SignalPlus Macro Research Report (20231113): Bulls continue to rebound

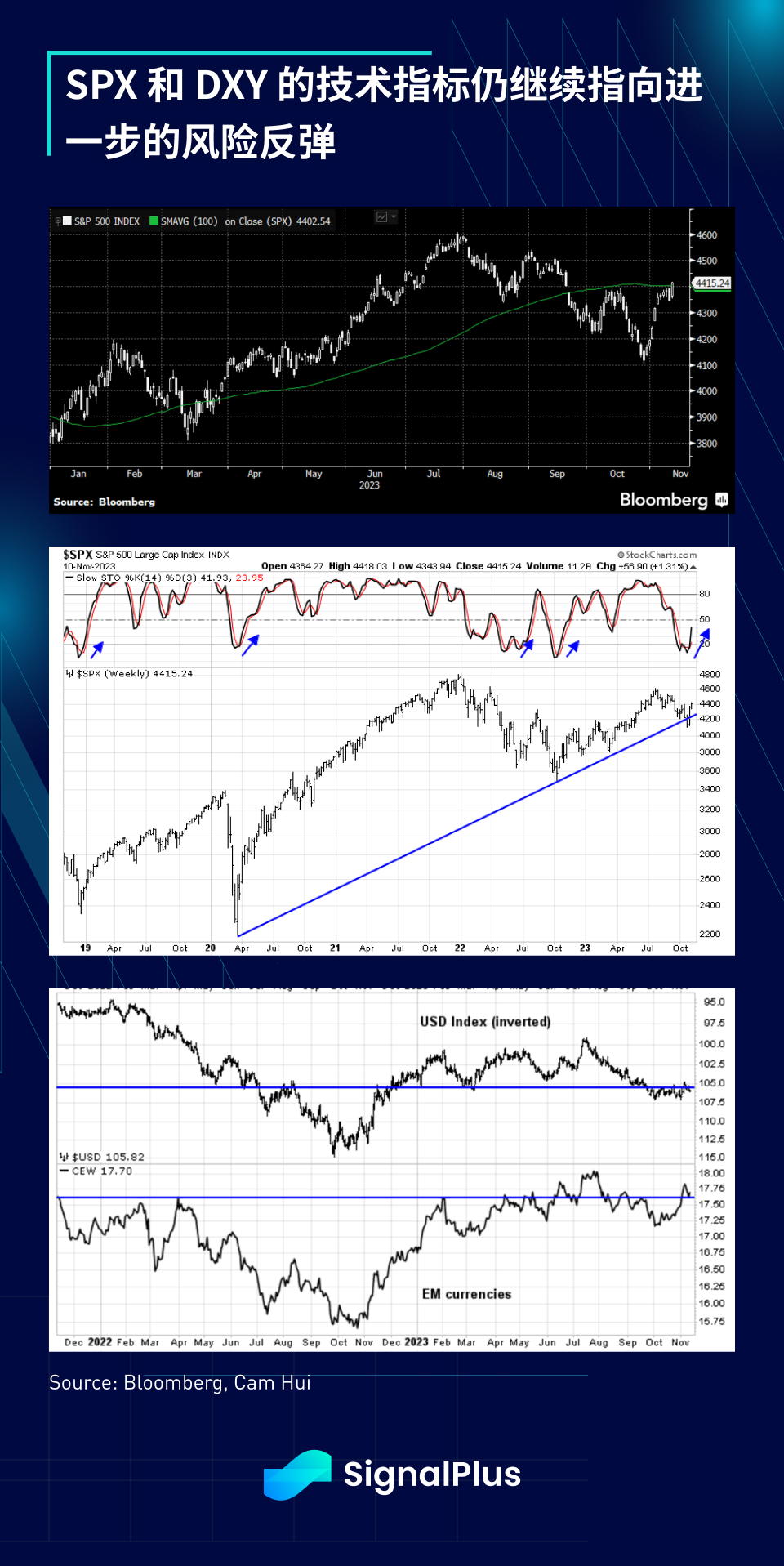

Trading activity was light on Friday (50 – 75% of normal trading volume), but risk assets continued to perform strongly at the end of the week, with the SPX regaining its 100-day moving average and long-term trendline, and stochastics moving from oversold levels Rebound; emerging market currencies appear ready to break out, the U.S. dollar index may be forming a local top, overall risk sentiment remains high, and the market is currently showing few signs of weakness.

