EigenLayer: 「再誓約」を通じてイーサリアム信頼層を拡張

編曲・編曲:ベーズ研究所

編曲・編曲:ベーズ研究所

先週、EigenLayerはBlockchain Capital主導で5,000万米ドルの資金調達を受けたと発表し、Coinbase Ventures、Polychain Capital、Bixin Ventures、Hack VCなどの業界で有名なVCが投資に参加した。

背景

背景

2009 年に、サトシ ナカモトという名前の匿名の開発者が、ビットコイン ネットワークを作成することによって、デジタル世界に「分散型信頼」の概念を初めて導入しました。ビットコインネットワークは、UTXOとスクリプト言語を使用したピアツーピアのデジタル通貨システムとして設計されていますが、ネットワーク上にさまざまなプログラムを構築できないという制限があります。この問題を解決するために、2015 年に Vitalik Buterin は Ethereum ネットワークを立ち上げ、開発者がチューリング完全言語 Solidity を使用してさまざまな分散型アプリケーション (dApps) を構築できるようにしました。

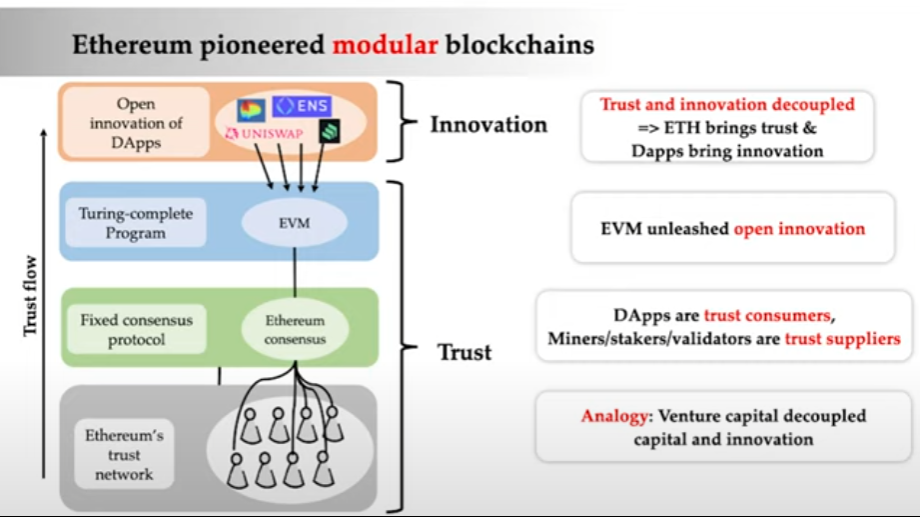

上の図に示すように、イーサリアムには分散型信頼を担う 3 つのモジュールがあります。

トラストレイヤー: 分散型ブロックプロデューサー (バリデーター) のネットワーク。

コンセンサス層: ブロックがどのように生成されるか、および分散ネットワーク内でどのチェーンが正規として認識されるべきかに関するルール。

実行層: イーサリアム仮想マシン (EVM)。

イーサリアムにはビットコインと同様の信頼層がありますが、実行層としてEVMを使用するため、その上にさまざまなdAppを構築できます。ただし、イーサリアムには 2 つの大きな制限があります。

まず、独立したコンセンサスプロトコル(Tendermint、Snowmanなど)と実行層(Sealevel、FuelVMなど)を独立して構築するには、イーサリアムの信頼層を使用することは不可能であり、独立した信頼層を構築する必要があります。 。独立した実行レイヤーとしてイーサリアム上にレイヤー 2 ソリューションを構築することは可能ですが、トランザクションの決済は最終的には EVM 上のスマート コントラクトで行われ、必然的にイーサリアムの実行レイヤーに依存します。

