LD Capital:DWF的业务逻辑及如何利用相关信息指导二级交易?

原文作者:Yuuki&Jill,LD Capital

引言

今年以来,DWF 声名鹊起,大额投资不断,与其相关的代币动辄翻倍上涨;在当前加密市场深熊阶段 DWF 何以做到这一点?级市场投资者又该如何参与相关标的?

正文

DWF Labs 为 Digital Wave Finance (DWF) 的附属公司,DWF 是一家全球性的加密货币高频交易公司,自 2018 年开始,在 40 多个顶级交易平台进行现货和衍生品交易。DWF Labs 最初在加密市场亮相时是以做市商的形象,真正引起市场对 DWF 的关注始于一季度 CFX、ACH 等爆拉的香港概念币,到二季度 PEPE、LADYS 等几十倍涨幅的 MEME 币,再到近期的 YGG、CYBER 等涨幅数倍的上所标的。这其中 CFX、ACH 和 YGG 为 OTC 拿币,PEPE(MEME)、LADYS(MEME)、CYBER(币安 Launch Pool)等币由于筹码结构好,DWF 直接通过二级市场购买影响价格。

部分与 DWF 相关的代币涨幅数倍吸引市场关注

DWF 引起市场关注的原因除了其经手的币种会有较大的价格波动外,另一点则是与其它同行的不和。知名做市商 Wintermute、GSR 都曾在公开场合表达对 DWF 的不满,认为其是劣质做市商,是不良引行为者。

拆解 DWF 的业务范畴

在加密市场中,投资与做市通常是两个泾渭分明的概念,投资通常指在项目发售代币之前为团队注入资金支持项目开发、运营、营销等,作为报酬在项目上线后获得具备锁定期的代币份额;而做市旨在为已经发售的代币构建良好的流动性,降低交易成本,吸引更多交易者。投资行为的收益来源于被投项目的代币回报,做市行为的收益来源于项目方支付的做市费用以及在做市过程中赚取的点差(买卖差价);加密市场中知名的投资机构如A16Z、Paradigm;知名的做市商如 Wintermute、GSR 等。

DWF 因其经常会混淆投资与做市的概念而被加密市场参与者所诟病,其在官网中将自己定位为一家 Web3 风险投资和做市商,业务类型分为三种,投资、OTC 与做市。

从 DWF 相关标以往的表现看,其选标的以情绪题材为主,做市币种包括 CFX、MASK、YGG、C 98、WAVES 等。但是究其过往做市案例会发现其极少真正的支持项目长期发展。DWF 通常选择为已经发币的“困境”项目注入资金折扣拿币,而后在二级市场抛售获利。而且在这个过程中往往会暴力拉盘自己所“投资”的项目,除去高价卖币之外也为其自身在散户心中树立起赚钱效应的形象,继而将这一形象优势作为产品继续出售给项目方;譬如通过联合项目方披露大额投资信息,制造市场利好,吸引流动性以更好的卖币出货。

表面业务:投资、做市、OTC、营销

业务本质:为“困境”项目注入资金,OTC 折扣拿币,二级市场出售获利;暴力拉盘打造品牌形象,并将其作为产品继续出售给项目方。

具体案例如下:

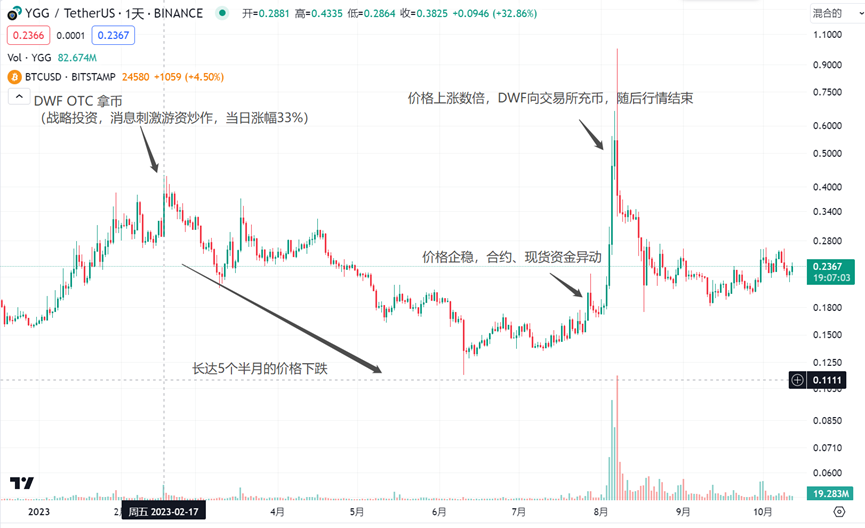

1、YGG&C 98 :OTC 买币,二级市场拉盘出货

2023 年 2 月 17 日,链游公会 Yield Guild Games(YGG)已通过出售 Token 募集到 1380 万美元资金,DWF Labs 和A16Z领投(YGG 早在 2021 年就已经发币)。

