Zonff Partners: 2023 Q3 Web3 primary market review and track analysis

Original source: Zonff Partners

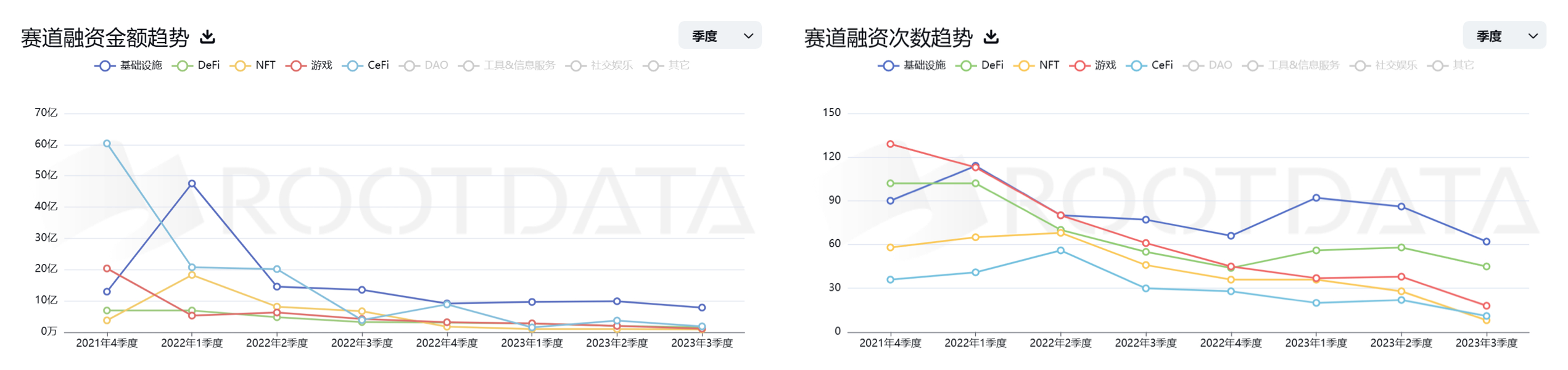

Activity on the supply side and demand side of the primary market has declined for three consecutive quarters

In Q3 2023, the total market financing amount was US$1.694 billion, with 170 financing events, and the average financing size increased slightly (Ramp and BitGo, two fund infrastructures for traditional institutions, completed a financing amount of 400 million). The financing amount in October 2023 was US$426 million, which continued to hit the lowest financing amount in the past four years. The amount of financing and financing events have continued to decline, and the overall trading in the market is not active. Institutions still focus on conservative strategies, and the main investment directions are infrastructure and strong fundamental project funds, such as Flashbot.

Data source: RootData

Market sentiment is dull and is expected to pick up in the next two quarters

As investment and financing funds continue to decline, the decline is gradually narrowing. The original main tracks such as DeFi, GameFi, and games have dropped to freezing point. The RWA and BTC projects have not brought continuous activity to the altcoin market.

We believe that the current state of the primary market has seen sentiment passivation similar to Q4 in 2019. Institutions only invest in projects with strong fundamentals. Optimization projects on the regular track have completed the layout of the basic framework in the past year and a half. For sentiment Large-scale or small innovative projects are relatively conservative, and it is difficult for the market to use new narratives to break the emotional freezing point in a short period of time. The current market conditions require renewed confidence after fundamental growth reaches a qualitative change.

Chart source: ROOTDATA 2023.09.28

Considering the current volume of funds on the chain, the number of wallets and infrastructure fundamentals continue to grow, we believe that the primary market is experiencing a bottom and is expected to bottom out and recover in the next two quarters:

1. Zksync, Starknet, Celestia, Layerzero, Eigenlayer, Scroll and other projects will have major fundamental updates and testnet iterations in the next two quarters, or the mainnet will be launched, which can drive potential on-chain behavioral activity and further ecological development. In terms of layout opportunities, the large-scale Infra project was not launched in Q3, and there was no main line of behavior and emotions on the chain;

2. The Ethereum Cancun upgrade will bring further prosperity to the L2 ecosystem. Q3 L2 ecological TVL has stabilized at tens of billions of dollars. Asset volume and transaction volume have entered a growth bottleneck period. The Cancun upgrade has brought lower Gas costs and faster On-chain experience, and effectively boosting secondary market prices and sentiment, is expected to bring new layout opportunities to the L2 ecosystem;

3. The game track will usher in a large-scale launch, with a high probability of driving the market; the supply of current game products is complete, and the game financing volume will exceed 5 billion US dollars in the second half of 2021. After a preparation period of more than one and a half years, the new The first-generation chain game has been greatly improved in terms of production quality, operational maturity, playability, and experience optimization, and will be launched in the next three quarters;

