PSE Trading: Powell said there is a high probability of ending interest rate hikes in 2024

Original author:@MacroFang,PSE Trading Trader

The Federal Reserve has kept interest rates unchanged for the third time, marking the end of its aggressive rate hike campaign and forecasting a series of rate cuts starting in 2024. In a unanimous decision, officials agreed to keep the benchmark federal funds rate at 5.25% to 5.5%, the highest level since 2001. For the first time since March 2021, there are no further expectations for rising interest rates.

Interest rate cut = stock market surge

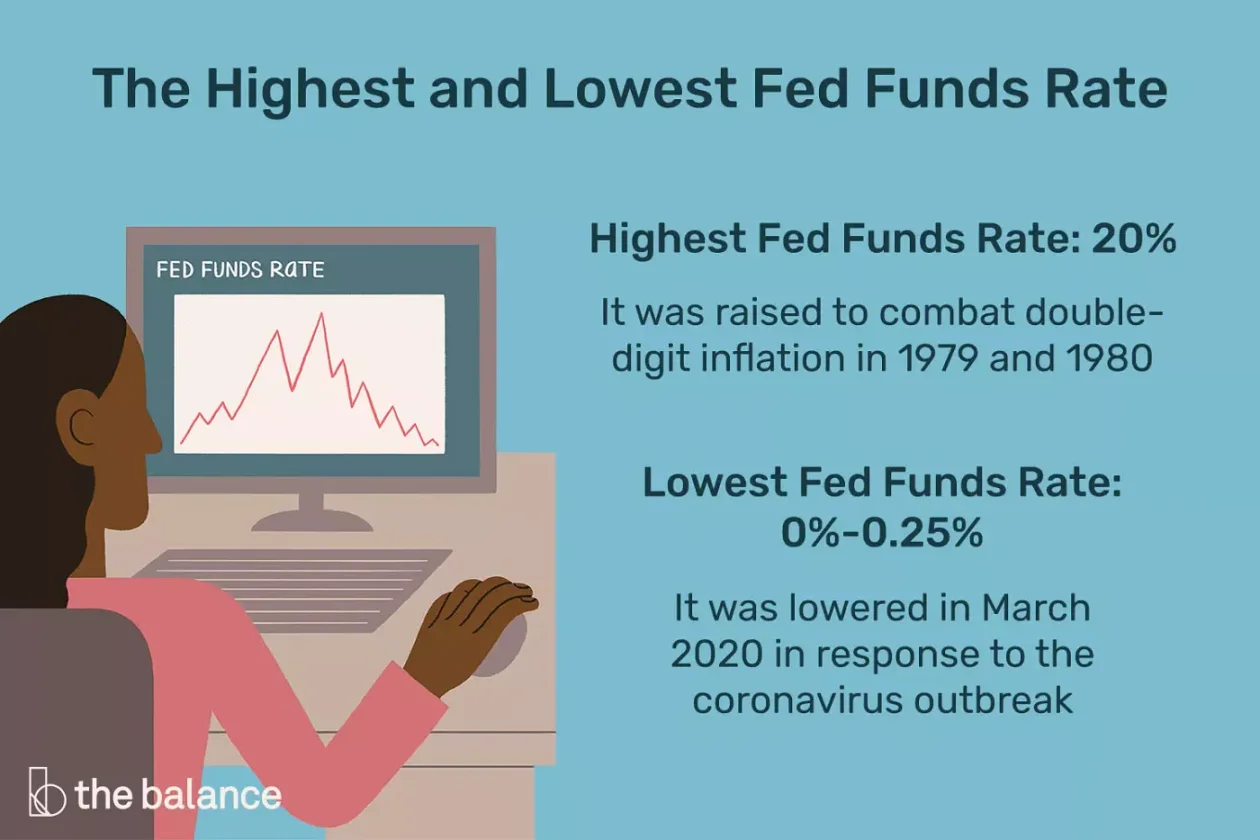

Rate cuts are often seen as fuel for markets. In fact, we can look back at the 2020 interest rate cut to 0% during the epidemic. After the Fed completed a series of interest rate cuts, the SP index rose sharply. Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend.

SPX rallied in Dec 2020, since Fed started cutting rates

Fed’s 2024 interest rate cut plan: 75 basis points next year

The Fed expects to cut interest rates by 75 basis points next year, much faster than expected in September. The median forecast for the federal funds rate at the end of 2024 is 4.6%, although individual forecasts fluctuate widely. Eight officials forecast fewer than three rate cuts next year, while five expected more.

Dot plot

Powell: There is a high probability of ending interest rate hikes in 2024

Chairman Jerome Powell made clear that these forecasts did not constitute a preset plan. He has left open the possibility of further raising interest rates as needed to control a surge in price pressures. However, he did confirm that there was discussion to consider a rate cut at this weeks meeting.

In early December, Powell warned the market against holding out expectations for a rate cut in the first quarter of next year, saying it was too early to tell whether the policy stance was tightened enough and to predict when policy might be loosened. Powell and other policymakers agree that achieving the 2% inflation target will be tough. Policymakers have pledged to keep interest rates high enough for long enough to ensure price inflation returns to target, leading market participants to expect a rate cut as early as March.

While forecasting lower inflation this year and next, the Feds preferred price measure, which excludes food and energy, is expected to rise 2.4% in 2024. Economic growth for next year was revised slightly downward, while unemployment forecasts remained unchanged.

Impact on Treasury Bond Yields

Treasury yields have fallen sharply in recent weeks, effectively erasing gains from the summer through October. A significant tightening of financial conditions may reduce the need for further increases in interest rates. Falling interest rates are already starting to impact the economy, lowering mortgage rates and triggering a recent increase in demand for refinances and home purchases.

Three major benefits: BTC and ETH

The Federal Reserves interest rate cuts have a significant impact on traditional financial markets as well as the cryptocurrency market, especially Bitcoin and other cryptocurrencies.

We see three major benefits for BTC and ETH:

ETF Approval

BTC Halving

Fed cuts interest rates

Bitcoin ETP inflows have soared in recent month as anticipation of a spot ETF has grown.

In a low interest rate environment, investors tend to look for high-yielding assets to achieve the desired returns. This environment could be favorable for Bitcoin, a non-interest-bearing asset that makes it an attractive investment alternative due to its potential for high returns.

Asset managers have been adding to ETH futures as well

Historically, Bitcoin has performed well under low interest rates due to its decentralized nature and potential for significant price appreciation. With interest rates slashed to 0% in 2020 in response to the COVID-19 pandemic, Bitcoins price surged as it was seen as a hedge against inflation and a store of value in an uncertain economic environment.

Interest rate cut = long risk assets

Lower interest rates are also beneficial for other risk assets. Companies can borrow money at low interest rates, thereby increasing capital investment and growth. This situation can stimulate the stock market and increase the value of risky assets. Conversely, assets viewed as safer, such as bonds, may see reduced demand as their relatively lower yields become less attractive.

In summary, while the Feds potential interest rate scissors in 2024 will have broad implications for a range of financial markets, it may be particularly beneficial to Bitcoin and other risk assets because it creates a favorable investment environment.