Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMediumGet deeper research and insights.

Market and Industry Snapshot:

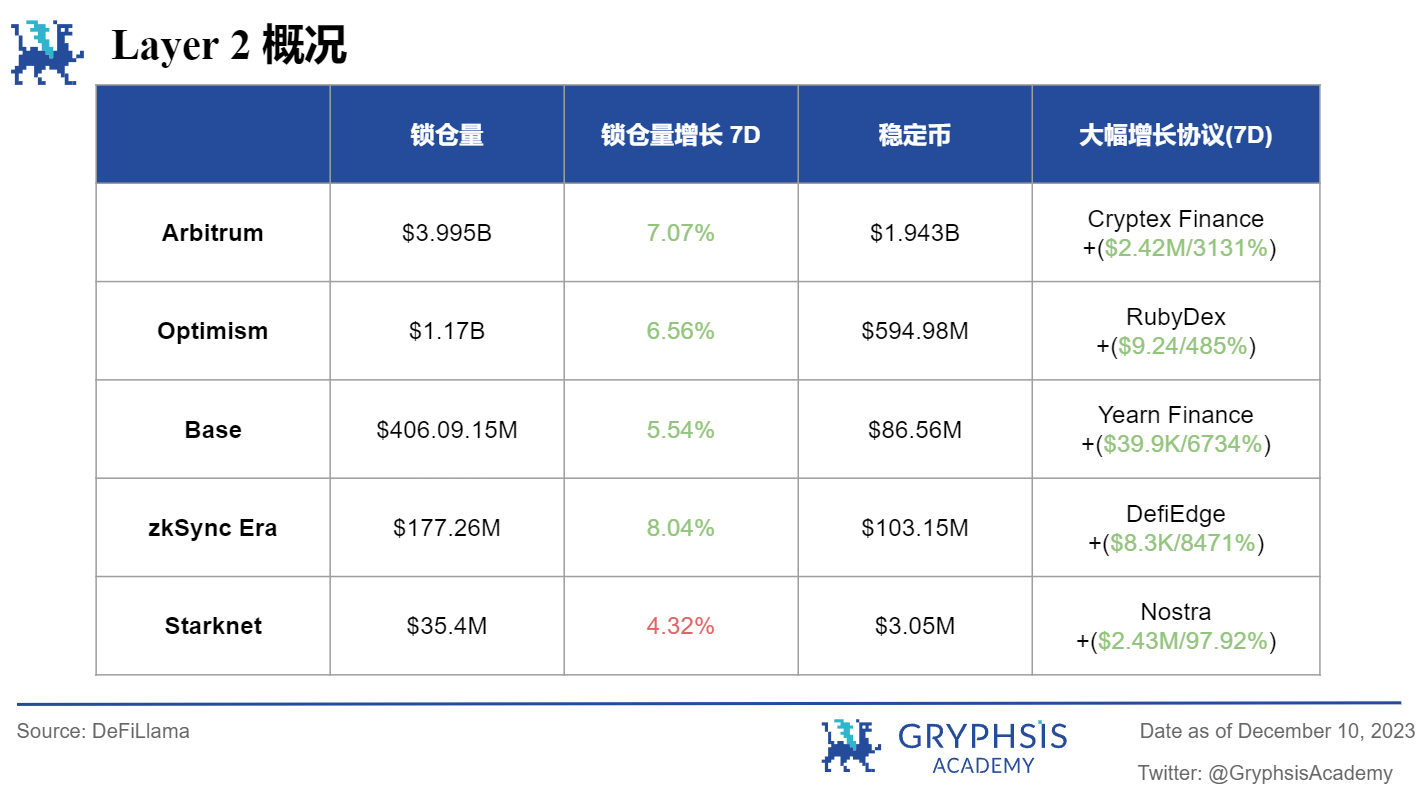

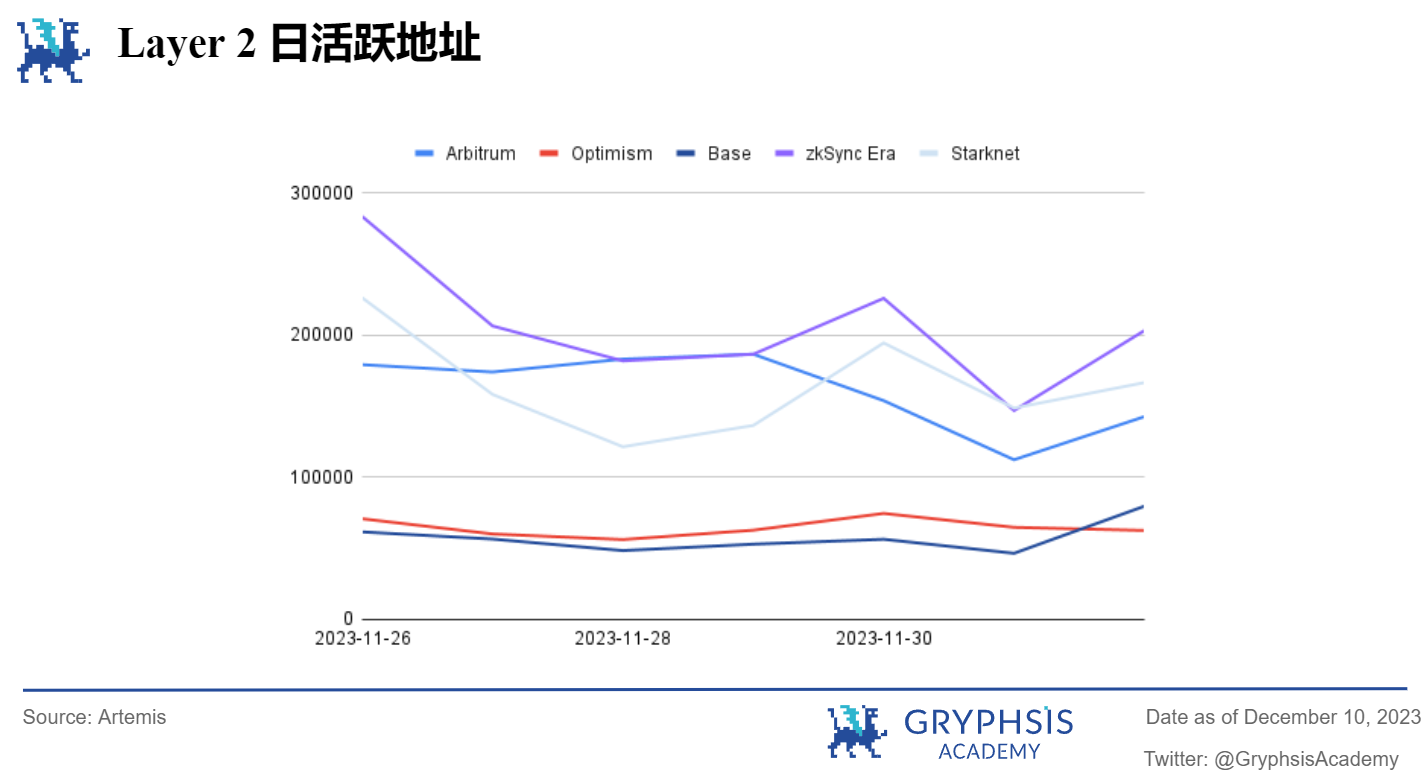

Layer 2 Overview:

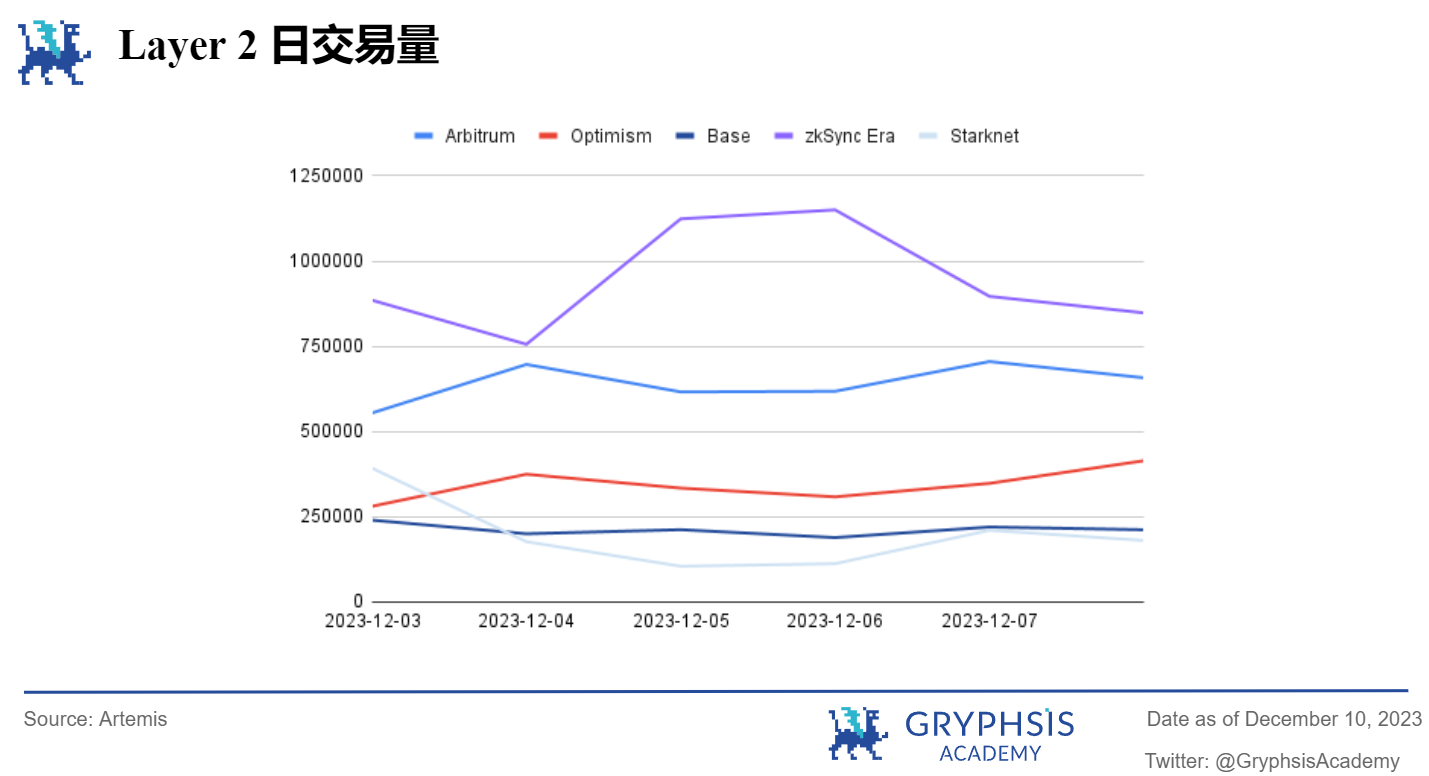

Last week, Layer 2 saw a large change, with zkSync Era showing the most obvious growth at 8.04%. Protocols like Cryptex Finance, RubyDex and YearnFinance, DefiEdge have demonstrated noteworthy TVL growth rates.

