Weekly Editors Picks (1021-1027)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Arthur Hayes: Global wartime inflation concerns may fuel a new crypto bull market

Pax Americana must go to the point of increasing the cost of its debt to unsustainable levels in order to support ally Israel.

The Fed believes it can beat inflation by raising borrowing costs by raising the policy rate (federal funds) and shrinking the size of its balance sheet, which is mostly made up of U.S. Treasuries and mortgage-backed securities (MBS). At a press conference at the Feds September meeting, Powell essentially said the Fed was very close to completing its rate hikes. At present, the United States has not experienced economic recession and financial disaster. But raising interest rates in a bear market is extremely dangerous, making the worlds too big to fail banks hide time bombs beneath the surface of record profits. If U.S. defense spending goes into absurd mode, trillions of dollars will be borrowed to support the war machine. Thats why bonds are selling off and yields are rising.

Bitcoin, as well as gold, is rising against the backdrop of a sharp decline in long-term U.S. Treasury bonds following Bidens speech. Now is the time to start moving short-term U.S. Treasuries into cryptocurrencies. The first stop is always Bitcoin, then Ethereum, and finally spamcoins.

When DWF Labs first appeared in the crypto market, it acted as a market maker. The real attention of the market to DWF began with Hong Kong concept coins such as CFX and ACH that exploded in the first quarter. In the second quarter, PEPE, LADYS and other coins increased dozens of times. MEME currency, and then the recent YGG, CYBER, etc. have increased several times on the target. Among them, CFX, ACH and YGG obtain coins for OTC. PEPE (MEME), LADYS (MEME), CYBER (Binance Launch Pool) and other coins have good chip structures, and DWF directly affects the price through secondary market purchases.

DWF has been criticized by crypto market participants because it often confuses the concepts of investment and market making. It positions itself as a Web3 venture capital and market maker on its official website. Its business types are divided into three types: investment, OTC and market making. city. The essence of its business is to inject funds into difficult projects, get coins at OTC discounts, and sell them in the secondary market for profit; violently pull offers to build a brand image, and continue to sell them to project parties as products.

In its early days, DWF built its brand image by creating a wealth effect through market pull. It was itself a product of the bear market under weak supervision. It took advantage of the development difficulties of the project team in the bear market and the psychology of retail investors in the market to achieve profits from both ends. After judging that DWF has the intention to pull the market, the sharp increase in contract positions and spot trading volume is a signal that the market has started; the interaction between the address on the DWF chain and the exchange address (high price), the decline in positions, and the extreme negative rate of funds often mark the end of the market.

An in-depth understanding of the airdrop industry: “fake data” and the Lumao Party

There is already an entire industry of finding airdrops built specifically for airdrop hunters. But the users attracted to these sites are often highly employed and represent the short-term speculation that the industry as a whole suffers from. When the community has completed the airdrop calculations for speculators, the entire airdrop game is full of corruption. This is far from value-adding and value-destroying for the entire ecosystem.

Counterfeit products will justify false valuations. As long as the cost of airdrops is lower than the potential rewards, airdrops will prevail. If the on-chain numbers are inflated, then unsuspecting participants who dont know how to parse the data will report what they see and ultimately deceive end retail investors into believing that the projects they invest in have real market appeal. force. The more people believe the data, the further this cycle will continue.

Permissionless identities may solve the above problems.

Zee Prime Capital: The “wedge”, the key to the success of crypto projects

Every market is made up of more granular niches; if youre a startup, chances are you can explain the niche your product serves at the outset. The mystery of a problem is how it goes from being a concern to a few to being a concern to the majority. In some cases, great products create specific problems for consumers to solve. This is why there is no standard answer to building startups (and investing in them), and is often inspired by science fiction. The point is not to build a perfect product for everyone. The key is to solve someones problem (or specify a problem as discussed previously) and then use that momentum to expand into adjacent areas while iterating on the product.

Successful companies avoid competition through their entry points, creating their own monopoly markets. Every major brand today started with a narrow wedge.

Cryptocurrency has two directions: one is censorship-resistant and private currency/payments (which has been successful, but difficult to scale); the other is creating global wealth online through technology. Of the latter, cryptocurrencies have a huge wedge — it’s the volatility and easy access to liquidity (unlike in the real world) of every new asset. Volatility buys founders time and users’ attention. In many ways, its a customer acquisition tool. The best cryptocurrency founders use this momentum to test and launch killer products while managing pressure and inflated expectations.

