DeFi historical research: DeFi development history before Uniswap

Original author: 0xKooKoo, Geek Web3 MoleDAO technical consultant, former Bybit technical director

Original source:Geek Web3

Note: This article is the author’s archaeological research on DeFi at this stage. There may be errors or biases. It is only for communication purposes. We look forward to your corrections.

Introduction

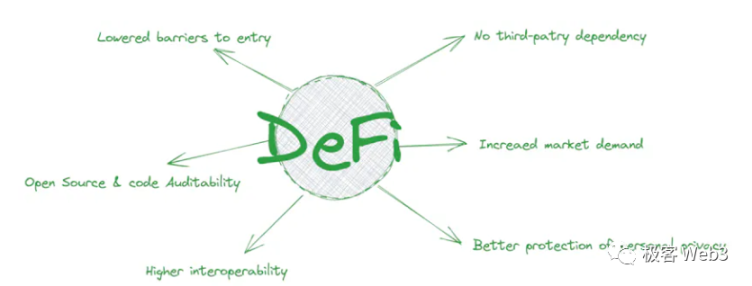

Most people came into contact with DeFi during the DeFi Summer of 2020, and I think there are probably the following reasons why DeFi suddenly became popular.

No need to rely on third parties. DeFi, like Bitcoin, does not need to rely on any third party (except Oracle). Users only need to access the encrypted wallet and sign to complete transactions on the entire chain. As long as the smart contract is safe, no one can take away the user. Assets, Notyourkey, Notyourcoin. I believe that old leeks who have experienced the Mt. Gox theft incident and new players who have experienced the tragedy of FTX misappropriating user assets can better understand this feeling of lack of trust.

Market demand increases. Before DeFiSummer occurred, there was a huge demand for liquidity globally. Low interest rates in the traditional financial system and easing global liquidity policies led to funds looking for higher yield opportunities. DeFi offers a viable alternative, attracting massive inflows with higher interest rates and greater investment opportunities.

Better protect personal privacy. DeFi requires no or only a small amount of KYC. DeFi platforms are built on blockchain technology and execute transactions and agreements through smart contracts. Unlike traditional financial institutions, DeFi does not have a centralized management agency or intermediary, but is automatically executed by codes and protocols.

This decentralized nature makes it impossible for DeFi platforms to directly collect and manage users personally identifiable information, making it impossible to conduct KYC procedures common in traditional financial institutions. There are indeed many alpha opportunities on pure chains, and those who can seize these opportunities are professional players. Professional players do not want to expose their strategies and personal information, so DeFi is indeed the best choice for these players.

The threshold is lower and Permissionless. DeFi has indeed solved some problems and deficiencies in the traditional financial system to a certain extent. For example, anyone can list your token on Uniswap, which greatly improves the breadth of transactions. As long as people have trading needs for a certain token, they can be satisfied on DeFi without having to wait for a centralized exchange to go through multiple reviews to select the currency.

Code auditability. DeFi projects are often open source and their smart contract code can be audited and verified by anyone. This openness and transparency allows people to inspect the code to ensure there are no hidden malicious behaviors or risks. In contrast, the back-end programs of traditional financial institutions are relatively closed source, and people cannot directly audit their internal operations.

Highly interoperable. Different protocols and platforms in the DeFi ecosystem can connect and cooperate with each other to form a seamless financial network. Because of this, the DeFi community usually tends to maintain the principles of openness and interconnection to promote more innovation and development.

