Weekly Editors Picks (1216-1222)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

invest

What are the elements of a track that makes you sit right and get a hot start?

The threshold for participation is low, there is continuous discussion, a hundred flowers bloom rather than a single one, it is new, the track concept is imaginative, and the project party and the community actively promote it.

For investors, what requires more skill is how to exit safely during the carnival. You can refer to the following signals: reinventing the wheel without innovation, funds and enthusiasm are dispersed; the popularity and prices of leading companies have cooled down, and there has been no steady rise.

Spartan: Nine major crypto industry trends in 2024

AAA Web3 games, building on Bitcoin, consumer applications and Asian markets, MA-driven integration, major applications, zero-knowledge proofs and modular blockchains, on-chain proxies, virtual goods and aesthetic crypto brands, DePIN and Bitcoin Coin ecology, AI×blockchain, Web3 consumer, social and gaming, tokenization of RWA and Bitcoin network.

An overview of the three major narratives and hot projects in 2024

Narratives typically unfold in a time-based pattern. Different characteristics determine whether a narrative is short, medium, or long. We can analyze the dynamics of specific industries over a period of time through platforms such as CoinGecko; reasonable measurement of social media popularity can play a huge role in identifying narratives (such as Twitter); some narratives are triggered by events outside the cryptocurrency field (such as macro).

Once a potential narrative has been identified, the next step is to research specific items within that narrative. Important metrics to track include market capitalization and fully diluted market capitalization (FDV).

AI projects worthy of attention include Bittensor (TAO), Render (RNDR), SingularityNet (AGIX), Ocean Protocol (OCEAN) Autonolas (OLAS), PAAL AI (PAAL), OctaSpace (OCTA), and Akash Network (AKT).

RWA projects worthy of attention include Maple Finance (MPL), Centrifuge (CFG), Pendle (PENDLE), Landshare (LAND), Realio (RIO), Goldfinch (GFI), Propchain (PROPC), Galileo Protocol (LEOX), Clearpool ( CPOOL), Credefi (CREDI).

Projects worth watching on GameFi include Nakamoto Games (NAKA), Shrapnel (SHRAP), Big Time (BIGTIME), Star Atlas ($ATLAS), Dubbz (DUBBZ).

A look at Messari analyst positions: Solana becomes investment consensus

We are bullish on Bitcoin and Solana, and bullish on AI tokens. Most of them hold SOL or related ecological tokens, followed by AI concept tokens such as OLAS\AKT\TAO\RNDR, and DePIN, DeSoc, and DeSci. Emerging narratives. For a more complete argument, see Messari: Top 10 Investment Trends for 2024》。

Pantera Capital: 6 Biggest Predictions for the Crypto Market in 2024

Bitcoin’s resurgence and “DeFi Summer 2.0”; tokenizing social experiences for new consumer use cases; adding TradFi-DeFi “bridges” such as stablecoins and mirrored assets; the convergence of modular blockchains and zero-knowledge proofs ; More computing-intensive applications are put on the chain, such as AI and DePIN; a hub and spoke model that integrates public blockchain ecosystems and application chains.

Glassnode: 2023 Annual On-Chain Data Review

Net capital inflows into BTC, ETH and stablecoins. October is a major pivot point for institutional capital flows. Currently, the supply of Bitcoin held by long-term holders is almost at an all-time high, and the vast majority of Bitcoin is now profitable. Tether re-establishes stablecoin dominance, CME futures disrupts Binance, and options markets see significant growth.

Explore the next hot track after Bitcoin Inscription: POW Mining Coin

The reason why the POW mechanism can rise again is that in addition to its security, stable infrastructure, fairness and decentralization characteristics, the combination with emerging technologies also brings new opportunities and development space for it. Some new POW projects combine current technology trends, such as artificial intelligence, Internet of Things and other technologies, and propose innovative application scenarios and solutions, attracting the attention of more developers and users.

From the perspective of market value growth potential, the current POW mining currency is in a golden period with huge potential.

The article further introduces Kaspa, Spacemesh, Conflux, and Bittensor.

AUCTION has skyrocketed. Are there any other “golden shovels” worth paying attention to?

The golden shovel continues to inject capital leverage vitality into the crypto industry. The Bitcoin ecosystem includes Bounce Brand (AUCTION), TurtSat (TURT), BitStable (BSSB), MultiBit (MUBI), and other ecosystems include Solana Saga mobile phone, TonUP (UP), and SuiPad (SUIP).