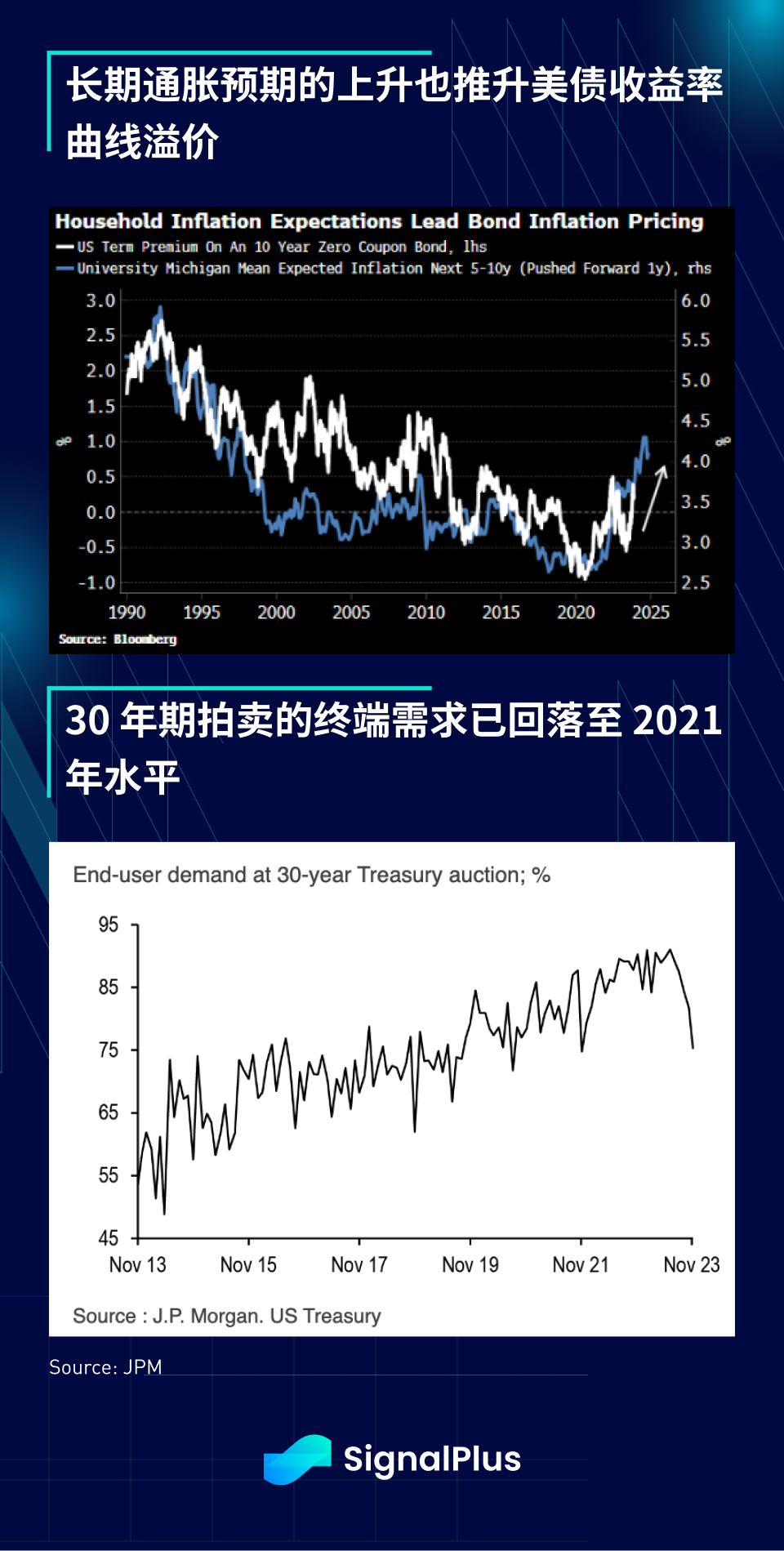

In terms of interest rate markets, Lagarde dismissed all expectations of a rate cut in the next few quarters, leaving European short-dated bonds weak, causing interest rate markets to trade flat on Friday; in the United States, the only one worth watching The data is from the University of Michigan consumer confidence survey, in which the current situation index and the expected index are both lower than expected. On the other hand, the one-year inflation expectation has risen to 4.4%, which is higher than market expectations, and the 5-10 long-term inflation expectations have also increased accordingly. ; Rising long-term inflation expectations are generally negative for fixed income term premiums (longer rates are higher and the curve is steeper), and this is one of the Feds biggest concerns when addressing inflation expectations.

