RWA through the eyes of the Fed: Tokenization and financial stability

Original source:Federal Reserve Working Papers

Original compilation:Will Awang

In a working paper on tokenization by the Federal Reserve on September 8, it was stated that tokenization is a new and rapidly growing financial innovation in the encryption market, analyzed from three perspectives: scale, advantages and risks. . First, the concept of tokenization is introduced, which refers to the process of building digital representations (encrypted tokens) for non-encrypted assets (underlying assets). In the process, tokenization creates a link between the crypto-asset ecosystem and the traditional financial system. At sufficient scale, tokenized assets may transfer the risk of severe volatility from the crypto market to the underlying asset market of traditional finance.

This 29-page paper has been compiled below so that everyone can further understand RWA and tokenization, underlying assets and encrypted assets, supervision and financial stability. Borrowing a sentence from the principal: Any financial technology is accompanied by risks. The deep integration of regulatory technology and RWA with DeFi will be an important scenario for future iterations of encryption technology development.

This follows the previous compilationBinance (real world asset tokenization RWA, a bridge between TradFi and DeFi),Citi (Blockchain’s Next Billion Users and Ten Trillions of Value, Money, Tokens and Games), as well as our own writingRWA Research Report: In-depth analysis of the current implementation path of RWA and the prospects of future RWA-Fi, another RWA research report later. The following, enjoy:

1. What is tokenization?

Tokenization refers to the process of linking the value of underlying assets (Reference Assets) to the value of cryptographic tokens. Strictly speaking, tokenization will allow token holders to have the right to legally dispose of the underlying assets at a legal level. So far, most tokenization projects on the market have been initiated by small VC-backed crypto companies, while traditional financial institutions such as Santander Bank, Franklin Templeton Fund, and JPMorgan Chase have also announced their crypto-related tokens. ization pilot project.

Like stablecoins, tokenization will have different characteristics depending on the design scheme. Generally speaking, tokenization usually contains the following 5 characteristics: (1) based on blockchain; (2) owning the underlying assets; (3) a mechanism to capture the value of the underlying assets; (4) a storage/custody asset way; (5) A redemption mechanism for tokens/underlying assets. Generally speaking, tokenization connects the encryption market with the market where the underlying assets are located. The design of the tokenization scheme will differentiate various tokens and affect the traditional financial market to varying degrees.

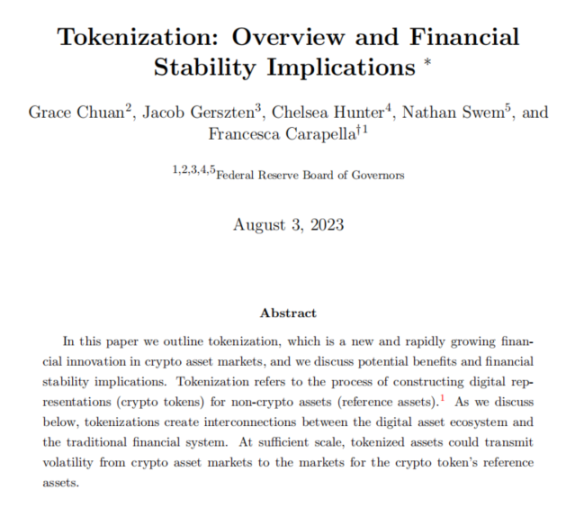

The first factor to consider when designing a tokenization solution is the underlying blockchain, which is used for the issuance, storage, and trading of tokens. Some projects issue their tokens on private permissioned blockchains that require permission, while other projects issue their tokens on permissionless public blockchains. Permissioned blockchains are typically controlled by a centralized entity that approves selected participants into a private ecosystem. Issuing tokens on permissionless blockchains (Bitcoin, Ethereum, Solana, etc.) allows public participation and has fewer restrictions, but the issuer has weaker control over the tokens. Tokens on permissionless blockchains can also be plugged into decentralized finance (DeFi) protocols, such as decentralized exchanges. See Figure 1 for examples of project tokens issued on permissioned and permissionless blockchains.