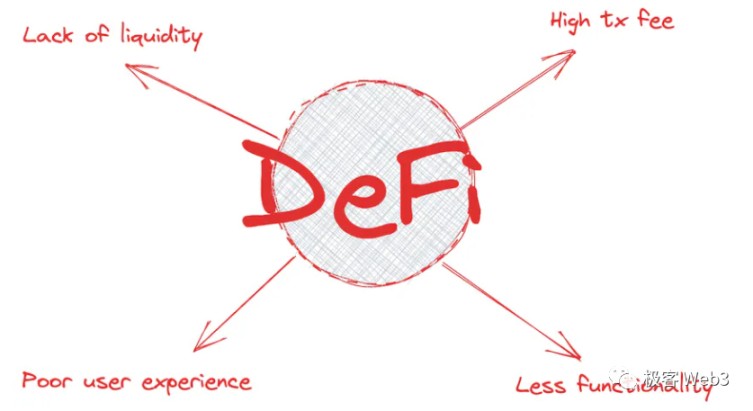

But DeFi also has some problems:

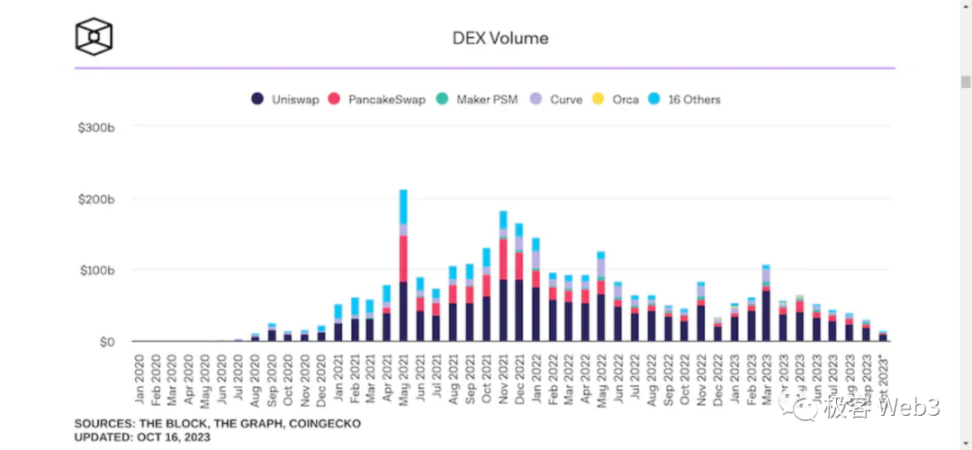

Lack of liquidity. Compared with the liquidity of centralized exchanges, DEX still has a lot of room for improvement. According to the latest data from theblock.co on October 16, 2023, DEX spot trading volume in the past month was only 13.45% compared to CEX spot trading volume in the same period last year. . In addition, the lack of liquidity brings about the problem of excessive transaction slippage. For example, spending 1500 USDT on CEX can buy 1 tokenA, but in the liquid pool on the chain with poor liquidity, the same 1500 USDT can only You can buy 0.9 tokenA, and one transaction is equivalent to a 10% drop.

Transaction fees are high. Because DeFi transactions are conducted on the chain, they will be subject to the performance and storage space of the public chain. For example, Uniswap’s transaction fees may rise sharply due to congestion on the Ethereum main network. For example, I had an ordinary transaction before The experience of being charged a handling fee of up to 200 USD really made me want to give up.

Fewer features. Compared with the wide range of businesses of centralized exchanges, such as grid trading, fixed investment robots, financial products and other customized services, DeFis current business is still very low-level and scattered, such as only simple swap transactions, liquidity mining, and Staking , Farming et al.

Poor interactive experience. The interactive experience of DeFi is much worse than that of mature CEX. For example, it takes several seconds to wait for a transaction, the signature content is not direct, the noun concepts are not unified, and the product flow logic is not smooth. But this problem is actually quite good, because as long as standards are gradually unified, many front-end codes and product logic can form mature and easy-to-use templates, and then all companies will actually be similar.

The Past: The Past History of DeFi

It can be said that from the day BTC came out, people have wanted to be able to conduct transactions in a decentralized way, and financial innovations on this chain have emerged one after another. Since BTC is not very programmable, everyone did not think too much about this path. Later, Ethereum came out and the imagination space was opened. Many projects used ICO to raise funds.

