Gryphsis Academy: Improvements and Valuation Outlook of dYdX v4 Economic Model

TL;DR

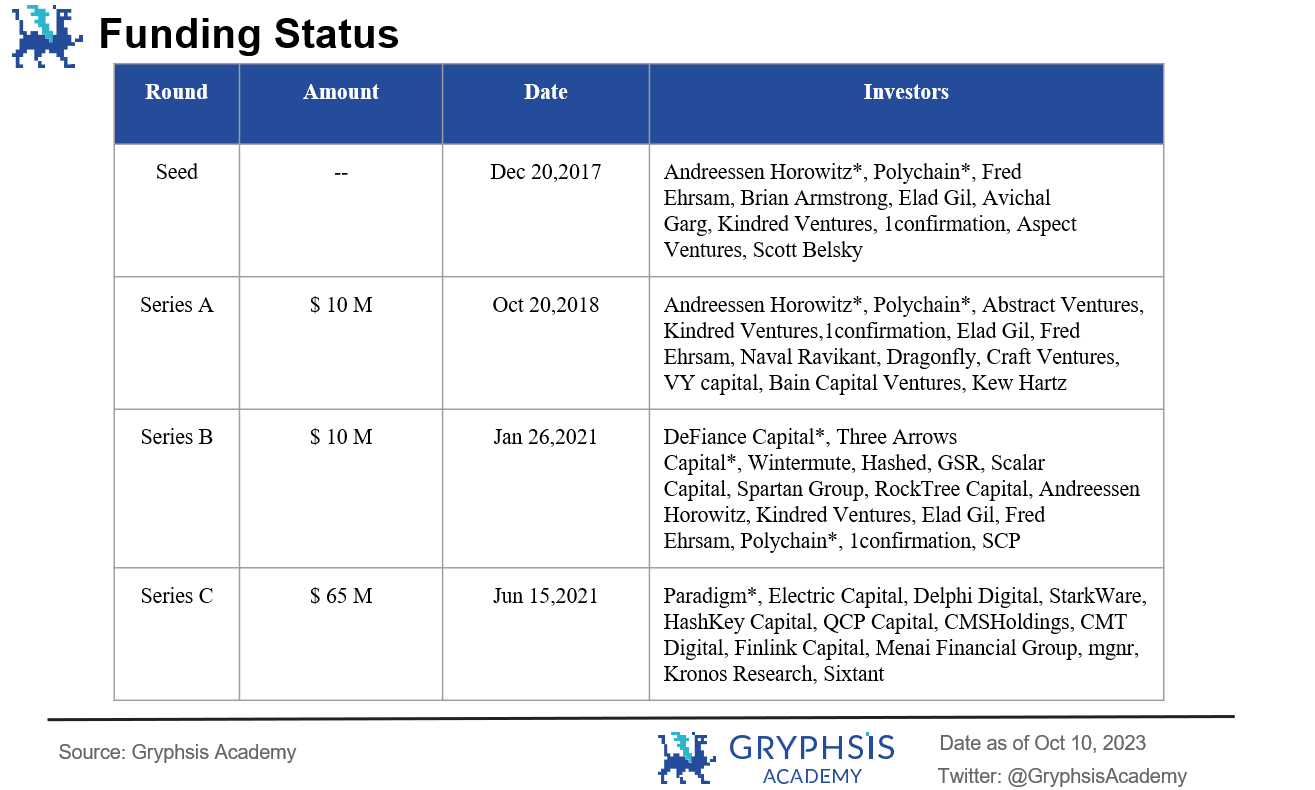

1. Founded in 2017, dYdX is a decentralized perpetual contract exchange that integrates three functions: lending, margin trading and perpetual contracts. dYdX has currently completed four rounds of financing, invested by well-known institutions such as Paradigm and A16Z.

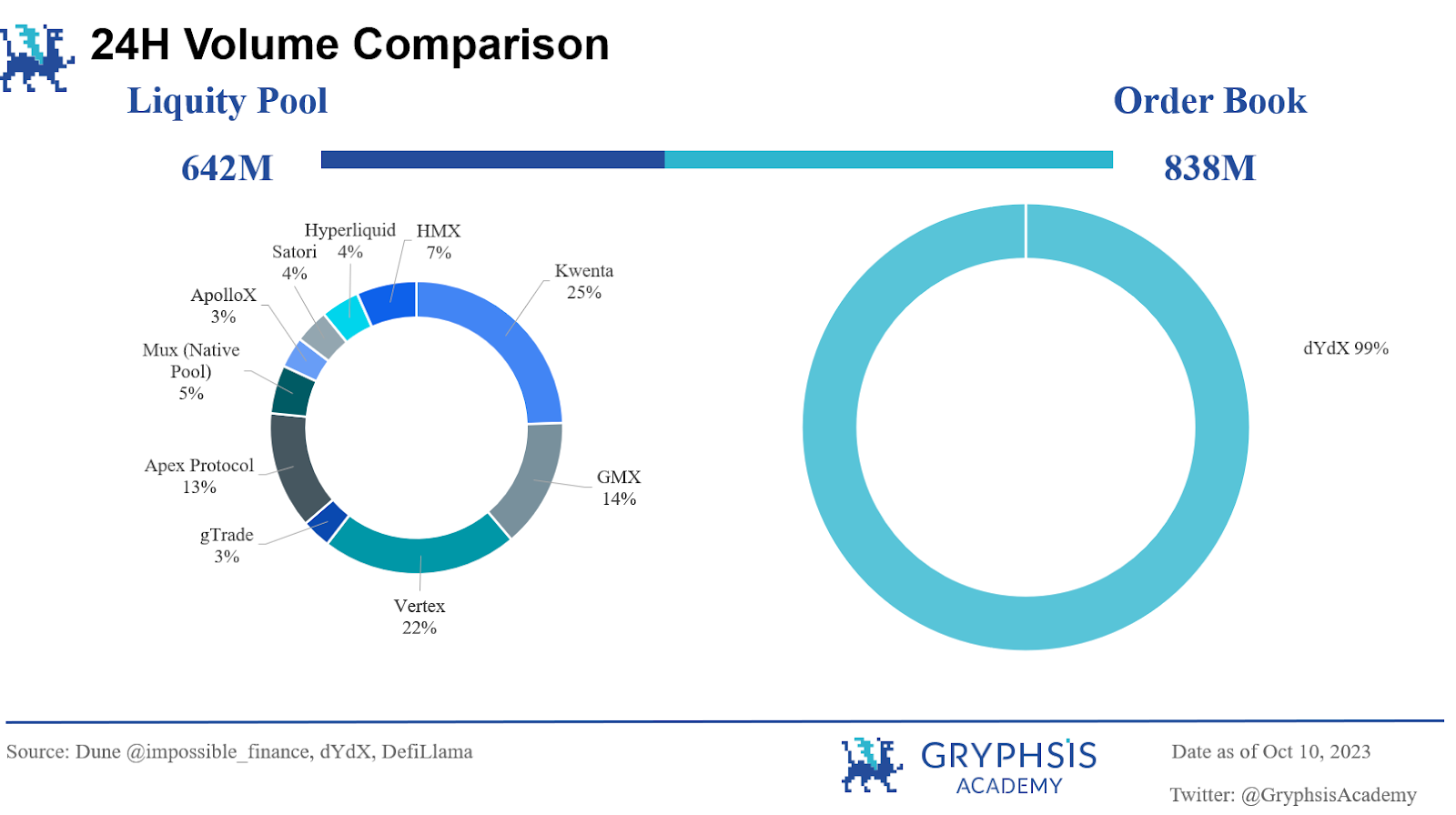

2. In 2021, after migrating to Starkware, dYdX solved the TPS and Gas fee problems. The current daily trading volume exceeds 800 million US dollars, occupying the leading position in the perpetual contract market.