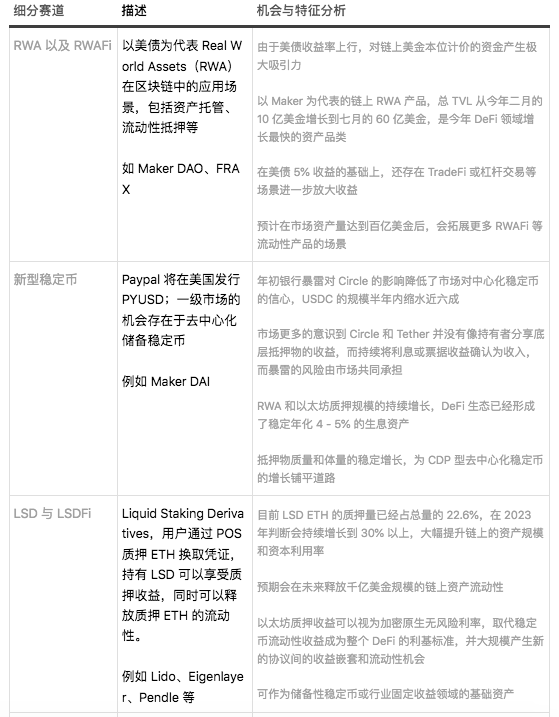

Industry track analysis

Taken together, this bear market cycle has lasted for more than 6 quarters. During this period, almost all old narratives have evolved and developed to varying degrees. Some of them have been fully falsified by the market, and new narratives have also appeared one by one to test the waters, resulting in Effective market feedback. In 6 quarters of observational research, we believe that the market has produced relatively sufficient inductive and deductive materials, which can lead to more reliable research ideas and observation perspectives.

ETH will undergo the Cancun upgrade in the next six months, and BTC will undergo the next halving in 7 months;We believe that by Q3 of 2023, the potential core tracks in the next bull market cycle have basically emerged in the market.

Based on past market experience and summary, we divide the existing main tracks intofour categories:

Ethereum Legitimacy Drive (Important)

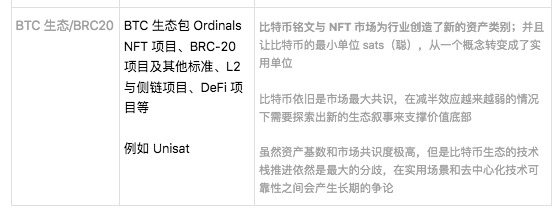

Ethereum orthodoxy mainly describes the core technical path of the current development of blockchain. This category has raised more than 10 billion US dollars in total funding during the six-quarter bear market, basically accounting for about 40% of the entire market fundraising.

As large-scale project airdrops have become one of the few effective asset issuance paths and market hot spots in the bear market, such projects have continued to accumulate high user data and ecological resources; at the same time, projects in the Ethereum Legitimacy category are important in the early stages Its core capability is ecological BD, which enhances brand reputation and ecological attention through cooperation news, narrative nesting, airdrop expectations, strong capital endorsement, etc. of leading projects; the fundamental development of such projects is mainly based on the technical ecology and narrative It is mainly constructed and is not affected much by market sentiment and Bitcoin price. With good financial strength and airdrop effect, we believe that it is easier to become the main leading track of the market in the early stage of the bull market.

The objective trend reaches an inflection point or creates a new asset class (important)

Rapid growth and leading the market in primary market tracks usually require meeting one of the following criteria:

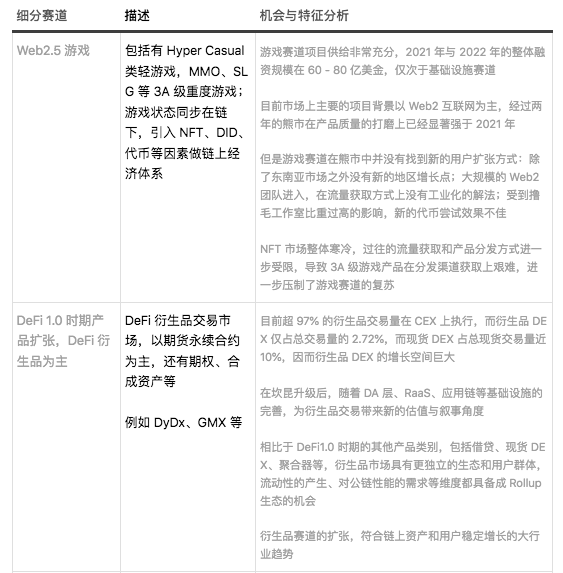

The original track or technical environment has developed steadily, and new narrative ideas or operational strategies have emerged, such as GameFi and DeFi;

Objective trends and the steady growth of users or assets will lead to qualitative changes and create new product categories, such as derivatives trading;

New narratives generate new asset classes, and the distribution channels of a large number of new assets are unrestricted, such as NFT;

From this, we have sorted out which types of tracks on the current market meet one of the above criteria, and believe that some market segments have begun to gradually approach an inflection point and are likely to become the engine of the next round of bull market.

Expansion of mature track

Rely on user scenario breakthroughs or operational experience to bring large-scale traffic