SignalPlus Volatility Column (20231117): Coin price IV maintains a positive correlation trend and falls simultaneously, Vol Skew retraces sharply

Yesterday (16 Nov), the number of people filing for initial unemployment benefits in the United States increased more than expected to 231,000, the highest level in the past three months. At the same time, the number of people continuing to apply for unemployment benefits also rose to 1.865 million, the highest level in the past two years.Both sets of unemployment data showed weakness in the U.S. labor market, further strengthening the markets view that the Federal Reserve will pause on raising interest rates.. As of now, the two-year/ten-year U.S. bondClosed downat 4.809%/4.392%. U.S. stock indexesnarrow range, the Dow closed down 0.13%, and the SP 500/Nasdaq closed up 0.1%/0.12% respectively.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

In terms of digital currency,Realized volatility remains high, BTC quickly gave up almost all its gains after touching a high of 38,000, and returned to around $36,000 after rebounding above the recent pivot point (about $35,300). ETH once again fell below the 2,000 mark and consolidated near $1,960.

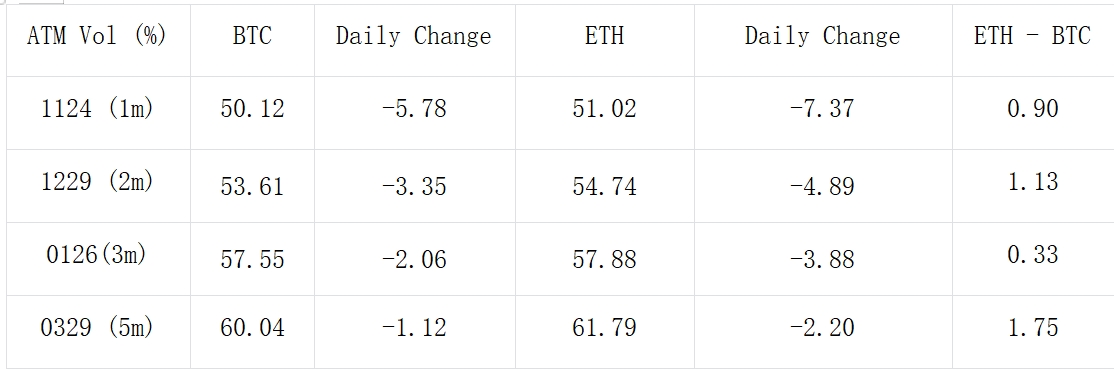

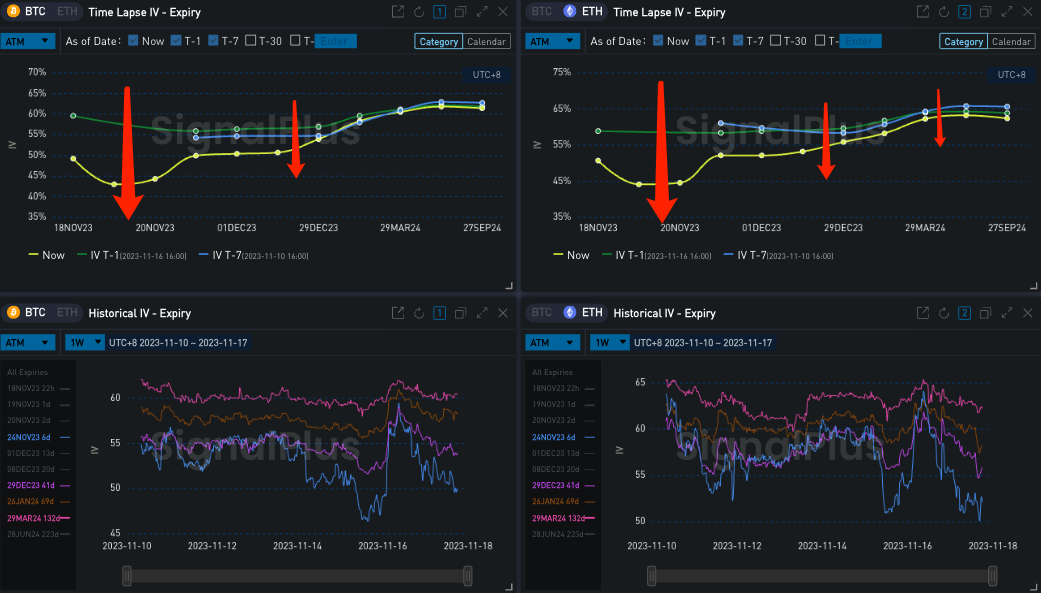

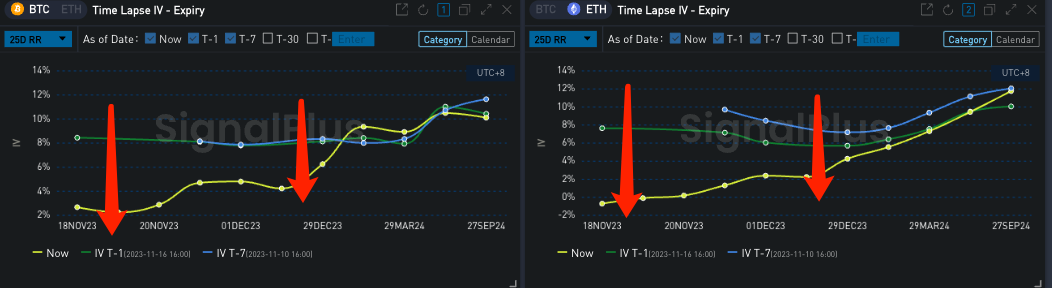

