Gryphsis Cryptocurrency Weekly Report: The world’s largest Bitcoin futures ETF breaks all-time high in assets under management in 2021

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMediumGet deeper research and insights.

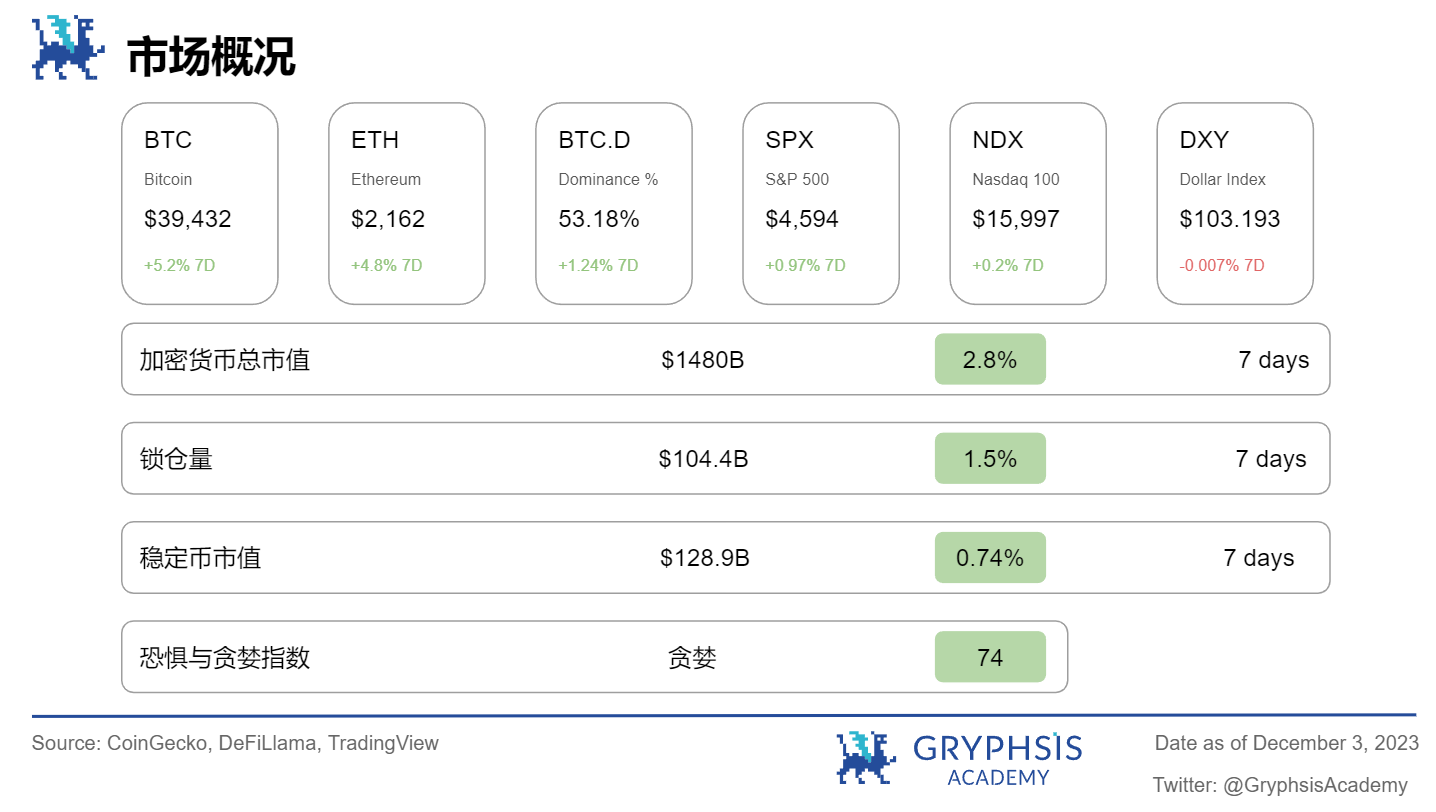

Market and Industry Snapshot:

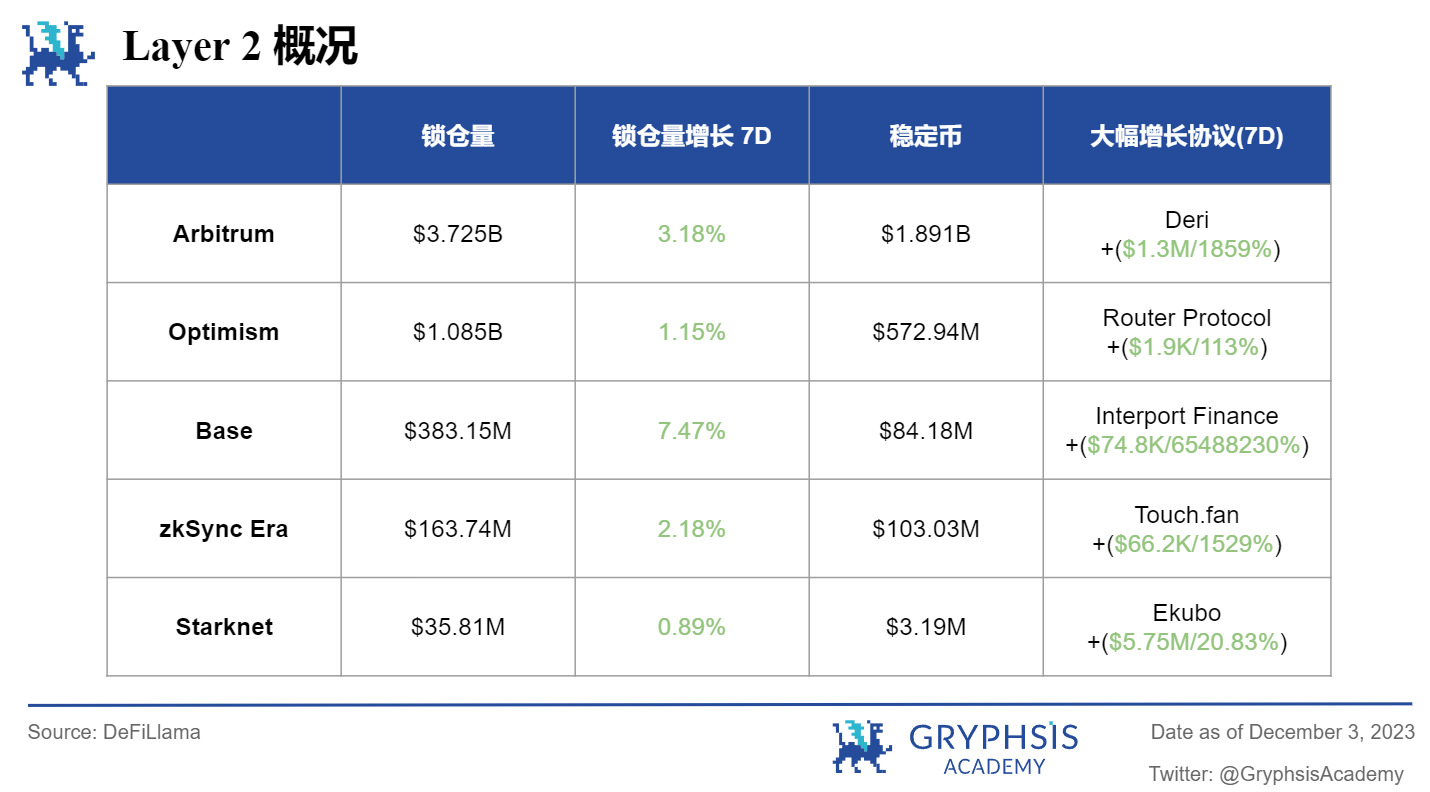

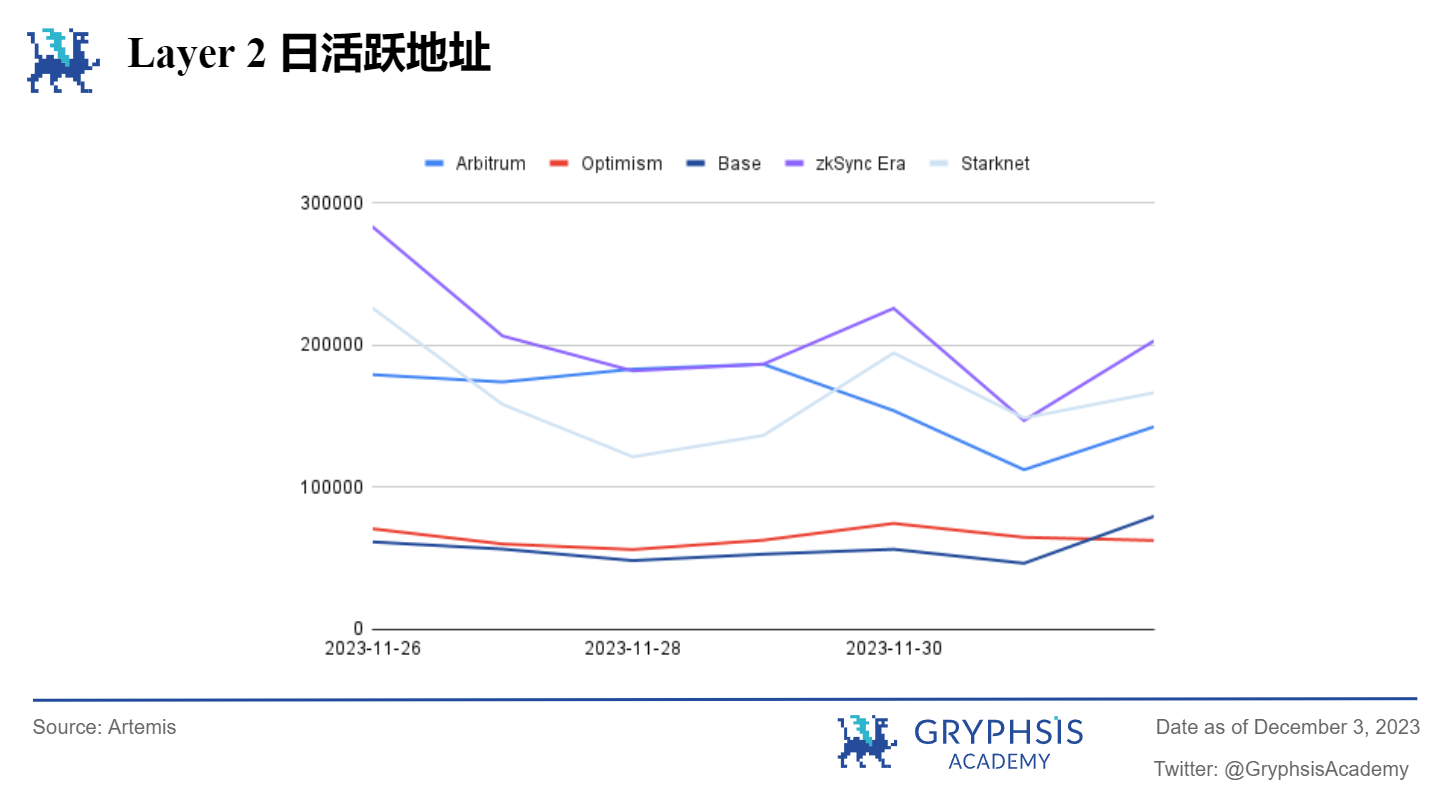

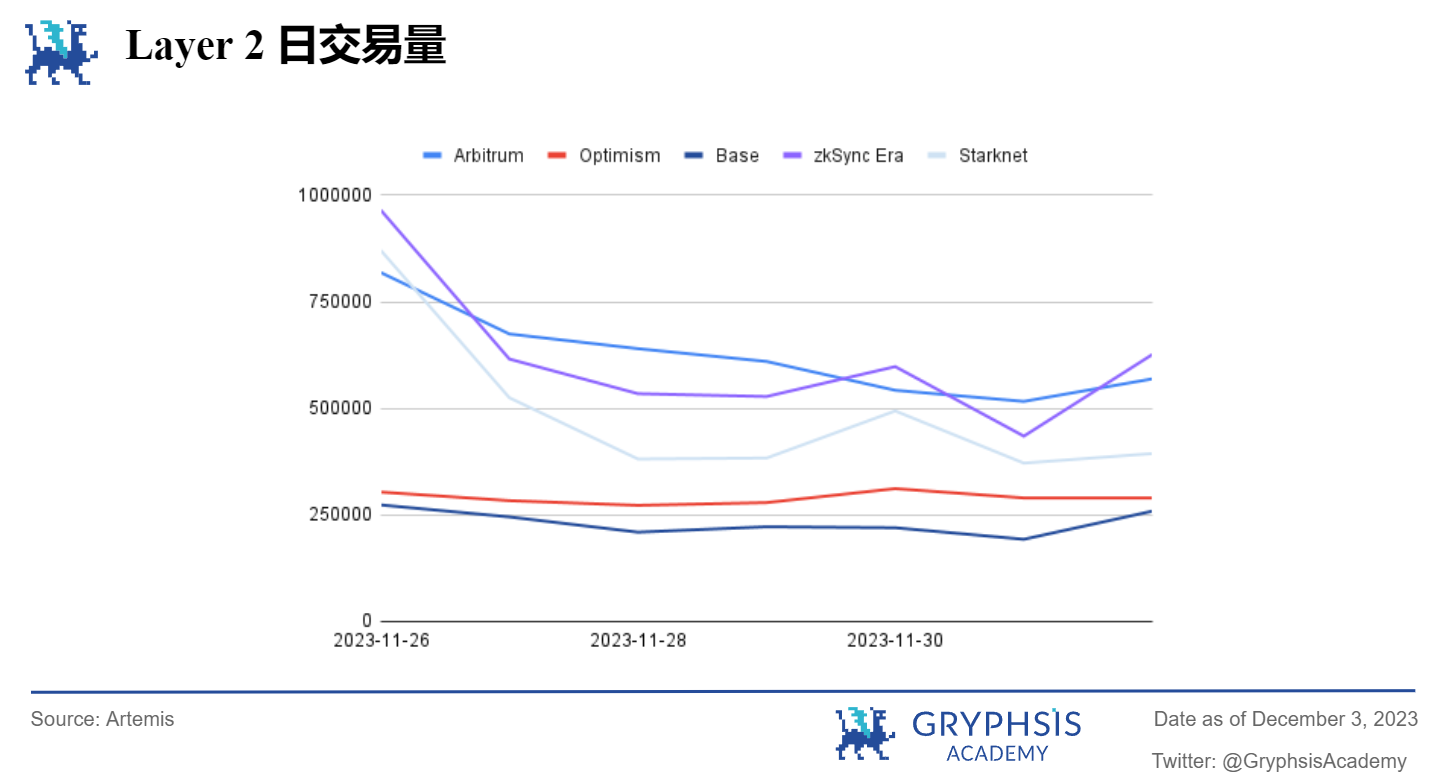

Layer 2 Overview:

Last week, Layer 2 showed positive growth as a whole, with Base showing the most obvious growth at 7.47%. Protocols like Deri, Router Protocol and Interport Finance, Touch.fan have demonstrated noteworthy TVL growth rates.

