The decentralized liquidity protocol OpenX has launched a network-wide public beta and will issue airdrops

Recently, BRC-20 has been extremely popular in X and various crypto communities, and is even regarded as the future of the BTC ecosystem by some users.

In the Ordinals protocol, token depoly, mint, transfer and other behaviors are all realized by users publishing specific data fields to the chain. This makes the inscriptions cast based on this protocol naturally have fair emission characteristics, and users directly send transactions to the chain. Note specific parameters to participate in asset circulation.

There is no doubt that the natural de-“project-orientation” of BTC inscription is the best fuel to detonate Fomo sentiment. In the past month, related concept tokens such as ORDI and SATS have been pushed to a climax by the market and a round of “ Sudden wealth effect, the current market value of tokens in this sector has exceeded US$1 billion.

However, some users believe that the fair launch of BRC-20 is just a stolen concept. It is difficult for retail investors to participate in the early mint or low-price accumulation of growing assets. This results in the BRC-20 concept token being extremely market-manipulable. Because of this, they can depoly a token at any time and rely on pull offers to gain traffic and fans.

BRC-20 is an experimental token standard that supports the deployment, minting and transfer of non-fungible tokens on the Bitcoin blockchain, but compared to ERC-20 or BEP-20 tokens, BRC-20 tokens It does not yet have smart contract functionality.

Underneath the lively appearance of the BRC-20 token, the issue of extreme lack of liquidity has been selectively ignored by many users.

Throughout the Crypto annals, although the encryption market has successfully exceeded the trillion market capitalization mark in 2021, it seems to be still far away from the electronic cash system mentioned by Satoshi Nakamoto. Whether it is the leading BTC, the ecological king ETH, or the recent crazy money-collecting BRC-20, all cryptocurrencies have to face one problem: lack of liquidity.

A hub platform for liquidity aggregation

The liquidity of cryptocurrency has always been the focus and lifeblood of the development of the entire industry. For a long time in the past, the entire industry has been focusing on capital inflows and market value.

But in the next 14 years of Crypto, the construction of cryptocurrency liquidity facilities may become an important direction for the development of the industry.

Of course, there is no shortage of teams and products in the Crypto industry with the core concept of building liquidity and application scenarios. Since the birth of uniswap, the decentralized liquidity trading platform has become an indispensable asset circulation tool in the entire industry.

However, most of the first-generation DEXs had single functions and were unable to build a wider range of token liquidity scenarios. Therefore, many teams are also trying to build decentralized liquidity financial hub platforms to achieve multi-scenario liquidity of cryptocurrencies. Many people believe that such products will be an important facility for the future development of crypto.

Currently, a decentralized liquidity protocol called OpenX Foundation (also known as OpenX) developed under the leadership of the Korean Foundation has attracted the attention of a large number of crypto users when participating in offline conferences in South Korea, Turkey and other places.

The picture shows the meeting scene released by the official website. The meeting was hosted by LBank.

According to the project’s public information, OpenX Foundation is a decentralized liquidity aggregation and financial hub platform. The core operating logic of its protocol is to use local liquidity sources OPEN and OPX tokens to aggregate decentralized liquidity assets and provide users with Unified financial services such as trading, lending and staking.

There are many liquidity protocols on the market. What are the advantages of OpenX? Compared with traditional liquidity trading platforms, OpenX has made some innovations and optimizations in operation:

Implement Liquidity as a Service (LAAS): By aggregating multiple sources of liquidity to form a single deep pool, achieving higher transaction depth can provide users with a trading experience that is almost equivalent to CEX.

The OpenX derivatives exchange was opened: This is an improved version of the QAMM exchange based on the LAAS pool. The main features are large trading volume and deep liquidity.

Build RWA products: This is an innovative RWA framework that can support the blockchainization of diversified traditional assets such as equity, bonds and even real estate. To support these traditional asset-heavy blockchain chains, one must have a strong capital background.

Fiat currency lending business: OpenX supports users to mortgage crypto assets to lend out stable-value currencies such as fiat currencies or earn interest, which is something that most products on the market do not have.

Consortium background, building a bridge between cryptocurrency and traditional finance

There is an implicit consensus in the Crypto industry: to judge the life cycle of a project, first look at the investment institutions. OpenX has relatively strong capital support behind it, and the investment institutions announced by the project also confirm this.

Officially: OpenX is invested and supported by the Korean foundation Hillstone Partners. Hillstone Partners is a Korean local professional buyout fund. The company was co-founded by experts with more than 10 years of experience in financial institutions such as Samsung Asset Management, Merrill Lynch, Barclays, Mirae Asset, Dasin Securities, and KTB.

With the support of the local Korean consortium, OpenX also inherits the financial strength and risk resistance that other liquidity protocols do not have, or has a longer life cycle and user fault tolerance.

As the demand for decentralized liquidity provision continues to increase throughout the crypto market, OpenX may be able to enable flows and swaps between crypto assets and traditional financial assets and provide a true liquidity solution for the crypto industry.

As of the time of publication, OPNEX has participated in many offline activities in Turkey, South Korea and other places, and has linked up and cooperated with many well-known web3 companies, and the market response has been good.

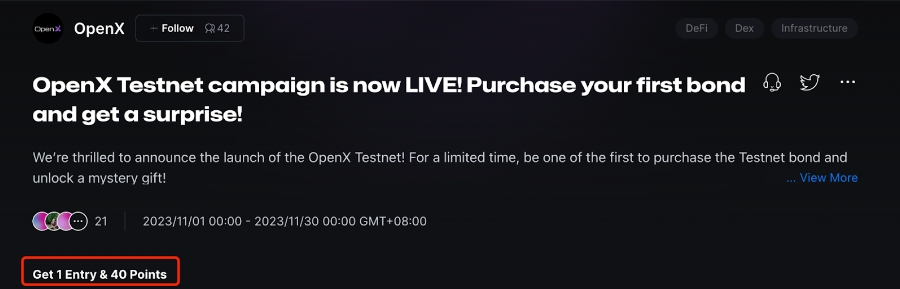

Currently, OpenX has launched a test network airdrop event on Galaxy. Users who meet the public test airdrop conditions can receive 1 Entry+ 40 Points.

The deadline for the public beta is the 30th of this month

Generally speaking, the points distributed by the Crypto project during the testnet airdrop phase will form a mapping relationship with the mainnet tokens. Therefore, the points obtained during this round of openx public beta airdrops have a probability of being converted into mainnet tokens in the future. Users who are interested in playing new games can follow the project trends through official channels.

Decentralized liquidity protocol OpenX opens network-wide public beta and will issue airdrops

The decentralized liquidity aggregation and financial hub platform OpenX Foundation (also known as OpenX) has launched a testnet airdrop event on Galaxy. Users who meet the public test airdrop conditions can receive 1 Entry+ 40 Points. The open beta ends on November 30th.

OpenX uses local liquidity sources OPEN and OPX tokens to aggregate decentralized liquid assets and provide users with unified financial services such as trading, lending and staking. Its innovations include the realization of Liquidity as a Service (LAAS), the launch of OpenX derivatives exchange, RWA business, and legal currency lending business.

It is reported that OpenX is participated by Korean professional MA fund Hillstone Partners.