Folius Ventures: A journey in search of Web3 gaming’s north star

Original author: Aiko (Twitter: @0xAikoDai)

Original source: Folius Ventures

Summary

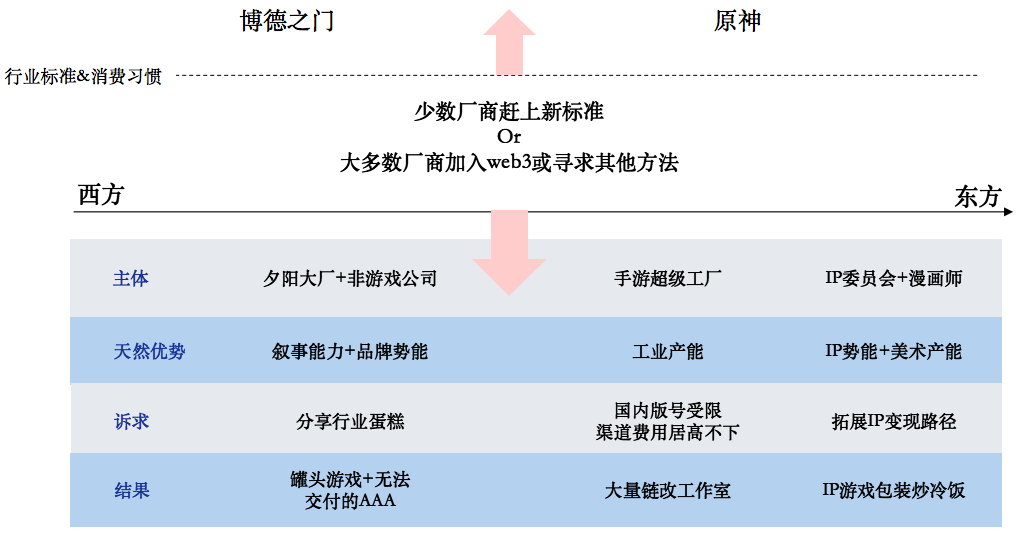

In the context of improving standards and overcapacity in the global game industry, Web3 has become one of the ways for game manufacturers to recover costs due to its high profit margin throughout the life cycle, attracting many web2 teams. However, web3 currently has overcapacity on the supply side and exhausted demand-side liquidity. After two years of development, its shortcomings have gradually emerged. Therefore, this research report sorts out the competitive landscape of the web3 game industry and the existing feasible entrepreneurial opportunities.

For teams that are still in the development stage of web3 products, it needs to be clear that as an industry with imperfect infrastructure but extremely high profit margins, the team must have the ability to be versatile; and there is a huge cognitive gap between most waist teams and head teams, and they need to be as soon as possible See gaps and accelerate learning iterations. At the same time, new business models are still emerging one after another. The team can make full use of web3 commercialization to innovate and seize market opportunities; and seize the opportunities brought by changes in the distribution end pattern to seize traffic-based super apps and traffic entrances, or independently open up the market Become a super app yourself.

In addition, for those teams who are still exploring and waiting to see, they can first seize the parallel opportunities between Web2 and Web3 when the customer acquisition cost of web2 remains high and the business model has bottlenecks, especially those driven by casual games and AI. Large player base. Secondly, by summarizing and digesting past successful/hot project experiences, you can also learn a lot of methodologies and use them skillfully in operations. Third, products that meet the entertainment needs of more users and have long-term business models can be built on high-traffic portals. Fourth, based on new asset forms, there are still opportunities for asset gamification + commercial innovation. Then, for full-chain games, it is recommended that the team build an excellent open source racetrack instead of reinventing the wheel, which may have the opportunity to start the next wave of craze. Finally, in the future Crypto agent (crypto+AI) field, there is a high probability that traffic will still be king. The team should adhere to the traffic-dominated path. In the near future, on-chain AI agents will definitely tend to cooperate with high-quality traffic entrances.

Corresponding to our first two research reports, this time we try to summarize the cyclical changes in the industry and provide some more universal, macro, and feasible suggestions for entrepreneurs at different stages. During the writing process, I was deeply aware that the industry has entered a deep water zone, the progress of infrastructure is slow, and the market liquidity is lacking, it is not easy to start a business; but I hope that developers can find some methodologies and breakthrough inspiration in this article to cope with the market winter, here I also sincerely pay tribute to the seekers who keep moving forward.

For many game manufacturers who are limited by version numbers and purchase fees, Web3 is indeed a good choice...