Another consideration is the underlying asset of the token. There are many categories of underlying assets, such as on-chain assets and off-chain assets, intangible assets and tangible assets, etc. The underlying assets off-chain are independent of the crypto market and can be tangible (such as real estate and commodities) or intangible (intellectual property and traditional financial securities). Off-chain/Tokenization of underlying assets typically involves an off-chain agent, such as a bank, to assess the value of the underlying assets and provide custody services. Tokenization of on-chain/encrypted assets requires the inclusion of smart contracts to provide custody and asset valuation of encrypted assets.

The last factor to consider is the redemption mechanism. Like some stablecoins, issuers allow token holders to redeem their tokens for the underlying asset. This redemption mechanism can connect the crypto market and the underlying asset market. In addition, tokenized assets can also be traded in secondary markets, such as centralized crypto exchanges and DeFi exchanges. Although some security tokens involving claims or shares on other chains do not contain a redemption mechanism, they still grant token holders some other rights, such as cash flow disposal rights related to their underlying assets.

2. Current tokenization market size and types of tokenized assets

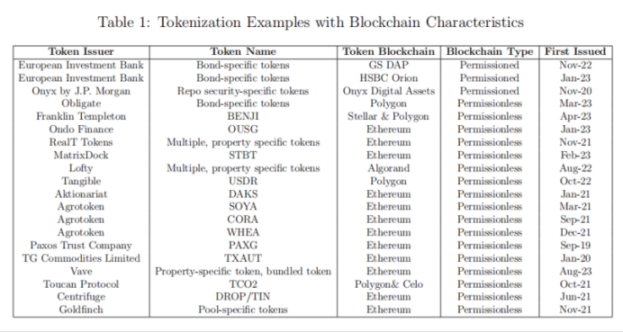

Based on public channel information, we estimate that the tokenization market size on permissionless blockchains will be $2.15 billion as of May 2023. These assets are usually issued by DeFi protocols such as Centrifuge and traditional financial companies such as Paxos. Due to different tokenization schemes, there is no unified standard and it is difficult to obtain a comprehensive set of data information. Therefore, we will use public data from the DeFiLlam platform to demonstrate the booming development of tokenization in DeFi. As shown in Table 1, the value locked (TVL) of the entire DeFi market has remained basically stable since June 2022, while Table 2 shows that since July 2021, the TVL of the asset class Real World Assets (RWA) has increased significantly. It continues to grow compared to similar assets or compared to the entire DeFi market. Many new tokenization projects have been officially announced recently, covering a variety of underlying assets, such as agricultural products, gold, precious metals, real estate and other financial assets.

A typical recent tokenization project involves agricultural product categories SOYA, CORA and WHEA, which refer to soybeans, corn and wheat respectively. The project is a pilot program launched in Argentina in March 2022 by Santander Bank and crypto company Agrotoken. By embedding the recovery rights of the underlying assets in the tokens, and building the infrastructure to verify and process transactions and redemptions, Santander Bank is able to accept these tokens as collateral for loans. Santander Bank and Agrotoken said they hope to promote commodity tokenization solutions in larger markets such as Brazil and the United States in the future.

Another type of underlying assets that can be tokenized is gold and real estate. As of May 2023, the market size of tokenized gold is approximately US$1 billion. Two tokenized golds account for 99% of the market share, namely Pax Gold (PAXG) issued by Paxos Trust Company and Tether Gold (XAUt) issued by TG Commodities Limited. Both issuers set one token unit equal to one ounce of gold, which is kept by the issuer itself in compliance with standards set by the London Gold Market Association (LBMA). PAXG can be redeemed by equivalent US dollars, while XAUt can be redeemed by the issuer selling it through the Swiss gold market. Overall, the two models are basically consistent and have the same value as gold futures.

Compared with commodities such as agricultural products and gold, real estate, as the underlying asset, faces difficulties in standardization, weak circulation, difficulty in value assessment, and more complex legal and tax issues. These pose great challenges to real estate tokenization. Real Token Inc. (RealT) is a real estate tokenization project that collects residential properties and tokenizes their equity. Each property is independently held by a limited liability company (LLC). The property itself is not tokenized, but the shares of the LLC company are tokenized, so that each property can be jointly held by different investors. have. This project mainly provides international investors with a way to invest in U.S. real estate in return for property rentals. As of September 2022, RealT has tokenized 970 properties with a total value of $52 million.