CeFi

Potential ETF managers (called sponsors) submit plans to create an ETF to the SEC. In official comments and statements, the SEC emphasized that because Bitcoin is a volatile asset, the crypto industry is rife with fraud and abuse, and other investor protection measures have not yet been introduced, the crypto market is not mature enough to provide investors with ETF products. the underlying assets.

On the other hand, many cryptocurrency proponents believe that the lack of spot ETF products is evidence of the anti-crypto and anti-Bitcoin stance that some U.S. policymakers appear to have embraced.

Bitcoin Ecology

After the surge, what’s new in the Bitcoin ecology and narrative?

On October 24, Ordinals creator Casey Rodarmor merged the v 0.10.0 update into the Ordinals code. This update was hailed by the community as the largest update ever. Among the important functions are: batch inscription, adding metadata, inscription number end point, and remote burning commands.

A certain wallet owner consciously “extracted” rare satoshis eight years ago.

OrdiBots founder @RAF_BTC tweeted on the morning of the 24th, announcing that the new series of Ordibots 3D will be launched randomly. This new series of 3D releases uses the BRC-69 standard, which enables complete 3D assets to be implemented on the chain.

0x Wizard proposes $ordi as a governance token.

Developer @MikaelBTC introduced that BRC-100 is built based on Ordinals, introducing protocol inheritance, application nesting, state machine model and decentralized governance, bringing computing power to the Bitcoin blockchain, making it possible to build AMM DEX, lending, etc. Bitcoin-native decentralized applications are possible.

Ethereum and Scaling

ETH HK Vitalik’s latest speech: Challenges and new opportunities of Ethereum

Vitalik has repeatedly emphasized the importance and necessity of account abstraction. He believes that account abstraction is promoted for convenience and security reasons. The promotion and popularization of account abstraction requires the joint efforts of all actors in the ecosystem. The overall goal is to make the on-chain experience consistent with the centralized service experience.

There are too many L2s on the market at present, but when it comes to capacity expansion, rollup is not always necessary. The project should clearly understand its requirements for security and scalability, and at what level they are, before deciding whether to go to Rollup. For example, scenarios such as account key storage and high-value financial assets have extremely high requirements for security, while games or non-financial applications may have higher requirements for scalability. Clarify the difference between Validium and Rollup, and get it right.

On the issue of encapsulation vs extension, Ethereum has always chosen extension. The design philosophy of Ethereum is derived from Unix, creating a minimalist and universal kernel to allow user needs to be realized by developers at the application layer. The key technology that supports Ethereum to achieve this is: EVM. Turing-complete smart contract language allows developers to customize their applications at the application layer. However, it is not that simple for decentralized infrastructure to encapsulate upper-layer application functions. It is not just about integrating a piece of code. Behind it is the biggest problem of decentralized systems: governance. Encapsulation means that in addition to development and maintenance, the core team must also undertake the governance of these functions. At the same time, there is a risk of weakening the trust model of Ethereum and introducing problems that may potentially affect sustainable development.

You can also learn Native Extension from Unix.

Uniswaps Hook allows developers to use Hook to add extensions to the pool without permission to achieve a functionally diverse pool experience, without the need for the core team to constantly upgrade functions through encapsulation. Arbitrum Stylus allows application developers to package precompiled contracts by themselves. Representatives of new L1 public chains based on the Native Extension paradigm include Artela.

In-depth analysis: The harm of Lido centralization is not as great as imagined

Currently, Lido has pledged 8,813,670 ETH, occupying 31.8% of the Ethereum pledge market. This centralization phenomenon raises concerns about Ethereum’s centralization.

However, Lido distributes these funds to 29 designated operators to perform the actual staking operations. So it can be roughly understood that each operator bears part of the risks on average, so the risk concentration is not that high. Secondly, node operators have no motive to do evil. To change the finality of Ethereum, Lido needs to let 29 node operators do something very detrimental to the protocol itself, and node operators will face being cut. Lido has a set of public and strict standards for the selection of node operators. It will try its best to ensure the server diversity, geographical distribution, client diversity and other characteristics of node operators to avoid centralized aggregation. Even if Lidos 29 node operators join forces to harm their own business, the social layer can step in, remove the malicious Lido node operators, and move the business to a new chain.

