Foresight Ventures: Taproot assets protocol is online, and the market is recovering strongly

1. Macro liquidity

Monetary liquidity is tightening. U.S. economic data in September exceeded expectations, while geopolitical risks increased and risk aversion increased. The market expects that after keeping interest rates unchanged in November, the probability of the Federal Reserve raising interest rates in January next year has risen to more than 60%. It is also possible to raise interest rates in December this year, but the probability of raising interest rates is lower than in January next year. U.S. stocks fluctuated and fell, and U.S. bond interest rates soared. Crypto markets bucked the trend.

2. Whole market conditions

Top 100 gainers by market capitalization:

BTC rallied this week on fake news coming through spot ETFs. BTC’s market share rose to 52%, performing better than most altcoins. Market hot spots revolve around the concept of BTC and Korean small coins.

1) BTC: The next halving cycle is less than 200 days away. Historically, BTC usually rises first in the early stages of a bull market. The probability of passing spot ETFs in the future is still high, but in the long run, the news is difficult to determine whether it is bullish or bearish. There is a view that ETFs have a lower probability of passing in a bear market and are more likely to pass in a bull market, because bull markets are more popular and have a money-making effect. The U.S. stock ETF market size is approximately US$5.6 trillion. Assuming that investors convert 0.5-1% into BTC spot ETFs, that is a volume of US$30-60 billion.

2) BLUR: It is the leader in NFT exchanges and lending, with the largest market share. The recent proposal to use 1% of trading proceeds for buyback and burn would translate into a conservatively estimated purchasing power of $30,000 per day. The BLUR token has performed poorly, down 90% from its highs, with a new big unlock coming in November.

3) PAAL: It is an AI chatbot that has gained 1 million users and will start a repurchase mechanism in the future. But there is a 4% transaction tax.

3. BTC market

1) Data on the chain

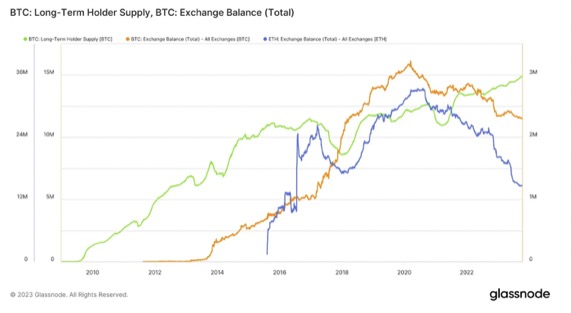

BTC supply has dropped to 2018 levels. On-chain data shows that the supply of BTC to long-term holders is at an all-time high, indicating that long-term holders are unwilling to sell at current price levels, which may provide support to prevent further price deterioration.

Stablecoins were flat overall. The market value of the five main stablecoins, including USDT, USDC, DAI, TUSD and BUSD, reached its highest point in March 2022 at US$163 billion, and then began to decline to the current market value of US$120 billion, a decrease of 26% in 17 months. More importantly, when U.S. investors can change from a net outflow of funds to an inflow of funds, they will see the market gradually transform from a bear market to a bull market.

Stablecoins were flat overall. The market value of the five main stablecoins, including USDT, USDC, DAI, TUSD and BUSD, reached its highest point in March 2022 at US$163 billion, and then began to decline to the current market value of US$120 billion, a decrease of 26% in 17 months. More importantly, when U.S. investors can change from a net outflow of funds to an inflow of funds, they will see the market gradually transform from a bear market to a bull market.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level of 1 and holders were generally in the red. The current indicator is 0.58, entering the recovery phase.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level of 1 and holders were generally in the red. The current indicator is 0.58, entering the recovery phase.