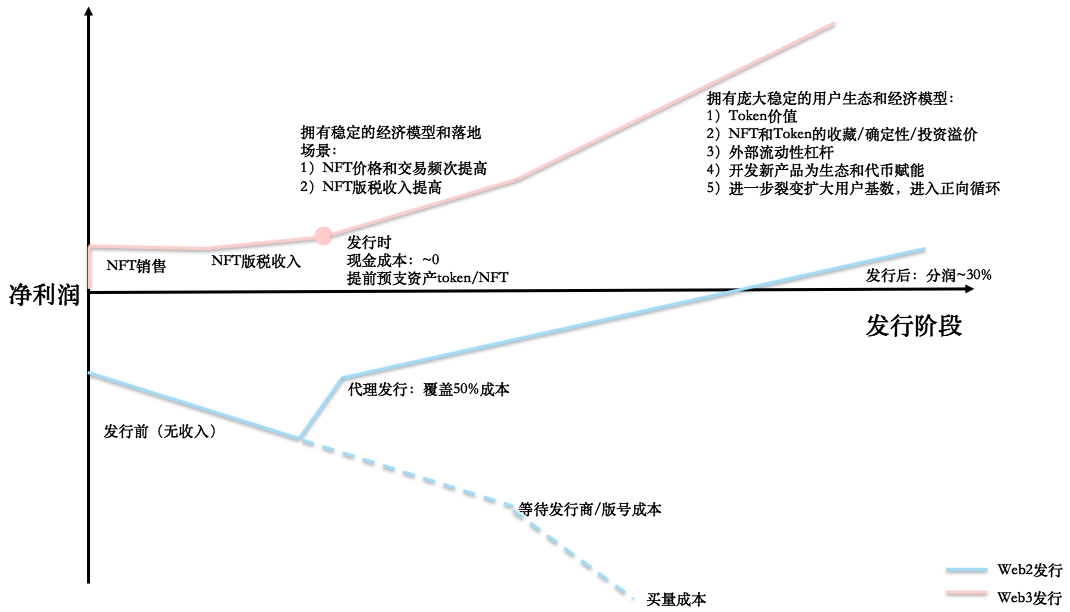

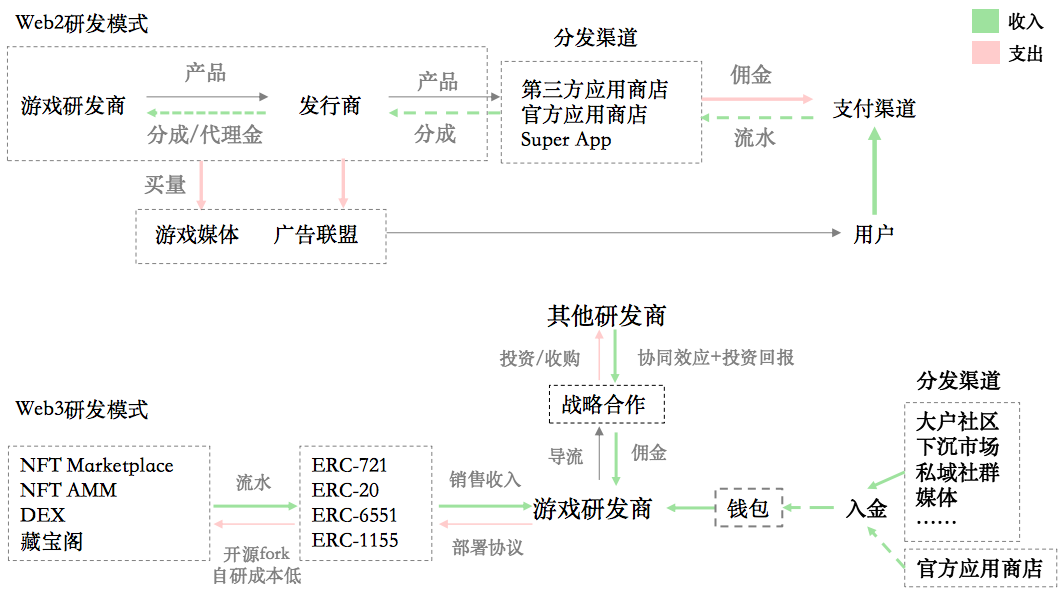

Web3 provides a commercial starting point around the entire life cycle of the game: NFT/FT/taxation. Compared with traditional research and development methods, web3 is indeed an effective way to increase game profit margins and complete globalization.

Supply side: However, in the context of the standards of the Eastern and Western game industries being raised, web3, as the only outlet, has taken over a lot of excess productivity. After two years of development, problems have gradually emerged.

Demand side: We have entered an era of lack of liquidity, the stock market is limited, attention is scarce and shifts extremely quickly. Therefore, at this stage, the team should focus on polishing the product and incentive model, and strive to break through the circle to gain customers, so as to catch the fast train of the era of abundant liquidity.

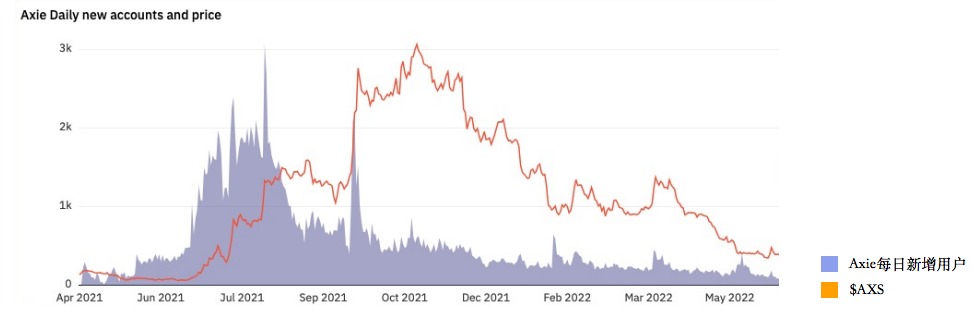

The liquidity of the market that is part of Axie’s success is something that cannot be replicated.