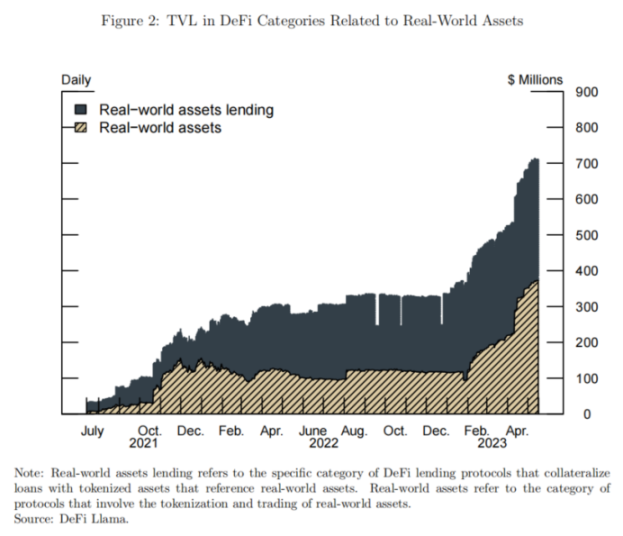

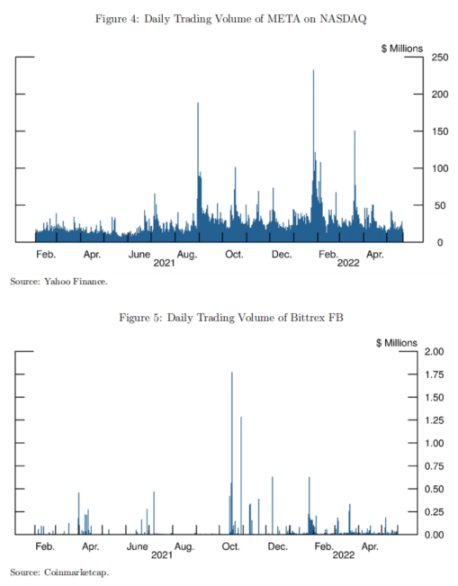

The tokenization of financial assets involves underlying assets such as securities, bonds, and ETFs. Unlike directly holding securities, the price of tokenized securities and the price of the securities themselves may be different, on the one hand because the tokens are traded 24/7, and on the other hand because of the programmability of the tokens and the integration with DeFi. Combinatoriality can bring different liquidity to tokens. We use Table 345 to show the difference in price of META securities and the security tokens corresponding to MEAT, as well as the difference in trading volume (based on Bittrex FB).

Securities can be tokenized on traditional compliant exchanges, or tokens can be issued directly on the blockchain. Switzerland-based Akionariat provides tokenization services to Swiss companies. Publicly traded U.S. companies such as Amazon (AMZN), Tesla (TSLA) and Apple (AAPL) currently or formerly had tokenized securities traded on Bittrex and FTX.

Earlier in 2023, Ondo Finance issued tokenized funds. The underlying assets of these tokenized funds were ETFs of U.S. debt and corporate bonds. Shares in these tokenized funds represent shares in their corresponding ETFs. In addition, Ondo Finance also holds a small portion of stablecoins as liquidity reserves. Ondo Finance serves as the administrator of the tokenized fund, Clear Street serves as the broker and custodian of the fund, and Coinbase serves as the custodian of the stablecoin.

3. Possible benefits of tokenization

Tokenization can bring many benefits, including allowing investors to enter markets that previously had high investment barriers and were difficult to access. For example, tokenized real estate could allow investors to purchase a small share of a specific commercial building or residence, as opposed to real estate trusts (REITs), which are investment vehicles for a portfolio of properties.

The programmability of the token and the ability to utilize smart contracts allows some additional functionality to be embedded into the token, which may also benefit the market for the underlying asset. For example, liquidity savings mechanisms can be applied to the token settlement process, which are difficult to implement in the real world. These blockchain features may lower the barriers to entry for a broad range of investors, leading to more competitive and liquid markets, as well as better price discovery.

