Avalanche Q3 report: strategic cooperation covers multiple fields, and the ecosystem is full of vitality

Original author -Yi Jun Lee

Compile - Odaily 0xAyA

Overview

Avalanche is a public chain platform designed for scalability, with a multi-chain framework composed of subnets of a scalable network. The main network includes P chain, X chain and C chain. The P chain manages validators and subnet-level functionality, the X chain manages Avalanche native tokens (digital representations of real-world assets), and the popular C chain is an implementation of the Ethereum Virtual Machine.

A subnet on Avalanche refers to a subset of nodes or validators that together reach consensus on transactions on one or more blockchains. A subnet can be a network running within another network or a network built on top of a larger network. Avalanches subnet architecture provides builders with fast finality, custom virtual machine support, and a wide range of configuration parameters.

Various partnerships, deployments and initiatives across the DeFi, NFT, gaming and enterprise sectors enriched Avalanche’s ecosystem in Q3 2023, demonstrating the convergence of traditional finance and DeFi, gaming innovation and enterprise blockchain solutions .

Key developments: Q3 2023

RedStonePartnering with Avalanche Evergreen to promote institutional participation in decentralized protocols through custom data feeds on the Avalanche Spruce testnet. Avalanches Evergreen subnet offers professional blockchain deployments, blending the benefits of a public network with enterprise capabilities including KYC management. The Spruce testnet provides a secure environment for traditional financial institutions to explore blockchain and DeFi applications, bridging the gap between traditional finance and DeFi.

The Avalanche Foundation launches “Avalanche Vista”, allocating up to $50 million to purchase tokenized assets on its blockchain to highlight the value of asset tokenization and promote its role in on-chain finance. The initiative will include various types of assets, It aims to demonstrate the efficiency of blockchain in traditional manual financial processes and to solve challenges in private equity investment through the use of on-chain asset issuance and management.

Avalanche Foundation and Sigma PrimeCollaborate to enhance the stability and security of its AvalancheGo code base. Sigma Prime, known for its extensive expertise in blockchain security and development of the Ethereum consensus client Lighthouse, is creating fuzzers to identify and resolve potential bugs in AvalancheGo, thereby enhancing network reliability and ensuring the safety of users and developers Staff stability.

Movement LabsRaised $3.4 million in pre-seed funding to expand development and adoption of Move, a smart contract language, and launch Movement SDK and M 1, a scalable blockchain integrated with Avalanche consensus. The funding is aimed at enhancing Move’s security and scalability in smart contract development, providing solutions to common blockchain issues such as re-entrancy attacks, while providing a community-facing blockchain through M1.

Ava Labs launches newC-Chain Explorer, integrating all Avalanche main network chains (P, X and C chains) into the Avalanche subnet browser center. This platform enhances Avalanche’s transparency by providing a comprehensive view of real-time and historical blockchain data. C-Chain explorer offers a variety of advanced features and search options, including coordinated transaction information with other chains, staking and token details, atomic transaction specifics, as well as the Glacier API and Metrics API, and more.

Avalanche launchesAvalanche Academy, designed to educate developers to create cutting-edge blockchain applications. It offers a wide range of courses including Avalanche basics, EVM tuning, Subnet structure, and development tools. Graduates will receive a diploma upon completion of the course.

The Avalanche Foundation launches“Ted Yin” Funding Program, to support and fund open source projects leveraging the Avalanche public blockchain. This initiative recognizes computer scientist Ted Yin for his significant contributions to the Avalanche community.