3. dYdX adopts a tiered transaction fee mechanism to convert liquidity by charging lower fees to Makers and users with large transaction volumes, resulting in lower handling fee levels; to encourage the adoption of the new version v4, the protocol will allocate $DYDX to early users Token rewards further expand the handling fee advantage.

4. v4 new version features:

dYdX v4 migrates to an independent chain based on Cosmos SDK.

Update the order process, off-chain matching and on-chain consensus.

There is no gas fee for submitting/cancelling an order, you are only charged upon completion.

dYdX implements completely decentralized management.

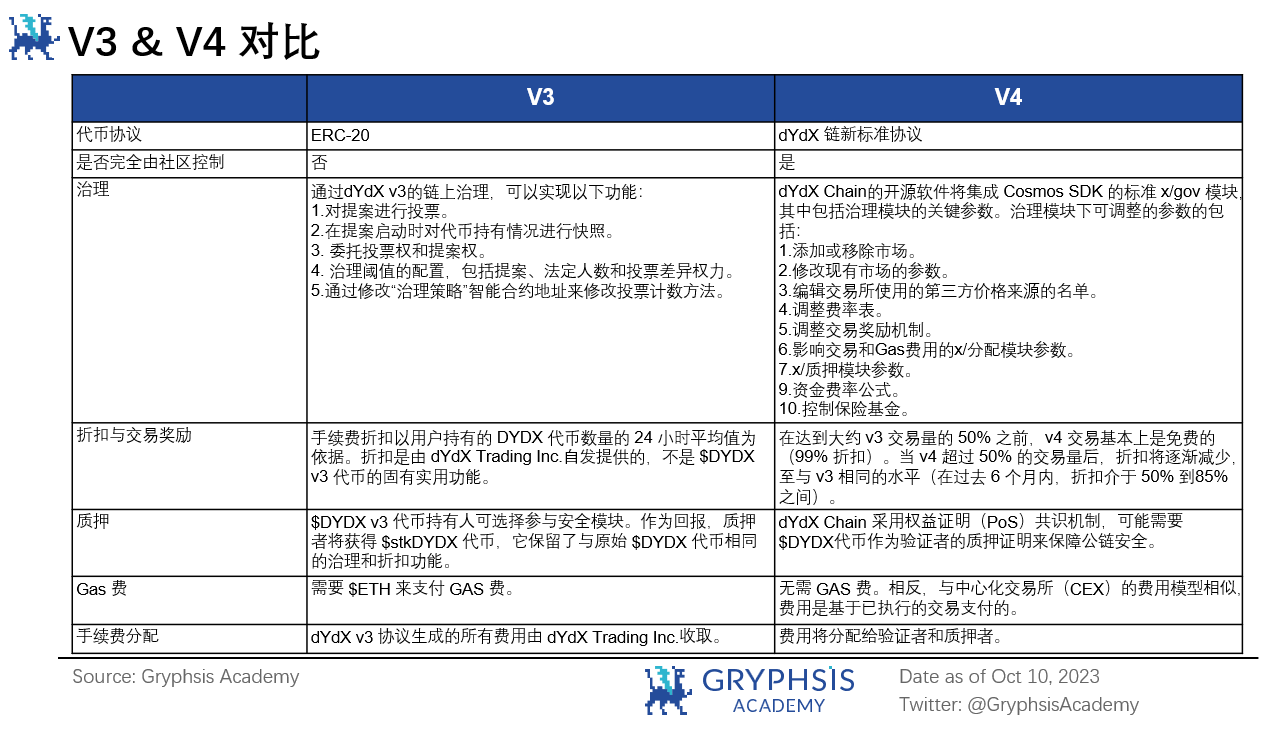

5. Compared with v3, v4 has made marginal improvements in six aspects: protocol standards, governance functions, discount functions, pledge functions, gas payment and fee distribution, increasing the actual use and value capture capabilities of the tokens.

6. Reasons why dYdX chose Cosmos:

Cosmos offers decentralization and high performance.

The decentralization of v4 helps avoid regulation.

Cosmos natively supports USDC, improving dYdX liquidity and reducing risks caused by cross-chain assets.

Cosmos provides dYdX with better scalability and composability.

7. We believe that Layer 1 staking and fee distribution increase the actual use and value capture capabilities of the token, and the introduction of the Cosmos native stablecoin increases the liquidity of the token. The three will jointly improve the fundamentals of the $DYDX token. , bringing continuous benefits to the token. But at the same time we should also be aware of the risks associated with reduced security.

1. Project Introduction

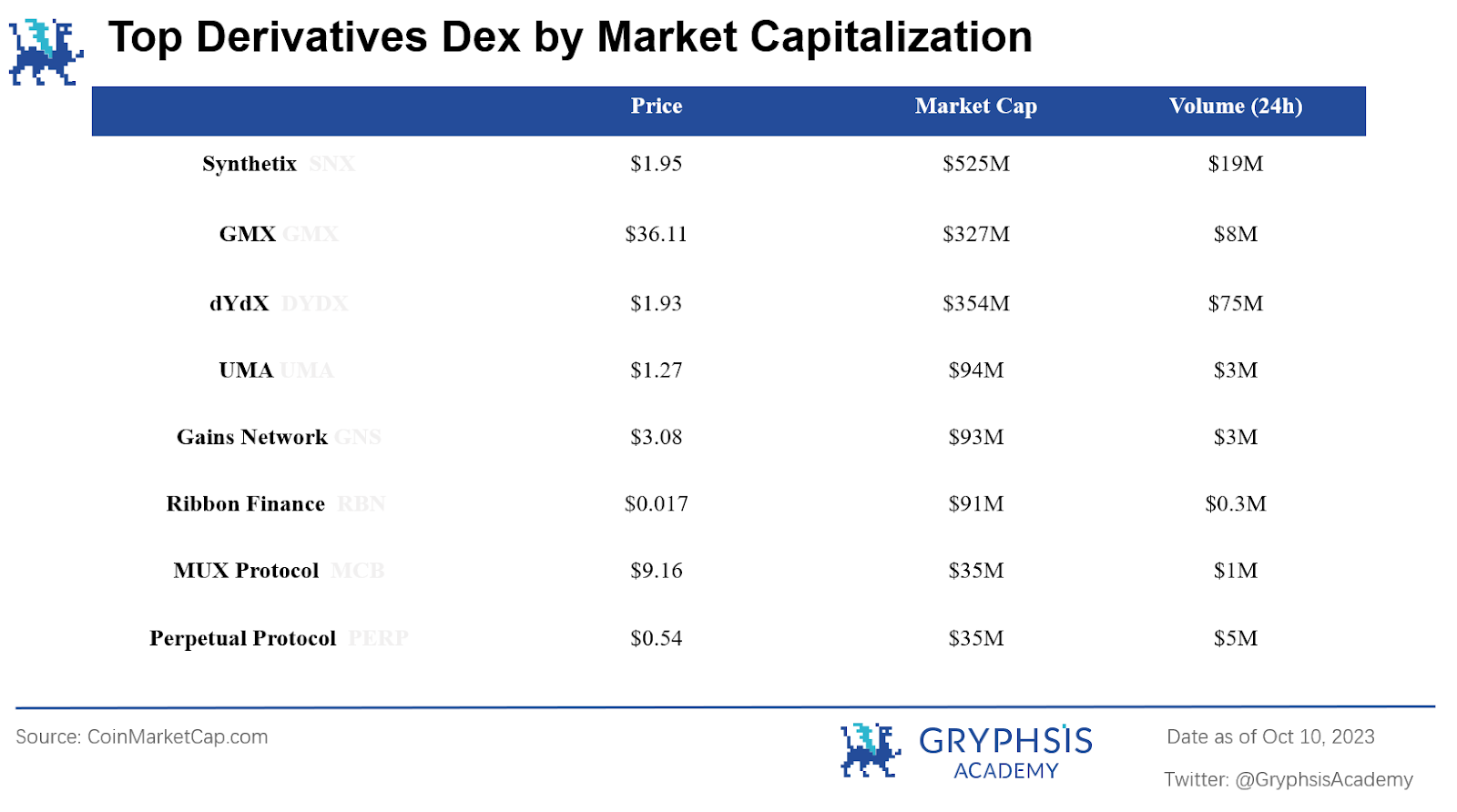

dYdX is a decentralized perpetual contract exchange currently hosted on the Ethereum Layer 2 blockchain built by StarkWare. It relies on the security of Ethereum and uses zero-knowledge proof to speed up transactions and reduce transaction costs. cost. dYdX adopts an order book model and has outstanding performance in 24 H trading volume and DAU. It is the largest and most used perpetual contract in the market, with daily trading volume exceeding$ 800 M, exceeding the combined trading volume of Kwenta, GMX, gTrade, Vertex and other protocols.

