Head Trader settles in to analyze T2T2 products and economic model

Recently, SocialFi project T2T2 announced the official launch of internal testing of its decentralized copying product. Currently, many leading traders (Traders) have settled in, including: institutional traders, top players on the Binance Contract winning rate list, Telegram Bot team, and some Traders with flow.

T2T2’s single room is strongly bound to Twitter, so users can check the trading levels of settled Traders on Twitter or other public channels before choosing whether to pay to follow orders.

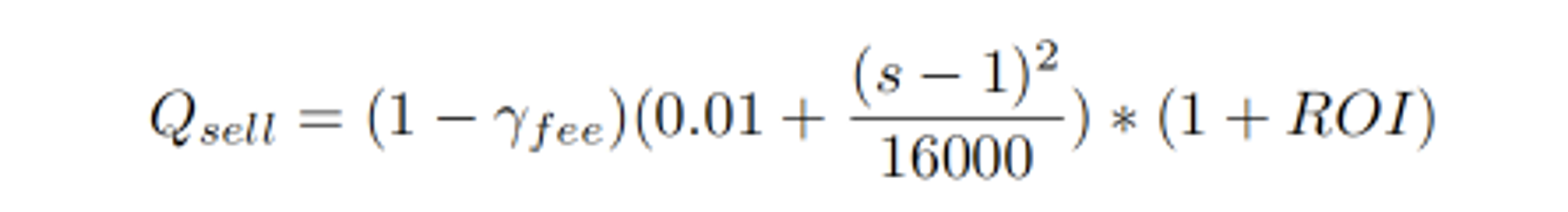

Let’s understand the social logic behind it from the v1 white paper formula released by T2T2:

T 2 T 2 v1 Whitepaper

The formula is simple:

S represents the number of KEYs, which is derived from Friend Tech’s social model. The more people participate and the earlier, the more opportunities there are to make money.

ROI is the net value of the fund with single currency speculation. When the market is hot, the ROI feedback is better.

Fee represents the handling fee, which is the profit share given to the homeowner.

A constant term of 0.01 is used to prevent bots.

The product is simple but directly addresses the essential needs of users. People want to gain income through investment, or play pvp games with other players, not always social chat.