Ava Labs launchesFirewood, a cutting-edge database designed in Rust for optimized storage of Merkleized blockchain state. To solve the major bottleneck of efficient state management for blockchain scalability, Firewood provides a specialized storage stack that goes beyond general-purpose key-value stores such as LevelDB/RocksDB. Designed for efficient Merkleized blockchain state storage, Firewood promises to enhance the scalability of the Avalanche network and is continuously developed to contribute to its advancement.

ecosystem

Avalanche hosts a large ecosystem of dApps and protocols on its C-chain and subnet, and users canEcosystem pageto explore. Q3 2023 saw many exciting updates to the Avalanche ecosystem projects and protocols, specifically:

DeFi

Interoperability between Ethereum and Avalanche through LayerZero,UniswapExpansion into Avalanche C-chain enhances its DEX ecosystem. The move brings Uniswap’s massive trading volume and innovative centralized liquidity model to Avalanche, providing new opportunities for liquidity providers and traders in the platform’s growing DeFi space.

BalancerDeployed on Avalanche, it is designed to enhance liquidity staking growth and expand DeFi opportunities by working with four Avalanche Liquid Staked Token (LST) protocols. Balancer aims to optimize the DeFi technology stack for Avalanche participants by leveraging its innovative composable stable pools and booster pools to efficiently manage yield tokens and combine liquidity pools with yield markets.

Struct FinanceLaunched on Avalanche C-Chain, offering interest vaults and diversified yield strategies. Struct aims to democratize financial products and promote the development of Avalanches DeFi ecosystem. Liquidity providers can choose between fixed and variable rates of return at different stages of volatility.

GMX V2 betaLaunched on Arbitrum and Avalanche, providing traders with new features such as additional assets, multiple collateral types, faster execution, and low-fee swaps. Liquidity providers benefit from segregated pools and enhanced balancing and swap incentives.

The Avalanche Foundation contributes to the decentralized exchange on the Avalanche subnet (Dexalot Subnet)DexalotAllocated up to $3 million in AVAX tokens to enhance its decentralized trading capabilities. The funding is part of the Avalanche Multiverse program and will be distributed over 12 months and has milestones.

By CavalReThe developed Multiswap has been launched on Avalanche, allowing users to exchange multiple tokens in a single transaction and create liquidity pools with any number of tokens. It allows liquidity providers to have exposure to all liquidity pool assets, potentially earn revenue from transaction fees, and is similar to a decentralized ETF.

CerchiaLeveraging the Avalanche blockchain, it pioneers direct peer-to-peer insurance risk trading, allowing insurance buyers to obtain storm loss protection directly from institutional investors. This approach uses smart contracts to automate payments and Backed’s tokenized U.S. Treasury ETF as collateral to generate returns.

NFTs and games

HUGPartnering with Avaissance from the Avalanche Foundation to increase exposure for emerging artists through weekly art challenges and exposure during Korea Blockchain Week. Avaissance artists join the HUG platform, connecting them to a global community of collectors.

Solert GamesWorked with Ava Labs to create a new Avalanche Subnet, enhance game performance by fusing Web2 and Web3 features, and launch the mobile game Legends at War. Leveraging its Gas token LAW, the Solert subnet aims to provide developers with a global platform and an innovative gaming ecosystem where players can influence governance and strategy.

Rumble Kong League(RKL) chose Avalanche for its blockchain extension, prioritizing a user-friendly Web3 gaming experience. The transition to Avalanche will be gradual, ensuring a seamless player experience that focuses on in-game operations rather than technical aspects. Although all future transactions and interactions will be conducted on Avalanche, RKL remains inclusive of various blockchains and focuses its mid- to long-term goals on the Avalanche network.

Neowiz, a well-known Korean game publisher has teamed up with Avalanche Arcad 3 to explore Web3 games through its Web3 offshoot Intella X. The partnership, announced at the Avalanche House Seoul 2023 conference, aims to leverage Neowizs gaming experience and Avalanches Web3 capabilities to enhance the Web3 gaming industry. The focus of this cooperation is to share Web3 game technology expertise and hope to provide users with top-notch Web3 games.