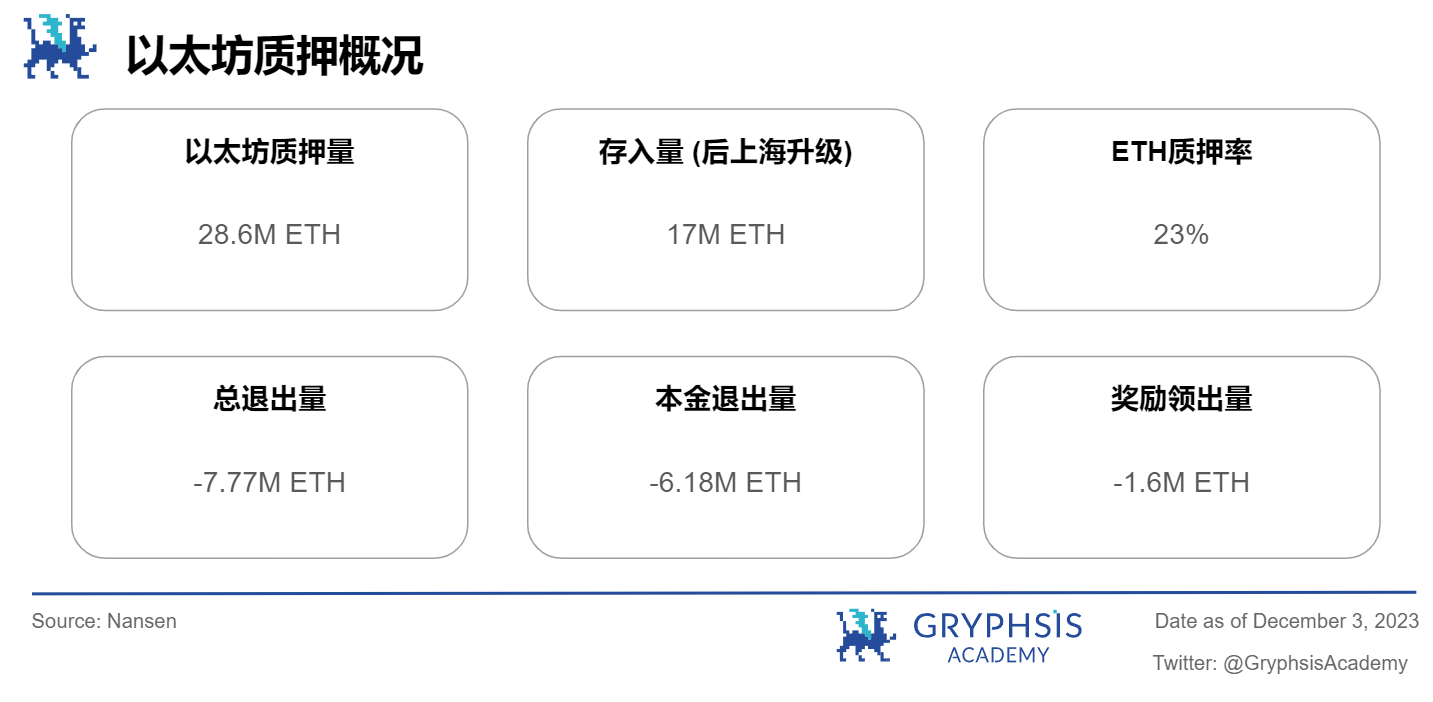

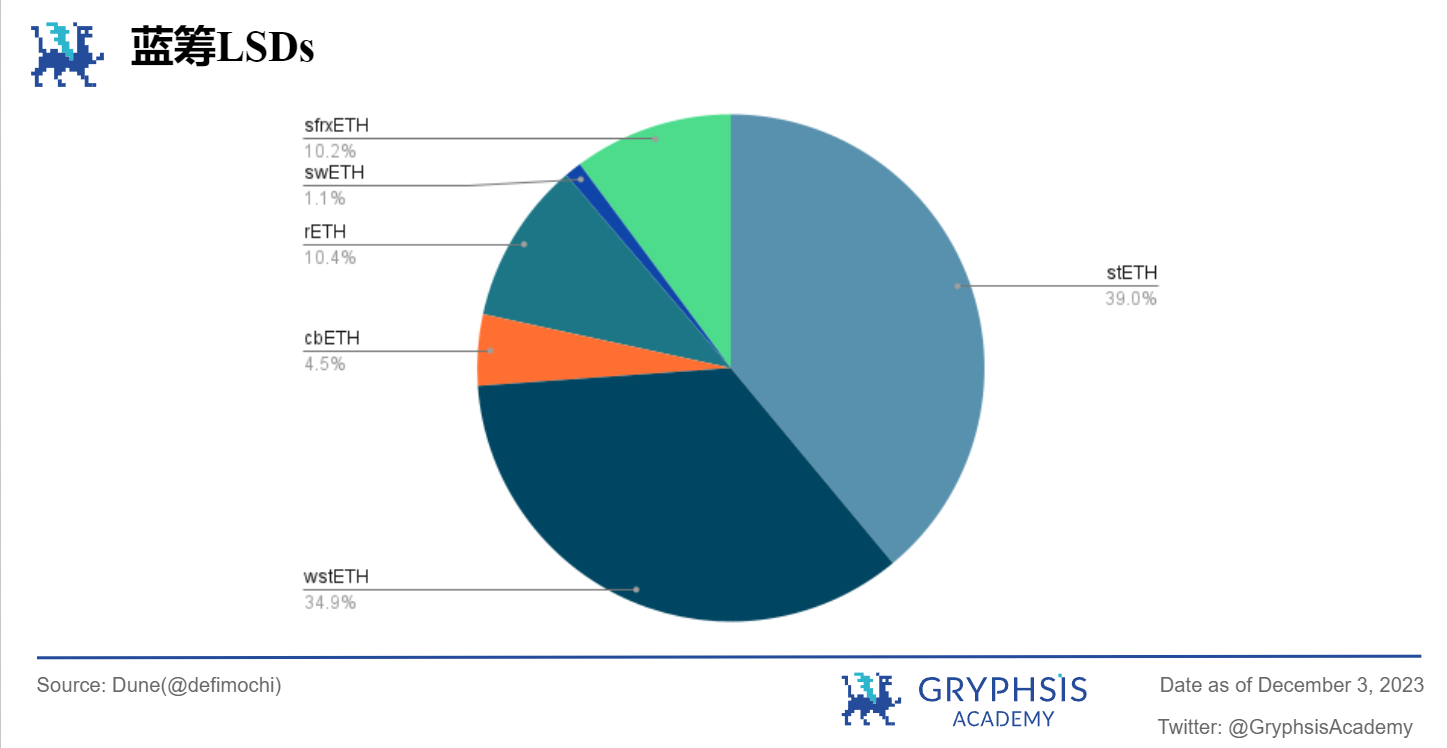

LSD Sector Overview:

In the LSD field, the basic amount of Ethereum pledged remains unchanged, but the total withdrawal volume increased by 12.9%. In terms of market share, sfrxETH grew significantly this week at 7.18%, while swETH fell by 3.22%.

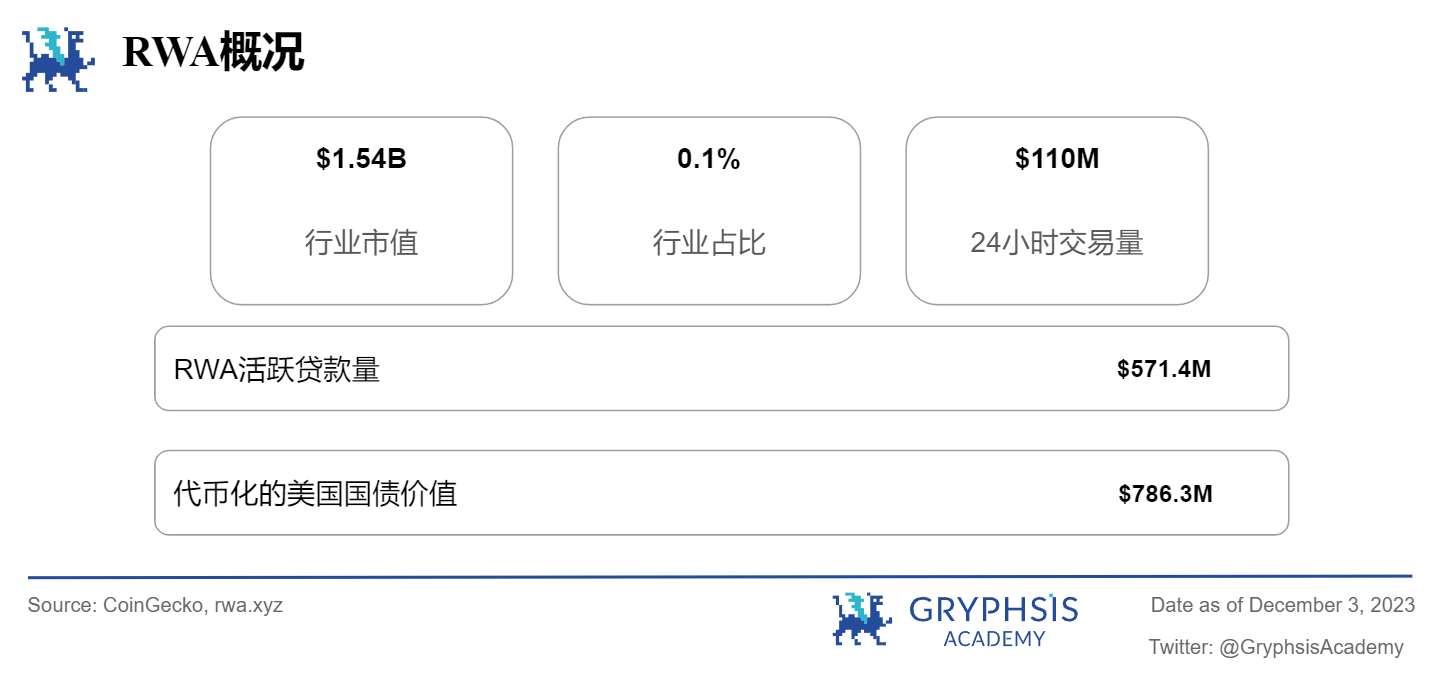

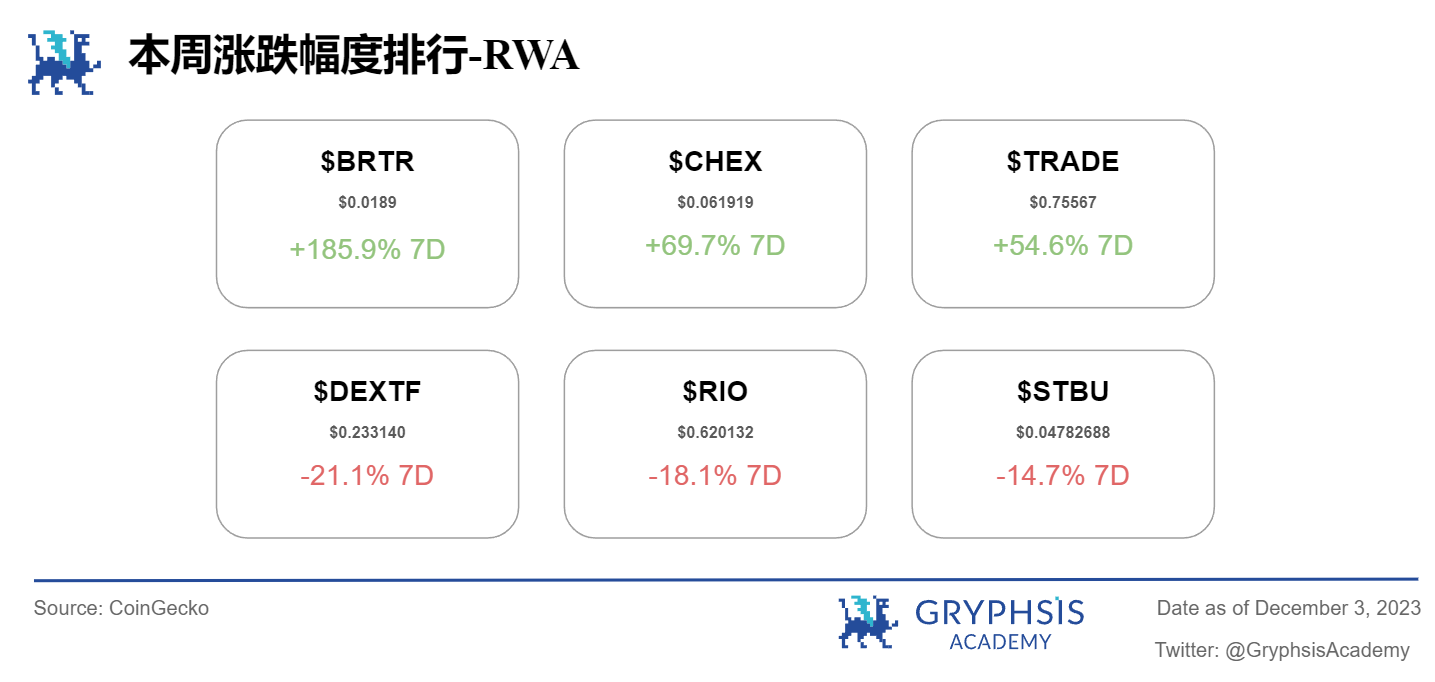

RWA Sector Overview:

Last week, the total market value of the worlds real assets increased by 14.07%, accounting for 0.1% of the industry. In addition, RWA tokenized treasury decreased slightly by 0.29%. Notable growth tokens include $BRTR, $CHEX, and $TRADE. Tokens like $DEXTF, $RIO, and $STBU experienced larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

Largest Bitcoin futures ETF hits record 2021 asset management high

Weekly Agreement Recommendations:

Aevo

Weekly VC Investment Focus

MYX Finance ($ 5 M)

Wormhole($ 225 M)

OCEAN($ 6.2 M)

Twitter Alpha:

@0x AndrewMoh on RWA

@wacy_time 1 on recent token unlock

@stacy_muur on MetaBlox

@0x AndrewMoh on MYX Finance

@TheDeFISaint on SCWs

Macro overview

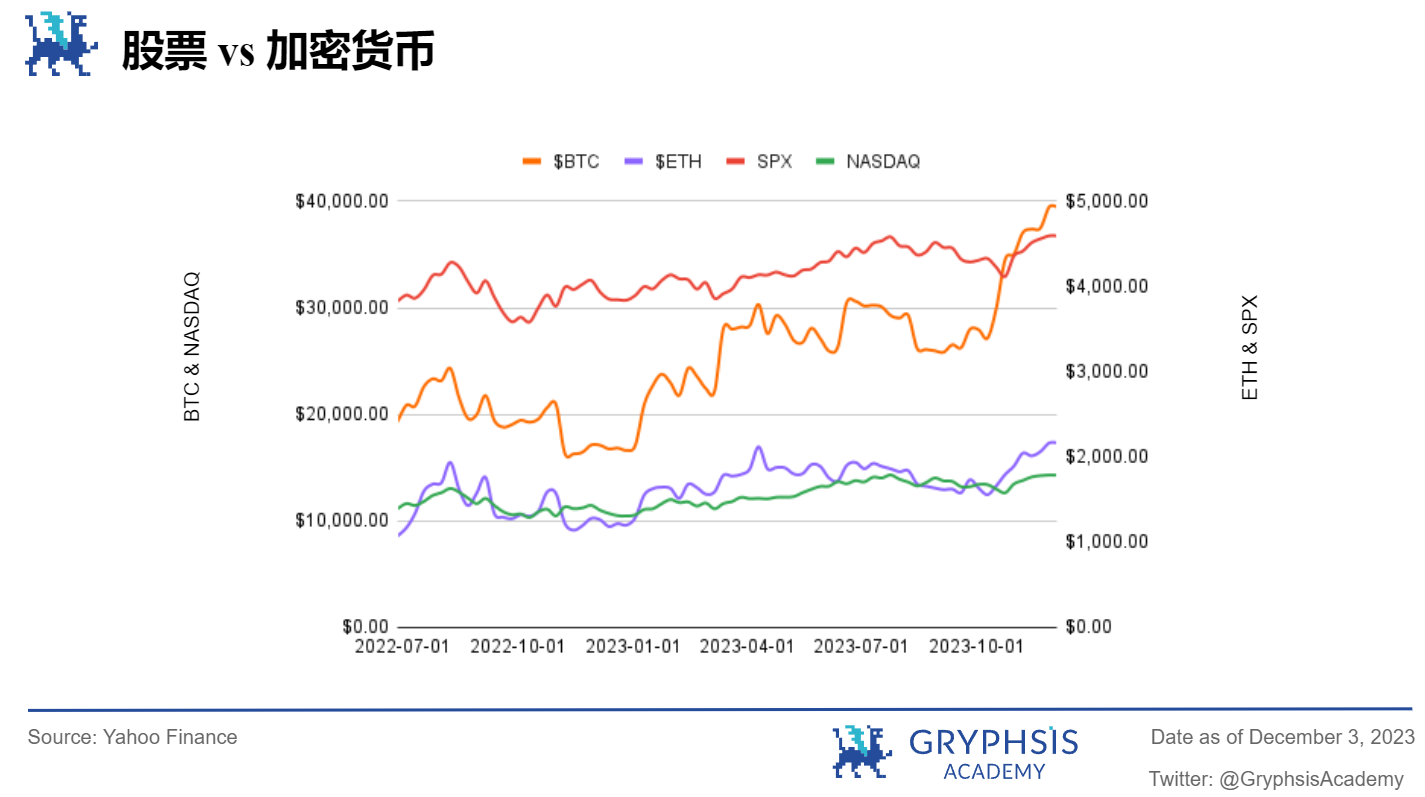

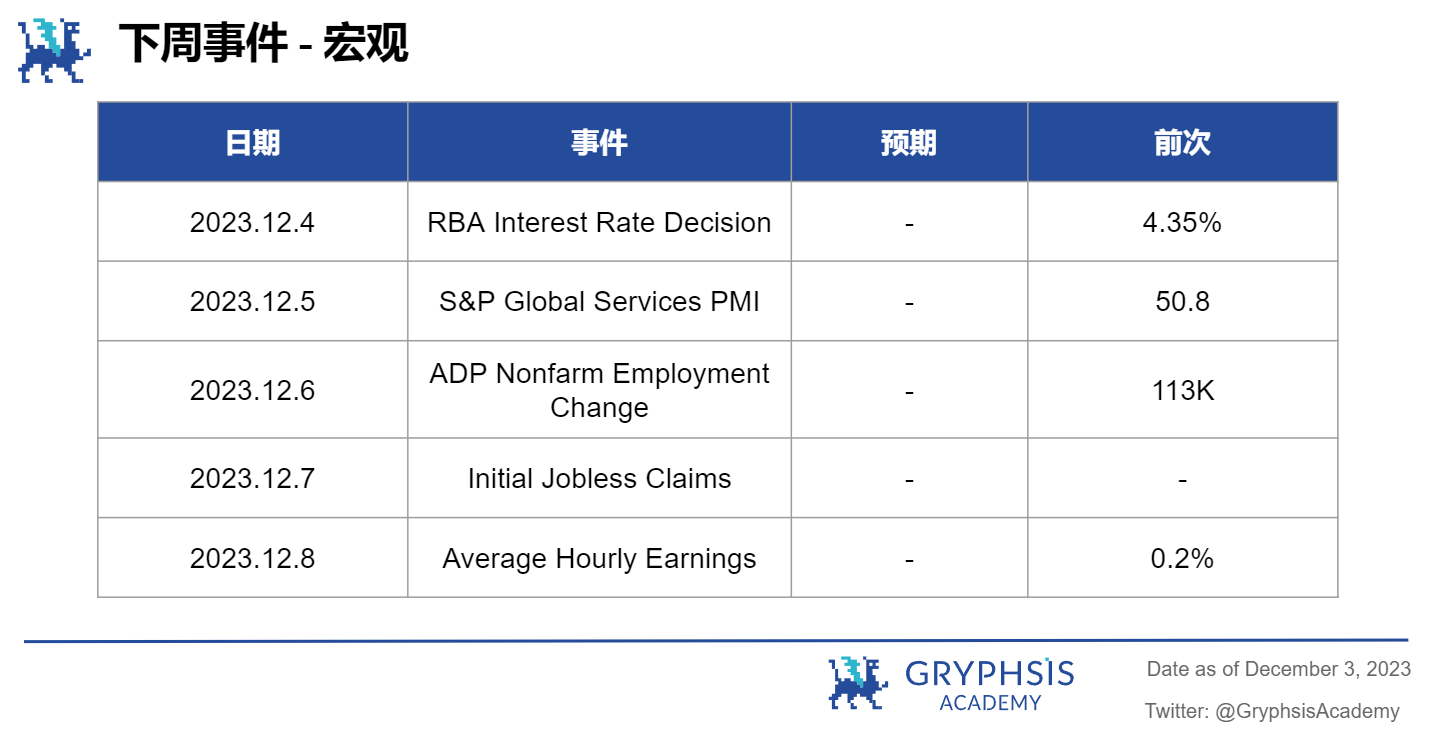

This week, the stock market level remained stable with no significant changes, and the gains in the crypto sector were more obvious. $BTC and $ETH rose 5.2% and 4.8% respectively. In the coming week, pay attention to major events such as the Reserve Bank of Australias interest rate decision, ADP non-farm employment changes, initial jobless claims, average hourly earnings and other major events.

Big news this week

Worlds largest Bitcoin futures ETF breaks all-time high in assets under management in 2021

ProShares Bitcoin Strategy ETF (BITO), which offers Bitcoin futures funds in the United States, hit an all-time high of $1.47 billion in assets under management this week, surpassing the previous record set in December 2021.

Unlike some other Bitcoin futures ETFs, BITO closely tracks the spot price of the asset. At the same time, BITOs average daily trading volume ranks in the top 5% of all U.S. ETFs. This shows that it has received widespread attention from investors and is believed to be also popular in the United States. The positive impact of a series of Bitcoin spot ETF filings.

Simeon Hyman, global investment strategist at ProShares, said BITO’s record AUM demonstrates investors’ need for a familiar, easy-to-understand and regulated way to access Bitcoin and related returns. At the same time, such buying pressure has also kept Bitcoin prices rising as investment giants such as BlackRock (BLK) and Fidelity wait for U.S. regulators to approve the launch of a Bitcoin spot ETF.

BITO’s rally has not only attracted the attention of institutional investors, but also traders. In June, investors poured in more than $65 million in one week, the biggest inflow in a year, beating the previous 2023 high of just over $40 million in April.