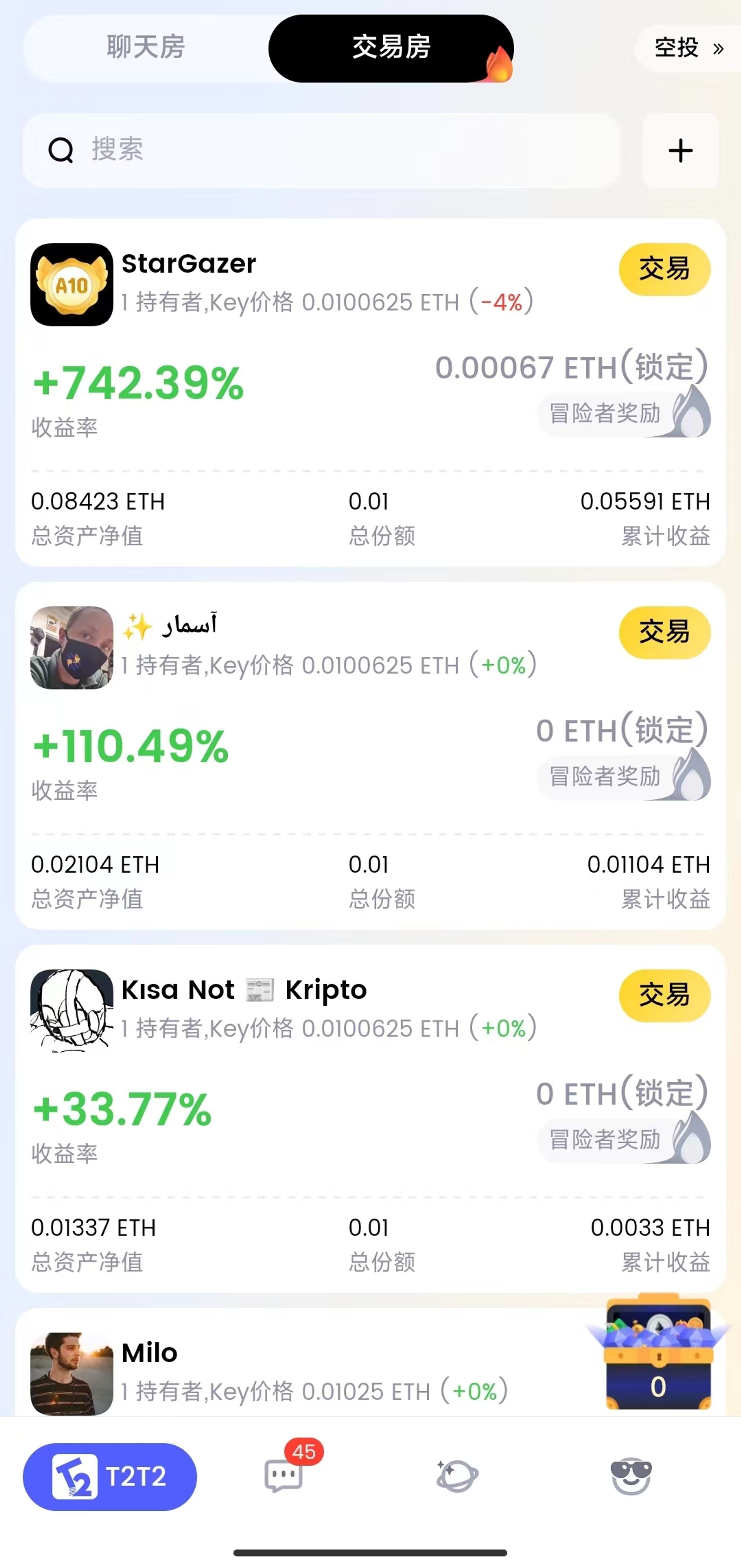

On-chain ROI ranking on T 2 T 2

At this point, T2T2 has started a new exploration in the social model, giving up satisfying users’ needs for upward social interaction, and instead pointing to the more fundamental asset side: leading users to follow orders, starting with DEX, and will also expand to contracts in the future. DEX, everything is on the chain. In fact, no matter whether Friend Tech issues coins or not, it will not affect T2T2’s accumulated first-mover advantages, single barriers, and user network.