From the perspective of DAU: its new users entered in April 2021, broke out of the circle for the first time in June, and growth was weak in August. The shortcomings of its economic model are revealed here; however, due to its huge user base and smooth game experience, it continued to grow in October. As the market moved higher, a new peak appeared.

From the perspective of $AXS: its growth curve is highly consistent with the rise of BTC, and because DAU has leveraged huge flows, its rise is more significant than that of BTC; when the era of abundant liquidity comes, the price of $AXS is raised to Next order of magnitude.

Conclusion: A product with large external traffic and smooth experience, even if it enters the end of the products life cycle, its value will be reflected in the market exponentially in the era of abundant liquidity, and form a second curve of growth. Therefore, in the context of the era of liquidity depletion, game teams should lower their short-term expectations for the market, and focus on 1) polishing products; 2) innovating incentive mechanisms; and 3) breaking through circles to gain customers in the long term, which is better to welcome the arrival of abundant liquidity.

What is the competitive landscape of web3 game entrepreneurship now?

Analysis from the four dimensions of industry profit margin, team perception, business model, and market:

1. Web3 is an industry with imperfect infrastructure but extremely high profit margins. A generalist team can reap the biggest dividends, but a team without generalist capabilities will have more difficulties and a higher error rate.

Web3 is an industry with imperfect infrastructure but extremely high profit margins. A generalist team can reap the biggest dividends, but a team without generalist capabilities will have more difficulties and a higher error rate.

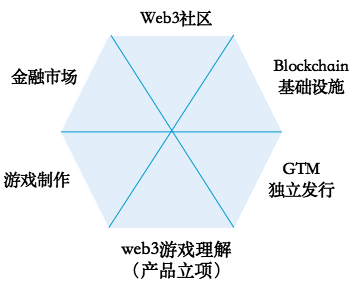

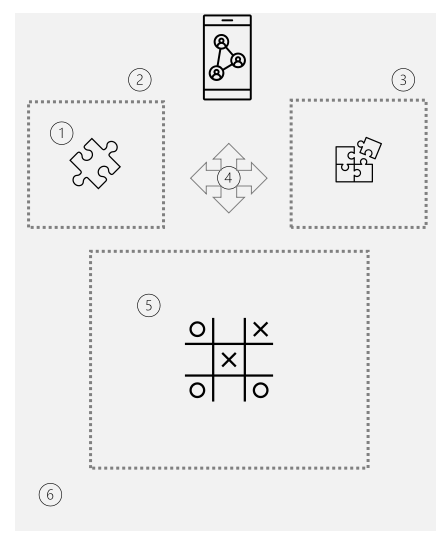

Web3 Game Team Skill Stack:

Since the industry infrastructure is not good enough and profits are high enough, Web3 game companies are driven to self-research the entire stack as much as possible instead of passively extracting money. Therefore, the Web3 team needs to be versatile in building an ecological ecosystem and cannot rely on the mature industry infrastructure in the past or the release pipeline configured by major manufacturers.

Moreover, Web3s strong financial attributes and strong community are the soil for user growth and increased profits. If the team also has financial capabilities, independent issuance capabilities, and community operation capabilities, and makes good use of web3s native methods, its final cash cost for customer acquisition should be Extremely low, and the income ceiling is extremely high.

Therefore, if the team is still staffed by the previous web2 game manufacturer, it can only act as a content supplier, and cannot conduct self-research and development, integrate production and sales, and cannot make full use of Web3 financial tools to grow and increase revenue. In the era of liquidity exhaustion, its web3 The learning and practicing process will be doubly difficult.

To sum up, the entrepreneurial environment of web3 requires the team to have talents who truly understand global game distribution and financial markets, as well as strong technical capabilities for development and implementation. These very few generalist teams can enjoy the largest premium in the industry; in the past, a game production team When Web2 vendors with strong capabilities enter Web3, if they do not have the above-mentioned all-rounders, their financing, asset issuance, community operations and major node errors will be higher, and the volatile financial market will increase their pressure and fear.