2) Futures market

2) Futures market

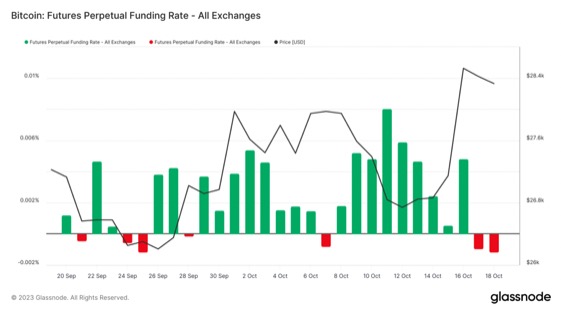

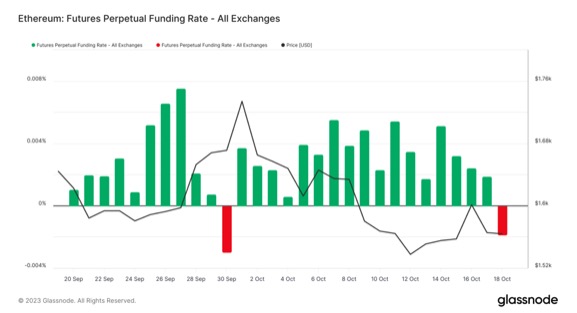

Futures funding rates: The rates are negative this week, and short-selling sentiment is dominant. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

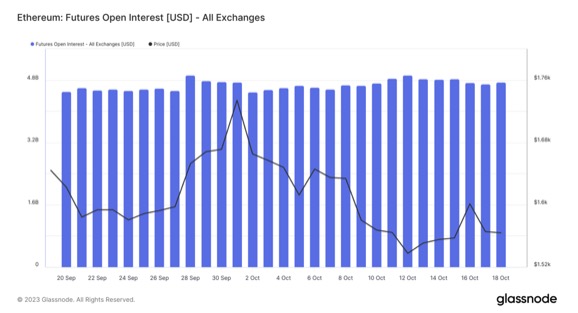

Futures positions: The total BTC positions increased slightly this week, in sync with the price, and speculative funds entered the market.

Futures long-short ratio: 1.0. Market sentiment is neutral. Retail investor sentiment is mostly a contrarian indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market price

BTC was pulled by the own news. It is estimated that there will be no market in the second half of the month, and the market will oscillate at the top to build a top market. BTC rose, ETH and altcoins fell, and BTC’s market share increased to 52%. Before the halving, there is a high probability that only BTC will rise. It is recommended to gradually increase your BTC position during the market decline.

market data:

market data:

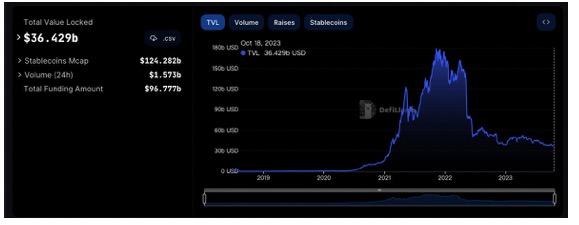

The total lock-up amount of the public chain

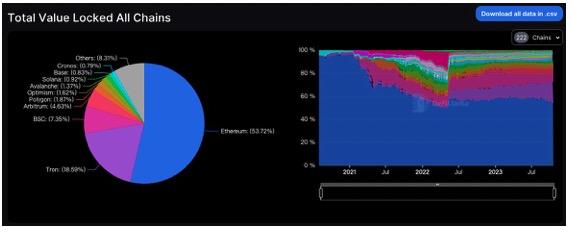

2. TVL proportion of each public chain

2. TVL proportion of each public chain

TVL fell nearly 1b overall this week, rising 2.2%. After the news of the Bitcoin ETF being approved by the SEC was released in the middle of last week, the price of BTC directly broke through the 30,000 mark, and then was pressured by strong short orders to return to the range of 28,000 to 29,000. BTC still failed to stabilize at 30,000 or so. This week, the TVL and ETH chains fell by 3.7%, the ARB chain fell by 1.3%, and the OP chain fell by 1.7%, but the other mainstream public chains all experienced slight increases. It is worth paying attention to the Gnosis chain, which has risen by more than 90% in the past month, and the number of protocols on the chain has reached 52.

TVL fell nearly 1b overall this week, rising 2.2%. After the news of the Bitcoin ETF being approved by the SEC was released in the middle of last week, the price of BTC directly broke through the 30,000 mark, and then was pressured by strong short orders to return to the range of 28,000 to 29,000. BTC still failed to stabilize at 30,000 or so. This week, the TVL and ETH chains fell by 3.7%, the ARB chain fell by 1.3%, and the OP chain fell by 1.7%, but the other mainstream public chains all experienced slight increases. It is worth paying attention to the Gnosis chain, which has risen by more than 90% in the past month, and the number of protocols on the chain has reached 52.