The rise of the DePIN circuit, a look at 6 projects worthy of attention

IoTeX (IOTX)、Hivemapper (HONEY)、DIMO (DIMO)、Streamr ( DATA )、WiCrypt(WNT)、XNET(XNET)。

Start a business

Revisiting the application layer: The era of reflexivity is finally over

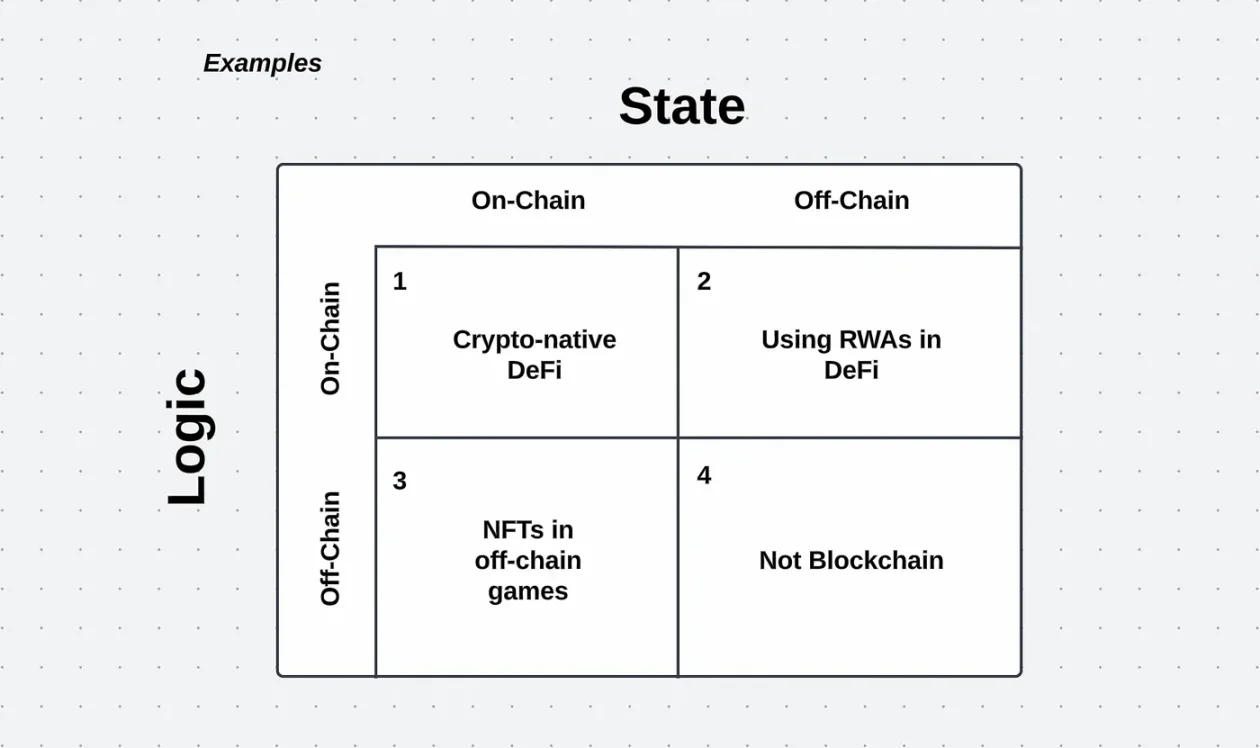

Cryptocurrencies have little real-world appeal beyond speculation. The application layer has two components: state and logic. State is data; logic is calculation. Both state and logic can be on-chain or off-chain.

The first quadrant: the complete on-chain economy represents speculation and inefficient financial services; the second quadrant (programmable finance) is represented by RWA, centers and stablecoins; the third quadrant (off-chain applications) is represented by social assets ( For example, NFT, friend.tech), and DEPIN that represent identity.

As Quadrants 2 and 3 take up an ever-larger share of the cryptoeconomy, the market will become less reflexive. Once we develop exogenous demand for crypto assets and protocols, Quadrant 1 becomes less cyclical. Suddenly, Uniswap was no longer just an engine to facilitate speculation, it was a decentralized business with relatively stable demand.