After the ERC 20 protocol was finalized, the flow of assets on the chain became more abundant, and a series of innovative financial products emerged.

Next, let’s do some archeology and see what difficult journeys DeFi has gone through along the way, and what products and celebrities have made great innovations.

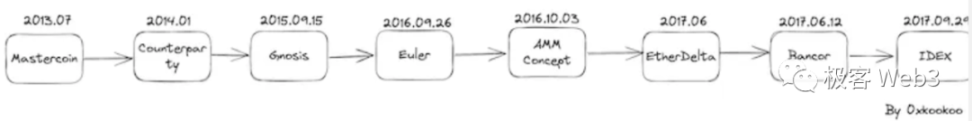

The earliest discussion about decentralized finance can be traced back to July 2013, when Mastercoin founder JR. Willett launched the first ICO on the bitcointalk forum and stated that only those who participate in donations can enjoy decentralized transactions. Distributed betting and other new features that are superior to Bitcoin. This also allowed him to successfully raise 4,740 Bitcoins, which was worth $500,000 at the time.

In 2014, Robert Dermody and others co-founded CounterpartyProtocol, a peer-to-peer financial platform and distributed open source network protocol built on the Bitcoin blockchain.

The problem it solves is to allow users to create their own tokens on the Bitcoin blockchain. Counterparty has a native currency called XCP, which is produced from Bitcoin through the proof of burn mechanism.

Counterparty provides financial instruments such as derivatives that Bitcoin cannot provide. Counterparty was used by Overstock.com to trade fiat securities on the blockchain. Counterparty has also created a decentralized asset exchange on which various digital assets can be traded. Users can use Counterparty using the counterpartyd node software and Counterwallet web wallet.

Counterparty also implements things like smart contracts and dapps on Bitcoin. It also provides an open source and decentralized platform to conduct financial activities without relying on any central authority. Several well-known NFT projects such as SpellsofGenesis and RarePepe are built on the Counterparty platform.

Overall, the Counterparty protocol utilizes the Bitcoin network and technology to solve financial products and services that Bitcoin itself cannot provide, making it a more comprehensive decentralized financial platform. Moreover, the Counterparty protocol is still alive today and is one of the oldest and most famous decentralized finance (DeFi) platforms.

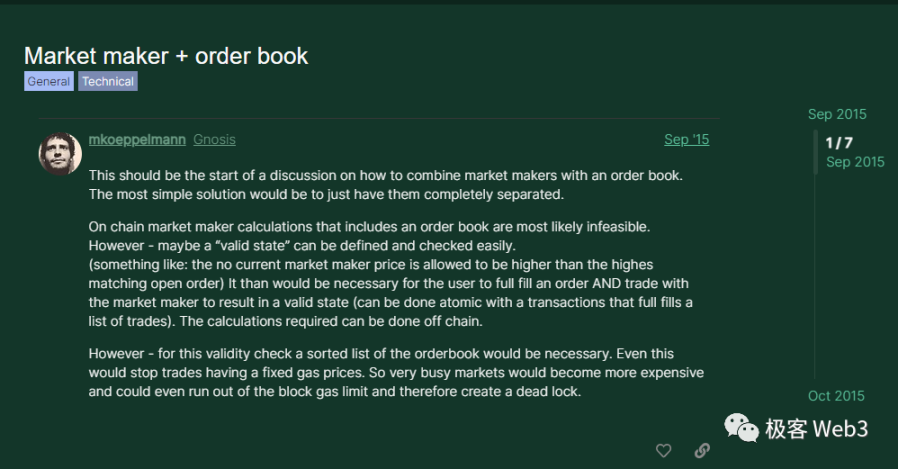

On September 15, 2015, Gnosis founder Martin posted his thoughts on how to combine MarketMaker and OrderBook on his own forum. This is also the earliest post I have found about the decentralized prediction market.