In terms of options,Implied volatility maintains its recent positive correlation with the underlying trend.,There was a sharp decline, among which BTC has recently declined overall by about 3 to 4% Vol, and ETH has dropped by about 5%. at the same timeVol Skew has also seen a sharp retracement recently., the ETH front-end partial term of 25 dRR has dropped to near zero.

Source: Deribit (as of 17 NOV 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus, BTC/ETH 25 dRR shows sharp retracement

In terms of trading, BTCEnthusiasm for buying bullish strategies has waned significantly, but there are still Call Spreads such as 17 Nov 37000 vs 38000 and Call Calendar of short selling and long buying continuing yesterday’s trading trend.

In addition, it was observed that BTC 26 Jan 50000-C had a cumulative large purchase of 1,650 BTC, and OI increased by 720.5 BTC, which may be a bet on the approval of the SEC resolution in January next year; at the same time, a large number of BTC 34000-P recently appeared on 24 Nov Buyback, OI reduced by 725 BTC.

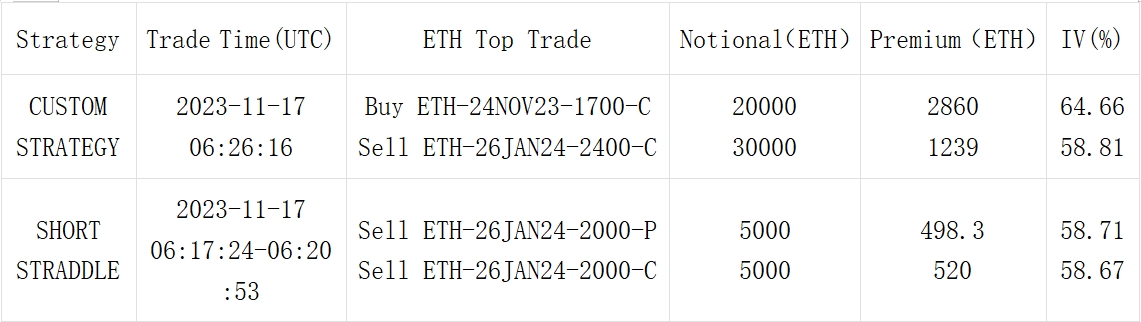

In addition, a customized strategy of 50,000 ETH Notional also attracted market attention. This strategy bought 20,000 ITM 1700 C on 24 Nov when ETH just fell below the $2,000 mark, and sold 30,000 ITM 1700 C on the far end of 26 Jan. Zhang 2400 C, the total Premium cost is more than 1600 ETH.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com