Weekly Financing Express - 25 projects received investment, with a total disclosed financing of approximately US$302 million (12.11-12.17)

According to incomplete statistics from Odaily, a total of 25 blockchain financing events at home and abroad were announced from December 11th to December 17th, a significant increase from last week’s data (16 cases). The total amount of financing disclosed was approximately US$302 million, which was higher than last week’s data (16 cases). Last weeks figure ($105 million) was up significantly.

Last week, the project that received the largest amount of investment was Line Next (USD 140 million), an NFT subsidiary of Line; Andalusia Labs, a comprehensive encryption company, also followed closely (USD 48 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

Line’s NFT subsidiary Line Next completes US$140 million in financing

On December 13, Line Next, Line’s NFT subsidiary, announced that it had received a US$140 million investment from private equity fund operator Crescendo Equity Partners and its consortium, making it the largest investment in Asia’s blockchain and Web3 fields this year.

Line Next plans to use this round of financing to promote the popularity of Web3, expand its global platform business, and develop new services, including the global NFT platform DOSI, which will be launched in January next year, as well as social applications and Web3 games based on artificial intelligence technology.

Andalusia Labs raises $48 million in Series A funding, led by Lightspeed Venture Partners

On December 13, Andalusia Labs announced the completion of a $48 million Series A round of financing, led by Lightspeed Venture Partners, with participation from Mubadala Capital, Pantera Capital, Framework Ventures, Bain Capital Ventures and Digital Currency Group.

This round of funding will be used for product development and team expansion. The company has raised about $51 million in total so far. The company has three product lines: L2 called Karak; crypto risk management market Subsea, and institutional platform Watchtower.

Digital asset exchange GFO-X completed US$30 million in Series B financing, led by MG Investments

On December 11, GFO-X, a digital asset exchange authorized by the British FCA, announced the completion of a US$30 million Series B round of financing. MG Investments led the investment and will join the board of directors of Global Futures and Options Holdings.

This strategic investment will enhance market credibility by funding GFO-X’s upcoming product launches and supporting future innovation in the compliant digital asset space.

On December 14, David Riegelnig, a former private banking executive at Credit Suisse AG, launched Rulematch, a cryptocurrency trading platform for institutional clients that supports Bitcoin and Ethereum transactions. It has been sold to most countries in the European Union, the United Kingdom and Singapore. Customers are open.

In addition, Rulematch has raised $14 million in funding with participation from ConsenSys Mesh, Flow Traders and FiveT Fintech and is currently in the process of a new round of financing.

Web3 authentication platform Dynamic raises $13.5 million in funding, led by a16z and Founders Fund

On December 13, Web3 identity authentication platform Dynamic announced the completion of US$13.5 million in financing, led by a16z and Founders Fund. Dynamic aims to provide cryptocurrency and non-cryptocurrency companies with technology to create a seamless login experience powered by digital wallets.

On December 15, UAE chain game studio Farcana completed a US$10 million seed round of financing, with participation from Animoca Brands, Polygon Ventures, Fenbushi Capital, Rarestone Capital, MMPro Trust, Unpopular Ventures, Kapo Capital, Emchain, Hasu Capital, Dravus Investment, etc. .

Farcana will use the funding to continue development of its third-person multiplayer shooter.

Bitcoin rebate platform Lolli completes US$8 million in financing, led by BITKRAFT Ventures

On December 14, Bitcoin rebate platform Lolli completed an $8 million Series B round of financing. This round of financing was led by BITKRAFT Ventures and included Sfermion, Ulta Beauty’s Prisma Ventures, Hypersphere Ventures, ZebPay CEO Rahul Pagidipati, 2 Punks Capital, MZ Web3 Fund, Seven Seven Six, Founders Funds Pathfinder Ventures, Bain Capital Ventures, Serena Williams Serena Ventures, Logan Paul and MrBeasts Night Media also participated.

On December 13, Bitcoin mining company Bit Origin announced that it had received $6.74 million in financing and would open a new mine in Wyoming. The data center has a capacity of 25 MW and can accommodate 4,480 to 8,400 Bitcoin mining machines.

Digital bank Pave Bank completes US$5.2 million in financing, led by 468 Capital

On December 15, digital bank Pave Bank completed US$5.2 million in financing, led by 468 Capital, with participation from Quona Capital, Financial Technology Partners, BR Capital, w 3.fund, Daedalus and others.

It is reported that Pave Bank is innovating the concept of programmable currency. PaveBank received a banking license in Georgia and plans to begin serving customers in the first quarter of next year.

Metagood completes US$5 million in seed round financing, led by Sora Ventures

On December 14, blockchain technology and digital asset company Metagood announced the completion of a $5 million seed round of financing. The round was led by Sora Ventures, with participation from ACTAI Ventures, Bitcoin Frontier Fund, Bitcoin Magazine Fund, London Real Ventures and Peach.xyz. The new funding will fund Osura’s new technology and product development and marketing, as well as foster collaborations with artists.