Tokenization may also facilitate borrowing and lending by using tokens as collateral, as is the case with tokenized agricultural products discussed above, since directly using agricultural products as collateral would be costly or difficult to implement. In addition, the settlement of tokenized assets is more convenient than the underlying assets or financial assets in the real world. Traditional securities settlement systems, such as Fedwire Securities Services and the Depository Trust and Clearing Corporation (DTCC), generally settle trades on a gross or net basis throughout the settlement cycle, usually one business day after the trade.

ETFs are the financial instruments that most closely resemble tokenized assets, and existing empirical evidence may suggest that tokenization may also improve liquidity in the underlying asset market. The academic literature on ETFs demonstrates a strong positive correlation between the liquidity of ETFs and underlying assets, and finds that additional trading activity in ETFs leads to higher information exchange/circulation of underlying assets in ETFs. For tokens, a mechanism similar to that of ETFs means that greater liquidity of tokens in the crypto market may be more conducive to value discovery of the underlying assets.

4. The impact of tokenization on financial stability

The tokenized market size below a billion dollars is relatively small for the entire crypto market or the traditional financial market, and does not cause overall financial stability problems. However, if the tokenized market continues to grow in volume and size, it could pose financial stability risks to the crypto market as well as the traditional financial system.

In the long term, the redemption mechanisms involved in tokenization between the crypto-asset ecosystem and the traditional financial system may have potential impacts on financial stability. For example, at sufficient scale, an emergency sell-off of tokenized assets could have an impact on traditional financial markets, as price dislocations in crypto markets provide market participants with the opportunity to redeem the underlying assets of tokenized assets for arbitrage. Therefore, a mechanism may be needed to deal with value transmission in the two markets mentioned above.

Additionally, tokenized assets may be problematic due to lack of liquidity in the underlying assets. Examples may include real estate or other illiquid underlying assets. This issue is also discussed in the academic literature on ETFs, namely that there is a strong correlation between the underlying assets liquidity, price discovery, and volatility in ETFs.

Another financial stability risk is the token asset issuers themselves. Token assets with redemption options may suffer from similar problems as asset-backed stablecoins, such as Tether. Any uncertainty about the underlying asset—particularly a lack of disclosure and issuer information asymmetry—could increase investor incentives to redeem the underlying asset, thereby triggering a sell-off in tokenized assets.

This liquidity transmission may also be exacerbated by the characteristics of crypto markets. Crypto exchanges allow for continuous trading of crypto assets 24/7, while most underlying asset markets are only open during business hours. Mismatching of trading hours may have unpredictable effects on investors or institutions in special circumstances.

For example, an issuer of a tokenized asset with a redemption option may face a sell-off of tokens over the weekend. Since the underlying asset is held off-chain and traditional markets close trading on weekends, redeemers cannot quickly obtain the underlying asset. This situation is likely to worsen, with declines in the value of tokenized assets potentially threatening the solvency of institutions holding significant shares on their balance sheets. Furthermore, even if institutions were able to obtain liquidity from traditional markets, they would have difficulty injecting it during the hours when traditional markets were closed.

Therefore, a large-scale sell-off of tokenized assets may quickly reduce the market value of the institutions holding the assets as well as the issuers, affecting their ability to borrow and thus their ability to repay debts. Another example might be related to the automatic margin call mechanism of DeFi exchanges, which triggers the requirement to liquidate or exchange tokens, which can have unpredictable effects on the underlying asset market.

With the development of tokenization technology and tokenized asset markets, tokenized assets themselves may become the underlying assets. Given that crypto asset prices are more volatile than similar underlying assets in the real world, price fluctuations in such tokenized assets may be transmitted to traditional financial markets.

As the scale of the tokenized asset market continues to expand, traditional financial institutions may participate in various ways, either by directly holding tokenized assets or by holding tokenized assets as collateral. Examples of this could include Santander Bank providing loans to farmers using tokenized agricultural products as collateral. As mentioned above, we have also seen cases such as Ondo Finance tokenizing US government money market funds.

Furthermore, while similar in nature to JPMorgan Chases first use of money market fund (MMF) stock equity as collateral for repurchase and securities lending transactions, Ondo Finances move could have a more profound impact on traditional financial markets. Ondo Finances tokens are deployed on the public blockchain Ethereum, rather than the institutions own private permissioned blockchain, which means Ondo Finance has no control over how users and DeFi protocols interact. As of May 2023, Ondo Finances tokenized funds accounted for 32% of the entire tokenized asset market. According to DeFiLlama, Ondo Finance is the largest tokenization project in this category, and its token OUSG can also be used as collateral on Flux Financ, the 19th largest lending protocol.