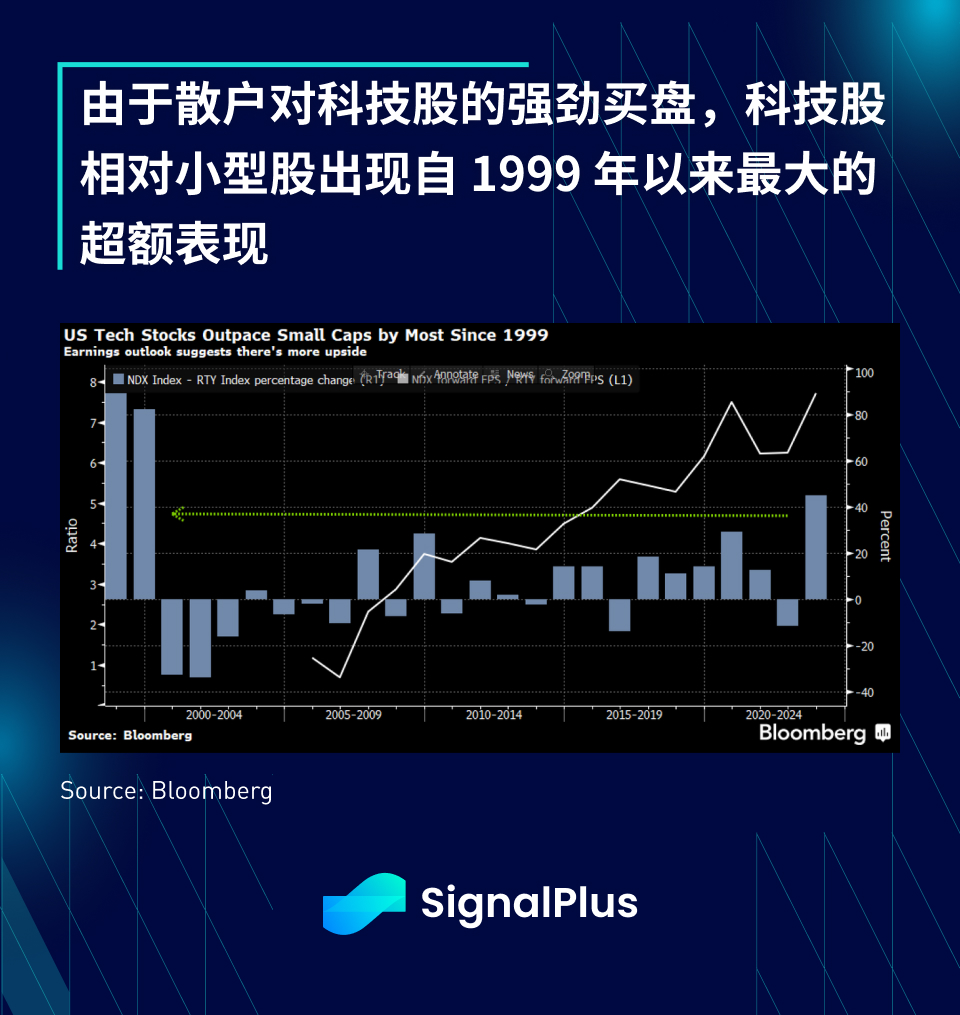

According to JPM data, retail traders have been actively increasing equity exposure over the past few weeks (+1.4 standard deviations above the 12-month average), with the majority of inflows through ETFs, with a strong focus on technology compared to the overall index. The preference for equities is quite clear (SPX -1.3 standard deviations, NASDAQ +1.2 standard deviations), while despite the strong rebound in fixed income, inflows into bonds have been relatively limited (+0.4 standard deviations), with CTAs estimated to be through short covering Increased equity exposure by nearly $6 billion, while institutional investors added $18 billion to long equity futures positions.