值得关注的是,DWF Labs 在 2 月 10 日就已经从 YGG 财库中收到 800 万枚 YGG,并于 2 月 14 日首次转入币安 70 万枚, 2 月 17 日媒体报道投资信息,随后 DWF 又分两次于 6 月 19 日转入币安 365 万枚、 8 月 6 日转入币安 365 万枚。结合 YGG 价格表现: 2 月 17 日,YGG 受投资信息影响,当日最大涨幅 50% ,收涨 33% ;而后就开始了长达 5 个半月的下跌,直到今年 8 月初拉盘行情启动,YGG 相较前低涨超 7 倍,行情结束时伴随 DWF 将最后一笔 YGG 代币转入币安。

如果作为二级市场投资者,在 YGG 行情启动之初可以观察到合约数据的异常。YGG 的合约数据在早期表现出持仓量的暴涨,费率的稳定;在中期表现出持仓增长的放缓,费率的下降,在后期表现出多头平仓带来的持仓下降。

类似的操盘手法也可以在 CYBER 等标的中观察到: 8 月 22 日,DWF 从币安交易所提出 17 万枚 CYBER,当时 CYBER 价格约 4.5 美元,随后价格连续下跌,最低下跌至 3.5 美元;7 天后 CYBER 上涨行情启动,最高涨至 16.2 美元,相较于 DWF 提币时的价格上涨约 3.6 倍,相较于前低 CYBER 上涨约 4.6 倍。CYBER 作为币安 Launch Pool 项目,上线早期筹码结构好,二级市场抛压小。DWF 对 CYBER 的项目的参与推断为二级市场买币拉盘,较少涉及与项目方的关系。(类似今年 2 季度 DWF 参与 PEPE、LADYS 等 Meme 币)

在资金数据层面,CYBER 的表现与 YGG 类似:合约数据在早期表现出持仓量的暴涨,费率的稳定;在中期表现出持仓增长的放缓,费率的下降,在后期表现出多头平仓带来的持仓下降。

2023 年 2 月 2 日,DWF 链上地址收到从 Coin 98 官方地址的转账,共计 412 万枚左右,按当日市价折算约 111 万美元(当日 C98 二级市场价格约为 0.27 美元),随后立即转入币安交易所;8 月 8 日,Coin 98 宣布获得 DWF Labs 的七位数投资,以推动Web3的大规模采用;10 月 12 日,据媒体报道,DWF 向 C 98 转账 100 万 USDT。结合 C98 价格表现,在 DWF 收到代币并转入交易所后,C98 短暂上涨后进入了长达 5 个月的下跌, 8 月 8 日媒体发文价格两天时间较前低拉涨 58% ,随后快速下跌。回顾该事件,其本质或为 DWF 向 C98 项目方 9 折拿币,而后二级市场抛售获利。

C98 在拉涨前期的数据表现为持仓的大幅增长,行情结束的标志为多头平仓带来的持仓下降同时伴随费率的回归。

相似拉盘手法的标的还有 LEVER、WAVES、CFX、MASK、ARPA 等

上述为近期比较典型的 DWF 操盘标的,可以看出 DWF 通常会参与合约和现货两个市场,在行情启动早期会观察到大量资金涌入合约市场,由于主力资金早期合约做多故在持仓上涨的同时不会影响到费率;中期通常表现为现货拉盘,主力合约多头开始平仓,该阶段往往表现为现货价格暴涨,合约负费率严重,持仓增长停滞或下降;部分标的还会有最后一波的拉涨拉制造流动性使得主力现货获得更好的出货价格与流动性,部分标的在合约主力多头平仓获利后行情会直接结束,关键需要判断在最后阶段对于主力来讲现货继续拉涨产生的收益收益是否会大于成本。(如上方是否存在关键压力位,盘面是否存在大量抛压)