2. Team background and financing situation

dYdX was founded in 2017, and the team has certain blockchain industry background and technical strength. It is worth mentioning that dYdX has close ties with the centralized exchange Coinbase. First of all, some core team members of dYdX have worked at Coinbase, among which founder Antonio Juliano once served as a senior engineer at Coinbase. Secondly, Coinbase also actively participated in dYdX’s seed round investment and provided liquidity support for its lending products. In addition, the current CEO of dYdX is Charles dHaussy, who previously served as head of global business development at ConsenSys and also served as head of fintech at investHK. According to the information provided, dYdX’s executive team and board members all graduated from world-renowned universities and have worked in well-known companies such as Wharton FinTech, AIG, LinkedIn, etc. This shows that the dYdX team has extensive expertise in the financial and technology fields knowledge and experience.

At present, dYdX has completed 4 rounds of financing, raising a total of US$87 million. It has a strong lineup of financiers and sufficient funds. The investment list includes Paradigm, Polychain Capital, Andreessen Horowitz (A16Z) and other well-known institutions in the industry, as well as well-known market makers. Wintermute.

3. Development history and track status

dYdX was originally built on the Ethereum mainnet, but the outbreak of DeFi Summer caused it to encounter the problem of skyrocketing Gas, and the congestion of the Ethereum network also seriously affected the users trading experience. In order to solve the problem of Gas fees, in 2021, dYdX moved to the more scalable Ethereum Layer 2-Starkware platform, which effectively solved the problems of transaction speed (TPS) and Gas fees. After the migration, the trading volume of the dYdX platform increased significantly,dYdX v3 trading volume totals approximately $1 T, ranking first in the perpetual contract Dex market.

4. Business segment division and transaction fee improvements

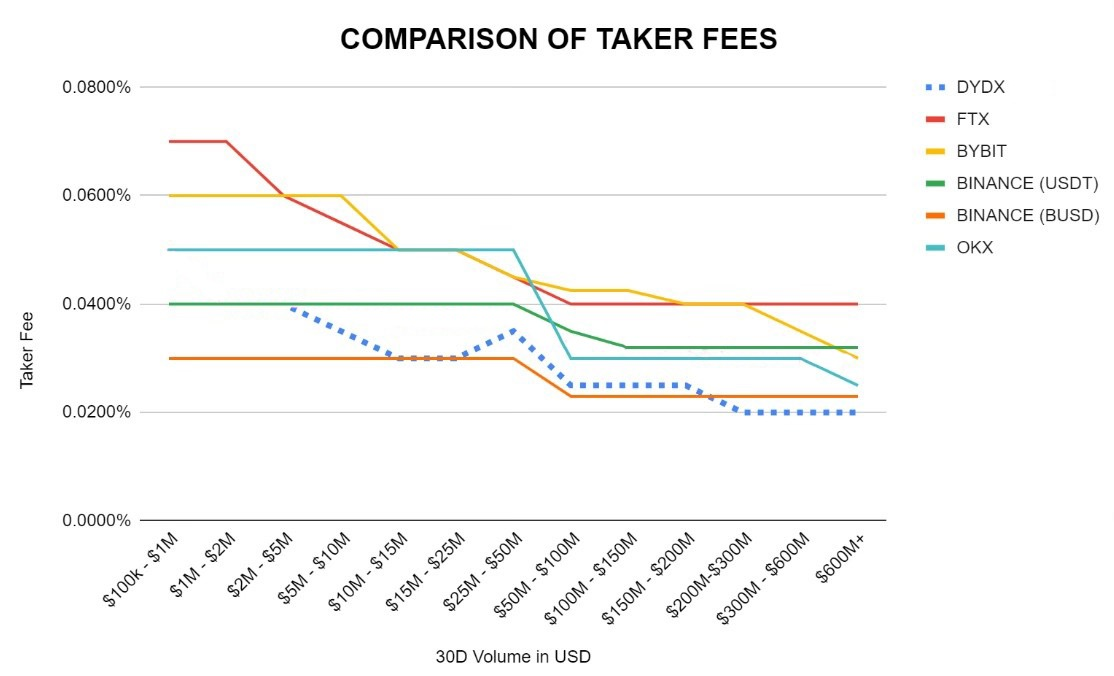

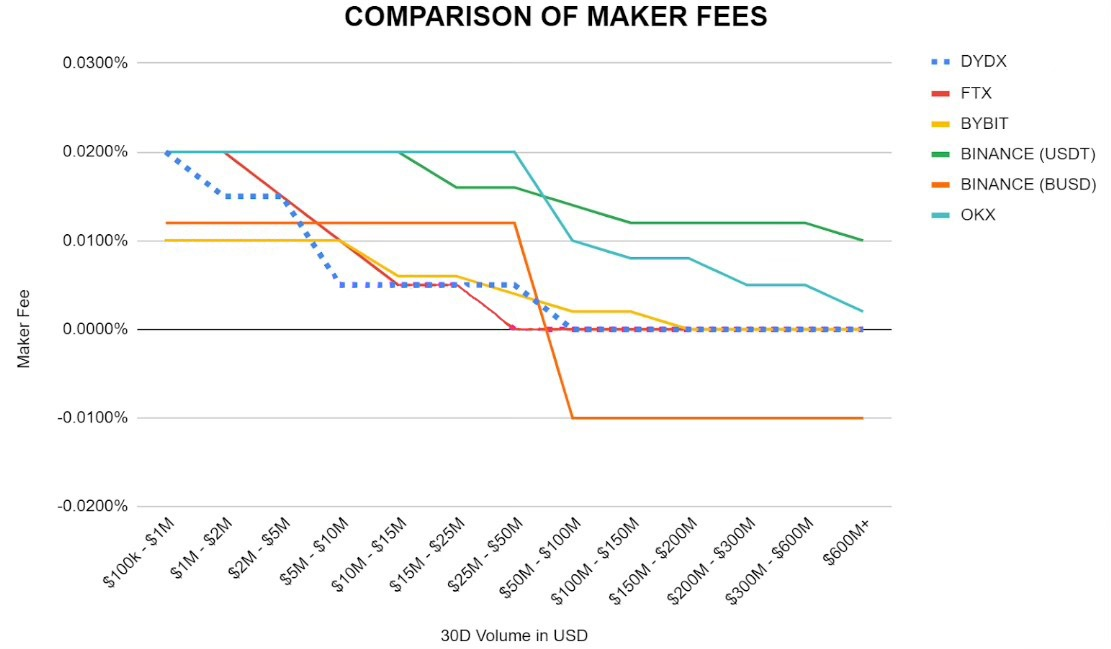

dYdX also includes three functions: lending, margin trading and perpetual contracts. Margin trading comes with a borrowing function. The funds deposited by users automatically form a fund pool. If there are insufficient funds during the transaction, they will automatically borrow and pay interest. dYdX converts liquidity by charging lower fees to Makers. The larger the monthly trading volume, the lower the fee. This mechanism is friendly to institutions and professional traders. As shown in the figure, it can be seen that dYdX has lower transaction fees and has a greater advantage among major trading platforms.