Finally, similar to the role of asset securitization, tokenization may package riskier or less liquid underlying assets into safe and easily tradable assets, potentially resulting in higher leverage and risk taking. Once the risk is exposed, these assets will trigger systemic events.

5. Conclusion

This article aims to provide a background on the tokenization of assets and discuss the possible benefits as well as the risks to financial stability. Currently, asset tokenization is very small, but tokenization projects involving various types of underlying assets are in development, suggesting that asset tokenization may occupy a larger part of the crypto ecosystem in the future. Among the possible benefits of tokenization, the most prominent are lowering barriers to entry into otherwise inaccessible markets and improving the liquidity of such markets. The financial stability risks brought by asset tokenization are mainly reflected in the interconnection between tokenized assets between the crypto ecosystem and the traditional financial system, which may transfer risks from one financial system to another.

Attachment: Information on some asset tokenization projects

Digital bonds issued by the European Investment Bank

The European Investment Bank has issued several blockchain bond products. The first bond was issued through the HSBC Orion platform based on a combination of private and public blockchains, with a total bond size of GBP 50 million. The blockchain serves as a record of legal ownership of bonds and manages floating rate instruments and bond life cycle events. The bonds will be held in digital accounts through the HSBC Orion platform.

The second bond was issued through Goldman Sachs’ private blockchain GS DAP, with a total bond size of 100 million euros and a 2-year term. The bonds are represented as security tokens, which investors can purchase using fiat currency, with Goldman Sachs Europe, Santander Bank and Socie Generale acting as co-managers, which then settle the issuer in the form of a CBDC. . The tokens are provided by the Bank of France and the Central Bank of Luxembourg. Soci etet Generale Securities Securities Services (SGSS Luembourg) serves as the on-chain asset custodian, and Goldman Sachs Europe serves as the account custodian of the CBDC.

The bond is characterized by T+ 0 instant settlement, secondary transactions can only be conducted over-the-counter, and are settled off-chain in legal currency. Bond coupons are paid in fiat euros, with Goldman Sachs Europe acting as payment agent to distribute these payments to bondholders.

J.P. Morgan’s Onyx platform

The Onyx platform operated by J.P. Morgan has the ability to tokenize assets and trade crypto assets. Onyx is based on a permissioned blockchain and mainly serves institutional clients, such as providing cross-currency transactions for digital Japanese yen and digital Singapore dollars, and providing services for Singapore government bond issuance. In the future, JPMorgan Chase said it will conduct bookkeeping transactions on the Onyx platform for U.S. Treasury bonds or money market funds.

The Onyx platform also completes the settlement of intraday repo trades between JPMorgan brokers and banking entities. Both the collateral and cash components of the repo transaction can be settled using the Onyx platform. For repo transactions, cash transactions are settled using its JPM Coin, a blockchain-based bank account system. Since its launch in 2020, the platform has generated $300 billion in revenue.

Obligate

Obligate is a blockchain-based debt tokenization protocol that allows companies to issue bonds and commercial paper directly on the blockchain. The agreement supports the issuance of euro-denominated bonds by German industrial company Siemens on the Polygon network, bringing the total size of the debt to $64 million. Obligate also provides support for Swiss commodities trading firm Muff Trading AG. When investors purchase these bonds, they receive ERC-20 tokens in their crypto wallets. According to their website, all future bonds will be denominated in USDC and issuers must go through a KYC process.

Investors will be able to access Obligate through existing crypto wallets. For each investment, investors hold a corresponding eNote (ERC-20), which has the right to receive payment at maturity or collateral in the event of default.

Franklin Templeton

Franklin Templeton, an American asset management company, provides tokenized U.S. government monetary funds based on two public blockchains, Stellar and Polygon. Investors can purchase Benji tokens, with each token representing a share in the tokenized fund. Each share aims to maintain a stable share price of $1 and can be redeemed at any time. Share ownership is recorded on the Stellar blockchain network’s proprietary system.