HyperspaceLaunched an NFT marketplace and launchpad on Avalanche, introducing features such as real-time trading and analysis for NFT collectors. The platform also plans to launch more features and APIs in the future, and launch the famous Mint-Dokyo through its distribution platform. This development marks an important step in Hyperspace’s multi-chain journey and enhances the NFT ecosystem on Avalanche.

Dreamushas integrated the Avalanche blockchain into its popular ticketing app OK Cashbag to enhance the ticket buying experience for its 21 million users. The move is aimed at solving the problem of ticket reselling and counterfeiting in South Korea’s concert ticket industry. Avalanche-powered tickets, powered by the dedicated Avalanche subnet, are now available for a variety of events, with plans to release a blockchain-enhanced secondary market in the future.

enterprise

Spanish healthcare REIT Manicipi SA plans via SecuritizeRaised €150 million by issuing tokenized shares. Securitize plans to start trading in September and operate within a regulatory sandbox monitored by Spains CNMV. They are actively working to obtain securities licenses in Spain and the EU to adapt to the trend of tokenizing real-world assets on the chain, as demonstrated by initiatives such as Avalanche’s $50 million fund for issuers of tokenized assets.

Loyalty MarketingWorking with PlayThink to bring its Ponta rewards program to the blockchain via Avalanches Subnet infrastructure, it aims to provide Web3 services to its nearly 100 million users by the end of 2023. The plan will provide large-scale NFT issuance anddistribution, leveraging Avalanche’s smart contract capabilities and fast transaction finality. The subnet will facilitate users participation in NFT-based rewards and activities without requiring them to acquire digital assets.