Gnosis is a decentralized prediction market built on the Ethereum protocol. It provides an open platform for people to predict the outcome of any event, greatly simplifying the creation process of customized prediction market applications. At the same time, Gnosis uses the characteristics of blockchain trust machines and automatic execution of smart contracts to allow players to enter the prediction market more flexibly and freely, bringing greater room for imagination to the prediction market. By the way, this Martin is very powerful, and the following GnosisChain (formerlyxDaiChain), Balancer, SAFE wallet and CowSwap are all related to him.

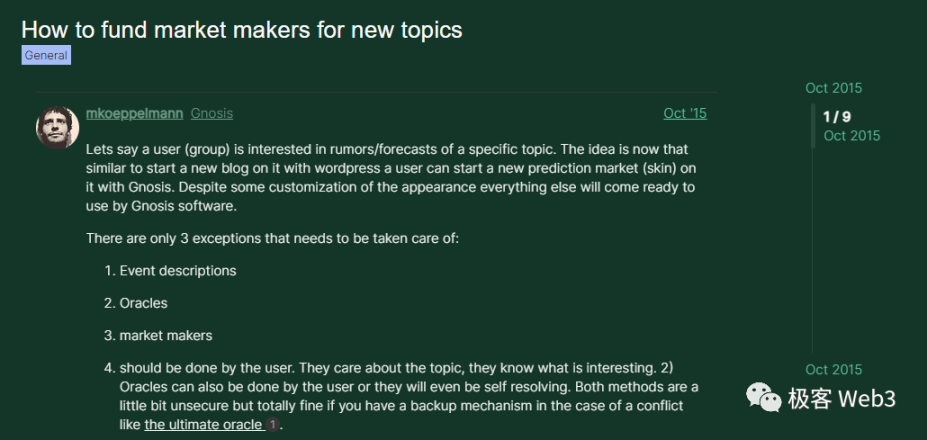

On October 27, 2015, Gnosis founder Martin initiated another discussion on his own forum on how to provide a certain amount of funds as initial liquidity for the newly created PredictionTopic to ensure the normal operation of the market.

Such as providing funding through project grants, such as working with other investors or foundations to obtain financial support, this post highlights the importance of community engagement. It can be said that this is the earliest discussion thread on how to attract more mobility and participation that I found during the archaeological process.

On September 26, 2016, Nick Johnson, chief development engineer of Ethereum and ENS, posted a post on reddit, proposing the concept of a decentralized exchange called Euler. The main contents include:

Euler allows users to purchase Euler coins with different types of tokens. Euler holds these tokens, and the number of tokens determines how many Euler coins users can exchange for them. Purchasing the first Euler coin requires 1 token, the second requires e tokens, the third requires e^ 2 tokens, and so on, calculating the price of each Euler coin with exponential growth.

When new tokens are added, a collection phase needs to be run, and users can submit bids to provide new tokens to exchange for Euler coins. Finalize the initial price of the new token. The total value of Euler coins should be equal to the total value of all tokens held by Euler. It can provide some protection against the impact of individual token price fluctuations on its value.

At the same time, a mechanism should be set up to quickly stop buying a damaged token to prevent the token from being spam to redeem other tokens. Overall, this system is designed to be simple and decentralized, but there are also some economic implications that need further investigation.

Prologue to AMM

On October 3, 2016, Vitalik posted a post on reddit, which was inspired by Nick Johnson and proposed a new method of using distributed exchanges with reference to some emerging DEXs at the time:

Use an on-chain automated market maker mechanism similar to prediction markets to run distributed exchanges, without the need to place and cancel orders like ordinary exchanges.

Users can invest in this market maker, increase the depth DEPTH and obtain a profit share, which can also reduce the risk of the market maker. Compared with traditional exchanges, this method can significantly reduce the price difference, but only requires on-chain transactions during actual transactions, without the need to place and cancel orders. Issues were also raised about the addition of new tokens and the need to stop buying when prices fluctuate too much. Subsequently, we discussed how to add multi-asset support, and the issues of commission that investors need to consider when investing and withdrawing.

