Review of Q3 Web3 investment and financing: AI+ has just emerged, and Paradigm successfully bet on the topic

Original - Odaily

Author - Husband How

Will the third quarter of this year be the last darkness before the dawn of cryptocurrency?

At the macro level, despite repeated inflation in the United States in Q3, the Feds interest rate hike is expected to be nearing completion, and interest rates are expected to remain stable after this year; the U.S. SEC still holds a bias against the encryption industry, but the boundaries of the regulatory framework are becoming increasingly clear; Singapore, Encryption policies in Hong Kong and other regions have also gradually improved.

From an internal perspective in the crypto market, the lending turmoil of the founder of Curve has had a great impact on the DeFi track, especially in the lending field. Leading projects have introduced contractionary policies; the NFT market is still bleak, and the prices of monkeys continue to hit new lows. There are also many blue chips that no one cares about; in terms of CeFi, major projects are constantly catering to the regulatory requirements of many countries.

From a data perspective, Bitcoin and Ethereum experienced record lows in price volatility in the third quarter; DeFi TVL was $38 billion, and TVL changes have flattened from 2023 onwards.

It can be said that in the third quarter of 2023, the encryption market was as light as water.

The secondary market is relatively quiet, and there is not much activity in the primary market. The amount and quantity of financing continue to decline, but the rate of decline tends to be flat. Institutions are more cautious in taking action, both in terms of number and amount, but the AI+ field has attracted much attention.

Looking back at Q3 primary market investment and financing activities, Odaily found:

● Starting from 2022, the amount of financing in the crypto market will continue to decline, but the rate of decline will level off;

● The number of financings in Q3 was 232, and the total disclosed financing amount was US$1.725 billion;

● AI tools are developing rapidly, and AI+ may become the focus of a new round of project development;

● Capital investors are more cautious, with only Binance Labs and a16z investing more than 10 times;

● The projects invested by Paradigm are relatively popular among the Q3 financing projects, represented by Flashbots and friend.tech.

Note: Odaily divides all projects that disclose financing in Q2 (the actual close time is often earlier than the news announcement) into five major tracks according to the business type, service objects, business model and other dimensions of each project: infrastructure, applications, technical service providers, Financial service providers and other service providers. Each track is divided into different sub-sections including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain and others.

Crypto market financing amounts continue to decline, but the rate is leveling off

From the first quarter of 2022 to the third quarter of 2023, financing events and financing amounts in the global crypto market have generally been on a downward trend (excluding fund raising and mergers and acquisitions). The Q3 of 2023 dropped by 64.71% compared with the Q3 of 2022, but the overall decline curve has tended to be flat, and the primary market as a whole is in a stable development stage.

The number of financings in Q3 was 232, with a total disclosed amount of US$1.725 billion.

According to incomplete statistics from Odaily, a total of 232 investment and financing events occurred in the global encryption market from July to September 2023 (excluding fund raising and mergers and acquisitions), with a total disclosed amount of US$1.725 billion, distributed among infrastructure and technology service providers , financial service providers, applications and other service provider tracks. Among them, the financial service provider track received the largest amount of financing, at US$525 million; the application track received the largest number of financings, 103.

The above figure reflects to a certain extent that the Q3 application track has become a hot field, and more developers and entrepreneurs are switching from the infrastructure field to the application field, which may indicate that the Web3 infrastructure has the soil to carry the rapid development of upper-layer applications to a certain extent; The financial services track is closely connected with the traditional financial industry, opening up multi-faceted channels for new money to take over the next bull market.

