Paradigm: Gambling table on Mars, cryptocurrency pioneering and speculation

Original author:Matt Huang

Original source: Paradigm

Original compilation: MarsBit, MK

We can think of cryptocurrencies as a new Odaily being colonized.

Many critics viewed it as a deserted and worthless Odaily, or even considered it to be nothing more than a sleazy casino. Optimists, however, see potential in this uncharted land: a place where more advanced financial systems and internet platforms can be built.

The new settlers come in all shapes and sizes, ranging from explorers attracted by cutting-edge technology to shady speculators. Innovators and researchers are attracted by new possibilities, and ordinary people, especially those marginalized on Earth, are joining their ranks.

Governance is still in an uncertain stage, with some Earth jurisdictions banning their citizens from traveling to New Odaily, while others are seeking to find their footing in this new world.

The history of this new Odaily has been marked by cycles of speculation and hype, leading many to doubt its future direction. Today’s cryptocurrency speculation frenzy is simply a self-starting process. Just as the 1849 gold rush transformed San Francisco from a sleepy village to a major port (and eventually a center of technological innovation), today’s cryptocurrency boom is attracting settlers and prompting the construction of infrastructure that will allow it to move from A barren Odaily turns into a prosperous crypto-civilization.

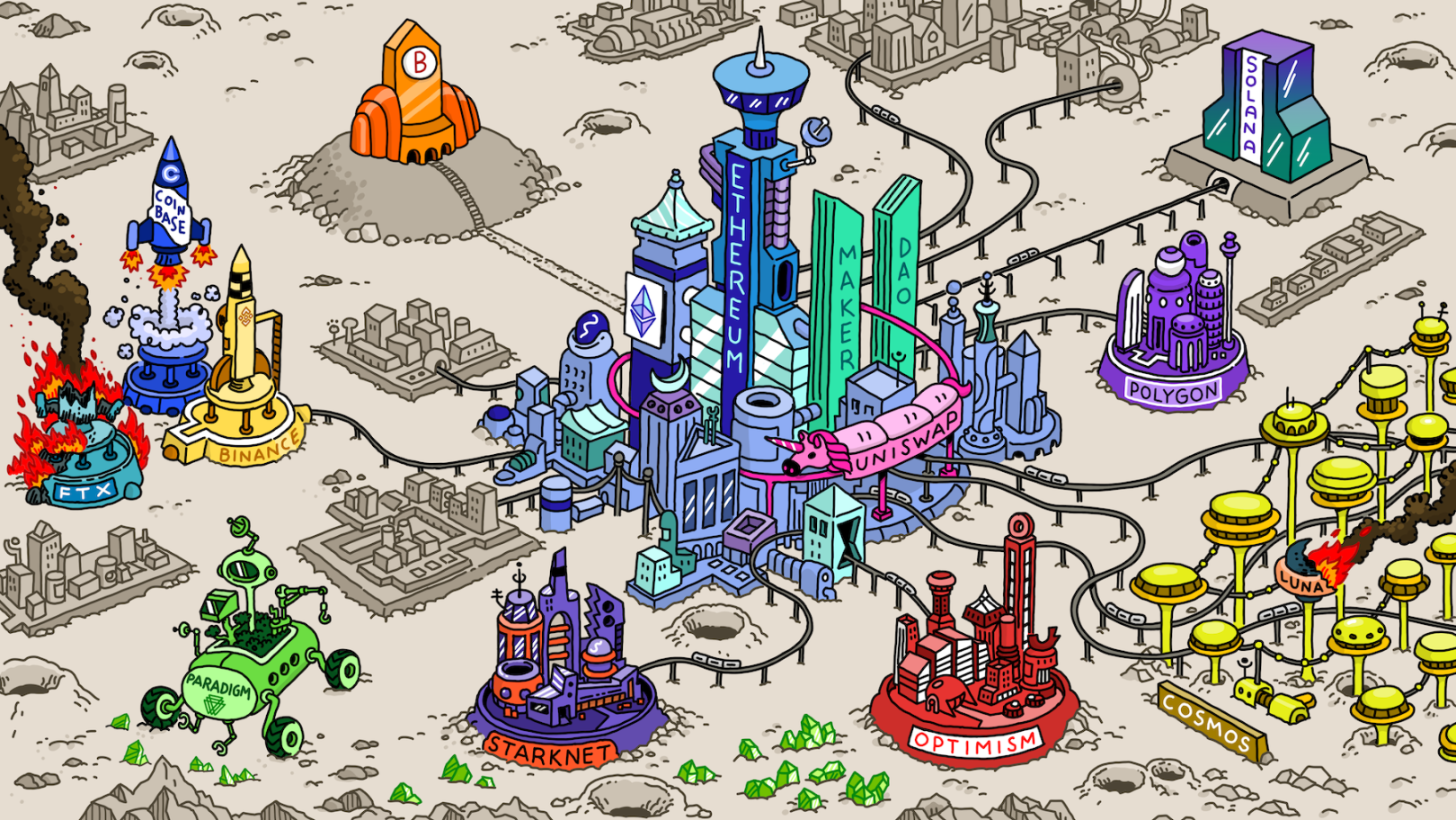

The new crypto Odaily has been born. Bitcoin was one of the first settlers, and exchanges like Coinbase and Binance allow you to trade in and out of it easily. Ethereum has become the largest city, and Uniswap is the best means of transportation...

Why should we choose encryption?

Settling on a new Odaily definitely requires a huge amount of effort. But is it really worth it?

Where the existing system fails, we most need a new property rights system. BTC, ETH, and stablecoins have been adopted globally, especially in places like Argentina, Turkey, and Ukraine, where they are becoming more widely accepted by ordinary people.

While many are still waiting for that encryption “killer app,” it’s actually already here. Its just that for those living in the first world, this change may not be easy to detect. If you ask an Argentinian about encryption, they will tell you its uses without hesitation. Today, cryptocurrency is not only a useful tool but also a speculative high-end market. It is evolving rapidly and is becoming a classic Christensen example of disruptive innovation, becoming increasingly useful to more people.