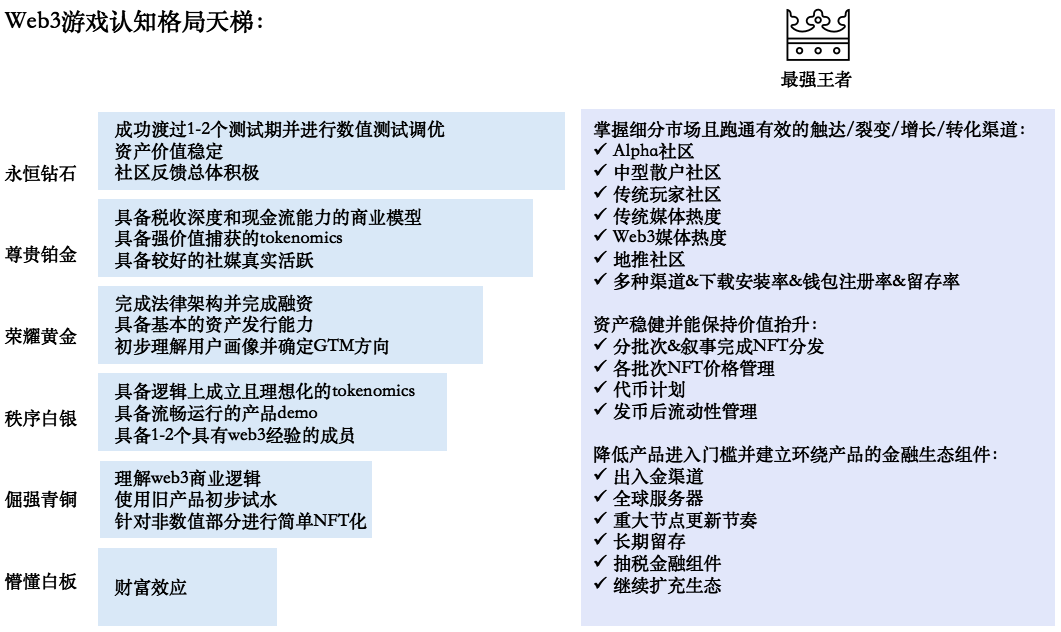

2. There is a huge gap between waist and head manufacturers. Most manufacturers may not reach the volume threshold, which requires the team to have strong evolutionary capabilities iteration speed.

Web3 game cognitive landscape ladder:

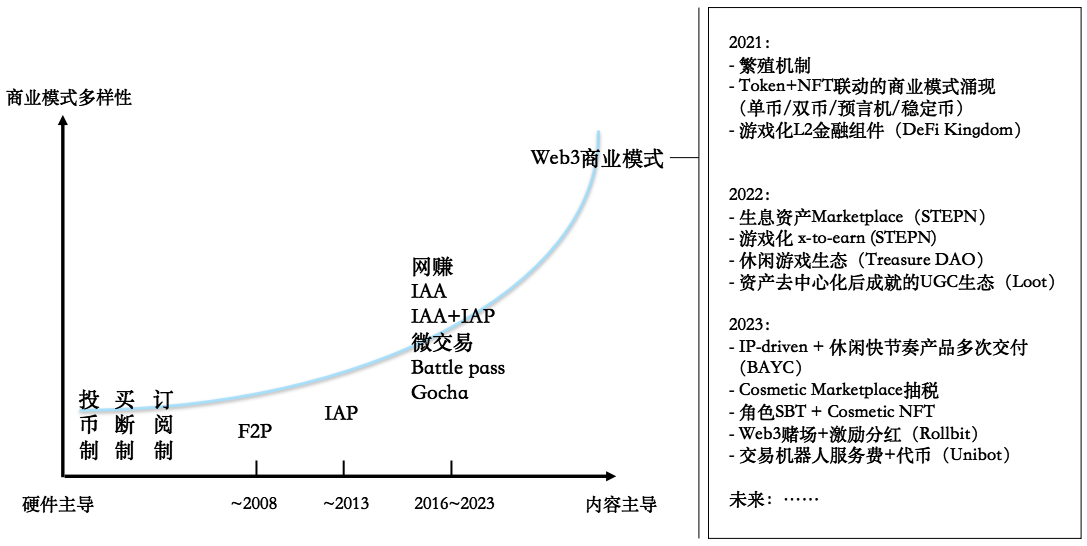

3. Business model innovations are emerging one after another. The more liquidity dries up in this era, the more innovation and change are required. The Web3 business model changes with market hot spots/new asset forms, and the team needs to innovate with a full understanding of the market economic model.

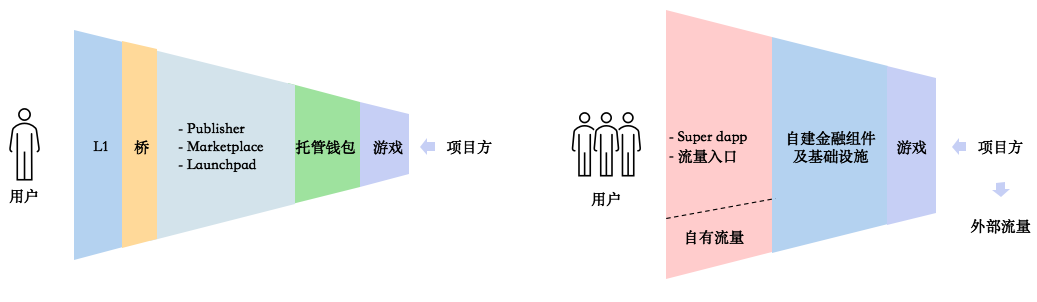

4. The traffic diversion potential of L1/2 and the platform is gradually declining. Super ecology and traffic portals that are superior to a single L1/2 have emerged and are expected to compete in the next cycle. Project parties need to choose good trees as soon as possible or take the initiative to open up new paths for UA.