In addition to Lido, the most noteworthy ones should be centralized staking platforms such as Coinbase and Binance. Without Lido, centralized exchanges will soon occupy most of the staking market, which will be detrimental to the decentralization promoted by Ethereum. will be a greater threat. Because a centralized exchange can serve as a single entity, once its market share exceeds 50%, it is likely to attract the attention of government departments. They may use policies to pressure the exchange to manipulate the Ethereum pledge market. This is important for The development of Ethereum decentralization is absolutely disastrous.

Ethereum co-founder Vitalik mentioned when participating in the Discord discussion of Reflexer Finance (RAI) that RAI can support non-popular liquid staking tokens (other LSD tokens besides stETH) as collateral. This move can solve the problem of Lidos excessive market share.

New ecology and cross-chain

A new generation of secure, high-performance cross-chain bridges will become mainstream. Full-chain applications will become the new dApp paradigm. Liquidity swap bridges will be replaced by official bridges from asset issuers such as USDC.

Currently, most cross-chain bridges still use external verification solutions. Users Gas costs and development and implementation costs are relatively low, and they support any message cross-chain. But the most criticized aspect of external verification is security. A new generation of more secure cross-chain bridges is growing rapidly. Among them are dual-security layer bridges such as LayerZero and Chainlink CCIP; there are ZK bridges that combine ZK technology and light clients (representative projects: Polyhedra, MAP Protocol, Way Network ); there are optimistic verification bridges that use economic game mechanisms to protect cross-chain security (representative projects: Nomad, cBridge); and bridges that combine ZK and TEE technologies (representative projects: Bool Network).