LSD Sector Overview:

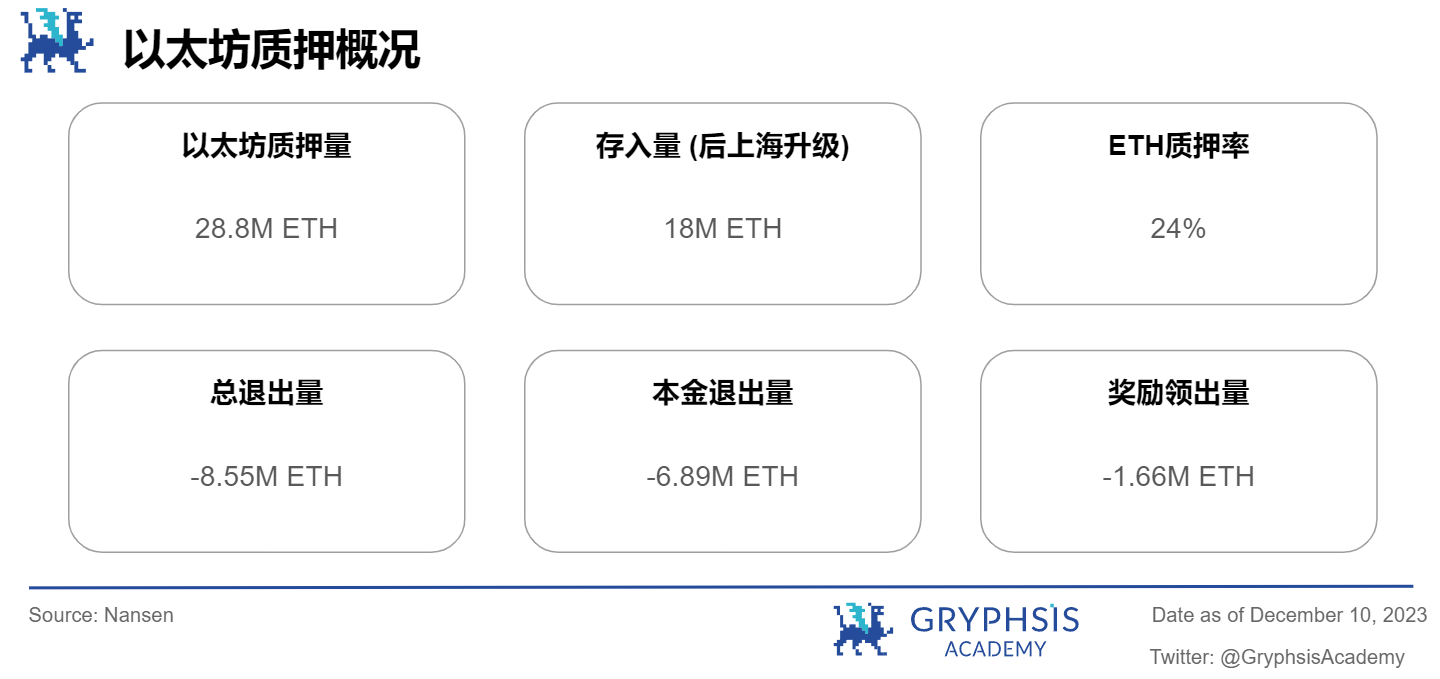

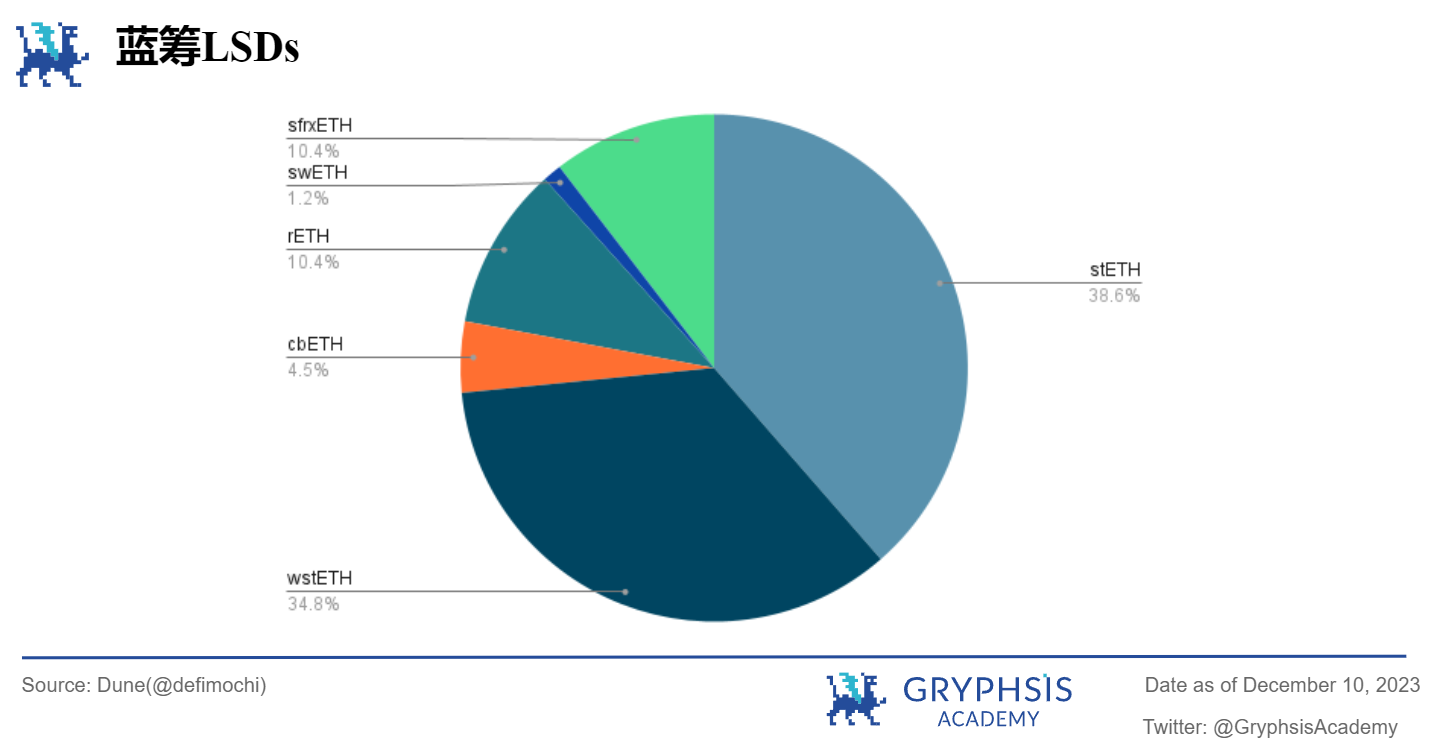

In the LSD field, the amount of Ethereum pledges and deposits have all increased, and the pledge rate has exceeded the hovering boundary in recent weeks and reached 24%. But at the same time, total exits are rising. In terms of market share, all blue-chip LSD amounts increased, with swETH seeing significant growth this week at 21.45%.

RWA Sector Overview:

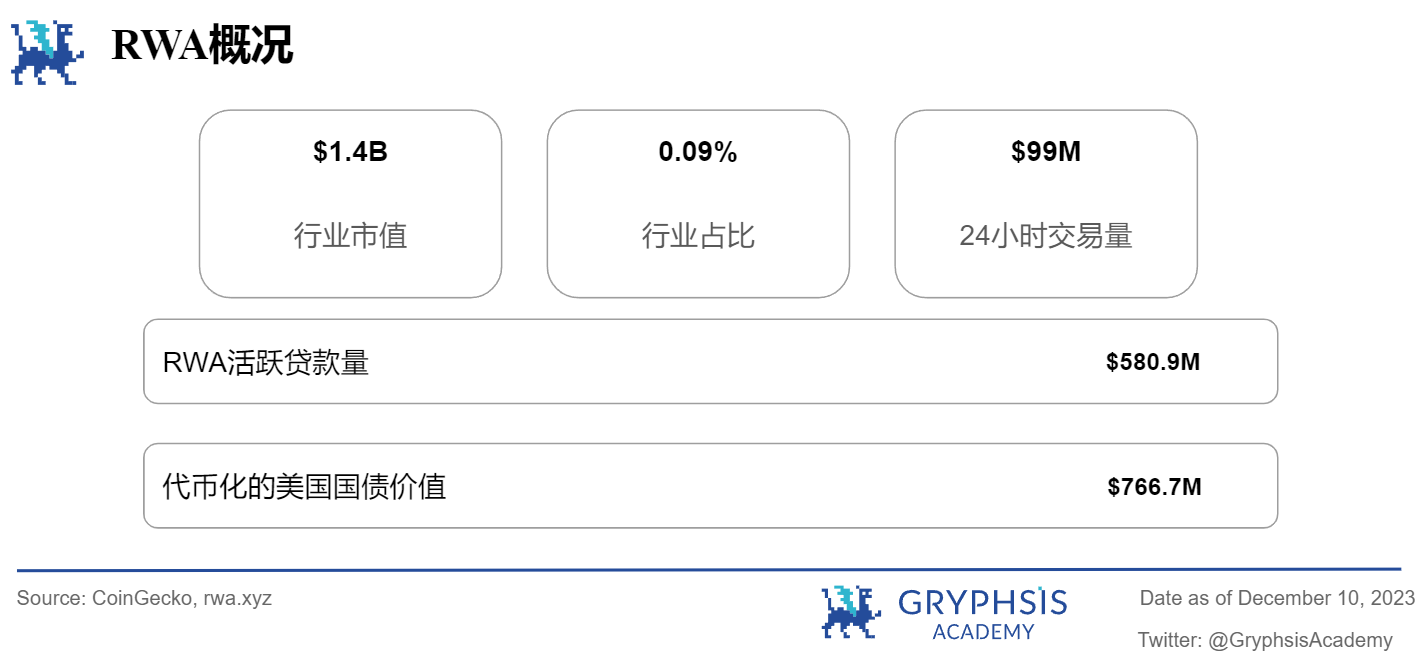

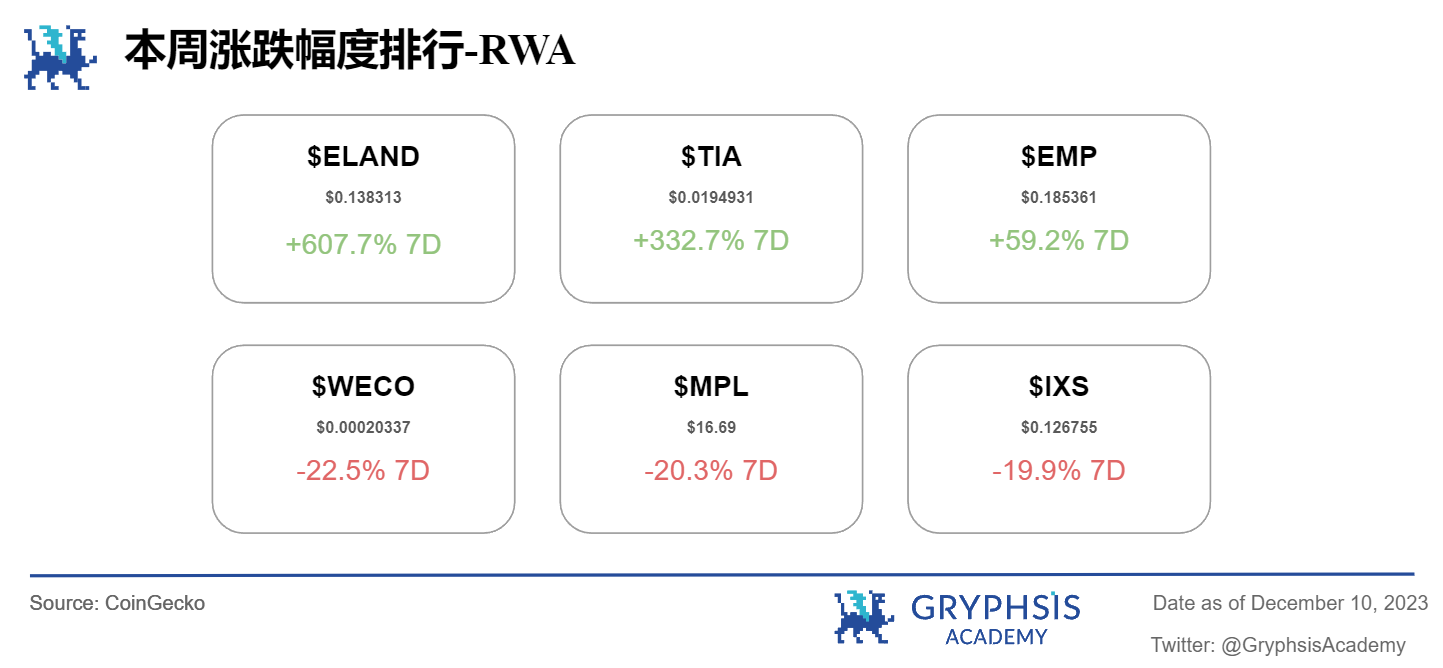

Last week, the worlds real assets fell by 9.09% as a whole, and the 24-hour trading volume fell below 100 M. In addition, the RWA tokenized treasury increased slightly but the value of tokenized U.S. Treasury bonds fell by 2.22%. Notable growth tokens include $ELAND, $TIA, and $EMP. Tokens like $WECO, $MPL, and $IXS experienced larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

BTC Surpasses $ 42 K for First Time in 2023

Weekly Agreement Recommendations:

Chainflip

Weekly VC Investment Focus

Curvance ($ 3.6 M)

Babylon($ 18 M)

Versatus Labs($ 2.3 M)

Twitter Alpha:

