SignalPlus Volatility Column (20231201): Prices pulled back in the short term, Doomsday IV surged

Yesterday (30 Nov), the United States announced that its core PCE increased by 0.2% in October, which was consistent with market expectations. The number of people continuing to apply for unemployment benefits unexpectedly rose. Fed officials also refuted some previous dovish views. The President of the San Francisco Fed Daly said that it is too early to judge whether the Fed will end raising interest rates, and it has not considered cutting interest rates at all. New York Fed President Williams believes that interest rates are currently close to their peak, but if inflation remains stubborn, it may need to raise interest rates again. . In terms of U.S. Treasuries, the two-year U.S. Treasury yield rose sharply during the U.S. session to reach an intraday high of nearly 4.73%. It then gave up most of its gains and fell to 4.70%, now trading at 4.665%. The ten-year U.S. Treasury yield returned to the 4.3% mark. reported 4.326%. The three major U.S. stock indexes were mixed, with the Dow closing up 1.47%, the SP 500 closing up 0.38%, and the Nasdaq closing down 0.23%.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

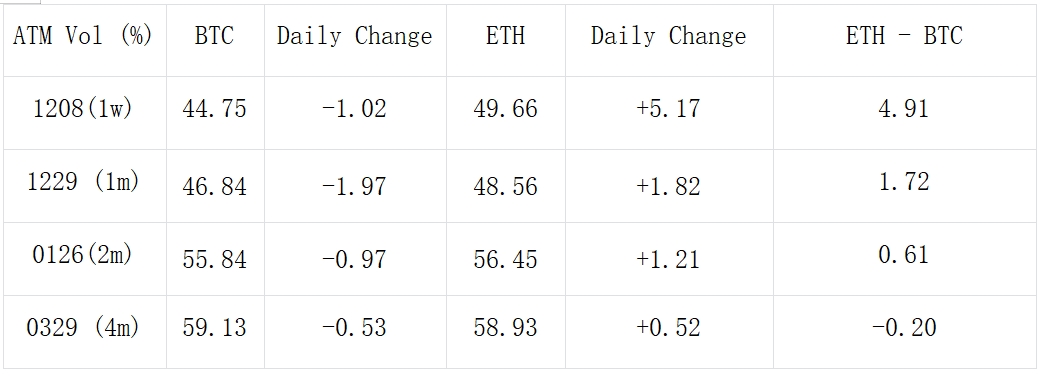

In terms of digital currencies, BTC/ETH fluctuated around 38000/2050 respectively, closing slightly down to 37815.36 (-0.803%) / 2034.97 (-1.16%). In terms of implied volatility, except for a slight decrease of about 1.5% Vol in the late option IV, there are no significant changes in the other tenors.

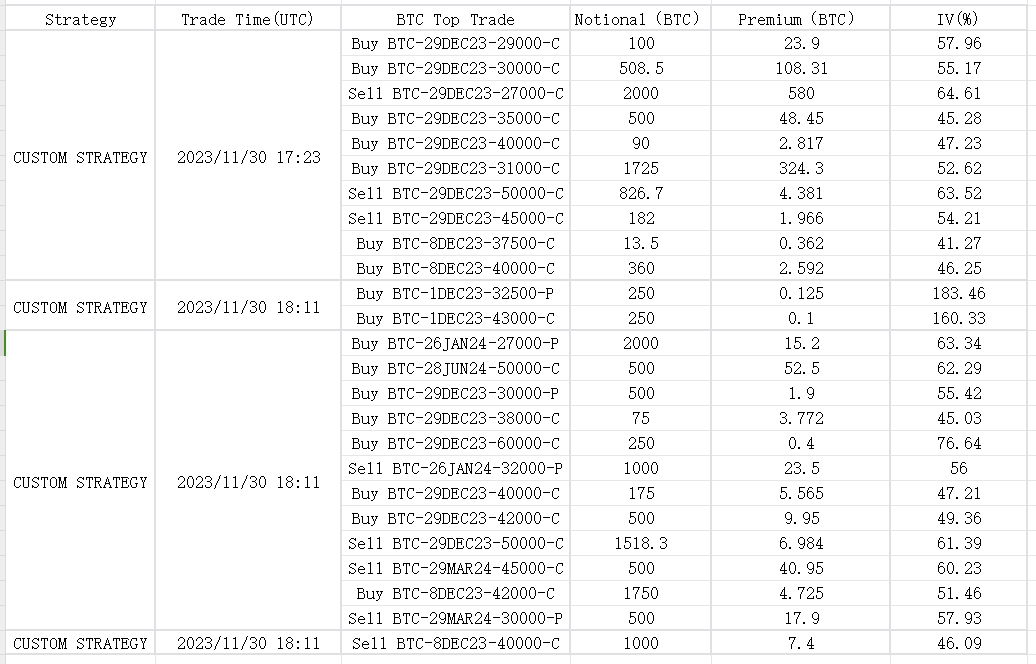

From a trading perspective, BTC bullish strategy trading was still hot at the end of December, with representative examples including the ratio of Buy 40,000 vs Sell 45,000, and the 36,000-40,000-44,000 Sell Fly. ETH is also dominated by bullish strategies, but the distribution of transactions has shifted to forwards. Among them, the call spread/triangular spread in March vs. June has become a trading hot spot; in addition, there are many Call Spread strategies betting on the SEC in January. To a certain extent, this flow also causes Januarys forward IV to continue to maintain a steeper slope relative to the end of the year, reflecting the markets expectations for a further return of volatility after the start of the year.

Source: Deribit (as of 1 DEC 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com