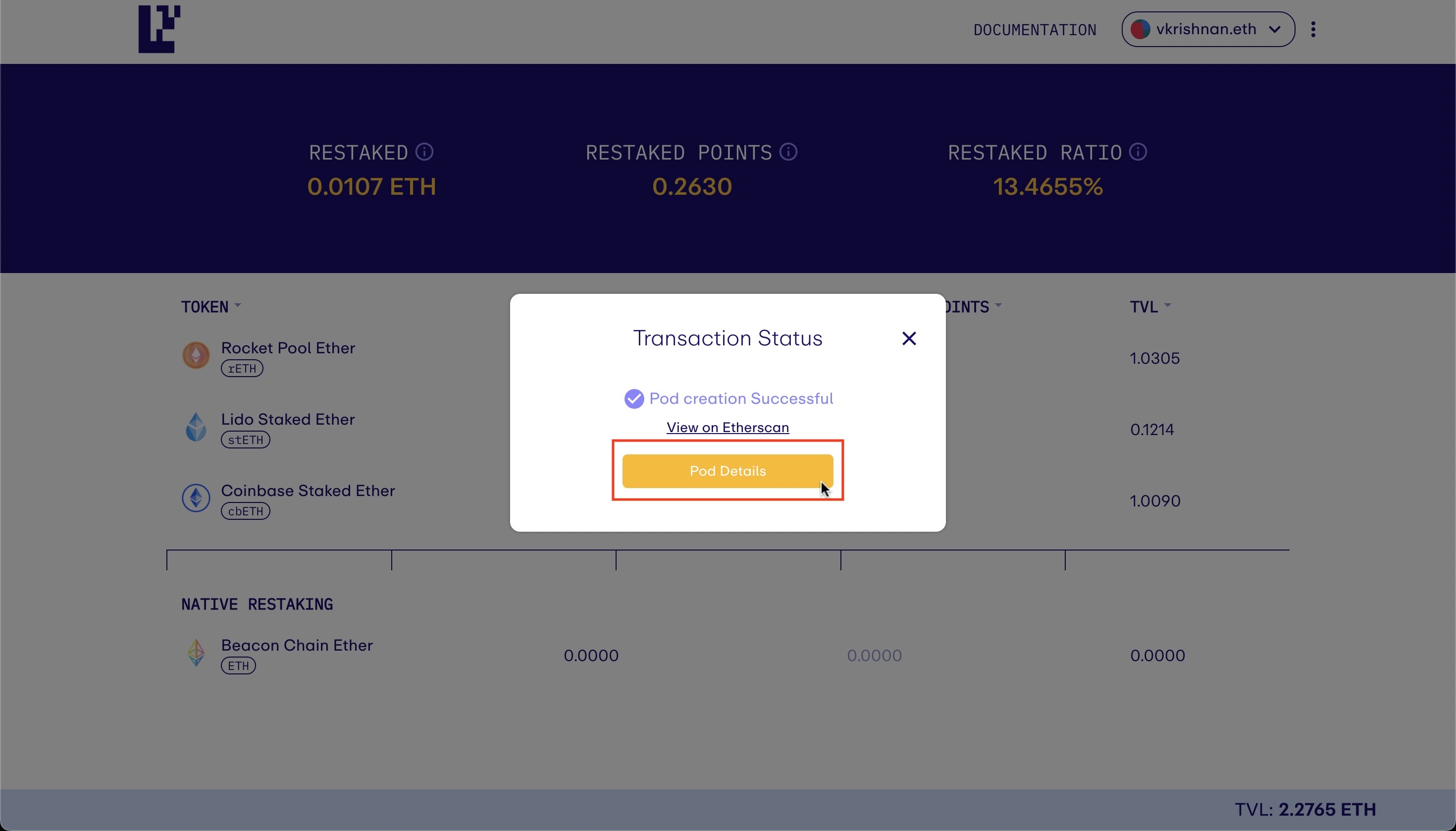

For users who are running verification nodes independently and want to re-stake through this method, they can refer to the official documentation.Tutorial content, assigning the validators withdrawal credentials to the EigenPods address. The specific deposit operation consists of four steps.

First, enter the DappOfficial website, link wallet.

Then you need to click Create EigenPod to create an EigenPods. After success, click Pod Details to get the specific address of the EigenPods.

Next, the user needs to configure the withdrawal credentials on the Beacon chain (to complete this step, you need to run the Ethereum verification node first) to the EigenPods address.

Finally, you can also return to the homepage to detect changes in your re-staking rewards in real time.

The first stage is just the beginning

According to EigenLayer’s official previous disclosure, the launch of the project will be divided into three phases to attract various participants to join the ecosystem.

In the first phase Stakers (that is, the operation we performed above), stakers can try to re-stake through EigenLayer; in the second phase Operators, node operators can accept stakers pledges on EigenLayer. Delegation; in the third stage Services, active verification services will be online.

last month,EigenLayer has announced the launch of the second phase of the testnet and revealed the mystery of its data availability solution EigenDA, allowing Rollup to directly use EigenDA as a data availability layer.

Earlier this month, EigenDA announced that it was conducting launch testing with several partners including AltLayer, Caldera, Celo, Layer N, Mantle, Movement, Polymer Labs, and Versatus, and a few days ago it announced support for OP Stack.

Whether this can help EigenLayer open a new narrative chapter, Odaily will continue to pay attention.