Zephyr has skyrocketed, is it considered a dark horse in the market?

Original - Odaily

Edit - 0xAyA

What is Zephyr and why has it increased so much?

This is the first thought most people have when they see this algorithmic stablecoin project. When the markets hot spots are focused on the Inscription Ecosystem, ZEPH, the base currency of this protocol, has doubled five times in 10 days in a corner that few people care about, and its rise has also successfully attracted peoples attention. This protocol is based on Monero What exactly is the algorithmic stablecoin mechanism constructed?

According to the white paper, Zephyr combines the algorithms and reserve backing methods of the Djed stablecoin framework with the privacy-enhancing features of Monero. Based on the proven Minimal Djed protocol and combined with Monero’s powerful privacy protection features, Zephyr launches the first private, reserve-backed stablecoin system. There are three types of tokens in the ecosystem: base currency (ZEPH), stable currency (ZephUSD), and reserve currency (ZephRSV). Users can use the former to mint the latter two.

According to the white paper, Zephyr combines the algorithms and reserve backing methods of the Djed stablecoin framework with the privacy-enhancing features of Monero. Based on the proven Minimal Djed protocol and combined with Monero’s powerful privacy protection features, Zephyr launches the first private, reserve-backed stablecoin system. There are three types of tokens in the ecosystem: base currency (ZEPH), stable currency (ZephUSD), and reserve currency (ZephRSV). Users can use the former to mint the latter two.

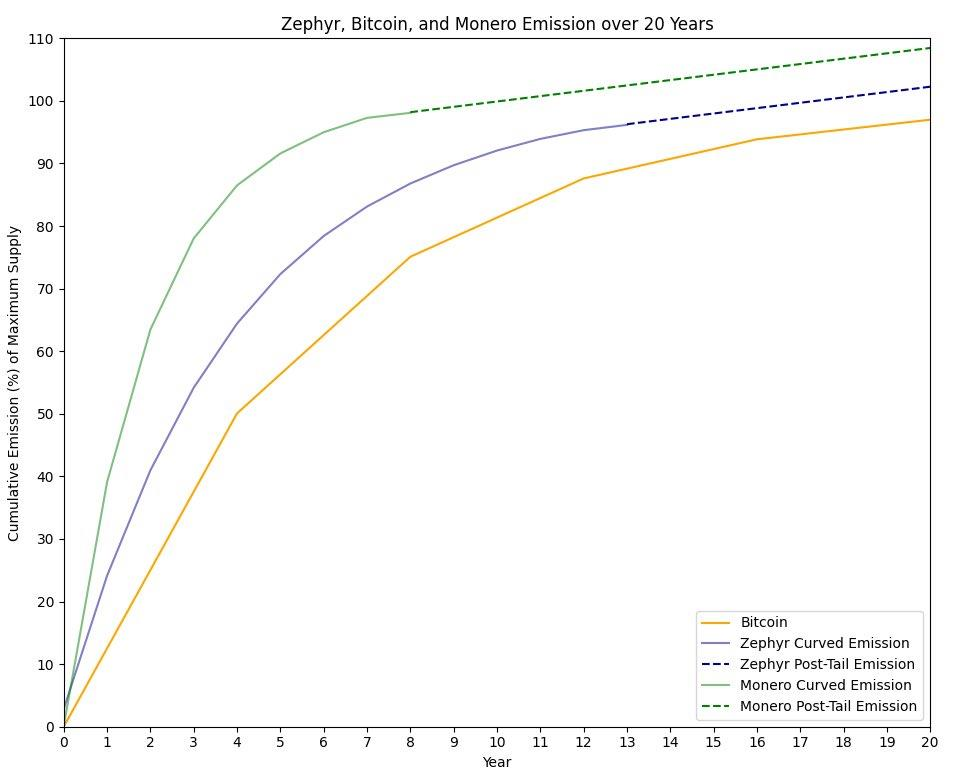

The base currency ZEPH itself is obtained through PoW algorithm mining. Compared with Monero, Zephyrs emission curve is slightly slower. The purpose of this design choice is to reward early adopters and reduce dilution to them. At the same time, slowing down the initial emission also reduces the potential inflationary impact on the ZEPH price, which is beneficial to the stability of the algorithmic stablecoin system.

Minting the stablecoin ZephUSD requires 4-8 times over-collateralization of ZEPH. This design makes on the one hand the more ZephUSD is minted, the greater the demand for ZEPH in the market and the price will rise accordingly; on the other hand, ZEPHs own mechanism also ensures that ZephUSD will not enter a death spiral like the UST system - the supply of ZEPH will always be discharged regularly through PoW mining, and its supply is not subject to the minting of stable coins and reserve coins. and the impact of the redemption process, which prevents the Zephyr protocol from minting excess base tokens. The design of these two underlying layers helps the entire protocol prevent potential market manipulation and price fluctuations, thereby improving the stability and sustainability of the entire system, while also providing institutional incentives for currency price increases.

ZephUSD also has the anonymity of Monero - although the narrative of privacy coins has not been recognized by most people in the market for various reasons for a long time, it still has its much-needed value in some areas. The technology behind it enables ZephUSD to operate in a decentralized manner, eliminating potential risks associated with centralized control while enabling users to trade freely and anonymously without fear of volatility or surveillance.

The reserve currency ZephRSV exists as a backup asset for adjusting the entire ecosystem. As more ZephUSD coins are minted and redeemed, transaction fees will increase and be deposited into a reserve pool, while 20% of transaction fees will be provided to ZephRSV holders as a reward. This process not only expands the earning potential for ZephRSV holders, but also contributes to the stability of ZephUSD, as these transaction fees increase the value of the reserve, thereby strengthening ZephUSD’s over-collateralization. At the same time, ZephRSV has also set a maximum savings ratio of up to 800% to ensure that ZephRSV will not be diluted in value due to large amounts of minting.

Since their inception, all algorithmic stablecoins have had to face a common challenge: how to strike an optimal balance between protecting the base currency and the value of the stablecoin.

The Zephyr protocol minimizes the risks of stablecoins through careful design, and uses the PoW mechanism to keep the output of base coins within a controllable range, thus largely solving this problem that has plagued the market for a long time. Although the design of the protocol itself prevents ZephUSD from quickly conquering the city and occupying a large amount of market liquidity like other stablecoins, the security gained at the expense of growth can always be guaranteed - after all, stability The most important thing about a currency is stability.

ZEPH’s successful rise is inseparable from its over-collateralization mechanism and the design of PoW mining, but does the market recognize and accept this design? Can it promote innovation in the algorithmic stablecoin track? Market acceptance and innovation promotion do not happen overnight and require long-term efforts and positive feedback from the market. Although ZEPHs design has potential, it still takes time to test whether it can ultimately survive in the algorithmic stablecoin track filled with experts.