SignalPlus Volatility Column (20231128): Entering the end of the year, IV fell

Yesterday (27 No v2 3), the U.S. bond yields fell overall. The ten-year U.S. bond yield once fell to an intraday low of 4.37%. It rebounded back to 4.40% before the U.S. stock market opened. The two-year U.S. bond yield is more sensitive to interest rate policies. U.S. bonds fell again to 4.9% and are now at 4.877%. U.S. stock market fluctuations were relatively muted, with the Nasdaq/Dow/SP 500 closing down 0.07%/0.16%/0.2% respectively.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

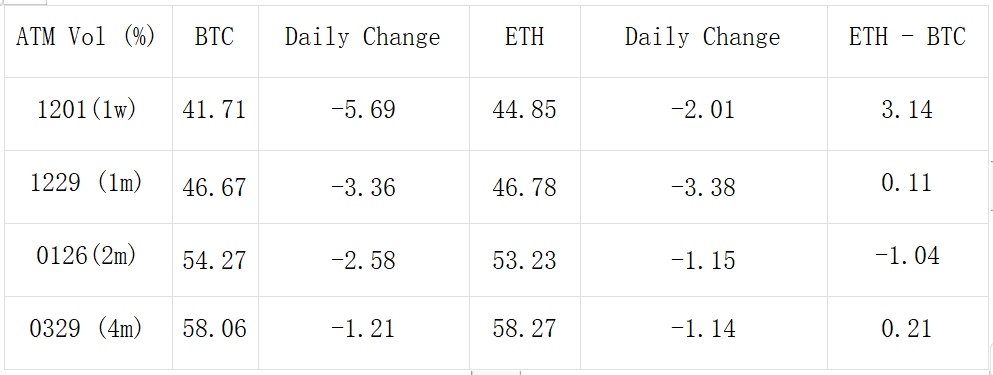

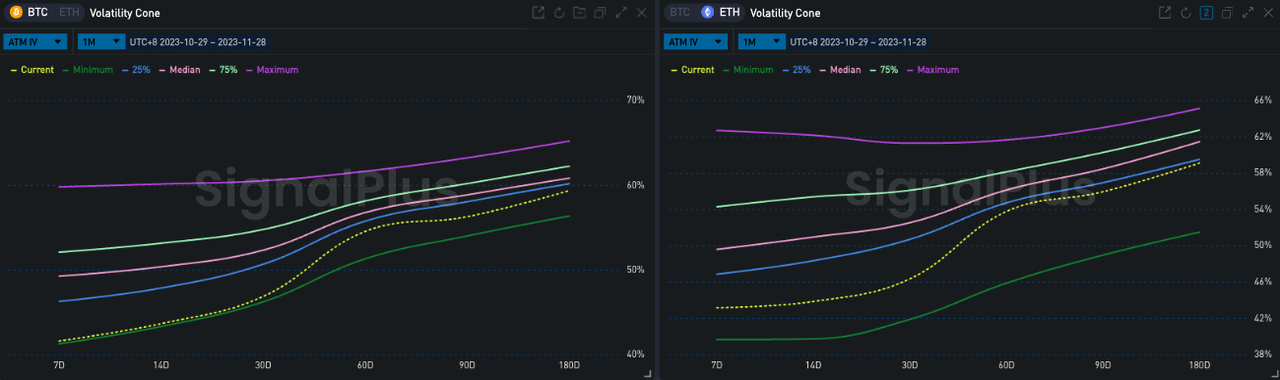

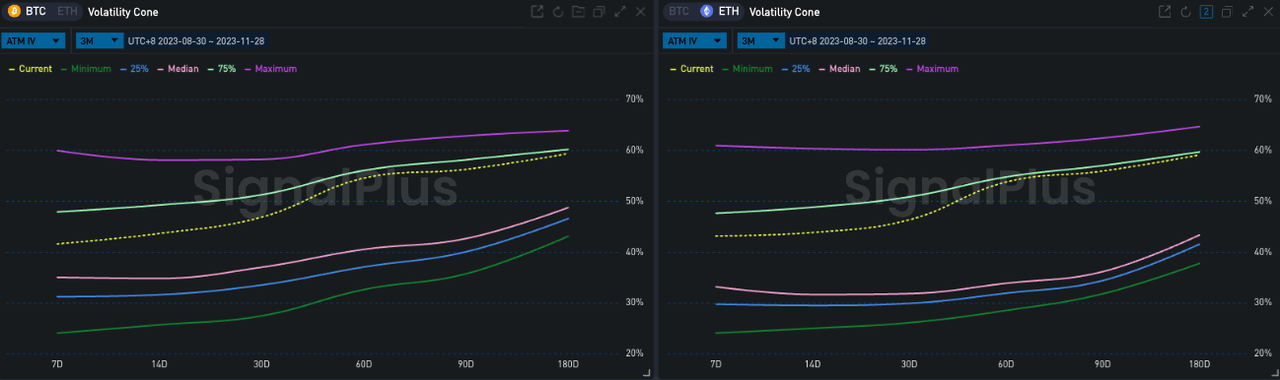

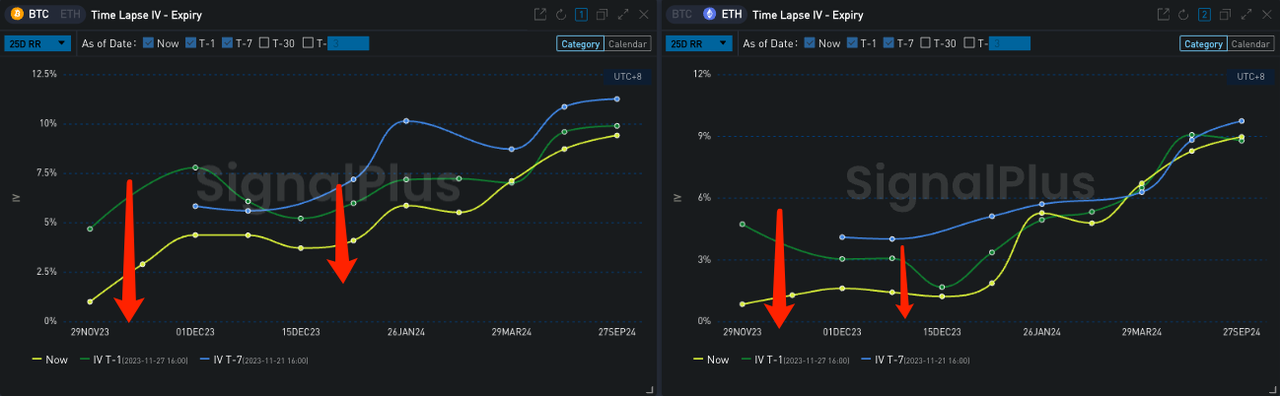

Digital currencies entered the market, with BTC prices fluctuating slightly around 37,000, and ETH mostly fluctuating above $2,000, falling below the 2,000 mark twice. In options, implied volatility has fallen along with realized volatility, with Vol retreating from a recent rally heading into the final month of the year, but remains relatively high compared to the past three months. In addition, as the markets bullish sentiment cools down, the slope of the mid-front-end curve is gradually flattening, and the term Vol Skew becomes steeper.

Source: Deribit (as of 28 NOV 16:00 UTC+8)

Source: SignalPlus,IV overall decline

Source: SignalPlus, Vol has retreated from recent gains but remains relatively high compared to the past three months