@crypthoem on Avalanche’s RWA

@pikachu_crypto on $JTO

@0x AndrewMoh on Base Alpha

@0x AndrewMoh on MYX Finance

@TheDeFISaint on SCWs

Macro overview

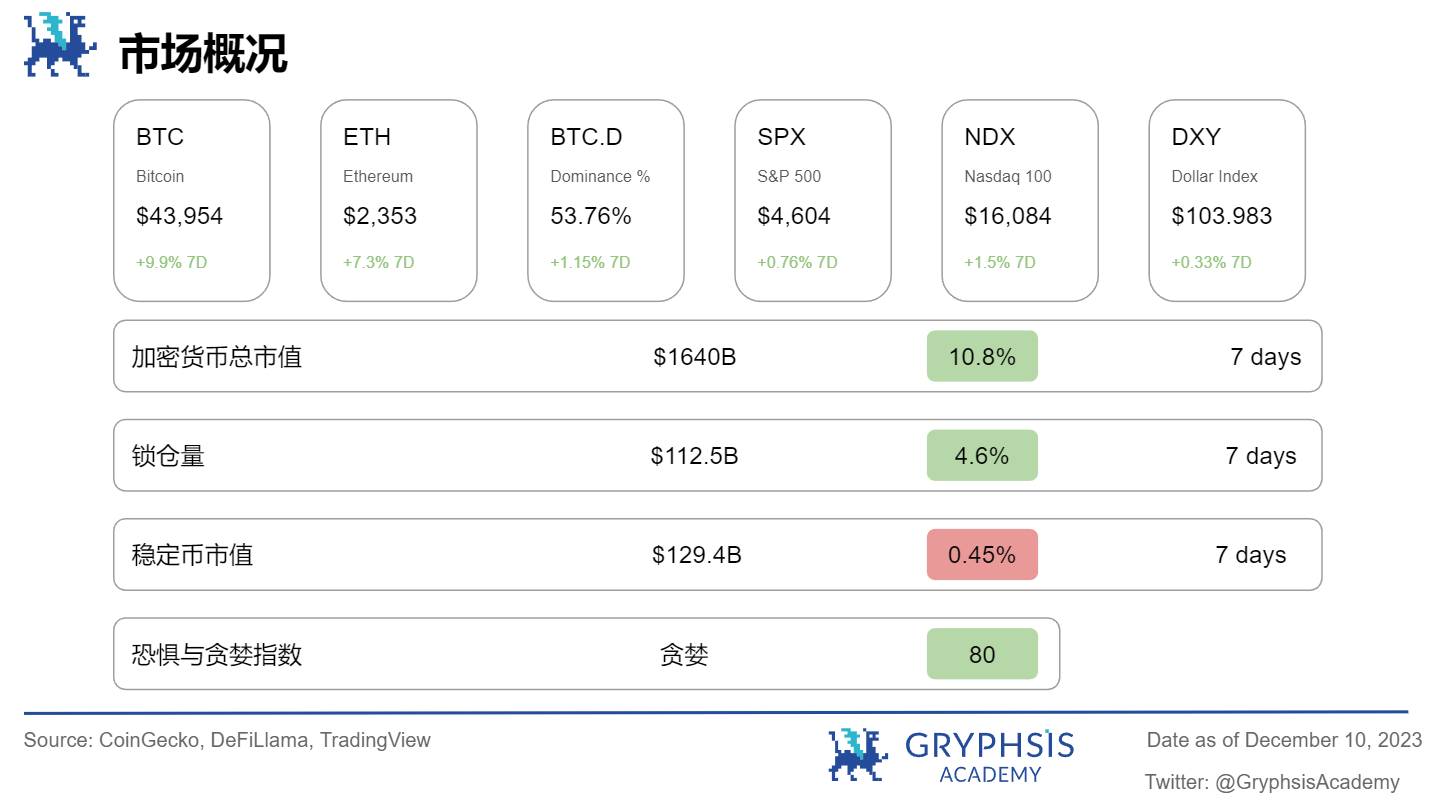

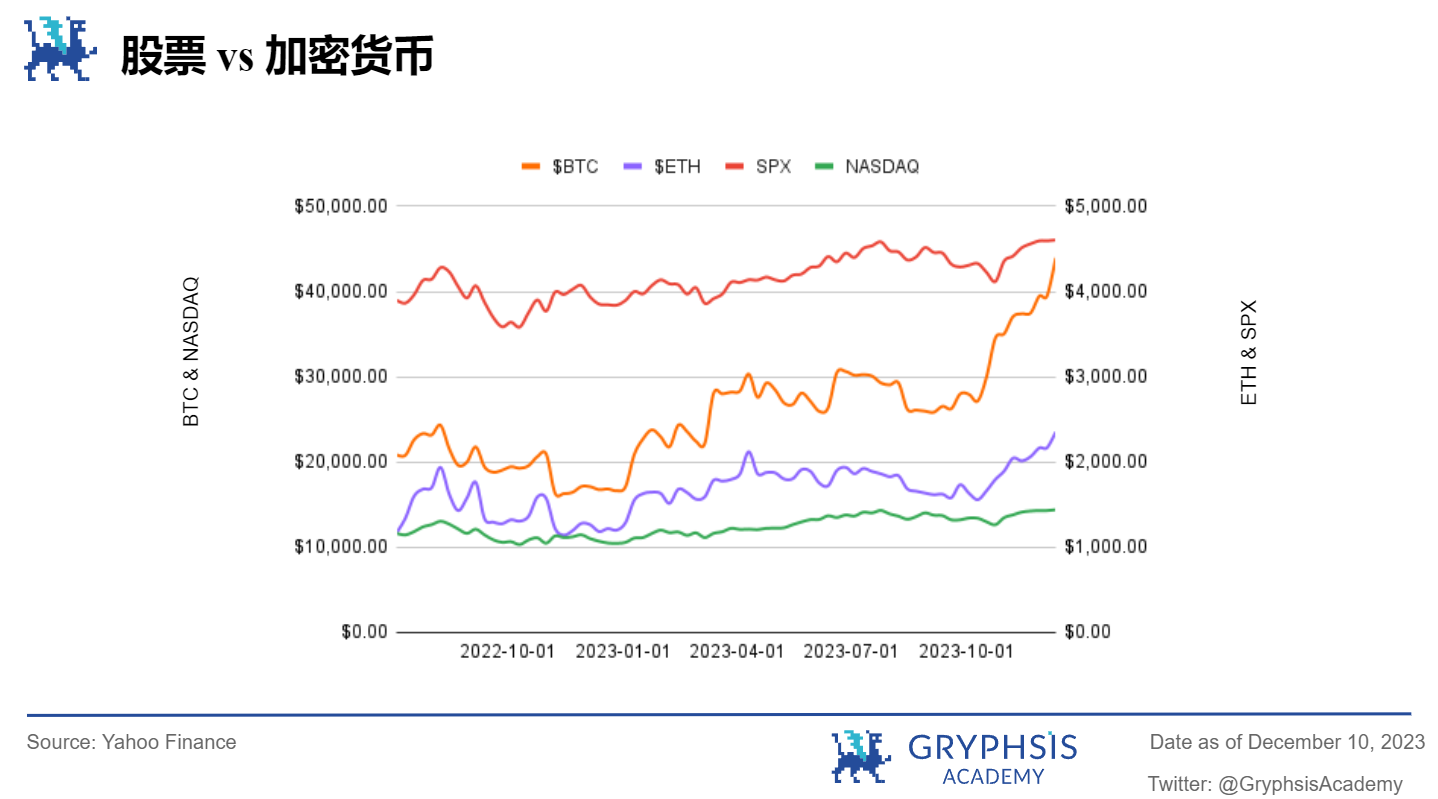

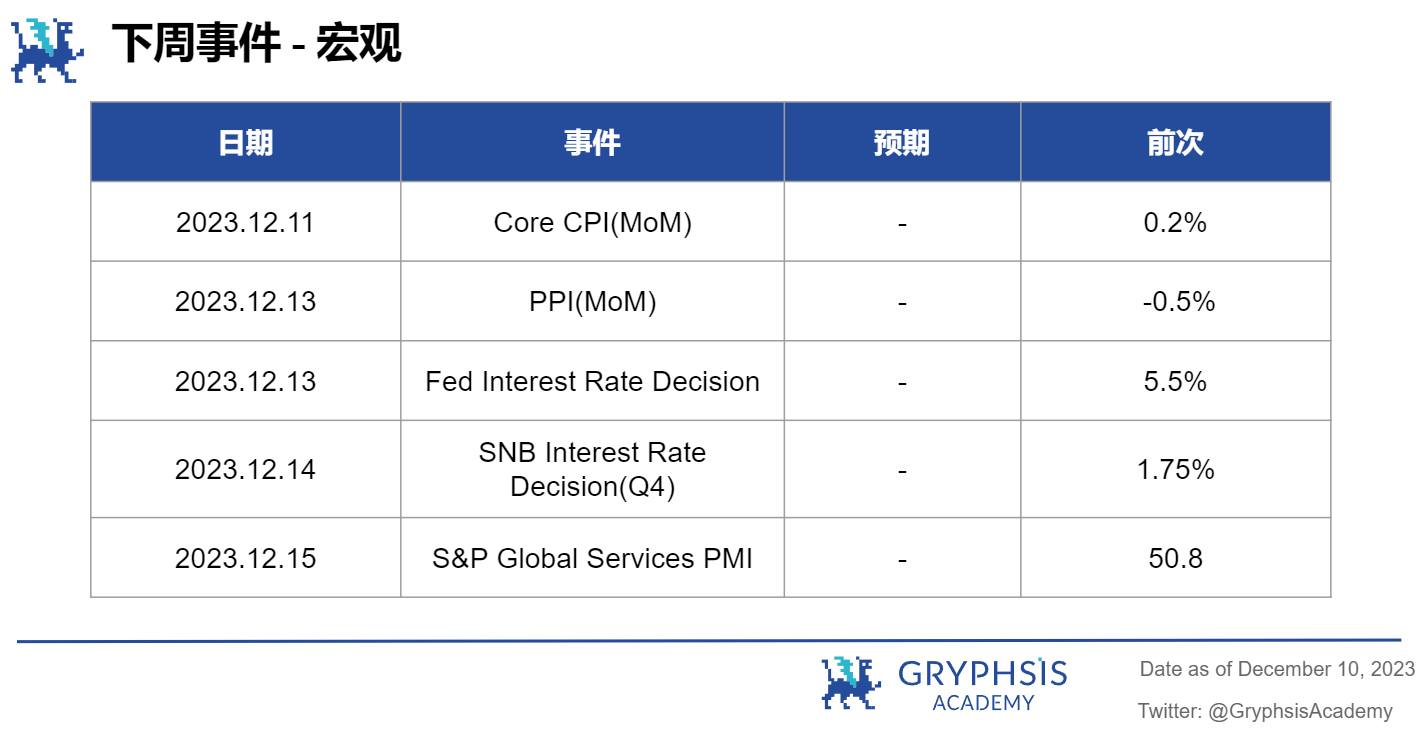

This week saw slight gains at the stock market level, with the SPX and NASDAQ up 0.21% and 0.69% respectively, modest gains compared to the apparent gains in the crypto sector. In the coming week, pay attention to major events such as core CPI, PPI, the Federal Reserve interest rate decision and the Swiss National Bank interest rate decision.

Big news this week

BTC tops 42K for first time this year as panic buying drives cryptocurrency market cap past $1.5 trillion

Since the collapse of Terra, the price of Bitcoin (BTC) has exceeded $42,000 for the first time and the first time since April 2022; in addition, the price of Ethereum (ETH) has also exceeded $2,200. According to CoinDesk index data, Bitcoin prices have been testing the $40,000 level in recent days, finally breaking through this level on Monday (December 4).

The rally also led to gains in cryptocurrency stocks, including cryptocurrency exchanges Coinbase (COIN) and Microstrategy (MSTR), as well as Bitcoin miners Marathon Digital (MARA) and Riot (RIOT), which all rose more than 10%. But other top 10 cryptocurrencies by market capitalization saw smaller gains.

The new high reached by Bitcoin this time also pushed the market value of cryptocurrency to exceed US$1.5 trillion for the first time. Analysts said the rally was fueled by bets on lower interest rates, expectations for a spot Bitcoin ETF and panic buying.

BTC prices have been suppressed by the important resistance level of $38,000 for most of November. After breaking through, BTC rose 5.8% in the past 24 hours. Ethereum (ETH), BNB, and ADA were up 2%-3% on the day, while XRP was trading essentially flat.

The rise of Bitcoin and the increase in crypto market value indirectly driven by it marks the end of the crypto winter since the collapse of Terra in May 2022, and the crypto industry has ushered in a new round of bull market.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose Chainflip, a cross-chain protocol that supports interactions between native value chains.

The asset conversion of past users, from the initial CEX to Uniswaps pioneering and innovative DEX transactions, has created a new era of on-chain transactions. However, as the ecology gradually becomes richer, the demand for cross-ecological interactive assets is growing day by day. As a result, cross-chain bridges and liquidity protocols such as Wormhole, Layerzero, etc. have emerged, thus deriving a series of cross-chain aggregators. By integrating various bridges and The liquidity protocol thus forms a variety of cross-chain paths to help users realize the conversion of different assets in different ecologies.

Chainflip is different from such solutions in that it is committed to realizing the conversion of native assets between chains. There is no need to encapsulate assets or complicated paths, and directly provide liquidity on the supported chain to support transactions. UniSwap is a single-chain Swap AMM protocol, so Chainflip can be understood as a cross-chain AMM protocol.

Currently, Chainflip is still in the test network stage, allowing Ethereum, Bitcoin, and Polkadot to cross each other. However, the mainnet will be launched soon, along with the following updates:

→Swapping launch: Support BTC transactions

→LP incentive program: Provide 1 M LP incentive to motivate LP

→Integrations with Squid & Axelar

→Zellic audit completion

→More chains, wallet, & aggregator integrations

The Chanflip protocol solution has the following characteristics:

Decentralization: Chainflip supports the exchange of native assets. Each supported chain has a corresponding pool. There is no need to aggregate other bridges or liquidity protocols to achieve value conversion between native chains.

Security: It has its own POS verification network to maintain network asset security. All transaction status changes must be jointly confirmed by more than 2/3 of the nodes to achieve overall security. So it can also be called Cross-Chain Liquidity Network.

In addition to having its own POS verification network, the JIT AMM (Just In Time) mechanism it implements is also eye-catching. This mechanism is based on Uniswap V3.

It is essentially a (mixed) liquidity pool that allows LPs to update their liquidity prices before execution when a user initiates a cross-chain transaction. If an LP successfully changes the price and obtains the users transaction, it will Win the deal and get the fees. LPs can reduce user slippage losses by aggregating liquidity on the public order book and making their own offers, minimizing slippage and providing precise pricing by letting LPs compete with each other.