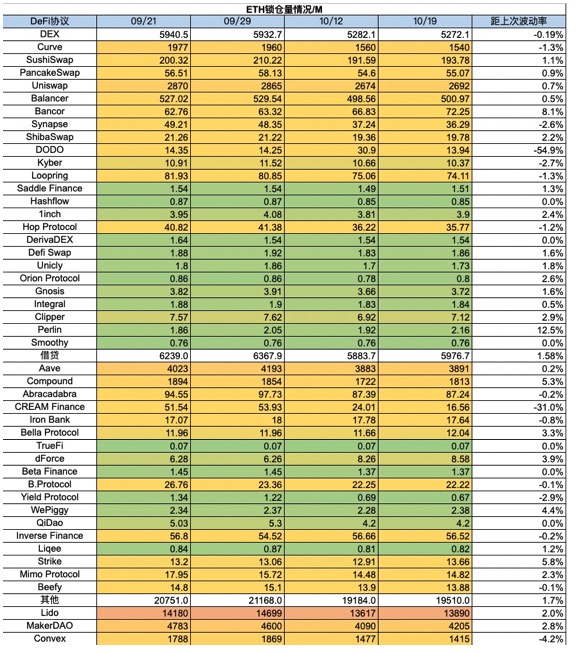

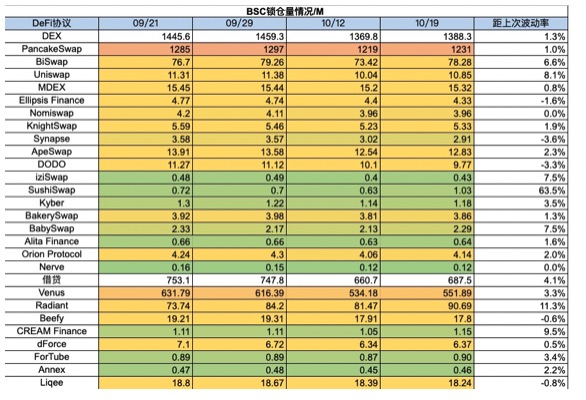

3. The lock-up amount of each chain protocol

1) ETH lock-up amount

2) BSC lock-up amount

3) Polygon lock-up amount

3) Polygon lock-up amount

4) Arbitrum lock-up amount

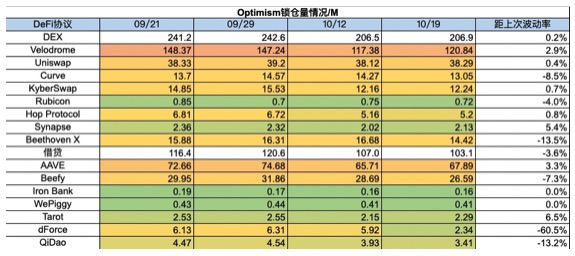

5) Optimism lock-up amount

6) Base lock-up amount

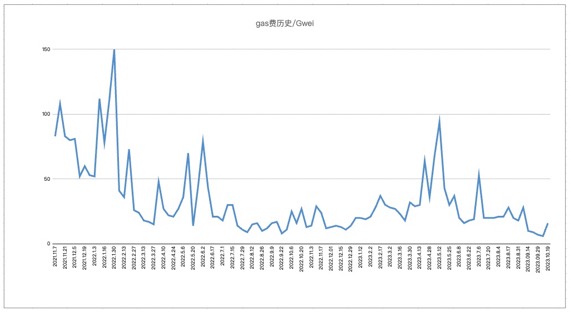

4. ETH Gas Fee History

On-chain transfer fees are approximately $1.36, Uniswap transaction fees are approximately $4.62, and OpenSea transaction fees are approximately $1.79. Gas usage and transaction fees have increased significantly this week. From the perspective of gas consumption, Uniswap still occupies the top position, accounting for 15.45% of the entire market.