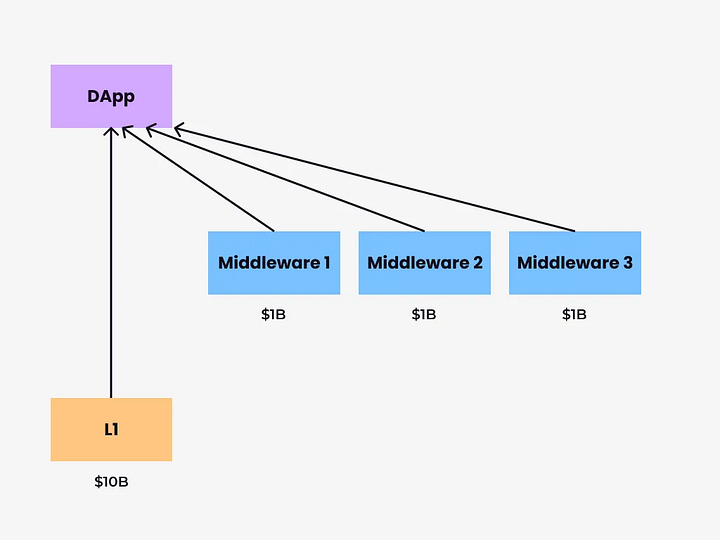

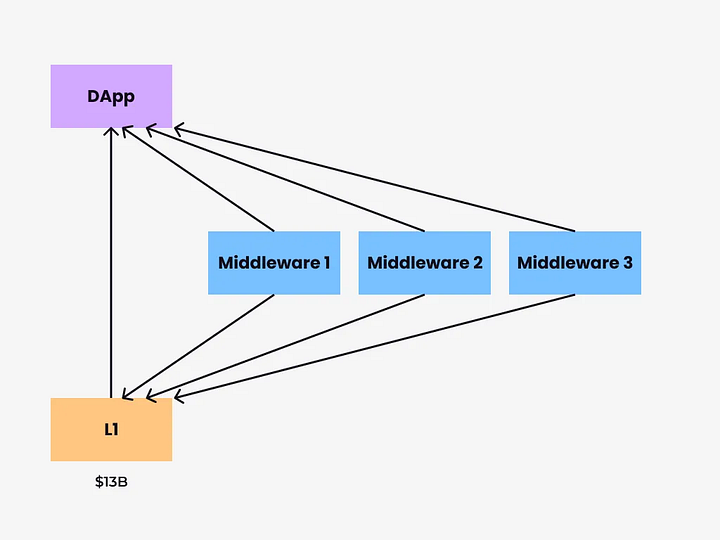

第二に、イーサリアム ネットワーク上の dApp はイーサリアムの強力なセキュリティによって保護されているように見えますが、実際にはオラクルやクロスチェーン ブリッジなどのミドルウェアなどの外部のセキュリティ要素に大きく影響されます。

たとえば、以下の図に示すように、dApp を構築する L1 が 100 億ドルの ETH で保護されているとしても、ミドルウェアがそれぞれ 10 億ドルの ETH で保護されている場合、dApp は実際にはセキュリティの弱いミドルウェアに依存していることになります。これは、クロスチェーンブリッジやオラクルの問題によりDeFiプロトコルが経験したハッキングインシデントで簡単に観察できます。

上記の問題はすべて、断片化された信頼から生じます。では、dAppsを構築する際にイーサリアムの強力な信頼層を活用することは可能でしょうか?つまり、ミドルウェアに依存することはできないのでしょうか?

これらの問題を解決するのがEigenLayerです。

EigenLayer の仕組み

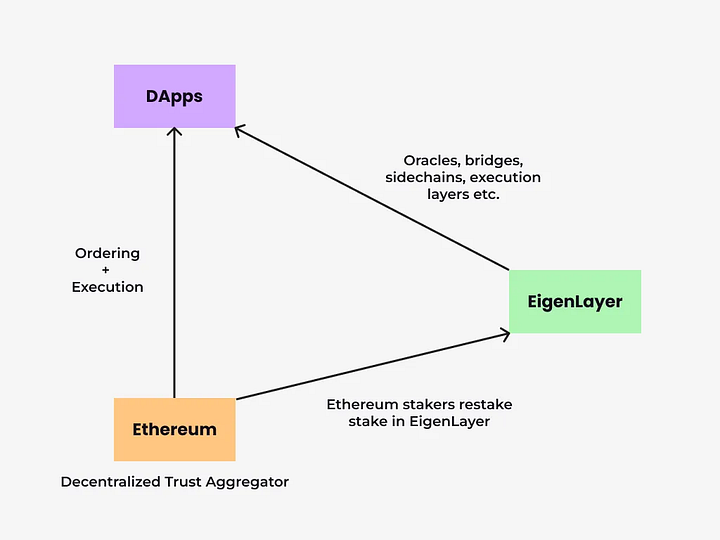

EigenLayer は、シアトルにあるワシントン大学の電気およびコンピュータ工学科の教授である Sreeram Kannan が主導するプロジェクトで、他のプロトコルや dApp がイーサリアム ネットワークのセキュリティを利用できるようにすることを目的としています。