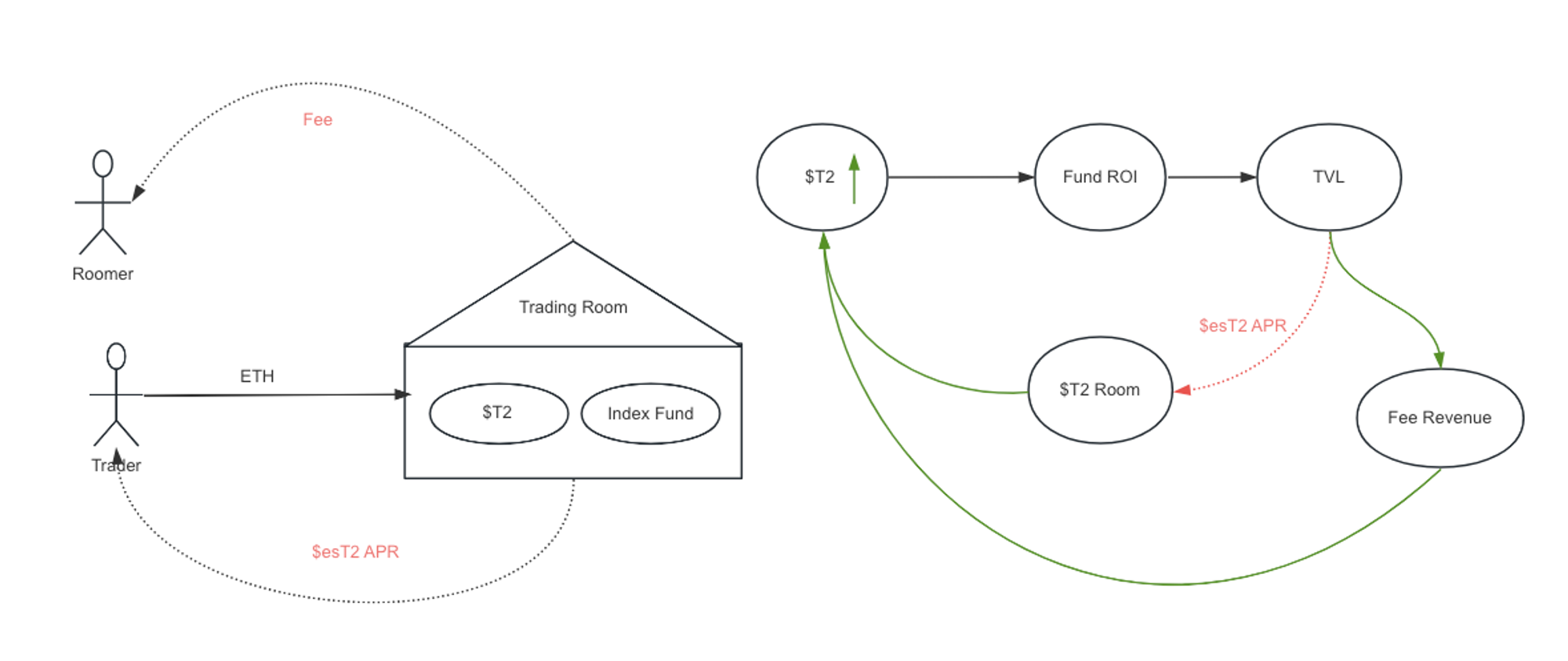

At the same time, T2T2 also released the Tokenomic model, which introduced a new token flywheel in the latest copying mode, which is very degen: in addition to being able to follow orders, ordinary users have additional arbitrage subsidies and share the inflation benefits of the entire system. .

The left side shows the logic of the users normal order with the homeowner. The homeowner can allocate an index fund, part of $T2, or even allocate $T2. Then the operating logic of this flywheel is very clear:

As the price of T2 increases, the ROI of following orders will be very high, which will further attract users to follow orders and contribute TVL transaction volume, and then the transaction fees will be returned to the homeowners and the platform. Then this constitutes the first flywheel, which increases the income of homeowners and platforms through price increases, thereby providing value support for the increase in T2.

When platform fees and homeowner income expand, then the homeowner will allocate more T2 positions, because this can help the ROI and TVL of his room increase, and the greater the proportion of allocation, the faster the T2 price will rise. The higher the inflation incentives shared by participating copycat users, so this constitutes the second flywheel.

Stimulated by these two flywheels, the KEY held by early users can also achieve rapid growth. Users who mine high-quality traders in the early stages can also earn the KEY gains of subsequent single users.