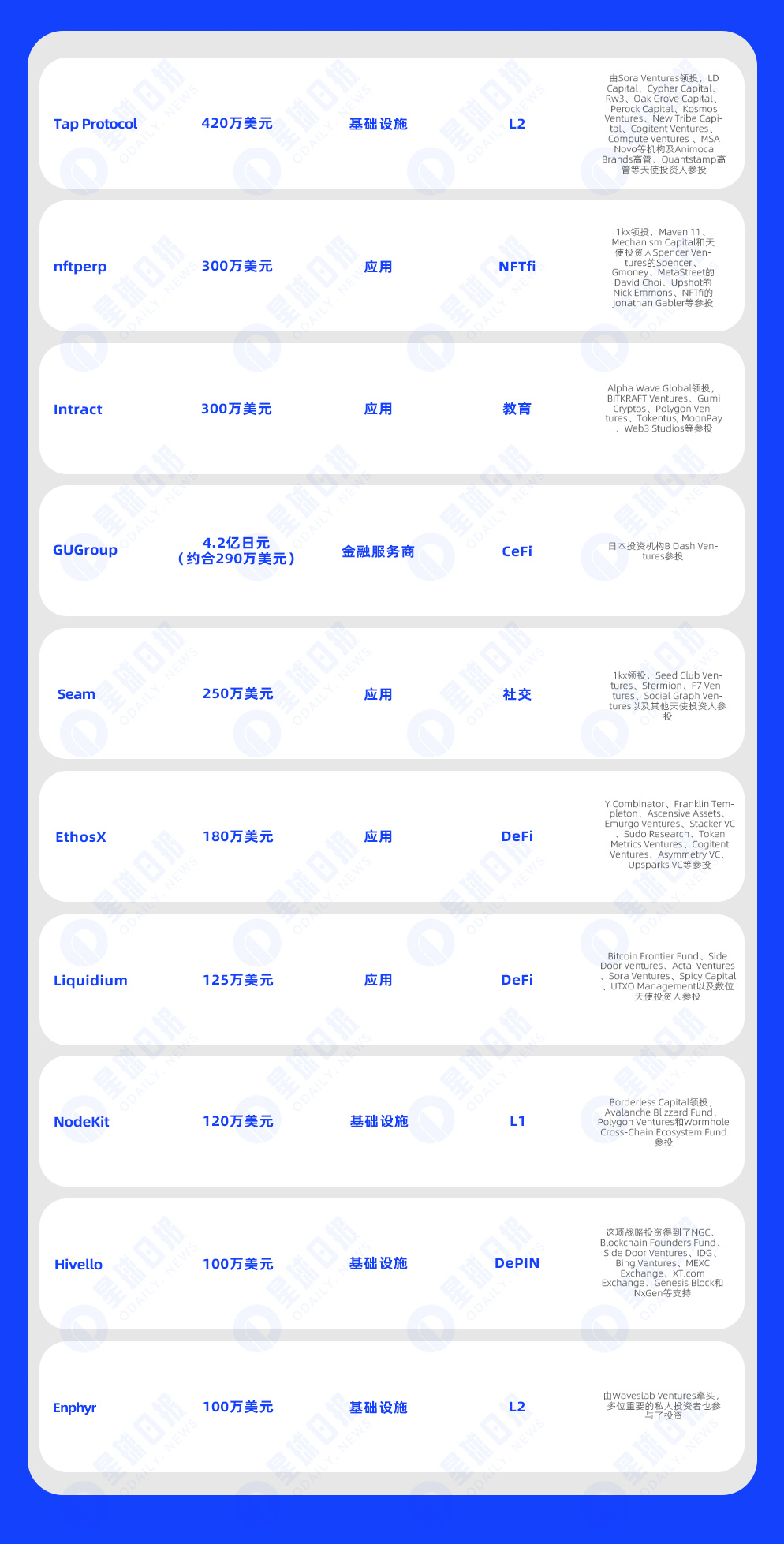

Bitcoin ecological project Tap Protocol completed US$4.2 million in financing, led by Sora Ventures

On December 16, Tap Protocol completed US$4.2 million in financing. This financing was led by Sora Ventures, LD Capital, Cypher Capital, Rw 3, Oak Grove Capital, Perock Capital, Kosmos Ventures, New Tribe Capital, Cogitent Ventures, Compute Ventures, MSA Novo and other institutions, as well as angel investors such as Animoca Brands executives and Quantstamp executives participated in the investment.

On December 14, the NFT perpetual contract trading platform nftperp completed a US$3 million Series A financing, led by 1kx, Maven 11, Mechanism Capital and angel investors Spencer Ventures, Gmoney, MetaStreet’s David Choi, Upshot’s Nick Emmons, Jonathan Gabler of NFTfi and others participated in the investment. Additionally, nftperp announced that its v2 version will be available soon.