Token economic model:

Chanflips native token $FLIP adopts an elastic supply mechanism, and there are 90 M of $FLIP at the time of creation. However, due to its POS mechanism network, validators can obtain additional $FLIP rewards for producing blocks, thereby effectively motivating and maintaining network security. Since the emission reward is related to the number of tokens staked by the validator, it is estimated that there will be an inflation rate of approximately 6% -22% per year.

However, users need to pay transaction fees for every transaction on Chainflip, which is denominated in USDC. These accumulated USDC will be used to purchase $FLIP and destroy it, thereby controlling inflation by creating buying pressure and destruction mechanisms.

our insights

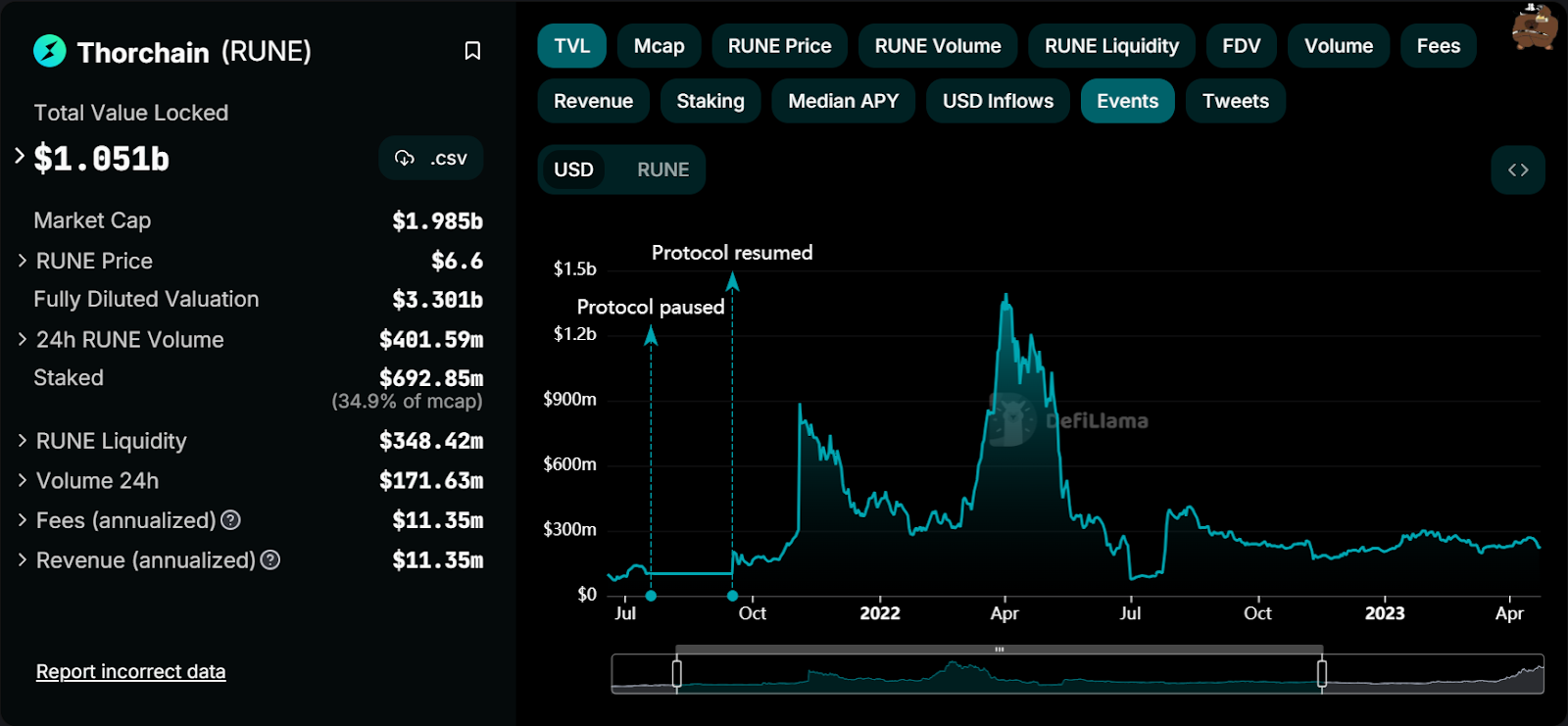

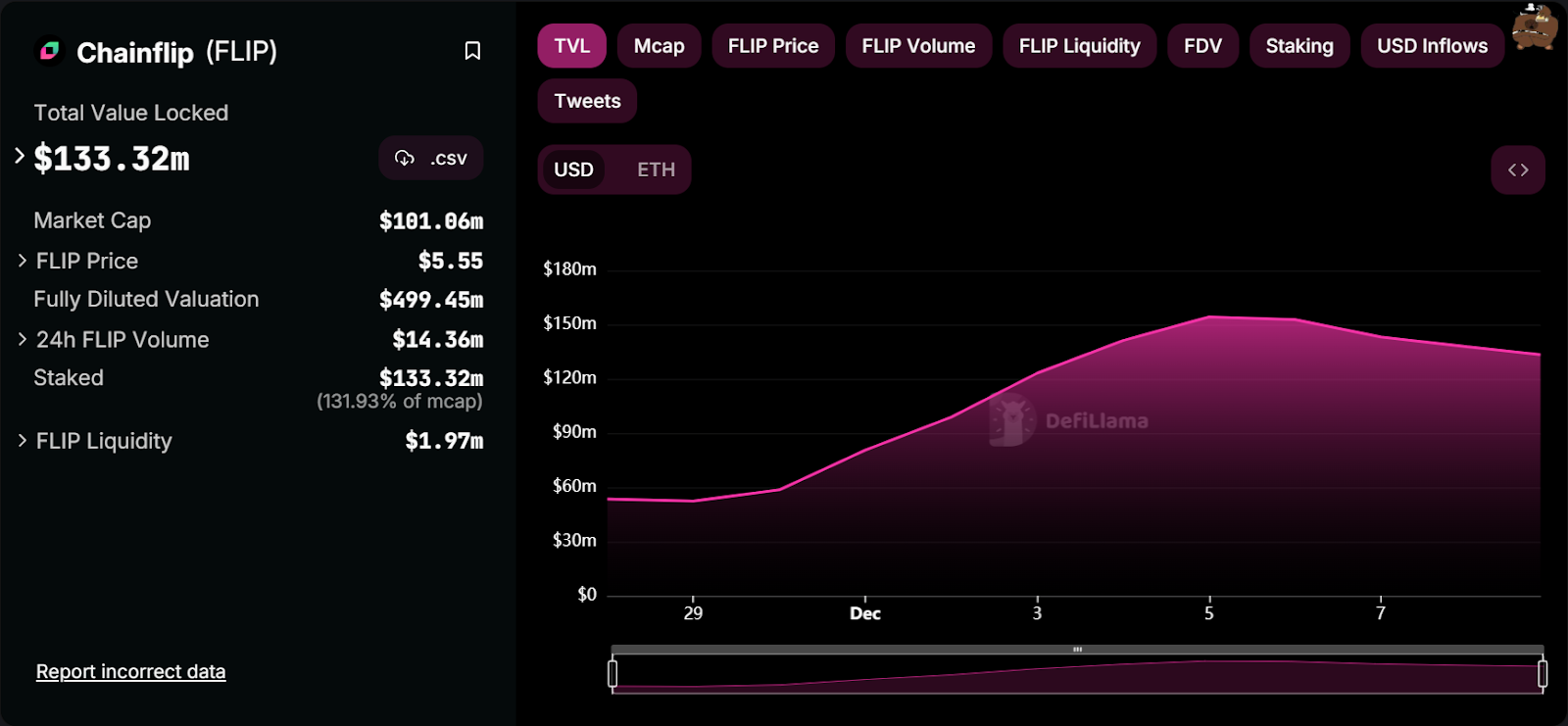

Currently, the trading platform focusing on inter-chain native assets is dominated by THORchain. There is also Maya, a fork project of THORchain, which focuses on cross-chain transactions on this basis. Let’s make a brief analysis and comparison between THORchain and Chainflip.

From the perspective of ecological data: the current TVL of THORchain is 1.051 Billion, while the current Chainflip is only 133.32 M, a difference of 10 times; the 24-hour trading volume of the token $RUNE is nearly 40 times that of $FLIP, and the liquidity of the token is higher; but Judging from the token pledge amount, currently more than 131.93% of MC’s $FLIP is pledged in the ecosystem, while $RUNE’s pledge amount is only 34.9% of MC’s.

Source: Defillama

Source: Defillama

From a product perspective, THORchain currently supports many native asset swaps on multiple chains including THORchain, Ethereum, Avalanche, and BSC chains, with a large support space; however, Chainfilp is still in the testnet stage and only supports three chains and their respective supported ones. Tokens (3). So in terms of product maturity, Chainflip still has a long way to go, but Chainflip is slightly better in terms of product experience such as wallet connection.

From the perspective of ecological financing, THORchain has raised a total of 4 rounds of financing. Except for strategic financing and other details that have not been disclosed, the estimated total financing amount is 5 M. Investment institutions include Delphi Digital, Multicoin Capital, and Judging from the available funds and team resources, Chainflip may have stronger support for its development.

However, since the current development stages of the two are different, the above analysis is only for reference. We will focus on Chainflip’s future growth potential.

As mentioned above, in terms of the token pledge ratio, the total number of pledged tokens/tokens in circulation is 1.31, considering its own POS mechanism network and the only token emission is from validator rewards. Validators need to stake tokens, and the proportion of block rewards they receive is linked to the amount of their pledges. So it can be seen that basically the validators will stake the emission rewards they receive to obtain higher emissions.

In addition, the official updates on the main network include Swap functions, liquidity incentives, and its own token repurchase and burning mechanism. It can be seen that Chainflip attracts users to participate in the ecosystem at all levels while staking tokens to control selling pressure.