5. Changes in NFT market data

NFT-500 Index

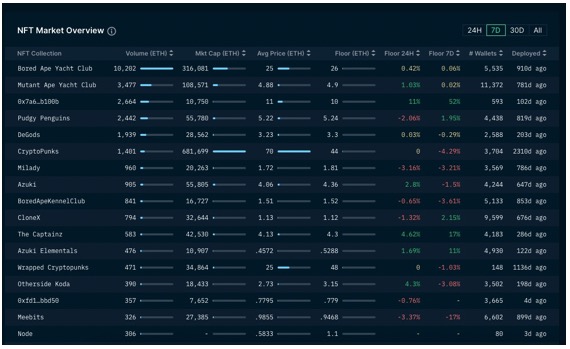

NFT market situation

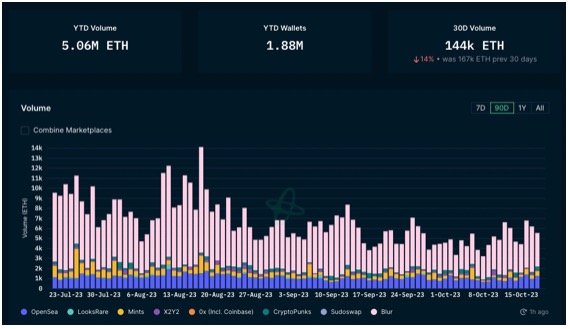

NFT trading market share

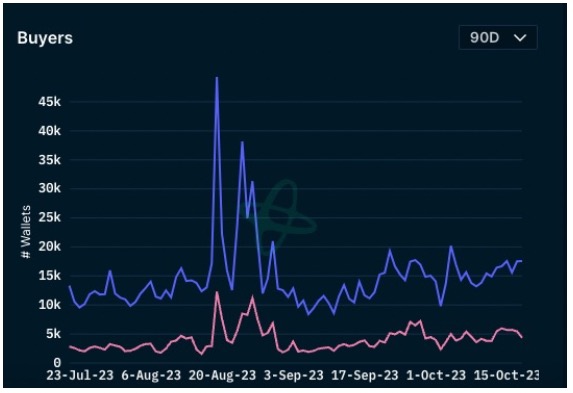

NFT buyer analysis

The floor prices of leading blue-chip projects did not fluctuate much this week, with BAYC and MAYC both rising by less than 0.1%. Except, CryptoPunks, Milady, Azuki and BoredApeKennelClub all fell slightly. It is worth paying attention to Winds of Yawanawa, which is an NFT project launched on July 10, 2023. There are a total of 650 unique Amazon River climate maps for display NFT, which includes landscape pictures, weather, storms, directions , temperature and various natural climates. The item is up 52% in the past week. The number of total wallets and repeat buyers has not changed significantly, and the NFT market has not yet seen signs of recovery.

The floor prices of leading blue-chip projects did not fluctuate much this week, with BAYC and MAYC both rising by less than 0.1%. Except, CryptoPunks, Milady, Azuki and BoredApeKennelClub all fell slightly. It is worth paying attention to Winds of Yawanawa, which is an NFT project launched on July 10, 2023. There are a total of 650 unique Amazon River climate maps for display NFT, which includes landscape pictures, weather, storms, directions , temperature and various natural climates. The item is up 52% in the past week. The number of total wallets and repeat buyers has not changed significantly, and the NFT market has not yet seen signs of recovery.

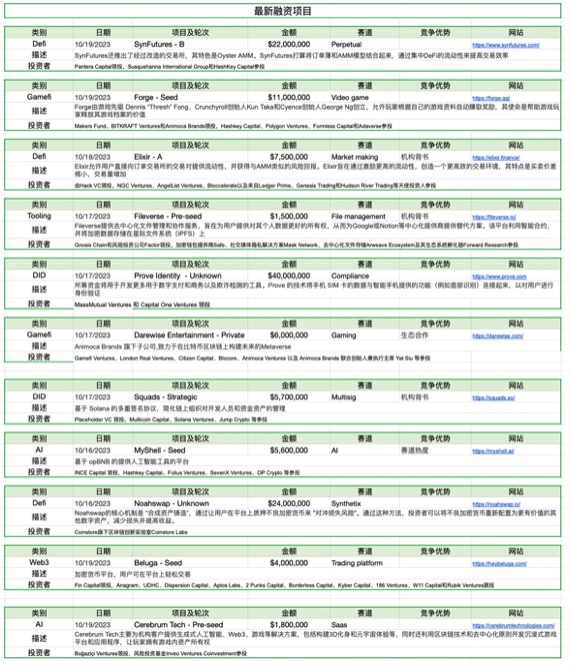

Latest financing projects

Foresight Ventures Portfolio Update

Space and Time:

Data

Space and Time (SxT), a decentralized data warehouse pioneering new use cases for zk-proofs, has announced its integration with Chainlink. zk-Verifier, which SxTs SQL attestation solution relies on, is now available in Chainlink nodes. Therefore, dapps only need to connect to Chainlink’s node network to access verifiable proofs of a centralized or decentralized database.