92.5% of the tokenized fund’s assets come from U.S. institutions, with the remainder in cash. Investors can make purchases through the Benji Investments app. The tokenized fund currently has more than $272 million in assets under management.

Ondo Finance

Ondo Finance provides several tokenized fund products, including OUSG, OSTB, OHYG and OMMF. The underlying assets of the tokenized funds are Blackrock U.S. Treasury Bond ETF, PIMCO Enhanced Short-term Active ETF, Blackrock iBoxx High Yield Corporate Bond ETF and U.S. Tag Funds. Earnings from OMMF tokens will be airdropped to token holders on a daily basis, while earnings from other tokens (such as OHYG) will be automatically reinvested in underlying assets. Token holders can receive traditional fund accounting reports from third-party service providers to verify fund assets.

Tokens can be redeemed daily but may take multiple days to settle. If the fund has dollars on hand, redemptions occur immediately. If not, the fund would sell the ETF shares, transfer the dollars from Clear Street to Coinbase, where Coinbase would convert the dollars to USDC and then pay the USDC to token holders.

RealT

Real Token Inc. (RealT) collects residential properties and tokenizes their equity. Each property is independently held by a limited liability company (LLC). The property itself is not tokenized, but the shares of the LLC company are tokenized. Therefore, the shares of each company that owns the property will be divided into shares and can be jointly held by the investors. This project mainly provides international investors with a way to invest in U.S. real estate and provide them with a return on property rentals. As of September 2022, RealT has tokenized 970 properties with a total value of $52 million.

From a legal perspective, RealT is a company registered in Delaware called Real Token LLC. The entity exists to simplify the process of tokenizing properties by placing each property under a series of LLC companies and providing shares to earn returns.

RealT’s tokens can be used as collateral for the RMM DeFi lending protocol, which is based on Aave V2. So far, only non-US users can access the RMM protocol and lend the stablecoin DAI.

MatrixDock

MatrixDock issues its stablecoin (STBT), with each stablecoin anchored at $1. The stablecoin is backed by U.S. Treasury bonds with a maturity of no more than 6 months and repurchase agreements. STBT can be minted or redeemed. Users must first deposit USDC/USDT/DAI. Once the purchase of the underlying asset is confirmed, the deposited USDC/USDT/DAI will mint STBT tokens. Redemptions can be made through MatrixDock’s app or by transferring STBT to the issuer’s dedicated address for a period of T+ 4 (New York Bank Days only). If the holder redeems STBT before maturity, the execution price is calculated as the Treasury bond settlement price divided by the fair market value (FMV) of the previous day.

Lofty

Lofty will provide tokenization of US real estate based on the Algorand blockchain. The way it works is very similar to RealT, that is, after the property is transferred from the seller to Lofty, Lofty places each property in a separate LLC company and tokenizes the shares of the LLC company. The income from holding these tokens comes from the rental income of the underlying assets and the appreciation of the property. Since the underlying asset is a legal interest and not the underlying asset itself, there is unlikely to be a way to redeem it.

Tangible

Tangible is an NFT marketplace for real-world assets, allowing users to convert wine, gold bars, watches, and real estate into NFTs. Real-world assets are secured and stored in Tangibles secure storage facilities. Users can purchase NFTs with the platforms native stablecoin (Real USD is mainly supported by interest income from real estate, and the APY is expected to be between 10% - 15%) or tokens such as DAI. All NFTs can be redeemed as the underlying asset only when the holder owns all shares of the NFT.

Aktionariat

Aktionariat is a legally compliant digital platform only available in Switzerland. The Aktionariat platform provides other companies with the tools needed to tokenize their shares and enable them to be traded. Since Aktionariat has the ability to hold and trade both tokenized and traditional stocks, the price of the shares will depend on the total supply, including the share of shares listed, and the company’s valuation. Aktionariat builds a shareholder register by tracking transaction addresses on the blockchain and mapping them to addresses stored in an off-chain database, updating them in real time. However, due to the distinction between shareholders and token holders, token transfers may not necessarily result in a change of registration. The company can also convert back to a traditional shareholding by buying back its tokens from shareholders and burning their tokens.