It can be said that this post laid the foundation for AMM type DEX and opened up a market worth hundreds of billions.

In June 2017, EtherDelta (EtherDelta) was officially launched and became the first Ethereum decentralized exchange recognized by regulatory authorities because it completed the registration procedures with the U.S. Securities and Exchange Commission long before it went online.

But in fact, as early as June 23, 2016, EtherDelta founder Zachary Coburn (Zack for short) had submitted the first commit on Github. EtherDelta was the first decentralized exchange to register with the US regulatory agency CFTC. Place.

Generally speaking, the main advantages of EtherDelta becoming the first Ethereum DEX in 2017 are that it achieves purer decentralization, low threshold, strong anonymity, low cost and stable performance. The technical principle of EtherDelta is as follows:

Implement an order book trading system using smart contracts. Users issue, cancel, and match buy and sell orders through trading contracts. Order book information and transaction records are stored on the Ethereum blockchain to achieve decentralized trading. You only need to access the EtherDelta website through the web or mobile terminal to use it, without downloading a dedicated application.

Deltas website interacts with the EtherDelta smart contract via JavaScript, reading order book information and conducting transactions with counterparty users. Users need to broadcast transactions to the Ethereum network and pay gas fees when issuing or canceling orders. After the counterparty clicks on the order, the trading contract automatically deducts the buyers assets and sends them to the seller, realized on-chain.

The smart contract records each transaction, including the involve account address, type and amount of transaction tokens. User assets are always kept in their own wallets and will not be controlled on the EtherDelta service. EtherDelta charges a 0.3% transaction fee, which is entirely borne by the buyer. The entire transaction process is guaranteed to be decentralized, transparent and open, but relies on the performance of the Ethereum network.

EtherDelta also had some shortcomings at the time

During the order matching process, manual operations are required. Traders need to search for orders on the website themselves to see if they meet their needs. Once they find a suitable order, they also need to manually match it with the other partys order. This means that at the same point in time, both parties need to reach a consensus on the price. In short, the entire process requires manual operation and cannot be completed automatically.

Order matching processing speed is slow. After placing an order, users may have to wait a long time for the transaction to be completed, because the processing speed of Ethereum was not fast at that time, and the liquidity was not strong;

Waste of gasFee. Due to the high latency of the EtherDelta order book, some Takers may be blind to each others orders. This can lead to a situation where multiple takers compete to fill the same maker order, causing the order to fail with some delay and gasFee being wasted on all but the winning taker.

Later, EtherDelta also faced some doubts, such as the former CTO being accused of insider trading. For details, please see the indictment issued by the US SEC on November 8, 2018. The report concluded that certain digital assets, such as ERC-20 tokens, are securities and therefore can be regulated by the SEC. The SEC stated that all platforms that trade such assets are required to register with the SEC as a securities exchange, but EtherDelta has not done so.

Although Coburn did not formally confirm or deny the SECs allegations, he agreed to settle with the regulator to pay $300,000 in disgorgement, a $75,000 penalty and $13,000 in prejudgment interest. In order to establish that Zachary Coburn was personally liable, the SEC certified that:

EtherDelta violated the securities laws, and Coburn caused EtherDelta to violate the Securities Exchange Act and knew or should have known that his actions would cause EtherDelta to violate the securities laws.

EtherDelta is unlucky. It has registered with the CFTC (Commodity Futures Trading Commission) in the United States, but has not registered with the SEC (Securities and Exchange Commission), another important U.S. regulatory agency. EtherDelta reported to the CFTC mainly because it mainly trades digital currencies rather than financial securities. However, the SEC later issued guidance classifying many tokens as securities, so in theory EtherDelta should also report to the SEC. However, at that time, the SECs supervision of blockchain innovations had not yet been clarified, and EtherDelta did not proactively report to the SEC.

