BTC fell by $3,000 in one hour, is it a normal correction or the end of the bull market?

Original - Odaily

Author-husband how

OKX Ouyi Quotes show that at 10 a.m. this morning, the price of Bitcoin fell by more than 3,000 US dollars in an hour, falling to a minimum of 40,200 US dollars. This is the first time that Bitcoin has fallen below 41,000 US dollars since it exceeded 40,000 US dollars on December 4. . As of press time, BTC has rebounded to $42,008, a 24-hour drop of 4.17%.

Market review: Bitcoin briefly fell to $40,200

Due to market expectations for Bitcoin spot ETFs and the slowdown in the Federal Reserves interest rate hike policy, Bitcoin experienced a sharp rise last week, rising from a maximum of $39,428 to $44,726.8, with a maximum increase of 13.43%. But today at 10:12 Beijing time, the price of Bitcoin fell briefly from US$43,700 to US$40,200, the largest single-day drop of 7.7%, the largest single-day drop since this round of rising prices.

In the past seven days, both Bitcoin and altcoins have been rising sharply. Among them, the established public chain has seen a larger rise. However, after experiencing a decline this morning, although the overall increase has occurred, it has shrunk more. In the past 7 days, ETH has only increased by 1.1%, with a tentative price of $2237.58. The ETH/BTC exchange rate has rebounded, but is still at a low level, with a maximum of 0.05483, and is currently tentatively quoted at 0.05304.

In the previous 7 days, among the top ten tokens by market capitalization, only Solana (11.1%) and DOGE (14.1%) increased more than BTC; among the top 50 tokens by market capitalization were AVAX (57.8%), DOT (20.9%), and IMX ( 30.8%), INJ (28.3%) and EGLD (28.4) increased by more than 20%, and the remaining other tokens generally showed an upward trend.

Affected by the downward trend of the overall market, the current total crypto market value has exceeded 1.641 billion U.S. dollars, with a 24-hour decrease of 3.3%; crypto users’ trading enthusiasm is generally on the rise. Today’s Panic and Greed Index is 74 (last week’s average was 73), and the degree of greed has changed little. , overall greedy.

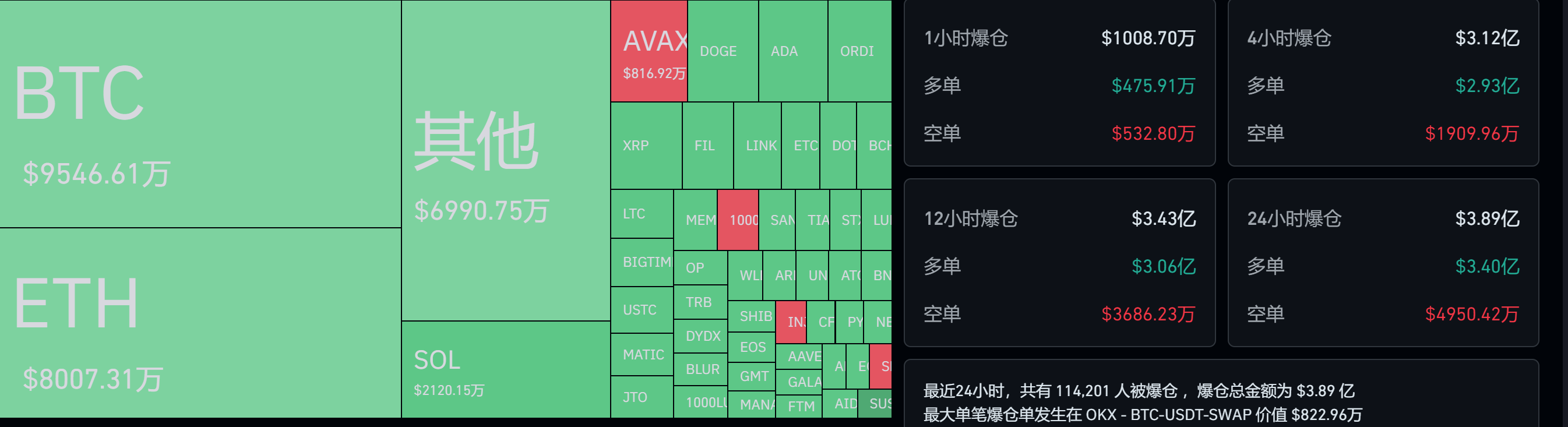

In terms of derivatives trading,According to CoinglassAccording to the data, the entire network liquidated USD 389 million in the past 24 hours, including USD 95.4661 million in BTC and USD 80.0731 million in ETH. A total of 114,201 people became victims of liquidation.

