LD Capital: Overview of new POW tokens: A victory for miners, communities and mining machine manufacturers?

Original author: LD Capital, Duoduo

Ethereum transferred from POW to POS in September 2022. The miner community is looking for new POW tokens, which has spawned some new POW projects. After more than a year of development, in November 2023, the price of the new POW project Kaspa surged, with a market value of more than US$3 billion, entering the top thirty. Driven by Kaspa, new POW tokens have achieved relatively good gains as a whole.

Ethereum transferred from POW to POS in September 2022. The miner community is looking for new POW tokens, which has spawned some new POW projects. After more than a year of development, in November 2023, the price of the new POW project Kaspa surged, with a market value of more than US$3 billion, entering the top thirty. Driven by Kaspa, new POW tokens have achieved relatively good gains as a whole.

This report briefly analyzes the reasons for the rise of POW projects, takes stock of new POW projects with a market value of more than 40 million, and current problems.

1. Reasons for the rise of new POW projects

First of all, Ethereum moved from POW to POS in September 2022, resulting in a large amount of spare computing power. These computing power are looking for new POW projects. Kaspa was launched during this period and quickly gained support from these computing power. Some miners of old POW tokens have observed the new trend and have successively invested their computing power in new POW projects.

Secondly, there are some investors who prefer the POW model, believing that this model is the orthodoxy of the blockchain, and have become early participants in the POW project community. The main members are mainly from European and American communities, and many Twitter bloggers participated in early POW projects.

Third, the market value of new POW projects is lower, which is more friendly to newcomers who have just entered this market. New people are willing to buy a project with a low market value and wait for the overall market to come. The old POW projects, such as BCH and LTC, have higher market capitalization and many hold-ups. As for the Ethereum series projects, due to the previous gathering of a large number of VCs, the valuations were very high. The market value of newly listed tokens was hundreds of millions of dollars, accompanied by a long period of release and selling pressure. For these projects, newcomers have low willingness to enter.

Fourth, these projects have a tendency to incorporate new trends in narrative. In addition to high-performance, smart contract operating platforms, most of them are combined with concepts such as artificial intelligence and the Internet of Things to propose the concept of useful proof of work to attract financial attention.

Fifth, Kaspa was promoted by miners and communities in the early days. By February 2023, it had attracted much attention in the POW project. In March 2023, mining machine manufacturers launched professional mining machines to increase mining computing power. At this point, mining machine manufacturers have entered the market and participated in the new POW project. The sudden increase in computing power caused the price of KAS to fall, but then it continued to rise until it ranked among the top 30 in market capitalization.

With the success of KAS, the market value of new POW tokens has opened up, and projects with acceptable fundamentals have all achieved good gains in November.

2. Brief introduction to new POW projects

When POW projects are launched, their market value is usually only a few hundred thousand dollars. After early community development, tokens were listed on small exchanges such as Xeggex (called “Egg Exchange” by the community). Danzhi has a large number of POW tokens with a market value ranging from hundreds of thousands to millions. Early players struck gold here.

After a POW project reaches a market value of 5 million to 10 million US dollars, it may enter a second-tier exchange, such as Matcha or Gate.io. After being listed on a second-tier exchange, the market capitalization can grow to between $10 million and $50 million. As for a larger market value, it requires more funding and fundamentals.

In terms of market capitalization, KAS and TAO are in the first tier, with a market capitalization of more than US$1 billion and a market capitalization ranking within the 50th place. In the second tier, that is, with a market value of more than US$100 million, there is only one project, QUBIC. Moreover, the project has not yet been listed on any second-tier exchanges, the actual trading volume is very low, and the price may be artificially high. The third tier is between US$10 million and US$100 million. At the bottom are a large number of tokens under $10 million.