Overall, BITO’s record AUM suggests investor interest in Bitcoin is growing, with renewed institutional demand for the asset from institutional investors spurred by a series of Bitcoin spot ETF filings in the United States. The rise in buying demand for BITO has accelerated Bitcoin’s rise.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we selected Aevo, a derivatives Layer 2 focused on options and perpetual trading, led by Paradigm, DragonFly XYZ, and Coinbase.

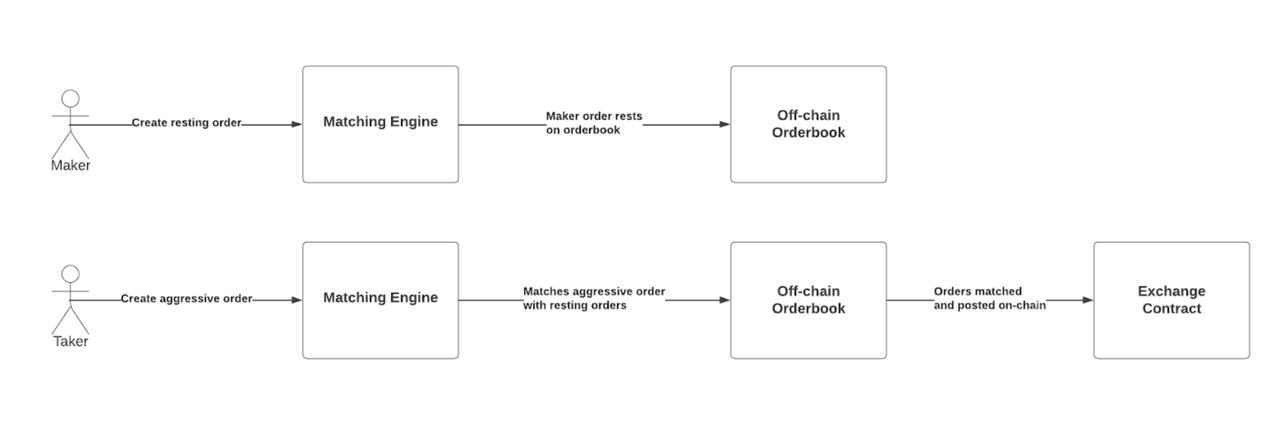

Its development team is the same as Ribbon Finance, and it was later voted by Ribbon DAO to merge with the Aevo protocol in August this year. Aevo uses customized EVM roll-up technology to aggregate transactions onto Ethereum. Like DYDX, it issues matches transactions off-chain, executed and settled by smart contracts deployed on L2 Rollup. Currently supports three chains: Arbitrum, Ethereum, and Optimism.

It designed a risk engine off-chain to check whether the account margin requirements are met to create orders. The users assets and positions are always retained in the smart contract on the chain.

What is more distinctive is that Aevo is deployed on its customized Aevo Rollup, which is essentially Layer 2 built using OP Stack. Aevo introduces its own sequencer Conduit. When a transaction is generated, Conduit packages the transaction arrangement and sends it to Ethereum. Aevo Rollup provides a 2-hour transaction dispute period. If you want to withdraw a transaction that has been published on Ethereum, it only takes 2-3 hours to be fully confirmed.

In addition to supporting traditional trading functions, Aevo also supports Pre-Lanch Futures. Recently, such as $PYTH, $BONK, $BLAST, etc., Aevo has been updated very quickly, allowing users to trade before the project issues the tokens, so that they can obtain the tokens immediately after the issuance. Traders need to buy tokens when the contract expires, or sell them for profit, thereby earning higher returns after the project is officially launched.

https://docs.aevo.xyz/aevo-exchange/perpetuals-specifications/blast-pre-launch-futures

And since Aevo is now combined with Ribbon, the native token $RBN issued by Ribbon will also be converted into $AEVO before January-February 2024. Users need to lock it for 3 months in exchange for $sAEVO (Staked Aevo), and the holding of $sAEVO Those who will enjoy the following benefits:

a) Rewards for all activities are doubled (the official is preparing some large-scale activities)

b) Fee discounts on all products and services

c) Propose new governance proposals

d) Be eligible to be nominated as a committee member

e) 2x voting power

Since $AEVO is converted from $RBN, there will be no major changes in the distribution and quantity of $AEVO holders. And in the economic model of $RBN, the DAO owns 45% of $RBN, and it reallocated the use of these future $AEVO in its latest proposal.

Generally speaking, the economic model of $AEVO has been clear. After the rebrand, users will be focused on motivating users to pledge to obtain $sAEVO. Users can also enjoy more rights through holding, and in the future, $AEVO will use various incentives to promote user interaction. and platform development.

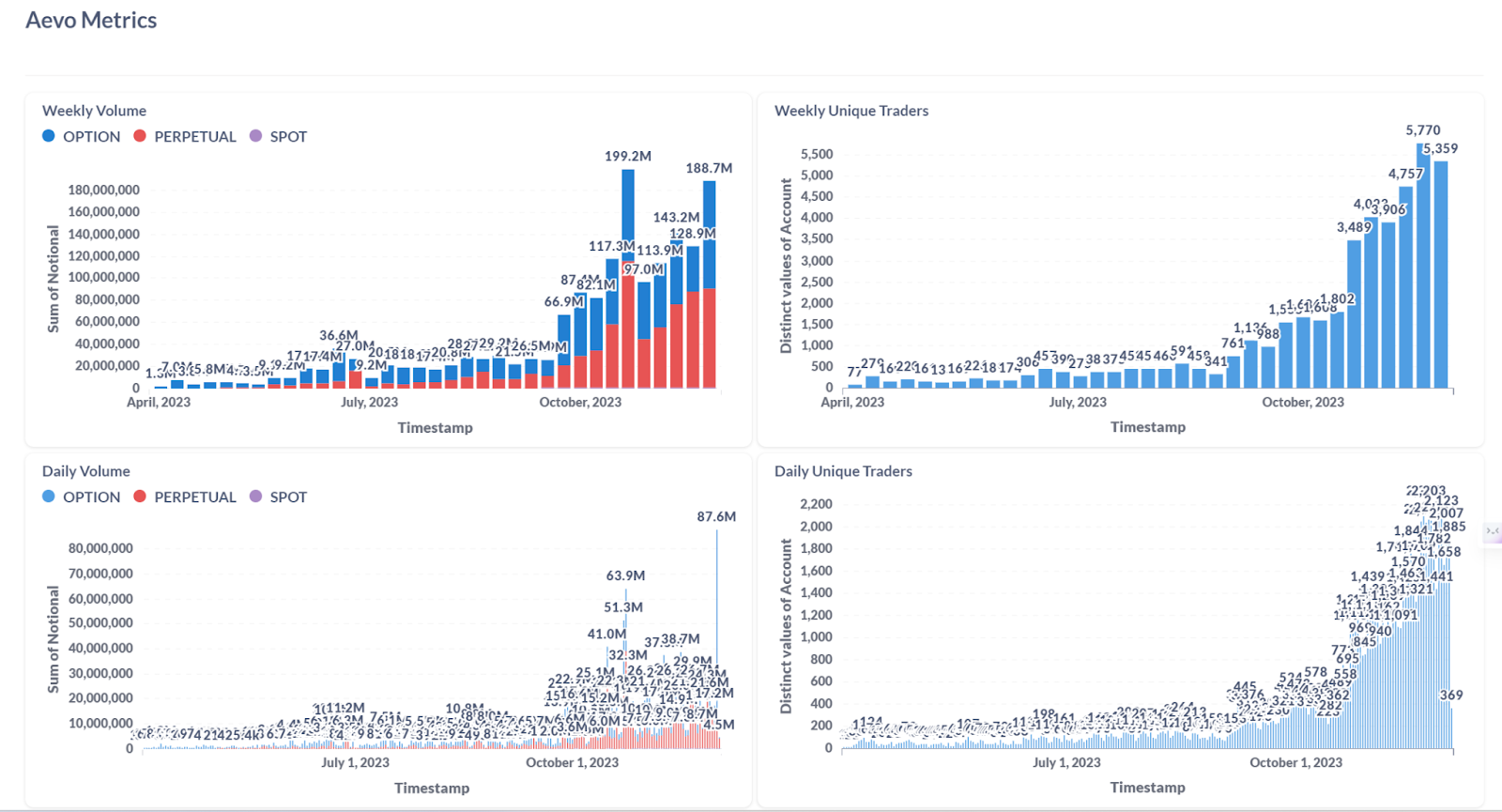

our insights

Options options trading allows users to purchase assets at a fixed price. The current overall market value of the track is 78.69 M. It is in the middle and lower reaches of the Defi track and the current market has a large room for development. Currently, Lyra, Dual Finance, and Aevo dominate. As far as Aevo is concerned, the overall transaction volume and the number of active users are currently on the rise, and its development is relatively optimistic.