The game is dependent on L1/2 or publishing platform for the following reasons:

1) Well-known ecology has more brand potential, and games can easily gain attention due to the head mine effect;

2) Limited by team capabilities and infrastructure, the game cannot independently have a complete set of user deposit and account systems, which must be provided by the platform.

Problems and hidden dangers:

1) The conversion link for users to enter the game is too long, assets have been transferred several times, and the user churn rate is high.

2) Being bound to the platform may gain more market attention during the mainnet launch period, but the total traffic pool/liquidity is small, and it is easy for everyone to gain and lose.

3) The existing market ceiling is limited, and some L1/2 and platforms also need traffic-based masterpieces to break through.

New players on the issuing side:

1) Super dapp: With long-tail traffic, increasingly complete financial components, and expanding influence, it has gradually evolved into a super ecosystem (such as STEPN, Axie), which can help other games in external social media and internal infrastructure.

2) Traffic entrance: Wallets and social apps are gradually improving their financial/technical components (such as Metamask and Telegram), revealing their ability to carry more complex dapp financial interactions, utilizing natural traffic pools while also shortening the user conversion path.

For the project party:

1) The options for individual game distribution are gradually increasing, and you need to choose the ecology that best matches the user profile/has the strongest traffic support.

2) The attention of the existing market has shifted with the liquidity/wealth effect, and it is still necessary to independently explore external ways to acquire customers.

So, in the liquidity depletion cycle, what other directions are worth exploring for the web3 game team?

1. Look for parallel opportunities between Web2 and Web3 games, and catch up with new users’ consumption habits and AI experience when web2 has high customer acquisition costs and commercialization has entered a bottleneck.

Phenomenon 1: Facing the same user group, web2’s customer acquisition cost increases again

The growth of games in the web2 global market over the past 23 years is largely due to pan-leisure tracks such as match-3, simulation management, and casual casino. However, the purchase cost of tracks is high, and after the popularity of Xundao Daqian, traditional H 5 The cost of acquiring small games has tripled again. Web3 faces the same user habits, cheaper customer acquisition costs, and higher profit margins.

Suggestion: Teams that make casual games can not consider platform-based play methods to compete for retention rates. Instead, they can use the characteristics of casual games with large traffic and rapid attention shifts to continuously release products and use mutual placement of ads + tokens in self-built dex. Use swap and other methods to import traffic and liquidity into new games.

Phenomenon 2: The card-drawing business model has reached a bottleneck and has no room for innovation.

The business model of Gocha (krypton gold card drawing) was introduced to China from Japan for ten years. However, in the past six months, especially after the domestic version was liberalized, it has been found that players’ consumption power has been weak, and the scale of user payment has generally declined. On the other hand, games such as Ni Shuihan have also achieved success with light payment and large DAU.

Recommendation: web3 has many commercialization tools and is suitable for commercial innovation. It is recommended to read our first two research reports to maximize the profit margin of NFT+token+tax.

Phenomenon 3: Simplified experience, high frequency stimulation

Find a game that can be quickly picked up and addicted and turn it into a mobile game. From Vampire Survivor to Hustle Agent, from a gameplay prototype of Crazy Knights, several games were born that ranked on WeChat mini programs. The top ten games can be found from the AAA realistic art production pipeline to the three-dimensional two-dimensional industrial production capacity battle. However, when users are tired of aesthetics, they increasingly choose to play high-frequency exciting mini-games. Kill fragmented time.

Suggestion: Simplification and incentive design based on the gameplay prototype is more in line with the capability stack of the web3 team. Secondly, the closer it is to the original stimulation of opening boxes, the more similar it is to the pleasure of economic incentives of web3 itself. From this, it can be inferred that there are more templates to refer to. , and the user portraits are more overlapping.

The web3 team can also consider adding an idle experience when making the game, so that the game itself has the effect of an electronic disk string instead of unlimited 24-hour gold farming. Therefore, the design of the energy value system we mentioned before is also very important.

Phenomenon 4: Developing hand in hand with AI and the gaming industry

Parallel opportunities in the game industry led by AI do exist, but it is recommended not to add entities unless necessary.

For teams whose original middle road collapsed/or who came to web3 due to fierce traditional competition, they should again consider this opportunity for industry change, especially in the context of domestic censorship and the inability to adopt large foreign models. It is best to take advantage of it while AI creates novel experiences and next-generation products, while directly using web3 to achieve global distribution and higher-leverage commercialization.

Suggestion: start designing from the economic/diplomatic/agent level. For example, the agent based on the SLG game I mentioned in the article. This also means more trading and profit margins for AI.

2. Seize the window period to digest the proven routines of Web3 in the past, and use cleverness in the early and middle stages of operation.

Early stage:

- Find the right data pool: (refer to Friend.tech)

When X (formerly Twitter) incentivized creators and this incentive stimulated social media communication effects, it connected to this open (API interface or data crawlable) data source and quickly completed the financialization (Share) of KOL. Perhaps entrepreneurs in this direction can also expand their ideas to find other qualified data pools. After all, the core of its business model is to package the off-chain POW and traffic into the chain, and the purpose of the chain is to rent valuable data, information, and people.