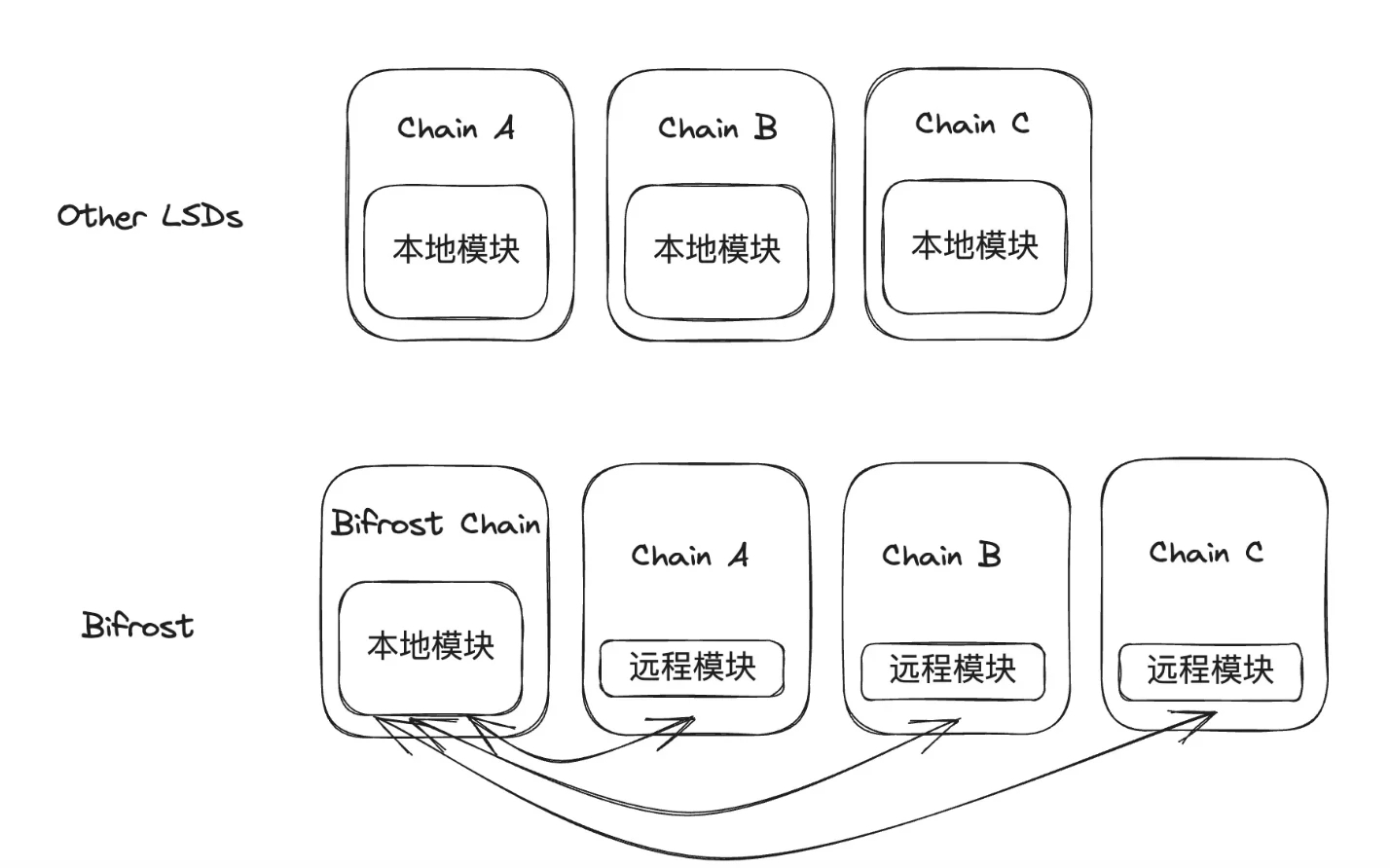

The application layer needs a new paradigm to hide the chain layer, that is, chain abstraction. For example: Bifrost has deployed a remote modular on other chains to receive user requests and pass them to Bifrost Parachain across chains. After the liquidity staking module is processed, the results are returned to the remote module across chains. Users only need to initiate a request on the remote chain, and the subsequent process will be triggered and completed by Relayers.

Bifrost calls its architecture full-chain architecture. The comparison with the multi-chain deployment strategies of other LSD protocols is as follows:

The CCTP launched by USDC issuer Circle makes the efforts of many SwapBridges meaningless. The main form of liquidity that SwapBridge reserves on each chain is USDC. Then CCTP can support the USDC on the X chain to be directly replaced with the native USDC on the Y chain through burn-mint logic, without the need for liquidity reserves. In other words, CCTP has no liquidity costs at all, and the bridge fees experienced by users can be extremely low.

Dismantling Scroll’s technology stack: the operating mechanism of universal ZK-Rollup

As a general zk-rollup, Scroll features bytecode compatibility and provides many advantages of zk proof at the L2 level without affecting the tools and network effects of EVM.

Full EVM compatibility is seen as the ultimate goal of L2, and this is where Scrolls core value lies: a more powerful version of Ethereum. Scrolls bytecode compatibility perfectly combines all the advantages of zk-proof with the maximum compatibility of Ethereum.

Scroll focuses more on the synchronization aspect of zks proofs rather than its privacy aspects, which allows the protocol to compress large amounts of computation into a tiny proof. All ZK proofs will eventually be completed by a decentralized certifier network.

Hot Topics of the Week

In the past week,ETF progress showed multiple positive signals, and BTC surged overnight to exceed $35,000(Topics),SEC has recognized Grayscale’s spot Ethereum ETF filing,Coinbase files brief responding to SEC charges, saying SEC charges exceed jurisdiction, October 25The Panic and Greed Index is 72, which is similar to the value when BTC peaked at $69,000 in 2021,In total, FTX/Alameda addresses have transferred more than $59 million in cryptocurrency, Bitcoin Core core developerDisclosure of Lightning Network security vulnerabilitiesandAnnounce withdrawal;

In addition, on policy and macro markets, Gary Gensler:Cryptocurrency is an area rife with “fraud, bankruptcies and money laundering”, CFTC Commissioner:Institutional interest in investing in cryptocurrencies, market ready for spot Bitcoin ETF,JPMorgan:If SEC refuses to approve Bitcoin spot ETF, applicant could face legal action;

In terms of opinions and voices, SBF:Don’t recall ever discussing the $13 billion funding gap with FTX executives,Citadel Securities denies being behind last years UST de-anchoring, and accused Terraform of seeking to divert attention, Vitalik:Crypto industry stagnation, privacy and open internet infrastructure could all lead to Ethereum’s failure, founder of DeFiance Capital:The ETH/BTC exchange rate may truly bottom out after the Bitcoin halving next year;

In terms of institutions, large companies and leading projects,Elon Musk plans to build X into a comprehensive financial platform similar to WeChat in 2024,Coinbase launches “Stand With Crypto” initiative to fight IRS proposed crypto tax law,Ledger launches wallet recovery solution Ledger Recover,The Aave front-end has added a token flash swap function without any front-end fees.,dYdX Chain plans to distribute all protocol fees to validators and stakers,Starknet announces decentralization roadmap, designed to transition the operations of orderers and provers to a decentralized proof-of-stake protocol,Polkadot Slot Auction First Round Project’s DOT Unlocks;

NFT and GameFi areas,Memeland pre-sale oversubscribed...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~