EigenLayer を簡単に理解すると、Cosmos ICS (Interchain Security) のイーサリアム バージョンと考えることができます。 Cosmos エコシステムにおける Lisk の最大の欠点は、チェーンのセキュリティを維持するために新しいバリデーターのセットをブートストラップする必要があることです。ただし、新しい AppChain が Cosmos の ICS を使用する場合、Cosmos バリデーターはブロック報酬と引き換えに新しく参加した AppChain のトランザクションを検証できるため、新しい AppChain は Cosmos の強力なセキュリティに依存できます。

EigenLayer の目標は Cosmos ICS と似ていますが、コア メカニズムとして「再ステーキング」というわずかに異なるアプローチを使用します。

「再ステーキング」とは、すでに誓約されたトークンを使用して再度ステーキングすることを指します。

イーサリアムバリデーターは、ETHトークンがブロックの作成と検証のプロセスに参加することを誓約し、悪意のある動作があった場合にはETHの一部を没収(スラッシュ)することでネットワークのセキュリティを強化します。

EigenLayer はさらに一歩進んで、すでに誓約された ETH トークンを他のプロトコルや dApp に再ステークして検証プロセスに参加できるようにすることで、他のプロトコルや dApp がイーサリアム ネットワークのセキュリティをある程度まで活用できるようにします。

ただし、「再ステーキング」プロセス中、ETH トークンはイーサリアムだけでなく他のプロトコルによって課されるスラッシュの対象となります。再ステーキングプロセスに参加しているバリデーターが、別のプロトコルの没収ペナルティによりステーキング済みの ETH トークンを失った場合、イーサリアムネットワークのルールに従っていたとしても、ステーキング済みの ETH トークンは引き続き失われます。

現在、イーサリアムネットワーク上のバリデーターが悪意のある行為を行った場合、ステーキングした 32 ETH トークンの半分、つまり最大 16 ETH を没収される可能性があります。そして、EigenLayer は残りの半分を没収することを許可します。

「再ステーキング」に参加するとリスクが 2 倍になりますが、イーサリアム ブロックの報酬だけでなく他のプロトコルからの報酬も獲得できるため、総報酬も増加します。したがって、検証者は、EigenLayer の「再誓約」を通じて他のプロトコルを検証し、追加の報酬を得ることができます。イーサリアムネットワークにステークしている通常のユーザーも、これらの利点から恩恵を受けることができます。

EigenLayer の使用例

1. その他のコンセンサスプロトコルと実行環境

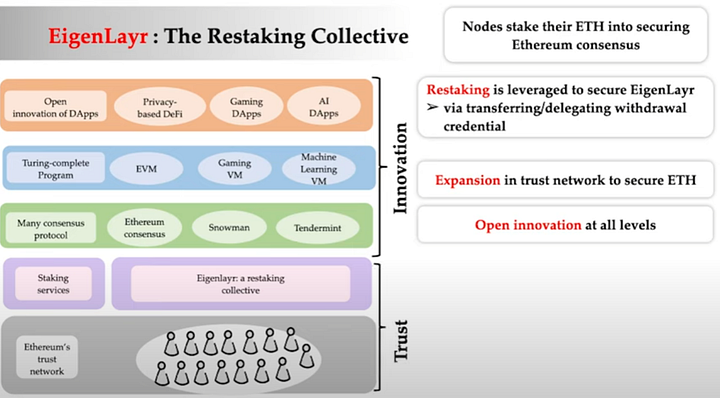

EigenLayer は、「再ステーキング」と呼ばれる新しいメカニズムを導入することでこの問題を解決できます。これにより、イーサリアム ネットワーク内のバリデーターは、オラクルやクロスチェーン ブリッジなどの他のミドルウェアにセキュリティを提供するだけでなく、ネットワークの使用にもセキュリティを提供できるようになります。新しいコンセンサス プロトコルと実行層がセキュリティを提供します。開発者が、Ethereum のセキュリティをある程度組み合わせながら、Avalanche の Snowman コンセンサス プロトコルをコンセンサス レイヤーとして使用し、ゲーム実行に最適化された仮想マシンを実行レイヤーとして使用したい場合、EigenLayer を使用することでこれが可能になります。