Source: SignalPlus, mid-front Vol Skew down

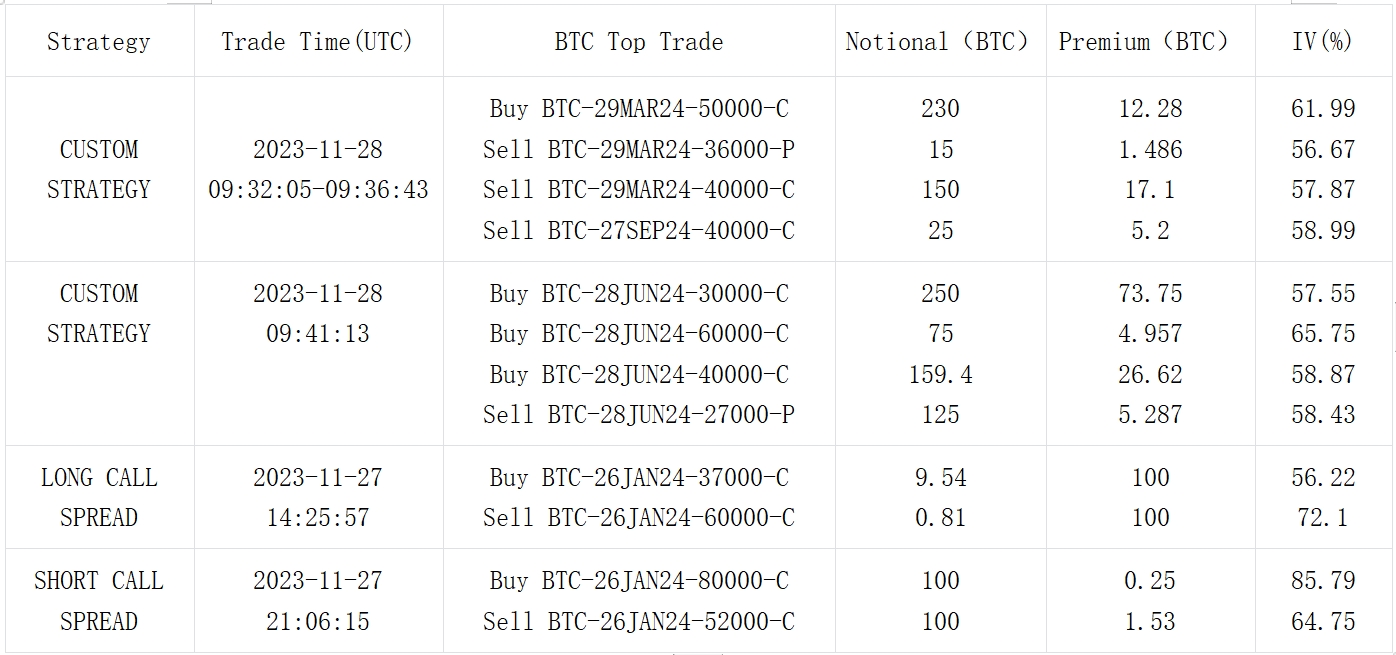

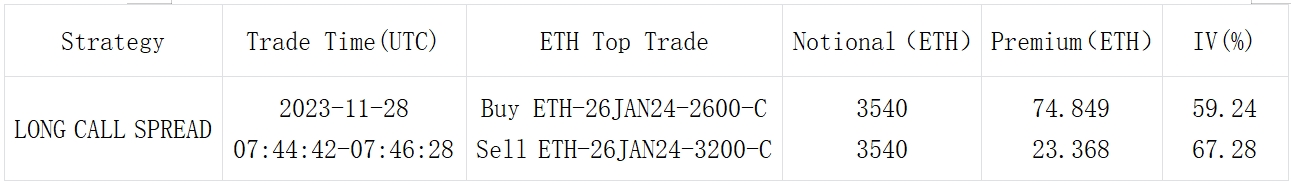

There was no significant change in BTC options OI in the past day, and trading was relatively lackluster.1 DEC/29 DEC There are more bulk shops selling Put near some ATMs than usual.. ETH transactions are mainly concentrated in call options (P/C Ratio= 0.38, which is almost only 1/2 of BTC). One group of buying 26 Jan 24 2600 vs 3200 Call Spread has become a hot spot in the bulk market and can be seen on the Deribit platform.Call options at 2100-2200 have been heavily sold by retail traders recently, pushing down the IV and Vol Skew on the front end.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com