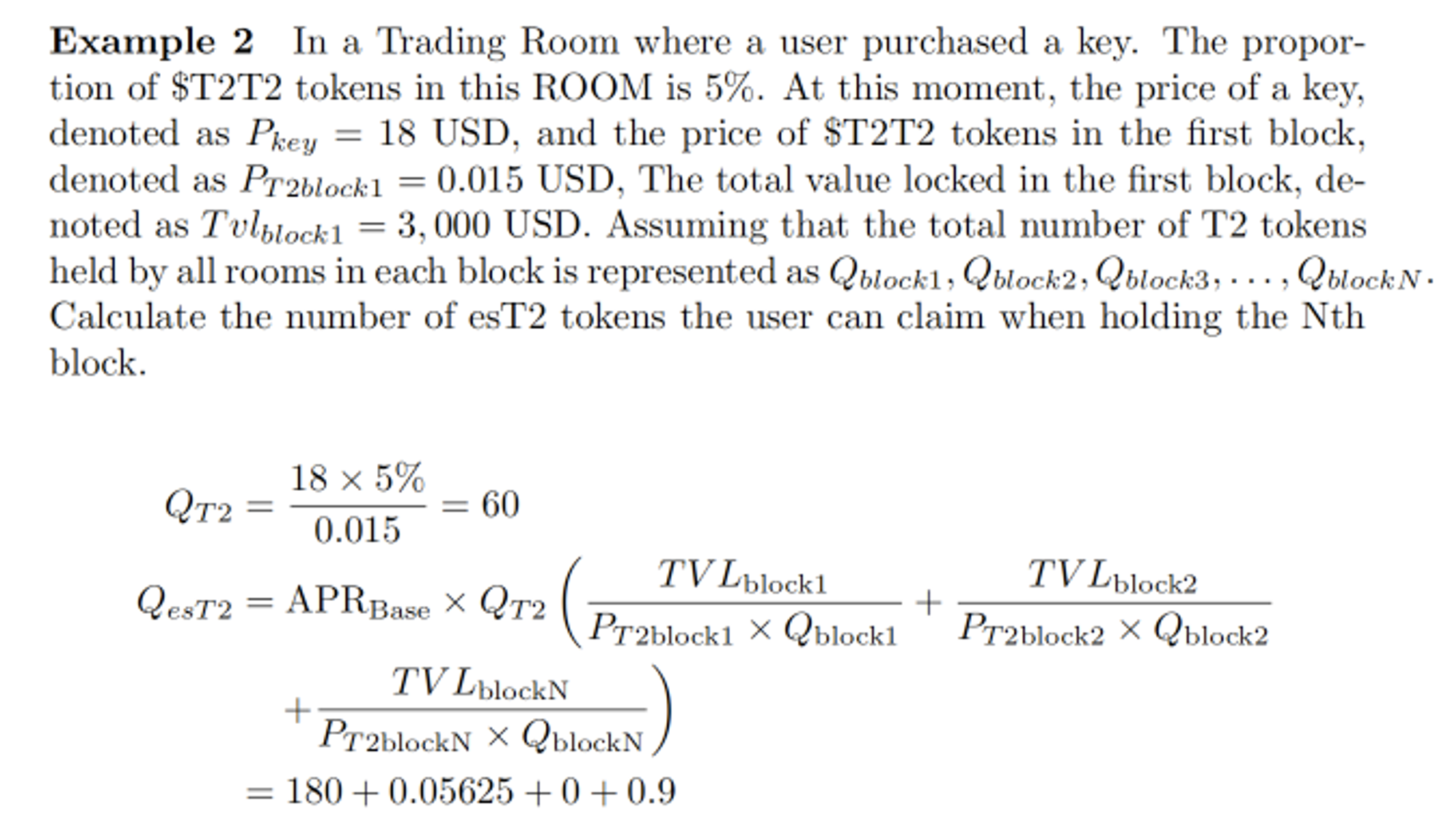

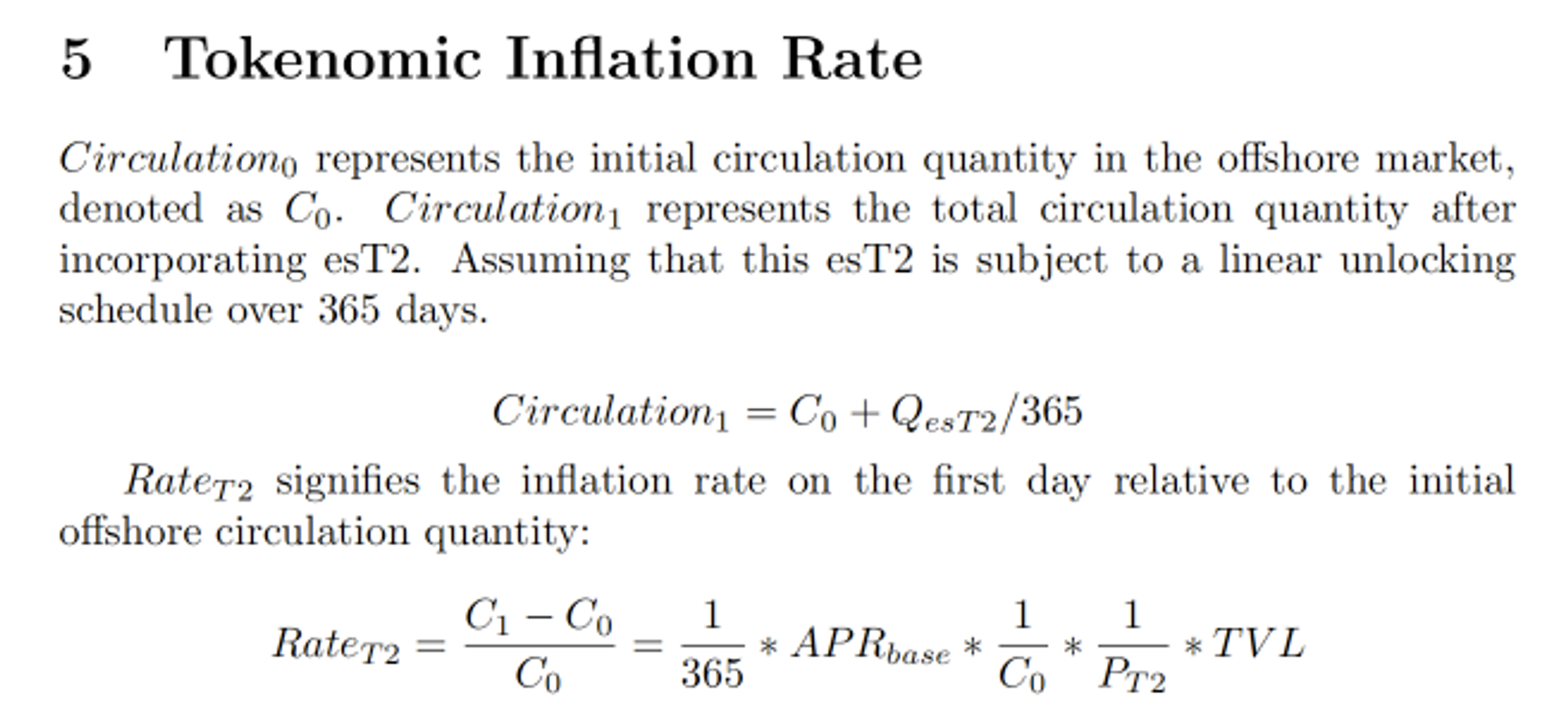

Regarding the second flywheel, the inflation incentives and examples in the white paper are clearer:

The translation of this part is that the inflation incentive is linked to the system fee (TVL). The higher the system fee, the more inflation incentives will be shared. More importantly, it is strongly related to the rooms T2 holdings. The more T2 holdings, the longer the room follows orders (the more block rewards it accumulates), and the greater the inflation incentives it gets. More extreme, when the room coefficient is 100%, all inflation incentives are equally distributed to the holding room of T2. That is, based on this redistribution mechanism, the income of the entire system is transferred to the T2 room. If there is no T2 room, the inflation incentive is 0.

In the fifth chapter of the white paper, the platform calculated the inflation incentive, and its issuance is 365 days of linear unlocking. Therefore, from the perspective of the inflation model, in the first 3-6 months, it is basically a deflationary level, which will stimulate early The flywheel rotates.

In general, whether it is for homeowners or retail investors, participating in T2T2, waiting and changing, and participating in Friend Tech + TG bot + ve(3, 3) + contract order.

refer to:

[ 1 ] T2T2 v1:A Bonding Curve For Index Fund.

https://docs.t2t2.com/protocol-design/t2t2-v1-bonding-curve-for-index-investment-white-paper

[ 2 ] Product internal testing application

https://twitter.com/T2T2_official/status/1721067379109896378

[3] T2T2 docs