In general, Chainflip is currently a cross-chain native asset exchange protocol. Its product mechanism is mature and the experience is good, but the delivery speed is slow. Strong control over circulation at the token level may effectively attract a wave of users in the upcoming mainnet function launch (LP incentives).

https://www.panewslab.com/zh/articledetails/8847uif5.html

Gryphsis Research Focus

Welcome to this week’s Gryphsis Research Spotlight, where we share the latest insights from our team. Our dedicated research team continues to explore the most cutting-edge trends, developments and breakthroughs in the crypto space. This week, we’re excited to share our newly released report, so let’s dive in!

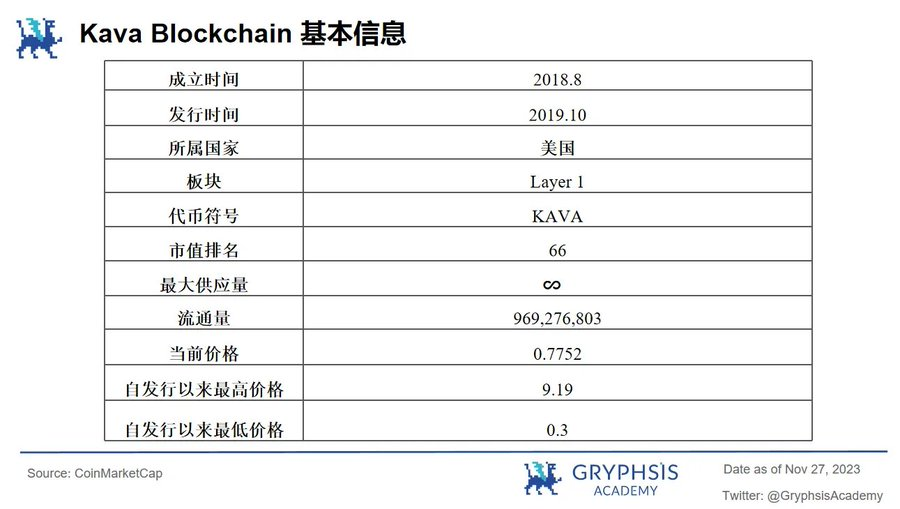

Kava was originally a Defi Hub chain for CDP full-chain lending, but later switched to an interoperable chain developed using the Cosmos SDK that is compatible with EVM and allows users to seamlessly interact with ecological assets.

Kava was originally a Defi Hub chain for CDP full-chain lending, but later switched to an interoperable chain developed using the Cosmos SDK that is compatible with EVM and allows users to seamlessly interact with ecological assets.

Now as the stablecoin Hub chain of Cosmos, there are currently 72.5 M USDT in the treasury. As the undertaker of EVM’s native stablecoin assets entering the Cosmos ecosystem, it plays an important role in Cosmos’ DeFi.

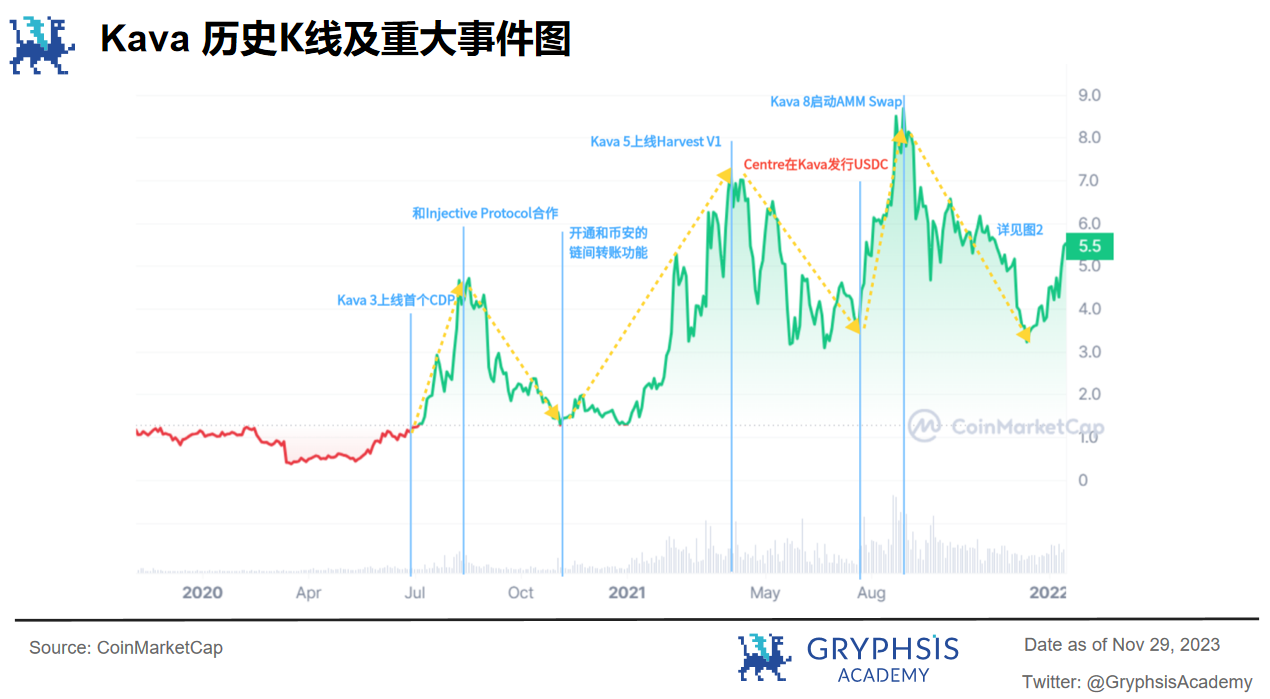

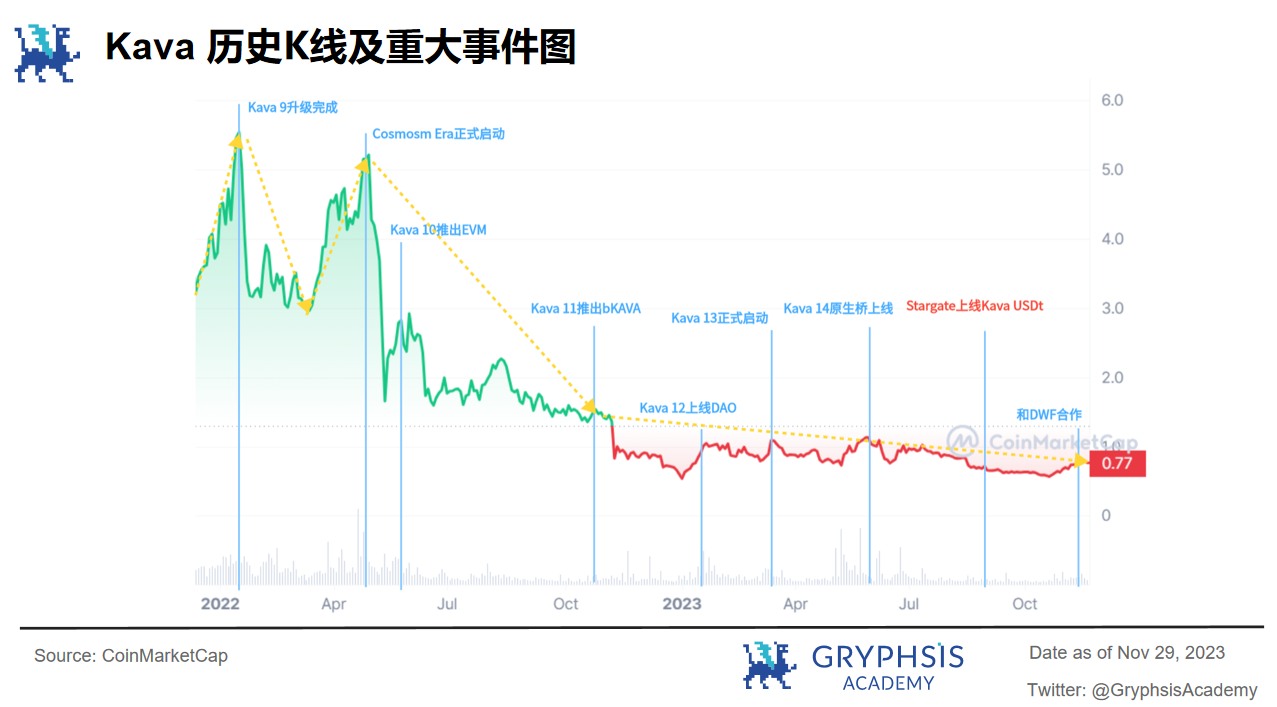

We briefly reviewed the historical events of Kava and the corresponding K-line chart:

We briefly reviewed the historical events of Kava and the corresponding K-line chart:

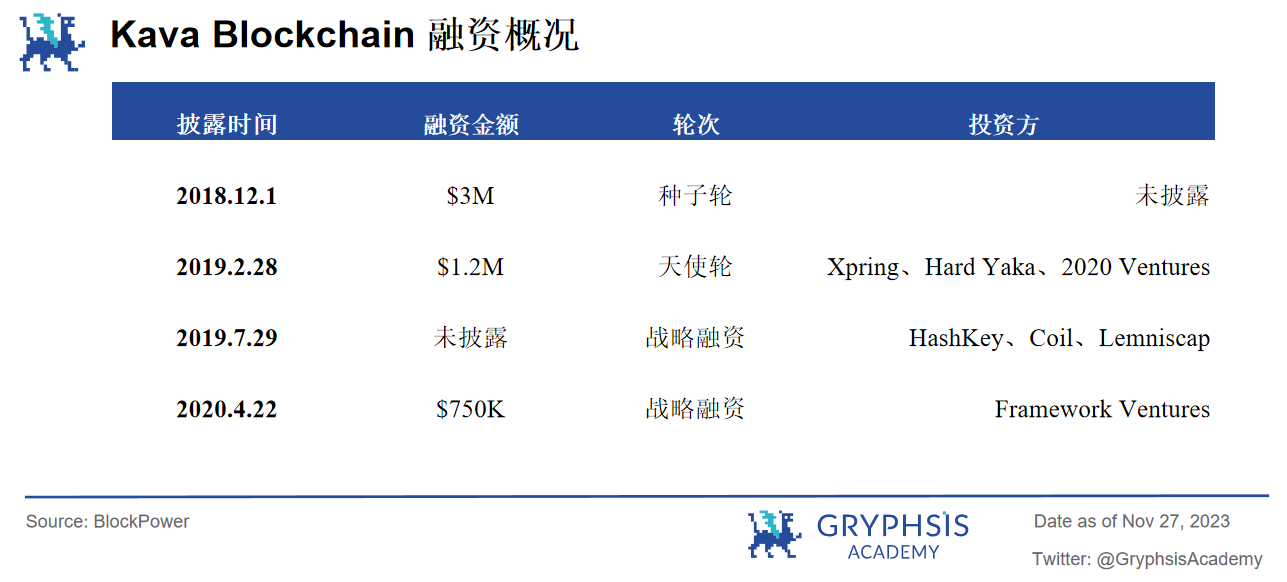

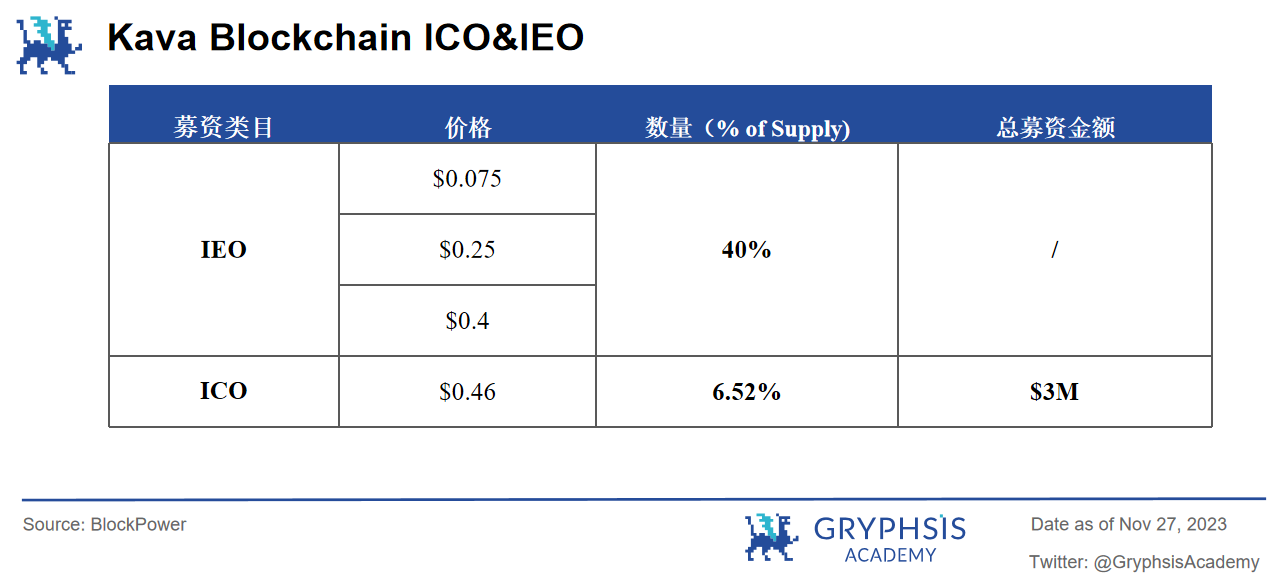

Kava has disclosed financing of nearly $5M, with investors including Binance Labs, HashKey, etc. $KAVA was issued on October 16, 2019, and 40% of the initial supply was sold to investors through multiple rounds of private placements. An additional 6.25% of the total supply was publicly sold on Binance Launchpad at a price of $0.46, raising a total of $3 M.

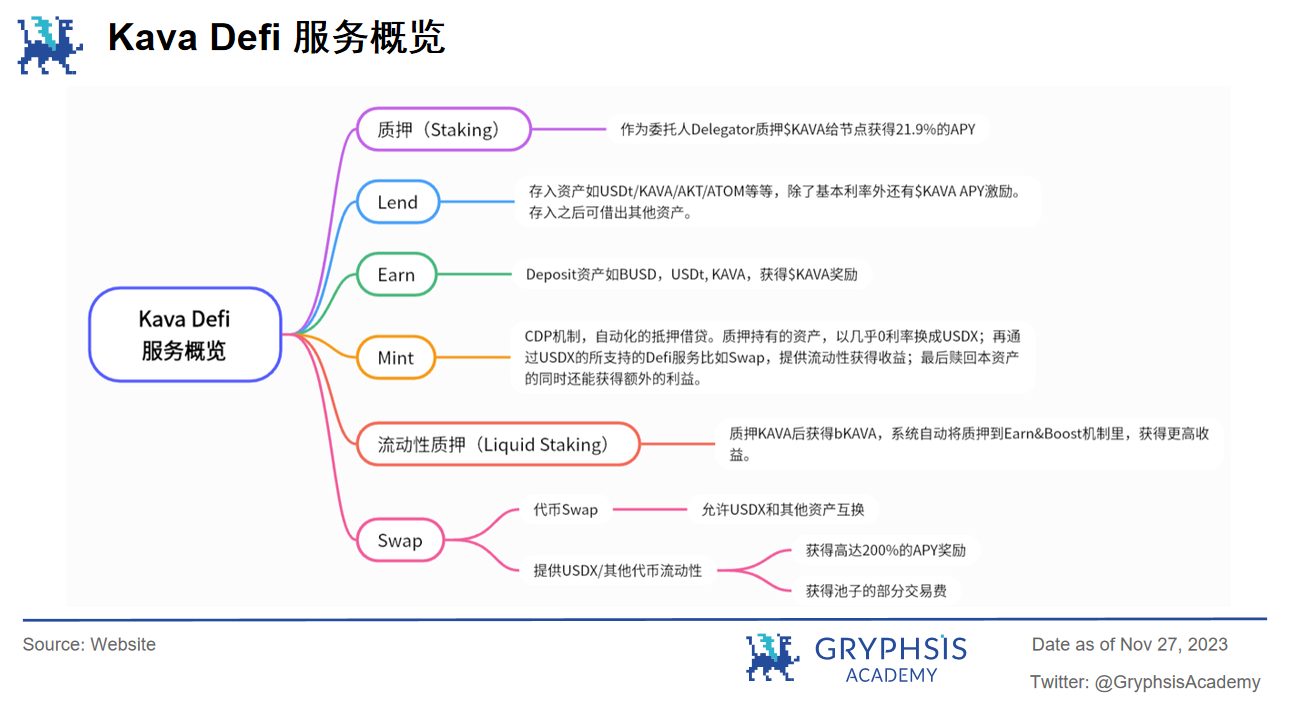

Kava is mainly divided into the following Defi services:

Kava is mainly divided into the following Defi services:

Kava Staking: Retail investors holding $KAVA can act as principals to pledge their assets to the entrusted node and obtain income from it.

Kava Lend: From Harvest to Hard Protocol at the beginning, and finally changed its name. Allow users to deposit BTC, XRP, BNB, BUSD and other ecological assets as suppliers, and lend other assets. The ecosystem not only provides basic interest rate incentives to loan users, but also $KAVA mining incentives.

Kava Earn: As a Defi profit strategy, users are encouraged to lock $bKAVA to obtain high APY, thus increasing Kava’s TVL.

Kava Mint: Renamed from the Kava CDP protocol, it allows users to mortgage cross-chain assets to mint the mortgage stablecoin USDX.

Liquid Staking: Stake the $KAVA you hold to obtain $bKAVA. The system will transfer the deposited $KAVA to the Earn mechanism to obtain higher returns.

Kava Swap: An AMM model’s Swap mechanism that allows users to seamlessly trade various assets on different blockchains or earn additional income by providing liquidity.

The current total TVL of Kava is 340.67 M, the market value of the stablecoin is 129.06 M, and the daily trading volume is 1.44 M. More than 116 protocols have been deployed on it, of which the DeFi category accounts for a high proportion. However, according to the protocol rankings, Kava’s native Defi service currently dominates. The top five are basically covered by Kava Lend, Kava Mint, Kava Earn, etc. There is no outstanding native service in the ecosystem like Blur on Arbitrum. Independent Agreement.

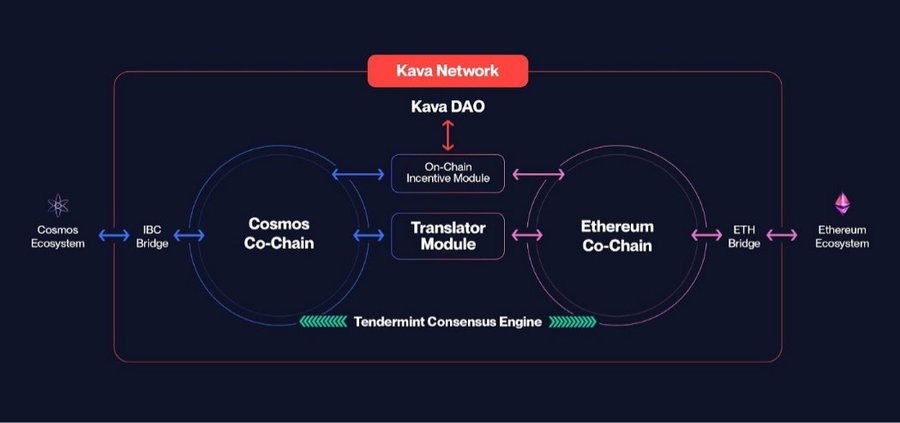

Its structure is divided into Cosmos Co-Chain and Ethereum Co-Chain, both of which are created on the Tendermint consensus engine. Ethereum Co-Chain allows developers to use Solidity to deploy or directly migrate applications to Kava. Cosmos Co-Chain communicates with the entire Cosmos ecosystem through the IBC protocol, and the two connect two different execution environments through the Translator Module.