Currency is just the first killer app, it wont be the last. Cryptocurrencies will give rise to a more transparent, programmable and open set of crypto-financial services. It is a cheaper, more convenient and more inclusive solution for those who are unable to access banking services due to high fees, or who do not trust the increasingly centralized banking system. We are seeing the rapid rise of stablecoin payments and loans that can be obtained through simple coding rather than complex banking or brokerage procedures. Systemic risk can even be reduced by tracking collateral globally.

Going forward, as cryptographic infrastructure expands, we can foresee new consumer applications becoming possible. Creators will have more rights in their creations, and users will have more control over their identities.

From a larger perspective, this new Odaily provides us with an opportunity to reinvent our existing system and upgrade it to a more advanced and flexible system. Crypto can do this not only for currency, finance and digital property, but everything the internet has done for information and media.

More importantly, encryption provides a means of protecting against an increasingly centralized world. In a world where bigness is becoming mainstream, we are slowly losing focus on the power of individuality and diversity. By enabling small and diverse forces to work together, encryption becomes an important force against centralized power, an important force for freedom, and protects us from the control of big corporations and big governments.

Speculation and cryptocurrencies

While cryptocurrencies have their advantages, is their speculative nature really necessary? In fact, speculation is not only necessary, but can be extremely productive.

Speculative investing is the cornerstone of technological revolutions. From the rise of telecommunications and the internet to the rise of rail, electricity and automobiles alike, new technological breakthroughs are often intertwined with speculation and asset bubbles. As Carlotta Pérez has meticulously documented, they became inseparable in the move toward mainstream acceptance. In the cryptocurrency space, speculation drives attention and awareness, investment flows, talent pooling, infrastructure development, academic research and the acceptance of established companies.