There are some bloody stories about EtherDelta’s team feuding, such as forking a forkDelta, and even becoming the first decentralized exchange to run away due to centralized equity disputes.

The approximate timeline is:

In early 2018, Yide’s founding team sold the platform to Chinese businessman Chen Jun. According to an exposed document signed on December 15, 2017, Yide Company conducted an equity delivery and prepared to start raising ETH (Ethereum) from the market.

On February 9, 2018, the team issued a statement saying that Yide was upgrading its technology. On February 18, the German exchange was exposed by the media to have suspended trading. On February 19, the foreign founding technical team, after selling the Yide platform to obtain funds, forked the Yide project and ran a new ForkDelta trading platform.

On February 21, 2018, the German exchange stopped trading again, and the actual controller Chen Jun was exposed to have run away.

The AMM era officially begins

BancorProtocol was launched on June 12, 2017, and ICO raised $153 million

The most important innovation of Bancor is the introduction of the AMM mechanism into the field of decentralized exchanges for the first time, solving a series of challenges in decentralized transactions, which actually laid the foundation for AMM applications in the Ethereum ecosystem. Unlike the traditional order book method of matching buy and sell orders, Bancor uses a liquidity pool to solve the problem of order pricing and matching on decentralized exchanges. Users can trade without waiting for counterparties.

On September 29, 2017, IDEX, co-founded by the two brothers AlexWearn and PhilipWearn, officially launched its beta version, but its project source code was first uploaded to Github in January 2017.

2017 was the peak period of the IC0 bubble. Various ICO projects emerged, but most of them had uneven quality and were full of chaos. As the ICO market cools down, people holding various tokens are beginning to look for ways to change hands. However, the mainstream exchanges at that time were not decentralized, and there were risks of third-party agency control, which provided opportunities for IDEX.

It imitates the Counterparty protocol previously built on Bitcoin and implements the decentralized transaction function on the first generation of Ethereum. Users can trade various Ethereum and ERC 20 standard tokens through IDEX to avoid trusting third-party organizations and institutions.

IDEX focuses on

high speed. IDEX uses offline order book matching, which makes transactions faster than EtherDelta, and the user experience is more like a middle-man exchange.

High security. Its core is smart contracts. User assets are not controlled by intermediaries and the risks are lower.

Fully functional. It supports instant cancellation of untraded orders (and it’s free because it’s off-chain cancellation), market price trading and other functions, making it easy to operate.

Supports multiple tokens. When it was launched in 2017, it already supported more than 200 ERC 20 transactions, with good selectivity.

Low transaction fees. The transaction fee is 0.3%, which is cheaper than other decentralized exchanges.

High anonymity. IDEX does not require real-name authentication at the beginning of its launch, which is suitable for users who pursue privacy.

But at that time, the entire DEX was just getting started, and the trading volume was low. In 2017, the entire year was only about 50 million US dollars. Although IDEX was very popular at the time, the trading volume was still very small. This proves that the decentralized exchange products and ecology were still very immature at that time and needed to continuously enrich the products and enhance the user experience.

On November 8, 2018, an article concluded that IDEX was firmly ranked first among DEXs at that time.

MakerDAO (launched in December 2017)

The main innovations of MakerDAO include:

Low Volatility: By introducing the stablecoin Dai, MakerDAO provides a USD-pegged cryptocurrency that enables users to trade and store value in the cryptocurrency market while reducing the risk of price fluctuations.

Weak centralization risk: Traditional centralized stablecoins are issued and supported by centralized institutions, and there are problems of trust and risk concentration. MakerDAOs decentralized model avoids the risks of a single centralized institution and allows users to directly participate in and control the system through smart contracts and mortgage assets.

Transparency and Autonomy: MakerDAO adopts the decentralized autonomous organization (DAO) model to enable holders of MKR tokens to participate in decision-making and governance of the platform. This model increases the transparency of the system and community participation, improves the fairness of decision-making and the reliability of the system.