Its structure is divided into Cosmos Co-Chain and Ethereum Co-Chain, both of which are created on the Tendermint consensus engine. Ethereum Co-Chain allows developers to use Solidity to deploy or directly migrate applications to Kava. Cosmos Co-Chain communicates with the entire Cosmos ecosystem through the IBC protocol, and the two connect two different execution environments through the Translator Module.

Kava is internally divided into Kava IBC (Cosmos environment) and Kava EVM (EVM environment), among which:

1) Cosmos to EVM:

The native internal bridge launched in Kava 14, as a Cosmos SDK module, can be integrated into various applications and wallets. Allows users to transfer Cosmos assets to the EVM environment in the form of ERC 20, thereby realizing asset transfer.

2) EVM to Cosmos:

Currently, Kava EVM is allowed to cross to Kava IBC, Osmosis and Injective on the Cosmos side and Evmos on the EVM side. $USDtand $ATOM.

However, we can find that Kava’s asset transfer on the EVM side is weak. The only supported Evmos chain is not part of the Ethereum ecosystem. It is also a Layer 1 compatible with both EVM and Cosmos. Therefore, the level of Kavas real interaction with the Ethereum ecosystem has not yet been fully realized. Currently, it is only supported by Stargate or other cross-chain aggregators, and the scope of internal support is weak.

Kava uses a dual-token economic model, with the equity and governance token $KAVA and the stablecoin $USDX.

$KAVA: As an ecological token, it has a wide range of uses, such as being a pledge token for POS, a form of inflation rewards, transaction fees, voting and governance, etc.

$bKAVA: Liquid pledged derivatives token, allowing pledged $KAVA to still enjoy liquidity.

$wKAVA: $wKAVA is the encapsulated token of $KAVA, with ERC 20 attributes.

$USDX: The systems native stablecoin is mainly used in the CDP protocol. By pledging tokens, USDX is obtained to obtain higher liquidity, similar to DAI in MakerDAO.

In the upcoming K15, it is clearly proposed to abandon the inflation rate, that is, the number of tokens circulating in the market is the maximum supply. No new $KAVA can be created, and the inflation rate is scheduled to be permanently reduced to 0 on December 31st.

$KAVAs surplus comes primarily from native project emissions, transaction fees, and the foundation. That is, $KAVA, as this part of the ecological fee, will return to the community rather than directly to the node validators. It is up to the community to decide how the funds are used (destroyed or reinvested), further increasing the decentralization of the network.

In this way, the total supply of $KAVA will only decrease but not increase. As $KAVA serves as an ecological fee and enjoys governance rights, the demand will gradually increase during the subsequent ecological growth, and the demand side will increase significantly.

As an interoperable chain between Cosmos and EVM, Kava has relatively weak internal support for EVM assets on the Cosmos side, but it still has advantages compared with other competing products. In particular, it has USDT (EVM) stablecoin assets of $72.5M in the treasury, which provides a basis for subsequent interoperability with the Cosmos ecosystem.

In addition, in the context of the current prevailing narrative of application chain, whether it is Layer 2 Stack or Layer 1 such as Cosmos Polkadot, ecological development can never be separated from interoperability. As an interoperable chain, Kava will implement DeFi service intermediaries between major EVM application chains and Cosmos application chains in the future.

It is worth noting that $KAVA, as an ecological governance fee token, will achieve 0 inflation on December 7. Stopping supply-side output in the context of expanding application scenarios will undoubtedly trigger an explosion on the demand side. Combined with its formal cooperation with DWF, I believe $KAVA can bring more surprises in the future.

Full report: link.medium.com/g2r17wtNlFb

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Curvance

Curvance is a DeFi protocol that provides users with efficient returns and can support both Ethereum and many other mainstream public chains. Curvance has announced the completion of a $3.6 million seed round, with support from Offchain Labs, Wormhole, and well-known investors. Chris Carapola, co-founder of Curvance, said Curvance will use the capital raised to expand its value proposition and provide a more accessible money market experience for DeFi users.

https://x.com/Curvance/status/1732052722969718843?s=20

Babylon

Bitcoin staking protocol Babylon has secured $18 million in Series A funding co-led by Polychain Capital and Hack VC. Babylon is a new protocol designed to allow Bitcoin holders to stake and earn rewards on a proof-of-stake blockchain. The protocol is scheduled to launch around the “next Bitcoin halving,” which is expected to be April 2024. Babylon is already connecting with the Cosmos Hub and Polygon networks. Investors in the round also include Framework Ventures, Polygon Ventures, Castle Island Ventures, OKX Ventures and Symbolic Capital.

https://x.com/babylon_chain/status/1732766789241634838?s=20

Versatus Labs

Blockchain scaling startup Versatus Labs (formerly known as VRRB Labs) has closed a $2.3 million seed round at a $50 million valuation. The company, which previously set out to develop a Layer 1 network, has turned to blockchain for scaling. Versatus Labs is currently focused on Ethereum and is building a stateless rollup - LASR - designed to improve scalability. Andrew Smith, founder and CEO of Versatus Labs, said LASR can be either a Layer 2, Layer 3 or Layer 1 offline execution environment. Investors in the round include NGC Ventures, Republic Crypto and Hyperithm.

https://x.com/VersatusLabs/status/1732449189051707738?s=20

protocol event

TON blockchain slows to a halt as Ordinals-inspired protocol sees surge in activity

Uphold launches self-custody wallet that supports XRP token

BitDegree Joins Forces with Leading Web3 Companies to Educate the Masses About Web3

Merit Circle DAO seeks to grow ecosystem with Immutable partnership

Xion rolls out testnet based on 'generalized abstraction'

Industry updates

US defense authorization bill leaves out crypto provisions

Senators propose a bill to expand Treasury sanctions powers and address crypto.

Republican presidential debate sees candidates discuss SBF, Binance, CBDCs and Gary Gensler

Terraform Labs asks judge to let jury decide if UST and LUNA tokens are securities

JPMorgan CEO Jamie Dimon tells Sen. Elizabeth Warren that government should shut down crypto

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://twitter.com/crypthoem/status/1732525315174301740?s=19

https://twitter.com/pikachu_crypto/status/1732609637550047521?s=19

https://twitter.com/0x AndrewMoh/status/1732350340937527296? s= 19

https://twitter.com/DeFiMinty/status/1732441094011437560?s=19

https://twitter.com/wacy_time1/status/1732466207713095845?s=19

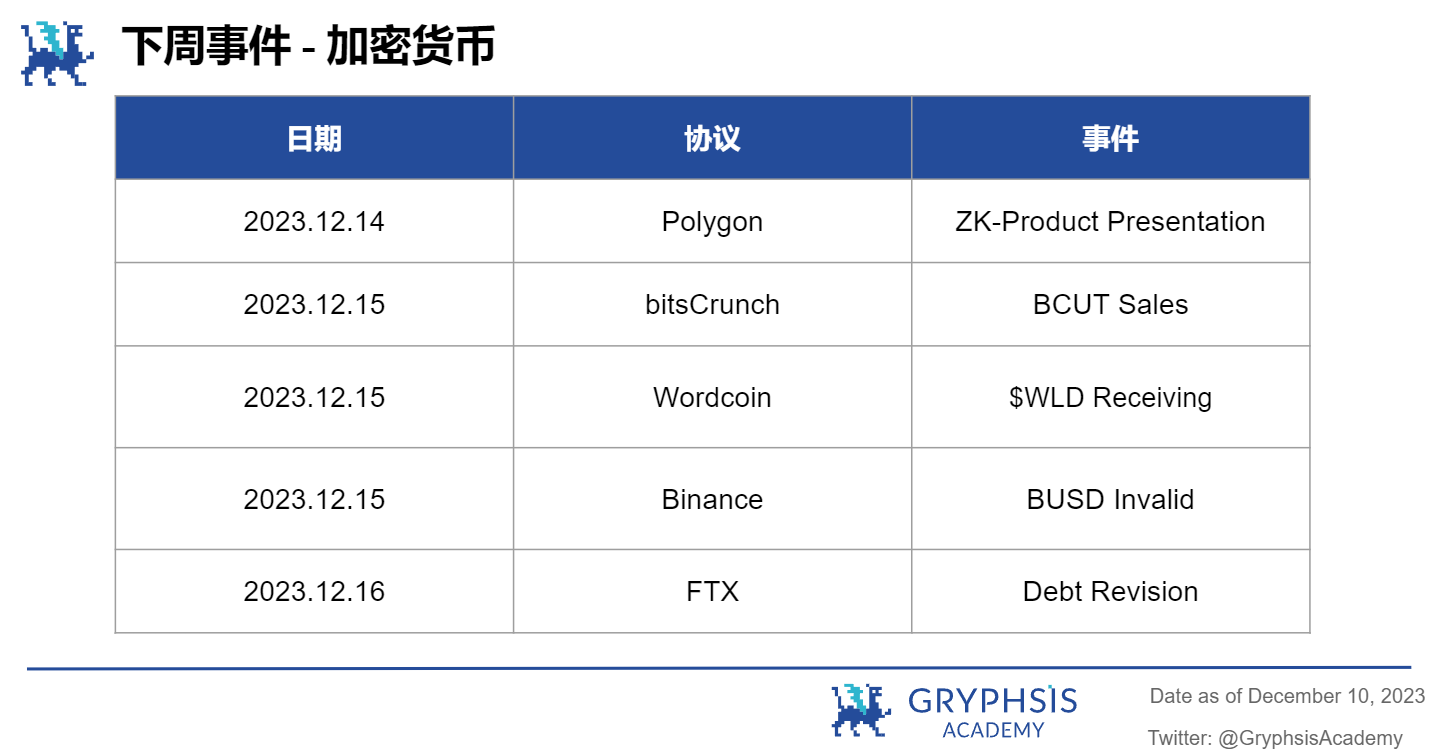

next week events

news source:

https://foresightnews.pro/article/detail/6116

https://www.panewslab.com/zh/articledetails/ph4354siz6kv.html

https://www.theblock.co/post/266518/bitcoin-staking-babylon-series-a

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.