Furthermore, there is a deeper connection between speculation and cryptocurrency: it is the Hello World of digital asset rights. People tend to trade when they have the opportunity to create a rare asset. Give a group of kids some Pokémon cards and watch what happens. The real value of a new property rights system lies in its ability to reliably record the transfer of property, which is why people would naturally start trying and testing it. If this new system does not gain widespread acceptance, it could lead to a polynomial future in which price fluctuations and trading activity appear to be more speculative.

I remember that in the early days of Bitcoin, it was a fantasy that it would one day reach the legal status and value it has today. I witnessed early adopters gleefully mining, contributing, experimenting, and even buying pizza. Now, more than a decade later, BTC and other crypto-assets such as ETH are steadily transforming from speculative gadgets to global currency commodities.

Speculation has also played a central role in cryptocurrency becoming a decentralized financial system. Many financial products have obvious utility value on one side of the transaction, but require speculation to satisfy the needs of the other side. For example, someone may need a 30-year mortgage to purchase a home, but there is no inherent need to provide the 30-year loan. Our modern financial system mediates between such practical needs and the more abstract need for financial gain. In the cryptocurrency space, a similar system is being established that includes players such as speculative traders, infrastructure providers, market makers, MEV searchers, blockchain builders, DeFi protocols, stablecoin issuers, Uniswap arbitrageurs, etc. . Building such an N-party market is not easy, and it takes time to develop. But over time, as participants become more mature and liquidity increases, chain-based financial markets will become more powerful.

The “casino” of speculation has a dark side

While some criticisms of cryptocurrencies may lack creativity, some of them have merit. A casino can be a useful launch tool, but it can also have unwelcome consequences and backlash.

Innovation relies on capital and labor being used for valuable experimentation. Excessive speculation, airdrop farming, and other shenanigans can create noise that interferes with price signals that could guide beneficial innovation. Even the most well-intentioned entrepreneurs can be misled by false price information or distracted by short-term profits, slowing down the actual construction process required for cryptocurrencies.

Short-term speculation is essentially a zero-sum game in which experienced traders extract value from newbies, which can cause them ongoing harm. A free market should admit all kinds of participants, as long as their actions are legal and ethical. But if we view cryptocurrency adoption as part of a social coordination game, choosing the optimal time frame may become a prisoner’s dilemma. By working together over the long term, we can achieve a more satisfactory result.

Ultimately, bad behavior is commonplace: scammers, fraudsters, and hackers are a constant threat. Imagine a world filled with gangsters who “welcome” new entrants through violence and robbery — this is San Francisco’s cryptocurrency scene. Like the early days of the Internet or the Gold Rush, this frontier open space breeds not only innovation but also lawlessness. While good players still prevail—for example, we’ve been fortunate enough to witness the rise of a group of the world’s top white hat security experts—the field still needs more self-regulation and regulation.

Why is progress so slow?

Cryptocurrency is almost 15 years old. Shouldn’t it be popular and mainstream by now?

In fact, it takes time to open up a new area, and most people will only be willing to move to a new area when the infrastructure is complete and they are no longer socially excluded. Technological progress also has its limits and can only go as fast as a certain level. The social dissemination of new ideas often involves twists and turns rather than smooth sailing. Due to the speculative nature of the asset, it experiences cyclical violent fluctuations; one moment people are highly optimistic about the prospects of cryptocurrency, thinking that it is everything in the future, and the next moment they claim that it has lost its vitality.

Building social consensus around cryptocurrencies is even more challenging than creating network effects around communications protocols or social networks. People can quickly realize the practical value of WhatsApp or Instagram because they can communicate with a small and familiar group of friends through these platforms. And for a new property rights system, which is about how to transact safely with people you dont know well or fully trust, that requires broader recognition and legitimacy. We still have a long way to go, but it’s encouraging to know that today you can already trade with over 100 million people using BTC, ETH or stablecoins.