Nansen on-chain data

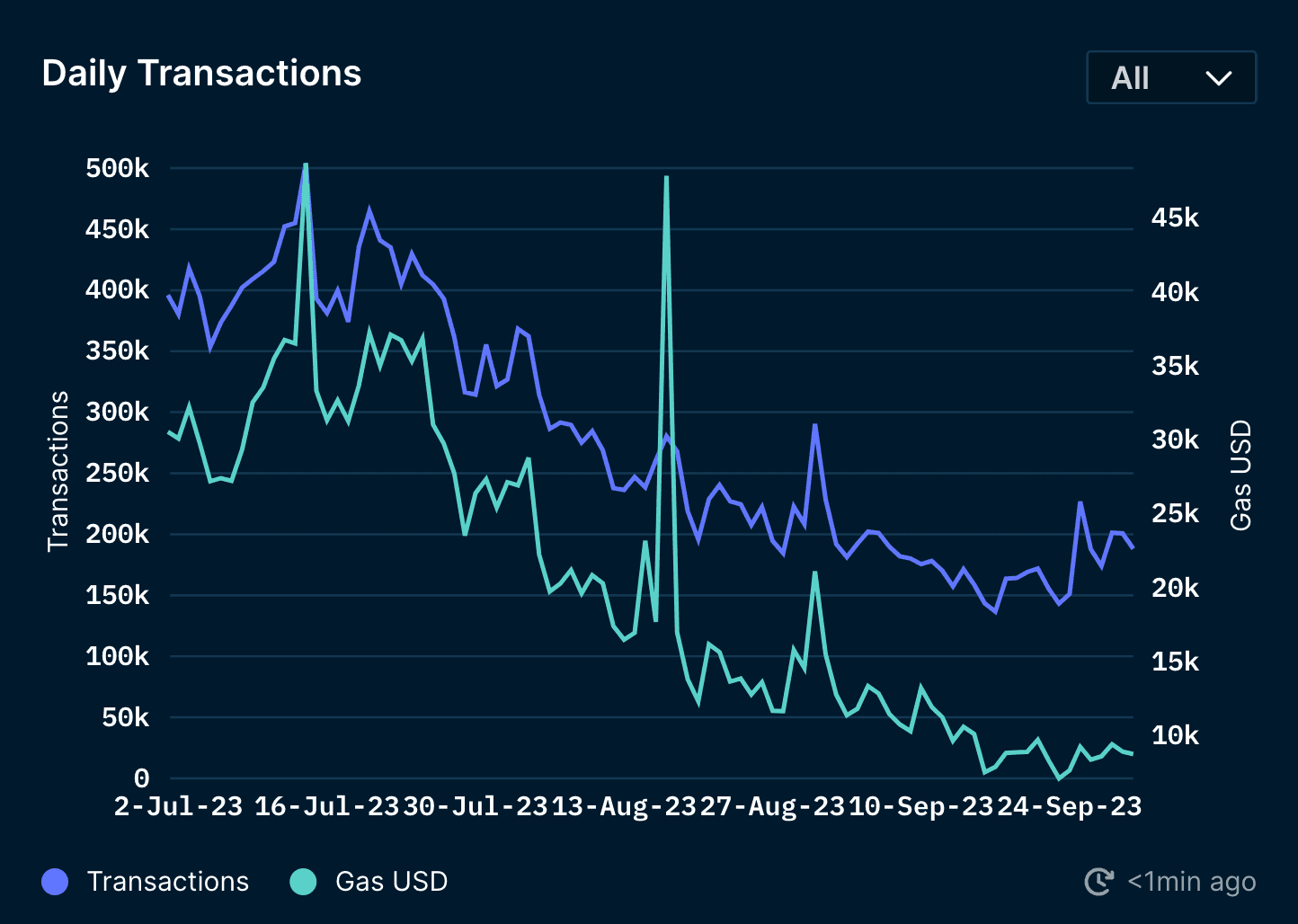

C chain daily transactions

source:Avalanche C-Chain Daily Deals

In the third quarter of 2023, the number of daily transactions on the Avalanche C chain fluctuated, ranging from 136,000 to 504,000 transactions. This means that daily trading volume fell slightly to 550,000 from 200,000 in the previous quarter. At the same time, Gas usage within the network also showed a similar trend, fluctuating between 8.7k and 49k.