2. 既存のセキュリティを組み合わせて強化する

他のプロトコルでも、既存のセキュリティ メカニズムを維持しながら、EigenLayer を利用できます。

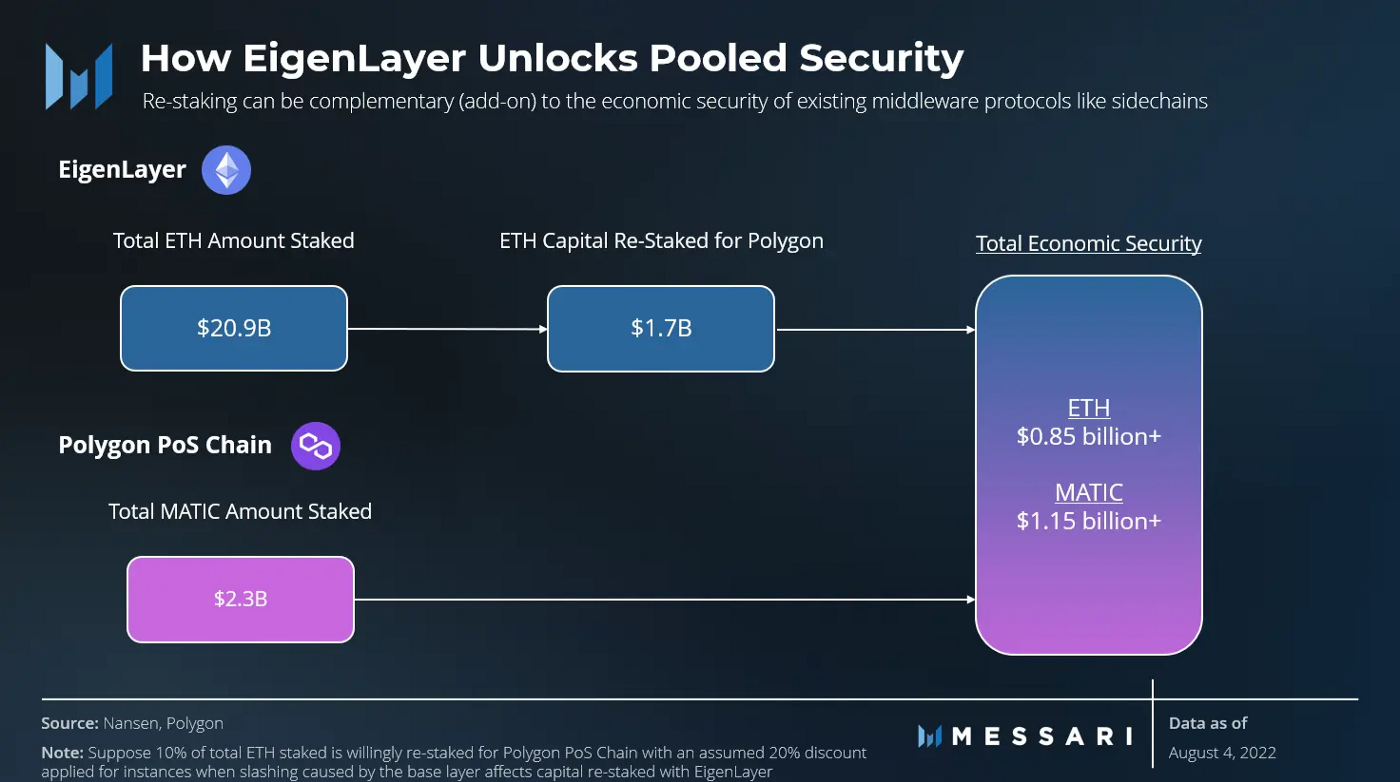

たとえば、Polygon がネットワーク セキュリティに EigenLayer を使用しているとします。ステーキングされたトークンの 50% 以上がセキュリティを侵害すると仮定すると、Polygon ネットワークにステーキングされた MATIC トークンの価値が 23 億ドルであれば、ネットワークを侵害するために必要な金額は 11 億 5000 万ドルになります。 17 億ドルの ETH が Polygon ネットワークに「再ステーキング」された場合、Polygon ネットワークの総経済的安全性は 8 億 5,000 万ドル増加し、より高いレベルの安全性を享受できるようになります。

これにより、ミドルウェアのセキュリティが弱いという問題も解決できます。たとえイーサリアムに担保に入れられた少量の ETH トークンがさまざまなミドルウェア (オラクルやクロスチェーン ブリッジなど) に「再担保」されたとしても、ETH の莫大な市場価値によりミドルウェアのセキュリティが大幅に向上します。同様に、ミドルウェアの安定性が向上すると、それに依存する DeFi プロトコルの安定性も向上します。

