SignalPlus Volatility Column (20231102): FOMC Night

On FOMC night, the market is focused on the release of US data, the Feds interest rate decision and Chairman Powells remarks. Published on 1 Nov 20: 15 UTC+ 8 before the meeting startedADP employment numbersThe increase was recorded at 113,000, lower than the expected 150,000, stimulating the purchase of some risky products including digital currencies.BTC once rose 2% + broke through the 35,000 mark,But it quickly gave up all the gains.。22: 00 UTC+ 8 U.S. job openings exceed expectations in September, rising for the second consecutive month, underscoring the strong demand for labor in all sectors of the economy, while the ISM Manufacturing PMI recorded 46.7, well below expectations and the previous value of 49, marking the largest decline in a year,BTC continued to fall after that, reaching around 34,000 and then began to rebound slightly.. 2 Nov 2:00 am UTC+ 8 FOMC meeting begins,The Federal Reserve kept interest rates unchanged as expected. The statement added attention to the tightening of financial conditions, emphasizing the two-way risks to inflation and the strong expansion of U.S. economic activity in the third quarter.U.S. bond yields fell after the resolution was announced. In subsequent speeches, Powell said,The interest rate hike cycle is coming to an end. The Fed is acting cautiously, considering whether it must raise interest rates again, and is not considering cutting interest rates.. Although there was a hint of hawkishness in Chairman Baos remarks, as investors do not expect the Fed to raise interest rates further,U.S. Treasury yields begin to fall at an accelerated pace, the current two-year/ten-year U.S. Treasury bonds closed at 4.95%/4.71% respectively, and the inversion narrowed to 0.24%. influenced by,Digital currency also accumulates potential,Accelerating to gain a foothold above 35,000 at 4 am UTC+8,And once challenged the 36,000 mark. BTC/ETH options IV also rose sharply across the board starting at 4 oclock(BTC+5%, ETH+7%) untilThe price peaked at UTC+ 8 11:00 am, and IV fell back together with the price., and finally BTC/ETH closed at 35297.71/1835.1 (+ 2.39% /+ 1.59%)

Source: Binance & TradingView

Source: SignalPlus, Economic Calendar

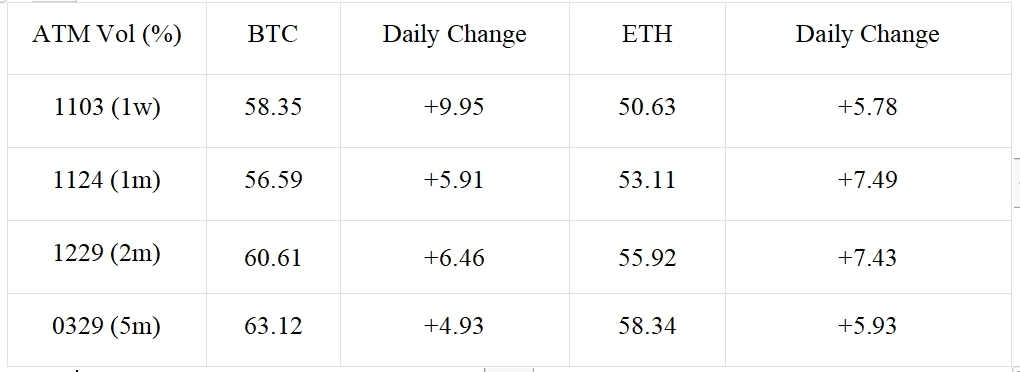

Source: Deribit (as of 2 NOV 16:00 UTC+8)

Source: SignalPlus

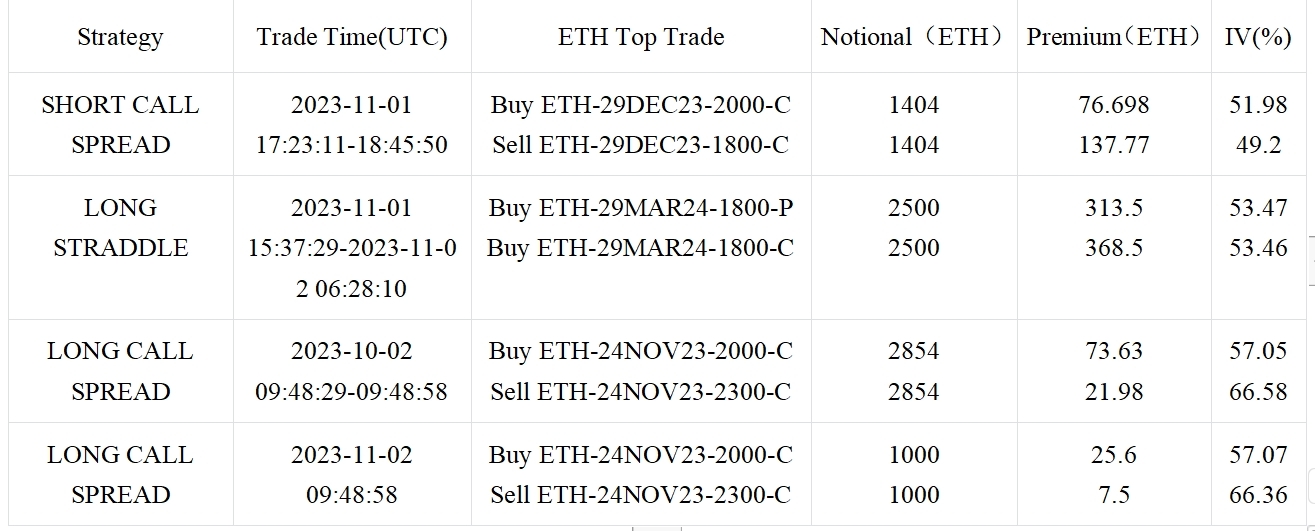

In terms of transactions,Call SpreadStill the most popular strategy in the bulk markets. On BTC, there are not only short-term C/S represented by 10 Nov 37500 vs 40000, but also a single 500 group of 42000 vs 50000 Long C/S at the end of the year. We continue to be optimistic about the recent rise in BTC. In terms of ETH, before the price started to break through at 4 oclock, the 1800 vs 2000 call spread was heavily sold at the end of the year. When the market rose, a large number of 2000 vs 2300 call spreads were opened on 24 Nov. At the same time, we can also observe that the recent Vol Skew of BTC/ETH is more tilted towards the Call side, with the 25 dRR rising sharply.

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com