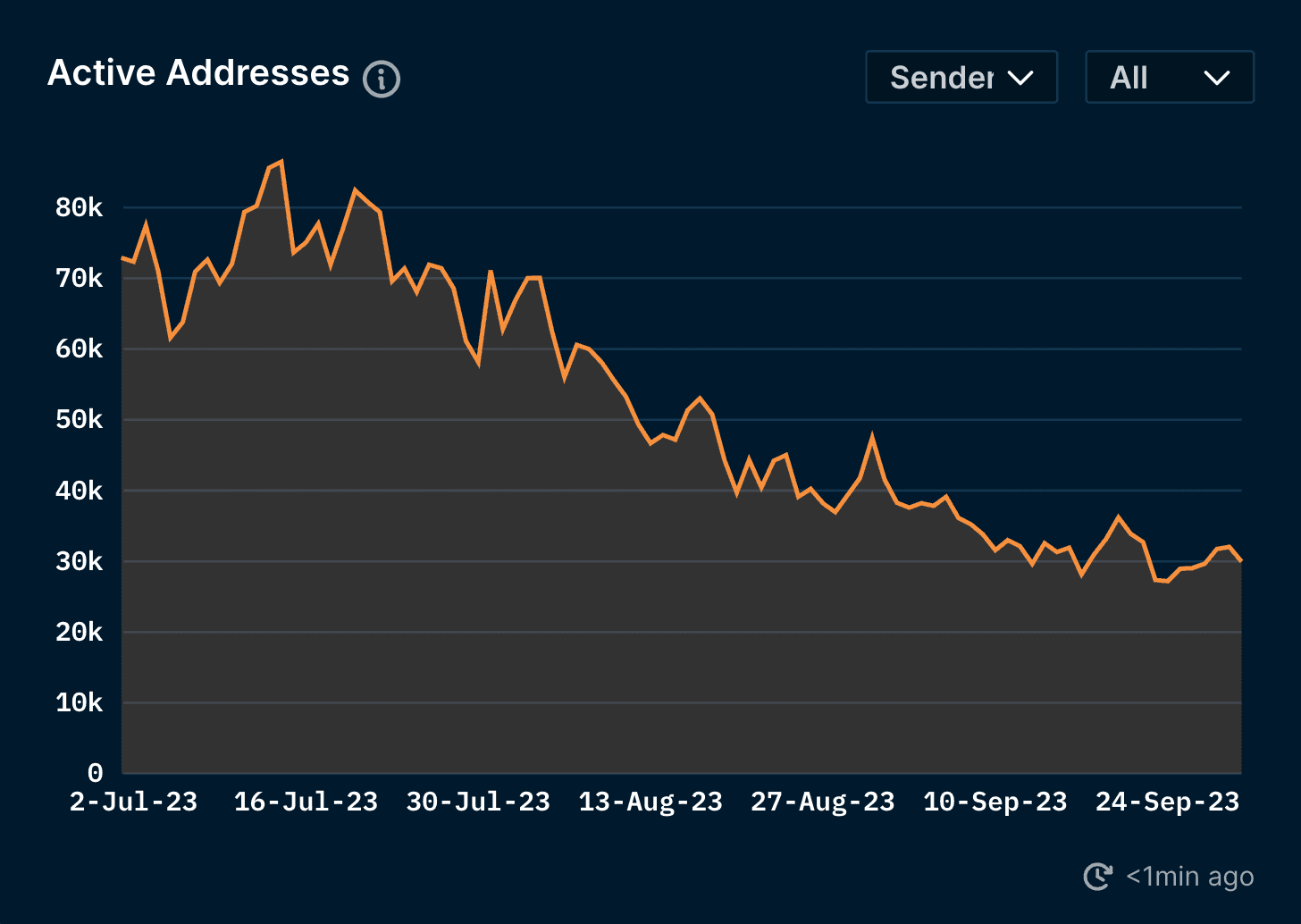

C chain daily active address

source:Avalanche C chain daily active address

In the third quarter of 2023, Avalanches C-chain daily active addresses peaked at 86,000, with this number fluctuating between 27,000 and 86,000. The networks user activity trended downward throughout the quarter. In comparison, daily active addresses in the second quarter ranged from 22,000 to a maximum of 117,000.