Learning and earning platform Intract completes US$3 million in financing, led by Alpha Wave Global

On December 13, the learning and earning platform Intract announced the completion of US$3 million in financing, led by Alpha Wave Global, with participation from BITKRAFT Ventures, Gumi Cryptos, Polygon Ventures, Tokentus, MoonPay, Web3 Studios, etc. This financing will be used to expand the size of the team and conduct user promotion.

Japanese stablecoin technology provider GUGroup completes $2.9 million in financing

On December 13, Japanese stablecoin technology provider GUGroup completed 420 million yen (approximately US$2.9 million) in financing, with Japanese investment institution B Dash Ventures participating in the investment. GUGroup also raised part of the capital by selling tokens to a number of overseas investors.

Social platform Seam completed US$2.5 million in seed round financing, led by 1kx

On December 11, social platform Seam announced the completion of a US$2.5 million seed round of financing, led by 1kx, with participation from Seed Club Ventures, Sfermion, F 7 Ventures, Social Graph Ventures and other angel investors. Seam allows users to code, design and curate their ideal social space online.

On December 15, decentralized derivatives infrastructure EthosX announced the completion of a new round of financing of US$1.8 million from Y Combinator, Franklin Templeton, Ascensive Assets, Emurgo Ventures, Stacker VC, Sudo Research, Token Metrics Ventures, Cogient Ventures, and Asymmetry VC , Upsparks VC and others participated in the investment.

Bitcoin Ordinals lending platform Liquidium completes $1.25 million in Pre-Seed round of financing

On December 11, according to official news, Bitcoin Ordinals lending platform Liquidium announced the completion of a $1.25 million Pre-Seed round of financing, with participation from Bitcoin Frontier Fund, Side Door Ventures, Actai Ventures, Sora Ventures, Spicy Capital, UTXO Management and several angel investors. cast.

NodeKit completes US$1.2 million in Pre-Seed round of financing, led by Borderless Capital

On December 13, NodeKit, the SEQ development team based on Avalanche, announced the completion of a $1.2 million Pre-Seed round of financing, led by Borderless Capital, with participation from Avalanche Blizzard Fund, Polygon Ventures and Wormhole Cross-Chain Ecosystem Fund.

SEQ is a shared sequencer Layer 1 network that will help Rollup chains launch and decentralize their transaction ordering. SEQ will operate as an independent blockchain or subnet within the Avalanche ecosystem.

Decentralized infrastructure Hivello completes $1 million in funding

On December 14, decentralized physical infrastructure network (DePIN) Hivello announced the completion of $1 million in pre-seed financing. The strategic investment is backed by NGC, Blockchain Founders Fund, Side Door Ventures, IDG, Bing Ventures, MEXC Exchange, XT.com Exchange, Genesis Block and NxGen, among others.

Layer 2 project Enphyr completes US$1 million in seed round financing, led by Waveslab Ventures

On December 15, Layer 2 solution Enphyr raised $1 million in a recent seed funding round, valuing the company at $10 million. The round was led by Waveslab Ventures, with participation from a number of major private investors.

KuCoin Labs announces strategic investment in Bitcoin second-layer project Dovi

On December 11, KuCoin Labs announced a strategic investment in Dovi, a second-layer Bitcoin project, and stated that it would assist Dovi in achieving key milestones in its development. By integrating a series of technologies and innovative concepts, Dovi aims to optimize user experience and transactions in the BTC ecosystem. KuCoin Labs stated that it will continue to be committed to incubating and investing in the BTC ecosystem, and welcomes other BTC ecosystem project parties to submit financing or incubation needs through the official registration channel.

On December 13, Spielworks, an encryption startup focusing on DeFi and games, completed strategic financing. The Swiss non-profit organization The Hashgraph Association (THA) participated in the investment. The specific amount has not yet been disclosed.

This round of financing will be used by Spielworks to acquire Atomic Hub, a one-stop NFT platform, while accelerating the use of Hederas high-performance open source public ledger to expand its Web3 game ecosystem business and reduce transaction costs for chain game players.

Dora Factory Completes New Round of Strategic Financing, Announces New Ecosystem Partners

On December 14, Dora Factory, a decentralized governance infrastructure and multi-chain public goods funding protocol stack, announced the completion of a new round of strategic financing. Institutions participating in this round of financing include dao 5, Whampoa Digital and 7 other well-known strategic investors, marking a major expansion of Dora Factory’s new phase of strategy.

On December 14, according to official news, bitSmiley, a stablecoin protocol on the BTC ecosystem, announced the completion of its first round of investment on the X platform, jointly led by OKX Ventures and ABCDE.

It is reported that bitSmiley is the first BTC ecological stablecoin protocol to receive institutional investment. This protocol allows users to over-collateralize native BTC on the BTC network to mint stablecoin bitUSD.

Aki Network completes Series A financing, led by MARBLEX and an undisclosed Japanese venture capital

On December 16, Aki Network announced the completion of Series A financing, led by MARBLEX and an undisclosed Japanese venture capital, with participation from Puzzle Ventures and other individual entrepreneurs, with a valuation of US$50 million.