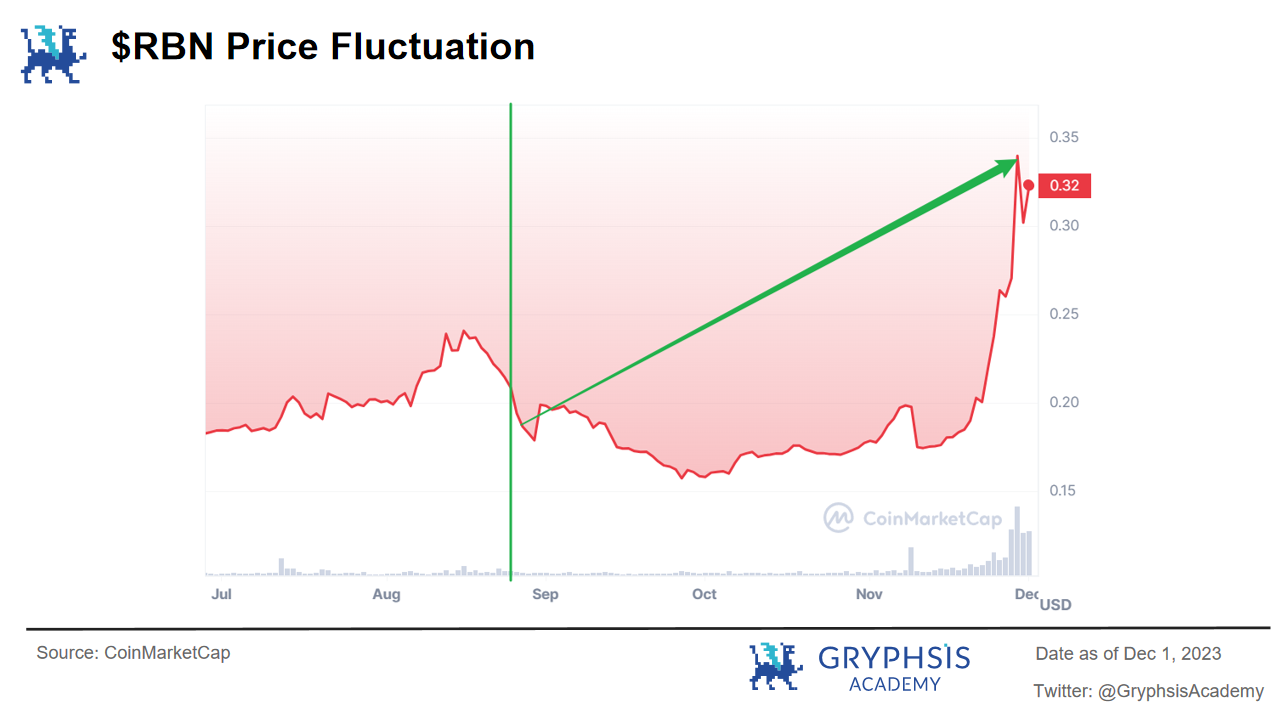

And since August 25, after Ribbon Finance announced the merger and Aevo’s corresponding token economic model was updated, $RBN has shown an upward trend overall.

If users want to participate in the Aevo ecosystem, they currently have the following paths:

Currently holding $RBN, after supporting the conversion, swap it to $sAEVO and enjoy the benefits it brings within the next three months.

If you don’t have $RBN, you can buy $AEVO after listing. You can keep it or pledge $AEVO to get $sAEVO and enjoy the benefits.

Since you must have a 3-month unlocking period if you want to hold $sAEVO, and the official incentives for $sAEVO holders are clear, it will take 3 months to choose to hold $RBN now or purchase $AEVO after it goes online and then stake it. Only in order to obtain $sAEVO tokens, there is no difference in time. However, what needs to be considered is the cost difference between the price of $RBN at this time and the price of $AEVO after the future Rebrand.

Considering that the current official focus is on motivating users to pledge $AEVO and providing a variety of incentives, it will reduce the market supply side of $AEVO to a certain extent, thus raising the price. And generally speaking, a token rebrand or a new narrative for a product usually triggers some positive sentiment, which may prompt price increases. Therefore, a basic judgment can be made about the current $RBN price and the subsequent $AEVO price.

However, participants still need to consider whether the three-month unlocking cycle and the real benefits obtained will affect the efficiency of funds and how the corresponding governance rights will feed back the rights and interests of holders. At present, Aevo will convert the previous Ribbon DAO into Aevo DAO, but whether the specific governance mechanism of the platform can realize the realization of governance rights requires further observation.

To sum up, the current overall development trend of Aevo is optimistic. As a Layer 2 option trading, its narrative is novel and its technology clearly uses the OP Stack solution. In addition, the official Rebrand expectations and staking incentives may make it attract A new outbreak.

Gryphsis Research Focus

Welcome to this week’s Gryphsis Research Spotlight, where we share the latest insights from our team. Our dedicated research team continues to explore the most cutting-edge trends, developments and breakthroughs in the crypto space. This week, we’re excited to share our newly released report, so let’s dive in!

Recently, major chain game tokens are about to move, and the GameFi sector has ushered in a small climax. GameFi, which has been dormant for a long time, seems to be back in peoples field of vision. Among them, Gala Games strongly led the gains, with an increase of more than 100%. Why is $Gala so strong? At present, the market is stabilizing, and the long-dormant blockchain gaming industry is recovering. Can $Gala become a value investment target in GameFi?

Gala Games is a blockchain game development company founded in 2018, aiming to build a decentralized game ecosystem. Gala Games is both a game development platform and a game aggregation platform.

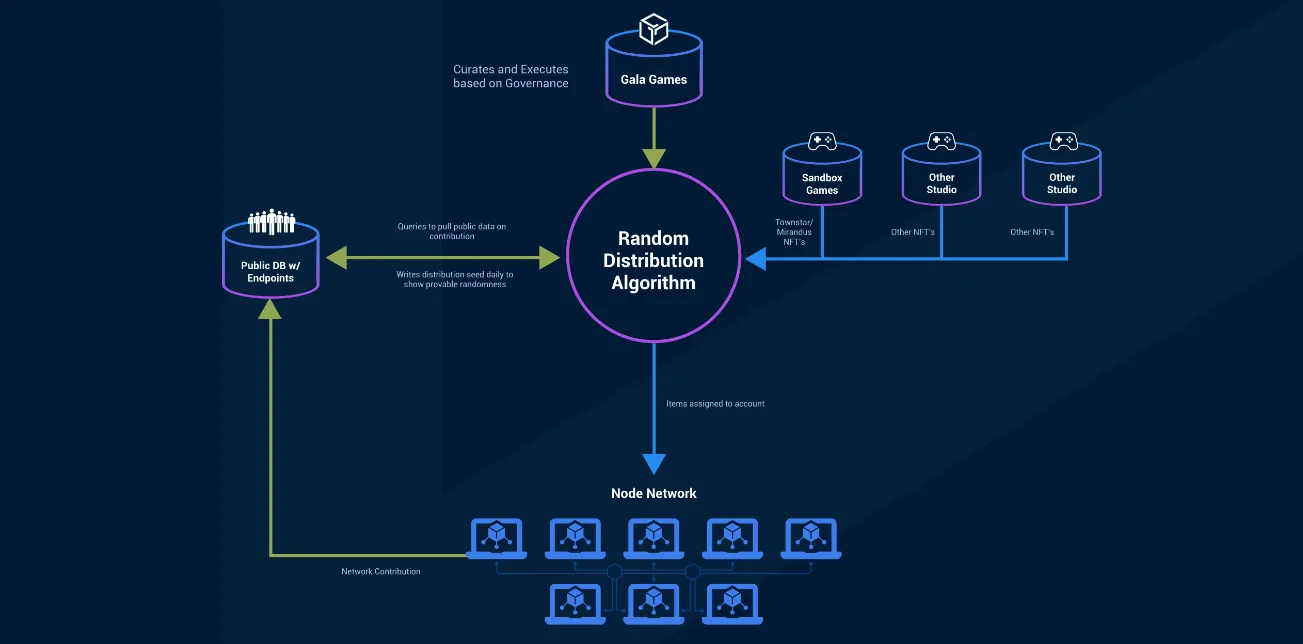

Gala has established exclusive network nodes, and the entire game ecosystem runs on a distributed node network, rather than on a centralized server controlled by a single entity. Galas founder node will provide power for the operation of the Gala ecosystem. Node users can decide which games can be launched on Gala Games platform through consensus voting, and all major decisions in the community are decided by node voting.

The Gala team has a deep relationship with Zynga, with most team members working at Zynga. Zynga is a social gaming service provider founded in 2007. It has extensive global influence in more than 175 countries and regions around the world, and has been downloaded more than 200.7 billion times on mobile devices. The FarmVille series and Zynga Poker are both Zynga Works that are very popular.

Gala did not conduct ICO or various forms of financing, and all funds for the establishment of Gala were provided by the founders. We can guess that the creation of Gala has received strong support from Zynga. From a results-oriented perspective, the sale of founder nodes is actually a disguised form of financing.

The current main uses of $Gala are: purchasing founder nodes and purchasing in-game NFTs. At the same time, the official also stated that in the future Galas Project GYRI will increase the role of Gala tokens in the ecosystem and empower it.