- Batch invitation system: (refer to STEPN, Friend.tech)

Use the invitation mechanism in batches to slowly release people, and complete product testing at each stage at the same time. Let the entry fomo social fission serve as a basis for economic incentives. Slowing down the user entry speed in the early stage actually extends the overall operational life of the project.

- NFT trading experience: (refer to Memeland, Matr1x)

In view of the fact that there are enough cases and gameplay left in the NFT market, this game is operated in an NFT-driven manner. There are many playbooks to refer to, and it even has a relatively complete industrial chain (based on NFT trader-whitelist intermediary-kol) as the core. (1) In the early stage of Twitter and alpha community marketing, pua users enthusiasm creates community depth; (2) The market is small and has poor liquidity, and it is easy to control and pull the market to create a wealth effect; (3) The expectations of several NFT series can continue to help the price improve; (4) Whether it is distribution or hype, it can help the team make some money + without paying a dime; (5) The final solidification depends on product + FT Airdrop + cash flow.

- Buying volume/regional arbitrage: (refer to Axie, Hooked)

Build more UA launch testing channels, and seize areas with low purchase volume costs to convert users to chain arbitrage; at the same time, establish a local promotion distribution system (guild) and add a token incentive layer to achieve the token wealth effect compared with the local per capita income level. It is more obvious, bringing opportunities to spread and break the circle.

Mid-term:

- Roll-off logic: (refer to STEPN)

Nowadays, many people are acquiring IP from web2 manufacturers. It tells the story of web3 distribution, but what many traditional manufacturers do not realize is that not only web3 can be regarded as a global distribution method, but you can even redistribute it on every chain. once. In view of the large gap in liquidity/user portraits/traffic support on each chain (especially in the era of big TVL), issuing new assets across chains means building head mines one after another for users, and users will continue to enter The new chain will make money by entering the market first. Or similar to rolling servers in traditional games, practice new accounts at a new starting line, verify your assumptions about the strategy, and get positive feedback.

- Leisure/fragmented operation: (refer to BAYC)

For mature IPs, games can be used as a starting point to enhance community cohesion and gather attention in the operation stage. Therefore, it is important to focus on high frequency and asset fomo, and there is no need to go far to produce AAA and lengthy games.

3. Rely on large traffic portals to create products that meet the entertainment needs of more users and have long-term business models. In other words, spread the existing entertainment needs + web2 business model through new traffic channels and add the web3 incentive layer.

Telegram bot:

After Unibot quickly became popular, many entrepreneurs joined the TG bot track to imitate the market, but so far we have only seen fine-tuning in strategy/performance of trading robots and GPT-like robots. Although trading bots have risen rapidly by meeting the trading needs of crypto users, their business models are single, UI/UX and trading strategy optimization ceilings are low, and the user scale has not yet exceeded 10,000, making it difficult to truly break through the circle and gain customers. long.

Therefore, new TG bot entrepreneurs need to open their minds, try products that are more in line with the habits of consumers, and establish a long-term and stable business model. Among them, the method with lower trial and error cost is to directly use the business model (gambling) of web2 that has been implemented through a new traffic channel (Telegram) and add the web3 incentive layer (token+NFT). Representative cases include Rollbit. In addition, the following ideas are for reference only:

Example:

Games: You can follow the infrastructure development process of WeChat mini programs to see the game performance that tg bot can provide, and the education for users from deep to shallow. It is recommended to conduct more launch tests and find out the user portrait based on the main user distribution areas (India, Russia, Middle East, etc.) and game preferences.

It is speculated that tg large-cap users can accept elemental games. Breaking the circle and growing need to rely on social and fission games, while crypto users are more able to accept the development + pvp prevention card gameplay.

[Simple Element Class] - Lianliankan, Tetris.

【Social Party Category】- You draw and I guess who is the undercover.

[Comparison and Fission Category] - One jump, and the sheep will become a sheep.

[Place Card Category] - Currently, WeChat mini-programs are among the top ones, such as Xindao Daqian, Salted Fish King, etc.

Lottery category: In view of the increasing number of valuable assets, there are not only consensus blue-chip NFT assets (BAYC/punk), but also IP co-branded assets and real-world collateral on the chain (such as Pokémon cards on the chain), combined There are a variety of lottery methods and dividend incentive mechanisms, and there are many ways to play.

[One Yuan Treasure Hunt] – Each person with 1 Yuan will have the opportunity to participate in the NFT blind box drawing of valuable items.

[Game Blind Box] - Similar to participating in the tree planting game, you can get a fruit blind box, and participating in the NFT game can get an NFT blind box lottery.

[Bargain Group Buying] - Group buy fragmented blue-chip NFT or directly make a tg launchpad bot. You can get it at a low price by forwarding and group buying, or participate in the lottery and get the set that was originally whitelisted in Discord.

Private domain: The first two involve the spread and fission of the tg group, and tg is still in the early stages of the content ecosystem. Before the content matrix is completed, the private domain can be built and commercialized by combining the DAO + creator ecology. .