DeFi and underlying facilities are favored by investors, and AI tools are developing rapidly

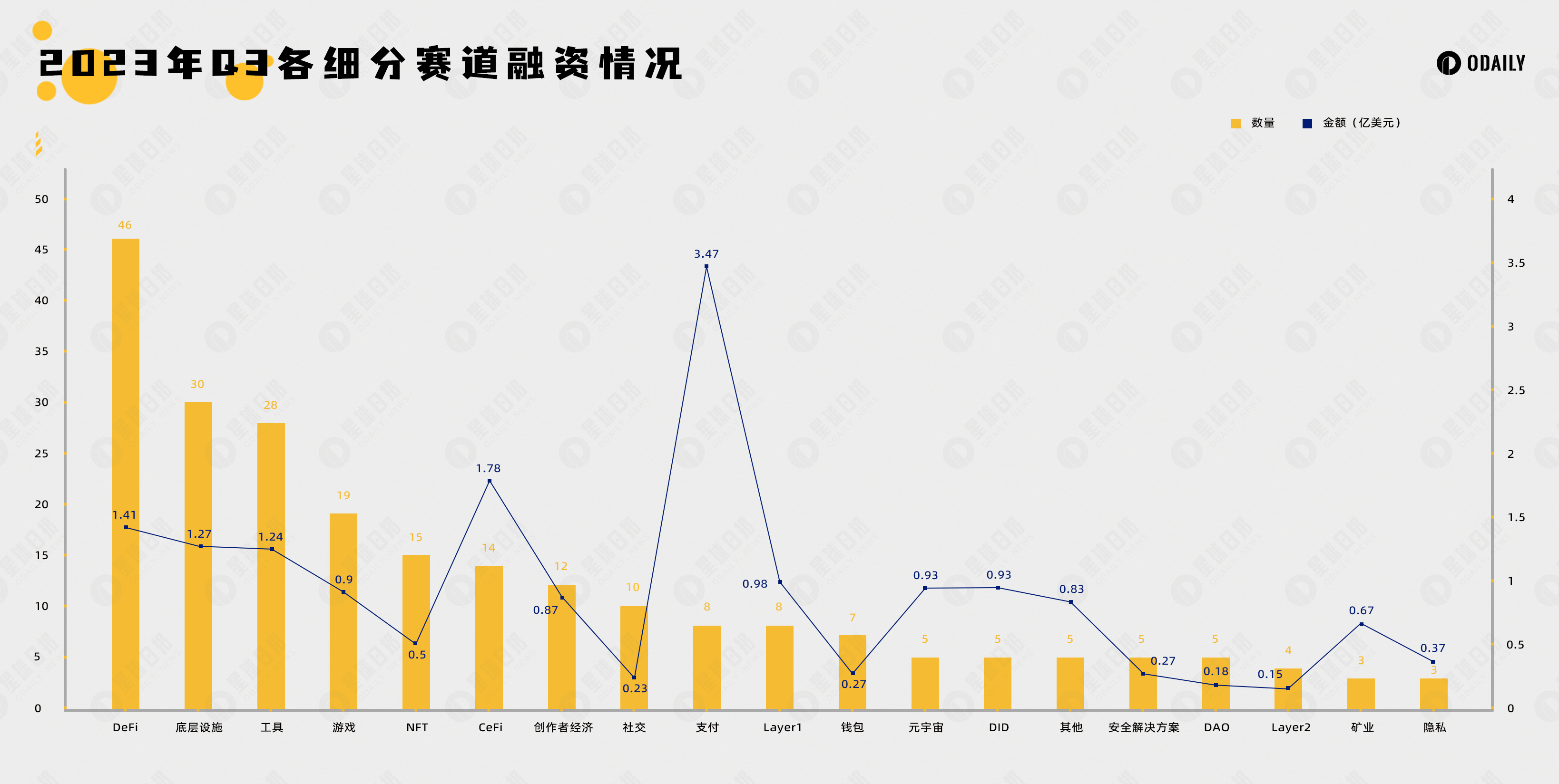

According to incomplete statistics from Odaily, financing events in the Q3 subdivision track are concentrated in DeFi, underlying facilities and tools, accounting for nearly half of the total financing events. Among them, there are 46 deals in the DeFi track, 30 deals in the underlying facilities track, and 30 deals in the tool track. 28 pens.