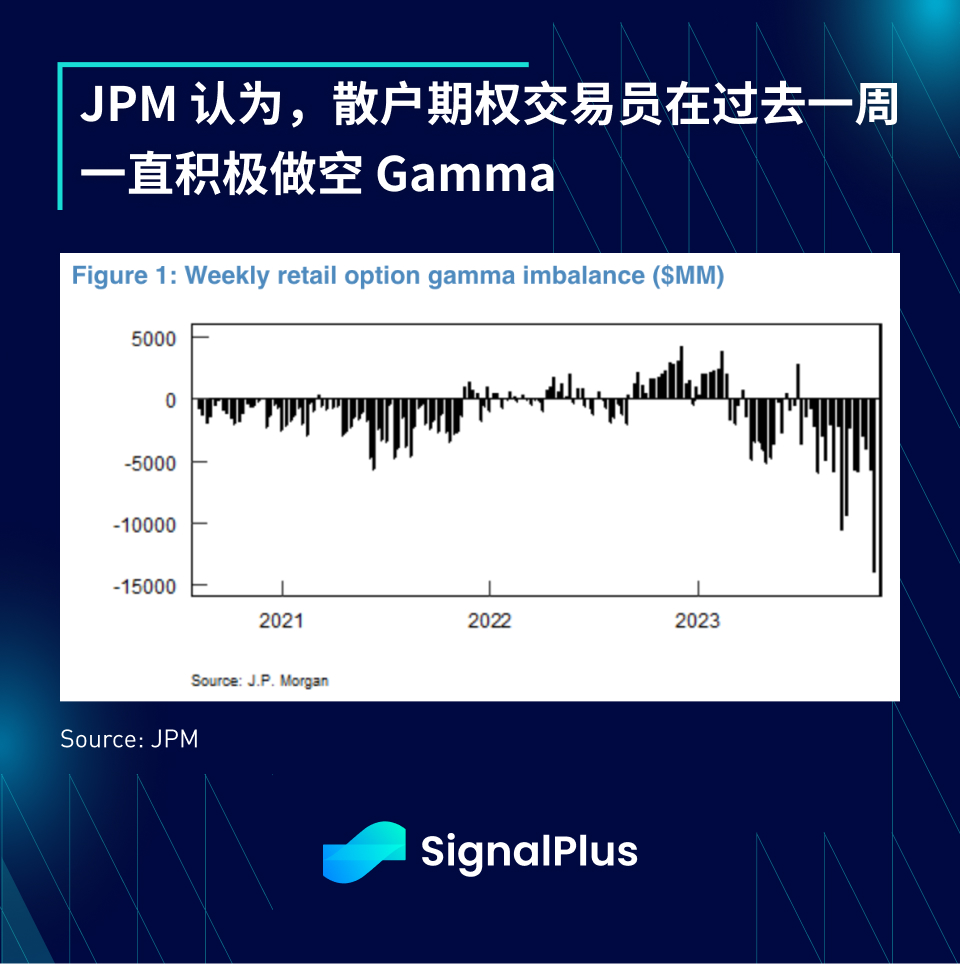

In the options market, retail traders are actively shorting delta and gamma exposures, mainly operating through 0 DTE. JPM estimates that the resulting gamma imbalance will be the most serious in its historical data. This gamma imbalance (with brokers Bulls on the contrary) may have contributed to the steady gains in stocks, with the SPX rising in nine of the past 10 days.