Looking beyond the casino

Many of the technologies we take for granted today were once considered impossible, useless, dangerous, or fraudulent. Today, Apple is the most valuable company in the world, but when it first went public in 1980, Massachusetts banned its stock sales because it was too risky. The same is true for cryptocurrencies, with voices claiming that Bitcoin is dead every year since 2010.

However, human history has proven time and again that our adherence to the status quo often leads us to resist reforms, especially when those reforms are disruptive. Cryptocurrencies are touching on profound ideas of money, value, governance, and human collaboration. We need to keep an open mind and explore the possibilities of building better things instead of rejecting cryptocurrencies simply because of skepticism.

We must look beyond the speculative nature of cryptocurrency and recognize that it is the guiding mechanism for one of the most important technologies today. We need to deeply explore the new Odaily-encryption technology world and think about its substantive construction and real uses, rather than just chasing speculative hot spots.

appendix

What would it mean if we compared crypto to a new Odaily?

crypto community

The crypto space represents a comprehensive ecosystem that we should all build together. There are more common ideals than differences among the different cities of this new Odaily. Rather than internal extremist conflicts, what is more important is convincing the inhabitants of Earth to settle in the new Odaily, or protecting this Odaily from inappropriate Earth regulations.

As Vitalik said, thinking about how to build a complete system is very important for encryption. New Odaily cannot rely on Earths infrastructure forever. The network systems we currently rely on include Google, Twitter, Github and credit card systems. We also have an independent Chinese network system including WeChat, Alipay, Weibo and DCEP. And we need to build an encrypted independent system that should operate like the Chinese system, but be more open and guarantee autonomous rights.

For a new Odaily, it is beneficial to have a unique culture. We may not want encryption to fade into the background, or for the new Odaily to resemble Earth.

builder

Building products in the crypto space is not just a technical question (What can be built on the new Odaily?), it is also a social question (Do the residents of the new Odaily really need this?).

A good way to find crypto startup ideas is to think through what early settlers on the new Odaily might need. Do they need food or shelter? Then you can consider providing such services. Another good approach is to consider the special characteristics of the new Odaily and implement some unique products based on this. Maybe gravity works differently, which could lead to new products.

Some products are best built for settlers on New Odaily, such as Decentralized Finance (DeFi); others can be seen as a bridge between New Odaily and the Earth, such as Centralized Finance (CeFi); and still others Utilize new Odailys technology to serve the planet, such as fintech products utilizing stablecoins.

A common failure mode is building a product for mainstream users before they are ready to migrate to the new Odaily. It would be wiser to focus on those who have adapted to the new Odaily environment or are preparing to move to the new Odaily. At the same time, another failure pattern is focusing too much on building for early settlers and neglecting the massive influx of new users that may come.

Existing businesses

Existing businesses on Earth also have a role to play. The most natural way is to act as a bridge between the new Odaily and the earth, while also trying to build localized products.

Think of crypto as an emerging market. It’s not just about adopting new technology, it’s about entering a new realm that has its own culture. Just like a restaurant adapting its menu to different countries, or a business hiring a local general manager, it can be helpful to adapt your team and product to the new Odaily features.

A common failure mode is misunderstanding the unique nature of the new Odaily, such as the fact that there was a time when banks were keen on blockchain not Bitcoin. Its as if youre just putting a new veneer on the bank to make it look more like the new Odaily, but completely losing its essential meaning.

Policy makers

Counterintuitively, crypto could ultimately benefit the U.S. dollar. The USD stablecoin has become one of the most popular currencies on New Odaily, with far more influence than any other currency on earth.

Witnessing disorder and brutality on New Odaily may give rise to the urge to take overly drastic action, such as banning travel to New Odaily or severely restricting activities there. But this will prevent the new Odaily from developing from its current infancy to a stage that may produce long-term innovation.

A better approach is to take a long-term view and retain safe harbors and permission-free freedoms. Punish criminals when they commit crimes, but remain open to experimentation and innovation by good doers.