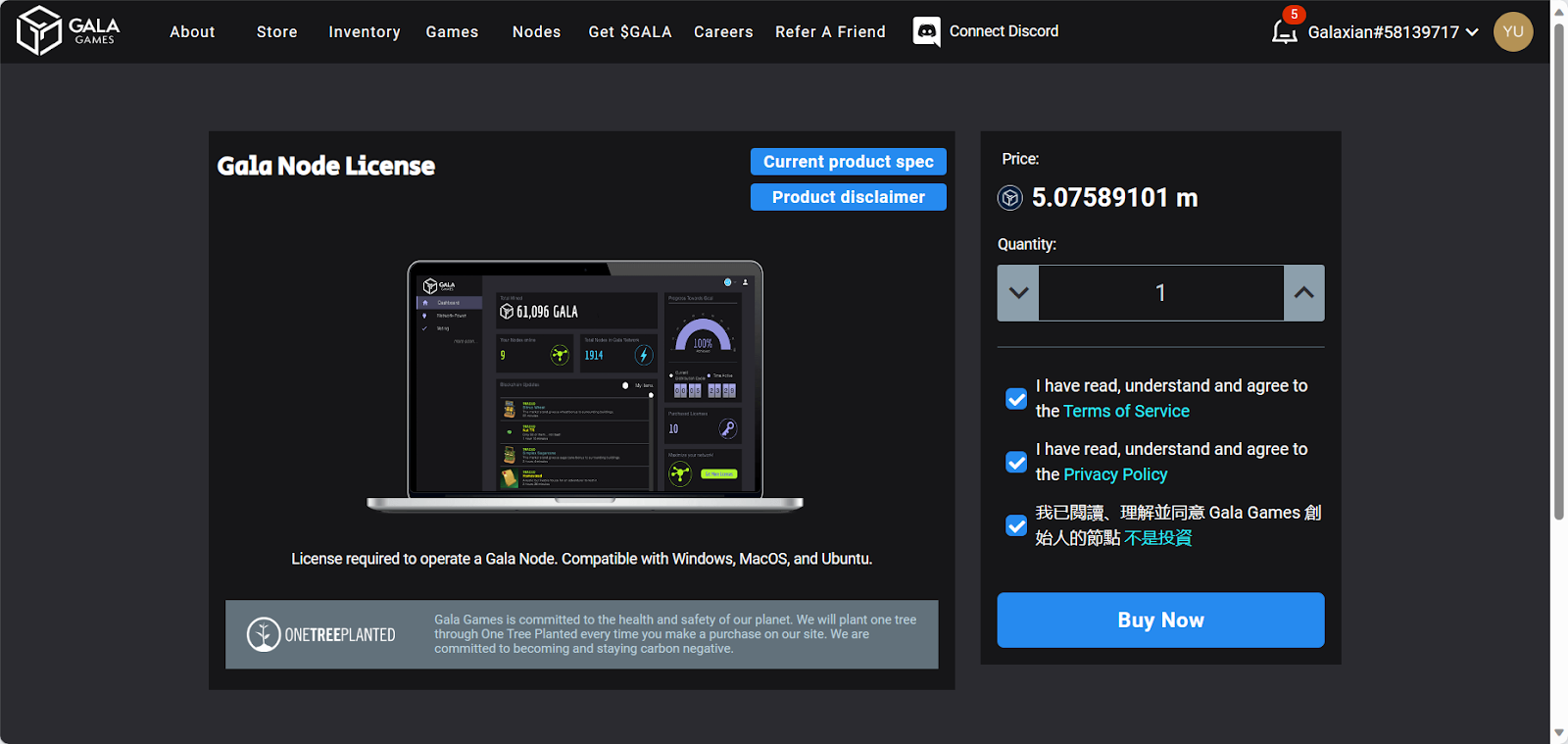

The current founder node price on the official website is around 5M Gala, which is equivalent to about US$100,000 at the current market price. The maximum number of founder nodes issued is 50,000, and the current number of active nodes has reached about 44,000. Purchasing a founder node with Gala is also similar to mining. This node is a POS node. Half of the Gala produced daily will be distributed to the founder node. The longer it runs, the more rewards you will receive. Every year on July 21st, the daily Gala output will be cut in half.

In addition, in order to solve the problem that under the current model, the daily rewards of founder nodes are halved every July and reduce the enthusiasm of founder nodes to operate, Gala launched the PAY-BY-BURN burning mechanism on January 13 this year. , when Gala is used to purchase and pay on the platform, the Gala used for purchase will be burned, and while being burned, the same amount of Gala will be distributed to the founder node, increasing the node income.

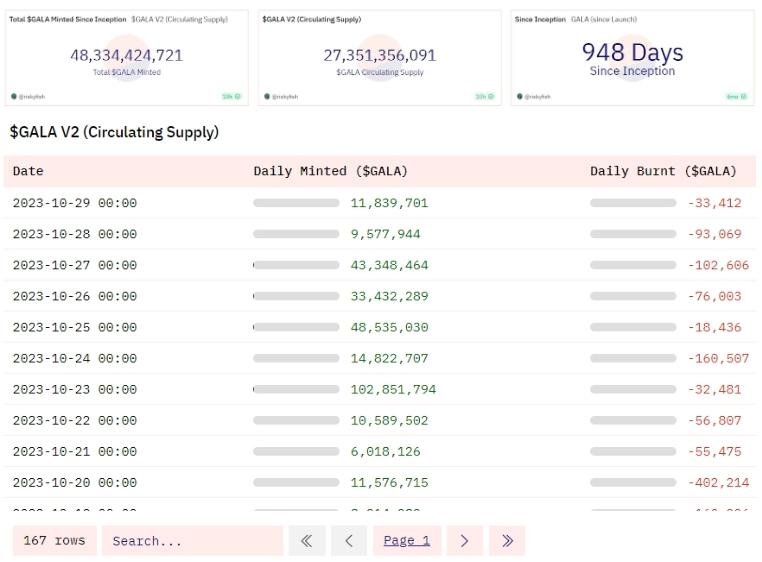

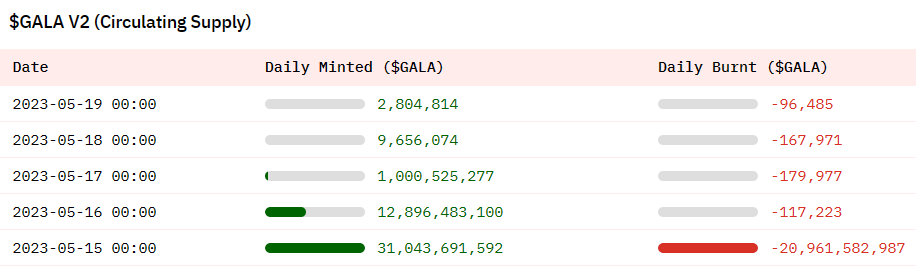

$Gala was upgraded to Gala V2 on May 15 this year. The figure accurately records the daily casting quantity and burning volume before and after the contract replacement and from the start of Gala casting on September 11, 2020 to the present. It is currently the 948th day since the casting began, and the total casting volume is approximately 48.3 billion. The circulation volume is approximately 27.3 billion, and the maximum supply is still 50 billion.

As for the teams income, although Gala officially states that it is used to support project development and fund the ecosystem, many members of the community are still worried that the Gala team will sell a large number of its tokens, causing the price to drop. For this reason, during the contract replacement on May 15 this year, the Gala team directly destroyed nearly 21 billion $Gala in hand.

Combined with the economic model of $Gala, according to this burning mechanism and the output of $Gala being halved every year, once a hit game is developed and the demand increases, $Gala will easily become a deflationary model in the future.

According to data, as of November 22, 2023, there were 18,726 $Gala currency holding addresses on Ethereum. The top 10 addresses account for 42.81% of $Gala, and the top 100 currency-holding addresses account for 73.26%. Most of the top 10 addresses are exchange addresses.

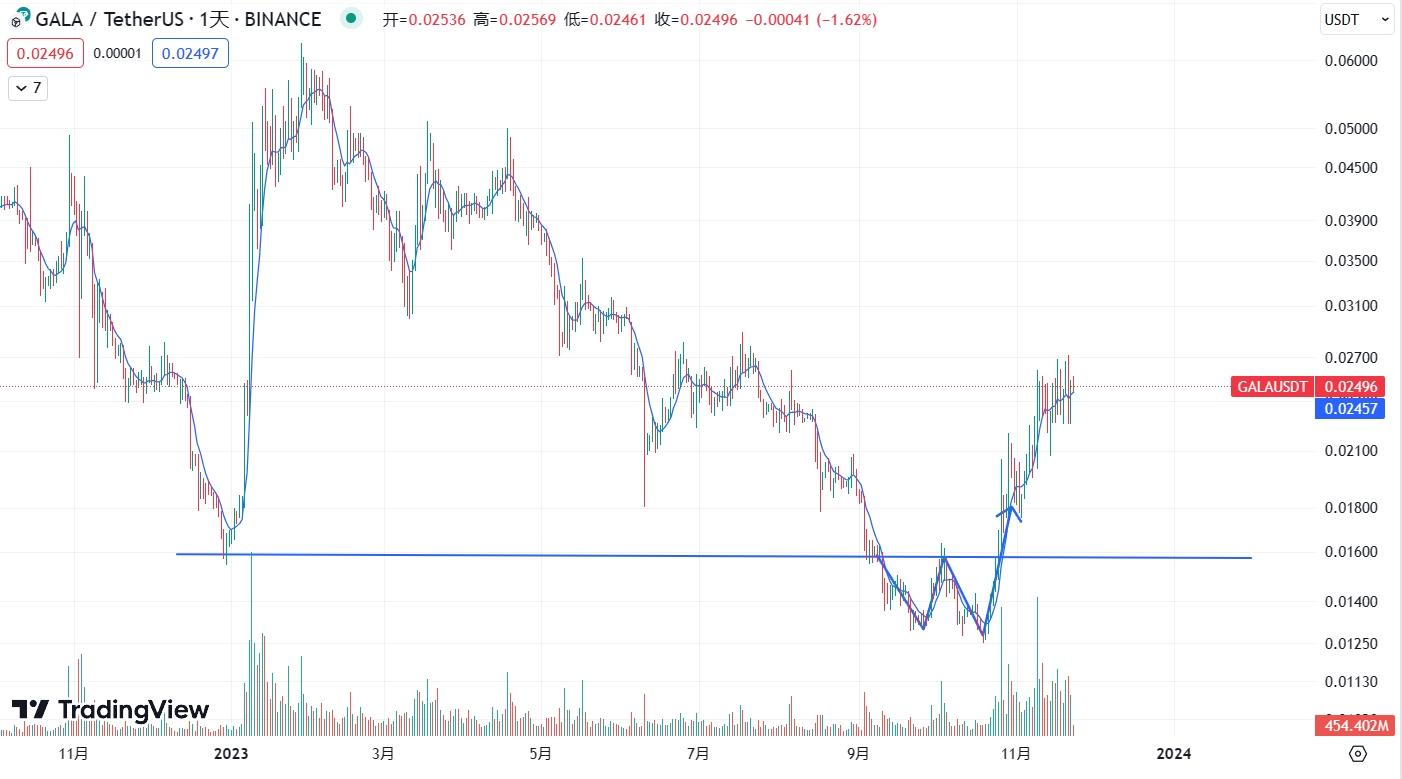

According to Trading View data, $Gala bottomed on October 19 and began to increase in volume in the subsequent market. The current price is about $0.025, rebounding about 100% from the bottom. The bottom formed a standard W bottom structure, and the neckline touched the upper limit. A strong support point for a downtrend. We can easily see that $Gala has most likely bottomed out and is ready for the bull market.