2、“营销式”投资、链上转账,利用品牌形象制造利好掩盖出货本质

DWF 作为一家新进的投资机构在熊市中频繁出手,DWF 合作项目超过 260 个;据媒体报道 DWF 投资项目超过 100 个,其中不乏大额投资,总结其投资超过 500 万美元的项目有:

DWF 联创 Grachev 表示,DWF Labs 没有外部投资者,但其如此高频且大手笔投资不仅让市场怀疑其资金从何而来。且其所投项目大多并非行业趋势项目,反而一些基本面一般或较差的老项目居多(如 EOS、ALGO 等);在其宣布投资后项目的产品开发、市场营销、社区合作也未见改善。判断 DWF 的一些行为或为“营销式”投资制造利好吸引散户,并在二级市场反复炒作币价,以便于团队出售代币。(FET 宣布投资 4000 万美元,截止目前 DWF 仅收到约 300 万美元代币)

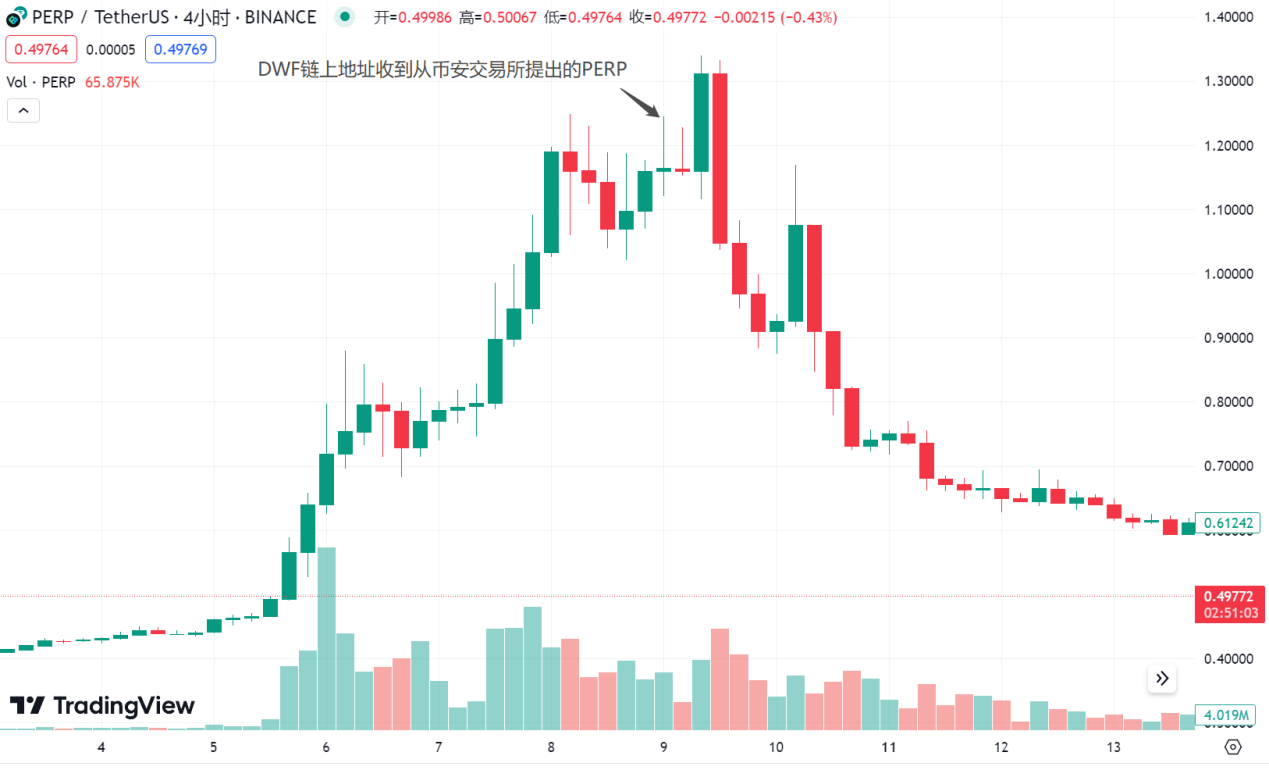

另, 9 月 8 日,DWF 链上地址收到来自币安的 PERP 转账,此前 PERP 已经上涨数倍,在 DWF 出现交易所提币情况后,PERP 买盘明显增多,币价短暂拉高后伴随大额砸盘进入下跌通道,行情结束。