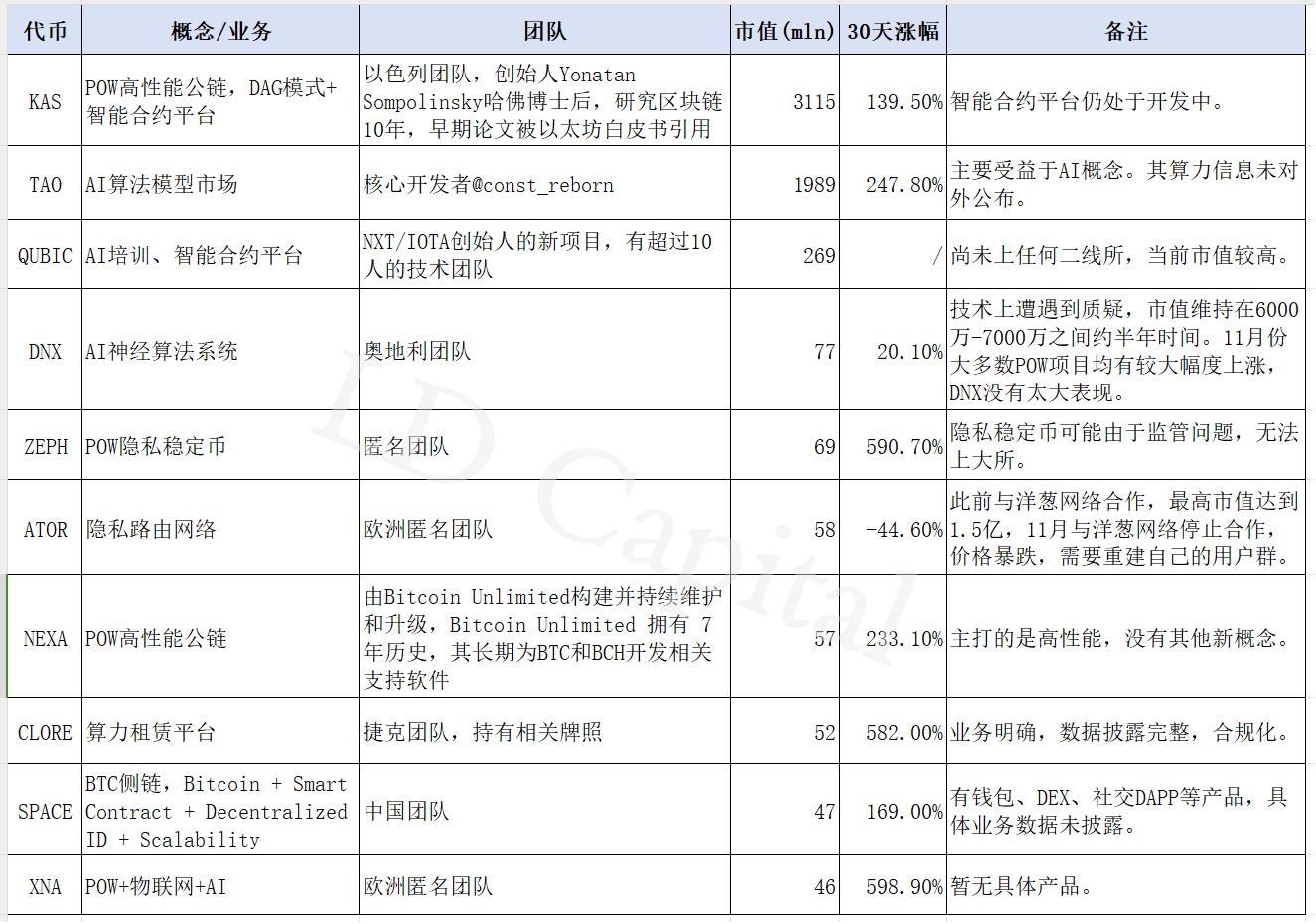

The table below is a brief summary of POW tokens with a market cap of over $40 million.

Source: LD Capital

3. Development issues of new POW projects

First, most projects are equivalent to L1 projects and are currently in the early stages of development. They have only built the structure of mining and currency issuance. As for business and ecology, most of them are still in the expansion stage. For example, KASs smart contract platform is currently under development. ZEPH is a stable currency, but its stable currency currently has no usage scenarios. ATOR is a privacy routing network, but due to the breakdown of cooperation with the Onion Network, it needs to rebuild its user base.

Second, POW tokens with certain fundamentals in the early stage have a market value between 40 million and 100 million US dollars, and have basically experienced a 5-10 times increase. Short-term development expectations have been digested, community financial power has also been consumed, and it is currently entering a period of shock and consolidation. Tokens with a market value of less than US$10 million have basically not reached second-tier exchanges. Their trading volume is very low and they are easily manipulated, with prices rising and falling in the short term.

Third, POW tokens are also facing the release of tokens. Most tokens may release 30% -40% of their tokens in the first two years. These tokens are mainly in the hands of large miners. If large miners sell off, the project tokens will face a larger decline.

Third, projects that are combined with specific AI businesses are more likely to receive financial attention. TAO and CLORE are concepts that superimpose POW and AI. TAO belongs to the AI algorithm model market. Developers around the world provide AI algorithm models, forming an AI algorithm model market; users choose the algorithm models they need. The higher the rating and the more used a model is, the more incentives its developers will receive. CLORE is an AI computing power rental platform equipped with nearly 6,000 NVIDIA mid-to-high-end GPU chips, which can be rented for mining, rendering, AI training, etc. Lessors who provide high-performance chips to the network will be incentivized with CLORE tokens.

4. Conclusion

It can be seen that the revival of POW projects is the result of the joint efforts of many parties. In essence, miners have the computing power to look for new POW projects, the community looks for projects with low market value and good narratives, and mining machine manufacturers look for projects that can gain community support. At the same time, the rise of AI has increased computing power to the level of infrastructure in the data era, and the POW project has its own computing power and can easily be combined with AI to create a secondary superposition of narratives.

However, a large number of POW projects are a mixed bag, and it is necessary to investigate and understand the project narrative, business, team, and community, think about the probability of its sustainable development, and the probability of obtaining large financial support.