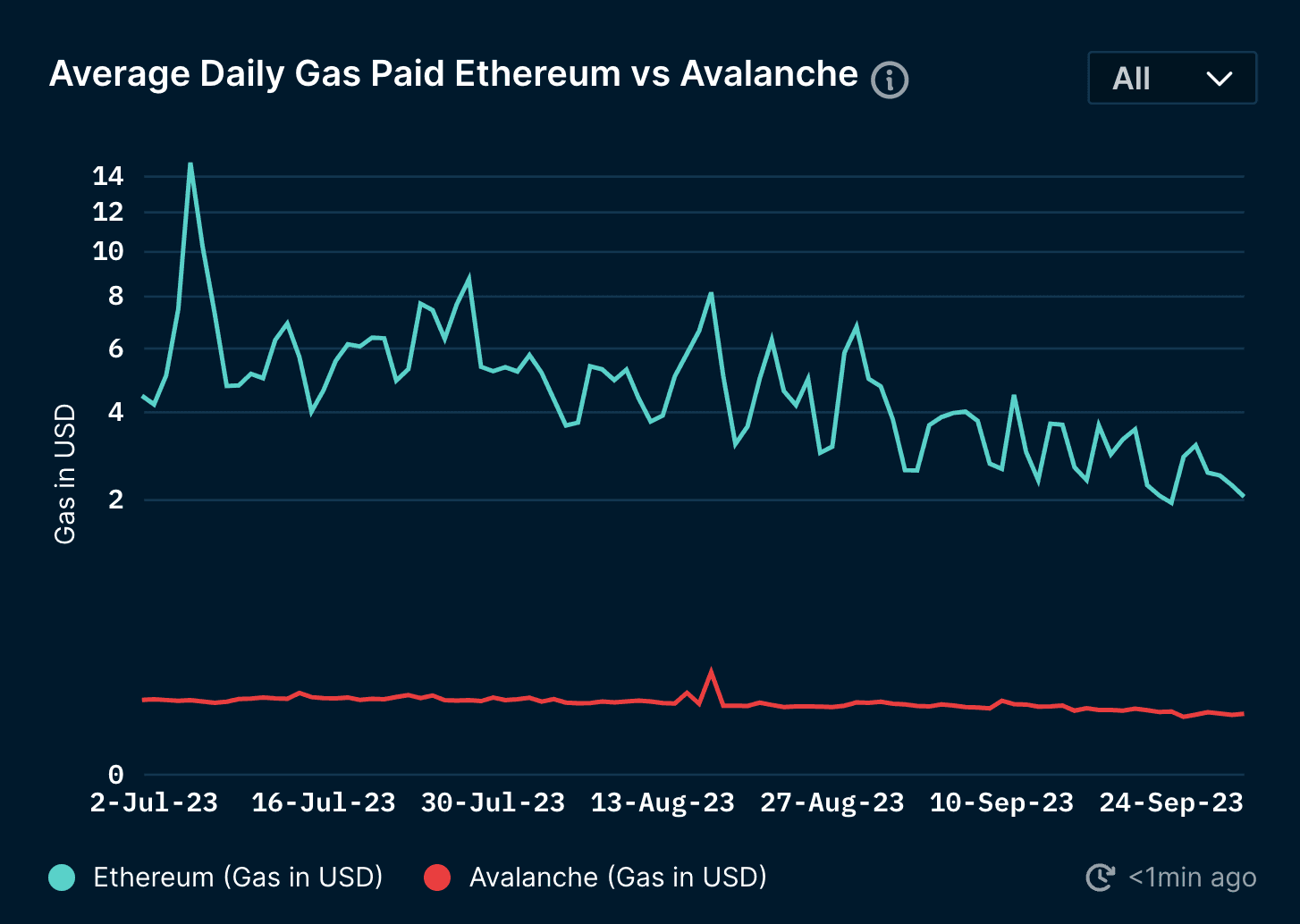

Average daily gas fee (compared to Ethereum)

source:Average daily gas costs of Ethereum and Avalanche C chains

In the third quarter of 2023, Avalanches average daily gas fees fluctuated between $0.04 and $0.17, in stark contrast to Ethereum, where users encountered higher gas fees, ranging from $1.95 to as high as $15. . The sudden surge in gas fees may be caused by the major liquidation event on August 18caused.