Judging from the distribution of the number of financings in sub-tracks, investment trends tend to be diversified, but DeFi and underlying facilities are still important areas for capital deployment.

Among them, in the DeFi track, DEX prefers the order book model, and the representative project is Brine Finance; the number of financings in the lending track is relatively average; the number of financings in the derivatives platform direction is more, 13, and the decentralized derivatives platform has always been A relatively blue ocean market in the DeFi field.

Although the DeFi track had a large number of financings in Q3, the leading investors in the crypto market did not pay too much attention here. Most of them focused on supplementing ecological supporting facilities, and no potential projects have been discovered yet.

Also favored by capital is the underlying facilities track, which received a total of 30 financings, ranking second. Among them, the MEV subdivision has entered the public eye. The MEV field has been pursued by capital through Paradigms intent-centric concept. The representative project is Flashbots.

In addition, financing news in the tool track is also very active, with a total of 28 transactions, ranking third. Since the rapid development of AI, AI+ tools have been sought after by capital, and the AI-assisted encryption market has gradually matured, with AI+ data analysis projects developing rapidly.

The maximum amount of investment received in a single transaction is US$300 million (Ramp)

According to incomplete statistics from Odaily, the Q3 subdivided track financing amount is led by the payment track, while other tracks tend to be flat. Paid track financing is $347 million.

In the bear market stage, when the overall financing amount is relatively low, the financing amount of a single project has a greater impact on the financing trend of the subdivided tracks. In order to avoid large error analysis, the Q3 financing amount analysis will focus on the introduction of the TOP 10 projects. . The projects in the figure below are divided according to segmented tracks, and also include traditional companies involved in the encryption business.

● Ramp provides fiat payment infrastructure between the crypto market and traditional financial markets.

● BitGo is a cryptocurrency custodian platform and is currently the custodian for FTX’s creditors.

● Flashbots is an MEV infrastructure service provider that aims to mitigate the negative externalities and existential risks that MEV brings to the smart contract blockchain.

● Futureverse is a metaverse infrastructure platform that combines AI with blockchain and aims to become a Web3 portal.

● Core Scientific is one of the largest blockchain data center providers and digital asset miners in North America.

● RISC Zero is Layer 1 built through zero-knowledge proof.

● Proof of Play is a GameFi project developer, and its current representative project is Pirate Nation.

● Cosmic Wire is Layer 1 focusing on entertainment, metaverse and other fields.

● ZetaChain is Layer 1 that focuses on multi-chain cross-chain.

The number of invested projects in the Ethereum mainnet ecosystem still dominates, but it is being challenged