DEPIN

An in-depth interpretation of 5 potential projects on the DePIN track

The article introduces Render Network, Helium, Livepeer, Arweave, and Hivemapper.

The DePIN track is still in a very early stage. Although it has great potential to break the circle, the threshold for non-Web3 users to access, understand and use it is actually relatively high, and it lacks complete infrastructure and unified standards. , resulting in mediocre development and usage experience and insufficient network availability. The moats for each project are not deep. From an investment perspective, DePIN is a business with upper and lower limits. The projects all have real demand, supply and income, and the token price has an invisible ceiling. A recent new concept in Solana is called OPOS (Only Possible On Solana), which claims that many applications will only be implemented on Solana, and DePIN is one of their main tracks.

Bitcoin Ecology

What is the real potential of Bitcoin asset issuance protocol RGB?

RGB requires that every state of each contract must be attached to a certain Bitcoin UTXO; once this state is to be changed, this UTXO must be spent and the transaction that spends it must be confirmed by the blockchain; in addition, spending it Bitcoin transactions must also provide a hash of the contents of the state transition to indicate the UTXO attached to the changed state. The advantages of RGB are lightweight verifiable status, scalability, differentiation of asset definitions and customs declaration mechanisms, enhanced privacy, restrictive terms, and cross-access.

We also recommend a super comprehensive review report: Summary and Outlook of Bitcoin Current Situation in 2023” and an article “Innovation Beyond Ordinals: A Detailed Look at Stamps and SRC-20 Tokens》。

inscription

A glance at the ecological landscape of Inscription Infrastructure

Wallets: Unisat, OX Web3 Wallet, Xverse, Ordinals Wallet, Hiro Wallet,

Cross-chain: MultiBit, Analysoor, TeleportDAO,

Trading markets: OKX Ordinals Market, Unisat Marketplace, Ordinals Market, Ordswap, Magic Eden Bitcoin, Orders Exchange,

Launchpad: TurtSat, Luminex, Foundry Tools: Looksordinal, iDclub, CoinTool, MCT, BIIS,

Data Query: ordiscan, BRC-20.io, OrdSpace, Ordinals Directory, Best in Slot, GeniiData, Whatscription, OrdinalHub.

Another recommended article is Index Navigation: A must-read for inscription players: A guide to the on-chain inscription market》。

Multiple ecology and cross-chain

recommendFull interpretation of the current situation of Solana DeFi: Overview of 10 major sectors》。

Hot Topics of the Week

In the past week, Inscription stress tested the performance of each public chain.SOL’s market capitalization exceeds US$42 billion,U.S. federal judge approves Binance and CFTC settlement agreement,SEC opens comment period to weigh whether Ethereum vs. Bitcoin spot ETFs should be treated differently,CertiK issues high-risk warning and urges to upgrade OKX iOS app,FTX and its affiliated debtors reach global settlement with joint official liquidators, Sanjian Capital liquidation party:Creditors are expected to recover approximately 45.74% of the assets;

In addition, in terms of opinions and voices, Bloomberg ETF analysts:SEC’s ongoing strategy to delay ETF filings is to prevent individual companies from having a first-mover advantage, Cosine: Maliciously stuck inscription transactions with low transaction fees are possible, Ordinals opponent, PoW inventor Adam Back:You cant block JPEG on Bitcoin,Zhu Su:Inscriptions are a very disruptive new primitive in cryptography;

In terms of institutions, large companies and leading projects, Delin Holdings:We are applying for a virtual asset management license from the Hong Kong Securities and Futures Commission and plan to control the allocation ratio of such assets below 5%.,Runes mainnet may be launched in April next year,BakerySwap:Bitcoin chain game project Bitcoin Cats IDO oversubscribed 150 times,ETHW Core announced its disbandment and the server will be temporarily transferred to OneDao,Public chain Lisk will build L2 through OP Stack based on the Gelato RaaS platform,andPlanned to airdrop on new chain,INJS:The distribution of INJS has been terminated due to the proliferation of bots, and the strategy will be adjusted to return in a better way in the future.;

In the field of NFT and GameFi, Delegate founder:Flooring Protocol may have been attacked, 14 BAYC and 36 Pudgy Penguins stolen,Boring Security:Since the BAYC stolen by NFT Trader is already in our hands, it will be returned to the stolen person free of charge,Epic Games store changes encryption policy, P2E games can be re-listed...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~