Source:dYdX Forums

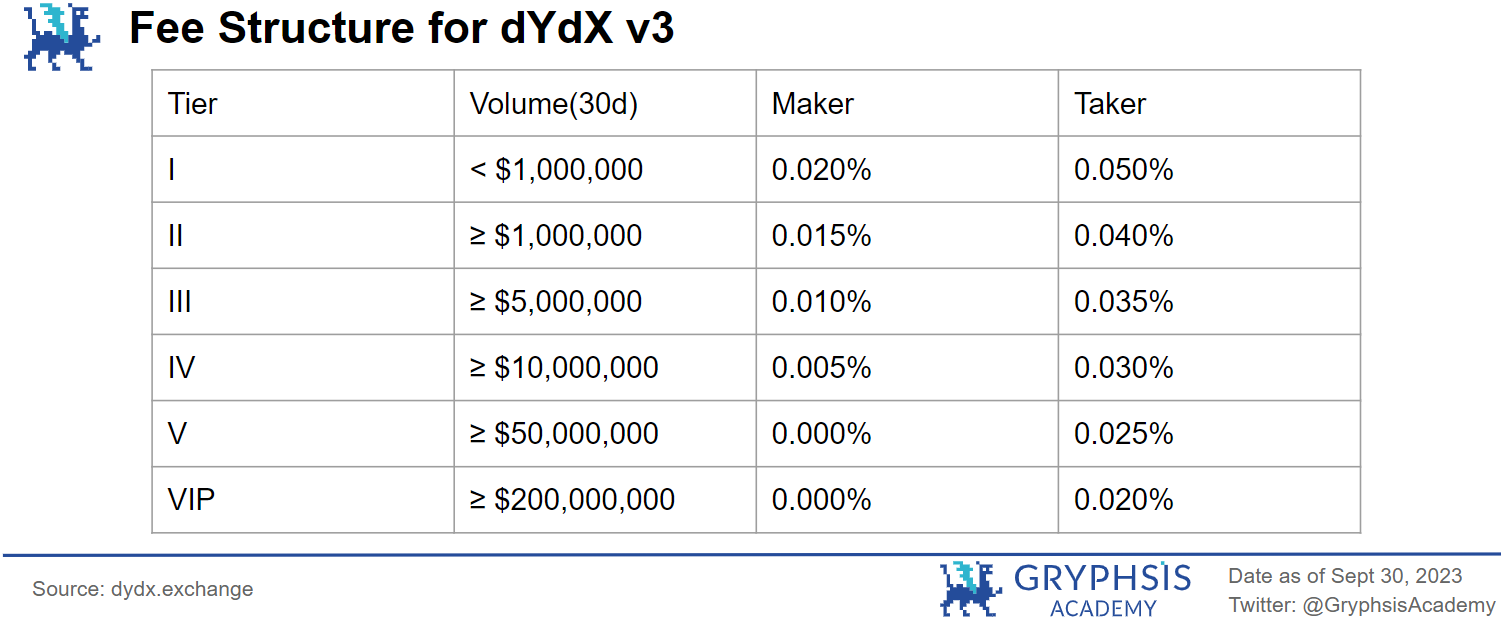

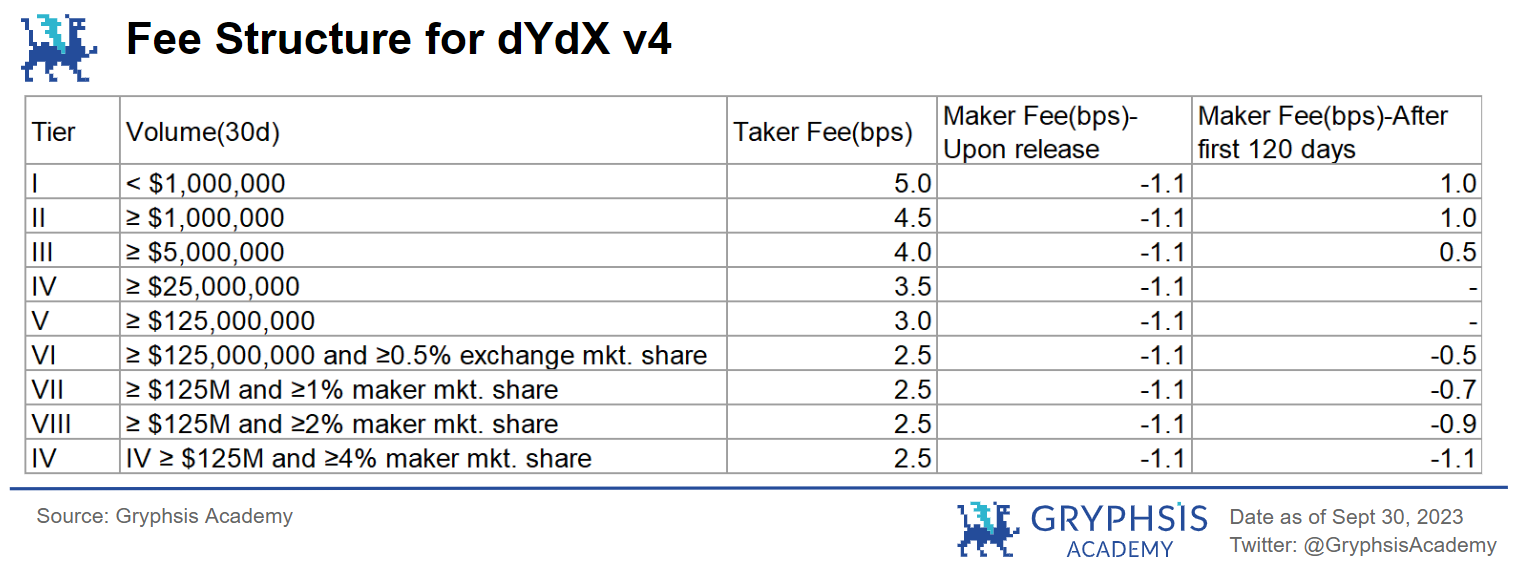

The transaction fees of dYdx vary according to the transaction volume level every 30 days. There are six transaction fee levels in v3. The larger the transaction volume, the higher the level, and the lower the transaction fees of Maker and Taker. When the transaction volume of 30 days When the amount is greater than or equal to $50, 000, 000, Makers transaction fee will become 0. according toofficial plan, in the first 120 days after v4 goes online, Maker will receive a transaction reward of 1.1 bps (1.1 bps= 0.011%). After 120 days of being online, Maker orders will pay handling fees. Unless the transaction volume on the 30th is greater than or equal to $25,000,000, Makers transaction fees will be waived. When the transaction volume on the 30th reaches $125, 000, 000 and exceeds 0.5% of the trading market share, Maker will regain trading rewards. Of course, this is just a current scenario, and subsequent fee levels may be adjusted by the governance community based on actual conditions.

At the same time, according to the latest passed on October 2proposal, the community will distribute $DYDX tokens worth $20 million to early adopters of v4 within 6 months, aiming to incentivize users to transition to v4 and seamlessly migrate to the dYdX chain. This measure can effectively increase the adoption rate of v4 and help the early growth of v4. This move also further improves dYdX’s fee advantage.

