SignalPlus Macro Research Report (20231127): As the economy slows down, may the Federal Reserve cut interest rates ahead of schedule?

The market after Thanksgiving was as calm as expected. Germany announced the suspension of debt restrictions in its latest budget, which led to weakness in fixed income in Europe and the United Kingdom, dragging down the bearish trend of U.S. bonds. Market price trends were generally flat, and trading volume was only 50% of usual. , and most markets closed early during the noon period.

In the past few weeks, the number of people continuing to apply for unemployment benefits has slowly increased, and the unemployment rate has also gradually increased, indicating that the economy has finally begun to slow down due to high interest rates. The minutes of the Federal Reserve meeting also reiterated the narrative that interest rates have peaked, while downward inflation pressure is expected to be in 2024. This paved the way for interest rate cuts starting from March to April this year.

October core PCE will be announced this Thursday, and the market generally believes that the month-on-month growth will be moderate at about 0.16%, which will further support the Federal Reserve not to raise interest rates this cycle; in addition, this week there are new home sales, Case-Shiller house prices Index, as well as data such as the ISM Manufacturing Index, Powell will also participate in a fireside chat where he is expected to reiterate his current views.

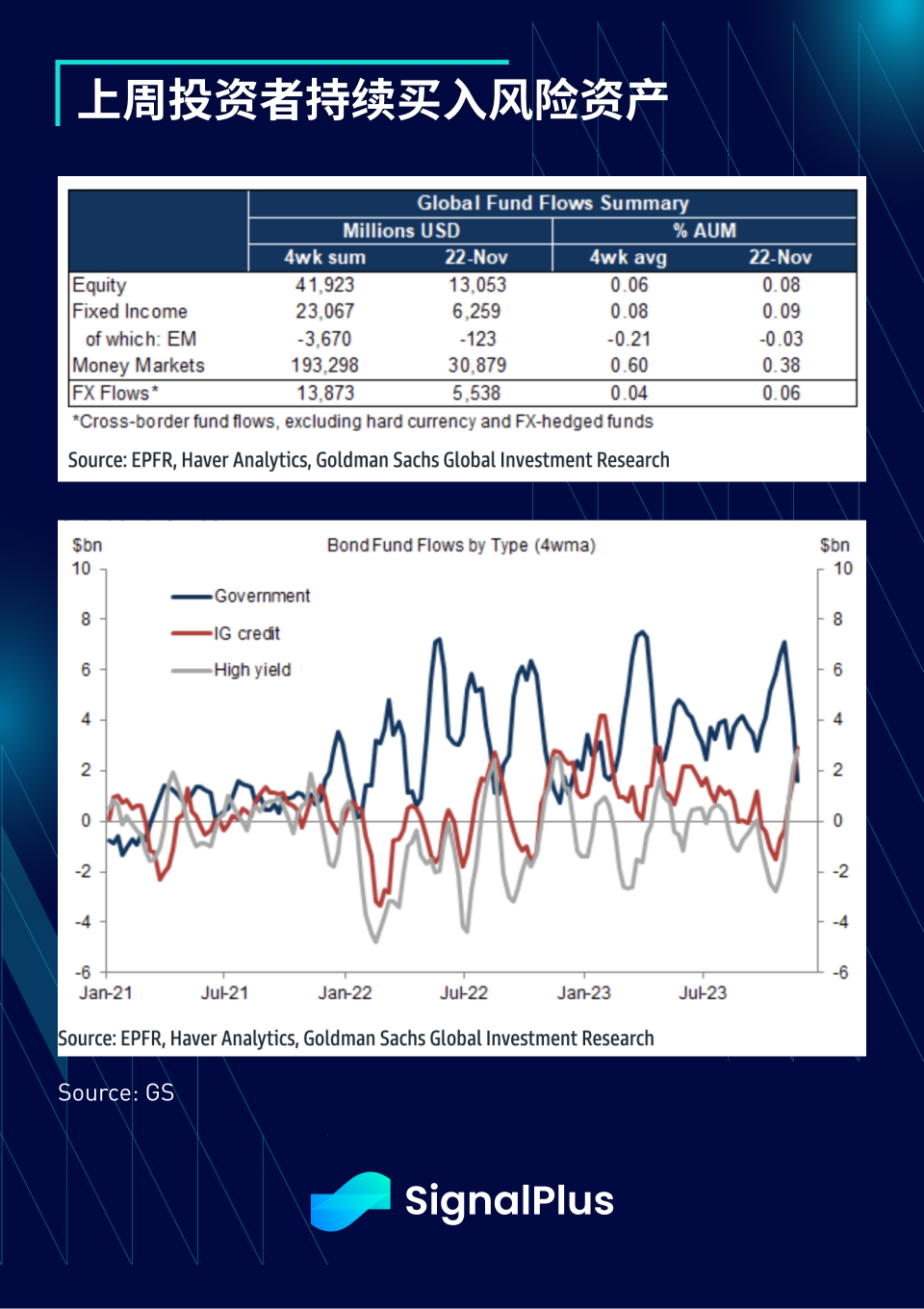

Funds flowed from U.S. Treasuries into investment-grade corporate bonds and junk bonds last week as extreme optimism in risk sentiment pushed investors further into risky assets. Stocks and money markets also saw significant inflows. Weak inflation and employment data discouraged investment. Investors have good reasons to maintain risk-on positions through the end of the year.