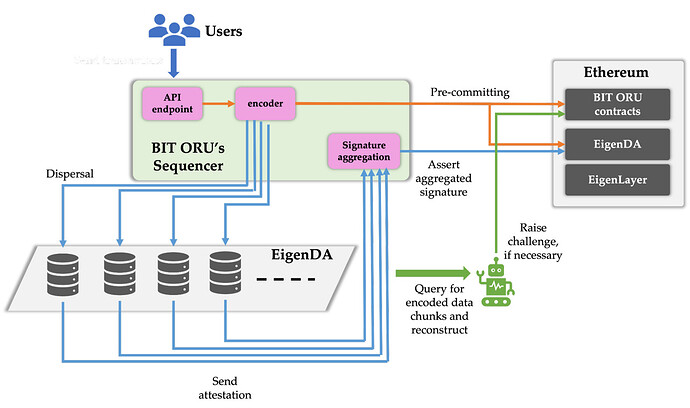

3、EigenDA

EigenDA は、EigenLayer チームによって開発されたデータ可用性レイヤーです。データ可用性レイヤーは、データのストレージと検証のみに焦点を当てたレイヤーであり、ネットワークのセキュリティとスケーラビリティにとっても重要です。他のデータ可用性レイヤーには、独自のトークン ステーキング メカニズムを通じてセキュリティを維持する Celestia および Polygon Avail が含まれます。ただし、EigenDA には、市場ですでに価値のある ETH トークンを通じてセキュリティを維持できるという利点があります。

現在、イーサリアム ネットワーク上のデータの可用性がロールアップ ネットワークのスケーリングにおける最大の制限要因となっていますが、EIP-4844 とシャーディングの導入により、イーサリアム上のデータの可用性とロールアップ ネットワークのスケーリングが改善されることが期待されています。したがって、EigenDA は Mantle Network のような L2 ネットワークで採用されています。 Mantle 氏は、イーサリアム ネットワークから決済層をフォークする一方で、データの可用性のために AigenDA を使用することを決定しました。

L2 ネットワークの観点から見ると、EigenDA を使用すると、他のデータ可用性レイヤーを使用するよりもイーサリアムからセキュリティが得られると言うのが簡単です。

EigenLayer のいくつかの欠点

ただし、EigenLayer の使用にはいくつかの問題があります。

まず、ユーザーは、EigenLayer のネイティブ トークンを使用することにあまり積極的ではない可能性があります。これは、ユーザーが他のプロトコルのネイティブ トークンを必要とせずに、EigenLayer に参加し、ETH を「再ステーキング」することで報酬を獲得できるためです。したがって、EigenLayerのトークンエコノミクスは大きな影響を受ける可能性があります。

第二に、セキュリティインシデントが懸念されます。イーサリアムネットワークにステーキングされた ETH の大部分が他のプロトコルでの「再ステーク」に使用された場合、プロトコルの 1 つにセキュリティホールがあり、大量の ETH が没収される可能性があります。これは、イーサリアム ネットワークのセキュリティの低下につながる可能性があります。これを防ぐために、ユーザーは「再ステーキング」用のプロトコルを調査および選択する際に注意する必要があります。また、没収条件が厳しすぎてはいけません。

第三に、Eigenlayer を使用したプロトコルのトークン報酬の分配を考慮する必要があります。 EigenLayer を採用する場合、プロトコルは既存の参加者と「再ステーキング」参加者にインセンティブとしてネイティブ トークンを配布する必要があります。 「再ステーキング」参加者にあまりにも多くの報酬が与えられると、プロトコルのトークンエコノミクスに影響を与え、既存の参加者が離脱する原因になります。逆に報酬が低すぎると「再ステーキング」への参加が減る可能性があります。

エピローグ

エピローグ

EigenLayer は、イーサリアムの信頼層の使用を可能にする「再ステーキング」と呼ばれる新しい概念を導入します。 EigenLayer には、他のプロトコルがイーサリアムのセキュリティを活用できるようにすることで、「分散型信頼」を追加する可能性があります。

EigenLayer に対するプロトコルの需要が高まるにつれて、より多くのユーザーが ETH を誓約するよう奨励され、それがイーサリアム全体のネットワーク セキュリティと ETH のトークン価値に貢献します。

中央銀行等が発表した「仮想通貨取引における誇大広告のリスクのさらなる防止及び対応に関する通知」によれば、本記事の内容は情報共有のみを目的としており、いかなる運営・投資を推奨・推奨するものではありません。違法な金融行為に参加する。

リスク警告:

中央銀行等が発表した「仮想通貨取引における誇大広告のリスクのさらなる防止及び対応に関する通知」によれば、本記事の内容は情報共有のみを目的としており、いかなる運営・投資を推奨・推奨するものではありません。違法な金融行為に参加する。