Agrotoken

Agrotoken can provide tokenization solutions for agricultural products, such as soybeans, corn and wheat. Each token represents 1 ton of the underlying commodity, and the commodity expiration date can also be marked as 30, 60 or 90 days or renewed to the maximum contract date. The exporter or collector will secure proof of grain reserves through an oracle. The protocol runs on the Ethereum public blockchain, and each token is an ERC-20 token.

The project is a pilot program launched in Argentina in March 2022 by Santander Bank and crypto company Agrotoken. Santander Bank is able to accept these tokens as collateral for loans by having recourse rights to the underlying commodities embedded in the tokens, as well as building the infrastructure to verify and process transactions and redemptions.

Through its partnership with Visa, Agrotoken has created a bank card accepted by 80 million stores and businesses associated with tokenized agricultural products projects. The company is effectively connecting Argentinian farmers and exporters with surplus grain to global business networks.

Paxos Trust

Paxos is a financial institution specializing in blockchain infrastructure and payment systems. It is also the custodian of many crypto projects, such as the stablecoin USDP and the tokenized gold Pax Gold (PAXG). PAXG runs exclusively on the Ethereum blockchain, is available for settlement 24/7, and represents approximately half of the market for tokenized gold. A PAXG token is equivalent to one ounce of gold and can be exchanged for the underlying physical gold itself, as well as interests in gold equity/credit, or can be sold directly for U.S. dollars through Paxos platform. Paxos Corporation is regulated by the New York State Department of Financial Services.

TG Commodities Limited

TG Commodities Limited is the issuer of Tether Gold (XAUt) and is headquartered in London. Legally, it is not the same entity as Hong Kong-based stablecoin issuer Tether Limited (USDT), but the two will be considered the same issuer. One XAUt is equivalent to one ounce of gold and can be exchanged for physical gold itself or for legal tender after the physical gold is sold on the Swiss gold market. All XAUt are backed by physical gold, and holders can search for specific gold bars related to their XAUt through Tether Golds website. Redemptions are only available for whole bars, ranging from 385 to 415 ounces.

Toucan Protocol

The Toucan protocol allows users who own carbon credits on a carbon registry to tokenize them and allow for trading. Tokenized carbon credits are called TCO 2s, which are programmed as NFTs, and the project and specific circumstances of the carbon credit can be distinguished by adding an additional name (such as TCO 2-GS-0001-2019). Toucan also manages two liquidity pools: a basic carbon pool and a natural carbon pool to increase liquidity and pool similar carbon credits. Natural Carbon Pool only accepts TCO 2 tokens generated from natural projects.

Centrifuge

Centrifuge is an open DeFi protocol and a real-world asset market. Owners of real-world assets act as initiators to create asset pools that are fully collateralized by real-world assets. The agreement is not limited to asset classes and has asset pools for multiple categories, such as mortgages, trade invoices, micro loans and consumer finance. At the same time, Centrifuge can be integrated into other DeFi protocols, for example, it carries most of the RWA assets in MakerDAO.

The tokenization of real-world assets is initiated by asset originators and the establishment of asset pools. Each asset pool is connected to a special purpose vehicle (SPV), which obtains the legal ownership of the assets from the asset originators. In order to separate the assets of the SPV from the business of the asset sponsor. Real-world assets will be tokenized into NFTs and linked to off-chain data. Investors deposit stablecoins (usually DAI) into an asset pool, and in return they receive two tokens representing the asset pool based on their risk appetite: TIN and DROP tokens. TIN and DROP tokens can be redeemed periodically, and returns to investors come from fees paid by borrowers who obtain financing from the asset pool. Investors can also receive rewards from the platform token CFG.

Goldfinch

Goldfinch is a decentralized lending protocol that provides crypto loans for fully collateralized off-chain assets. There are three main parties to the agreement: investors, borrowers, and auditors. Investors can also support the development of the protocol by contributing funds to the Goldfinch member vault.

Borrowers are off-chain borrowing entities who propose transaction terms related to loan amounts in the agreement, which are called borrowing pools. Investors can provide funds directly to the lending pool, or indirectly provide funds to the protocol, participating through the automated allocation process in the protocol. Investors can redeem their tokens on specific dates, such as once every quarter.