5. v4 economic model

5.1 Token distribution and unlocking cycle

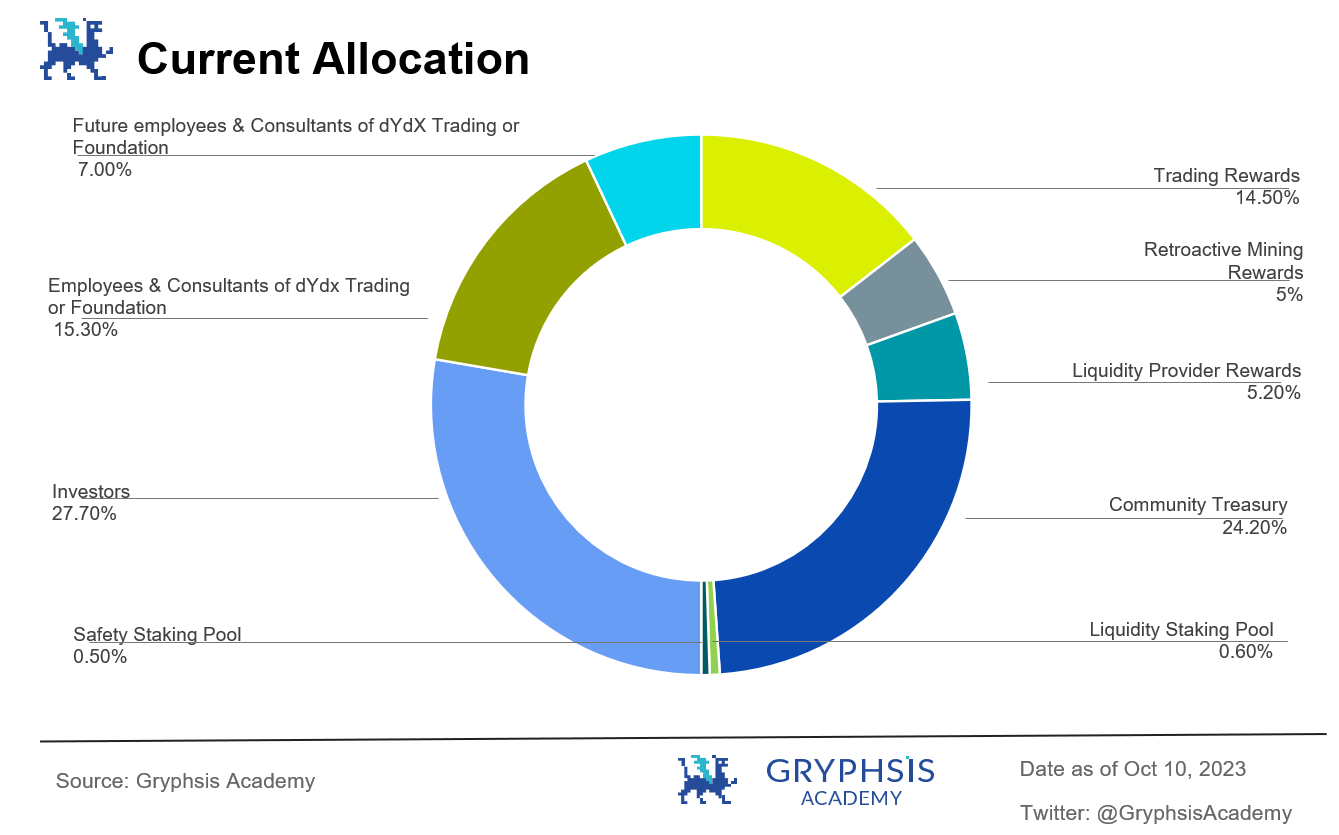

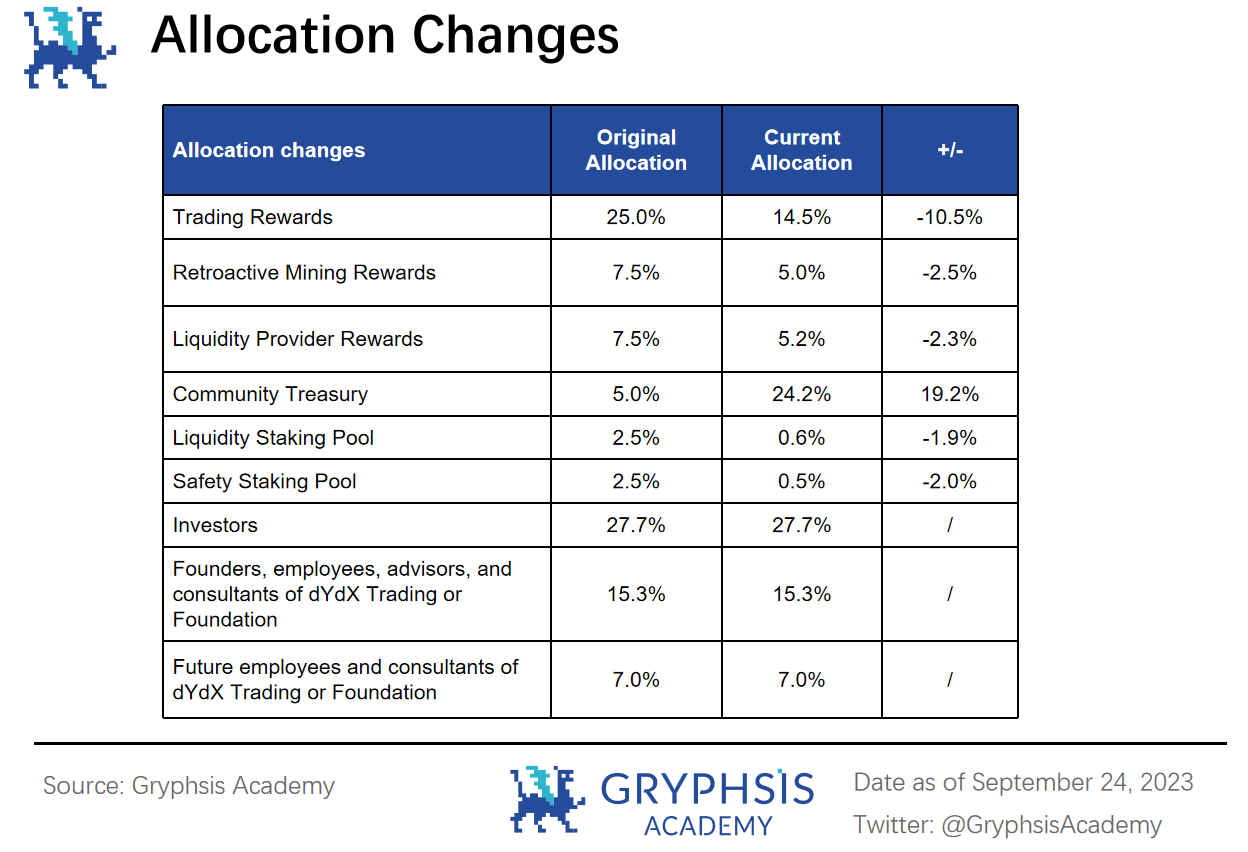

The total number of $DYDX tokens is 1 billion, which will be unlocked starting in August 2021 and released in five years. Currently, a number of governance proposals have been adopted (DIP 14 ,DIP 16 ,DIP 17 ,DIP 24 ), the initial distribution of tokens changes. The current distribution includes: 50% of the supply will be used by the community (14.5% as transaction rewards, 5% as retroactive mining rewards, 5.2% as LP rewards, 24.2% will go to the community treasury, 0.6% as USDC staking rewards, 0.5 % is the $DYDX security pool staking reward), and the other 50% is mainly used to distribute to investors and employees. After 5 years, an annual inflation rate of up to 2% can be used by the Governance to increase the supply of $DYDX, ensuring that the community has sufficient resources to continue developing dYdX. This inflation must be enacted through a management proposal, with an annual cap of 2%.