[Publish Links] - You can collect commissions whether you publish links in group chats or channels. You can trace the steps of browsing-clicking-downloading-forwarding to see the conversion rate. When rebates are given to users in the community, the rewards will be directly put into the wallet.

[Creator Community] - Establish a ranking voting bot in the creators community, the competition will be announced, and those with higher rankings will receive token rewards.

4. There are still opportunities for asset-based gamification + commercial innovation: Treasure Pavilion

Background 1:The overall liquidity of the NFT market has dried up, and the NFT market needs new narratives and trading hot spots.

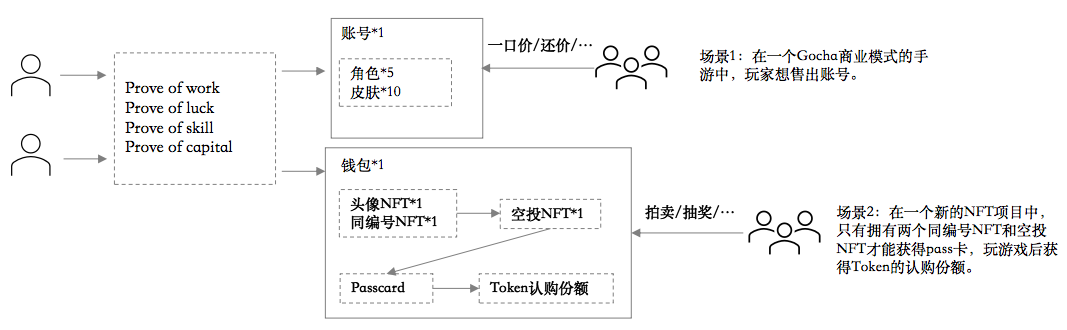

Background 2:At the application layer, the complexity of NFT-driven game assets has already increased. There are many types and quantities of assets under the same IP, and they are interlocked. The final value is reflected in the products and tokens. However, players still need to conduct over-the-counter transactions in the community, or manually collect NFTs that meet the requirements and purchase them one by one. The transaction method is very primitive.

Background 3:At the protocol layer, with the emergence of ERC-6551 and ERC-4337, although the underlying technical issues of account abstraction wallets have not yet been resolved (such as: no support yet and poor stability of private key generation wallets), with the improvement of infrastructure After improvement, the granularity of accounts and assets in the future will be quite different from today. Just like ERC-721 and ERC-20 have completely different interaction forms/financial attribute logic, the new asset form in the future will be: multi-agent + multi-granularity nested, which is more difficult to price uniformly. Therefore, based on the future The financial interaction forms and scenarios of assets will become more interesting.

suggestion:

The treasure chest type Marketplace first requires that the game itself can operate for a long time, have a large DAU, and have valuable assets and abundant liquidity;

Secondly, the game project team is required to be able to play and design operational activities, so that every sales operation activity can promote game activity and increase market transaction volume. This can refer to web2s regular game operation activities, launching festival gift packs/blind boxes, etc., but it will not affect the value of valuable assets (such as characters).

Web3ization of some mechanisms worth learning from: price increase lottery, treasure appraisal mechanism, open bidding auction, etc...

5. Full-chain games: To be an excellent open source racetrack, instead of reinventing the wheel, find innovative mechanisms with enough wealth effects and productize them + gamify them, and finally break through the circle to obtain external liquidity.

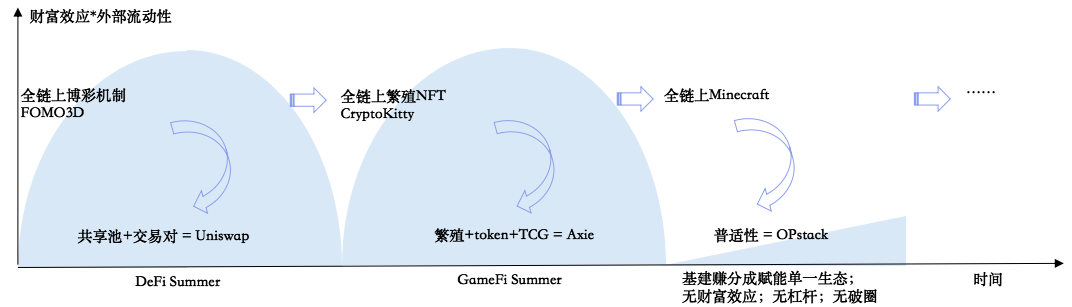

Background 1:The whole chain narrative takes over the liquidity from NFT and GameFi. Loot appeared right next to BAYC, Punk and other NFTs, and its highest market price was also the time when the community round of Dark Forest, the originator of games on the entire chain, had the largest number of participants. Full-chain gaming games (such as Wolf Game, Sunflower, etc.) also appeared after Axie and GameFi summer, but the FDV is below $5M, which is four thousandths of Axie and five thousandths of STEPN.

It can be seen that when the liquidity of NFT and GameFi is exhausted, the possibility of sudden emergence of games on the entire social gaming chain is relatively small. Even if an outbreak occurs, it may be difficult to break through the circle and gain customers.

