Ouke Cloud Chain Research Institute answers: Does the Oolong incident of Bitcoin spot ETF release a signal of loose supervision?

Original source: Ouke Cloud Chain Research Institute

Original author: Matthew Lee

On October 16, Cointelegraph dropped a bombshell claiming that the SEC approved BlackRock’s iShares Bitcoin spot ETF. Bitcoin prices surged immediately after the news, reaching a high of $30,535, according to OKX data. But gains immediately retreated after a BlackRock spokesperson told Bloomberg that the spot Bitcoin ETF application was still under review by the SEC.

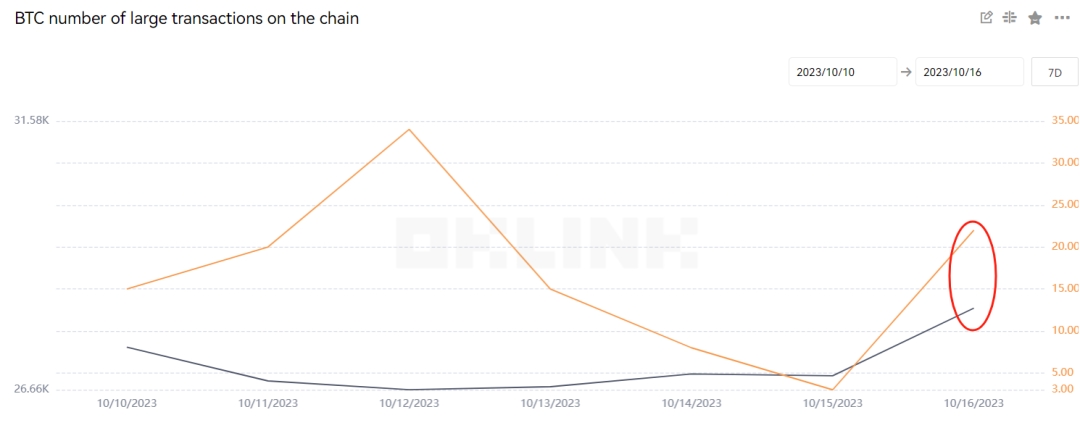

The announcement of the false news also caused the originally calm market to suddenly become restless. According to data from OKLink Explorer, the number of large-value Bitcoin transactions increased by 630% on the 16th.

Source:OKLink Explorer

Although it was confirmed to be false news, the explosive growth it brought surprised everyone. As a rare catalyst in the industry, the reason why the market is so excited about the fake news about the adoption of Bitcoin spot ETF is based on two points:

Release a signal of “loose” supervision

Regulatory pressure has led to a lackluster second half for the industry, and the adoption of a Bitcoin spot ETF at this time, which has been strongly resisted, would indicate that the SEC is softening its stance on the industry.

Broadening traditional funds’ exposure to cryptocurrencies

When most exchanges are unclear about compliance, for conservative investors, buying Bitcoin on the exchange is nothing more than a bet. If the regulation passes ETF, it can broaden the channels for traditional investors to purchase this asset and meet the needs of institutional asset diversification.

Bitcoin has been compared with gold because it has similar properties to gold and other precious metals in some aspects. Since the launch of the worlds first gold ETF in Australia, the speculative nature of gold has greatly increased since it does not need to be carried and stored, resulting in substantial gains in the medium term. According to data from the World Gold Council, investment in gold funds exceeds US$210 billion, while investment in Bitcoin funds is only US$28.8 billion, a difference of nearly 7.4 times. When Bitcoin is gradually accepted by mainstream funds, the scale of future growth can be imagined.

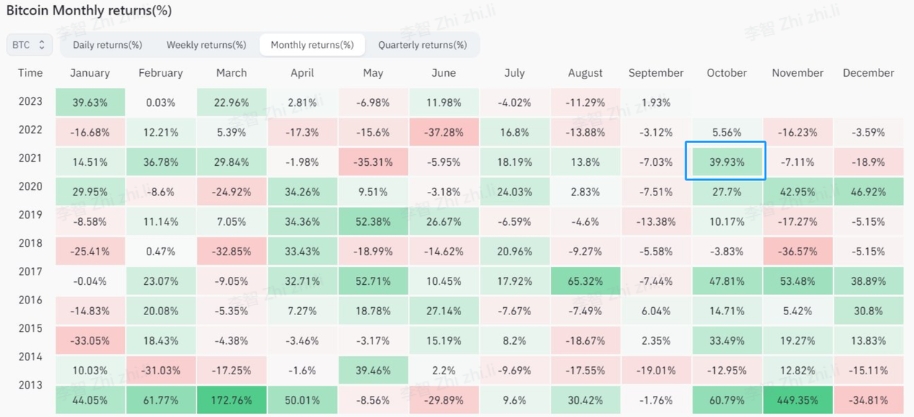

Taking history as a guide, can Bitcoin spot determine industry trends after passing

Also on October 16, two years ago, the SEC approved the fund management company ProShares to launch the first Bitcoin futures ETF listed in the United States. BTC surged 39.9% that month. However, most ETFs performed poorly after listing (some broke on the first day) and did not bring deeper and more lasting influence. A few months after the boots landed, BTC prices continued to fall from historical highs.

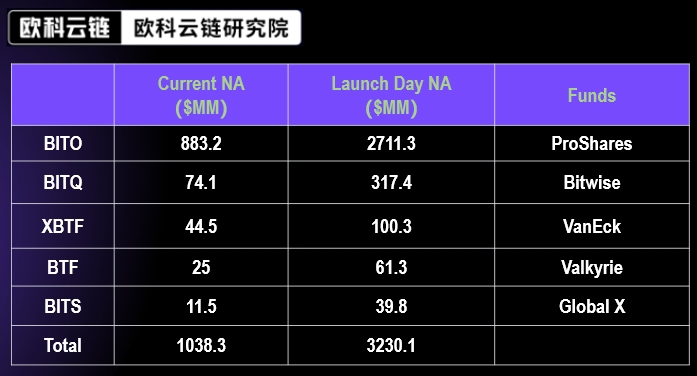

The following is the author’s list of the top five Bitcoin ETFs on the market. The market size of Bitcoin on October 18, 2021 (the time when most ETFs are listed) is about $1160 B, and the net assets held by ETFs add up to a scale of about $3 B, accounting for only 3 ‰. But it brought about a 39% increase in market value.

Source:OKG Research

Judging from the above data, futures ETFs are relatively limited in terms of capital inflows and sustained optimism. However, considering the higher acceptance and more abundant liquidity of spot ETFs, it may bring different results.

It is worth mentioning that the main reason for creating the previous bull market in the industry was the unprecedented loose environment of liquidity. With liquidity tightening, the specter of economic recession hanging over the market, and risk assets being sold off sharply, the durability of the impact of relying solely on spot ETFs is also questionable.

write at the end

The SEC also approved Ethereum futures ETFs not long ago, and the market response was very dull. The six Ethereum futures ETFs only had a trading volume of $1.92 million on the first trading day. Such a lukewarm response was beyond the authors expectation.

With the SEC announcing that it will not appeal against Grayscale, it has also raised the industrys expectations for the adoption of spot ETFs, and it is only a matter of time before it is approved. Based on rational analysis, it is not difficult to see the positive impact that the adoption of spot ETFs can have on the entire industry. Although the author is not optimistic about the promotion of spot ETF in a single situation, I have to admit that if the spot ETF is passed, it will have an impact on the entire industry that is incomparable to other factors.