The just-released spending data for the Black Friday week confirmed the markets strong expectations. According to Adobe data, consumer spending on Thanksgiving on Thursday reached $9.8 billion, an annual increase of 7.5%. Salesforces report also pointed out that Black Friday continued strong consumption. , online sales reached US$16.4 billion, an annual increase of 9%, setting another record, and American consumers once again proved that they have no flinch in spending.

Cryptocurrency prices remain solid following Binance settlement. The Binance exchange and BNB Smart Chain have essentially eliminated the risk of systemic collapse. TradFi analysts are almost unanimous in viewing this event as a positive event for the cryptocurrency space. Binance’s The spot market share dropped from 62% in February last year to 38% in November. Now that the possibility of long-term operation of the exchange in the United States has emerged, institutional users may increase their willingness to use it, and its market share has a chance to rebound.

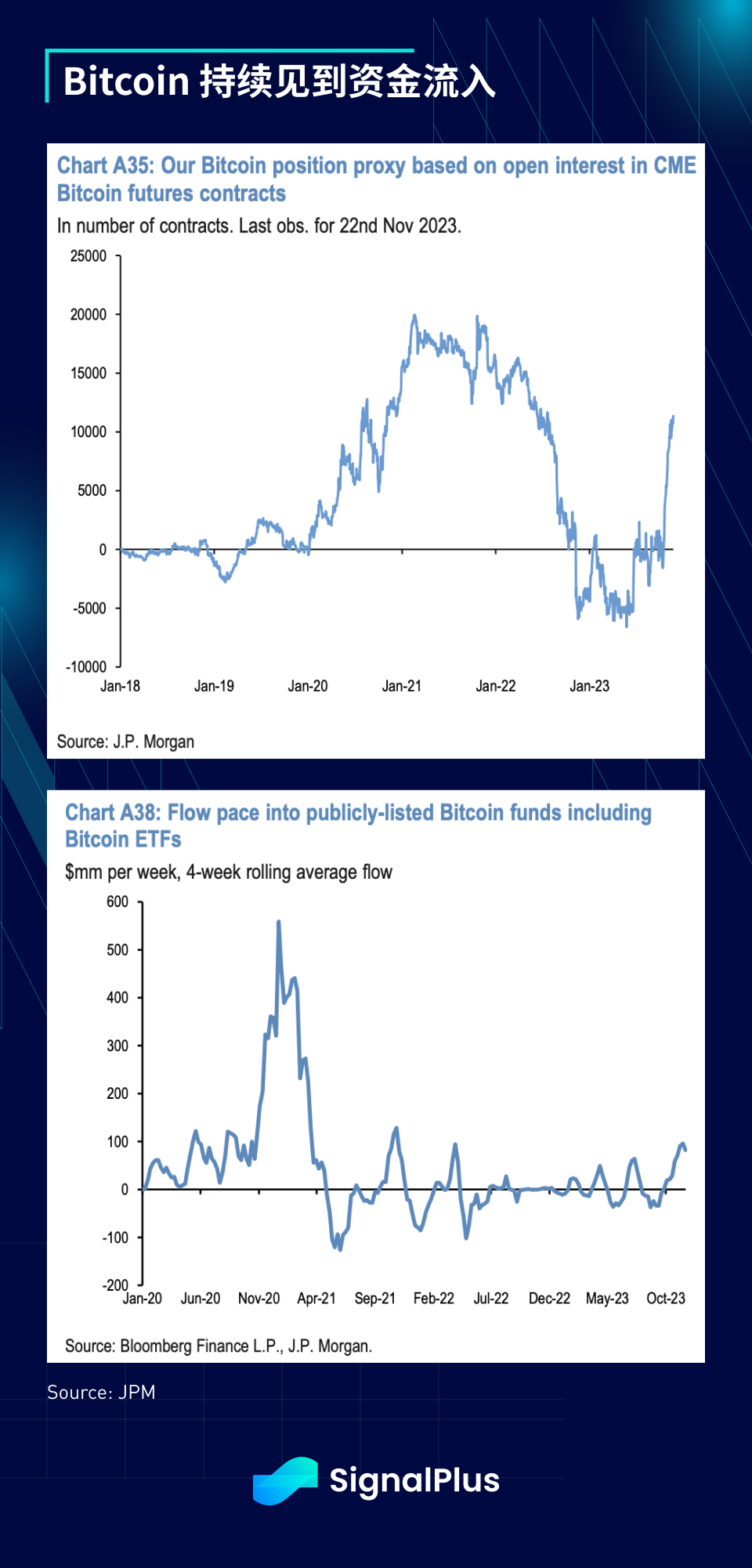

Institutional funds are still flowing into Bitcoin through CME futures, and ETF inflows have also rebounded to the highest level since the Luna crash in the first quarter of 2022; in addition, following Victory Securities, Interactive Brokers also received approval from the Securities Regulatory Commission to provide retail customers in Hong Kong The cryptocurrency trading service continues the city’s efforts to develop Hong Kong into a major digital asset hub and open cryptocurrencies to the public.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com