Background 2:In order to prevent the full-chain game from eventually becoming a crude POS/POW competition and optimize UI/UX, the team needs to dig deep into technical issues, and the trend of self-built Appchain/L2 driven by full-chain game technology is gradually emerging, going deeper layer by layer. The game and test network environment is closed, with only two-digit test users. It is easy to reinvent the wheel and is not universal. There is currently no sign of open source, and there is a long way to go before becoming permission-free and interoperable.

Analyzing three past cases of game innovation across the entire chain, the following common features can be summarized:

1) The innovation of games on the entire chain may not appear in the main tasks, but in the side tasks. If valuable branches can be identified in this process and turned into products, it may be possible to create a universal infrastructure. And if it can be financialized + gamified on top of the product, the user threshold can be greatly reduced. This can have the effect of breaking the circle and driving the influx of new liquidity.

2) Games that focus on simple and fomo asset gameplay and have wealth effects are more likely to drive industry-breaking innovation: for example, the prize pool dividend mechanism in Fomo 3D and the asset appreciation mechanism of reproductive deflation in CryptoKitty can become an excellent racecourse. .

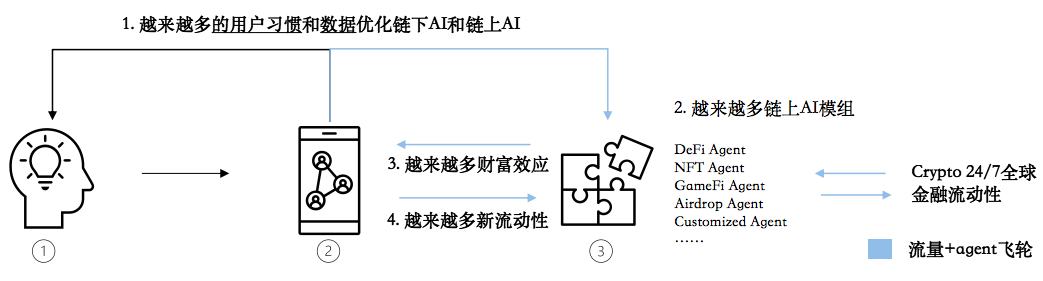

6. In the AI agent era, traffic is still king. Traffic dominance + crypto agent makes it easier to start volume and find good commercialization paths, while back-end AI can continue to optimize + modularize and seek cooperation with high-quality traffic portals.

① - LLM (optional):Convert user intentions from traditional keyboard/click input into natural language input, lowering the users entry barrier.

② - Front-end Dapp:Collect user habits and data.

There is a high probability that it will be open enough for social apps, chatbots and games, or the existing web2 traffic entrance will be transformed into a simpler and more user-friendly AI+web3 entrance.

③ - On-chain AI agent and its modules:In order to obtain more user habits and data, AI modules must be willing to open interfaces, and the web3 spiritual core is open source, license-free, and composable. Therefore, high-quality on-chain AI modules must work closely with traffic portals.

A comprehensive commercial brain map surrounding the Agent module on the chain

① - Agent:Commercialization of the AI agent itself: free trial + subscription system, commission on service fees, etc.

② - Asset layer surrounding a single Agent:There are many types of assets and various commercial realizations: Advanced Passcard (ERC-721), Agent Token (ERC-20), cash flow dividends to stakeholders, etc.

③ - Multi-agent asset game:An AI Agent airdrops tokens to other Agent users and performs vampire attacks; while old agents can choose to increase stakeholder dividends to regain users.

④ - Agent coordinator:It may be dominated by a large-traffic super app that packages multiple AI agents through user customization. Each AI has a different charging method (subscription/NFT/token, etc.), and an app with coordination logic can divert traffic. And help users make one-time settlement and earn handling fees from it.

⑤ - Agent game environment:More likely to be the first to realize and commercialize complex AI games. In basic behaviors such as playing airdrops, the interaction of AI is limited, and the ceiling of user profit margin is limited; but the game is equivalent to a scenario where a person formulates rules and can infinitely increase the frequency of interaction, profit margin, and complexity. Note that the game can be played off-chain. Users can store part of the funds in the apps hosted wallet and only need to upload the part involving economic interaction to the chain.

Several game models that can come to mind:

In the SLG game, users allocate funds, and AI controls national and diplomatic relations. Complex economic interactions such as negotiation, betrayal/cooperation, and bribery occur, and game projects can extract taxes from them.

In bidding auction board games (such as Modern Art/Monopoly), users allocate funds, and the auction and bidding are conducted by AI (AI also solves the problem of asynchronous games that require players to be present for a long time).

⑥ - 24/7 global financial liquidity pricing AI agents:An AI agent module releases a new function preview on a social platform, resulting in token demand/consumption expectations and hype expectations. Some people may buy the AI agents tokens.

Acknowledgments

Alen@qiqileyuan

Ben

Blanker@0x blanker

Chris@ChrisYicheng

Chris Lu@chrislulu 816

Frost @frost_lam

Jason@MapleLeafCap

Luozhu @LuozhuZhang

Saku@poemran

Yige Min@Alpacacheeze