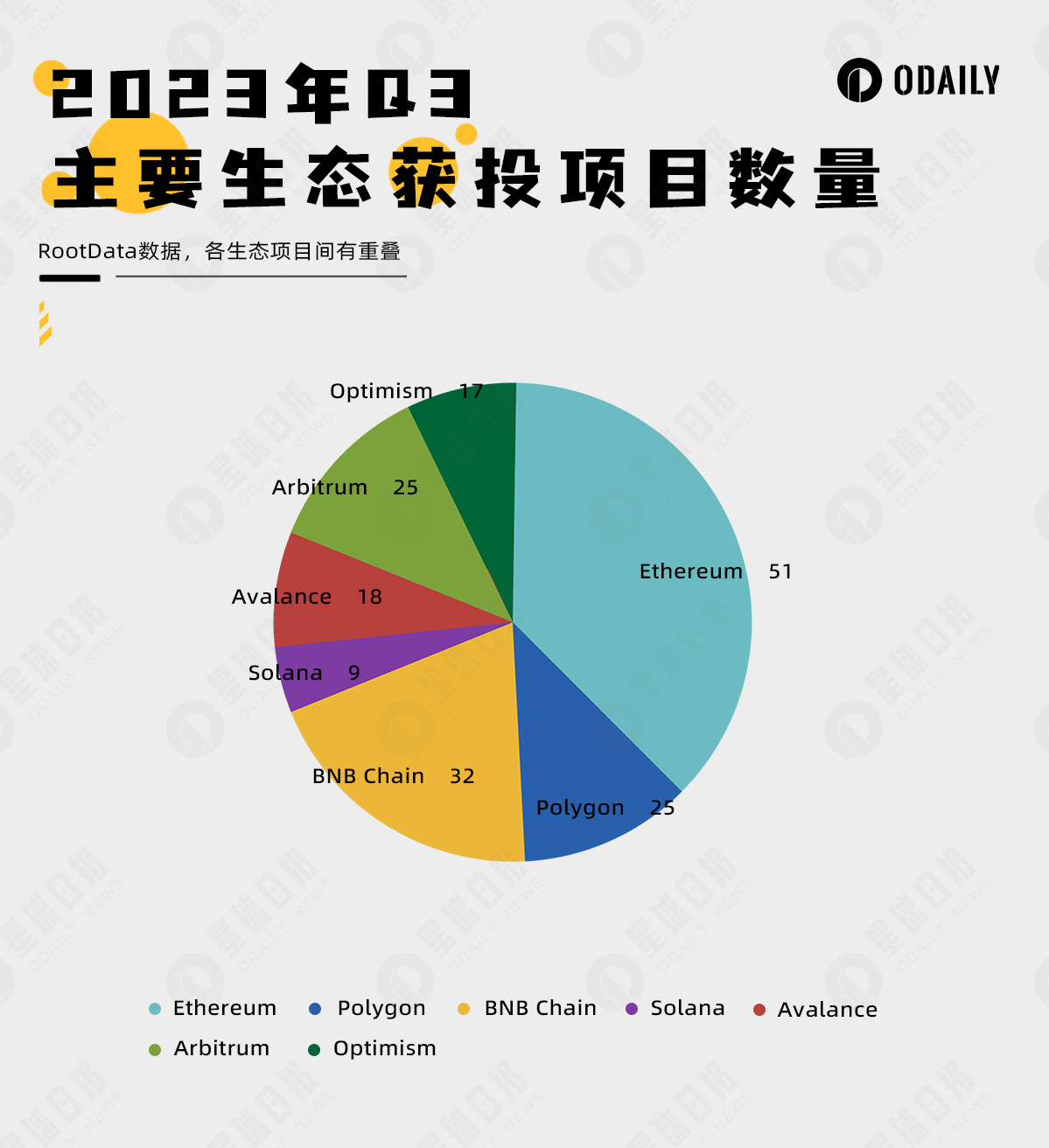

According to RootData statistics, the ecological project with the most financing projects in the figure below is Ethereum, with a total of 51 projects in Q3. Ecosystems that received more subsequent investments are: BNB chain (32 projects), Polygon (25 projects), Arbitrum (25 projects), Avalance (18 projects), Optimism (17 projects), and Solana (9 projects).

The above figure shows that although Ethereum leads the way in terms of the number of invested projects, most of them are already established projects, and the selection space for new projects is gradually moving towards Layer 2 or other Layer 1.

With the continuous development of Layer 2 and the impact of EVM-compatible Layer 1, Ethereum may gradually move from the front to the backstage, and eventually become a settlement layer that provides security.

Capital investors are more cautious, with only Binance Labs and a16z investing more than 10 times.

As the number of financings declines and market expectations are unclear, investment institutions are becoming more cautious in their investment behavior. In Q3, only two institutions made more than 10 investments, including Binance Labs, which made 12 investments, and a16z, which made 11 investments. TOP 10 The area where management spends the most money is infrastructure.

In addition, from the perspective of project popularity and market attention, the biggest investment winner in Q3 was Paradigm. It only made two investments, but it won the most popular intent-centric Flashbots and social application friend.tech in Q3.