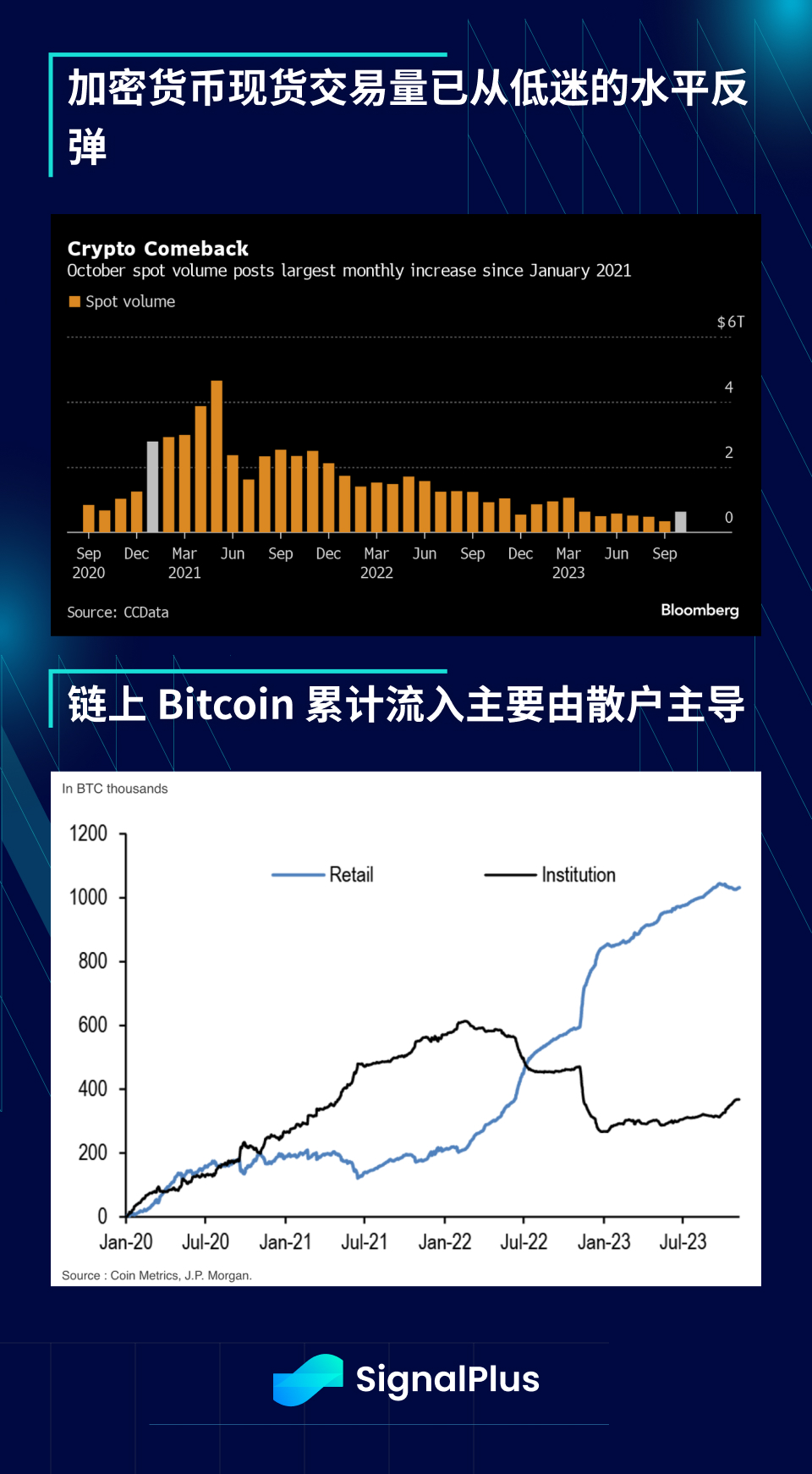

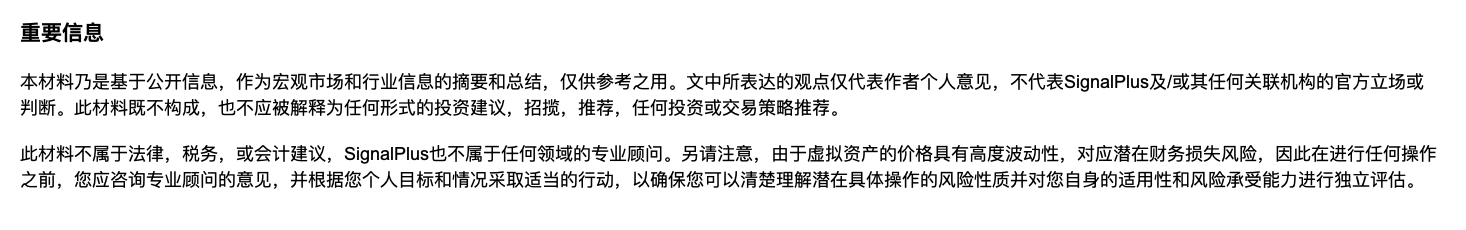

On the crypto side, spot trading volumes saw their largest monthly increase since January 2021 (albeit rebounding from depressed levels), driven primarily by retail longs, with institutional buying also picking up ahead of ETF approval; current bulls Positioning appears to have exceeded fundamentals, and even if the ETF is approved quickly, it will be at least a few quarters before structural inflows occur, so we recommend considering profit taking/doing some out-of-the-money covered call operations at this time.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com