10 月 17 日,BNX 宣布与 DWF 达成战略合作,此前 BNX 经历了一周的大幅上涨,在信息公布后迅速砸盘,大概率也是存在内幕交易,利用 DWF 的品牌效应发布新闻制造流动性出货。

项目方与 DWF 利用其品牌影响力制造利好吸引流动性出货的例子屡见不鲜,二级市场参与者在看到与 DWF 相关信息时需要仔细甄别。很多与 DWF 相关的标的价格持续下跌,如 EOS、CELO、FLOW、BICO 等。

3、寻找“困境”项目,利用熊市融资难的掌握议价权最大化利润

Abracadabra(SPELL)是一个以生息资产凭证(如 Curve 中的稳定币 LP、Yearn 的稳定币存款凭证等)为抵押物的稳定币项目,其在经历 UST 爆雷(UST 曾经是 Abracadabra 的重要底层资产,UST 爆雷后 Abracadabra 累计了大量坏账)与漫长的熊市中稳定币市值的萎缩后,协议 TVL、币价、持续低迷,发展难以为继。其在 9 月 14 日通过了 AIP#28 号提案,提案内容为引入 DWF 为 SPELL 的做市商。并签订了如下做市条款为: 1、Abracadabra 为 DWF 提供为期 24 个月 180 万美元的 SPELL 贷款;2、DWF 将从 DAO 中以市场价 15% 的折价购买 100 万美元的代币,该部分份额锁定 24 个月;3、Abracadabra 向 DWF 支付行权日在贷款期结束后的欧式看涨期权作为做市费用。

在该做市条款中 Abracadabra 项目方付出的代价相较于行业中其他的做市项目明显更高,包括折扣买币与欧式期权。由于做市条款中包含市价折扣买币,故站在 DWF 的角度,短期做低币价有利于其利益最大化;结合市场表现,SPELL 的价格在 DWF 入场后一路下挫。具体如下:

该提案从 9 月 11 日开始投票,到 9 月 14 日投票通过,受此信息的影响,SPELL 的价格从 9 月 11 日的低点 0.0003716 上涨至 9 月 19 日的高点 0.0006390 ,最大涨幅 72% (市场游资炒作)。

9 月 19 日 Abracadabra 向 DWF 提供了 3.3 M 的 SPELL 贷款,随后 DWF 将其转入币安,SPELL 进入下跌通道,现报价 0.0004416 ,相较于前期高点已经下跌 31% 。

从资金数据上也可以看出,在 SPELL 的短期行情中,资金的一致性很差, 70% 的涨幅存在多股资金接力,不确定性强。

总结来看:DWF 早期通过拉盘制造财富效应打造品牌形象;其本身是弱监管下熊市催生的产物,利用熊市中项目团队发展困境与市场散户心理实现两头盈利。熊市中的项目方普遍面临变现难,融资难的问题,直接出售代币又会打击脆弱的市场信心,严重利空代币价格,影响项目生态。在这种情况下,DWF 作为一条项目方卖币的桥梁出现,通过 OTC 或其他营销手段帮助项目方出货。如将从项目方手中 OTC 代币的行为表述为战略投资,实则并未观察到其对项目的长期发展提供实质帮助反而转头将代币出售;通过宣传包装的方式掩盖项目方通过其变相出货的本质,DWF 也在这个过程中实现了对项目方和用户的两头盈利。

作为二级市场投资者,在看到某项目与 DWF 合作的信息后需首先需要区分其属于 DWF 什么业务(二级投资、OTC、做市、营销),针对不同的业务使用不同的策略。在以往的市场表现中:

1、DWF 直接参与二级市场投资的标的需要重点关注,该类标的通常为筹码结构良好的上所新币或者 Meme;

2、DWF 向项目方 OTC 买币(包装为战略投资)的标的在二级市场价格上往往首先表现出数月的下跌,而后急速的拉盘,在 DWF 向交易所充币之后行情结束(拉盘行情通常不超过 1 周);

3、DWF 真正的做市项目不具备翻倍行情,但通常会引来游资炒作,有短暂的建仓窗口期,抓住可以先人一步;

4、DWF 相关的营销新闻引发的行情胜率与盈亏比较差,背后逻辑为利益相关方利用 DWF 目前的市场影响力吸引流动性砸盘出货。

判断 DWF 有拉盘意愿后,合约持仓与现货成交量的暴涨是行情启动的信号;DWF 链上地址与交易所地址交互(价格高位)、持仓下降、资金极端负费率往往标志行情的尾声。