Source:DIP 16 ,DIP 20 ,DIP 24 ,DIP 14 ,DIP 17

Source:DIP 16 ,DIP 20 ,DIP 24 ,DIP 14 ,DIP 17

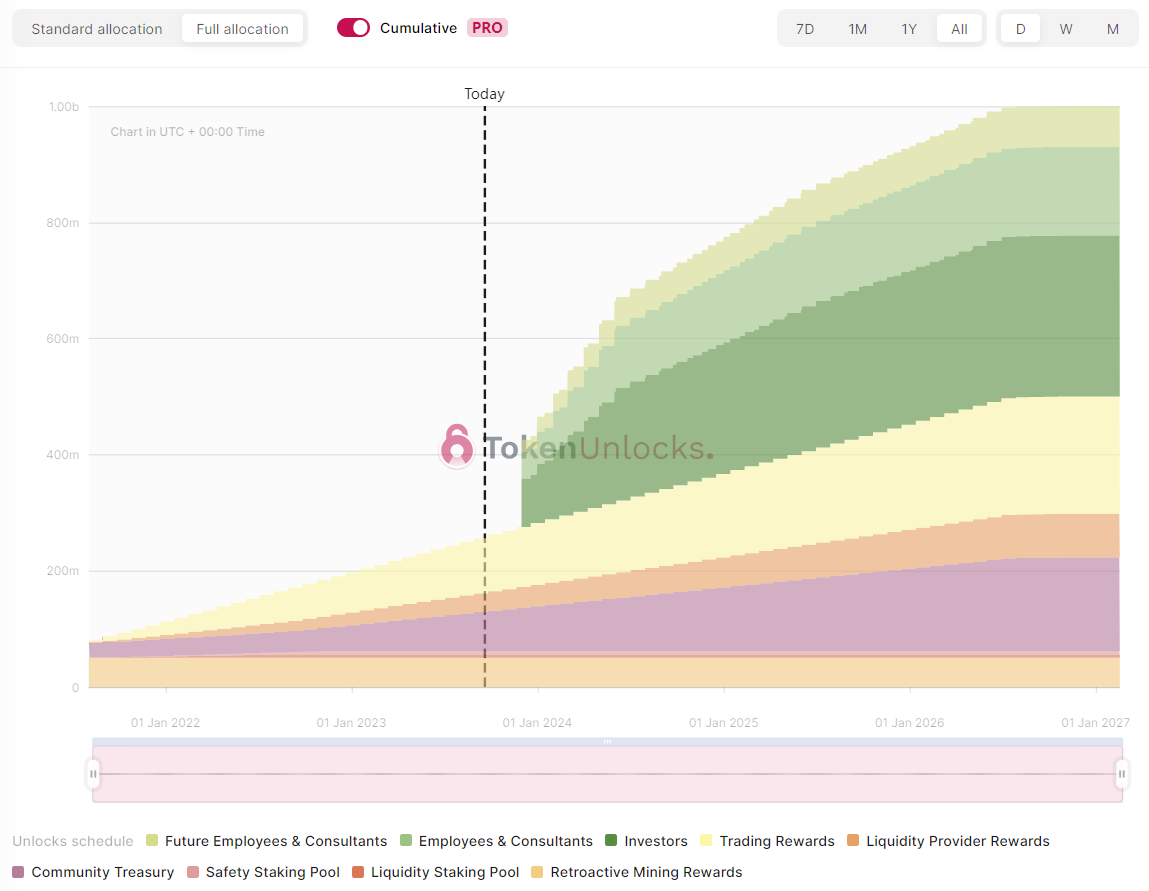

Source:TokenUnlocks

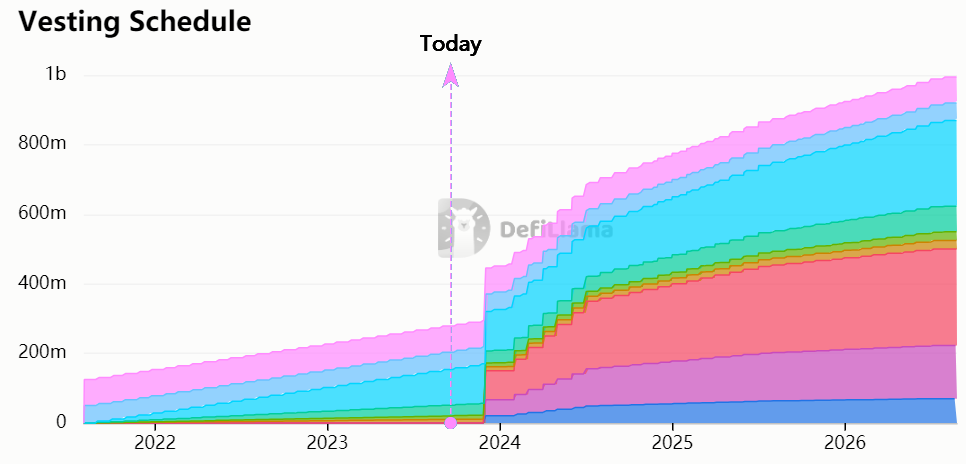

Source:DefiLlama

5.2 Token usage and value capture

In the v3 version, the main uses of $DYDX tokens include governance, fee discounts and staking. Among them, the security pledge module will be launched in October 2022.proposalis closed. v4 adds the use of validator staking. With v4, dYdX becomes completely decentralized and fully governed by token holders. This enables $DYDX token holders to specify the functionality of the token, add and remove markets, and modify dYdX v4 parameters. Building on its success with perpetual contracts, dYdX can also enter the spot market and become an all-around DeFi application with high user retention.

6. v4 marginal improvements

6.1 Main features of the new version

The new version v4 of dYdX will be launched on the mainnet in the fourth quarter of 2023. The following are the main features of the new version:

1)Layer 2 → Alt Layer 1

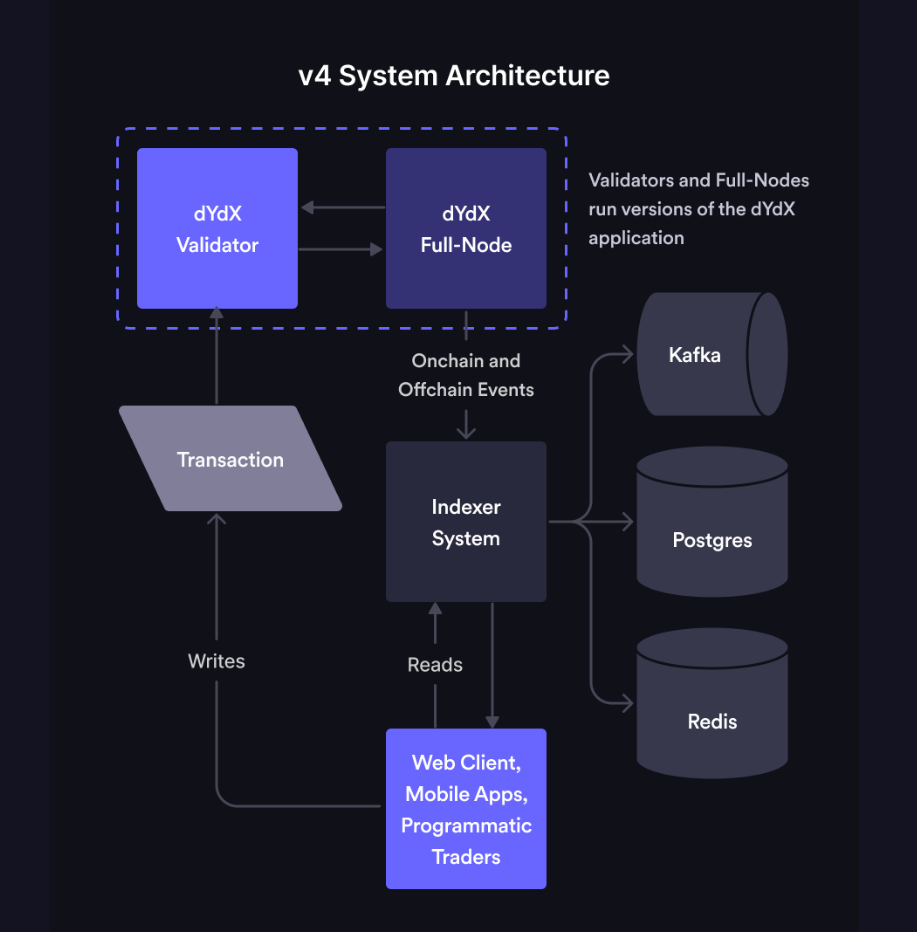

dYdX v4 no longer relies on the Ethereum main network, but develops an independent blockchain in the Cosmos ecosystem based on the Cosmos SDK and CometBFT POS mechanism. v4 uses a proof-of-stake consensus mechanism, supported by two types of nodes: Validators and Full Nodes. Among them, validators are responsible for storing orders, transmitting transactions and generating new blocks through the consensus process. Full nodes do not participate in the consensus mechanism and are only responsible for transmitting transactions and processing new blocks.

Source:dYdX

2) Update of ordering mechanism

When an order is placed on v4, it will follow the following process: User trades on the frontend → Transaction is sent to validators → Orders are matched and new blocks are generated → Consensus process: ⅔ of validator nodes vote to confirm → Updated data is passed through the index The handler is returned to the front end.

3) No gas fee is required for limit orders

In dYdX v4, each validator runs an order book off-chain. User orders submitted and canceled will be propagated off-chain through the network. Only after the order is successfully matched in real-time, the transaction results will be submitted to the chain. Therefore, users submitting and canceling orders are off-chain behaviors and do not need to pay gas fees. The protocol will only charge transaction fees when the order is completed and uploaded to the chain.

4) Governance is completely decentralized

based on the executedDIP 18-Operations SubDAOProposal, DAO will gain full control of the protocol. dYdX Trading Inc. no longer has control over the protocol. dYdX will be completely decentralized in operations. The community will help the platform smoothly complete the transformation of its operational structure by establishing Operations SubDAO.

6.2 v3 v4 comparison

according tov4 incentive planandv4 Adoption and Token Migration PlanFor the proposal, we sort out the marginal improvements in token usage of v4 compared to v3 from six aspects: token protocol standards, governance functions, discount functions, staking functions, gas payment and fee distribution. For a detailed description of the comparison, please see The following table:

6.3 Reasons why dYdX chose Cosmos

1) Decentralization and high performance

The implementation mechanism of the order book and matching engine makes dYdX have extremely high requirements for throughput, and the Ethereum network currently has scalability problems. The security, speed and scalability of the Cosmos network can help dYdX solve these problems and provide Traders offer faster transaction speeds, lower fees and a fully decentralized trading experience.

2) Resist supervision

According to the latest report from the U.S. Commodity Futures Trading Commission (CFTC) in SeptemberRuling,Opyn, Inc.、ZeroEx, Inc.、Deridex, Inc.,All three DeFi protocols were suspected of illegally providing digital asset derivatives transactions and faced hundreds of thousands of dollars in fines. Compared with the SEC, the CFTC has stricter regulations on cryptocurrency. Under such a trend, sooner or later the CFTC will extend its regulatory reach to more decentralized perpetual contract trading platforms based on smart contracts and require them to implement KYC. It is worth noting that the three accused agreements are all entities registered in California. dYdX Trading, Inc faces the same situation. As a single entity registered in the United States, dYdX Trading, Inc. enjoys all fee income in v3 and has the right to control the protocol. Such a centralized management method is easily noticed by regulators. Although dYdX has been very cautious on regulatory issues in the United States and does not provide any services to American residents, in the face of increasingly stringent regulatory trends, it is obviously a wise move to fully decentralize as soon as possible. In the v4 version, dYdX becomes completely decentralized. dYdX Trading, Inc. (the platform) will no longer run any centralized components, and dYdX will be managed and controlled by the community. After complete decentralization, regulatory agencies will not be able to label dYdX as a centralized exchange, and dYdX can further expand the market and expand more users.