According to Binance contract data, the recent long-short position ratio, the long-short ratio of large investors positions, and the long-short ratio of the number of large accounts are all much greater than 1. We can clearly see that both large investors and retail investors are relatively bullish on the future of $Gala Prices show a positive attitude.

Although there are signs of recovery in chain games in recent times, generally speaking, the GameFi track has always been in a sluggish state from 2022 to now. If the GameFi boom in 2021 is the result of sufficient funds and speculation in the bull market, then now The price of GameFi Token is still at the bottom stage where the price has returned to value after the bubble burst and has stabilized.

The logic of the GameFi track in the last bull market was the P2E earning mechanism, which attracted a large number of people and pushed up the token price. As one of the representatives, Gala has achieved a thousand-fold increase, but unlike most chain games, its real focus is on player experience rather than the pursuit of quick money. Gala wants people to play blockchain games not because they can make money, but because the games are actually fun.

While most Web3 game companies such as Immutable Kong came to talk to people about his vision of making blockchain games you really want to play.

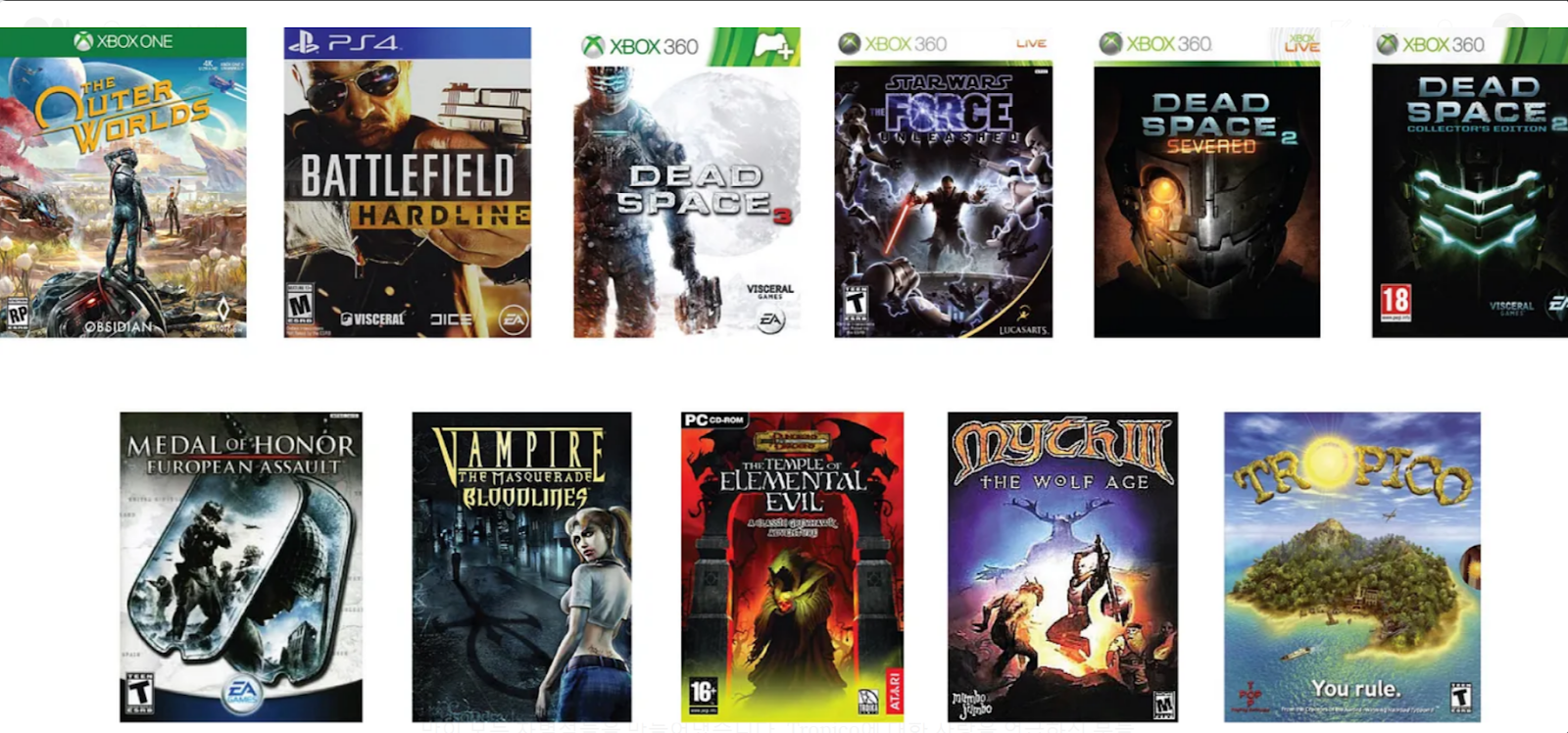

In terms of game development team, Gala Games’ project team is also one of the few in the blockchain game field to be composed of well-known traditional game industry developers. Compared with other blockchain game teams, Gala’s game production level and delivery level are obviously superior. The picture shows a game that art director Craig participated in designing.

There are bound to be some risks in project development. The teams high requirements for game quality, long game development cycle, and Galas relatively centralized operation method may have a negative impact on Galas development.

The current $Gala currency price has bottomed out, and we have emerged from the bear market. Under the conditions of the recovery of the chain game sector and the stabilization of the market, the project team focuses on the interests of the community to destroy the tokens and truly wants to make a good game. , the upgrade of the economic model, and the successful bottoming of funds. If you are optimistic about the GameFi track and can reasonably control risks, $Gala is undoubtedly a currency worthy of value investment. These all indicate that Gala is ready to welcome the bull market. preparation. I believe that with Galas structure and vision, it is only a matter of time before it can create a truly fun Web3 hit game and retain users for a long time.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

MYX Finance

MYX, a decentralized perpetual contract exchange incubated by D 11 Labs, recently announced the completion of a US$5 million seed round of financing, with a valuation reaching US$50 million. This round of financing was led by Sequoia China, with participation from Consensys, hackVC, OKX Ventures, Redpoint China, HashKey Capital and other institutions. MYX plans to accelerate technological innovation and market expansion, and promote the rapid launch and scalable development of its mainnet products.

https://x.com/MYX_Finance/status/1729479613674590224?s=20

Wormhole

Wormhole successfully raised $225 million, with a valuation reaching $2.5 billion. Investors include Brevan Howard, Coinbase Ventures, Multicoin Capital, etc. The company also established Wormhole Labs, an independent technology company, becoming a core contributor to Wormhole.

https://x.com/wormholecrypto/status/1729869578963222945?s=20

OCEAN

Jack Dorsey led a $6.2 million seed round to support the launch of Mummolin’s OCEAN project, a decentralized Bitcoin mining pool and other mining decentralization projects. OCEAN plans to provide non-custodial payments directly to miners from block rewards. OCEAN is designed to help miners regain autonomy and decision-making power over more complex processes in mining operations, and is designed to be non-custodial, transparent and permissionless.

https://x.com/jack/status/1729698161806000569?s=20

protocol event

Binance ending support of BUSD stablecoin in December

Celsius starts to open crypto withdrawals for holders of some claims

Wormhole closes $ 225 million funding round at $ 2.5 billion valuation

Sei blockchain to add EVM support in V2 upgrade

Velodrome, Aerodrome hit by attack on front-end websites

Industry updates

U.S. Treasury's Wally Adeyemo calls for more authority to go after bad actors in crypto

Bankruptcy court says FTX debtors can start selling assets including Grayscale units

Crypto custody firm Copper launches institutional trading platform for tokenized securities

SEC asks public for feedback on proposed spot bitcoin ETFs from Franklin Templeton, Hashdex

EU lawmakers want metaverse strategy that supports the bloc's businesses

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/0x AndrewMoh/status/1729087473895301430? s= 20

https://x.com/wacy_time1/status/1729899827423539231?s=20

https://x.com/stacy_muur/status/1730157832602083441?s=20

https://x.com/0x AndrewMoh/status/1730094341614678054? s= 20

https://x.com/TheDeFISaint/status/1729888296589721724?s=20

next week events

news source:

https://www.theblock.co/post/265347/bankruptcy-court-says-ftx-debtors-can-start-selling-assets-including-grayscale-units

https://www.theblock.co/post/265286/binance-ending-support-of-busd-stablecoin-in-december

https://www.theblock.co/post/265186/celsius-starts-to-open-crypto-withdrawals-for-holders-of-some-claims

https://www.theblock.co/post/265130/sei-blockchain-to-add-ethereum-virtual-machine-support-in-v2-upgrade

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.