The total BTC contract holdings on the entire network were US$19.181 billion, a decrease of 2.2% in 24 H. Among them, CME ranked first with a holding of $5.107 billion, and Binance ranked second with a holding of $4.204 billion. In addition, the ETH contract holdings on the entire network were US$7.861 billion, a 24-hour decrease of 7.62%.

Grayscale productsThe discount rate has decreased compared with last week. The discount rate of GBTCs net asset value is currently -10.71%. The discount rates of other gray mainstream currency trusts are as follows: ETH (-13.47%) and ETC (-28.60%); there are 11 positive Premium products are FIL (+575.11%), SOL (+240.62%), LINK (+234.18%), MANA (+160.13%), XLM (+118.32%), LPT (+55.76%), BAT ( +57.45%), LTC (+49.04%), ZEN (+45.00%), BCH (+72.73%) and ZEC (+4.17%).

Crypto-related listed companies are generally under the influence of rising prices, with stock prices generally rising by around 5% in the past week. Among them, the share price of Coinbase (NASDAQ: COIN), a US-compliant encryption platform, rose 7.66% today and was provisionally reported at US$146.62; the share price of MicroStrategy (NASDAQ: MSTR), the largest listed company with Bitcoin holdings, rose 4.96% today and was provisionally reported at US$599.39.

Callback to deleverage, looking forward to it"V"word inversion

Today, the overall market suddenly went down. There was no adverse news at the news level, and the market sentiment was generally upward. One possible reason is that the market has risen sharply recently, and the strong bullish sentiment has caused a market correction.

Especially in recent days, the funding rates of perpetual contracts on major platforms have soared, hitting new highs one after another. The BTC funding rate even reached 0.03%. A correction can better reduce the leverage ratio of the market and achieve a healthier rise.

In addition, social media has a more objective view of this round of corrections.

Michael Saylor, co-founder of MicroStrategy, posted on the X platform that he was ready for a stampede, with a picture of a Bitcoin golden bull.

CredibleCrypto posted on the"V"The word reversed and crossed $60,000.

Civic founder Vinny Lingham posted on the X platform that liquidity in the crypto market was low on Sunday night. This (the fall) is just an easy way to scare retail investors.

Will Clemente, co-founder of Reflexivity Research, posted on the X platform that Bitcoin doubled in 2 months without a correction, and it is not surprising that there is a correction now. Pullbacks push weak hands and leverage out of the market, setting a stronger foundation for eventual gains. Bitcoin’s volatility is a feature, not a bug.

According to the above-mentioned remarks of the well-known OG in the industry, it can be seen that the overall sentiment in the market is still upward, and most people believe that this time it is just dormant before the rise.

Future: The overall benefits remain unchanged, interest rate cut + halving + spot ETF approval

Although Bitcoin had a brief correction today, it did not fall below $40,000. The future trend is still affected by the following factors.

One is the expectation of approval of the Bitcoin spot ETF. The most critical time point at present is before January 10 next year. Bloomberg analyst James Seyffart said that the approval window for spot Bitcoin ETFs is expected to be between January 5 and 10, 2024. If the Bitcoin spot ETF is finally approved, it may bring more incremental funds to the crypto market, thus driving up the price of Bitcoin. Refer to the case of the price surge after the passage of the gold spot ETF.

The second is the halving market. The Bitcoin halving time is on May 9, 2024, and the time is gradually approaching. According to the previous halving market, Bitcoin is due to the decline in issuance speed and the reduction of the supply side. If the demand remains unchanged, it will also lead to an increase. In addition, historical data shows that Bitcoin will peak around 368-550 days after the halving, and then bottom out 779-914 days after the halving.

Third, the Federal Reserve is expected to cut interest rates. Currently, major institutions or relevant data are saying that the possibility of the Federal Reserve cutting interest rates in 2024 is gradually increasing.

Feedback from market conditions shows that the crypto market fluctuates more frequently. Odaily would like to remind everyone that investment involves risks and should be treated with caution.