Space and Time:

Data

DeFi options trading platform Diving Board announced that it is built on Space and Time’s verifiable computing layer. Space and Time relies on its decentralized data warehouse and full-stack zero-knowledge (ZK) development tools to ensure that Diving Board’s aggregations and algorithms are verifiable. based on data and calculations, thereby enhancing the credibility and transparency of the platform.

The platform is now available in alpha. https://alpha.divingboard.io

Shardeum

Shardeum

Layer 1

Shardeum and its co-founder Omar Syed will release a white paper at 15:30 UTC on November 8, 2023 (23:30 on November 8, Beijing time). At that time, he will have an in-depth understanding of dynamic sharding, automatic expansion, standby nodes, and arbitration proofs. The technology behind it.

Previously, Shardeum completed US$5.4 million in strategic financing and was valued at US$248 million.

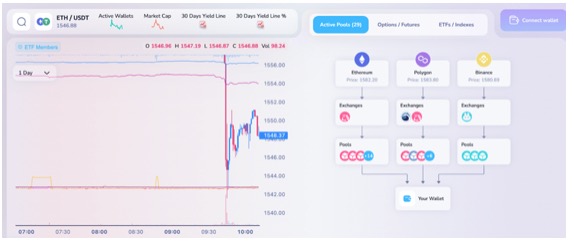

WalletConnect

infrastructure

WalletConnect releases Web3 Modal v3.1 and launches it as the first web3 modal to support EIP-6963! The application can provide its users with a seamless wallet connection experience supported by EIP-6963, which is currently supported by more than 10 wallets.

EIP-6963 not only helps users easily use and manage multiple browser extension wallets, but also allows applications to automatically display the name and logo of the wallet in the user interface, making the connection experience clearer. This is because EIP-6963 provides wallets with the opportunity to inject more information such as wallet name, logo, UUID, and RDNS. The launch of EIP-6963 will potentially break the hegemony of leading wallet providers like Metamask and create a more competitive environment among providers.

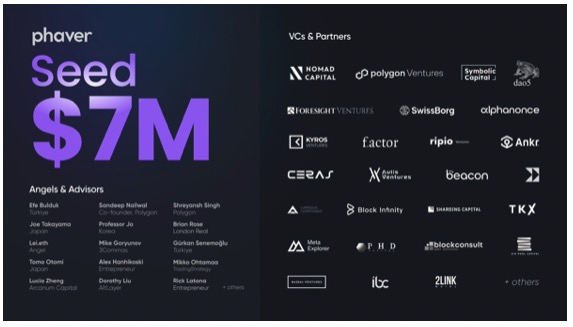

Phaver

SocialFi

Web3 social application Phaver announced the completion of a $7 million seed round of financing, with participation from Polygon Ventures, Nomad Capital, Symbolic Capital, dao 5, Foresight Ventures, Alphanonce, f.actor, Superhero Capital, SwissBorg, etc. Phaver has raised more than $8 million in total funding to date, valuing it at approximately $80 million, which will be used for product development, team expansion and other partnerships. As the largest mobile application software on Lens Protocol, Phaver has basically shown stable linear growth since its official launch and currently has about 250,000 users.

EthStorage

infrastructure

EthStorage, the Ethereum second-layer data storage solution project, announced that it is collaborating with Hyper Oracle and Delphinus Lab to release the zkGo compiler. Based on the latest version of Go 1.21.0, zkGo is the first compiler that can compile ordinary Go code into Wasm code compatible with the ZK protocol. The generated Wasm code can already be used for zero-knowledge proof and on-chain verification through the zkWasm tool of Delphinus Lab, providing a broader ecological space for Go developers to enter the ZK technology field.