KyberNetwork (launched on February 26, 2018)

The main innovations of KyberNetwork include:

Instant exchange: KyberNetwork allows users to directly conduct instant exchanges between tokens without the need for an exchange. Users can trade directly through KyberNetworks smart contracts without buying or selling on a centralized exchange.

Decentralized Liquidity Pools: KyberNetwork introduces decentralized liquidity pools, providing a deeper and more liquid market by pooling funds from multiple participants. These liquidity pools are provided by users who hold tokens and are managed through smart contracts.

Best Price Execution: KyberNetwork automatically selects the best price and liquidity source to execute trades through smart contracts. This means users get the most favorable exchange rates and avoid comparing and choosing between multiple exchanges.

Flexible integration: KyberNetwork provides open APIs and smart contract interfaces, allowing other decentralized applications (DApps) and services to seamlessly integrate and utilize KyberNetwork’s liquidity.

0x Protocol (launched in May 2018, ICO raised $24 million)

The main innovations and problems solved by the 0x protocol include:

It provides open source decentralized transaction protocols and APIs, supports DApps to be developed on top of them, and reduces development thresholds and integration costs. 0x positions itself as the “settlement layer” for decentralized exchanges. It is not a facilitator of trade, but an infrastructure on which any type of venue can be built, such as eBay, Amazon, order book DEX, even with the granularity and control of order flow familiar to traditional financial giants.

Supports trading of any ERC 20 token, not limited to two tokens. Adopt an economic incentive model based on the governance token ZRX. Provide a unique 0x Mesh network to connect each relay node.

0x Protocol built Matcha, a consumer-facing DEX aggregator that uses the 0x API and smart order routing to aggregate liquidity and provide optimal trade execution. After that, other DEX aggregators came out one after another. The advantage is that they aggregate the liquidity on the chain, which is equivalent to wholesalers purchasing goods from different factories and then selling them uniformly to make a profit.

Compound (launched in September 2018), TVL exceeded US$100 million for the first time in 2019

Compound’s main innovations include:

Introducing digital asset lending into the Ethereum ecosystem for the first time, Compound is the first protocol to implement cross-asset lending of ETH and ERC 20 tokens.

There is no need for physical collateral, just deposit digital assets into smart contracts to obtain loans, which greatly reduces the cost threshold for obtaining loans.

With the interest rate market-driven mechanism, Compound adjusts the interest rates of different assets in real time based on supply and demand to balance the market.

Supports a variety of mainstream stablecoins and token lending, such as USDC, DAI, etc., providing users with higher selectivity.

Lending assets can be used directly without delivery, which simplifies the lending process and users can return the loan and get back the collateral at any time.

Providing open and non-confrontational APIs greatly promotes the application of lending business among DApps.

Implemented using smart contracts that are simple to operate and easy to audit, this is also an important reason why DeFi has taken the world by storm.

Overall, Compound uses digital assets and blockchain technology to provide convenient and efficient decentralized lending services to users around the world. It solves the cost efficiency and localization problems faced by traditional finance and creates a new situation in the development of DeFi.

dYdX (launched in October 2018), the highest TVL has exceeded 1 billion US dollars.

The main innovations and problems solved by the dYdX protocol are as follows:

A decentralized perpetual contract trading platform has been built, allowing users to trade perpetual contracts on the chain, avoiding the risks and asset custody issues of centralized exchanges. Using a hybrid on-chain and off-chain order book, the off-chain order book improves transaction efficiency, and the on-chain order book ensures transparency. Through off-chain order books, dYdX can provide lower slippage and deeper liquidity, enabling high-frequency trading and low transaction costs.

Allow users to participate in governance and obtain miner benefits by staking assets. It provides decentralized leverage trading and supports multiple assets. Users can achieve leverage trading up to 20X. It supports overnight margin trading and isolated margin trading, and allows users to adjust the position margin rate according to their own risk preferences.

(To be continued)