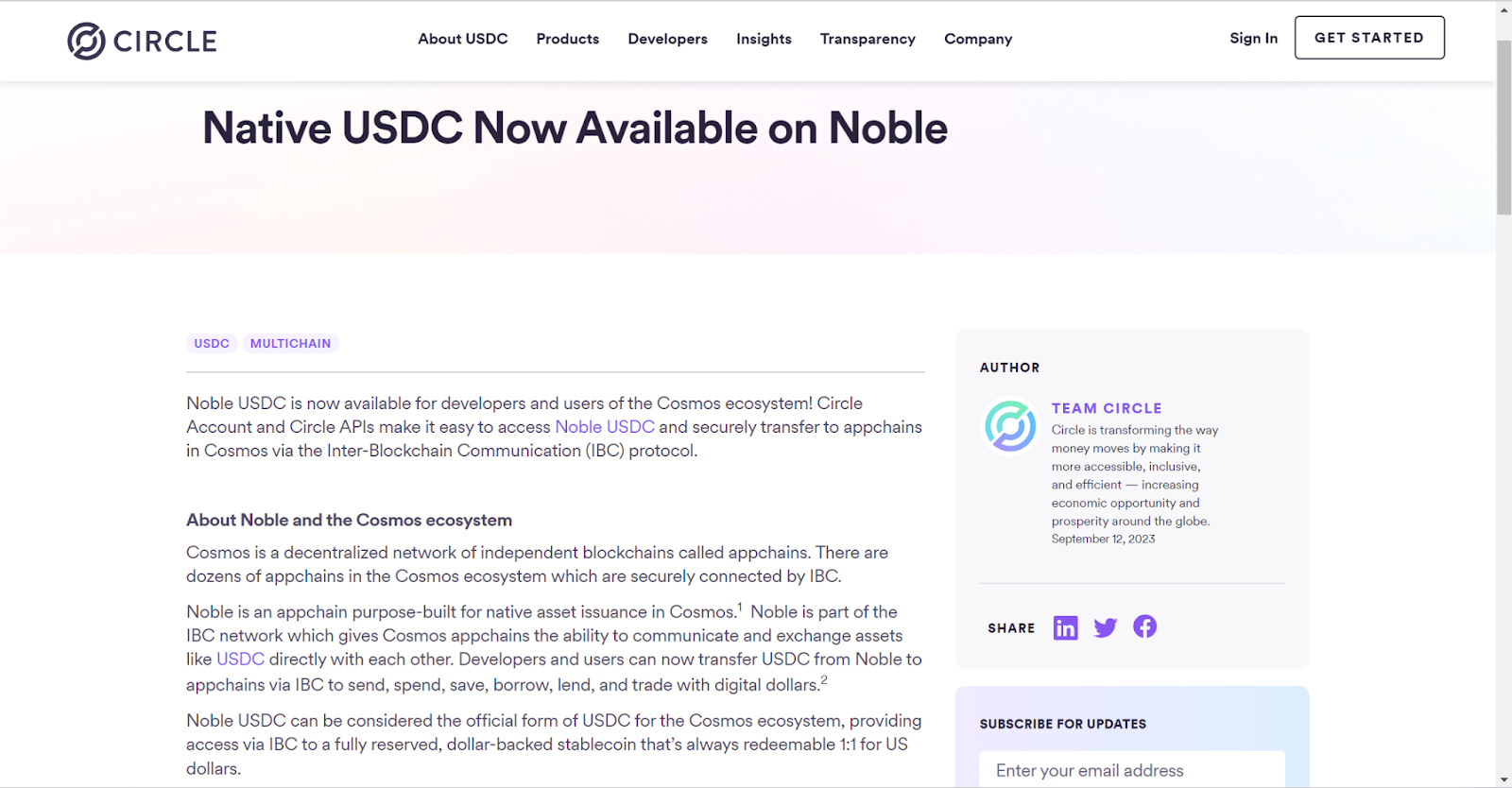

3) Cosmos supports native USDC

The dYdX chain, as a new Layer 1 chain with its own validator set, requires users to connect using a cross-chain bridge. As Ethereum co-founder Vitalik Buterin said, when assets are packaged, locked, and transmitted through different chains through cross-chain bridges, the security of the assets depends not only on the original network, but also on the other chains the assets pass through. Hacker attacks on cross-chain bridges are common, which greatly threatens the flow of large amounts of funds. If the risk of cross-chain bridges cannot be dealt with, this will be a fatal blow to dYdX, which has many giant whales.Circle recently issued native USDC in Cosmos, helps to improve the liquidity of dYdX and reduces the demand and risk of cross-chain assets. This is one of the indispensable reasons why dYdX chose Cosmos.

4) Scalability composability

We know that trading on the dYdX app starts with"block"recorded on the blockchain. The amount of data held per block is limited and they are executed every few seconds. As more users use the blockchain, the demand for limited block space increases, which also increases gas fees. The application chain launched by dYdX v4 with the help of Cosmos can solve this problem to a certain extent. Unlike most rollups, the application chain is a sovereign blockchain optimized for specific applications. Application chain builders can customize all parts from the protocol layer to the front end and have their own consensus protocol, which fundamentally releases new features while enhancing decentralization and scalability. dYdX v3 uses Starknet, which belongs to L2, but v4 will transition dYdX to the application chain. For dYdX, the application chain model provides more decentralization, scalability, composability and speed than current rollup solutions.

7. v4 Forecast and Outlook

Currently, for dYdX v3, all trading revenue goes to dYdX Trading, Inc. Apart from governance and staking to earn fee discounts and platform rewards, the $DYDX token has almost no wealth effect, which has also become an important factor hindering the rise in currency prices. This flaw will be improved in dYdX v4, which will not distribute fee income to any centralized entity. In addition, the community hasproposalThrough this, $DYDX, as the L1 token of the dYdX chain, will be used to pledge and protect the dYdX chain, and has more practical uses.

1) Layer 1 pledge increases currency holding demand

The Safety Staking Module (SSM) protects the dYdX protocol in fund shortage events (smart contract risks, etc.). In the past, stakers received dYdX from the genesis supply for taking risks. In v3, holding dYdX in a security module was one of the tokens uses, but that didnt really drive demand for people to buy $DYDX tokens. In the event that the protocol is short of funds, the funds staked by Stakers may be reduced. Therefore, the effectiveness of the SSM mechanism is questionable, because smart contract risks are likely to cause the price of tokens to fall and the value of the security module reserve to be greatly reduced. Therefore, on November 28, 2022, the community adoptedDIP-17 Proposal to cancel v3 staking rewards.

according toofficial announcement, after the release of the dYdX v4 mainnet, dYdX Chain will become a PoS (Proof-of-Stake) blockchain network. At this time, v4 will require an L1 protocol token for staking to the verifier. validators) to ensure the security of the chain and let the Staker of the L1 token manage the blockchain network. Currently, the dYdX community hasproposalBy using $DYDX as the L1 token of the dYdX chain. Since dYdX adopts the PoS mechanism, the corresponding purpose of L1 tokens is node pledge. Anyone who pledges tokens to reach the specified amount will have the opportunity to become a pledge node to ensure network security. Although we are currently not sure how many $DYDX tokens must be pledged to become a node, nor do we know how many nodes will be given, and what the Delegate mechanism is. However, it can be expected that the new staking model of v4 will replace the previous SSM staking model of v3 and will increase the demand for currency holdings of $DYDX, thereby driving up the currency price.

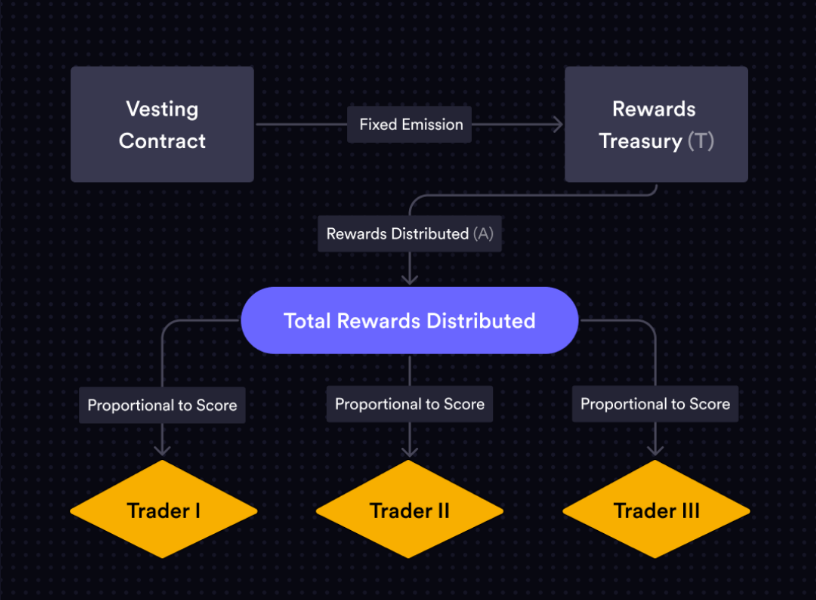

2) Handling fee distribution improves token fundamentals

according toOfficial documentationThe initial idea is that after each transaction, part of the handling fee will be sent directly to the user by the smart contract as a transaction reward. The maximum reward for each transaction shall not exceed the handling fee of the transaction.

Because the transaction reward is capped at the net transaction fee generated by the block protocol, and the allocated transaction reward may flow block by block, the protocol can incentivize transaction activity without overspending, save a lot of money, and reduce costs. Currency inflation.

Source:dYdX

according toplan, v4 does not require GAS fees to submit and cancel orders, only the handling fee at the time of transaction is charged. The $DYDX token will most likely be used to pay transaction fees. This greatly expands the actual use of tokens and increases the rigid demand for tokens. In addition, the distribution of handling fees is entirely determined by the community. If the community passes the proposal, more of the platforms income will flow into the hands of $DYDX token holders, and $DYDX tokens will be able to capture more from the development of the protocol. Much value.

3) The introduction of native stablecoins increases the security of assets

Circle recently announced that Cosmos will support native USDC. The introduction of the native stablecoin on the chain not only improves the liquidity of $DYDX tokens, reduces the demand and risk of cross-chain assets, and ensures the security of assets on the dYdX chain.

With an objective and rational attitude, we believe that dYdX v4 will empower tokens and bring a series of benefits. At the same time, we should also see that the move to abandon Ethereum and establish a new chain also containsReduced securityPotential risks:

L2 Rollup still has an advantage over Cosmos because it relies on Ethereums superior security without the high cost of maintaining its own security. If users have confidence in the underlying Ethereum blockchain, then they will have confidence in the security of dYdX transactions on L2. However, in v4, users need to trust a new set of validators on the dYdX chain. In addition, node staking also needs to be paid in $DYDX tokens, but compared to ETH, peoples consensus on the value of $DYDX is not as firm as ETH.