C Entities with top ranking users and transactions on the chain

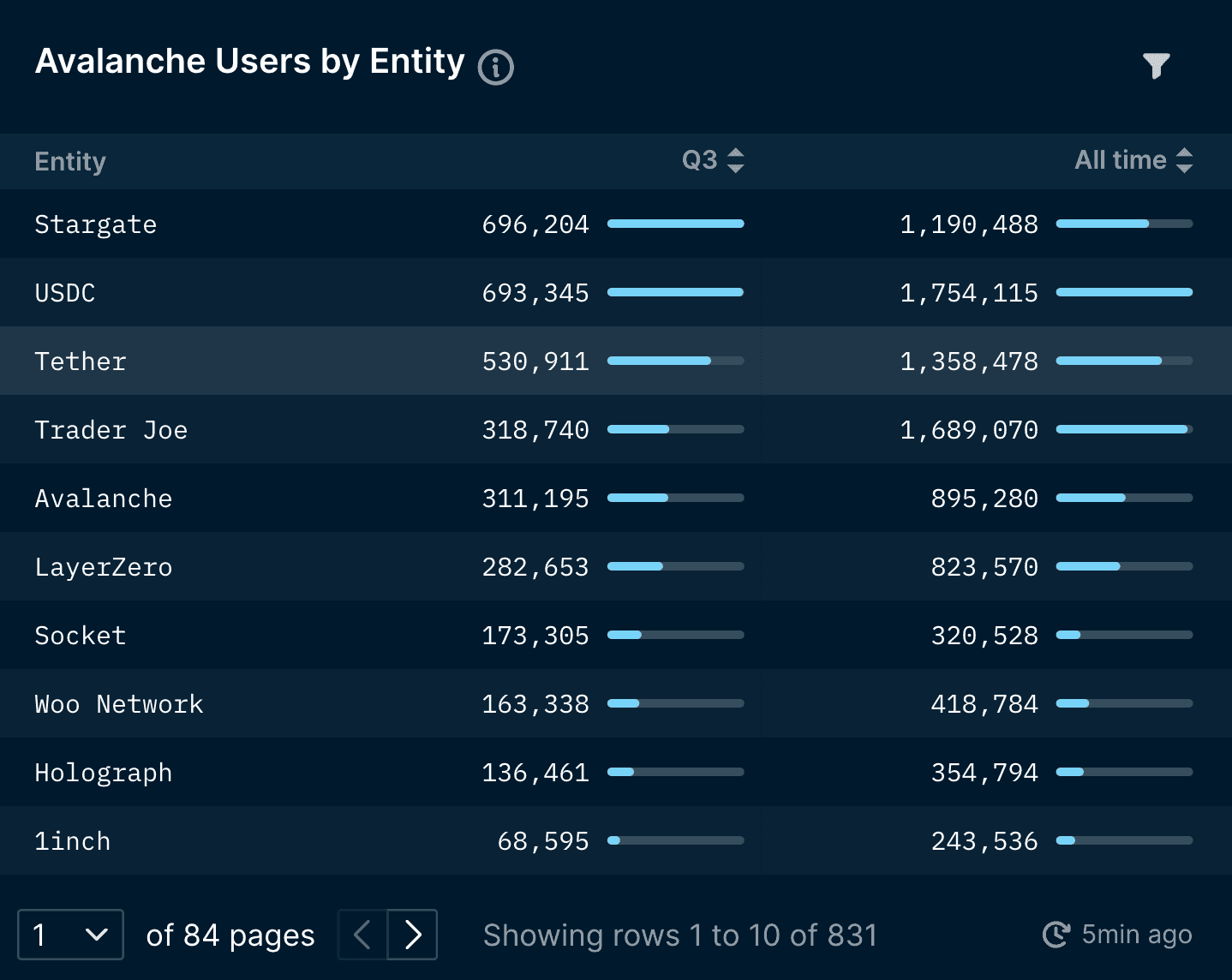

source:Top entities ranked by Avalanche C-Chain users (data does not include untagged entities)

