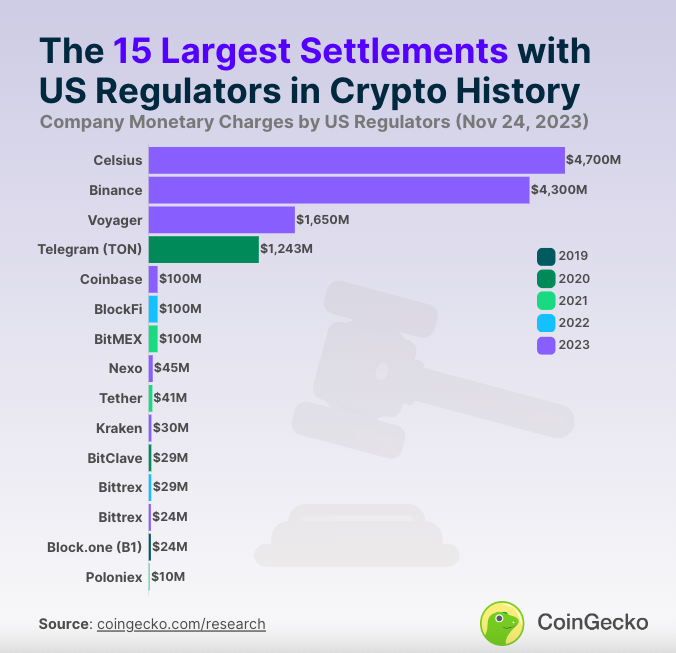

Top 15 U.S. Crypto Enforcement Actions: Binance’s $4.3 billion settlement ranks second

Original author -CoinGecko Lim Yu Qian

Compiled - Odaily Nian Yinsitang

Editors note: CoinGecko recently released US Regulators v Crypto: $ 12.4 B in Largest SettlementsReport, combing through settlements between U.S. regulators and major crypto companies, listing the Top 15 crypto enforcement actions in the country. Odaily compiles it as follows:

Top 15 Encryption Enforcement Actions in the United States

Now-bankrupt crypto lender Celsius has agreed to pay $4.7 billion, the largest settlement to date, in a crypto lawsuit brought by U.S. regulators.Celsius settled a lawsuit with the U.S. Federal Trade Commission (FTC) in July 2023 over the companys violation of investor protections. It should be noted, however, that Celsius payment of the settlement was delayed until after its bankruptcy proceedings.

And Binance’s $4.3 billion settlement makes it the second-largest enforcement action.Even so, the settlement with Binance is considered a landmark victory for U.S. regulators, as it is the only multi-billion dollar settlement to date by an operating cryptocurrency company. gold. BinanceAgreed to plead guilty in November 2023 to resolve litigation with multiple U.S. regulators, including the Department of Justice (DOJ), Treasury and the Commodity Futures Trading Commission (CFTC).

The third largest crypto enforcement action was against Voyager, another bankrupt crypto lender, which reached a $1.65 billion settlement with the FTC in October 2023.Similar to the Celsius settlement, Voyagers settlement payments were also deferred until after its bankruptcy proceedings.

So far, only 15 of the crypto lawsuits brought by U.S. regulators have resulted in settlements of more than $10 million.In contrast, Violation TrackerData Display, 48 lawsuits in the traditional financial services industry settled for more than $1 billion.

Among the Top 15 Encryption Enforcement Actions Launched in the United States,Violations of investor protection, anti-money laundering (AML) deficiencies and violations of economic sanctions are the main types of accusations.

When will major U.S. crypto enforcement actions take place?

Nearly half of the 15 largest crypto enforcement actions in the United States were settled in 2023 (47%).Regulatory scrutiny of the crypto industry has intensified globally this year following the collapse of centralized cryptocurrency exchange FTX in November 2022.

It’s also worth mentioning that the top four crypto litigation settlements with U.S. regulators all occurred in 2023, starting with Coinbase’s $100 million settlement with the New York Department of Financial Services (NYDFS).

2019-2022: US regulators win 8 major crypto lawsuit settlements

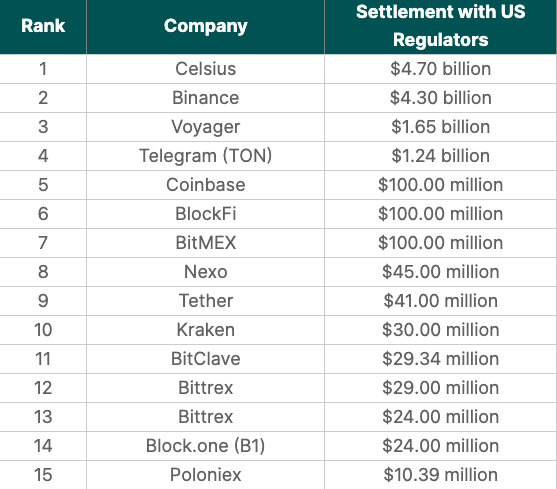

In late 2019, U.S. regulators reached the first major crypto litigation settlement with Block.one (now B1), the company behind EOS. At the time, the U.S. Securities and Exchange Commission (SEC) reached a $24 million settlement with Block.one over allegations that the company sold unregistered securities.

SEC wins two more major crypto lawsuits in 2020, among which ICO issuer BitClave reached a settlement of US$29.34 million in May, and Telegram reached a settlement of US$1.24 billion in June over the issuance of Gram tokens under its subsidiary TON Issuer. The $1.24 billion settlement includes $1.22 billion in disgorgement and $18.5 million in civil penalties.

Amid the 2021 bull run, U.S. regulators have again taken three major crypto enforcement actions against high-profile industry players.In August, cryptocurrency exchanges Poloniex and BitMEX settled with regulators for $10.39 million and $100 million, respectively. Then in October, stablecoin issuer Tether reached a $41 million settlement with the CFTC, claiming that USDT was fully backed by U.S. dollar assets.The CFTC also settled with Tether’s parent company, Bitfinex, paying a $1.5 million fine over illegal trading charges.

In 2022, cryptocurrency lender BlockFi reached a $100 million settlement with the U.S. SEC and the North American Securities Administrators Association (NASAA), the same year cryptocurrency exchangeBittrex reaches $29 million settlement with Treasury。

Which regulatory agencies led each of the 15 crypto enforcement actions?

To date, seven U.S. regulators launching crypto lawsuits have reached 15 settlements with large industry players. The U.S. SEC alone has led or co-led 8 crypto lawsuits, these lawsuits rank among the top 15 settlements to date, but it is worth noting that the SEC was not involved in the Binance settlement coordinated in November 2023.

This was followed by the Treasury Department and the CFTC, which each led three cryptocurrency lawsuit settlements, and the FTC led two. Meanwhile, the U.S. Department of Justice, the New York Department of Financial Services, and NASAA each led or co-led 1 major crypto litigation settlement.

Top 15 settlements reached between US regulators and crypto companies

As of November 24, 2023, the Top 15 litigation settlements between crypto companies and U.S. regulators are as follows:

Research Methodology: The study examined the settlement amounts crypto companies reached with U.S. regulators in federal court cases, based on official announcements from 2019 to November 24, 2023. Settlement years are attributed based on the dates of the respective announcements and do not include charges against individuals.