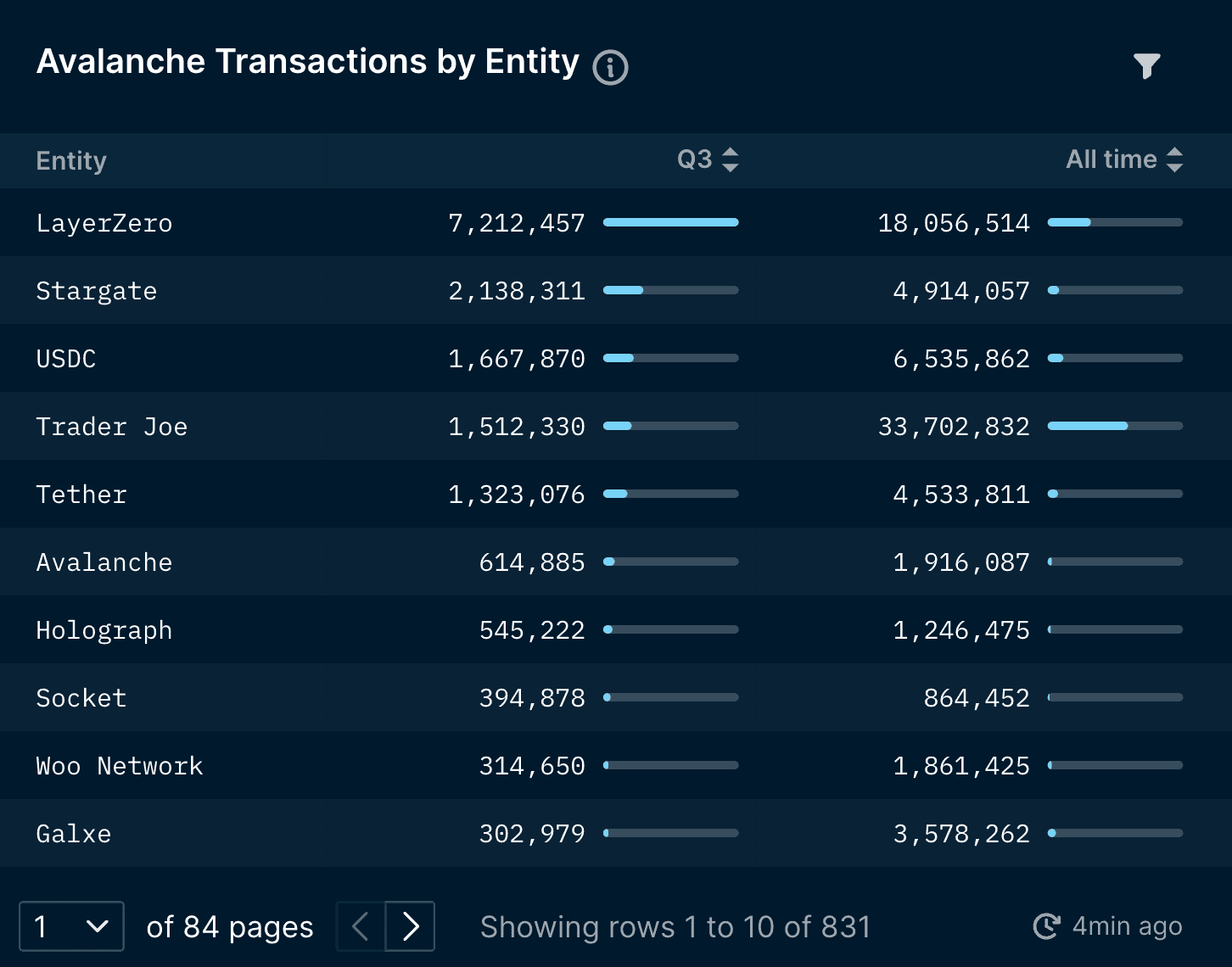

source:Avalanche C-Chain Top Entities by Transaction (data excludes untagged entities)

To gain insight into the players that dominated the third quarter of 2023, Avalanche’s transaction and user activity focused on some well-known players, according to Nansen’s analysis. LayerZero dominated with 7.21 million transactions, followed by Stargate and USDC, which recorded 2.14 million and 1.67 million transactions respectively. Stargate leads in user engagement with 696,000 users, followed by Tether and USDC with 693,000 and 531,000 users respectively.

Summarize

Overall, Avalanche’s Q3 2023 showcased a vibrant ecosystem that successfully navigated fluctuations in trading activity and maintained low gas fees relative to Ethereum. Strategic collaborations and innovations span various sectors, including DeFi, NFTs, and gaming, adding vitality to its ecosystem. At the same time, on-chain data reveals key player dynamics and user engagement.

Looking forward, these insights and developments highlight Avalanche’s potential to further optimize its platform, enhance user experience, and solidify its position in the blockchain space, towards a future that seamlessly integrates traditional and decentralized finance and technology ecosystems. Forward.